Who is a co-borrower on a mortgage?

When purchasing an apartment with a mortgage, one person or several may act as a borrower. If a loan is issued for two people, they acquire the status of co-borrowers. Such citizens have equal rights and equal responsibilities regarding the loan. This means that the debt to the creditor must be repaid by both co-borrowers jointly or each individually.

The terms of the loan agreement may provide for a situation where real estate is purchased for only one of the co-borrowers. He will subsequently be registered as the owner of the property. In this case, both co-borrowers are equally liable for the loan debt. Even the one who does not become the owner of the object.

Lender, i.e. the bank has the right to make demands for debt repayment to each co-borrower separately or to both of them simultaneously.

Co-borrowers can be close relatives or legal strangers. It is common for most mortgage transactions to involve spouses. Less often these are parents and children, etc.

If the mortgage co-borrower decides to repay the entire loan debt on his own and the terms of the agreement do not prevent this, he can pay off the creditor and then demand recovery of part of the paid amount from the second co-borrower.

Ownership options and rights of the parties

When assigning a property deduction, they relied on the correctness of the documents. So, how do you need to register real estate in order to be able to get a refund of part of its value? Let's look at all the possible options.

Joint ownership

When purchasing real estate during marriage, the spouses become its full owners. In this case, regardless of whether the co-borrower is registered as the owner, he has the right to count on a deduction from his part, which means half the cost.

On a note!

If the co-borrowers are a married couple, then it does not matter who holds the title to the property or who actually paid the debt. It is important that both of them are equal owners and have the opportunity to receive their part of the compensation.

This is important to know: The Mortgage Law - prospects and features of the new edition of 2020

If the first party to the mortgage agreement is the banking institution itself, then the other participants are the borrower and co-borrowers. The latter have equal rights and responsibilities. They are equally responsible to the bank.

We remind you! You can have your situation assessed by a lawyer - it's free! Call!

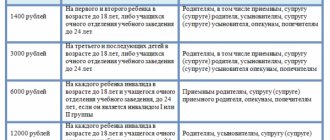

The fact that borrowers designated by the mortgage agreement can act as applicants for a tax deduction is clear. Moreover, the married couple has the right to determine the share of the return. When applying for interest compensation, you can submit any ratio of marital parts, the main thing is to take them into account in the tax return.

In a situation where one of the spouses does not have the opportunity to file a deduction for his part, you can write a refusal. This will allow his other half to reimburse personal income tax for the entire cost of the property, but within the limits. For the principal amount of 2 million, the order is written once and cannot be changed. By percentage, that is, by the amount of 3 million, new proportions can be designated each time. They are taken into account when submitting the annual declaration.

Attention!

The maximum amount is limited to 2 million if it is payment for an apartment and 3 million for credit interest. 13 percent of the agreed limits are subject to refund.

Can a co-borrower receive a tax deduction on mortgage interest?

When purchasing residential real estate, some new owners have the right to receive a tax deduction. Its value is fixed in Art. 220 Tax Code of the Russian Federation. The maximum amount will be 13% of 2 million rubles. The process of providing a deduction when purchasing an apartment is a refund of part of the previously paid income tax. Accordingly, only a person who regularly pays personal income tax has the right to deduction.

If real estate is purchased under a mortgage loan agreement, in addition to the main deduction upon purchase, you can return part of the funds in the form of a deduction for the payment of interest on the mortgage. The maximum possible amount is 13% of 3 million rubles.

The amount of tax deduction depends on:

- amount paid to the bank;

- the amount of income tax paid.

When drawing up a mortgage loan agreement, it may indicate several co-borrowers. As a rule, these are spouses, but not necessarily. In this case, co-borrowers can also receive a deduction for both the main loan and interest payments. Its size and the procedure for registration will depend on the related relationships of the co-borrowers.

For spouses

The Family Code establishes that property acquired by spouses during the period of marriage is recognized as their joint property. Unless they independently determine otherwise by the terms of the written agreement. This means that when spouses purchase an apartment, it is assumed that they spent the funds for the purchase from the general family budget.

Therefore, spouses can receive a joint tax deduction if real estate is acquired as joint property. And it doesn’t matter in this case whether the husband and wife are listed as co-borrowers or not.

But both spouses can receive a deduction for interest only if, according to the agreement, they are co-borrowers. Otherwise, a tax refund is possible only for those who are official borrowers.

When spouses purchase an apartment in joint ownership, if they act as co-borrowers, they are entitled to one deduction for both. But they can distribute them in any proportions at their own discretion or completely arrange them for only one person.

If the co-borrowers are not spouses

The spouse does not necessarily act as a co-borrower on the mortgage. A woman and a man can live together, but not register their relationship. Moreover, the law does not prevent complete strangers from registering as co-borrowers. For example, an employee and his employer.

In this case, each of them can receive a deduction. Moreover, these will be separate tax deductions. Their size will depend on the amount contributed by each co-borrower. But the maximum possible for everyone individually is 2 million and 3 million rubles.

When purchasing an apartment with a mortgage, unmarried co-borrowers can apply for separate tax deductions subject to the following conditions:

- Each of the co-borrowers in the purchased property received their share in the property. And this fact is confirmed by an extract from Rosreestr.

- Each co-borrower pays his or her share of the debt to the bank from a separate account. Even if shares in real estate are allocated to two owners, but only one of the co-borrowers repaid the debt to the bank, only he alone will have the right to receive a deduction on interest and on the principal debt.

What are the requirements

The main requirements for the return of part of the funds imposed by the tax service on real estate buyers:

- The person must be a resident of the state and a personal income tax payer. If there is no permanent job, and, accordingly, no deductions are received from the account, nothing will be returned to you. There will be no refund if tax is paid according to the simplified system.

- Have a share of ownership. In addition to paying the debt, you will need documentation confirming that part of the property is registered in your name. There are amendments in the case where the co-borrowers are spouses, which is discussed below.

- You really need to pay off your debt. Not just be listed in the bank’s database as one of the borrowers, but also deposit certain amounts from your account. Moreover, the amount of payments will depend on the size of the amount (that is, the amount of money spent by the taxpayer on “useful” needs, according to the state).

- The limit has not yet been reached. According to subparagraph 1 of paragraph 3 of Article 220 of the Tax Code of the Russian Federation, you can use the procedure several times when purchasing subsequent apartments, but within certain limits (13% of the amount spent, but not more than two million rubles, that is, the limit is 260 thousand). If the state has not yet returned the money to you for purchasing housing, you can count on this amount. If there was a precedent - for its remainder, if there is one.

- The property is not purchased from a close relative. You will not get anything back when trading with parents, siblings or children. Even with an honest fact of payment to an interdependent seller.

Recommended article: Is it profitable to take out a mortgage for a long term and why?

Answering a popular question: is a co-borrower entitled to a tax deduction on a mortgage if he is not the owner? In general, no, with one exception, which we will discuss below.

Conditions for registration

The answer to the question whether a co-borrower can receive a tax deduction under a mortgage loan agreement will depend on several factors. If co-borrowers are married and bought housing as joint property, they are entitled to one deduction for both, in any case. They can divide the allocated amount in any proportion.

And if the co-borrowers are not married, the following options are possible for them:

- Everyone receives separate deductions corresponding to the value of their share in the real estate, provided that according to the documents, everyone paid their own part of the debt and received a share in the property.

- If only one co-borrower is registered as the owner, and he also paid the loan, the deduction is due to him alone.

- One co-borrower was registered as the owner, but the second one paid the debt. In this case, no one is entitled to a deduction.

- Each of the co-borrowers has their own share in the purchased apartment, but only one of them paid the debt to the bank. In this case, the deduction is due only to the one who paid.

That is, in order to qualify for a deduction, a citizen must receive property in joint or shared ownership and independently repay the debt to the bank.

Compensation amount

The Tax Code of the Russian Federation determines only the maximum deduction when purchasing real estate. The final result will depend on a number of factors. If an apartment was purchased as joint property by spouses, they have the right to a deduction for interest and a deduction for the main agreement.

The maximum amount will be provided only if they paid it as a debt to the bank. Provided that the amount paid was less, the deduction will be calculated from it.

For example, an apartment was bought with a mortgage for 2 million 150 thousand rubles. At the same time, the initial payment amounted to 400 thousand rubles. This means that the main debt to the creditor is 1 million 750 thousand rubles. In this case, the spouses will be returned 13% of this amount - 227 thousand 500 rubles.

The overpayment of interest for the married couple amounted to 1 million 800 thousand rubles, so the deduction for payment of interest on the loan for them is equal to 234 thousand rubles.

In this case, it is more profitable for the spouses to distribute the deduction on the main loan among themselves in any convenient shares. And deduct interest for only one person, if they plan to ever take out a mortgage again in the future.

The fact is that the balance of the deduction on the main loan can be transferred to the next transaction. For example, if the spouses decide to divide 227 thousand 500 rubles. in equal proportions (113 thousand 125 rubles), then each of them will be able to return another 146 thousand 875 rubles upon the next purchase of real estate. every.

And the deduction for mortgage interest does not carry over to other transactions. Therefore, if you register it only in the name of the husband, the wife will be able to receive a deduction for the interest on the next mortgage. And if a deduction for interest is issued for two, under the next mortgage lending agreement, neither spouse can claim a tax refund for interest.

If the acquired real estate is registered in the shared ownership of co-borrowers, regardless of whether they are spouses or not, the amount of the deduction will depend on the amount paid by a particular co-borrower. Naturally with a maximum limit.

For example, a man and woman living together bought an apartment worth 6 million rubles. We registered the property as shared ownership of 50% each. The total overpayment on the loan amounted to 5 million rubles.

Men and women have the right to receive a tax deduction. Under the main agreement, each person is entitled to 13% of 2 million rubles. Plus the amount of interest deduction for each will be 325 thousand rubles. (13% of 2.5 million rubles).

In total, out of 12 million rubles. co-borrowers will return 1 million 117 thousand rubles.

Who can apply for a tax deduction on a mortgage if there are three co-borrowers and one owner?

What is this note under my question? I am still waiting for a qualified answer from your specialist to my question, and not a formal reply. Repeat your question. It feels like we are talking to you, not texting. Or do your experts read questions blindfolded? Very, very disappointed

Opportunities for obtaining a deduction Citizens of the Russian Federation and foreign citizens who legally carry out labor activities in our country and pay tax on personal income have the right to apply for a tax deduction. persons This type of deduction is provided only once in a lifetime, in the amount of 13% of the costs incurred by the applicant in connection with the acquisition of residential real estate, with the proviso that its value does not exceed 2 million rubles. This means that if the price of the purchased residential property exceeds 2 million rubles, 13% in any case will be accrued only on these 2 million rubles, which means that the maximum amount of property deduction will not exceed 260 thousand rubles. It is also important to note that 13% of the present value of housing is returned only if the housing was purchased after 2009; a transaction completed earlier involves calculating a deduction only for real estate, the cost of which is 2 times less than that mentioned earlier. It should also be said that the parent of a child who has not reached the age of majority has the right to claim this deduction. The point is that if the purchased housing was subsequently registered as the property of the children, then the parent also has the right to receive a deduction. The great news for those who purchased their home using a mortgage is that these people are entitled to receive a tax deduction. Moreover, this may apply not only to the cost of the real estate itself, but also to the interest that you undertake to pay to the bank in accordance with the agreement. The optimal amount of interest, which gives the right to provide a deduction, should not exceed 3 million rubles. It must be said that you can apply to the tax office for the due deduction at any time, regardless of when you purchased a home or concluded a mortgage loan agreement. How is the deduction provided? The property deduction for a mortgage can be allocated as a total amount and paid in a lump sum, or it can be paid in fractions. The fact is that the total annual deduction cannot exceed the amount of income tax paid by a certain citizen during the reporting year when the purchase of residential real estate was made. For example, this is housing purchased in 2010 for 2 million rubles, then you should expect to receive a deduction in the amount of 260 thousand rubles. However, if the amount of income tax you paid for this period is no more than 50 thousand rubles, this means that you can only hope for this amount. The remaining money of the accrued deduction will be paid in subsequent years until its entire amount is repaid. If we are talking directly about receiving a property deduction for the interest paid to the bank accrued on a mortgage loan, then they can be paid at a time, but only if the mortgage is fully repaid. If payments on a housing loan have not yet been stopped, then an annual deduction is provided at a rate of 13%, calculated on the amount of bank interest actually paid for the year. The duration of such payments is limited only by the duration of the mortgage loan, as well as by the optimal limit of the amount used to calculate the deduction, which is equal to 3 million rubles, the amount of the deduction itself will be 390.0 thousand rubles. Deduction from interest on a mortgage Those who know first-hand what a mortgage is also know that with a long term of such a loan, you have to pay interest on it, the amount of which is a very “tidy” amount, it can reach up to 3 -x million rubles. If these are the terms of your loan, then know that you have the right to contact the tax authorities located at your place of residence to receive partial compensation for the costs incurred associated with the payment of interest. To receive a deduction, you will first need to contact the bank and get a certificate stating how much interest will be charged to you for the entire period allotted for repaying the mortgage loan, as well as the interest to be paid annually. Based on the received bank document, the total amount of property deduction due is calculated, as well as the amount of compensation broken down by year. It must be emphasized that regardless of whether the interest limit of 3 million rubles has been exhausted, the borrower has the right to provide a mortgage interest deduction only once in his life, and only in relation to a single residential property. But the fact is that since 2014, the legislator has given citizens the right to apply for additional deductions when purchasing a second (subsequent) residential premises, if the first one was purchased after 2009 and its cost was less than 2 million rubles. In this case, the additional charge will be calculated from the residual value of the maximum calculation amount. That is, if the first residential property was purchased for a million rubles, and the amount of the deduction was 130 thousand rubles, then as a result of the acquisition of subsequent residential real estate of a greater value (for example, for 3 million rubles), you can count on the remainder of the maximum deduction amount from the remaining amount, that is, another 130 thousand rubles. Documents provided for calculating the property deduction First of all, of course, you will need an identification document of the applicant. For Russian citizens, this is a passport of a citizen of the Russian Federation, and for foreigners, a passport of a foreign citizen or any document equivalent to such. Declaration (form 3-NDFL) (See How to fill out a declaration (NDFL3) when buying an apartment?). To confirm the withheld amounts of income tax, a certificate of form 2-NDFL is provided; it must be taken from the accounting department of your enterprise (organization, company). It should be said that income tax is paid only from the “white” salary, so if your salary is minimal, get ready to receive a tax deduction in doses over several years. You will also need documents that can confirm the expenses incurred in connection with the purchase of housing: this is a purchase and sale agreement, a certificate of ownership, an act of acceptance and transfer, a copy of the mortgage loan agreement and a bank statement about the interest accrued by the lender. If the property was purchased for children, then official papers will be required that can confirm the borrower’s relationship with them. Deduction through the employer The deduction provides for payment in two options: directly through the tax organization - by allocating the total annual amount, or through the employer through monthly additional payments. How this happens If you plan to use the calculated deduction for a specific purchase, then, of course, a more profitable option is to receive the entire amount at once. In such a situation, it is better for you to prepare the entire set of documents to submit to the tax authority and prepare to wait, approximately 2 to 4 months, for the decision that the tax office must make regarding the provision of deductions and transfer of money. In order to speed up this process, and if you do not have any special plans for these financial resources, you can obtain them at your enterprise. To do this, you will also have to contact the tax office at your place of residence with the mentioned set of documents and receive an order, which must subsequently be provided at the applicant’s place of work. Based on such an order, the employer has the right to exempt you from paying income tax on the income received; the amount will be paid to you monthly as an addition to the basic salary. Its size is calculated very easily - just calculate 13% of your “white” salary. It should be specifically emphasized that this method of paying a tax deduction is possible only before the expiration of a 3-year period from the date of purchase of residential premises. If during this period the accrued deduction amount is not paid to you in full, then in any case you will have to contact the tax authority for its “remainders”, then you can only wait for the receipts. An example of calculating the amount of the required deduction For example, an apartment worth 3 million rubles was purchased under a mortgage program. The mortgage was issued for 15 years, during this period the interest accrued on the loan is 2 million rubles. In such a situation, you have the right to count on a property deduction calculated at a rate of 13% of the cost of residential premises, but not more than 2 million rubles - which is 260.0 thousand, and in addition to this amount another 13% of 2 million ( what was the interest on the mortgage loan) - this is another 260.0 thousand rubles. As a result, the total amount of payment due to you will be 520.0 thousand. The only limitation is that 260.0 thousand rubles for the immediate cost of housing can be paid to you in a lump sum (provided that such an action allows you to withhold and pay income tax). But 260.0 thousand for “mortgage” bank interest will be paid to you throughout the entire lending period (if it is not yet completed). It is important to emphasize that both spouses have the right to return 13% of the amounts paid for the purchase of residential premises, provided that they work and conscientiously pay tax on the income they receive. Persons who do not have the right to receive a property deduction There are categories of citizens who do not have the right to receive such a deduction. These categories include persons: Those who work “unofficially”, therefore, who do not pay income tax; Those engaged in individual entrepreneurial activities and using a simplified or patent tax system; Citizens who have become owners of housing paid for by other persons, as confirmed by documents submitted for consideration (payment orders, checks, etc.); Persons who previously applied for a tax deduction for another or the same residential real estate, the value of which is from 2 million rubles or more, as well as deduction for accrued bank interest. The deduction may also be refused if the applicant provides false information or an incomplete set of documents required to apply for a property tax deduction. In this case, you have the right to deduct from the moment you submit the missing documents or submit correct data. The refusal of the tax authority on other grounds is considered unlawful and can be appealed to higher structural units of the tax inspectorate or to court.

We recommend reading: Confirmation of residence permit in 2020 in St. Petersburg

How to apply for a deduction

To receive a tax deduction, co-borrowers can act in two ways:

- Send your application to your place of work.

- Contact the Federal Tax Service office.

If co-borrowers draw up one joint deduction and intend to distribute it, it is more convenient for them to contact the Tax Service. In this case, you should always wait until the end of the year in which the payment was made and submit an application only from the next tax period.

First, the spouses need to formalize and receive a deduction under the main agreement. Next, interest deductions are provided. If one of the spouses had the right to a deduction in the past and has already used it in full, he is not entitled to a new one. In this case, the entire amount will be returned to only one of them. But if a deduction for the purchase has already been issued, but not for interest, then the spouse does not have the right to a deduction under the main agreement, but they must return personal income tax to him for the interest.

The application to the Federal Tax Service is considered within three months. If the decision is positive, the money will be transferred to the borrowers’ personal accounts in a lump sum within a month.

You can apply for interest deduction every year or accumulate the amount over several years. The right to unspent deduction is not lost throughout your life. But income tax will only be refunded for the three years preceding the filing of the application.

If the deduction is issued at the place of work, you must first obtain a certificate from the Federal Tax Service stating that the applicant is entitled to it. The accounting department of the enterprise considers the application within a month. If the decision is positive, the money is not returned, but is no longer retained in subsequent periods. Those. the borrower does not pay personal income tax until the entire deduction amount is collected in this way.

How to apply for a tax deduction for a co-borrower - step-by-step instructions

It is worth considering how to correctly file a tax deduction so that there is no refusal. It must be taken into account that the status of a co-borrower does not automatically give the right to receive money from the state when making scheduled payments.

Step 1. Collection of necessary documents. It is important that the fact of payment can be confirmed. So, these could be printouts of an account statement or a receipt on which the payer's name is written. If the payment was in cash and the checks are anonymous, then it will not be possible to prove that it was the co-borrower who spent the money.

Collection of necessary documents

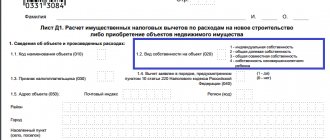

Step 2. Filling out the 3-NDFL declaration in accordance with all requirements. It is not difficult to fill out, so there is no need to pay someone else for this service.

Filling out the declaration

Step 3. Providing documents to Federal Tax Service employees.

Provision of documents

Step 4. Conducting a desk audit and making payments in accordance with the requirements of the law.

Carrying out a desk audit

Thus, getting a tax deduction is not difficult . It is only important to make sure that all documents have been provided to the Federal Tax Service employees. You can get advice by calling the hotline to find out what is required in a particular case. However, the list of documents is standard. If a refusal comes for some reason, an explanation is always provided. This allows you to correct the situation and submit a request for a tax deduction again.