It is so customary that sooner or later grief comes to every family - the death of one of its members. Usually, after the funeral, the question arises of dividing the property of the deceased between relatives. In this situation, the direct heirs will inherit the real estate and other assets.

The situation is quite simple when it comes to a family that has lived a long and happy life. The story is more dramatic when it is not the first marriage, but the husband has children from another woman. Here events may develop slightly differently and give rise to disputes and conflicts.

The article is intended to resolve possible contradictions and collisions. By understanding all the details now, you can protect yourself from negative consequences in the future.

Who is the direct heir after the death of a spouse if there is no will?

If the husband dies, who are the first priority heirs? It has been established that, according to the law, close relatives of the deceased are legal successors. The legislator divided all recipients into 8 (eight) queues depending on the degree of relationship.

The first heirs are those who were closest to the deceased. Article 1142 of the Civil Code of the Russian Federation provides a list of these persons.

First priority heirs after death without a will:

- wife;

- son or daughter;

- parents;

- grandchildren or granddaughters by right of representation.

An important condition for a woman to inherit is the registration of family relations with a man in the registry office. If she is absent, she cannot be an heir by law. The legal spouse must receive 50% of the acquired joint property in the process of family relations.

Children, whether natural, adopted or from a previous marriage, inherit equally. If a man has been deprived of parental rights, his children can also inherit.

In the case where the father abandoned the child who was later adopted by another person, then this child loses the opportunity to inherit the property of his biological father. An exception is the case when a daughter or son, after adoption, maintained a relationship with a parent, in accordance with a court decision (clause 3 of Article 1147 of the Civil Code of the Russian Federation).

Note! The spouse's children, unless adopted, do not legally inherit the property of their mother's husband. However, if they are disabled and were dependent on him for at least a year, then they are entitled to a share on an equal basis with the other heirs.

In addition, the husband’s unborn children conceived by him during his lifetime may inherit. If such a situation arises, the division of the inheritance is carried out only after the birth of the baby, with the participation of his legal representatives.

Parents are a separate category that inherits somewhat less frequently, due to the fact that the overwhelming majority of people die at an old age, when they are no longer alive. In this situation, it does not matter whether the parents are married or not.

Adoptive parents are also treated the same - they have the same rights as biological parents. Guardians and trustees cannot claim inheritance.

Who is the direct heir after the death of one of the spouses?

Registration of an official marriage is the basis for the emergence of mutual rights/responsibilities of spouses (including property).

Therefore, when inheriting, the marital share is allocated first, which is considered in the following way:

- under the terms of the marriage contract;

- half of the property acquired after marriage is transferred to the remaining spouse if no prenuptial agreement has been drawn up.

Important! If the deceased spouse included in the contents of the will a mention of the property of the second partner, the valuables are excluded from the list of inheritance.

After the spousal share is allocated, the remaining part of the property is divided, to which the spouse also claims. The common-law husband and wife do not inherit, except on condition of dependency.

Inheritance after the death of a husband

Example 1:

Citizen O. died in a car accident. He is survived by his wife, citizen P., with whom a marriage agreement was not signed, son S., and daughter of his wife T., who was not adopted. An apartment worth 3,000,000 rubles is inherited. The notary determined the marital share - ½ of an apartment worth 1.5 million. The remainder is divided as follows:

- wife – ¼ part of the property;

- son – ¼ share of the apartment.

The wife's daughter does not receive the inheritance.

Example 2:

After marriage, citizen K. inherited a house worth 4.5 million rubles. The marriage contract was not signed, so the house belongs entirely to the spouse. The man died, leaving the property as an inheritance. After the opening of the inheritance, it was established that in addition to his official wife, the man had an illegitimate child. The court ordered a DNA test to confirm the relationship. The house is divided equally between the official wife and the illegitimate child.

Inheritance after wife's death

After the death of a wife, the following can claim inheritance:

- children (biological, adopted, even those in respect of whom the woman has been deprived of parental rights);

- parents (the share of each is calculated separately);

- official spouse, regardless of cohabitation.

Example:

After the wedding, the Ivanov couple purchased a Deo car, registered to their husband. Also, after marriage, the husband’s parents gave their son an apartment, formalized by a gift deed. Citizen Ivanova died and the notary decided to divide the property in the following way:

- the apartment is not inherited, it belongs entirely to the husband;

- ½ part of the car is the spousal share of citizen Ivanov;

- ½ of the car goes to the husband due to the absence of children and other first-degree relatives.

Rights of children from first marriage

This category has the right to inherit by law. It doesn’t matter how close they are to their parent after their father’s divorce from their mother, the main thing is that there is no fact of their adoption by another person.

Most often, a person’s second or third spouse experiences a negative attitude towards these children, which is due to the peculiarity of the female character. They need to be prepared for the fact that after the death of their father, a will may appear written by him, where everything he has acquired will be written to his wife.

If it is known for certain that there has recently been hostile relations between husband and wife, and the man did not think of writing a will with such text, then it is worth trying to challenge it in court, presenting compelling arguments.

In legal practice, it happens that children may not have known about the death of a close relative and missed the established deadline for entering into an inheritance.

The court may restore the deadline for accepting the inheritance in accordance with Art. 1155 of the Civil Code of the Russian Federation, taking into account the fact that the person did not know about this fact or he had valid reasons that prevented him from coming and completing all legal formalities.

In such a situation, the son or daughter of the deceased father must apply to the court to restore inheritance rights. This can be done within 6 (six) months from the moment the reasons for missing the deadline no longer exist.

The court takes measures to preserve the property due to the legal heir, which was previously distributed among other participants in the legal relationship.

Previously issued registration documents for divided property will be declared invalid. In this situation, the share of the new legal successor is allocated at the expense of the inherited material benefits of other participants.

If all parties to the agreement are ready to allocate the due portion to the emerging party and everyone has reached a consensus, then the matter will be resolved without a trial. A new agreement is concluded and the rights to real estate are re-registered.

How is the inheritance divided after the death of a wife?

The inheritance after the death of the wife will be divided depending on the type of inheritance, as well as on the relatives who have the right to the property of the deceased. If the inheritance is by will, then it will be distributed among the persons specified in the will .

But this will be the case if the deceased wife did not support a dependent during her lifetime, or did not have minor and disabled children and parents. If these persons are not present, then the property will undoubtedly become the property of the people specified in the will, unless, of course, they decide to accept the inheritance.

Attention

If the inheritance occurs according to the law, then first of all, her legal spouse, children, as well as her parents . Moreover, these persons have the right to renounce the property of the share in favor of another person, or not to take any action at all (Article 1157 of the Civil Code of the Russian Federation).

If the property is abandoned by the heirs of the first priority, then it passes in order to the persons of the second priority, etc.

The day of the wife’s death will be the day the inheritance opens (Article 1114 of the Civil Code of the Russian Federation). It is from this moment that the period will begin during which it is necessary to make a decision about the inherited property, namely: take it for yourself, or refuse it.

How property is inherited by law

In the absence of a will, property is inherited by the successors of the deceased in accordance with current legislation - according to the principle of priority. First, you should receive a death certificate.

The algorithm then broadly consists of the following steps:

- Applying to a notary to present rights to inheritance.

- Providing a list of required documents.

- Opening and conducting an inheritance case by a notary within the period established by law.

- After the expiration of time, obtaining a certificate of inheritance.

- Re-registration of the received property with the Rosreestr authorities.

Despite its apparent simplicity, this process sometimes contains a number of nuances. Another action the wife should take when her husband dies is to try to find a will, on the basis of which it will be extremely clear which scenario is possible.

Contacting a notary

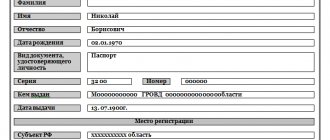

When the death certificate is in hand, you should choose a notary at the place of residence of the deceased. You must first collect documents that must be presented.

Their list includes:

- civil passport of the applicant (spouse);

- stamp death certificate;

- marriage certificate;

- will (if there is one);

- title documents on property, depending on the inherited object.

Once all of them are handed over to the notary, he checks their authenticity and makes copies. Then the applicant writes a statement about his right to inheritance. As soon as the application is submitted, the official opens an inheritance case.

Deadlines for registration

The general period for opening an inheritance is 6 (six) months after the death of a person. Conducting a case can take up significantly more time.

The main thing when visiting a notary is to provide a mandatory list of documents on the basis of which the case is opened, without violating the deadlines.

The legislation makes it possible to bring a number of title documents for property to a notary after some time, but no later than the day of its closing. The main thing is to open a case, and then you can deliver certificates and technical passports.

Documents for an apartment and other property

Things can be completely different. They differ in their functionality and purpose.

May be inherited:

- residential buildings;

- land;

- motor transport;

- deposits, securities;

- household appliances and furniture, jewelry.

Each property has its own list of documents. The more functionality, the more information and evidence usually needs to be provided.

So for real estate (apartment or house) you need to additionally present :

- technical certificate;

- certificate of absence of debts for payment of utilities;

- document on the estimated value of the object;

- receipt of payment of all tax payments;

- building plan.

Often a person already has some of these documents in his hands. The other part should be obtained from government agencies. It's better to take care of this in advance.

The following list is required for a car or other vehicle:

- registration certificate;

- certificate of the estimated value of the object;

- certificate of absence of tax deduction arrears.

It is important that the documents are not expired and that the item does not change ownership. The car or motorcycle must not be under arrest or mortgaged.

To receive savings from a bank you must provide:

- bank account details or the agreement itself;

- savings book;

- details of the rented safe deposit box;

If there are no account or agreement numbers, but there is reliable information that the deposits exist, the notary will independently find it by sending a request.

When there is a question about shares, you should provide:

- information about the legal entity;

- extract from the organization's register.

An extract from the register can be taken by any person claiming an inheritance. To do this, you should meet with a representative of the department or HR department, or another authorized person in the organization who can resolve this issue.

Who bears the registration costs and how much?

Any notary expenses have their own cost, including those under consideration. Therefore, before your visit you need to take the required amount of money with you. There is a rule - each heir independently pays for notary services and state fees in the indicated amounts.

If they are minors, then their legal representatives pay for the services. Their mother pays for their children and herself.

In accordance with Art. 333.24 of the Tax Code of the Russian Federation, the following notary fees exist: :

- A certificate from a notary will cost the first-priority heirs in the amount of 0.3% of the total value of the property, but not more than 100 thousand rubles. For all other relatives it is 0.6%.

- For issuing a certificate for the share of jointly acquired property - 200 rubles.

- Payment for an application to claim inheritance rights – 100 rubles.

- Issuance of duplicate documents – 100 rubles.

- Sending a request to the bank – 50 rubles.

The most significant amount is the payment of the state fee for obtaining a certificate of inheritance. All other expenses are not large.

How is the inheritance distributed after the death of the husband?

When the stage of property division begins, the main criterion will be the correct allocation of shares and property. It is important that everyone who can inherit receives their share.

At this stage, joint and personal property should be divided. When inheriting by law, jointly acquired property is determined, from which a mandatory marital share is allocated equal to 50% of this property.

After which, the remaining part of the property, including personal property, is divided between the heirs in equal shares.

Common shared ownership

There is such a thing as shared property between spouses. This is when all property before marriage or during it is divided into equal or unequal parts. This happens on the basis of a marriage contract concluded between the parties.

The marriage contract determines to what extent it belongs to the spouses and, accordingly, is inherited after their death. If there is this document, everything will be inherited in the way specified in it.

Mandatory heirs

In jurisprudence, there is a concept of obligatory heirs. Such persons, in any situation, regardless of the will of the testator and his successors, are entitled to a mandatory share in the property.

To this category in accordance with Art. 1149 of the Civil Code of the Russian Federation these include :

- minors and disabled children;

- disabled spouse and parents;

- disabled dependents who were supported by the testator for at least a year before the tragic event.

Provided that the spouse is a pensioner, she will also count on the obligatory part, regardless of the presence of a will. The share of this category is at least 50% of the amount that would be required by law.

Allocation of spousal share

It can be identified by contacting a notary. To do this, you need to write an application and provide title documents for real estate and other property so that the division occurs legally.

The share will include exactly half of the property acquired during the marriage. It is not divided among other legal successors. Usually the other parties are notified of such a step.

What is not included in the section is what was not acquired during marriage, what was given or inherited by the spouse during his lifetime, as well as property privatized without the participation of the wife.

Who are the heirs of the first stage?

According to existing legislation, in 2020, first of all, the following are called for inheritance:

- Spouses

The first priority of inheritance by law is the wife or husband who was in an officially registered state marriage with the deceased. At the same time, “common-law” spouses, as well as dependents and cohabitants, do not have the right to claim the property of the testator , except in cases where this is provided for by the laws of the Russian Federation (we will discuss this further).

However, even when inheriting after the death of a spouse, it is necessary to understand that not all property is subject to division between relatives. After all, all real estate, movable property or things acquired during the period of marriage are considered marital property. That is, such property belongs to the wife and husband on equal rights.

That is why experienced lawyers recommend, before proceeding with the registration of an inheritance, to allocate from the joint property of the spouses the share of the one who can further dispose of it. Then you can distribute the remaining inheritance (the deceased's share) among the heirs in order of priority.

It is worth noting that joint property, according to the Civil Code of the Russian Federation, is not property that is not subject to allocation to the married half. That is, the property that was received by the testator before marriage, no matter whether it was purchased, received as a gift or inherited.

- Parents

EVERYONE NEEDS TO KNOW THIS:

How to inherit a dacha?

The testator's mother and father are also included in the first priority of inheritance. At the same time, it does not matter at all whether they are married or divorced. Also, adoptive parents, who by law have rights similar to parents, are treated as parents, except in cases where the adoption was canceled according to a court decision.

Parents who are legally deprived of parental rights in court are deprived of inheritance rights.

- Children

The same category of primary heirs also includes the children of the testator. Remember that if the latter was deprived of parental rights, he lost the right to inherit property after the death of the child, but children do not lose this right after the death of the parent who did not have parental rights. This fact is due to the fact that a mother or father deprived of parental rights, although they lose their rights to the child by a court decision, are still not released from the responsibilities associated with their children.

Natural or biological children have the same inheritance rights as adopted children. Moreover, if the testator was married to a person who has his own children, they do not have the right of priority inheritance .

According to the existing norms and laws of the Russian Federation, stepdaughters and stepsons are included only in the 7th line of inheritance. Thus, they can claim the property of their stepmother or stepfather only if there are no heirs from the previous 6 lines of inheritance. You can get acquainted with all the stages of inheritance by looking at this table:

It is worth mentioning separately about children born after the death of the owner of the property, who have the same rights to the inheritance or part of it as children born during the life of the testator.

Who is the first heir after the death of his wife?

The situation is the same with the distribution of property after the death of a spouse. Before the immediate division, the part of the property that was acquired during the marriage to the deceased is separated from the common inheritance. Thus, 50% of such property belongs to the husband, and the remaining half is subject to inheritance by the following persons:

- spouse;

- children;

- parents of the testator.

Who is the first heir after the death of her husband?

So, having considered the information described above, we can conclude that the first heirs after the death of the husband are his:

- spouse;

- children;

- parents (mother and father).

EVERYONE NEEDS TO KNOW THIS:

Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012

The process of distributing the common inheritance begins only after calculations and the allocation of half the share of property acquired jointly by the spouses during marriage. It is the husband’s part, in this case, that will be the share of the inheritance to be distributed among the remaining heirs.

If only one citizen from the list acts as heir and there are no others, then he will receive all the property of the testator. Well, if the deceased does not have any of the heirs of the 1st category or they refused the inherited property, the right of inheritance passes to the remaining heirs in order of legal priority.

Who is the first heir after the death of the mother?

According to the legislation existing in 2020, among the first applicants for inheritance after the death of the mother are:

- spouse;

- children;

- parents.

At the same time, the husband has the right to inherited property only if he was in a state marriage with the deceased, which will need to be documented when opening a case.

The same applies to children and parents - they will also need to present relevant documents proving the degree of relationship with the testator.

If the mother was in an official marriage, then before dividing movable and immovable property, it is necessary to isolate the share of property acquired jointly during the marriage (only necessary if the husband is alive). The second half of the inheritance will be divided among the remaining heirs.

The father and mother (grandfather and grandmother) have the right to inherit property if they have parental rights and have not been deprived of them in court.

Also, instead of the mother’s children, her grandchildren have the right to receive the inheritance first if their parents died with her or before her.

Who is the first heir after the death of his father?

If the head of the family did not leave a will, then the following may inherit his property first:

- spouse;

- children;

- parents of the testator.

As in the case of the mother, before distributing the common inheritance between the above-mentioned persons, the spouse’s share (part of the property acquired during marriage) is allocated. This part of the property is not subject to division and is the property of the mother, while the father's share is distributed among the heirs by law. At the same time, the shares of the heirs of the 1st stage are equal .

EVERYONE NEEDS TO KNOW THIS:

When is a will promulgated after death?

In the event that the above persons have renounced their shares or there are none, the right of inheritance passes to the applicants of the 2nd stage of inheritance. It is worth noting that if the testator does not have a single heir in any of the queues, then all of his property will be considered escheat and will become the property of the state.

Does the ex-wife have rights?

She retains certain opportunities to sue for part of the property, provided that after the divorce, everything acquired was not divided between the spouses. The ex-wife has the right to go to court, claiming her part. This usually happens when the question of dividing real estate arises.

When property in a previous marriage was legally divided after or during a divorce, the ex-wife has no right to claim any share.

It is important that the husband or wife does not have any unresolved issues related to the division of acquired property in a previous marriage.

Who has the right to inheritance after the death of a former spouse?

In the article Art. 1142 of the Civil Code of the Russian Federation clearly defines the heirs of the first stage. These include the children, spouse and parents of the testator.

As for children themselves, it will not matter at all whether their parents are legally married or not. The legal status of the child remains unchanged. The main thing that must be present in this situation is a birth certificate in which the testator must be indicated in the father column.

The spouse is also the heir of the first priority, according to the current legislation, which also states that both spouses have equal rights to jointly acquired property, if the latter was not divided during a divorce for a number of reasons. Therefore, the second spouse may well become the owner of his share after the death of the first.

The legislation clearly defines that absolutely all property acquired at the time of cohabitation in a marriage relationship is recognized as jointly acquired and is subject to division in equal parts between spouses. Moreover, it does not matter here the fact in whose name the property was registered and by whom it was personally acquired. Consequently, the legal share of the inheritance will pass from the deceased to the previously married spouse, regardless of whether he is called to this inheritance or not.

The only exception in this case may be a marriage contract concluded between the spouses, which officially determines the shares of each spouse.

The legislation of the Russian Federation allows the notary to determine the due share in the inheritance of the spouse claiming it. You can obtain such an official conclusion on the right to own half of the deceased’s inherited property by contacting the notary’s office where this inheritance process is being conducted.

Possible conflicts with children from a first marriage

The relationship between children and the father's real wife is often characterized as hostile. Therefore, you should expect surprises.

This may be an untimely notification of the death of the father to the children, an attempt to independently appropriate the things of the deceased (books, clothes, equipment) that do not require a written or notarized agreement on the division of inherited property.

Attempts to divide the inheritance mass without the participation of children cannot be ruled out. Let's give a couple of life situations.

Example No. 1. Savings in marriage

After his death, the man was left with a two-room apartment, a garage and 2 million rubles in the bank. Among the heirs were his wife and two children from a previous marriage. The apartment and garage were purchased by a citizen until his last marriage.

The funds were recognized as assets, and the wife received her share in the amount of 1 million rubles according to the law. Everything else was divided in three equal parts between the wife and two children.

Example No. 2. Division of property between wife and children from first marriage

After the death of the husband, his retired wife and son and daughter from a previous marriage remained alive. The inheritance consisted of an apartment, a dacha, a car, and a deposit in the amount of 1 million rubles.

The only common family property was a car. In this situation, the wife teaches 50% of the car as an obligatory part. Everything else is divided between her and the children in three equal shares.

The first heirs after the death of her husband

If a spouse dies without leaving a will, the first to claim his inheritance are:

- legal wife (find out about the share of the wife’s inheritance after the death of the spouse from the article https://nasledstvo.today/3701-vydelenie-dolei-naslednikov-po-zakonu-v-nasledstvennom-imushhestve-razdel-obshhego-imushhestva-suprugov);

- children (blood, adopted, born out of wedlock, if paternity is confirmed, as well as biological children who were born alive after the death of the testator);

- parents.

Recommendations that will help

In conclusion, I would like to note a number of points that it is advisable to take into account in such situations. It is better to prevent possible negative consequences than to correct them later.

First of all, it is necessary:

- Determine whether a will was written by the deceased.

- If most of the things were acquired by the wife, and the husband has children from a previous relationship, a will should be written.

- When the parties are in an unequal financial situation, it is best to conclude a marriage contract.

- Do not enter into conflict throughout your family life with children from your first marriage, but rather show them attention and friendliness.

- First of all, the person (spouse) who lived with the deceased and used them will claim household items, furniture, and equipment.

Everything needs to be resolved through negotiations, including emerging issues related to the division of inheritance. You need to demand only what belongs by law.

Author: Oleg Vladimirovich Roslyakov, source.