The problem of donation becomes relevant when the owner of real estate is looking for an opportunity to register in the legal field his will to freely transfer to any person (most often a close relative) the rights to this real estate.

But what if the owner of the property wants to make a gift during his lifetime, but with the proviso that the new owner ( the donee) has the right to accept this gift only after the death of the donor.

The desire of the property owner to formalize just such a transaction is quite understandable. Many have heard about many years of litigation in which heirs are at odds with each other in attempts to challenge the will and divide the property of the testator (deceased) against his will. To stop disagreements between relatives, property owners are trying to find a way out by donating real estate during their lifetime.

However, the Civil Code of the Russian Federation (Civil Code of the Russian Federation) limits the circle of people willing to make such gifts. The restrictions are reasonable because they significantly protect the rights of living property owners.

As Part 2 of Art. 17 of the Civil Code of the Russian Federation, a citizen receives the opportunity to participate in civil transactions ( acquire rights and perform duties ) at the time of birth and loses this opportunity at the time of death. The obligation to donate an item that the donor undertakes under the gift agreement exists exactly as long as the donor is alive.

Attention

The person who accepted the gift must have time to formalize his right only as long as the donor is alive. It is considered that real estate has been accepted as a gift only after its state registration (Part 3 of Article 574 of the Civil Code of the Russian Federation). Otherwise, you will have to prove your right to the gift in court.

It is prohibited to include in the text of the deed of gift a condition that the recipient has the right to accept the gift (in the case of real estate, to register ownership) only after the death of the one who made such a gift (Part 3 of Article 572 of the Civil Code of the Russian Federation).

Concept and parties to the gift agreement

Despite the fact that the act of donation is called an agreement, civil law does not provide for any agreements between the donor and the donee. This is a one-sided transaction , under which only the donor has obligations.

Any mutually beneficial agreements must be made according to the rules of the purchase and sale agreement or other compensated transactions. The definition of donation is given in Part 1 of Art. 572 of the Civil Code of the Russian Federation, and, based on it, we can give the following characteristics to these legal relations.

- The donor undertakes the obligation to give the donee property (part of the property) that is owned by the donor.

- The donor is prohibited from demanding payment from the recipient for transferring the gift .

- Although the donee does not assume any obligations under the deed of gift, he is a party to this agreement and must sign it. Subsequently, the recipient has the right to refuse the gift. The procedure for signing the contract itself does not oblige the recipient to any action.

Form of gift agreement

According to the general rules of civil proceedings, a gift can be made in two forms:

- by oral application (Part 1 of Article 574 of the Civil Code of the Russian Federation);

- execution of a written document (Part 2 of Article 574 of the Civil Code of the Russian Federation).

Important

A verbal order for a gift that the donee can accept only after the death of the donor is illegal. This rule applies to gifts between citizens of cars, household items (furniture, household appliances, etc.), and any movable property.

The form of the real estate gift transaction is more strict:

- Real estate can only by written agreement;

- a written deed of gift must undergo mandatory state registration (Part 3 of Article 574 of the Civil Code of the Russian Federation);

- a notarized form of certification of the transaction is not mandatory . Roughly speaking, the donor has the right to write a gift agreement by hand, and the recipient of the gift will be able to transfer the property to himself under this agreement;

- all terms of the gift agreement must be set out in accordance with Russian legislation and civil rules. That is why those wishing to make a gift are recommended to contact notaries to draw up a notarized gift agreement, since the notary will be able to draw up the correct text of the transaction. Moreover, he bears financial responsibility for errors made in the contract. The fact that the law does not indicate that a notarial form is mandatory does not exclude the right of a party to contact a notary on its own initiative.

- An agreement drawn up in violation of civil law will not pass state registration.

Subject of the gift agreement

Property that can be donated should not be excluded from civil circulation .

Ownership rights must be registered in accordance with the norms of the legislation that was in force at the time the ownership rights arose. This is especially true for rebuilt or completed real estate properties. A property that does not comply with the documents cannot be transferred as a gift.

Additionally

The contract may contain a promise of a gift in the future .

Moreover, it is valid only if it is concluded in writing and contains a clear intention to complete the transaction. The subject of the donation must be specified in detail in the deed of gift . If we are talking about real estate, then the address, area, and title documents for the object must be included (Part 2 of Article 572 of the Civil Code of the Russian Federation).

Can a will replace a deed of gift?

Of course, the legislation of the Russian Federation provides for the possibility of transferring an apartment, summer house and other property after death to relatives. But, in this case, instead of a gift agreement, an open or closed will should be drawn up, the conditions and procedure for drawing up which are regulated by Chapter 62 of the Civil Code of the Russian Federation.

This act must be drawn up in simple written form in the presence of a lawyer, who will eventually certify the document and also call the heirs listed in the will after the death of the drafter.

A prerequisite for the preparation of this document is the legal right of ownership of property, which is transferred to the heirs. At the same time, the testator must be legally competent and of age at the time of drawing up the content. Otherwise, the will will not have legal force. Also, subsequently the testator has the legal right, if desired, to change the document completely or a separate part of it.

Conditions and when the deed of gift and will comes into force

As you can see, there are a number of fundamental differences between documents when they come into force, distinguishing a will from a deed of gift. Thus, the main one is the fact that the apartment will become the property of the recipient, according to the gift agreement, only in the case of mandatory registration of the document in the Russian Register, and in the case of a will, after the death of the testator.

In addition, unlike a deed of gift, a will must be certified by a notary. We remind you that, according to the law, in the case of a gift, notarization of a document in 2020 occurs at the request of the parties.

In addition, the testator, in accordance with the provisions described in Article 1149 of the Civil Code of the Russian Federation, is obliged, when drawing up a will, to allocate a so-called obligatory share for a separate group of heirs, which is not required at all when drawing up a deed of gift.

At the same time, when concluding a gift agreement, the consent of each of the owners of the transferred property is required. At the same time, a donation is an irreversible transaction, but a will is not.

Another important condition is the payment of taxes. For example, when concluding a gift transaction between close relatives, 13% tax is not charged, and when receiving a share of the inheritance, the heirs calculate and pay the state inheritance duty.

EVERYONE NEEDS TO KNOW THIS:

Garage donation agreement: sample, how to draw up and deadlines

Is it possible to give after death?

As can be seen from a systematic analysis of civil law norms, a gift agreement, according to which the recipient accepts the gift only after the death of the donor, cannot be concluded by the parties .

In addition, the Civil Code of the Russian Federation has a direct ban on concluding such agreements (Part 3 of Article 572 of the Civil Code of the Russian Federation). According to this norm, such a gift is void.

Important

If the contract itself contains a condition that the recipient of the gift has the right to accept it (register ownership) only after the death of the giver, then such a transaction is void .

If there is no clause in the contract, but in fact the recipient did not accept the gift (did not register) during the life of the donor. After the donor has died, re-registration will be possible only after a positive completion of the legal battle to recognize the deed of gift as valid.

When dealing with a void deed of gift, you need to realize that there is no need to challenge this document in court, since in accordance with Part 1 of Art. 166 of the Civil Code of the Russian Federation, such a gift is initially void and not controversial .

This is important because courts only consider disputes between citizens.

Challenging a deed of gift after the death of the donor

It should be remembered that during the lifetime of the donor, only he himself has the right to challenge the deed of gift. However, after the death of the donor, interested parties can challenge the deed of gift for the apartment. To do this, you should contact the court and provide compelling evidence, for example:

- The procedure for registering a deed of gift took place under pressure. If the relatives of the donor after his death can prove that the property was donated due to a threat to the life of the donor and his relatives, the case will be carefully considered by the judge.

- The papers were drawn up when the donor was incapacitated. The owner could put his signature on the document without even realizing his actions. Close and distant relatives of the donor have the right to challenge such a decision.

- The deed of gift was created through fraud. In this case, it is almost impossible to challenge the fact of deception. Interested parties challenging the deed of gift are required to provide the court with a compelling evidence base.

- Forgery of contract. Statements of the parties must be certified by Rosreestr. If any seals or signatures are missing, such documents not only need to be challenged, but also their illegality must be proven.

- During the process of drawing up the contract, the donor did not obtain the consent of the spouse. In this case, the donor may not require the consent of the spouse if the property is his personal property and was not acquired during the marriage.

- Lack of registration on the part of the donee. Notarization is not completely important, but without this procedure it is impossible to register a document. If this clause was not fulfilled during the life of the donor, after his death the property will be divided among the heirs.

Consequences of donation after death

Sometimes heirs are faced with situations where, after the death of a relative, it turns out that all or part of his property was donated. In such cases, the recipient of the gift provides the heirs with a gift agreement to confirm his rights.

Heirs have the right to disagree with the testator’s gift in the following cases:

- if at the time of opening of the inheritance (death) the property has not actually been donated (there is a condition in the agreement that the recipient accepts the gift only after the death of the donor);

- if in the deed of gift the donor disposed of property that did not belong to him. Most often this concerns movable property. For example, he donated furniture from his apartment, which belonged in equal shares to his wife.

Additionally

When it is established that the gift agreement is void , this is reported to the notary who is in charge of the inheritance case. In this case, the notary is obliged to be guided by the consequences of a void transaction, which are determined by Part 1 of Art. 167 of the Civil Code of the Russian Federation, that such a transaction does not entail any consequences .

If the testator left a will with the wording according to which he bequeaths to the heirs all his movable and immovable property in certain shares, the gift for a void transaction is included in the inheritance and is distributed among the heirs in those parts determined by the testator.

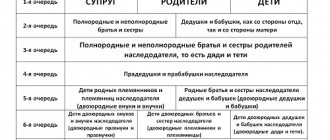

If a will is drawn up for specific objects of civil rights , then the heirs inherit the inheritance due to them under the will, and the property included in the inheritance as an insignificant gift is inherited according to the rules of inheritance by law.

If the testator did not leave a will , all his property, including an insignificant gift, is inherited among the heirs according to the law.

Alternative to donation after death

An alternative is a will . In a will, everyone has the right to dispose of property at their own discretion. To exercise this right, the testator, when drawing up a will, can:

- bequeath all your property to a specific person . However, such wills are most often contested, since the testator often has heirs who have the right to claim an obligatory share in the inheritance;

- bequeath specific property to specific persons . Such wills are difficult to challenge. But the person who draws up the will must ensure that the inheritance (for example, an apartment) is properly formalized and registered with government authorities, since otherwise the heir will not have rights to the unregistered piece of real estate.

Example

The father gave his son an apartment. The contract was certified by a notary. However, the son did not have time to register the apartment in his name before his father’s death. After the death of his father, his wife, with whom he did not live together, but did not formally file a divorce, filed an application to accept the inheritance. The notary established that the apartment donated to the son under the contract has not yet been registered in the son’s name, and on the basis of Part 3 of Art. 572 of the Civil Code of the Russian Federation included the apartment as part of the inheritance. The son filed an application to the court to recognize the donation as valid. Since the son had in his hands the act of acceptance and transfer of the apartment and the title documents on it, the court recognized that in fact the son accepted the gift from the donor and the gift agreement took place. Based on a court decision, the apartment was excluded from the inheritance.

What documents are needed to formalize a deed of gift for an apartment?

For mandatory registration of a gift agreement, the documents listed in this list are required:

- passports of both parties to the transaction;

- gift agreement drawn up in 3 copies (one each for the donee, the donor and the state registrar);

- technical passport of the living space received from the BTI;

- cadastral passport;

- documents that prove the legality of the donor's ownership of the transferred property;

- extract from the Unified State Register of Real Estate;

- a certificate from the BTI with the actual cost of housing;

- an extract from the house register confirming the fact that no one else is registered in the apartment except the donor;

- a receipt confirming successful payment of the state fee established for registration of the agreement in the Unified Register;

- consent of other co-owners (optional);

- consent of the spouse (optional);

- notarized power of attorney, if the interests of one of the parties are represented by a third party;

- permission from the guardianship and trusteeship authorities (if necessary).

EVERYONE NEEDS TO KNOW THIS:

Procedure for delivery of title documents