The concept of donation and subjects of the procedure

A gift agreement of the Civil Code of the Russian Federation implies a transfer of rights to property without mutual financial interest. It is issued exclusively in written form. The owner acts as the donor, and the new user acts as the donee. When it comes to property worth more than 3,000 rubles, a written agreement must be drawn up.

The document itself is usually called a deed of gift. The Civil Code does not provide for documentary recording of a transaction for an amount less than three thousand.

Who can be a donor?

Individuals and legal entities are allowed to transfer the right to property or donate an object, thing, property share, etc. The law says: ordinary citizens must be legally capable and of full age.

There are some restrictions for certain categories:

- Children under 14 years of age, as well as citizens suffering from mental disorders, cannot give objects and things worth more than 3,000 rubles, since a written agreement is required. Parents and guardians act in their interests, however, according to Article 575 of the Civil Code of the Russian Federation, representatives do not have the right to give anything valuable on behalf of the owner.

- Minors from 14 to 18 years of age and people partially limited in legal capacity can dispose of their property at their discretion. Gifts such as real and personal property are only permitted with the written permission of the legal guardians.

- A married person has free disposal of personal property. To transfer property acquired jointly during marriage, the consent of the second spouse is required, in writing, certified by a notary.

Fact

For organizations, only one condition for such an agreement is determined - the absence of commercial gain. A legal entity does not have the right to make gifts to other legal entities for the purpose of obvious or hidden profit.

Restrictions

A gift agreement under the civil code cannot be concluded if there is any legal restriction on the implementation of this transaction.

There are the following prohibitions on the donation procedure:

- if the transaction is planned to be carried out by commercial structures;

- conducting a transaction on behalf of minor children or incapacitated persons, including by legal guardians or representatives;

- if the recipients are civil servants, employees of social, educational and medical structures, if the donation is related to the performance of their official duties.

There are also certain restrictions that are imposed during the donation procedure. This applies to the property of legal entities, common joint property, as well as representative offices.

As for legal persons, then we mean the possession of property not as a result of the presence of proprietary rights, but as a result of the presence of the right of economic management or operational management. In such a case, property can be donated by the structure only if the owner gives his consent.

If we are talking about joint ownership of property, the donor must obtain consent to the gift from all other owners.

Donating an apartment to a close relative is exempt from tax by law. The reasons for canceling an apartment donation agreement can be found in the information in this article.

If the interests of one of the parties are represented by a trustee, the power of attorney issued in his name must contain accurate information about the person who receives the gift and information about the subject of the gift. Otherwise, the document will be considered void.

Rights and obligations of the parties

The current version of the Civil Code of the Russian Federation indicates the emergence of legal relations when donating. The transferor of the gift must:

- Take into account the interests of all shared owners of real estate; the share must first be officially allocated;

- Transfer the property to the new owner;

- Hand over title documents or symbolic objects, for example, keys to an apartment, jewelry;

- Compensate for losses or damages, if any.

This is also important to know:

Donating a share in an LLC: what is important to know when donating a share to another LLC participant, relative or third party

The previous owner has the right:

- Refuse the gift;

- Indicate additional conditions, for example, caring for his health, keeping the donor’s pet;

- Expect to live in the living space for life without ownership rights.

The recipient under the gift agreement has the rights and obligations:

- The donee may accept or refuse a gift in the form of real estate;

- Has grounds to demand performance of the contract in the future if there is a clause on the time of transfer of the object;

- May demand compensation for damage if it was caused by the donor’s refusal to fulfill his duties;

- Obliged to pay taxes and make payments as a law-abiding owner of the property.

Rights of the donation parties under the Civil Code of the Russian Federation

There must be two parties involved in a donation: the donor, who owns the thing being transferred, and the donee, the one who, as a result of the transaction, will receive at his disposal a certain thing or property rights.

Legal or physical persons can act as parties to the donation, if the legislation does not provide for any restrictions in relation to them. The Civil Code has separate articles that impose prohibitions and restrictions on donations (Articles 575, 576 of the Civil Code).

When a gift transaction is concluded, its participants acquire a certain set of rights and obligations. So, for example, the donor has the obligation to transfer the object to another person. In addition to this obligation, additional secondary obligations may apply, for example, transfer of documentation, compensation for harm that was caused to the donee.

Article 575. Prohibition of donation

Article 576. Restrictions on donation

The donor, within the framework of the donation transaction, is vested with the following rights:

- refuse to fulfill the contract (Article 577 of the Civil Code of Russia);

- cancel donation, this norm is enshrined in Article 578 of the Civil Code;

- indicate in the contract the auxiliary conditions that must be met for the transfer of property;

- fix in the contract a provision about your lifelong residence in the apartment.

Article 577. Refusal to execute a gift agreement

Article 578. Cancellation of donation

The donee has the following rights:

- accept a gift or refuse it;

- require that a gift be transferred if there was a promise to give something in the future;

- demand compensation for damage.

Conditions for canceling a transaction

Both parties to the transaction may refuse to fulfill the terms of the contract when making a gift. The owner may change his mind or the transaction may not be recognized as valid:

- If the owner is under pressure, there is a threat to his health and life;

- If the physical condition of the testator has sharply deteriorated (Article 577 of the Civil Code of the Russian Federation);

- In case of failure to fulfill counter obligations on the part of the recipient of the gift.

Important

The recipient has the right not to accept the gift, and also to demand cancellation of the transaction or compensation if this agreement was violated by the previous owner of the object. If a minor or a disabled person claims the property, and the interests were not taken into account, then such a transaction is considered invalid. The prohibition on donation also applies to works of art of special value without established ownership, for example, a found relic, ancient coins, etc.

Tax on donating an apartment to a relative in 2018

There are three types of donation:

- Donation.

- Promise.

- Donation.

The question arises whether the gift of real estate between relatives is taxable. The answer to the question is provided by Article 217 of the Tax Code of the Russian Federation - a gift to a close relative is not taxed. Close relatives are family: spouses, brother and sister, child and his parents, grandparents, and their grandchildren.

Anyone who wants to give an apartment, for example, to a daughter or sister, is exempt from paying. Give a deed of gift for cars, housing, a house, dachas, currencies to a family member. When transferring property rights to a wife from her husband, from a mother to a son or daughter, even to a minor child. The nephew who received the apartment as a gift already pays a fee, since the degree of relationship is low.

Gift Tax between Relatives 2020: What to Expect?

There are several types of real estate that can be donated:

- Apartment.

- House.

- A room in a communal apartment.

- Land plot.

The Tax Code innovations came into force at the beginning of the year. Among the innovations is the price specified in the contract (cadastral, carried out by the BTI, and not market). The owner was allocated 5 years to pay income if the apartment was purchased at the beginning of 2020. Cancellation of payment of duty on gift property. If the property has been owned for less than 5 years, there is no need to pay personal income tax.

Is it worth paying if the transaction is between close relatives?

The Tax Code of the Russian Federation establishes a clear list of those who need to pay tax on gifting an apartment and who do not. Among those exempt from payment are closely related relatives.

To whom can a deed of gift not be issued?

The Russian Civil Code establishes the circle of both individuals and legal entities who are prohibited from delivering a deed of gift. These include:

- Social workers providing municipal medical services, employees of boarding homes, palliative centers and hospices, and their close relatives;

- Officials in the public service at all levels, employees of the Bank of Russia and government bodies;

- Commercial organizations.

An exception for officials are gifts given by order of higher authorities on the occasion of celebrations, events, or business trips. The object is transferred to the balance sheet of the government agency in which the donee works.

Comparison of the gift agreement with other transactions

Any types of alienation of property (sale, exchange, inheritance) have a number of advantages and disadvantages regarding the implementation process, this also applies to the gift agreement. But even in comparison with other transactions, a gift agreement can still have many more advantages for the participants in such an agreement than disadvantages. Eg:

- the deed of gift is drawn up without material benefit;

- is not subject to income tax if the transaction is made between close relatives;

- in addition, it does not require notarization;

- there is also the opportunity to use the donated property during the life of the donor, which distinguishes such an agreement from a will;

- property is transferred exclusively to a specific entity, thereby excluding the option of other applicants;

- You can exercise your right to the donated property immediately after signing the relevant agreement.

As for the shortcomings, they include the fact that the donor can revoke a previously made decision, that is, return the donated property to his own ownership. If there is a debt in relation to the transferred property, then it passes to the donee, but it is worth notifying about this before making the gift.

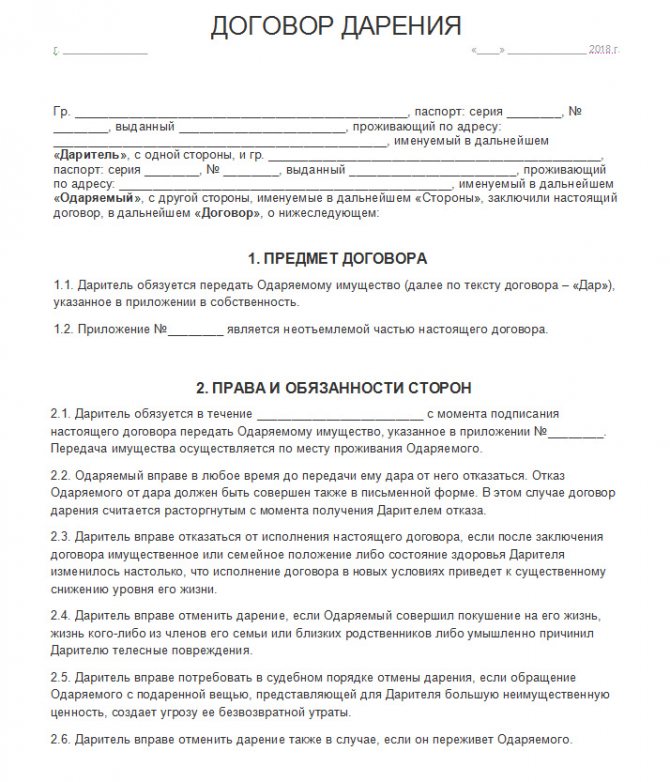

Rules for drawing up a document

What is a deed of gift and how to formalize it correctly worries both the giver and the recipient of the gift. The form of the agreement is written only. Donation does not oblige contracts to be certified by third parties. However, the legal force of the document is fully ensured by the services of a notary office. Registration of papers by a notary is paid, but it guarantees assistance in correctly drawing up a gift agreement. The process consists of several stages:

- Drawing up an agreement with details;

- Collection of additional documents and evidence;

- Contacting a notary office;

- For real estate – re-registration of ownership rights.

This is also important to know:

How to draw up a gift agreement with an encumbrance

There is a generally accepted sample document, contract form.

Free legal consultation

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

We will answer your question in 5 minutes!

Ask a Question

Fact

Model form of gift agreement

Contents of the deed of gift

The document must contain the following information:

- Name;

- Date and place of compilation;

- Data of the parties to the agreement;

- Subject of the agreement with a full description;

- Rights and obligations of the parties;

- Transfer procedure;

- Date or entry into rights of the donee;

- Other conditions for the alienated apartment;

- Details and signatures;

- "Visa" of a notary.

When transferring real estate, indicate the data and dimensions from the cadastral passport.

Related documentation package

The transaction is completed with the provision of the following documents:

- Copies of the donation agreement;

- Participants' passports;

- Evidence indicating the relationship of the donor and recipient;

- Consent of the spouse to the alienation of joint property or shared owners;

- Technical documentation from the BTI, cadastral passport, certificate of owner, if real estate is donated;

- With the participation of minors or incapacitated persons - consent of legal representatives or guardians.

Re-registration of property rights

If real estate is donated, then the ownership rights are re-registered. This can be done for the recipient at the Multifunctional Center or the Rosreestr authority. Registration takes about 10 days. Only after this the recipient is recognized as the owner.

Terms of the real estate donation agreement in 2020

Donation, however, like any other transaction in the Russian Federation, is regulated by the norms of current legislation and relevant acts. Moreover, if these rules do not allow the transaction to be fully regulated, then the rules that correspond to similar types of civil law relations are applied to it.

As we have repeatedly mentioned in the articles in the section on donations, for transactions of gratuitous transfer of ownership of real estate objects, as well as shares of such objects, the legislator presents a list of mandatory conditions:

- first of all, the transaction must be free of charge;

- before drawing up and registering a deed of gift, the donor must obtain the consent of the donee to accept the gift of real estate;

- the transaction is considered completed only after the mandatory re-registration of ownership of the property from the donor to the donee;

- in the content of the agreement, the parties cannot stipulate that the gift will be given to the recipient after the death of the donor (for these purposes, persons can use the execution of a will);

- real estate cannot be donated without the consent of other owners if it is jointly owned (consent to the transaction must be certified by a notary);

- Moreover, if the property is in common shared ownership, the gift transaction can be concluded without the consent of the remaining owners;

- in the case of donating real estate located on a plot of land owned by the donor, not only the building is donated, but also part of the land on which it is located (transferring only land or only, for example, a private house is prohibited!).

Also, today there is a category of citizens on whose behalf it is prohibited to issue gifts of gift (for example, incapacitated citizens and minors under 14 years of age) and a category of those citizens who are prohibited from accepting gifts under certain circumstances (for example, employees of medical institutions from patients). A complete list of such persons can be found by studying Article 575 of the Civil Code of the Russian Federation.

Donation of real estate with the condition of residence

There are situations when the donor wants not only to transfer his own real estate (apartment, house, cottage, etc.), but also to retain the right to live in this living space until the end of his days. In this case, the legislator allows, when drawing up a deed of gift, to include in it a condition securing the right to use and reside in the donated housing of the present owner.

EVERYONE NEEDS TO KNOW THIS:

How much does it cost to issue a deed of gift in 2020?

However, since donation, first of all, refers to gratuitous transactions, the agreement in question cannot contain any counter-obligations on the part of the donee. This, at first glance, contradicts the legality of the above-described condition, since the use and residence on the donated living space not only limits the donee’s disposal of the real estate, but also actually obliges him to provide the property for the use of the donor.

For this reason, including a lifelong residence clause in a gift agreement may have the following consequences:

- a clause that includes this condition will be considered void/invalid;

- the agreement will not be recognized as a gift agreement (according to the provisions described in Article 572 of the Civil Code of the Russian Federation, this transaction will be considered void and the consequences established in Article 170 of the Civil Code of the Russian Federation will be applied to it);

- the deed of gift will be recognized as a mixed transaction and the appropriate legislative norms will be applied to it (thus, according to Article 421, in order to classify an agreement as mixed, its content must contain conditions that relate to different types of transactions).

In the practice of lawyers of the website "Legal Aid", there have been numerous cases when they were able to prove in court proceedings that a gift agreement with the condition of the donor's lifelong residence is not a compensated transaction. To do this, it is enough to prove the fact that the use of the property, as well as the donor’s residence in the living space donated by him, does not incur any costs for the donee (1 paragraph 572 of Article of the Civil Code of the Russian Federation).

Important : Despite all of the above, it is worth noting that the position of the courts regarding such transactions in 2020 still boils down to the fact that the agreement with the conditions of use and residence of the donor is mixed. Therefore, when drawing up such a gift agreement, do not tempt fate and better consult with an experienced lawyer!

Costs for the donation procedure

According to the current edition of the Civil Code of the Russian Federation, the process of gratuitous transfer to the donee is accompanied by the payment of taxes and duties. However, under some conditions the procedure is carried out without costs. This applies to the transfer of donated property worth up to 3,000 rubles without legal registration of papers. All expenses are divided into:

- Document drafting services;

- Notary support;

- Gift tax;

- Re-registration of property rights.

The services of lawyers are required if the owner does not have sufficient legal literacy and the gift is of high value. It's worth thinking about this before donating. Notarization is popular when transferring ownership between legal entities or unrelated people. The current version of the Civil Code does not require mandatory contact with a notary. Costs for this part of the signing can reach up to 50,000 rubles. The service is valued at 3,000 rubles +0.2% of the cost of the gift for relatives. Tariffs depend on the price of the property and the status of the parties.

This is also important to know:

How to correctly conclude a garage donation agreement

Movable property requires a deposit of 0.3% for close people and 1% if the signing is between strangers.

The transfer of an object to the donee requires payment of a tax of 13%. However, if the agreement is concluded between relatives, then the participants in the deed of gift are exempt from such tax. The new owner must make annual contributions to the tax authorities as the new owner.

Fact

Re-registration and receipt of a property certificate for an individual costs 2,000 rubles. Legal entities are required to pay 22,000 rubles.

Additional conditions of gift deed

As we have already mentioned above, in addition to essential conditions, it is recommended to include additional conditions in gift agreements to avoid unspecified situations and undesirable consequences. Only the following conditions can act as such additional clauses, which do not violate the principle of donation:

- the actual period for the transfer of ownership of the object of donation (in cases where the agreement between the parties does not indicate a period or period for the transfer of ownership of the object - the donee takes ownership at the time of conclusion of the transaction);

- a list of conditions for the return of the gift (for example, the parties can add an additional condition to the gift agreement that the object being donated will be returned to the property of the donor if the recipient dies before him);

- data and information about the rights to the donated property of third parties;

- grounds for the formation of rights among the heirs of the donee to a gift transferred under a consensual gift agreement.

Important : We remind you that, according to the provisions of Article 581 of the Civil Code of the Russian Federation, when drawing up a contract of promise of a gift, the heirs of the donee do not have the right to receive this gift, unless otherwise was stated in the content of the gift contract.

It is also worth noting the fact that the absence of certain additional conditions in the deed of gift is not a basis for recognizing the gift transaction as invalid, or the agreement itself as void!

EVERYONE NEEDS TO KNOW THIS:

Written form of a gift agreement - rules and errors leading to the nullity of the agreement

Rules for refusal of donation and conditions for invalidation

Canceling a deal is often an unpleasant surprise, and sometimes an objective necessity. The owner can draw up a waiver of the transaction if the obligations specified in the document are not fulfilled by the donee. For example, repairs that have not been made or conditions for caring for a pet. The recipient himself may also not accept the gift if the terms of the transaction do not suit him. In addition, there are clauses in the law under which the transaction is unacceptable or will be considered invalid. These include:

- Drawing up an agreement through pressure or threats against the donor, there was an attempt on the life of the benefactor by the recipient, etc.;

- Deterioration of health before the actual transfer of rights;

- Carrying out a procedure on behalf of an incapacitated person or a minor;

- Lack of consent of other owners, shareholders;

- Discrepancies in the contract: textual, factual errors, data inconsistencies;

- Lack of documents;

- The recipient is a civil servant or an employee of a social or medical organization;

- The transfer is made between commercial organizations;

- The fact of using the gift for commercial purposes has been proven.

- The donor dies before the legal documents are re-registered and the property is actually transferred.

Also, an oral promise to donate any thing or things in the future, especially those worth more than 3,000 rubles, is not a full-fledged and legal gift agreement under the Civil Code. The revocation of oral promises is an area that the law does not regulate, but is a property of the individual moral qualities of the donor.

Refusal of donation: procedure

The contract can be terminated at the stage of oral promise before the re-registration or transfer of the offering. After fulfilling the obligations specified in the contract, the parties will not be able to cancel the deed of gift, say, for an apartment, except in certain cases. These include unforeseen circumstances, such as deterioration in the health or financial situation of the donor. The owner only needs to write an application to suspend the registration of the rights of the new owner with government agencies. The Civil Code provides for compensation for the recipient in the form of a requirement to repay the losses that he incurred in the process of acquiring rights. But such damages cannot be claimed if the actual performance of the gratuitous gesture has not taken place.

Important

It is practically impossible to cancel an already completed assignment of rights if the new owner transferred the rights to a third party or sold the property, unless this contradicted the terms of the deed of gift. Cancellation will require compelling reasons, which may result in a claim for compensation for material damages for the recipient.

Registration of a deed of gift according to the gift law

According to the law, you can give as a gift both the thing itself and the title documents for it or any symbol. For example, keys to an apartment or car. In the event that the right to own a thing or the thing itself will be transferred in the future, the form of deed of gift is written.

How to issue a deed of gift:

- The first step is collecting title documents (if any). For example, if an apartment is being donated, then you need an extract from the BTI, a floor plan and an extract from the house register. There are cases when the donor owns only a certain share in the apartment and wants to transfer it to the recipient under an agreement. In this situation, the donor must obtain notarized consent from the owners of other shares in this apartment.

- After this, it is necessary to draw up a gift agreement, describing in it the object of the gift and the details of the parties. If possible, it is necessary to indicate the cost of the object, its location, other characteristics and additional details.

- Then the deed of gift must be notarized. This is an optional procedure. However, it reduces the likelihood that the gift agreement will be invalidated in the future.

- After the agreement is signed, you need to register with Rosreestr.

Those gift recipients who are not immediate relatives of the donor must pay a tax of 13% of the value of the gift object

Who is the close relative of the donor:

- his sisters and brothers;

- Grandmothers and grandfathers;

- grandchildren;

- parents;

- spouses;

- children.

With a simple written form of such an agreement and its notarization, the accounting entries are different.

Features of drawing up a deed of gift with the participation of legal entities

Donation of property, where the parties are a legal entity, may be limited in scope or prohibited. According to Article of the Civil Code of the Russian Federation No. 572, the gratuitousness of the procedure excludes any mutual financial claims and the use of the gift for the purpose of obtaining benefits. Therefore, such transactions are prohibited.

This is also important to know:

Gift deed for an apartment: pros and cons

When transferring goods to a legal entity, which is a non-profit form of ownership, a public organization, a charitable foundation, etc., it is possible to dispose of the gift in order to obtain benefits. It will be difficult for the donor to refute the transaction if the funds received from the use of the gift go to the maintenance of a public organization and comply with the Charter.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

The donation procedure is permitted between a parent and subsidiary organization, but does not exempt from tax.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

If property worth more than 3,000 rubles is donated on behalf of a company, then the donation agreement of the Civil Code of the Russian Federation is concluded with the permission of the owner - founder of the company.

The agreement on the alienation of property can be canceled if the donor company goes bankrupt in the next six months. In this case, the alienated property will be used to pay off debt obligations.

Real estate gift tax from 2018

Donating an apartment to a relative can only be done on the following principles:

- Gratuitousness (when the donee depends on the donor, for example, a spouse receives a car as a gift from his wife, but at the same time she has a relationship with the car and can use it).

- Increases.

- Reduction, as a result of the transaction, the donor’s property decreases.

- Donation must be voluntary for both the donor and the recipient.

The taxable market price must be no less than 20% of the cost, the cadastral price - no less than 70%. The tax service may take action aimed at verifying the accuracy of the prices in the contract. To fill out the declaration, just do the following: download it from the Internet and fill it out yourself.

It is better to attach documents confirming the degree of relationship immediately. The tax service needs to provide 3-NDFL, copies of the gift agreement, documents that confirm ownership, technical documentation and a passport. A consultant at any bank will help you pay after filling out the declaration, but no later than July 15. In case of non-payment, the state obliges to pay a fine, voluntarily or through the court.

In case of failure to submit a declaration, a fine is charged for each month of delay, starting from May, 1000 rubles + 5%. For failure to pay, the fine is 20% of the established personal income tax; for repeated failure to pay, the fine is doubled. The penalty for non-payment is calculated for each day from July 16, its size is equal to the tax amount * 8.25% (refinancing rate) * 1/300 * number of days overdue.

From property transferred by inheritance

When inheriting property by a relative, including an apartment, the gift tax payable by the donee is equal to 2% of the total value of the property. An individual pays an income tax of 13%, receiving as a gift a house, a car, a base, houses, stocks, shares, shares. Other types of property will not be taxed.

Income tax on the sale of real estate shares

Having found out whether tax is paid when donating an apartment to a relative, it is worth finding out about the sale of a share of the real estate. Only that portion of the property referred to in the contract is taxed. The rate for residents and non-residents is different and is 13% and 30% respectively. A resident is someone who has lived in the territory of the state for at least 183 calendar days.

Donation

Article 582 of the Civil Code allows a gift to be reclassified as a donation if the item has the following features:

- Intended use determined by the donor;

- Public benefit;

- Inability to spend the donation in other interests without the consent of the owner;

- Exclusion of reciprocal gifts to donors.

Interesting

The donation will not be subject to the laws of gifting. All responsibility for preservation and maintenance will be on those who accepted the gift. In this case, the use will be checked by the contractor. In case of dishonesty, the object may be reclaimed.

Disputes arising under a donation agreement may be considered in court, but the form of the agreement itself will not be identified as a gift

Deed of gift in the Russian Federation

A deed of gift or a gift agreement in the Russian Federation secures the transfer of property rights to an object that is donated by the owner to another person. This document is gratuitous and one-sided. Thus, if in response to a gift the recipient provides a certain service or pays a sum of money for it, then the transaction will be considered invalid and the contract void.

Like any important legal document, a deed of gift has its own rules and drafting features. In Russian legislation, these issues are regulated by the Civil Code of the Russian Federation.

When drawing up a deed of gift, try to describe all the terms of the transaction as clearly and clearly as possible, as well as describe the object of the transaction, give its characteristics and indicate all the information about the parties.

Is it possible to issue a deed of gift for a minor?

In 2020, both adults and children under the age of majority can act as the donee. However, minors are still prohibited from being the donor.

When drawing up a gift agreement in favor of a minor child, the transaction has a number of unique features, both in the preparation of the document and in its execution. Since a minor is not considered legally competent, his signature has no legal force. Therefore, his legal representatives must sign the papers for him .

For the same reason, such a party in the text of the deed of gift should be referred to not as “the donee”, but as “the donee in the person of the legal representative.” Although the child will be the legal owner under the contract, he will only receive the right to dispose of the received property at the age of 18.

Is it possible to change the contents of the deed of gift?

Once a gift agreement has been drawn up and certified by the signatures of the parties, it cannot be changed! Since this document has legal force, it dictates the obligations and rights of the parties, according to the conditions they accepted during the gratuitous transfer of property.

EVERYONE NEEDS TO KNOW THIS:

How to draw up a debt gift agreement?

So, unlike an open or closed will, the contents of which can be changed at least a hundred times, a deed of gift comes into force at the moment the paper is signed by the parties to the transaction. That is why, according to the law of the Russian Federation, it is prohibited to make any changes to a contract document that has entered into force.

Is it possible to rewrite a gift deed to another person?

Gift deed is a document confirming the completion of a transaction. Therefore, it is impossible to cancel it or rewrite the object of the transaction to another person.

Thus, the process of drawing up a contract is the most important in completing a transaction. If you do not have experience, we recommend entrusting this issue to our lawyers and saving yourself from possible risks and problems in the future!

At the same time, the impossibility of transferring a deed of gift to another person is an obvious advantage for the donee.

Advantages and disadvantages of deed of gift in comparison with other methods of transferring rights

Considering various forms of assignment of rights, donation may be beneficial in some cases and unacceptable in others. This is due to the amount of the gift, expenses, relationships between participants and other conditions.

Purchase, sale and donation

Advantages of gratuitous alienation:

- Simple format: oral or written;

- Free alienation of shares;

- Speed of the procedure.

This is also important to know:

How to draw up a deed of gift for a house

Minuses:

- Payment of income tax by the recipient without relationship with the donor;

- Uncertainty about receiving a gift due to the donor’s right to refuse assignment.

Exchange and deed of gift for an apartment

The advantages of deed of gift over exchange are the same as in comparison with purchase and sale. Among the disadvantages, one can note the mandatory transfer of property in exchange for other property at the time of conclusion of the contract. There is also income tax, which is excluded in the exchange procedure. This is my advantage.

Rent and gift agreement

The main disadvantage of the agreement is the lack of monetary compensation that the donor would receive when registering the annuity. The previous owner receives nothing, since gratuitousness is required. There is also a disadvantage for the new owner in the form of paying 13% if he is not a relative of the donor.

Donation or bequest

The most common forms of contractual relations that are considered by citizens. This is usually true for relatives. In a difficult relationship, the donor thinks about the worthiness of his heirs. Difficult relationships will not be an obstacle to receiving an inheritance after death. But the deed of gift can be managed until death and the correctness of the decision can be assessed. In addition, after the transfer of property before death, other owners will not be able to lay claim to the property of the deceased.

Another advantage is the speed of the transaction and the opportunity to obtain rights before the death of the owner. When inheriting, the inheritance begins six months after the funeral. The disadvantage is the impossibility of specifying the conditions for receiving property that are in the will. Also, the sacrament of a will can later bring a “surprise” for the direct heir.

Conclusion

There are many alternative agreements for a gift agreement, which can be financially beneficial, but are complicated by legal conditions. Also, the simplicity and speed of issuing a deed of gift has its pitfalls for both the donor and the donee. Legal relations between relatives are perhaps one of the significant factors in favor of gratuitous transfer. The decisive factors are the value of the gift, the conditions, the relationship between the parties and the legal authorization from the Civil Code.

Free consultation

8 800 511-39-66Ask a question

Pros and cons of gifting with other types of transactions

The gift agreement, according to the Civil Code, provides for the re-registration of property rights. But just like any other type of transaction, the civil code presents both pros and cons for donations. Let's compare the deed of gift with other types of contractual relations.

Sales contract and the law of gift

The advantages of a free transaction in comparison with purchase and sale are:

- Ease of design. When the gift is inexpensive and does not exceed the threshold of 3,000 rubles, then the agreement is reached verbally. There is also no need to have documents endorsed by a notary unless the cases are included in the exclusive list.

- Speed of closing a deal. Depending on the situation, donation can be carried out within one day.

- Under a gift agreement, you can donate a share in property (Chapter 32), this allows you to exclude the rule of first priority for the purchase of part of the property from other owners.

The disadvantages include the mandatory payment of 13% income tax, and a narrow circle of people has the right to receive benefits. Another disadvantage is the revocation of the deed of gift, i.e. the donee cannot be sure that the contract will not be canceled in the future.

Deed of gift and exchange

The law of gift has the following advantages over exchange:

- Convenience and speed of registration.

- Property can be transferred bypassing the heirs, i.e. those relatives and persons entitled to property cannot make claims under the deed of gift. The legislation provides for this in Article No. 1149.

- The gratuitous transfer of any piece of property without the recipient having to pay for it.

From the point of view of the minuses, here we can talk about mandatory taxation and the free nature of the transaction.

Gift agreement and annuity

The law of gift in the case of annuity has a number of advantages, such as:

- A contract for re-registration of ownership is quickly and easily drawn up.

- Registration takes up to 14 days.

- There is no need to specify additional clauses if this is not dictated by the current civil legislation.

As in previous versions of transactions, the main disadvantage of donation is the payment of a tax of 13%.

Additionally, you can refer to Article No. 583 of civil law, on the basis of which financial resources must be paid under the annuity agreement. But the deed of gift not only does not imply such a condition, but it is forbidden to indicate this point in it.