Everyone is required to pay land tax, even those who received a plot of land for lifelong use, as an inheritance or as a gift. The amount of the fee is determined by the regional administration. However, vulnerable segments of the population are exempt from taxation. The state provides land tax benefits for disabled people of group 2 and other people suffering from physical disabilities.

Legal framework and which individuals are classified as disabled

Taxation laws are established by the Tax Code of the Russian Federation. This act makes policy and manages the budget, deciding who should pay how much, and who is partially or completely exempt from tax liability and receives privileges. The Tax Code of the Russian Federation approves benefits at the level of government at which they can manage the budget. For this reason, laws on advantages and concessions that are provided to owners of land plots are divided into 3 types:

- Federal regulations.

- Municipal regulations.

- Local decrees established by the local administrative authority.

Articles 395 and 391 (clause 5) of the Tax Code of the Russian Federation establish decrees on benefits for a number of individuals. According to this, citizens who meet the criteria of the list have the right to be exempt from paying fees for one of the land plots located on the territory of the Russian Federation. Article 387 of the Tax Code of Russia states that local regulations must comply with the general rules of the Tax Code.

A disabled person is a person whose life activity is limited by a physical, mental or mental impairment.

Conditions that prompt recognition of an individual as disabled:

- limited life functioning;

- health problems;

- need for protection and assistance.

According to the severity of health, disability groups I, II and III are distinguished. The first category (the heaviest) is determined for 2 years, the rest - for one year.

Citizens who have the right not to pay land tax are:

- Age pensioners, if the area of their land plot is less than 6 acres. This news is from 2020.

- Heroes of the USSR and the Russian Federation, participants of the Second World War, persons awarded the Badge of Military Glory.

- Disabled people of certain categories.

- People who are representatives of a small indigenous people living beyond the Arctic Circle, in the Far East and Siberia.

- Military personnel who fought in battles and were declared disabled.

- Settlers who are registered in religious communities.

- Persons injured during the occurrence and elimination of nuclear disasters.

In addition to the above-mentioned individuals, some organizations are exempt from paying the duty. For example, charity campaigns, buildings of the Russian Ministry of Justice, enterprises that build highways or railways, etc.

Payment of land tax by disabled people of group 2

To get benefits, you need to contact the Federal Tax Service. This can be done on their official website, come to the local administrative authority or call. Tax payments will not be canceled for people with preferential status if they do not write an application. You need to go to the Federal Tax Service with all the documents. The algorithm of actions is as follows:

- contacting a government agency to obtain information about registering a privilege;

- collecting the necessary documents and filling out the application;

- delivery of documents on time;

- Now the tax must be paid less or not at all.

You can reduce taxation by only one memory. You can choose the area that will be exempt from the duty yourself. It would be more rational to choose an area with a high price. It is impossible to reduce the tax on 2 nearby territories when, according to the papers, they are combined into one.

If for some reason a person did not know about this concession, then he can declare this in writing and receive the due funds three years before the date of application. The application may also be sent by mail. First, you need to sign all the papers, and send the letter with a subsequent response about receipt.

Recent news: as of 2020, the deadline for paying for rent has become October 1. If the receipt has not been received, then you need to go to the Federal Tax Service. This will help avoid legal problems (fines and penalties). In the same center you can ask that the papers arrive on time.

Characteristics of the category of disabled person of group 2

To receive group 2, a citizen must be diagnosed with persistent disorders, like other groups. But there are additional differences that give rise to category 2:

- Persons with this status are able to go through the process of examination and registration of disability on their own.

- It is enough for them to use medical equipment or the help of at least one person to conduct normal life activities. The difference from other citizens will be that a disabled person can only work in a workplace with special equipment or an assigned assistant.

- This category of persons, independently or with the help of another person, navigates space and controls their behavior in society.

- They have access to education, although only in a specialized educational institution or at home.

Important! The group in the Russian Federation is recognized as a working group and is assigned for a certain period.

After the expiration of the period, the disabled person must re-collect documents and undergo an examination.

Expert opinion

After receiving a new ITU conclusion, a group 2 disabled person has the right to re-apply for tax benefits. Periodic confirmation of status is required for all citizens under retirement age. This is because the group category can be changed depending on the individual's health status. In turn, this leads to changes in the list of tax benefits.

Starovoitova E.N., inspector of the Federal Tax Service of Vyazma

Types of benefits

The Tax Code distinguishes 3 methods of reducing duties:

- Complete liberation.

- Partial release.

- Municipal concessions.

Each benefit type must have its own code. It is registered when filling out the declaration.

In most cases, an absolute exemption from land tax for disabled people is not granted. Only residents of the North, Siberia, and the Far East who are engaged in traditional crafts and their old way of life in order to preserve the indigenous people can be completely liberated. Disabled people of these small nationalities can refuse to pay the fee for a loan.

Since 2014, there are 2 types of interest rates on ZN:

- 0.3% of the cadastral value for territories intended for Individual Housing Construction and agriculture;

- All other areas are subject to a 1.5% rate.

Article 391 of the Tax Code of the Russian Federation provides for a reduction in the cost of a plot by 10 thousand rubles, thereby reducing the tax on land plots. That is, if the land cost 60 thousand rubles, then a disabled person can reduce its value by 10 thousand rubles. It turns out that with a duty of 1.5%, a citizen with limited ability to live will have to pay 750 rubles instead of 900. The savings will be only 150 rubles.

In St. Petersburg, Moscow and a number of other regions, the size of the privilege is much greater. In the Russian capital, law No. 74 of November 24, 2004 provides for a reduction in the price of a plot by 1 million rubles. In other words, the tax amount will decrease by 1 million x 1.5% = 15 thousand rubles. But only disabled people from WWII and other military battles, those unable to work since childhood, and disabled people of the first and second groups can count on such concessions.

In the Leningrad region, the law of November 23, 2012 No. 617-105 establishes a partial exemption from the duty for pensions for disabled people from the Second World War and other military battles, groups 1, 2 and 3, and disabled people since childhood.

Group 2 disabled people can receive the following government support: free travel on public transport (except taxis), the right to free prosthetics of teeth and limbs, the possibility of a 35-hour work week, etc.

Details about tax benefits

So, disabled people of groups 1 and 2 receive tax breaks:

- for transport;

- property property;

- land.

Each type has its own conditions that require detailed consideration.

Property tax

According to current legislation, the list of beneficiaries who are exempt from paying property tax is regulated at the federal level. Among others, this list includes disabled people of groups 1 and 2. The following are exempt from taxation:

- apartments;

- private households;

- garage buildings;

- dachas;

- rooms;

- shares in the apartment.

Important! Tax exemption is provided only for the personal property of a disabled person. For example, if a person with a disability owns part of an apartment that is shared ownership between 3 homeowners, the tax base will only be removed from that part. Other owners are taxed in full.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Motor vehicle tax

This is important to know: Topographic survey of a land plot - features and prospects in 2020

If we talk about disabled people, then exemption from transport tax is provided for them under the following conditions:

- The vehicle has been converted for people with disabilities.

- The car is equipped with an engine with a capacity of less than 100 horsepower, purchased through social security authorities as part of a program to assist the disabled.

- Reduced rates for vehicles equipped with a 150-horsepower engine.

Important! Full or partial exemption from transport tax does not oblige a disabled person to personally use vehicles. The driver may be an official representative or a third party for whom a general power of attorney has been issued.

Land tax

Tax deduction

For citizens with disabilities who receive income, there are 2 options for benefits:

- Exemption of profits from tax for individuals.

- Standard tax deduction.

- funds that were used to purchase vouchers for sanatorium and resort treatment;

- expenses incurred by public organizations to provide medical care and other services to people with disabilities;

- costs for the purchase of rehabilitation means and technical equipment necessary for disabled people, including the maintenance of guide dogs;

- monetary and other assistance provided to disabled people of the Great Patriotic War or their widows.

The standard tax deduction for citizens with 1st and 2nd disability groups is 500 rubles monthly . If disability occurs as a result of a serious injury , the amount increases to 3,000 rubles .

In addition, tax breaks are provided for enterprises and organizations that employ people with disabilities. In particular, each employer or private entrepreneur pays insurance premiums for disabled people of 27.1%. If the staff of a public organization is 80% or more staffed by people with disabilities, such movements and foundations are completely exempt from property and land taxes.

State duties

For citizens with disabilities of groups 1 and 2, concessions are provided for the payment of state duties. The privilege works like this:

- Full exemption when considering cases by the magistrate and the Supreme Court, and by instances of general jurisdiction.

- 50% of the fee for the provision of notary services.

- State duty in any form is not collected from people who are in homes and boarding schools for the elderly.

An exception to this bill are cases related to the alienation of real estate and vehicles.

Registration of land tax benefits for disabled people of group 2

To obtain a privilege for a citizen with health problems, the following conditions must be met:

- Availability of all necessary documents.

- Only disabled people of 1st and 2nd degrees receive discounts.

- Group 3 of disabled people receive incentives if they are WWII veterans and participants in wars in hot spots.

- Disabled people of categories 2 and 3 must apply for the prerogative every year.

- The benefit can only be obtained if there are no debts to the state and housing and communal services.

Citizens who became disabled after the first day of 2004 cannot receive a discount on land tax. But they have the right to purchase other benefits and benefits.

Need to know

It is important to understand that tax benefits are available to every disabled person of groups 1 and 2, regardless of age and region of residence. However, these privileges are not granted by default, but are of a declarative nature: a citizen must independently contact certain authorities and provide documents to receive them.

To qualify for tax benefits, you must complete the following steps:

Considering that we are talking about citizens with disabilities who sometimes cannot move independently, the law allows for the above actions to be performed through a trusted representative. To do this, a notary is called to your home, who certifies photocopies of documents and issues a power of attorney for the legal representative.

Tax benefits are provided on the basis of photocopies of:

- passports;

- medical certificate confirming the disability group;

- work book (if any);

- personal rehabilitation program.

Important! Photocopies must be confirmed by the originals, so you will also have to take the originals of these documents with you.

The application, which is submitted to the territorial tax authority, is filled out in any form, however, it must contain the following information:

- surname and initials of the applicant;

- full name of the executive body to which the appeal is made;

- type of tax benefit (for exemption from transport tax, the license plate number of the car is indicated);

- disability group, reasons leading to disability;

- date of completion and signature of the applicant.

It should be noted that when it comes to disabled children, benefits apply not only to the child, but also to his parents/guardians. The same benefits apply to disabled minors as to adults. Considering that children cannot have personal vehicles, they receive relief from paying utility bills and are exempt from taxes on the part of their property. Parents and guardians who have a dependent child with disabilities receive privileges in paying personal income tax.

It should be added that the list of benefits for people with disabilities, including in terms of taxation, may vary depending on the region of residence, so the current conditions for providing financial and non-material support should be clarified at the local branch of the Federal Tax Service.

This is important to know: Land tax declaration for 2020 for legal entities

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

What package of documents will be required?

The benefit is awarded only at the request of the disabled person. If the victim has not written a proper application for the assignment, then the fee will have to be paid in full. To obtain the privilege, you need to collect the following documents:

- application for purchasing a discount (usually written to the Federal Tax Service, but is also allowed at home);

- passport or other document proving the identity of the applicant;

- certificate of disability from the hospital;

- paper for land, for which you will need to pay less;

- a copy of the work book.

With all this, you need to go to the Federal Tax Service or another administrative body.

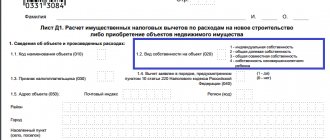

Application for land tax benefits for disabled people - sample

The application can be written both at the Federal Tax Service and at home. There is no mandatory format, but you need to use the recommended one. First you need to choose what duty is paid by the individual (here – land duty).

The owner writes the data in the order below:

- Full Name.

- Taxpayer identification number.

- Contacts (phone).

- Request for benefit, start date (usually next month) and period of work (year).

- Attributes of documents evidencing disability and details of the registration document.

Next, the applicant signs the paper.

How benefits work and how they are calculated

Discounts are valid for one year after application acceptance. After this period of time, you need to confirm your disability again, obtain the status of a beneficiary, and apply to the Federal Tax Service for an extension of the benefit.

The benefit is calculated by the following formula: Land Tax = plot size (sq. m.) x % rate (usually 1.5%) x Cadastral value (per 1 sq. m.).

A group 2 disabled person can reduce the cadastral price by 10 thousand rubles. The size of the plot is written in the Cadastral Passport or in another document on the land plot. The cadastral value can be found out if you have a Cadastral Number. The latter can be obtained from Roskadastre.

The interest rate may vary depending on the area where the land is located. You can pay tax through a savings bank, a terminal, or use the Internet.

Types of benefits provided to disabled people

At the regional level (Moscow and St. Petersburg), as well as municipalities, the size of the benefit often increases significantly. At these levels, benefits for people with disabilities are provided both in the form of a reduction in the tax base and in the form of a complete tax exemption.

In Moscow, benefits in the form of a reduction in the tax base by 1 million rubles on the basis of Law No. 74 of November 24, 2004 are provided to:

- disabled people of groups 1 and 2;

- disabled people since childhood;

- disabled people of the Second World War and other military operations.

In monetary terms, the size of such a benefit can be up to 15 thousand rubles. (1 million x 1.5%).

Features of providing benefits to disabled people of group 2

What to pay attention to:

- the legal representative has the right to draw up documents himself;

- compensation for paid ZN is written in a different form, different from the above statement;

- the discount is not provided to disabled people of the 3rd degree, if they are not participants in the Second World War or another military conflict;

- The maximum value of the concession from the total tax amount is 50%. In rare cases, more is possible;

- The benefit must be applied for annually.

The discount on land tax is of a declarative nature. For them to become a reality, you need to report this to the Federal Tax Service in writing and provide documents.

Benefits are regulated by local authorities. Therefore, the size of the discount depends on the economic situation in the republic or region.

Tax benefits for disabled people of 2nd group on land tax

Many people are interested in what benefits a disabled person of group 2 has for land tax. At the all-Russian level, disabled people as individuals can only count on exemption from payment if they are representatives of the indigenous populations of the Far East or North.

Please note that this exemption is not provided for disability status. But it has been determined that persons in the second group can reduce the tax base by 10 thousand rubles. This also applies to those who received this status from childhood or as a result of participation in hostilities.

This is important to know: What is interesting and useful to know about documents for the sale of land

Land tax benefits for disabled people of group 2 in the Moscow region

In the Moscow region, plots of land are especially expensive, which is why the issue of providing land tax benefits to group 2 disabled people is particularly acute. Full or partial exemption from payment is determined through special resolutions adopted by the administrations of cities and rural districts.

For example, in the rural settlement of Akseno-Butyrskoye, citizens can pay half as much as they were initially entitled to under the laws of the Russian Federation. At the same time, in the rural settlement of Vasilyevskoye, citizens with a confirmed second group were completely exempted from paying.

Land tax benefits for disabled people of group 3

Representatives of the third group are not deprived by law of the obligation to pay. However, the right to grant appropriate privileges is given to municipalities. However, a minimum number of administrations issue preferential bonuses to representatives of the 3rd disability group. Most of these citizens can only count on a reduction in the tax base by 10 thousand rubles.

For example, almost all land tax benefits for disabled people of group 3 in the Moscow region are intended for persons with 1st and 2nd degree disabilities. However, there are exceptions. In the rural settlement of Bukarevskoye, citizens with category 3 can reduce the mandatory amount to be paid by 50%. This right applies only to one plot that does not exceed the established size limits for individual housing construction or a summer cottage.

Benefits for disabled people of group 1 for land tax in 2020

Since persons with disability group 1, as a rule, have the most serious health problems, they receive more land tax benefits. According to the law, they can count on a reduction in the taxable amount (by 10 thousand rubles).

In Moscow, persons with 1st degree of disability can immediately reduce the established cadastral value by 1 million rubles. Although they are not exempt from payment at the national level, in almost every region they have the right to full or partial exemption.

Land tax benefits for disabled children

In almost all regions, without exception, there are benefits in paying land tax for people with disabilities who received their status while still a minor. Depending on the decisions made by specific administrations, they receive the right to:

- Reducing the tax base;

- Reducing the percentage (up to 50%);

- Complete exemption from payment.

Federal legislation mandatorily establishes the possibility for this category of citizens to reduce the base by 10 thousand rubles.