What is a reduction in the cadastral value of land plots?

Reducing the cadastral value of a land plot is a legal procedure for entering information about a decrease in cadastral value into the registration records. It is carried out at the initiative of the owner of the land plot on the basis of legal norms established for making changes to the state real estate cadastre (GKN).

The amount charged for payment of land tax depends on the established cadastral value of the plot . Therefore, the inflated value leads to an increase in the tax rate.

Used in several cases:

- If during the audit process the land valuation activities were carried out with errors or other pricing violations were committed.

- When the evaluation audit commission does not take into account the features of the storage device that reduce its useful properties.

- In case of soil damage on the site, regardless of the time of assessment.

- If the market value is significantly lower than the established cadastral value.

In each case, you can use the options of contacting the local branch of the State Committee for Taxation or Rosreestr, or contact the justice authorities.

Step-by-step instructions: how to change the cadastral value of a land plot?

Now let’s go through the entire algorithm and find out how the cadastral value of a land plot is revised.

Where to apply and when?

Changes in value based on the results of the audit are made without hindrance within 6 months after their publication on the official website. In this case, contact the Rosreestr branch.

If you didn't make it on time

Subsequently, the copyright holder can take the initiative only for one of the following reasons:

- When he was not informed about the ongoing audit at the location of the storage facility, and the results were not made public.

- When the claim for revaluation does not exceed 30% of the cadastral value established by the commission.

- If the established assessment amount exceeds the established market value or is equal to it.

- If violations are obtained by the soil of the landowner when using pesticides, due to objective circumstances, without the fault of the copyright holder.

Among similar objective reasons that allow changes in the assigned value are:

- reduction of storage area;

- change in permitted use;

- change of land category.

To reduce the cost, copyright holders contact the local branch of Rosreestr using an electronic queue . Submit an application to reduce the cost. The application is being considered by the Rosreestr administration. A positive decision leads to a mechanism for making changes without delay. The waiver is subject to the following conditions:

- technical shortcomings;

- motivated by legislation.

In the first case, the citizen has the right to receive a presented list of conditions to fulfill, taking into account the correction of which it is possible to resubmit the application. In another case, it is advisable to go to court.

Drawing up and submitting an application for revaluation of land plots

The rules for drawing up and the required form of the statement of claim are indicated in Articles 131 of the Civil Code of the Russian Federation and 125 of the Arbitration Procedure Code of the Russian Federation.

In the main part, an essential role is played by indicating the circumstances of the case, on the basis of which:

- the rights of the plaintiff were violated during the revaluation;

- the rights of the plaintiff were violated due to the illegal refusal to reduce the value;

- reasons why cost reduction is required.

If citizens have a country house or live in a regional center or rural area , they, if desired, send original applications and notarized photocopies of documents, including evidence base, by Russian Post, with notification of receipt by the addressee. Documents are also sent to the local branch of the State Committee for Taxation.

If the application is ignored by the management of the State Control Committee, then a month after transmission by mail, an application may be filed with the court.

Documentation

The application is accompanied by evidence of an illegal increase in the cadastral value of the land plot and the refusal of the State Property Committee administration to correct it. Evidence includes:

- Legal documentation.

- Certificate of ownership;

- Certificates confirming the admissibility of the required changes, including a soil survey report, independent assessment reports.

- An extract issued by Rosreestr indicating the fact of refusal and motivational reasons.

- Receipt for payment of state duty.

Fees and deadlines

The state fee for the court is 300 rubles. Making changes to the State Tax Code is not subject to duty.

Review by the State Committee for Taxation does not exceed one calendar month. The refusal can be appealed within 10 days. In court, the review can take two months.

For those who are just planning to become the owner of land plots, you should know what the redemption value of a land plot is and in what cases it is necessary.

Who has the right to apply for a price change?

To challenge the cadastral value used by the audit commission or to make adjustments to a value that has lost its relevance for a number of reasons, only the owner of the plot, who has the right to own it :

- property;

- lifelong inheritable ownership;

- permanent (unlimited) use.

Third parties from among close relatives and others can act in the interests of the landowner only on the basis of a notarized power of attorney given to him.

That is, this right is granted only to taxpayers whose property rights are violated as a result of overestimation of the cadastral value of land.

Tenants do not have the right to apply for a reduction in the cadastral value of the land, since they are not taxpayers.

Reasons for reduction

The indicated issue is resolved on the basis of an application submitted by the interested person or his representative:

- to Rosreestr;

- to the district court at the location of the court.

At the same time, the stated request requires legal support confirming the legality of the stated request . To do this, you will need to submit certificates and independent expert reports from licensed appraisers or from a soil science laboratory.

If soil damage occurred due to the fault of the owner of the site, this precedent is not accepted as a legal basis for reducing the cadastral value.

How to reduce the cadastral value of a land plot yourself after an audit?

No later than once every 5 years, a land audit is carried out in a planned land mass. These procedures are initiated by the administrative authority, which elects a specialized commission. After the audit work, the commission prepares reports within six months. These 6 months allow for the coordination of prices for plots on the part of their rights holders.

To do this, the following step-by-step actions are carried out on how to reduce the cadastral value of land:

- Find out from the media or on the Rosreestr website the time of the audit in the area where the plot of the interested party is located.

- Check the availability of publicly available information based on the results of the revaluation.

- Check the newly established value with the previously existing one before the audit.

- In the event of a significant increase in this, contact Rosreestr for a cadastral extract on the newly established value of the land plot.

- Check for the possibility of an error. In this case, submit an application to the head of the cadastral chamber.

Application and documents

Written in free form by hand , indicating the error and requesting a downward revision of the established cost. Finally, a date and signature are placed.

The applicant approaches Rosreestr in person, with a passport and a certificate of entitlement. Attaches the previously received extract.

Application for revision of cadastral value.

Fees and deadlines

In this case, no payment will be charged , the error will be corrected free of charge.

Such an application is considered mainly within 5 to 15 days .

The response to such a request must be in an official form and issued to the applicant in writing, signed by the head of the department, and certified by the seal of the registration authority.

Typically, consent to correction is received if the error actually arose through the fault of the registration authority or members of the authorized commission.

During this period, before the preparation of reports is completed, it is permissible to apply in the same way when an error was not made, but the cost increased by more than 30% . The listed provisions are based on the norms of Federal Law No. 221-FZ of July 24, 2007.

Land tax and changes in cadastral value

Changes in the cadastral value of land. Local authorities have the opportunity to influence the formation of the land tax rate for 2020. The basis for determining the amount of tax for each plot is its cadastral value.

The right of local authorities to change the cadastre can significantly change the land tax 2014. (Federal Law dated July 24, 2007 No. 221-FZ (as amended on July 23, 2013) “On the State Real Estate Cadastre” (as amended and additionally entered into force from January 1, 2014)

To independently determine the amount of land tax you need to:

- by requesting the cadastral service at the location, find out the cadastral value of the site,

- find out the percentage tax rate of land tax 2014 on the local government website (within the range: 0.3% - 1.5% in accordance with Article 394 of the Tax Code of the Russian Federation),

- about possible benefits that the taxpayer has, it is worth informing the authorities independently, in this case they will be taken into account in the calculation,

- multiply the interest rate by the value according to the cadastre, take into account the benefits - we get the tax amount,

- compare with the amount on the tax notice.

In case of discrepancy, it is worth making a correction with the tax service.

Part 2, Article 7, Clause 11 and Clause 14 of Federal Law No. 221-FZ take into account the possibility of adjusting the cadastral value of land. This:

- varying the purpose of operation,

- structural changes in the area of the site,

- change of owner status,

- other changes affecting the parameters of the site.

The owner of the plot initiates an act of changing the cadastral value, and on this basis a cadastral record is made.

Unfortunately, the taxpayer does not have the right to independently change the tax rate, even on the basis of an existing act.

In almost all regions of the Russian Federation in 2020, the change in cadastral value to market value will significantly increase land tax. Contacting the commission for resolving cadastre disputes will allow you to challenge this increase. Accordingly, 284 Federal Law is the main one referred to by the tax inspectorate.

Inaccurate information about the land plot and the established market value of the property at the time of establishment give the right to challenge.

What to do:

- order a final price report from an appraisal company,

- initiate an expert assessment in the appraiser’s organization,

- submit the prepared documents to the Rosreestr branch,

- provide: cadastral passport, notarized copies of title documents.

There are also benefits for this taxation. In accordance with Article 391 of the Tax Code of the Russian Federation, a group of individuals is defined for whom benefits are provided:

- absolute exemption from payment,

- tax deduction.

A careful study of the legislation will help to clarify the possible obligations of the landowner to the state and fulfill them on time.

Reduction without going to court

Sometimes the time has passed after the revaluation, the value has been established and entered into the State Property Committee information bank. But conditions that arose through no fault of the owner of the land plot, or were discovered by him, reduced the value of the allotment due to:

- man-made force majeure circumstances;

- soil poisoning with pesticides;

- as a result of natural disasters;

- detection of the listed circumstances that occurred earlier.

This list can be continued; it includes all facts that reduce the useful properties of land and have an objective origin.

In this case, you must follow the following instructions on how to reduce the cadastral value of a land plot:

- Conduct a soil examination and collect other evidence confirming soil damage.

- Contact the local branch of the State Committee for Human Rights in person or through a representative and submit an application addressed to the head.

- Attach to the application a package of documentation reflecting the eligibility of the applicant.

- Receive a receipt for documents submitted to Rosreestr. On the day specified in the receipt, come again to receive the results of the administration’s consideration of the issue.

- Receive an extract from the decision of the administration of the GKN department. If it expresses permission to replace the information, the documentation will be reissued.

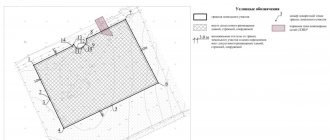

- Upon completion of the re-registration procedure, it is advisable to obtain a cadastral extract on the cadastral value of the land plot.

Application and documents

Must be completed on a standard form obtained from the registrar . Mostly, the registrar fills it out independently, and the applicant only double-checks the entered information and puts his own signature. In other cases, fill out the fields highlighted on the form for completion.

A certificate of ownership, a cadastral passport (see where and how to get it in this article) and documents confirming the authority of the request are presented:

- certificates of overvaluation;

- acts from independent appraisers;

- soil examination reports;

- other confirmations.

For example, if the usable area of a site changes as a result of bank erosion or the collapse of a ravine, it is permissible to present the result of a topographic survey.

Reducing the cadastral value of land plots: cost

The cost of the procedure will include expenses for obtaining certificates and certificates from property appraisers . Their cost usually starts from 3 thousand rubles. As the service becomes more complex, the amount paid for it increases. At least three acts from different appraisers may be required.

The same applies to soil science examination; its implementation is estimated at 5 thousand and increases in proportion to the increase in complexity of execution. In this case, one analysis is usually sufficient, but an additional land use assessment report may be required, excluding unusable parts of the site.

Fees and deadlines

Changes in price are free of charge . When ordering a cadastral extract or cadastral passport of a land plot with updated data, a proportionate amount will be charged. Accordingly, 200 or 350 rubles (Article 333.33 of the Tax Code of the Russian Federation).

Preparation of the decision should not exceed one calendar month.

Reducing the cadastral value of a land plot in court

If, in the cases indicated above, the administration of the GKN department refused to correct the error or reduce the specified parameter, at the request of the owner of the land plot, you need to go to court.

All issues related to real estate are considered in the district court at the location of the property, including the land plot.

Collection in court necessarily follows the pre-trial procedure, which is carried out in the cadastral chamber , also allowing for filing an application through the multifunctional center (MFC). Without a preliminary application to Rosreestr, which is confirmed by an official document, legal proceedings will not be initiated.

Going to court consists of the following steps:

- Receive an official document from the Rosreestr branch with a reasoned refusal to reduce the previously established price parameters of the land plot.

- Attach the received extract to the package of documentation that was submitted to Rosreestr. Supplement the evidence with other facts, which may include photographic materials and witness statements.

- Pay the fee by attaching the receipt to the package of documents.

- Write a statement of claim, attaching supporting documentation and submit it to the magistrate.

- Participate in polemics between the parties at a court hearing.

- Receive an extract from the court decision, based on the recognition of the claim, submit documents to Rosreestr again.

Statement of claim

If it is necessary to reduce the cadastral value of a land plot, the statement of claim is drawn up in the prescribed form (Article 131 of the Code of Civil Procedure of the Russian Federation). In addition to information about the magistrate and the parties, the following must be indicated:

- Circumstances that increase the cadastral value of land plots or those that require (allow) its reduction.

- Reasons why the value was not changed in the cadastral chamber.

- Request to the court to recognize the claim.

In conclusion, a list of applications is given, the filing date and signature are indicated..

Reducing the cadastral value of a land plot: statement of claim.

Documentation

Civil passports and two types of documentation are presented:

- title and title documents for land plots;

- evidence base.

These include those that were transferred to Rosreestr and additional evidence relevant to the case.

Last change to CS

The answer to the question of whether the cadastral value of an apartment changes annually is established at the legislative level. As mentioned above, the next revaluation should occur at least once every five years. But how often it is done is decided by the owner, who can be a private person, an enterprise, or a government agency.

The owner has the right to initiate a review of the land assessment results. Moreover, you won’t have to invent reasons for this for a long time. By law, changes in market indicators are already enough to call engineers for an assessment. In addition, nowhere is it precisely defined what is included in these “market indicators”.

Another important task for the owner is to determine when the cadastral value of the land has changed. To do this, the assessment engineer takes the following actions:

- studies documents regarding real estate;

- visits the site and studies its characteristics through visual inspection;

- prepares an act in which he describes the properties of the real estate and indicates its price value.

After this, the changed information is entered into the real estate register. However, the date of drawing up the act is the day when the price of the object changes.

In relation to land, there are special reasons why the cadastral value of a land plot changes:

- Reduction or increase in size and, accordingly, area.

- Transferring a site to a new category.

- Change of purpose or introduction of a new type of use permitted by local authorities.

Read more about the revision of the Cadastral Value of houses, apartments and land plots in the article “Changing the cadastral value of real estate.”