Pros and cons of drawing up the first document

Compared to a gift agreement, a will has its advantages and disadvantages.

From the side of the testator

The testator has the right to change the terms of the will at any time without informing the heirs about it. Despite the existence of a will, the testator is the owner of his property and can dispose of it at his own discretion.

This right entails the obligation of the testator to maintain the house and land, as well as pay taxes, until death.

From the side of the inheritance recipient

Until the moment of inheritance, the heirs do not know the contents of the will. If the recipient of the inheritance is under 18 years of age, all actions under the will must be carried out by his legal representative. If he fails to fulfill this obligation, the heir may be left without an inheritance.

According to the Civil Code of the Russian Federation, a circle of persons is determined who can claim their rights to a share in the inheritance despite the fact that their names are not indicated in the will.

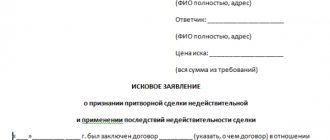

Consequences of invalidating a deed of gift

As we have repeatedly written in the section on donations, the invalidity of a transaction in 2020 can only be recognized by the court, and the list of grounds for filing such a claim is established by the legislator in the Civil Code of the Russian Federation.

We remind you that invalid transactions are usually divided into:

- Insignificant. At the same time, the court does not recognize, but only certifies the fact of the nullity of such agreements due to the fact that they are initially void (at the time of conclusion).

- Disputable. They may be recognized as such by a court decision.

So, among the most common grounds for declaring a gift transaction invalid are:

- Lack of indication of the subject of the donation in the agreement or its “vague” description;

- incapacity or minority of the donor and lack of permission to conduct the transaction from his legal representatives;

- failure to comply with legislator requirements for the form of a transaction;

- alienation of “all property” without specifying its specific parts;

- the recipient is included in the category of those who are prohibited from giving gifts;

- the donor is a legal entity that declares itself bankrupt within six months after the donation;

- the content of the gift agreement contains a counterclaim from the donor or any conditions;

- at the conclusion of the transaction, the donor did not receive permission to draw up a deed of gift from the spouse, while the gift itself is part of the jointly acquired property;

- the contract states that the donation will be made after the death of the donor (there is a will for this, but not a deed of gift!);

- the deal was concluded under threat of violence or one of the parties blackmailed the other.

It is worth noting that if one of the parties knew that it was participating in an initially void agreement, the citizen is classified by the legislator as unscrupulous, and the recognition of such a transaction by the court as invalid entails corresponding legal consequences (return of donated property, forced conclusion of another transaction, etc. .).

If the donee cannot, for any reason, return the property given to him under an invalid transaction, he will be obliged to fully reimburse the cost of the gift. Also, the donating party, who suffered as a result of the conclusion of such a deed of gift, has the legal right to demand financial compensation for moral damage.

EVERYONE NEEDS TO KNOW THIS:

Deed of gift for a car to a close relative - 2020 form

Advantages and disadvantages of a gift agreement

Being a bilateral transaction, a gift agreement is concluded only with the mutual consent of the donor and recipient to all conditions. The donee must be aware of the planned transfer of ownership of the land and house and be willing to receive them.

For the assignor

A donor (agent) wishing to donate a house and land acquired during marriage must obtain the written consent of the spouse to the transaction, otherwise it may be declared invalid.

Unlike a will, after the agreement is executed, the donor will no longer be able to change the terms of the gift or refuse to transfer property rights. Therefore, the donor must make an informed decision about the gratuitous transfer of his property before signing the contract.

For the successor

The person for whom the gift agreement is drawn up can be either an adult or a minor (counterparty). In the second case, it is necessary to obtain the consent of the guardianship authorities. As soon as the agreement is signed, the donee has the right to dispose of the property at his own discretion, without taking into account the opinion of the donor.

Consequences of a gift agreement in 2020

As follows from the above, a person who wishes to donate property or rights will be deprived of all rights to own and use this property or rights. At the same time, the difficulty lies in the fact that in the gift agreement itself the donor does not have the right to set conditions for the disposal of the object of the gift. Thus, the new owner can do whatever he sees fit with it, as long as it does not threaten the integrity of the object.

It is worth noting that if the object of the gift is an object of real estate, the transaction is considered concluded not at the moment of signing the contract or even at the moment of transfer of the attribute (for example, keys to an apartment), but only after the mandatory re-registration of property rights from one owner to another.

Tax Consequences of Gifting in 2020

Surely you know that the tax legislation of the Russian Federation classifies gifts that were received by individuals under a deed of gift as income received. Therefore, the acceptance of such gifts is subject to tax, the amount of which in 2020 is still 13% of the market total value of the gift at the time of conclusion of the transaction. In this case, for example, in the case of donating part of a house or apartment, the tax rate will also be 13% of the amount constituting the cost of this part.

The rate established above applies only to gift transactions in which residents of the Russian Federation were parties. But for foreigners, the tax rate is 30%.

Today, the tax is calculated after registration (optional) with the Rosreest authorities or after the appropriate execution of the agreement, within a period of no more than 14 days, after accepting the tax package of documents from the parties. It is worth noting that if the recipient lives outside the Russian Federation, the fee will need to be paid before receiving a certificate of ownership.

EVERYONE NEEDS TO KNOW THIS:

Conditions of the gift agreement - essential and additional

In this case, the person who has given his consent to accept the gift must personally appear at the tax office before July of the following year and provide a tax return and a receipt for payment of the relevant fee. If these requirements of the legislator are ignored, penalties will be applied to the donee.

Remember that the amount of tax is calculated precisely by the market value of the item of gift, which is stated in the agreement. If the tax inspector discovers that this price is underestimated in comparison with the cost of similar items on the market by more than 20%, the transaction will be rechecked, and a fine in the amount established by law will be imposed on the donee.

What is better to choose?

Thus, it is difficult to give a definite answer to the question of which is better: drawing up a deed of gift or a will for a house and land. Each design method has benefits for different parties.

A will is a safe transaction for the testator, in which he can make changes to the inheritance agreement . However, a will can become a problem for the heirs indicated in it, due to challenges from other claimants to the property.

A deed of gift is a transaction that is most beneficial for the recipient and is absolutely safe for him. But for the donor, this means an immediate loss of rights when signing the contract, which makes it practically impossible to challenge the transaction in the event of a change in his decision regarding the transfer of the gift.

The more specific the transaction agreement, the greater the likelihood that it will be recognized as valid and will not be challenged in the future. To protect yourself against possible risks, it is best to complete each stage of the transaction in the presence of a notary.

Video on the topic

Let's watch a video about which is better: a will or a deed of gift?

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

When compared, donation or sale agreements are characterized by a large number of distinctive features regarding the nature of the transactions. If in one case it may be more profitable to sell, then in another - donation. Below we will consider what will cost less and faster, what are the main differences between contracts, the pros and cons, as well as the features of challenging.

What is the difference between a purchase and sale agreement and a gift agreement?

The execution of a gift agreement (hereinafter referred to as DD) is regulated by Chapter. 32 of the Civil Code of the Russian Federation, purchase and sale – Ch. 30 Civil Code of the Russian Federation. Both procedures are considered bilateral, and are aimed at alienating the property of one person in favor of another. Transactions can be concluded orally or in writing, but if the donation occurs free of charge, then the sale is exclusively for money.

There are other differences:

| Donation | Purchase and sale |

| Donors can be all citizens, except those with incapacitated rights and children under 14 years of age. You cannot make gifts to employees of state, municipal, social, and medical institutions if this is related to their official duties (Article 575 of the Civil Code of the Russian Federation) | Everyone has the right to participate in the procedure, except for young children and incapacitated citizens. |

| According to Art. 36 of the RF IC, property received during marriage by deed of gift is recognized as the sole property of the spouse. But on the basis of Art. 37 of the RF IC, the second spouse can achieve recognition of a gift as common property if during their life together, through joint investments, its value has significantly increased | Property purchased during marriage is considered the joint property of the spouses, regardless of whose money it was purchased with (Article 34 of the RF IC). An exception is the presence of a marriage contract, according to which all valuables go to one of the spouses |

| Personal income tax of 13% is paid by the recipient of the gift - the donee. But close relatives of donors are exempt from taxation (Article 217 of the Tax Code of the Russian Federation) | Personal income tax is transferred by the seller, because he receives profit from the sale of valuables. |

Features of registration of deed of gift

According to Art. 574 of the Civil Code of the Russian Federation, the transaction is concluded orally, with the exception of cases when written form is required:

- Real estate is alienated;

- The giver plans to give the gift in the future (promise of gift).

The written DD is drawn up by the donor independently, but if necessary, the parties have the right to seek help from a lawyer or notary. Notarization is required if a share in the property right is alienated, the donor is a minor or a person with limited legal capacity, or a representative by proxy participates in the procedure on behalf of the owner or donee.

Important! When alienating real estate, registration of ownership of the donee in Rosreestr is required, but specific deadlines are not established. If a car is donated, information about the new owner is entered into the PTS, and it must be registered with the traffic police within 10 days after signing the deed of gift.

Pros and cons of deed of gift

Let's consider the advantages and disadvantages of a deed of gift:

| pros | Minuses |

| Simplicity of design | The donor does not benefit |

| Property received by a spouse during marriage under a DD is not divided upon divorce. | If the court decides to cancel the DD, the gift will have to be returned |

| Possibility of cancellation at the initiative of the donor | If a gift was purchased with funds from business activities and given within six months after the decision on the donor’s bankruptcy, creditors may challenge the transaction |

| Exemption from personal income tax for close relatives of donors | Incorrect execution of the DD in terms of content may result in its invalidity |

| Free procedure for the recipient | Sometimes notarization is required, which increases costs |

| You can't get a tax deduction like you would with a purchase. |

Contents of the gift agreement

When drawing up a deed of gift, you need to provide clear information about the transaction, the gift and the parties:

- Full name, passport details of the donee and the donor;

- Information about the item - gift;

- The nature of the DD: real (fulfilled immediately) or consensual (promise of donation);

- Obligations and rights of the parties;

- Conditions for cancellation or modification;

- Referral to obtain consent from the spouse (if required);

- Signatures of the parties to the transaction.

The agreement is drawn up in at least two copies, one each remains with the donor and the donee. If real estate is donated, you will need a third copy for Rosreestr.

Sample apartment donation agreement:

What is more profitable to register: a deed of gift or an inheritance?

When concluding an agreement, the question arises of registering the transfer of ownership rights. This stage should not be skipped or carried out at the wrong time. However, the interested party does not always understand which transaction is more profitable to register in a financial and legal sense.

The difference between a deed of gift and an inheritance is huge. The meaning of the transaction differs in that inheritance is possible only after the death of the owner, and donation involves the transfer of the right to the thing immediately after registration of the contract. The transfer of inheritance by will or by law is not registered in any way until the death of the owner.

A deed of gift is always beneficial for the donee, especially if he is a close relative of the donor. In this case, there are no tax expenses, the transaction is reliable, and it is difficult to challenge it.

This is important to know: How to get a housing loan from the state in Moscow

When registering property rights, you will have to pay a state fee in both cases. However, the donation is registered immediately, and for inheritance the death of the testator is required.

Features of drawing up a purchase and sale agreement

The purchase and sale agreement (hereinafter referred to as the PSA) is drawn up on a reimbursable basis: the seller undertakes to promptly transfer the goods or other things to the buyer, and the buyer undertakes to provide money in return. The procedure is regulated by Ch. 30 of the Civil Code of the Russian Federation and is divided into several types: contracting, supply of goods, sales of real estate or enterprises, retail trade.

The DCP is drawn up in simple written form, and notarization is required only in a few cases:

- A share in the right to real estate is for sale;

- Sale of real estate to a minor or person with limited legal capacity.

As with a gift, in the case of the sale of common property, the notarized consent of the seller’s spouse will be required.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Note! If the DCT requires a notarial form, and the interests of the seller or buyer are represented by an attorney, the power of attorney must be certified by a notary.

Pros and cons of a purchase and sale agreement

The advantages of the DCT include the ease of execution: it is enough to draw up the document in several copies, having previously agreed on the terms with the parties to the transaction.

There are other advantages:

- There are no restrictions for the parties, as in the case of DD, where it is prohibited to transfer gifts free of charge in favor of employees of municipal and state bodies, social institutions, and healthcare organizations, if the procedure is related to their work activities;

- The seller, unlike the donor, receives a benefit - money;

- PrEP is easier to cancel than DD.

- The seller is required to pay income tax. The donor does not pay it. If a valuable thing is acquired by spouses during marriage in the absence of a marriage contract, it is recognized as common property and will be divided upon divorce.

- The most significant disadvantage, due to which some are trying to cover up the sale of DD, is the obligation to notify the remaining owners in the event of a paid alienation of the share.

Legal advice: it is better not to try to cover up the sale of DD. Based on Art. 170 of the Civil Code of the Russian Federation, other owners whose pre-emptive right has been violated may recognize the transaction as sham. This entails its invalidity: the deed of gift will be cancelled, the donor and the donee will be returned to their previous position.

Lawyer, website author (Civil law, 6 years of experience)

Contents of the purchase and sale agreement

The content of the DCP must comply with the requirements of Chapter. 30 of the Civil Code of the Russian Federation, depending on the type of transaction. The document includes almost the same information as in the DD, but the cost of the property being sold must be indicated.

- Information about the seller and buyer;

- Product data;

- Duties of the parties;

- Conditions for canceling a transaction;

- Signatures of the buyer and seller.

Sample agreement for the sale and purchase of an apartment:

Consequences of donating an apartment in 2020

After state registration of ownership rights to the new owner, the donee becomes the legal owner of the property donated to him. Although, according to current legislation, the donor is deprived of ownership of the living space, he can continue to use it, provided that this clause was included in the donation agreement.

So, if the parties to the deed of gift have decided to retain the right of residence and use for the donor, he cannot be evicted from the apartment, even by a court decision. In addition, if the recipient alienates the living space to third parties, the donor himself continues to retain the right to reside in the apartment.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Also, it is worth noting that in 2020, judicial practice (based solely on the experience of the lawyers of the Legal Ambulance website) on this issue is very ambiguous. For example, some courts today believe that the donation of living space with the right of residence of the donor himself indicates that the transaction is compensated, which leads to its invalidity.

We are often asked what a recipient should do if, after accepting an apartment or private house as a gift, he finds out that he has utility debts. We answer - if such a situation arises, the donee is not obliged to pay the debts of the previous owner, since the burden of maintaining the property is assigned to its actual owner, and the donee becomes such only upon re-registration of ownership. That is, utility companies need to collect the debt from the previous owner.

After registering the ownership of the new owner’s housing, the agreement comes into force, and challenging the gift agreement becomes very difficult, because, according to Articles 577 and 578 of the Civil Code of the Russian Federation, this can only be done if there are the following reasons:

- The giving party may refuse to fulfill the obligation it has assumed to transfer a gift (both when concluding a real and when concluding a consensual transaction) if the donee has behaved unworthily towards the donor himself or members of his family (for example, he has committed an attempt on life or health listed persons);

- in addition, the donor has the legal right to refuse to provide the donee with a gift under a promise of gift agreement if, after the agreement is executed, his financial or family situation has significantly worsened compared to the moment when he signed the agreement;

- The former owner of the property can also terminate the gift agreement in 2020 in the event of unacceptable handling of the gift by the recipient, which may lead to damage or irretrievable loss of the donated property;

- the contract can be terminated if the legal entity acting as the donor declares itself bankrupt 6 months or less before the transaction is executed;

- The parties to the donation can independently add a clause to the agreement, according to which the donation will be terminated if the donor survives the donee (this “condition”, as a rule, is included so that the donated property does not pass to the heirs of the donee).

EVERYONE NEEDS TO KNOW THIS:

Donation as a gift for generally beneficial purposes

Also, instead of the donor, his relatives can terminate the gift agreement if it is proven that:

- at the time of signing the deed of gift, the donor did not realize the consequences of his actions or could not control his own actions;

- if at the time of conclusion of the transaction he was incapacitated or partially incapacitated;

- if the donor is a minor (under 14 years of age) or a citizen who has not reached the age of majority without the permission of his legal representatives (usually one of the parents).

At the same time, if points 2 and 3 do not need additional explanation and to confirm them it is enough to present the court with relevant certificates, documents or eyewitness accounts, then with point No. 1, everything is not so simple.

It is worth noting that it is almost impossible to prove that at the time of signing the deed of gift the person (donor) was not aware of the consequences of his actions. As a rule, the most effective evidence of this is an appropriate examination, which is ordered by the court when identifying the presence of certain factors that could affect the consciousness of a citizen (for example, it will be proven that the donor started taking strong medications the day before).

Challenging contracts

The grounds for challenging PrEP and DD differ.

In the first case, the list of reasons is much wider:

- Violations committed during privatization;

- The apartment is inherited, and some time after accepting the inheritance, another heir appears who did not declare his rights within the established time frame. He has the right to challenge the transaction;

- Drawing up a written contract by an incapacitated owner;

- The share was sold without granting a pre-emptive right to other owners;

- Common property was sold without the consent of the seller’s spouse;

- The seller is involved in bankruptcy proceedings and wants to avoid foreclosure by selling it. At the initiative of the creditors, all transactions over the past 3 years are disputed;

- The property of a minor was sold without the consent of the guardianship authorities.

The DD is canceled on the grounds specified in Art. 578 Civil Code of the Russian Federation. The court recognizes the DD as invalid if the donee intentionally killed the donor or caused harm to his health; when creditors apply to cancel a transaction concluded by a donor-participant in bankruptcy proceedings.

If the deed of gift was drawn up under the influence of threats or misconceptions, by an incapacitated or partially capable citizen, there is also a chance to cancel everything.

Lawyer's answers to frequently asked questions

What is cheaper for the recipient of property: donation or purchase and sale?

With DD, the donee pays personal income tax, unless the donor is a close relative - this is the only financial burden on him. When purchasing real estate, some citizens have the opportunity to receive a deduction. But you have to pay money.

What happens to the property donated or sold if the new owner dies?

If the DD provides for the possibility of cancellation upon the death of the donee, the donor has the right to cancel it (Article 578 of the Civil Code of the Russian Federation). Anything purchased under DCT is included in the inheritance estate.

What is cheaper in terms of registration with a notary: DCP or DD?

Prices are approximately the same everywhere. For mandatory certification, 0.5% of the value of the property is paid.

How to re-register ownership of real estate from a mother to an adult child faster and cheaper: by deed of gift or DCT?

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

It’s easier and cheaper to use a deed of gift: just draw up a deed of gift in writing, then submit documents to register ownership. Under PrEP, the child will have to pay money.

The apartment has two owners and was inherited. What is the easiest way to donate your share to the second owner?

The grounds for acquiring ownership rights do not matter. You can draw up a gift or sale agreement.

Contract form

An agreement to transfer a gift can be concluded orally (Article 574 of the Civil Code of the Russian Federation) if:

- The donor is an individual.

- The transferred property costs no more than 3,000 rubles.

- The transaction is real - made at the moment of transfer of the gift.

The basis of a gift agreement is the mutual desire of the two parties to the agreement to make a gratuitous transfer of any property from one party to the other.

The oral form does not need to be certified by a notary, which is the difference between a gift and a deed of gift. A written form of the transaction is required in the following cases:

- The donation is carried out by a legal entity.

- The cost of the gift is more than 3000 rubles.

- The parties enter into a consensual agreement, the execution of which is postponed for an indefinite period in the future.

- The object of the transaction is real estate.

What is the difference between a deed of gift and a gift agreement?

Donation agreement, in accordance with Art. 574 of the Civil Code of the Russian Federation, can be committed both orally and in writing. At the same time, the legislator has established a number of conditions, under which the execution of a written transaction is mandatory.

This is important to know: Validity period of the deed of gift for the apartment

Thus, compliance with the written form is mandatory if any of the following conditions are met:

- The donor in the transaction is an organization, and the subject of the transaction costs more than 3 thousand rubles.

- The transaction involves the fulfillment of the donor’s obligation in the future (for example, upon the occurrence of any events).

- The subject of the agreement is real estate, transactions with which are subject to mandatory registration with government agencies.

In the generally accepted sense, a deed of gift means only a written form of donation, that is, a deed of gift and a gift agreement are correlated in the minds of people as content and form. However, it is incorrect to talk about the correctness of such a ratio, since the concept of gift, as already mentioned, is not contained in the legislation.

Thus, the concepts of “donation agreement” and “deed of gift” are correlated as general and particular, since the agreement can be both oral and written, and the deed of gift can be exclusively written. This is the difference between a gift agreement and a deed of gift.

Difference between deed of gift and deed of gift

The concepts of “deed of gift” and “gift agreement” are identical and imply the gratuitous transfer of property by the donor to the legal successor. The first of them is more often used in free communication, and the second - in official documents, which is the difference between a deed of gift and a gift agreement.

Because from a legal point of view, any agreement between two parties constitutes a contract.

The terms “deed of gift” and “donation agreement” are used quite widely, but few clearly understand the difference between them. From a lexical point of view, these concepts are identical and mean the same thing, namely a notarized agreement that stipulates the gratuitous transfer (donation) of any property, real estate, legal rights from one party to this agreement to another.

But, if in colloquial speech the concept of deed of gift is more often used, then in official legal documents it is more appropriate to use the concept of gift agreement. This is due to the fact that for any lawyer this document is, first of all, an agreement concluded by two parties.

The essence of the gift agreement is the mutual desire of the two parties to complete a transaction for the gratuitous transfer of something from one party to the other.

The object of a gift can be both material and intangible benefits (rights to something, obligations towards something, and so on). Mutual desire means that the donor agrees to give his property as a gift, and the recipient agrees to accept this gift.

The main feature of this transaction, and at the same time the main difference from other types of alienation of property (purchase and sale, will, etc.), is its gratuitousness. The donor has no right to demand any material benefits or performance of any actions for his gift.

Other features of the deed of gift are:

- Donations on behalf of minors are prohibited. Naturally, this requirement applies only to real estate or other large gifts; minor gifts do not fall under this ban.

- The objects of donation can be not only material objects or goods. Free release from the performance of any obligations or transfer of claims to a third party also qualify as a gift.

- A gift is not only the transfer of an object in the present tense, but also a promise to fulfill it in the future.

A gift agreement can be canceled even after it has been signed and officially registered. This is possible in the following cases:

- After signing the deed of gift, the financial situation or health of the person giving the gift has worsened, and fulfilling the conditions of this deed of gift will further aggravate the situation and cause a further deterioration in the quality of his life.

- The donee has committed actions that harm the donor or his relatives. If this is followed by the death of the donor, then a lawsuit to terminate the deed of gift is filed by his heirs.

- The donee's treatment of the object of donation creates a direct threat to its preservation. This condition is applicable when the gift is dear to the donor, but does not represent significant material value.

The most popular are donation agreements for real estate objects – apartments, country houses, garden plots and land plots. In these cases, the deed of gift must be drawn up in writing. It is not necessary to have the deed of gift certified by a notary. However, the participation of competent lawyers (especially when writing a gift agreement) will not be superfluous.

The text of the deed of gift for real estate indicates:

- Date and place of drawing up the contract.

- Complete information about the parties to the contract.

- Maximum detailed information about the property subject to donation.

- Information about the rights of the donor to this property.

The text of the agreement should not contain any conditions for its conclusion.

It must be remembered that receiving a gift entails the need for the recipient to pay income tax for individuals in the amount of 13% of the value of the gift. Payment of tax is not required if the parties to the agreement are closely related.

Registration of a deed of gift is mandatory when the gift must subsequently be registered with the authorities of Rosreestr, the State Traffic Safety Inspectorate or others (apartment, dacha, car, yacht, etc.). In other cases, the mandatory preparation of a deed of gift is not stipulated by law.

This also applies to expensive gifts, such as jewelry, ornaments, and luxury items.

However, it would be more correct to draw up such an agreement. This will help in the future to avoid problems associated with claims of third parties on the object of the gift, or others.

The use of the terms “deed of gift” or “donation agreement” is acceptable in any situation. However, it will be more correct if the first of them remains only in colloquial everyday speech, and the second is used in official legal documents.

The concepts of “gift agreement” and “deed of gift” are equivalent and imply an agreement on the gratuitous transfer (donation) of property of legal rights or real estate from one person to another, certified by a notary.

Among ordinary people, the name “donation” has become more widespread. For official legal language, the “donation agreement” option is most acceptable, since the signing of such a document is the conclusion of an agreement between two parties.

Features and analogues of the agreement

Since the deed of gift and the gift agreement are one and the same thing, the features of the document’s execution are the same. The first feature of the document, as well as any other document, is the voluntary nature of actions in the contract .

The donor must confirm that he is transferring property of his own free will: a car, a house, luxury items, an apartment. And the recipient must confirm that he voluntarily accepts the property as a gift free of charge.

The second feature of the document is its gratuitous nature. The donor, giving away his property, cannot demand any material benefits from the recipient. Similar to such an agreement is a will, which allows you to inherit property.