Is it possible to challenge a deed of gift and who has the power to do so?

A deed of gift for an apartment is a legal document certified by a notary. Thanks to such a document, the first person can transfer any valuable item free of charge to another person without obligation. The subject of the gift agreement is considered a kind of “gift” that can be “given” not only to relatives, but also to a complete stranger. At the same time, it is almost impossible to challenge the transaction, with the exception of certain significant conditions that indicate the impurity of the transaction. In addition, read how to draw up a deed of gift for an apartment.

The gift agreement may have a delay in legal force. In order to avoid sudden termination of the transaction, it is important to indicate in the contract when the document will begin - immediately after execution, from the beginning of the specified date, or after the occurrence of some event. After specifying the date, the contract must be certified and registered.

This document must be signed by both parties and must have legal force (certified by a notary). In the same way, the deed of gift can be terminated peacefully. If both parties were unable to mutually agree to break the deal, then only the court can help resolve the dispute (cancel the deal).

The official document on the termination of the deed of gift is drawn up in the same form as was originally drawn up when making a gift. If the recipient decides to refuse the gift, then an official refusal of the gift should be drawn up. Then there is no need to draw up a peace agreement to terminate the deal.

The following persons can terminate the gift agreement:

- Persons involved in the transaction (donor and donee).

- Persons interested in the cancellation of the transaction. Mostly these are relatives and friends of the donor.

- Court (in cases of suspected fraud or detection of errors).

Reasons for challenging a transaction

It is very difficult to challenge a gift agreement, but it is possible. To do this, the initiative must be taken by:

- Donor.

- If there is a threat to the life of the donor or his relatives from the recipient. You can prove it with honey. a certificate indicating beatings and other bodily injuries, or collect other supporting documents.

- If the recipient does not appreciate the gift: he does not take care of the apartment, he causes pogrom and destruction there. All actions that lead to a deterioration in the condition of the donated apartment can be a serious reason for termination of the contract (but only in court and upon presentation of evidence).

- The donor can challenge the agreement if he has sudden financial difficulties, for example, his only home has disappeared.

- The donee. Under any circumstances, at any time, the recipient may refuse the gift. To do this, he needs to notarize and certify the waiver of the deed of gift. After the refusal receives legal force, the donee no longer has any rights to the property (apartment) previously donated to him. The return of the apartment must be immediate and in the same condition as when donated. Any deterioration of the apartment may entail unexpected material costs (if the donor complains to the court). In this case, you will have to restore the original appearance of the home at your own expense (if the property has been damaged).

- Government bodies. In this case, the consideration will be carried out exclusively in court. The reasons may be illegal transactions. Checks are carried out by the prosecutor's office and the investigation. If state The authorities will be able to prove the illegality of the transaction, then it will be unilaterally canceled and the person who violated the law will be held accountable.

Grounds and reasons for terminating a gift agreement in 2020

Since the gift agreement represents a special category of agreements, in order to terminate the transactions the plaintiff must have good reasons, which are provided for by the current Russian legislation. Thus, in 2020, both general and special grounds for termination of the contract can be applied to legal relations under deed of gift.

Important : The grounds of the first type today include recognition of the transaction as invalid, while special grounds include the donor’s refusal to fulfill the agreement and the recipient’s refusal to accept the object of the transaction under the conditions determined by the legislator for such situations.

It is worth noting that the grounds for terminating a real deed of gift are formed only after the completion of a gift agreement, and for terminating a consensual agreement or a promise of a gift agreement, it is enough to record a violation of the terms and conditions during the transaction.

At the same time, the grounds for recognizing the gift agreement as invalid must actually precede the conclusion of the agreement or appear upon signing the deed. Simply put, in this case there must be direct violations of the conditions and procedure for making a donation established by the legislator.

General grounds for invalidating a gift

In our last article, we mentioned that, despite its ambiguity, a gift agreement refers to bilateral transactions. Therefore, in order to recognize a deed of gift as invalid, the general grounds established in Articles 166-178 of the Civil Code of the Russian Federation can be applied. For example, Article 166 of the Civil Code of the Russian Federation defines 2 types of invalid transactions:

- voidable transactions;

- worthless transactions.

Important : Agreements that are invalid due to violation by the parties of established legal norms are initially void and can be canceled without a court decision, in contrast to voidable transactions, which can be terminated only after the relevant court decision is made.

Articles 168-179 of the Civil Code establish a list of general grounds, the presence of which leads to the invalidity of a transaction. We invite you to consider the most important of them, as well as familiarize yourself with the grounds that relate directly to gift agreements:

- the transaction is imaginary and concluded for show;

- the agreement was concluded to cover up another agreement (the so-called sham gift agreement);

In the 2 listed cases, the parties to the transaction do not have the goal of implementing legal relations that correspond to the gift agreement.

An example of a sham transaction is a situation where a legal entity or individual makes a donation, wanting to avoid confiscation of property by creditors. Thus, the donor enters into a deed of gift, initially intending to “circumvent” the rules established by the legislator and has no intention of transferring the property to the donee.

In Article 170 of the Civil Code one can find the definition of the above-mentioned transaction as void. The same will be considered as a gift agreement, with which the parties cover the purchase and sale.

- the deed of gift contains a condition that the object of the donation will be transferred to the donee after the death of the donor (3 paragraph 572 of the article);

Using a gift agreement to transfer property or rights after death is unacceptable! For these purposes, the law provides for a will.

- the gift agreement was concluded with errors or violations of form, subject or content.

Everything is clear here. Let us only note that an example of a violation of the form of a deed of gift may be the choice by the parties of an oral form of a gift agreement for objects, the ownership of which must be officially registered without fail. A void contract, for example, will be an agreement in the content of which there will be no designation of a gift (according to paragraph 2 of Article 572 of the Civil Code).

Also, it is worth considering categories of citizens who cannot, according to the provisions of Articles 575 and 576 of the Civil Code of the Russian Federation, act as parties to the donation:

- for the receiving party (donee) - citizens who are prohibited by law from accepting gratuitous gifts in connection with the performance of their official obligations or due to other factors related to their professional activities (employees of social services, educational, educational, medical institutions, as well as government employees and etc.);

- for the party transferring the gift (donor) - to citizens who are limited in making a gift and to persons who are prohibited from making gifts to others (for example, legal entities in transactions in which the gift is property belonging to them by right of economic or operational management, if these persons have not received the consent of the real owner of this property, etc.);

- legal entities engaged in entrepreneurial and commercial activities in relations with each other;

Important : An actual violation of the deed of gift may be the presence in the content of the gift agreement of a counter-provision or the presence of an indication in it that the promise of a gift is conditional on the mandatory fulfillment of some obligation on the part of the donee.

- the transaction of gratuitous donation was made by a person limited in legal capacity or completely incompetent (Article 171 of the Civil Code of the Russian Federation, as well as Article 176 of the Civil Code of the Russian Federation) or by a person who, at the time of the transaction, was in a state that did not allow him to understand the situation and/or direct his own actions ;

- the deed of gift was concluded through a mistake by one of the parties (Article 178 of the Civil Code of the Russian Federation) or under the influence of threats, deception and other negative circumstances (according to information from Article 179 of the Civil Code of the Russian Federation).

EVERYONE NEEDS TO KNOW THIS:

Donation of residential premises

Termination of a deed of gift at the initiative of the donor

In 2020, termination of a gift agreement at the initiative of the donor becomes possible exclusively on special grounds, implying the complete cancellation by the donating party of the executed deed of gift or the donor’s refusal to fulfill the obligations that he was supposed to fulfill based on the contract of promise of gift.

Thus, unilateral cancellation of a donation, in accordance with the provisions specified in Article 578 of the Civil Code of the Russian Federation, can be carried out in the following 3 cases:

- if the donee dies before the party who gave him the gift and this clause was agreed upon by the parties and is present in the content of the contract;

- if the donee does not properly care for the property donated to him, as a result of which it may be damaged (lose its properties) or completely destroyed (in this case, the donated property must have great intangible value for the donor, of which the donee must be aware);

- if the donee has made an attempt on the health or life of the donor himself or his close relatives.

The list of grounds established for refusal to fulfill a promise of gift agreement is contained in Article 577 of the Civil Code of the Russian Federation. Let's look at them:

- as a result of the transaction, the donor’s health, family or financial situation has significantly deteriorated, which will definitely reduce the quality of his standard of living;

In this case, it is very important that any of the changes described above occur as soon as possible after the conclusion of the deed of gift.

- If the donee has committed any illegal actions in relation to the donor himself, a list of which can be found in paragraph 1 of Article 578 of the Civil Code of the Russian Federation.

It is worth noting that, since the donor’s fault under these circumstances is excluded, the legislator completely exempts this person from compensation for damage to the donee (Clause 3, Article 577 of the Civil Code of the Russian Federation). At the same time, termination of a gift agreement if the donor refuses to fulfill his obligations is regulated on these grounds by Articles 451-453 of the Civil Code of the Russian Federation.

In addition, the legislation in force in 2020 provides for another basis, the presence of which allows the donor to refuse obligations regarding the transfer of a gift under a deed of gift - the destruction of the object of the transaction itself, a ban on its use at the legislative level, or the withdrawal of the gift from civil circulation.

Termination of a gift agreement at the initiative of the donee

Unilateral termination of a deed of gift at the request of the donee today becomes possible in the only case - if he exercises his right to refuse to accept the gift offered to him (Article 573 of the Civil Code). However, this person can exercise this right only if the gift agreement contains the donor’s promise to transfer the specified gift within a specified period. Simply put, the recipient can refuse the gift before accepting it.

In paragraph 2 of Article 573 of the Civil Code of the Russian Federation, a rule is established for making such a refusal at the initiative of the donee. Its essence is as follows:

- If the object of the gift is real estate, transactions with which require mandatory re-registration of ownership, refusal to accept such property also requires state registration.

- If the agreement was concluded between the parties in writing, the refusal must also be made in writing.

How to invalidate a transaction

Check for errors. The deed of gift will have legal force even if it is drawn up in writing without the participation of a notary. In such cases, errors are often made when drawing up a document (in the text of the contract or during registration).

Mostly mistakes are made when drawing up the terms of the contract. Sometimes the contract specifies conditions related to a material nature. Such a document can be challenged without any problems, since the gift agreement does not imply any monetary payments.

Also, a deed of gift is invalid if it contains a condition indicating that the apartment will be donated only after the death of the donor.

Gift without the consent of the spouse. This option includes a place of residence that was directly acquired jointly, i.e., in marriage. In this case, if one of the spouses did not consent to the execution of a deed of gift for the apartment, the transaction is considered invalid.

An example of a spouse's consent to donate an apartment.

Confirm the inadequacy and incapacity of the donor . It is considered the most popular method of challenging this type of transaction. Most often, the following are confirmed as incompetent: elderly people, disabled people, alcoholics, drug addicts. Less commonly, temporary incapacity can be attributed to people who have been subjected to hypnosis and psychological influence. The only way to prove the donor’s incompetence is to confirm it with a doctor’s report and collect as much evidence and witnesses as possible.

If the guardian, on his own behalf, donated property to a minor or incapacitated ward. Such transactions are against the law and are deprived of legal force.

Donating an apartment as a thank you to an employee for his professional activities. This type of transaction is considered not only invalid, but also illegal. Medical workers, social workers, civil servants, municipal workers and other persons on whom the donor depends do not have the right to accept gifts of not only apartments, but also other material assets.

Donation of a commercial direction (in favor of a legal organization). The ban was put in place solely to prevent fraud. But there is an exception - a deed of gift covering a debt is considered an acceptable procedure. The main condition is that the donor does not receive any material benefit from his gift.

Prove that the owner is forced to donate the apartment . This process is also considered popular, but at its core it is one of the complex court cases. Proving coercion is very difficult, especially if there are no witnesses.

Take, for example, a seemingly loving and caring grandson who suddenly attacked his grandmother with threats and forced her to write a deed of gift for a second apartment. After a while, the grandmother pulled herself together and filed a lawsuit to declare the transaction invalid due to coercion.

The grandson stated that the grandmother, out of spite, decided to take the donated apartment back. The old woman was a complex person by nature, and when questioned, the neighbors sided with her grandson, saying that the woman had always been greedy and capricious. As a result, the court sided with the grandson, and the poor grandmother lost her second apartment. Conclusion: the grandmother, unknowingly, did not collect significant evidence (although she could have) and lost the trial.

If the donor was misled. The donee can trick the donor into signing a gift deed. For example, under the pretext of signing another document. Most often, people who are gullible or have vision problems are susceptible to deception. In this case, a loved one can easily provide the donor with a deed of gift in the form of consent to treatment in a boarding house. The donor will sign all the documents without even thinking that this is a fraud.

It is possible to terminate such a transaction in court if the documents were not certified by a notary. Otherwise, the transaction remains in force, since the notary must explain the essence of the agreement to both parties and read the rights and obligations of each party.

Fraud. Under such circumstances, the court will have to prove that the transaction, formalized in the form of a gift agreement, was in fact a cover for a transaction of a different type. In this case, the interested party will have to prove that the donor received material benefits from the transaction. If you do not provide significant evidence, it will be impossible to invalidate the transaction.

Limitation periods

The statute of limitations is understood as the period during which the person who donated the apartment (donor) has the right to go to court for the protection of his rights established by law that have been violated. The legislation does not have any special period specifically for the cancellation of a deed of gift, and therefore the general rule regarding the statute of limitations for a deed of gift applies here.

For a voidable transaction, the limitation period is one year and it begins to run when the plaintiff learned or could have learned about facts that could be grounds for invalidating the contract.

For a void transaction, the statute of limitations is 3 years and begins to run from the date of signing the gift agreement.

However, even if the limitation period is missed, the party still has the right to file a statement of claim if the plaintiff substantiates the reasons for the untimely filing. In particular, these include emergency circumstances. Then the judge must accept the statement of claim for proceedings, despite the missed statute of limitations.

The practice of court decisions regarding the revocation of deeds of gift is varied, but more than 50% of disputes are related to imaginary transactions: purchase and sale are often hidden under deeds of deed of gift. Also, a large number of disputes are associated with the execution of a deed of gift under duress, while intoxicated, or in an inadequate state.

Litigation in such cases lasts quite a long time, since it is very difficult to prove this fact. The evidence may include witness statements, various medical records and extracts from them, doctors’ opinions, photographs, videos and various others.

A package of documents for challenging a deed of gift for an apartment

If the deed of gift is disputed peacefully, without trial, then it is enough to have the following documents with you:

- Refusal of deed of gift. Certified and registered.

- Document confirming ownership.

- Donation agreement.

- Passports.

- Agreement to terminate the contract.

A package of documents if the deed of gift is contested in court:

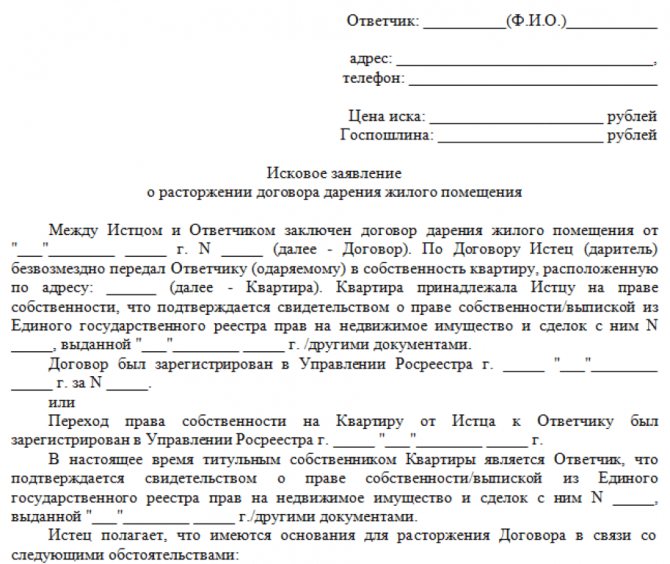

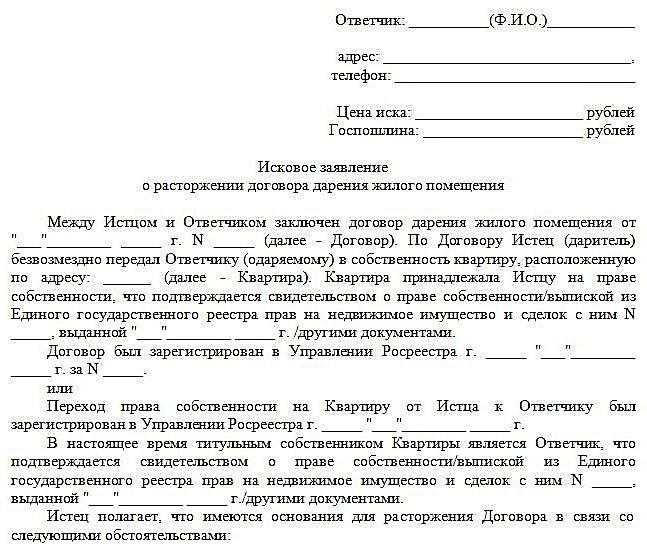

- Statement of claim for termination of the gift agreement.

- Donation agreement.

- Passport.

- Certificate for the apartment.

- Copies of the above documents.

An example of a statement of claim for termination of a contract.

Termination procedure by agreement of the parties

In the event of mutual agreement to terminate the gift agreement, the following procedure is established:

- Collection of documents.

- Drawing up an agreement to terminate the gift agreement.

- Contacting a notary to certify documents.

example of an agreement to terminate a deed of gift.

The procedure for terminating a gift agreement in 2020

In addition to the methods described above, today citizens can terminate a gift agreement voluntarily if the parties are unanimous in their decision to terminate the gift deed. This procedure will require the presence of a notary and his certification of the termination of the transaction. But unilateral termination of the deed of gift in 2020 is possible only after receiving the appropriate court decision.

As we mentioned above, the grounds for termination of such transactions are defined at the legislative level. Thus, general rules are contained in Article 29 of the Civil Code of the Russian Federation, and special rules are regulated by Articles 577 and 578 of the Civil Code of the Russian Federation.

If there are several grounds for terminating the gift agreement, it is recommended to apply all the reasons, which will allow you to more convincingly and comprehensively describe the current situation and increase the chances of obtaining the solution you need.

Voluntary procedure for termination of deed of gift

Voluntary termination of a deed of gift is possible upon certification of the cancellation transaction by a notary. Moreover, if the object of the gratuitous donation was real estate, which, according to the current legislation, is subject to state registration - after the agreement on termination of the gift agreement is notarized, the parties need to collect all the necessary documents (be sure to attach to them a receipt for payment of the state donation fee !), and then arrange a reverse re-registration of property rights with the state registration authority.

It is worth noting that in the event of a donor’s refusal to fulfill the obligation to transfer a gift or the donee’s refusal to accept a gift under a promise of gift agreement, better known as a consensual gift agreement, the agreement will be considered terminated only after the will of one of the parties, which must be drawn up in writing .

In addition, the legislator today provides for the cancellation of a gift based on a notary-certified application from the donor to the recipient. In 2020, this becomes possible in the following cases:

- intentional harm to health or attempted deprivation of life (according to paragraph 1 of paragraph 1 of article 578 of the Civil Code);

- manifestation of malicious ingratitude by the recipient towards the donor or his close relatives;

Important : It is worth noting that the grounds stated by the plaintiff must be confirmed by a court decision in a civil case or a similar decision in criminal proceedings.

- the donor outlives the donee, and the content of the gift agreement contains a clause on the termination of the deed of gift upon the occurrence of such circumstances (4 paragraph 578 of Article of the Civil Code of the Russian Federation).

EVERYONE NEEDS TO KNOW THIS:

Parties to the gift agreement: rights, obligations, prohibitions

At the same time, the termination of an initially void gift agreement, according to the legislation in force in Russia in 2020, does not require the above-mentioned court decision, although, based on the practice of lawyers of the Legal Aid website, we can conclude that the majority of such terminations of transactions still occur in court order, since 95% of recipients do not want to voluntarily return the gifts they received on a voluntary basis.

Judicial procedure for terminating a gift agreement

If one of the parties refuses to terminate the gift agreement voluntarily, you can try to challenge the gift deed in court by filing an appropriate lawsuit. However, for this, the plaintiff must “have in hand” compelling reasons that he will need to prove in court.

We remind our readers that only one of the parties to the transaction can terminate the deed of gift for special reasons. At the same time, in court, the former owner of the property (donor) may demand the cancellation of the deed of gift, according to the grounds specified in paragraph 2 of paragraph 578 of the article, the essence of which is the inappropriate attitude of the donee to the property received as a gift, which may be damaged or irretrievably lost as a result .

The judicial procedure for terminating such transactions is explained by the need to establish the facts and circumstances stated in the claim, which act as legal grounds for terminating the gift agreement, since the versions of the parties, as a rule, differ and the court needs to resolve the dispute based on indisputable facts.

However, there are 2 special cases when persons who did not participate in the transaction can file a similar claim with the court:

- If the donor is a legal entity or a person engaged in entrepreneurial activity who has completed a transaction in violation of the Federal Law “On Bankruptcy (Insolvency)”. That is, a person who donated property benefits within 6 months before he declared himself bankrupt, which are related to his commercial activities (3 paragraph 578 of Article of the Civil Code of the Russian Federation).

In such situations, the right to file a claim for termination of the deed of gift in court can be exercised by persons acting as creditors of the donor or representatives of government agencies whose purpose is to exercise control over commercial activities.

- If the donor was deprived of life by the donee (2 paragraph 1 of clause 578 of article 578 of the Civil Code).

Important : It is also worth noting that both voidable deeds of gift and initially void ones are subject to termination in court. Thus, not only the parties to the contract, but also any citizens interested in this, whose interests and rights were violated as a result of concluding an unlawful transaction (in the cases described in paragraph 3 of paragraph 166 of the Civil Code of the Russian Federation), have the right to demand the application of appropriate consequences to void contracts.

In addition, other persons can also make demands to terminate a voidable gift agreement, a full list of which can be found in paragraph 2 of Article 166 of the Civil Code of the Russian Federation. For example, according to paragraph 3 of Article 572 of the Civil Code of the Russian Federation, a deed of gift containing a condition for the transfer of the gift after the death of the donor is recognized as void, and the right to challenge it is given to the donor’s heirs by law, due to the fact that the property donated by him must become part of the so-called inherited mass , after which it should be distributed in parts established by the legislator among all heirs.

The right to challenge a gift transaction that was made by an incapacitated person, or a citizen who was subsequently recognized as such, has the legal representatives, as well as trustees and guardians. To do this, they are required to present to the court documents that confirm the grounds for termination of the deed of gift (for example, a certificate stating that the donor has a mental disorder), in accordance with Article 171, as well as the information set out in paragraph 2 of Article 177 of the Civil Code of the Russian Federation.

Also, a legally capable donor who, at the conclusion of the transaction, was in a state that prevented him from giving an account of his actions, or persons whose rights were violated by such a transaction (Clause 1, Article 177 of the Civil Code of the Russian Federation) can demand that the deed of gift be declared invalid in 2020.

The procedure for termination in court

If it is not possible to resolve the problem with the deed of gift peacefully, then the last and most effective way remains is to go to court. The procedure for going to court should be as follows:

- A person who wishes to challenge a gift agreement must draw up a statement of claim and only then apply this document to the court. Don't forget to pay the state fee. For a more correct and clear drafting of the claim, you can seek help from a lawyer or ask for advice from a notary.

- Next, you need to collect a complete package of documents and evidence. The main thing is to remember that the more and more powerful the evidence, the greater the chances of winning the trial. All certificates, checks, reports are the main assistants in the matter.

- Get witnesses who can legally support you in court and provide facts.

- The statement of claim must be at least two copies (the exact number depends on the number of participants in the transaction itself).

- After accepting the documents and drawing up the case, after 5 days the judge issues a ruling.

- If the situation is complex, the decision may take longer. Depending on the quality of the evidence provided, a specific decision will be made.

- If the court decision was not in favor of the plaintiff, then it is possible to challenge the court decision and appeal to the court of appeal.

- When the court sided with the plaintiff, all that remains is to wait for the date the decision comes into force and submit documents for re-registration of the apartment.

How to cancel a gift agreement: step-by-step procedure instructions

In all of the above situations, the donor should go to court to terminate the contract and subsequently return the donated apartment. When applying, you should take into account the statute of limitations, collect the necessary evidence and draw up a statement of claim.

Requirements for the content and form of the statement of claim are contained in Art. 131 of the Civil Procedure Code of the Russian Federation.

In the application itself you must indicate:

- the name of the court to which the claim will be filed;

- data of the defendant and data of the plaintiff;

- competently stated circumstances of the conclusion of the deed of gift, the grounds for cancellation of the gift agreement;

- if it is necessary to comply with the pre-trial settlement of the conflict, information about it must be provided;

- a list of documents required as attachments to the application (this is a copy of the deed of gift, a document confirming payment of the state duty, etc.).

In addition, in the statement of claim, indicate your coordinates - this can be an email address, telephone number, etc. The statement of claim must be signed personally. An application is submitted in the number of copies corresponding to the number of persons participating in the case.

After the procedure for accepting the case for proceedings, the judge must, within five days, issue a decision to initiate a civil case.

However, the court may not consider the application; if such a claim has already been considered and there is a corresponding decision, then the application may be refused.

The judge has the right to return the claim due to non-compliance with the procedure for pre-trial dispute resolution, or the plaintiff is found to be incompetent or his signature is missing; the case where the plaintiff has decided to withdraw the application is also subject to return, but this is only possible until the case has not yet been accepted for proceedings .

An example of a statement of claim for termination of an apartment donation agreement.

How to terminate a donation agreement for a share of an apartment

A deed of gift can be issued not only for the apartment as a whole, but also for its part (share). The donor can only be the owner of the share. But even in this case, there are often problems associated with the desire to terminate the gift agreement for a share in the apartment.

The procedure for terminating a deed of gift for an apartment share follows the same procedure as for an entire apartment. The only difference is the mandatory consent of all shareholders of the apartment to donate a share from the donor to the donee. If at least one shareholder does not give his consent, the transaction will be considered impossible. And if you still managed to complete the deal, then it will be possible to challenge it in court without any problems.

The consent of the shared owners of the apartment to carry out the transaction must be certified (possibly through a notary) and contain the signatures of all parties.

What form of gift agreement is appropriate in 2020

So, the form of deed of gift in 2020 directly depends on the following factors:

- transaction value, that is, the actual cost of the donated object acting as a gift;

- subjective composition of the parties to the donation;

- type of gift.

We remind you that the gift agreement today can still be concluded both in written and oral form.

In this case, most often, an oral agreement is used in transactions, the object of which is ordinary gifts of small value and property that does not require mandatory state registration, which, for example, includes real estate or vehicles.

In this case, the donation can be made both through the direct transfer of a gift from the donor to the recipient, and through a symbolic transfer (for example, transfer of documents for donated household appliances). Thus, the donation of movable property under a real contract can be made orally, if for this type of property the legislator has not established a mandatory procedure for registering the ownership rights of the new owner.

EVERYONE NEEDS TO KNOW THIS:

Individual entrepreneur gift agreement: conclusion of a deed of gift between individual entrepreneurs, individuals and legal entities

Exceptions may be cases when a legal entity acts as the giving party in a gratuitous donation transaction, and the total market value of the gift exceeds the threshold established by the legislator of 3,000 Russian rubles (according to the information provided in paragraph 2 of Article 574 of the Civil Code of the Russian Federation) .

Also, it is worth noting that the majority of practicing lawyers (including specialists from the Legal Aid website) consider oral deeds of gift to be problematic. This is confirmed by statistics according to which most of the claims related to the termination of gift agreements were concluded orally by the parties to the transaction.

Important : Based on the information specified in paragraph 3 of Article 574, as well as in Article 131 of the Civil Code of the Russian Federation, all gift agreements (both real and consensual) whose object is real estate must be concluded exclusively in writing. The reason for this is the fact that this type of property requires mandatory re-registration of ownership. In addition, according to paragraph 2 of Article 574 of the Civil Code, all gift transactions that contain a promise of donation must be formalized in writing.

If, by deed of gift, the donor transfers free of charge to the donee a transfer or claim of a debt (from the donor to the donee), then this transaction must be completed in accordance with the form indicated by paragraph 1 of Article 389 of the Civil Code of the Russian Federation for the assignment of a claim, or by paragraph 2 of Article 391 of the Civil Code RF for the transfer of debt obligations.

At the same time, a real gift agreement for debt forgiveness, the purpose of which is to free the donee from debt obligations to the donor, can be concluded in a free form.

Deadlines

The law establishes that filing an application to invalidate a gift agreement transaction is established for a period of no later than 3 years, starting from the moment the party discovers a violation of its rights. The limitation period for deeds of gift is of two types:

- On declaring a transaction invalid – for a period of no more than 3 years.

- Termination of the contract – for a period of no more than 1 year.

It is important to understand that after the deadlines established by law, it will be problematic to launch a case to liquidate the gift agreement transaction. Exceptionally compelling reasons with full evidence can be considered by the court after a delay.

After filing a claim in a timely manner, the court will accept all your documents for consideration. Within 30 days, the court will schedule a hearing on your requirements. The deadline for resolving issues depends solely on the complexity of the case and the prevailing circumstances.

How to cancel or terminate the donation of a share in an apartment through the court

The forced procedure for terminating a contract is somewhat different from the previous option. The plaintiff needs to carefully study the provisions of the contract. If the document contains grounds for unilateral termination of contractual relations, then they must be reflected in the statement of claim. If the agreement does not contain anything like this, then you should turn to the law. For example, an agreement can be challenged due to the commission of a crime against the donor or the death of the recipient.

Procedure

Algorithm of actions of the plaintiff:

- Preparation of documents.

- Filing a claim in court.

- Participation in legal proceedings.

- Obtaining a court decision.

- Re-registration of property rights.

If the initiators of the legal proceedings were the donor's legal successors, then after the court decision is made, his property is included in the inheritance. The procedure for inheriting the assets of a deceased subject is determined by law.

Procedure

The claim is filed in the district court at the defendant’s place of residence. If its address differs from the location of the apartment, then the link goes to the property. Written evidence of the stated claims is attached to the claim. Otherwise, the court will refuse to satisfy the claim. The plaintiff will have to attend the hearing in person or have a lawyer present. Based on the results of the trial, the court will make an appropriate decision. The parties are given a month to appeal. After the expiration of the period, the procedural document gains force. If the court's decision is positive, then the defendant will have to return the property or its value. If the court denies the claim, the plaintiff is left with nothing.

If an appeal is filed, the procedural document gains force based on the results of its revision. The court decision comes into force on the day it is announced by the panel of judges.

Statement

When preparing a statement of claim to challenge a gift agreement, you must be guided by the provisions of the Code of Civil Procedure of the Russian Federation. Failure to comply with the established form may lead to the immobilization of the claim. A standard sample can be downloaded from the website. However, without specialized education, it is advisable to use the services of a lawyer. He will study the factual circumstances of the case and transfer them to paper. Below is a sample document:

How many copies of the statement of claim should there be? The plaintiff must proceed from the number of participants in the trial.

If there are two participants (plaintiff/defendant), then three claims must be filed. One copy will be for the court.

Documentation

The grounds for termination of the transaction may be specified in the gift agreement or the law. The list of documents depends on the actual situation. For example, the recipient committed a crime against the donor or the owner of the property did not understand the consequences of his actions at the time of signing the agreement. Basic papers:

- A copy of the plaintiff's passport.

- Extract from the medical history.

- Results of forensic psychiatric examination.

- Resolution to initiate a criminal case.

- Court verdict in a criminal case.

- Certificate of inspection of residential premises by authorized persons.

- Photos, video materials.

- Other written evidence.

The list of documents is not exhaustive. More detailed information can be obtained from a specialized lawyer.

Expenses

When filing a claim of a property nature, but not subject to assessment, a fee of 300 rubles is withheld. (Article 333.19 of the Tax Code of the Russian Federation).

Additional costs may be caused by the participation of a lawyer, calling witnesses, filing an appeal against the decision of the first instance court.

Deadlines

The mandatory procedure for terminating transactions largely depends on the statute of limitations. Missing it may result in denial of claims. The statute of limitations for voidable transactions is 1 year ( Article 181 of the Civil Code of the Russian Federation).

The countdown of time begins from the moment of termination of the circumstances under the pressure of which the agreement was concluded (threat, violence).

Claims to declare a transaction void are filed within three years . A similar period is established for filing an application for application of the consequences of the invalidity of a void contract.

If necessary, the question of extending the deadline for protecting the violated right can be raised. For example, if the plaintiff was ill for a long time, studied or lived abroad, or was on a long business trip (Article 205 of the Civil Code of the Russian Federation).

Consequences of termination

When the court sides with the plaintiff, the donee is obliged to return the apartment to the donor. But sometimes it happens that the other party (the recipient) remains offended, because a valuable gift has to be returned. In this case, it happens that the losing party tries to sell the donated property or seeks to destroy it as much as possible (set it on fire, cause a pogrom, break walls, damage furniture or repairs).

If such dirty tricks took place, the donor must record the damage caused and prove that everything was in order during the transfer of property. The court will definitely side with the plaintiff and oblige the former donee to restore the original appearance of the apartment, or to cover all the costs of restoring the returned donated property.

To consolidate the information received, we suggest watching a useful video with lawyer Oleg Sukhov about the termination of a gift agreement:

It is quite possible to terminate a gift agreement; it is important to have a compelling reason that complies with the laws of the Russian Federation, collect the necessary package of documents and have with you all the evidence that you are right. The easiest way to cancel a deed of gift is to come to the agreement of both parties. Otherwise, the problem will be decided by the court.