Author of the article: Roman Gavrilov Last modified: January 2020 2012

How to draw up a deed of gift for an apartment for my daughter? Parents who want to provide their heir with housing in the future often turn to lawyers with this question. Donating residential property is a procedure that requires the donor to have thorough practical and theoretical preparation. It is extremely important to familiarize yourself with the legislative acts relating to this issue, as this will help to avoid mistakes when drawing up an agreement and carry out the transaction without breaking the law.

Expert commentary

Potapova Svetlana

Lawyer

Often, when registering ownership rights to donated residential real estate, you have to deal with the fact that Rosreestr refuses to carry out registration, since when checking the documents, errors were noticed in drawing up the contract or an insufficient number of documents required for the procedure. The information below will help you avoid all the problems described above.

How to give an apartment to your daughter? Registration of deed of gift

For the donation procedure, it is necessary to issue a deed of gift.

This is an official document, which is then submitted to the registration authority.

To draw up a document, you can contact a notary, or you can draw up the document yourself.

The law allows the use of both methods, the main thing is that in the end the deed of gift is registered.

However, the participation of a notary guarantees the safety and legality of the transaction, while an uncertified document is easier to challenge.

Next, we will tell you how to draw up a deed of gift for an apartment for your daughter.

The procedure for donating an apartment to a daughter

How to give an apartment to your daughter in Russia? To do this you need:

- draw up a gift agreement.

You can do this yourself, but it is better to use the services of a notary. According to the law, the document will still have to be certified, so it is better to let a specialist handle all stages of preparing a deed of gift for your daughter for an apartment. - The notary must be contacted together with the person acting as the recipient.

Again, by law, this person is obliged to express consent to the gift or refusal, so it will not be possible to surprise your child. - The lawyer should provide all the required documents, including a certificate of ownership of the apartment.

- You must pay the state fee and have a receipt in hand.

- Then follows the execution and notarization of the gift agreement.

- The last stage is registration of the document and ownership. If this is not done, the deed of gift will not have legal force, but will be perceived only as a notification of the will of the donor.

Help: You can submit documents for registration either in person or with the help of a notary. But then you will have to incur additional expenses.

Registration of a deed of gift for a land plot in favor of a son or daughter in 2020

We have already mentioned above that a land plot belongs to the category of objects of special regulation by the state. This fact is reflected in many legal transactions, influencing the specifics of their preparation and execution. And making a deed of land in favor of a son or daughter is no exception to the rule.

Important : Remember that, according to Article 260 of the Civil Code of the Russian Federation, only objects that are not limited and not withdrawn from civil circulation can be used as the subject of donation!

Since land plots belong to real estate, then, based on the provisions of Article 131, after a deed of gift has been drawn up between the parties, the donor and donee must contact the Rosreestr authorities for state registration of the new owner’s property rights. It is worth noting that in 2020 this procedure remains paid and is subject to a state duty, the amount of which currently amounts to 350 Russian rubles per plot or 100 Russian rubles per share of a land plot (Article 333.33 of the Tax Code of the Russian Federation).

We also remind you that if on the land plot that is the subject of the deed of gift there is any building or structure belonging to the donor, according to Article 35 of the Land Code of the Russian Federation, it must be transferred into the ownership of the donee along with this plot. Sometimes good news for many of our compatriots is the fact that, according to Article 18.1, Article 217 of the Tax Code, a daughter or son who acts as a donee in a gift transaction is exempt from paying income tax.

EVERYONE NEEDS TO KNOW THIS:

Judicial practice on gift deeds - everything about challenging the deed of gift in court

According to information from Article 7 of the Land Code of the Russian Federation, land plots actually have a designated purpose and are distributed by category by the legislator. Having accepted one of these plots as a gift, the recipient will have to continue to use it only for the purposes designated for this category of plots.

Parties should be especially attentive to the preparation of a deed of gift when the gift is land shares, that is, shares in the ownership of land that belongs to the category “intended for agricultural purposes.” After all, donating such objects becomes possible, according to Article 12 of Federal Law No. 101, adopted on July 24, 2002, only in favor of shareholders (such as the donor himself). Simply put, in order to donate them in favor of a son or daughter, the parent is obliged to carry out the appropriate procedure for forming a land plot from an existing share (according to Article 13 of Federal Law No. 101).

Registration of the contract

How to properly draw up a deed of gift for an apartment in favor of my daughter? The gift agreement must be drawn up in writing. In this case, you should take into account the presence of all the necessary points:

- personal data of the parties, that is, the donor and the recipient.

- Description of the subject of the contract. The apartment address, floor, number of rooms, etc. are indicated.

- Details of the document on the basis of which the property belongs to the donor.

- Signatures of the parties.

Additional clauses may also be specified in the agreement for donating an apartment to a daughter. For example, the donor may give a guarantee that the property will not be sold or given away until the deed is registered. It is also indicated whether the apartment is encumbered, etc.

IMPORTANT: You should know that the deed of gift should not contain conditions after which the recipient becomes the owner of the property. For example, after the death of the donor.

A gift agreement is a gratuitous transaction, implying that the parties do not have to fulfill any additional conditions in relation to each other.

Now you know how to make a deed of gift for an apartment for your daughter.

.

You know how to draw up a deed of gift for your daughter’s apartment. Now all that remains is the certification and registration step.

Amount of taxes and how to calculate them?

According to the Tax Code of the Russian Federation, the tax on gifting an apartment is 13% of the cost of the apartment.

The cost of the apartment is determined:

- the price specified in the apartment donation agreement (it should not be less than 70% of its cadastral value);

- if the price is not specified in the contract, then the tax is 70% of the value of the property according to the cadastral register.

For example:

If the gift agreement indicates the cost of the apartment is 5 million rubles and this amount corresponds to the cadastral price (i.e. not less than 70%), the gift tax will be 5 million * 13% = 650,000 rubles.

If the contract does not include the price of the apartment, but its cadastral value is 3 million. rubles, then the tax is 70% of this amount - 2.1 million * 13% = 273,000 rubles.

Property registration

After drawing up the gift agreement, the parties must contact Rosreestr.

If necessary, you can submit documents through the multifunctional center.

The following papers will be required:

- passports confirming the identities of the parties to the transaction;

- agreement (3 copies);

- certificate of payment of the duty;

- documents confirming ownership rights;

- consent of the husband or wife (if the property is considered common);

- consent of the guardianship authority.

REFERENCE: After the applicants apply, an employee of the registration authority or MFC will issue a receipt confirming the acceptance of the papers. The parties are also required to set a day for receiving the registered agreement and a certificate certifying the ownership of the recipient.

Registration takes approximately 3-7 days.

How to do this without the participation of a notary?

How to draw up a deed of gift for an apartment for my daughter without a notary? Many citizens ignore the notarization step, thereby not confirming the rights of the recipient to the property. The certification is an additional guarantee that the paper is drawn up in accordance with all the rules and will be difficult to challenge.

But if contacting a notary is not part of the donor’s plans, the transaction can be completed without him:

- draw up and sign a deed of gift by downloading a sample from the Internet or writing it by hand;

- submit the contract and other documents to the registration authority.

This can be done in person or through the MFC. In this case, a state duty of 1 thousand rubles must be paid. On the appointed day, the new owner will receive the registered documents back.

How to issue a deed of gift for an apartment if your daughter is a minor?

You can also give an apartment to a child under 18 years of age. But this procedure has its own nuances, so you should know:

- a minor does not have the right to sign a gift agreement. A second parent or guardian can do this for him. If there is no other parent, one of the close relatives will do.

- From the above it follows that the donor cannot sign for the recipient.

- If your daughter is over 14 years old, but has not reached the age of majority, she can sign the deed of gift. But the signature of the second parent (that is, the child’s representative) must also be affixed.

- The presence of a minor is not required when registering an agreement.

ATTENTION: Consent to the transaction from the guardianship authority may also be required. Otherwise, the procedure for donating real estate does not differ from the standard one.

.

Who can't pay?

The Tax Code of the Russian Federation exempts the following categories of relatives from paying tax on donated real estate:

- Husband wife;

- Grandparents;

- Parents, their children (adoptive parents and adopted children, respectively);

- Granddaughters/grandsons;

- Brothers/sisters (both full and half-blood).

Read here what tax you will have to pay when donating real estate to a close relative.

Warning

If a gifted close relative sells the donated property within three years, he will have to pay a tax of 13% on the sale of property owned for less than 3 years. But at the same time, an amount exceeding 1 million rubles is taxed.

For example,

An apartment worth 3.5 million rubles was donated to a close relative. in 2014. The gifted one did not pay tax on it, but decided to sell the apartment in 2020. Consequently, he will pay a tax in the amount of (3.5 million rubles – 1 million rubles) * 13% = 325,000 rubles.

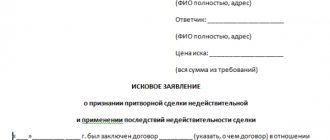

In what cases can property registration be refused or a contract declared invalid?

Despite the simplicity of registration, gift agreements are often disputed or do not allow the registration of property rights. Rosreestr may refuse:

- if consent was not provided for the donation of the co-owners of the property;

- not the entire package of papers was submitted;

- the guardianship authorities did not give their consent to the transaction;

- the donor has no right to dispose of the apartment.

A deed of gift may be invalidated if:

- the donor or recipient was incapacitated at the time of drawing up the document;

- the transfer of property hides another transaction, for example, the purchase and sale of real estate;

- the gift agreement was executed under the influence of violence, blackmail or threats;

- the paper was drawn up without notifying the mortgagee.

IMPORTANT: These are the main reasons that may affect the invalidation of a contract. This is why it is so important to consult with a lawyer before applying.

Which relatives are required to pay?

The following categories of relatives are not exempt from taxation by law for a donated apartment:

- Uncles;

- Nephewsnieces

- Son/daughter-in-law

- Any cousins (brothers, sisters, grandparents, grandchildren, etc.);

- Close people without family ties.

Read about who is entitled to property tax benefits here.

Attention!

Pensioners are deprived of benefits in this matter. Accordingly, if a pensioner received a gift of real estate not from a close relative, then he must pay a stable gift tax of 13%.

Read here what taxes pensioners can expect when paying property taxes.

Taxation

When transferring property without payment, it is necessary to pay a tax, the amount of which is 13% of its market or inventory value.

However, this rule does not apply to transactions between relatives. Therefore, when parents donate an apartment to their daughter, they do not need to pay tax.

It is very simple to draw up a deed of gift, the main thing is that all the rules are followed. The parties must be legally capable, and the paper must be drawn up in accordance with current legislation. And don’t forget about paying the state fee. Now you know in detail how to register a deed of gift for an apartment for your daughter. In addition, you are familiar with the sample agreement for donating an apartment to your daughter.

General information about giving gifts to a son or daughter in 2020

Registration of a deed of gift in 2020 in favor of your children remains one of the most popular ways of alienating property benefits within a family circle in Russia. And this is not surprising. The convenience and simplicity of the procedure, the absence of taxation and the ability to keep the gift within the family even in the event of a divorce are undeniable advantages that are typical only for this type of transaction.

It is also convenient that, according to current legislation, the form of donation depends on the type of property being transferred. For example, a gift of money can be made orally, but when giving a daughter or son a living space/real estate or a car, the parties to the deed of gift will need to not only draw up a written agreement, but also officially register it, re-registering ownership from the donor on the donee.

The very procedure for registering a transaction of gratuitous donation in favor of a son or daughter today is still carried out according to the general rules that are typical for most deeds of gift. However, it is worth noting that there are exceptions here too.

Important : Based on the information established in Article 574 of the Civil Code of the Russian Federation, most gift agreements in which parents and their children are parties can be concluded in a simplified oral form. The only exceptions are cases of drawing up a consensual agreement (an agreement promising a gift in the future), provided for in paragraph 2 of Article 574, as well as the transfer of property as a gift, which requires mandatory state registration (Article 131 of the Civil Code of the Russian Federation). Accompaniment of the transaction by a notary and his certification of the deed of gift today is still not mandatory, although these actions in 99% of cases help to avoid any conflicts and proceedings (up to the cancellation of gift agreements) in the future!

In addition to complying with the requirements set by the legislator for the form of the agreement, experienced lawyers on our site recommend that you carefully study the content of the agreement!

Thus, based on the norms defined by Article 432 of the Civil Code of the Russian Federation, the main act must necessarily specify the object of the transaction. Simply put, in order for the legislator to distinguish a gift from similar property benefits, it is necessary to indicate it:

- Basic properties;

- specifications;

- the actual market value of the item;

- existing defects and shortcomings, etc.

In addition, when drawing up a consensual agreement, the donor must express in writing his desire to transfer the gift specified in the agreement in the future, in accordance with paragraph 2 of Article 572 of the Civil Code of the Russian Federation.

Also, the deed of gift must contain the procedure for transferring property benefits to a daughter or son, as well as the conditions for the transfer and its method (1 paragraph 574 of Article of the Civil Code of the Russian Federation). It is also worth specifying the deadlines for the execution of the contract, the list of documents transferred with the gift and the procedures carried out (for example, an independent property assessment of the gift by an invited expert).

In the event that the child’s legal representatives (for example, specialists and employees of guardianship and guardianship authorities) take part in the gift transaction, this must be indicated in the contract.

In addition to all of the above, this agreement may contain:

- transitional provisions;

- a list of grounds for changing or terminating the gift agreement;

- procedure for resolving disputes that may arise between the parties in the future;

- various suspensive and disqualifying conditions (more details about them can be found in Article 157 of the Civil Code), etc.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement to a budgetary institution in 2020 - current sample, errors, rules