- 24.8.2016

- 20477

What you need to ask the previous homeowners to insure against unpleasant surprises in receipts for utility bills. A reminder for an apartment buyer who does not want to spend too much on rent in the future.

The size of the rent has become a significant factor when choosing an apartment. Especially if housing is purchased on the secondary market. According to the observations of Ekaterinburg realtors, today every second buyer is interested in the size of housing and communal services.

Tatiana Antonova

residential real estate specialist

Some realtors, before offering an apartment to buyers, carefully study the amount of housing and utility payments for this property. If the monthly amount in the receipt is lower than that of similar apartments, this fact must be disclosed to the buyer. If, for example, the buyer cannot choose from two or three options, then the size of the rent may become a decisive factor.

What is rent and what does it include?

Rent is the amount paid by residents of the Russian Federation to housing and communal services enterprises that provide housing maintenance. Payment is made for rent, repair work, maintenance of a residential building, and payments for utilities are also included in the rent.

What do utilities include:

- Cold water supply;

- Hot water supply;

- Drainage;

- Electricity supply;

- Gas supply;

- Heating.

Housing maintenance services

Almost every person, when receiving a payment receipt, studies the expense items related to housing services. What does it include, what expenses does the consumer pay for the maintenance of public property?

- Lighting;

- Maintenance cleaning for public areas that are part of the house;

- Expenses for cleaning and transporting waste;

- Fire safety;

- Landscaping and improvement of the courtyard area;

- Expenses for current and major repairs;

- Preparatory measures for seasonal operation of the structure;

- Expenses for maintaining public property;

- Activities to inspect public premises.

How to find out the inventory value of an apartment? What is it - read the link.

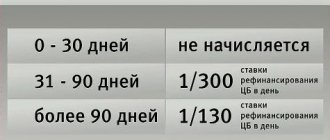

Payment period

Based on Article No. 155 of the Housing Code, deadlines for payment of utility bills are established. Payment must be made monthly by the 10th of the month.

There may be exceptions that must be specified in the rental agreement and a different number indicated.

For payment you will need the following documents:

- Receipt for payment;

- Payment documents;

- Account number;

- You can make a payment in several ways: Internet, mobile application, bank, Russian post.

Are debts for housing and communal services transferred to the recipient with an apartment?

Even if disagreements arise regarding debts, you should remember that no one except the court can oblige you to pay debts on utility bills and other payments that arose before the right to the apartment was transferred to you. If the management company goes to court, you can petition to have the mother involved as a proper defendant. Even if the court decides to collect the debt from you, you will have the right of recourse to claim the amount of the debt from it. Another point in this question is how long has the debt accumulated? According to Art. 196 of the Civil Code of the Russian Federation, the management company has the right to demand payment of debt exclusively within the limitation period, that is, for the last 3 years and no more. It is impossible to challenge the donation. The law does not provide for this. But the donor is given the opportunity to cancel the donation under the conditions established by Art. 578 Civil Code of the Russian Federation. Naturally, if the debt exceeds all maximum permissible amounts and terms, the management company will certainly sue the owner, and by decision of the court hearing the apartment may be seized for these debts. And once she is arrested, it will be impossible to give her as a gift. In the meantime, until the arrest is imposed, you can safely conclude a gift agreement and register it. Whether the recipient will agree to such a gift is another matter. After all, as mentioned above, there are two parties to the gift agreement, and if the one to whom this apartment is given agrees, then there is no problem. Debts for utility bills, as a general rule, are not transferred to the new owner of the apartment; this applies to any agreement. They can be transferred to him only with his consent, under a special clause in the contract. If there is no such clause, then the debt remains with the person who owned the apartment at that time.

Are debts transferred under a gift agreement?

What determines the size of the rent?

Theoretically, for all homeowners, the rent should be the same and directly depend on the tariffs set by service providers.

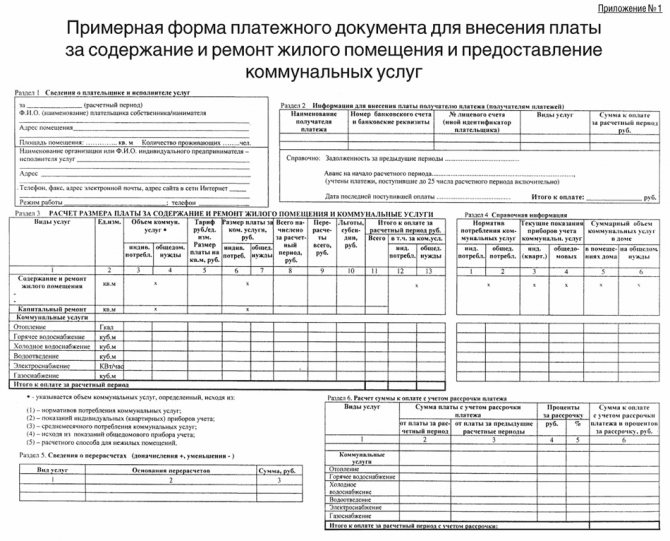

A sample rent receipt can be downloaded here.

But this is only in theory; in reality, all payments will be different and this is understandable.

The final amount on the receipt directly depends on many circumstances:

- Variety of resources and services provided;

- Footage of housing;

- Number of residents;

- Availability of metering devices;

- Tariffs set by service providers;

- Availability of benefits.

How to draw up a deed of gift for a house? You will learn about the pros and cons of this document here.

Example of a receipt.

How to independently calculate the amount of utility bills?

Sample calculation of cold water supply

The size of the cold water supply calculation directly depends on the availability of metering devices in your apartment. If the meter is installed, then payment is made based on the meter readings.

The tariff should be multiplied by the resources expended . For example, for Moscow the cost is 33.03 rubles per cubic meter. m., meter readings – 4 cubic meters.

4 * 33.03 = 132.12 rubles.

Example of hot water supply calculation

The calculation of hot water is carried out similarly. We multiply the sum of cubes (4) by the cost, which in Moscow is equal to 163.24 rubles per cubic meter. m.

4*163.24 = 652.96 rubles.

Electricity

Electricity is calculated using a simple formula: the volume of energy consumed (250 kW) is multiplied by the established tariff, equal to 5.38 rubles.

250 kV*5.38=1345 rub.

Gas payment calculation

This service is paid for one thousand cubic meters and screw of supplies . The tariff is equal to 6.16 rubles, calculated in the same way as the meter readings are multiplied by the tariff: that is, 11 square meters were consumed per month. m means:

11*6.16=67.76 rub.

Is it possible to sell a room in a communal apartment? Features of such transactions follow the link.

Payment for heating

If meters are installed in the apartment, the calculation will be made according to the following scheme: meter readings multiplied by the tariff. For example, the readings are 1.3 Gcal * 1006.04 = 1307.85 rubles.

You can also calculate the amount of utility bills using various online resources that host virtual calculators.

How to use an online calculator?

In order to make the calculation, you need to select one of the utilities, the presence of metering devices in the room from the drop-down menu list, then fill in the fields of the calculator with your initial data.

Gift of debts

Based on the analysis of these articles, we can conclude that from the moment the ownership of the gift arises, the donee has an obligation to maintain the thing given to him by the donor. Only after the moment of ownership arises, the new owner is obliged to pay all debts incurred during his stay in the property. At the same time, all debts that arose before this (that is, the debts of the donor) must be repaid by the donor himself as the person who was entrusted with the burden of maintaining the thing before transferring it as a gift.

Debts when donating an apartment The basic rules for determining the person who is obliged to repay debts when donating an item have already been described above. In relation to the donation of real estate (apartments, among others), it should be noted that the donee takes ownership only after undergoing state registration of the transfer of this right under a gift agreement.

About Resolution No. 307

Calculation of rent in terms of payment for maintenance and repair of the building is carried out on the basis of the amount that is required to maintain the rational maintenance of public property in the building.

In this case, payments must be made in accordance with the established standards of Decree of the Government of the Russian Federation dated August 13, 2006 No. 491 .

Adopted a little earlier, in May of the same year, decision No. 307 “Rules for the provision of public services to citizens” has become invalid since July 2016.

What documents need to be changed when changing registration? A complete list and recommendations are in this article.

The cost of apartment maintenance and repairs

In accordance with Decree No. 307, home maintenance and repair costs include:

- Supporting the performance of internal technical structures that provide electricity, gas, heat and drainage;

- Claiming debts on utility bills;

- Collection of meter readings;

- Maintenance of information systems for collecting and processing information about payments;

- Issuing invoices for housing and communal services.

Degree of improvement

The amount of payments for housing and communal services depends on the level of improvement of the living space. The degree of improvement of the building is based on the list of utilities that are provided to the resident.

The quality of housing and communal services provided to citizens is also of significant importance.

Are debts transferred under a gift agreement?

Civil Code of the Russian Federation, the written form of such an agreement is mandatory);

- a promise clearly expresses the intention of the giver.

Attention According to Art. 581 of the Civil Code of the Russian Federation, in the event of the death of the donor who promised to repay the donee’s debt, this obligation must be fulfilled by the donor’s heirs (except for those cases when the contract expressly provides otherwise). In turn, the heirs of the recipient of such a gift do not have the right to demand fulfillment of the promise in the event of the death of the donee. As follows from paragraph 4 of Art. 576 of the Civil Code of the Russian Federation, as well as from paragraph 1 of Art. 313 of the Civil Code of the Russian Federation, the creditor of the donee is obliged to accept the performance that is offered for the donee-debtor by a third party (donor), if the debtor assigned the obligation of performance to such a third party, agreeing to accept such a gift. As you know, the recipient of a gift must agree to accept it, otherwise the gift is not legal. Is the new owner of the apartment liable for the debts of the old owner? Timely actions taken will allow you to get rid of unpleasant complaints coming from utility service employees. Checking the status of utility payments Before concluding a transaction, the Buyer needs to check the actual status of the seller’s accounts; it is important to request the appropriate certificate even before concluding a purchase and sale agreement. Before making a transaction, you must obtain a certificate regarding the complete absence of debt for utilities. This will allow the new owner not to become a victim of a dishonest seller. When receiving this document, the buyer must pay attention to the date of its preparation. You can also always check your accounts online. Do debts for utility bills pass to the new owner? Important The third part of Article 158 is devoted to this nuance. The deed of gift is most often concluded between close relatives (which is confirmed by documents), the property under it immediately passes into the possession and disposal of the donee (conclude an agreement under which the property will pass to the property of the donee only after the death of the donor is in no way possible). After signing, the parties to the transaction submit documents to register the apartment to the new owner. The set of documents is standard, as for the purchase and sale of real estate, with the exception that a gift agreement is submitted. By the way, we should not forget that donating an apartment if it is owned by several people can only be done with the consent of all owners, and the consent of the spouses is also required. Our lawyers know the answer to your question. If you want to find out how to solve your particular problem, then ask our duty lawyer online.

Rent and meter data

In apartments that are not equipped with metering devices, utility bills are calculated based on indicators established by the state per person. These include:

- Cold and hot water supply;

- Gas supply;

- Drainage

Thus, the total amount will be calculated not from actual consumption, but from the number of people officially registered in a given living space.

What are permanent leasehold improvements? What they include, see the material at the link .

The calculation formula looks something like this:

Amount = N*T*L, where:

N – established indicator;

T – established tariff;

L – number of registered people in the residential premises.

When paying by meter, you only need to pay for the amount of resource actually spent.

Reducing the rent amount

Upon written application from citizens, it is possible to achieve a reduction in payment, but there must be compelling reasons and supporting documents for this. Such reasons include:

- The quality of the services provided does not correspond to what is specified in the agreement;

- Long interruption in the use of services;

- Lack of metering devices in the home;

- Subsidies.

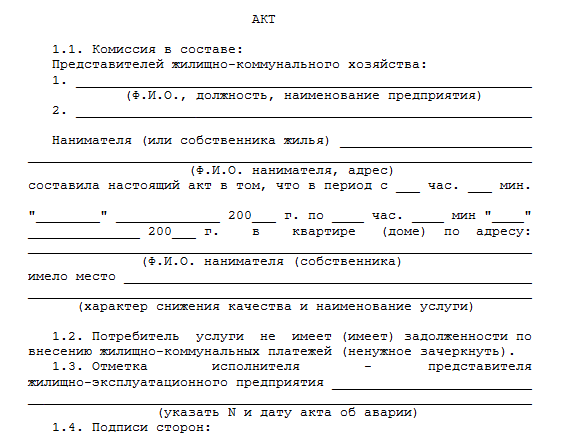

To recalculate the rent, you must submit an application and the necessary documents to the management company.

After which, your application will be verified and a violation report will be drawn up. In the future, based on this document, a decision may be made to reduce the payment amount.

Sample act on rent reduction.

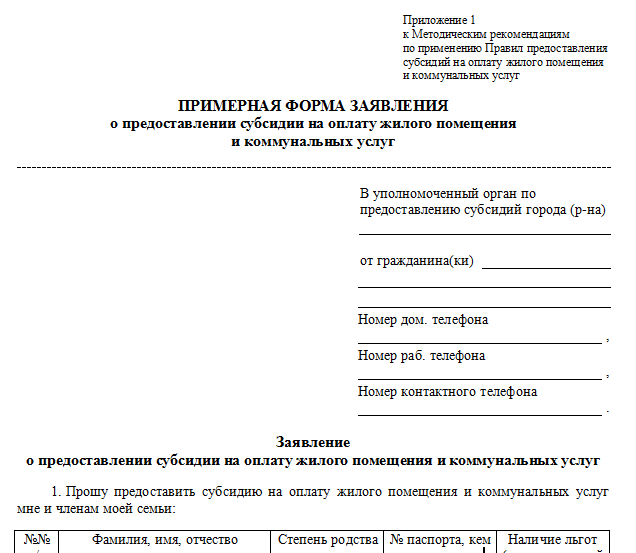

Subsidies and the procedure for their registration

Families that spend 15-23% of their personal monthly earnings on utility bills are entitled to subsidies. To do this, you need to contact the social welfare service or local government with a written application and the necessary package of documents:

- Certificate of income in form 2-NDFL;

- A document on the basis of which you live in this premises;

- Certificate of incapacity for work, disability, etc.

Payment of utility bills must be made every month . Payment of subsidies may be stopped if payments for housing and communal services have not been made for 2 months in a row.

What assistance can young families receive from the state? Detailed information in this publication.

The subsidy is valid for 6 months, so the recipient citizen must constantly prove the situation of the poor and re-apply with the application and documents.

Sample application for a subsidy.

Paying rent is an integral part of our lives. Such inconspicuous receipts contain complete information about social status - how many people live in a given living space, how many square meters, etc.

Try to be careful with payments, pay bills in good faith, this will save you from many misunderstandings and problems.

You will learn about the features of the new utility bill from this video:

Are debts transferred under a gift agreement?

Gift deed for an apartment.

Details of the issue The mother is the sole owner of a 3-room apartment, privatized more than 10 years ago. Debt in payment of utilities.

Form of share donation agreement. Payments for the child, as well as future expenses for utilities, fall on the shoulders of the parents, who are representatives, or guardians. Some citizens try to sell a share in communal apartments, having previously drawn up a share donation agreement.

The apartment has been registered as a gift since March 2006. We have a debt for utilities, the apartment has not been privatized, for the last 2 years we have been regularly paying the monthly fee, if possible we are paying off the old debt, there are 30,000 rubles left. Can the housing department through the court? Can a regular gift agreement be certified by The law does not require a notary.

And the debts will hang on the former owner until he pays or the management company files a lawsuit for collection through bailiffs. A gift agreement involves the gratuitous transfer of property into ownership, i.e.

Under an apartment donation agreement, are debts for utilities transferred to the donee or not?

- Are the debts of the donor transferred to the donee with the deed of gift for real estate? — Are the debts of the donor transferred to the donee with the deed of gift for real estate? more 1 answer. Moscow Viewed 990 times. Asked 2013-02-20 10:40:15 +0400 in the topic “Real Estate”

- Are loan debts inherited?

— Are loan debts passed on by inheritance? more 1 answer. Moscow Viewed 1042 times.Asked 2012-04-24 11:51:36 +0400 in the topic “Loans” Apartment donation agreement - Apartment donation agreement.

more 0 answers. St. Petersburg Viewed 158 times.

Asked 2011-04-15 15:57:53 +0400 in the topic “Housing Law” After how many years are utility debts written off?

— After how many years are utility debts written off?