Legislative regulation of the issue

In terms of legislation, the regulation of legal relations arising on the basis of land valuation is carried out by the Land Code of the Russian Federation.

In Russia there is a professional community of people who are involved in the assessment of land property - appraisers. Their activities are regulated by the federal law “On Valuation Activities”.

The process of concluding transactions regarding the valuation of land plots is regulated by the Civil Code of the Russian Federation and other regulations that define land plots as real estate.

Why is an assessment carried out?

Land property assessment is carried out by cadastral organizations.

This process consists of analyzing the situation on the real estate market and predicting the price of land in the near future.

The peculiarity of land assessment is that it is carried out en masse and is one of the main indicators when calculating the amount of tax for their owners.

If the owner of the land plot decides to put his plot of land up for sale, then he needs to contact the cadastral organization and evaluate the territory. During the examination, the individual characteristics of the property are studied, and the situation on the real estate market is also taken into account.

The procedure for carrying out cadastral work is regulated by Russian legislation in the field of land relations.

There are several methods for assessing land property, they are presented in the table:

| Method | Content |

| Normative methodology | With this method of land exploration, its value is assessed in accordance with regulatory standards. This valuation method is used when concluding various transactions regarding real estate, such as donating or transferring real estate to another person in accordance with a purchase and sale agreement. If several owners have the right to land plots, then the normative methodology helps determine the shares of land and the value of each part of the property. The normative assessment methodology is applied to all cases that are related to the legal relations of owners in accordance with the legislation of the Russian Federation |

| Sales comparison | Determination of the price of property with this approach is carried out on the basis of the market situation. The comparative points that the appraiser uses in the study are the following: ● the state of the real estate market; ● conditions for the sale of land; ● purpose of the memory; ● location of the storage unit; ● physical features of the land plot; ● soil composition; ● forecasts of economists; ● availability of infrastructure; ● availability of communications: gas, water, electricity. In the Russian Federation, the market is open, so using this approach is effective. Evaluators have the opportunity to obtain accurate data on which the study is based |

| Income method (annuity capitalization) | This method is used if it is necessary to determine income from land leased. Rental indicators must be formed in the form of regular income of the owner of the land plot. The rate depends on where the land plot is located, what size it is, whether it is difficult to get to it, and what is the intended purpose of such land |

| Distribution method | This approach is used to determine the value of shares in the total price of the complex |

| Isolation technique | This method of researching land property consists of isolating the characteristics of the quality of the land plot from the object of sale for comparison with other property. |

| Residual method | The purpose of the residual methodology is to determine which assets can be improved and get the maximum profit from them. This method is comprehensive: it includes a capitalization technique and a standardized approach |

| Breakdown technique | This approach is used when land ownership is divided into several small plots. The size of small plots and the total cost of land when selling small land plots is determined |

Valuing land using such methods includes costs such as:

- payment for services of appraisers;

- construction of infrastructure facilities (roads, engineering networks, etc.);

- clearing the territory, planning it, measuring it, dividing it;

- advertising and marketing research.

The concept of cadastral value

In accordance with paragraphs. 2 p. 1 art. 3 (hereinafter referred to as Federal Law 237), cadastral value (CV) is the price of a property determined as a result of a state assessment. It is established based on an analysis of market information and data related to the economic characteristics of the operation of the facility.

To determine the CS, special techniques are used.

This type of value is needed by the state for the purposes provided for by law, primarily for taxation.

Currently, the price of an object according to the cadastre is the tax base for calculating property taxes. The tax that each owner of an apartment, house or land pays once a year is calculated based on this amount.

Read more about what the cadastral value of real estate is.

Goals and types of assessment

There are several main purposes for determining the estimated value of a property:

- Concluding transactions between citizens - sale of land plots, donation, rent, inheritance, etc.

- Providing land ownership in the form of collateral when concluding a credit relationship with a bank.

- Disputes regarding property relations.

- Privatization.

- Registration of insurance for storage.

- Valuation of the enterprise (if the category of land used relates to industrial land plots).

- Assessing damage when crimes are committed against the owner of the land or in accidents.

- Formation of tax value for the owner's land.

The following types of land valuation help to meet the objectives:

- Mass - used to immediately explore several areas intended for land use, the size of which is quite impressive. Typically, this type of valuation is used when selling agricultural land, industrial plots, etc.

- Single assessment - carried out when it is necessary to examine the cost of one memory.

Both types of land property valuation are a system and require a thorough analysis of the current situation of the real estate market.

Who has the right to conduct an assessment?

Land valuation implies the presence of objects and subjects of valuation. Contacting specialists for an assessment is carried out by individuals or legal entities who are the owners of the land plot.

The subjects of assessment are:

- individuals who have a license to determine the value of land plots - appraisers;

- legal entities that are represented by organizations that have the right to evaluate property rights;

- LSG bodies that have the right to assess land;

- executive authorities that can carry out land assessment activities.

Important! When contacting organizations or persons carrying out land appraisal activities, the owner of real estate should review the company’s documentation, which confirms the right to carry out such activities. Otherwise, the result of the land assessment may not correspond to reality.

When is an assessment needed?

Land valuation can be useful in different situations, for example:

- Upon entering into inheritance rights. In this case, it is important to know the cost to determine the amount of the state fee that the heirs pay to the notary.

- When contributing property to the authorized capital as a contribution.

- To complete a real estate purchase and sale transaction. Here it is important to find out the market price for such objects, so as not to undercut the price, but also not to overinflate the cost of the plot.

- To challenge the cadastral price and reduce the amount of land tax.

- When drawing up a business plan to prepare an investment project.

- For the purpose of obtaining a mortgage or other loan from a bank that requires the payment of collateral.

- To conclude a land lease transaction with subsequent purchase.

- When conducting a comprehensive business assessment.

- For litigation related to a person's real estate.

- During enforcement proceedings.

This list of situations where land valuation may be required is not exhaustive.

Market and cadastral value of the plot

The property assessment specialist indicates in the service agreement the standards by which he will carry out assessment activities.

The cost of land plots can be determined on the basis of cadastral and market indicators.

- Cadastral price of land plot. With this assessment, the value of real estate is determined by analyzing market demand for similar types of property. The determination of such value is carried out after dividing the land plot into several small plots, as a result of which a mass type of land valuation is carried out.

Important! A certain cadastral price of real estate may not correspond to the actual cost of land. The price is reduced by challenging the assigned price in the courts.

- Market price of storage unit.

The cost of real estate in this case depends on what the price of land is at the moment and what is predicted in the future. This depends on the physical parameters of the earth and a number of indicators:

- infrastructure;

- location of the property;

- availability of communications;

- soil composition (important for agricultural objects).

Land assessment procedure

The process of conducting assessment activities is divided into several successive stages:

- Concluding a transaction with an appraisal company for the provision of services. The contract specifies all the information about the procedure: the goals and objectives of the assessment, by what standards the cost of the loan is assessed and other data. In addition to information about the upcoming procedure, the contract specifies all the data about the land plot itself: cadastral number, category of land, features, etc.

- Conducting a storage assessment. At this stage, the land and the situation on the real estate market are analyzed, the data obtained is summarized, after which an estimate of the price of the land plot is derived.

- coordination of research results;

- drawing up a report on the work performed.

The result of the study must be documented by the assessment organization or person in writing in the form of a report. Such a document is proof that the land plot is really worth the amount presented for the sale of the real estate.

In Russian practice there is not yet a unified form of reporting documentation. However, the data contained in such a document must comply with legal requirements.

The results of the research must disclose the following information:

- cost of the object of sale;

- information about the methodology for assessing knowledge;

- information about the interim assessment and final results of activities.

When conducting an assessment, the following documents are required:

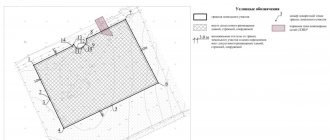

- cadastral passport of the land plot;

- information about the storage category;

- the owner's right to use the land plot;

- agreement for the provision of appraisal services.

Valuation of land plot: cadastral and market

It is carried out to determine future income from the assessed plot in the form of rent, taking into account the current market situation.

- Distribution method. It is based on an analysis of the land plot as an integral part of the complex - land and real estate as a whole. It is mainly used for integral property complexes and other complex, multifunctional objects.

- Selection method. Used to evaluate developed land, if there is information on the implementation of similar objects.

- Remainder method. It is used to evaluate sites in order to determine their investment attractiveness.

- Breakdown method. Used when dividing land into individual plots.

Features of land assessment

The mechanism for assessing a land plot is a complex process that requires careful preparation and painstaking work, as a result of which the Customer is provided with correct data in the form of an official report.

To conduct a land assessment, the following list of documents is provided:

- certificate of registration of land ownership or lease

- official cadastral site plan

- design and title documentation for buildings, structures and other changes on the land plot

- information about actual encumbrances on the land plot (lease, pledge and other easements).

The assessment of the value of a land plot is carried out with the calculation of the most profitable land use and certain goals of the procedure. First of all, based on the task at hand, specialists select the approach by which the land (land plot) will be assessed .

Main criteria for assessing land:

- Location of the site: city, town, agricultural or special purpose land

- Availability and quality of infrastructure: transport interchanges, social and amenities, proximity to economically attractive and cultural sites, etc.

- Efficiency of use of neighboring areas

- Environmental friendliness

The assessment of agricultural land takes into account specific factors - the purpose of the site, the climatic features of the region, the functions of the object and even the characteristics of the soil, for which experts in the field of geology and geodesy can be involved.

The value of assessing land (land plots) within the city is influenced by the level of development of social and engineering infrastructure, regional, environmental and other features, including transport links, aesthetic merits and prestige of the area. The basis for the formation of land valuation in the city is a comprehensive urban planning policy and the market value of analogues.

Land valuation cost

The cost of land valuation depends on many factors. Several goals and directions can be set simultaneously to conduct a comprehensive assessment, draw up a business plan and identify the most effective use of the facility. For example, assessing the value of a land plot for obtaining a loan can be carried out in parallel with assessing the effectiveness of investing financial resources in this territory. These two goals are not opposed to each other, but the amount of work appraisers have to carry out is extensive, in several directions at once. Therefore, the final cost of the service may increase due to the receipt of reliable analytical information and a comprehensive analysis of the market price of the land plot.

It should also be noted that the value of land is constantly changing, so the assessment of a land plot is carried out only for a certain period of time. If necessary, it should be updated and adjusted to take into account changes in the market and the environment at the valuation date.

Based on the results of the work performed, the Customer is issued an official report, which substantiates the assessment of the value of land plots , with a photo report and a list of sources of information received.

additional information on assessing the value of land in the sections: Land Appraisal, Valuation of Land in Settlements.