The category of beneficiaries, which is completely exempt from taxation, is defined by Art. 395 Tax Code of the Russian Federation. The remaining owners of land plots, with the exception of those who have the right to a deduction in accordance with Art. 391 of the Tax Code of the Russian Federation, you are required to pay tax. In this article we will look at land tax benefits, who is entitled to the benefit and what documents are needed to receive it.

Comprehensive information regarding the benefits applied in a particular region should be requested from tax authorities. As a rule, incentives are established at the local level to reduce the tax base. For example, pensioners in the Moscow region are given a 50% discount when paying tax, and in St. Petersburg, military pensioners who own a plot of up to 25 hectares do not pay tax. In Moscow, large families are exempt from land tax starting from 1 thousand rubles.

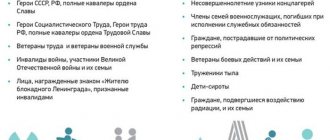

Categories of beneficiaries for whom relaxations apply in accordance with the law

So, benefits for land tax are regulated by the Tax Code (Articles 391, 395) and local legislation. The categories of persons who qualify for benefits are few in number.

| Category of beneficiaries | Which beneficiaries are exempt from paying land tax? | Which payer can count on a reduction in the tax base by 10 thousand rubles? |

| Legal entity | Organizations: Ministry of Justice (penal system), religious, folk arts and crafts, public organizations of disabled people, where at least 80% are disabled, FEZ participants, managers, residents of the special economic zone, other organizations and institutions specified in Art. 395 Tax Code of the Russian Federation | – |

| Individual | This includes those who live in remote areas of the country (North, Siberia, Far East), own a plot of land and traditionally engage in personal farming | – |

| Combat veterans | – | + |

| Disabled people from childhood and groups 1, 2 (received before 2014) | – | + |

| Chernobyl victims | – | + |

Benefits do not apply to land plots involved in business activities. An individual entrepreneur must pay tax on the land that is in his possession, even if it is idle. The same rule applies to almost all other land owners.

Thus, if combat veterans are provided with benefits in the form of a deduction in any case, then in relation to pensioners, labor veterans, and large families, benefits are applied only on the basis of current local regulations, since they are not considered beneficiaries.

How to apply for a benefit for 6 acres of land for pensioners?

Owning a country plot of land brings not only the joy of growing fresh vegetables, fruits and flowers, but for it, like for other property, it is necessary to pay a tax to the state treasury. But for many categories of our citizens, the Government made a pleasant gift - it exempted them completely or partially from taxation, for example, it established a benefit for 6 acres of land for pensioners. Payment of land tax

This is interesting: Land tax in the Chekhov region

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The Federal Tax Service (FTS) explains who is obliged to pay land taxes and the procedure for calculating them:

- All owners of land plots, regardless of the form of ownership: indefinite or lifelong inheritable ownership of the plot. With the exception of persons who own land by right of lease or executed under a transfer agreement for gratuitous use.

- The objects of tax collection include plots in the area where municipalities and cities of Federal significance are located. Lands limited in market circulation, for example, in places where the cultural heritage of different authorities or nationalities are located, do not include. Also excluded from taxation are plots that are part of historical reserves, archaeological excavations, and museums.

- The calculation of the tax base is based on the cadastral valuation of each specific plot; all information is located in a single Rosreestr database.

The exemption of persons of retirement age from the tax on 6 dacha acres is prescribed in Federal Law No. 436 of December 28, 2020.

Deputies of the State Duma adopted it based on the proposal of the President of the country, since pensioners can be classified as a socially vulnerable category of people.

The tax legislation of Russia was supplemented with subsection. 8 clause 5 art. 391 of the Tax Code, which includes another category of beneficiaries - people of retirement age.

The grounds for abolishing taxation for pensioners are also indicated in the Order of the Federal Tax Service of Russia dated March 26, 2018, number MMV-7-21/167.

If the owner of the plot has not previously enjoyed benefits, then he needs to submit a notification to the tax office at the location of the plot about his new status, based on the requirements of the order of the Federal Tax Service of Russia dated November 14, 2017, number MMV-7-21/897.

Therefore, for many citizens of our country, the relevant question is how to apply for benefits for 6 acres for pensioners in 2020, where and who is involved in this registration.

Land tax benefits: how to get a benefit?

Benefits are not automatically optimized. To confirm your rights to benefits, you should contact the tax authorities with an application and attach specific documents to your application. You can transfer a set of completed documents using one of the traditional methods:

- by post (registered mail);

- when visiting tax authorities in person;

- through the taxpayer’s personal account.

To send the kit via the post office, copies are made; they do not need to be certified by a notary. The applicant is notified of the decision, after which a recalculation is made from the time the right to the benefit becomes available.

New form for calculating land tax

Now, in order to calculate the land tax, they will first calculate the cadastral value of the plot. The next step will be to subtract the cost of 6 acres from the resulting figure and charge tax on the remaining difference. In general, from now on benefits are calculated not from a fixed amount, but for each site separately, which is much more fair. If the area of the property is less than or equal to 6 acres, land tax will not be charged. If a person has two or more plots, the benefit applies to only one of them. It follows from this that you need to choose the area for which the privilege will be more appropriate. So, if one of the available plots is less than 6 acres, and the other, on the contrary, is larger, then it is better to activate the benefits in relation to the larger plot. After making a choice, you must report it to the tax office.

Applications for property tax privileges have always been accepted until November 1st. This time, since the changes came into force only in January, the application can be submitted until July 1, 2018. If you do not inform the institution for which area a benefit is required, the tax office will make calculations everywhere, and will subtract the price of six hundred square meters from the tax that turns out to be the largest. Therefore, you can do nothing at all.

It is worth noting that when calculating for 2020, the updated privilege is also taken into account. Individuals will make payments until December 1, 2020. In almost a whole year, the tax office will have time to calculate everything, and the tax on 6 acres for pensioners will no longer be taken into account.

To prepare in advance, you can submit an application to the tax office, within which you indicate your rights to benefits. At the same time, you can select a site. In this case, there is no need for supporting documents, since the tax office itself will check all the data. You don’t have to go anywhere at all if you have access to your personal account. If initially the tax office randomly does not take into account the privilege, you should contact us again and they will recalculate everything.

This is interesting: How to remove a kiosk from the local area

What documents are required for an individual or legal entity to receive benefits?

Persons eligible for benefits should prepare a standard set of documents when applying to the tax office. In addition, certain categories of citizens are required to submit additional documents (hereinafter referred to as DD).

| Standard set of documents for all individuals | passport (identity document), certificate of ownership of the applicant’s land (state land act), Confirmation of registration, income certificate |

| DD for a pensioner | copy of pension certificate (notarized) |

| DD for disabled people of WWII and combat | WWII disabled person's certificate |

| DD for WWII participants (disabled due to illness or other reasons) | General certificate of a WWII veteran |

| DD for disabled people of groups 1 and 2 | a certificate of a disabled person, a pension certificate or a certificate from a medical labor commission indicating disability |

| Chernobyl victims | special certificates of participants in the liquidation of the Chernobyl disaster |

Depending on the available additional regional benefits, their types, and the category of the beneficiary, the list of documents submitted may vary. Therefore, it is advisable to clarify the entire list of required documents from the tax authorities in advance.

The grounds for providing benefits to individual entrepreneurs and legal entities are an individual entrepreneur’s certificate, charter, certificate of budget financing, title documents and other documents confirming the right to benefits.

Land tax rates and land tax calculation formula

Organizations calculate the amount of land tax independently. For individuals, the tax authorities calculate the amount of payment due. The amount of land tax does not depend on the results of the activities of their owners who use the land for their own purposes: for running private household plots, etc. The amount payable is a constant annual payment.

When calculating, tax rates (TS), cadastral price (CP) of a plot of land, as well as ownership coefficient (CV) are used. A numerical multiplier (MF) is applied if the site was used for less than a full year. The calculations also take into account the availability of benefits. The size of the maximum bet is tied to its purpose, i.e. the type of territory:

- 0.3% (the intended purpose of a plot of land is gardening, horticulture, for agricultural activities, defense, security, housing);

- 1.5% (for other types of land).

The indicated interest rates are maximum values fixed by federal law, therefore municipal authorities have no right to exceed them. Land tax is calculated using the standard formula: NS * CC * CV.

Terms of service

Land tax is a local fee. The procedure and conditions for its payment are fully discussed in Chapter. 31 NK.

The fee is taken from individuals who own land plots based on:

- ownership;

- permanent perpetual lease;

- inheritance as a lifelong owner.

Land tax benefits are provided on the basis of Art. 392 Tax Code for all pensioners.

The list of objects for which payment is not charged is given in Art. 389 NK. Among them:

- lands seized or limited in circulation on the basis of Art. 27 ZK (these include territories in which cultural objects, nature reserves, etc. are located);

- areas attached to forest or water resources;

- plots included in the array of common property allocated for an apartment building.

This is interesting: How to register an easement for a gas pipeline

The following persons are also exempt from payment:

- related to indigenous small northern peoples (if the site is used for fishing, economic activity or the traditional way of life for this people);

- owning a plot of land based on a lease agreement;

- received rights to free use of land (indefinite or urgent).

- having territories included in the property liability of a mutual investment fund (the tax burden falls on the management company itself).

Regional benefits for land tax

Current data on land tax benefits, which apply at the municipal level, can be found on the official website of the Federal Tax Service. For this purpose, the electronic service “Reference information on rates and benefits for property taxes” is used.

| Region | Some local benefits for tax periods 2015 - 2016. |

| Leningradskaya | In Fedorovsky joint venture, Tosnensky district, the following are exempt from payment: single pensioners and spouses (60 and 65 years old, respectively) living in the private sector with an income below the subsistence level, veterans and disabled people of the Great Patriotic War, home front workers; Shapkinskoye joint venture, Tosnensky district: pensioners living in the territory of the joint venture pay 40% of the tax amount |

| Moscow | Ivanteevka urban district: Chernobyl victims, low-income citizens registered with the Social Security Administration, and single pensioners were released; the tax base for honorary residents of the city was reduced by 70%, registered labor veterans of retirement age - by 50%, for families with 3 or more children under 18 years of age with an average per capita income below the subsistence level - by 50%, etc.; Urban settlement Pravdinsky, Pushkin district: large families were exempted from receiving land plots free of charge from the state; low-income pensioners pay 50% tax |

| Belgorodskaya | No new local benefits were introduced |

| Tula | RP Arsenyevo Arsenyevsky district: large families are exempted local government bodies, etc. |

| Ryazan | No new local benefits |

| Lipetskaya | Municipal formation Fashchevsky village council, Gryazinsky district: local government bodies and cultural, healthcare, educational institutions subsidized from the local or regional budget were exempted |

| Nizhny Novgorod | Chkalovsk: local government bodies, educational, sports, cultural institutions, media financed from the local budget have been liberated |

| Saratovskaya | Bolshezhuravskoe municipal formation of Arkadak district: the category of taxpayers whose lands were flooded in the spring-summer period receives a benefit in the amount of 10 thousand rubles. from the cadastral price |

| Sverdlovskaya | Eastern rural settlement: peasant farms and agricultural organizations whose income from the sale of their (or from shareholders) products exceeds 70% of the total profit are exempt |

| Chelyabinsk | Yuzhnouralsk urban district: age pensioners, disabled people of groups 1 and 2 (individual entrepreneurs and individuals) are exempt |

| Stavropol region | The village of Belye Kopani, Apanasenkovsky district: local government bodies and cultural institutions are freed (benefits for municipal lands) |

It is quite obvious that each region has its own benefits, which are established on the basis of decisions of local Councils of Deputies and Zemstvo Assemblies.

Reasons for refusal of land tax concessions

In order for the tax authorities to pass an application with documents for subsequent consideration and make a decision in favor of the applicant, at least the following conditions must be met:

- the applicant must fall under the category of beneficiaries in accordance with current local laws and the Tax Code;

- the text of the application must contain complete information, specific and correct, without errors or corrections;

- All required documents must be submitted to the tax authorities.

Upon receipt, the set of documents along with the application will be checked by tax authorities for their authenticity and correctness. If the inspector identifies at least one discrepancy, everything is returned to the applicant, indicating the errors. For this reason, the process of accepting documents and their consideration may be delayed.