Home / Real estate / Land / Taxes

Back

Published: 04/01/2017

Reading time: 10 min

0

528

Today, Russians can make most payments via the Internet, including tax payments and fees.

Taxpayers who have their own dacha or private house are required to transfer land tax to the budget within the established time frame. For non-payment, citizens face penalties and fines .

To avoid negative consequences, it is worth paying taxes on time. The most convenient way to transfer taxes is online payment.

- Advantages and disadvantages of paying land tax online

- Who is this service available to?

- Step-by-step instructions for paying land tax via the Internet Via the State Services website

- Through the Sberbank website

- Through electronic wallets

Advantages and disadvantages of paying land tax online

Paying land tax via the Internet has a number of advantages:

- the payment can be made without leaving home, which saves a lot of time on a visit to the bank and queues;

- You can pay tax at any time without being tied to the work of a bank branch;

- payment can be made without commission, which saves money (in many banks you have to pay up to 3% of the tax for payment processing);

- no need to fill out a payment order for fear of making a mistake in the details: online services automatically fill in the basic data;

- you can track the payment processing status in real time;

- You can download a payment slip confirming payment at any time;

- saving time on submitting reporting documentation to the Federal Tax Service (relevant for legal entities).

There are practically no disadvantages or limitations to online payment of taxes. Unless you need uninterrupted access to the Internet and, in some cases, connection to specialized services (Internet banking or client banking).

When making online payments, technical failures are possible, as a result of which the processing system is incorrect.

But such situations are rare and are possible not only with online payment, but also with traditional payment through a bank.

From a smartphone

You will need a mobile phone with the application installed. How to pay land tax through Sberbank online, step-by-step instructions:

- Open the application and enter the PIN code;

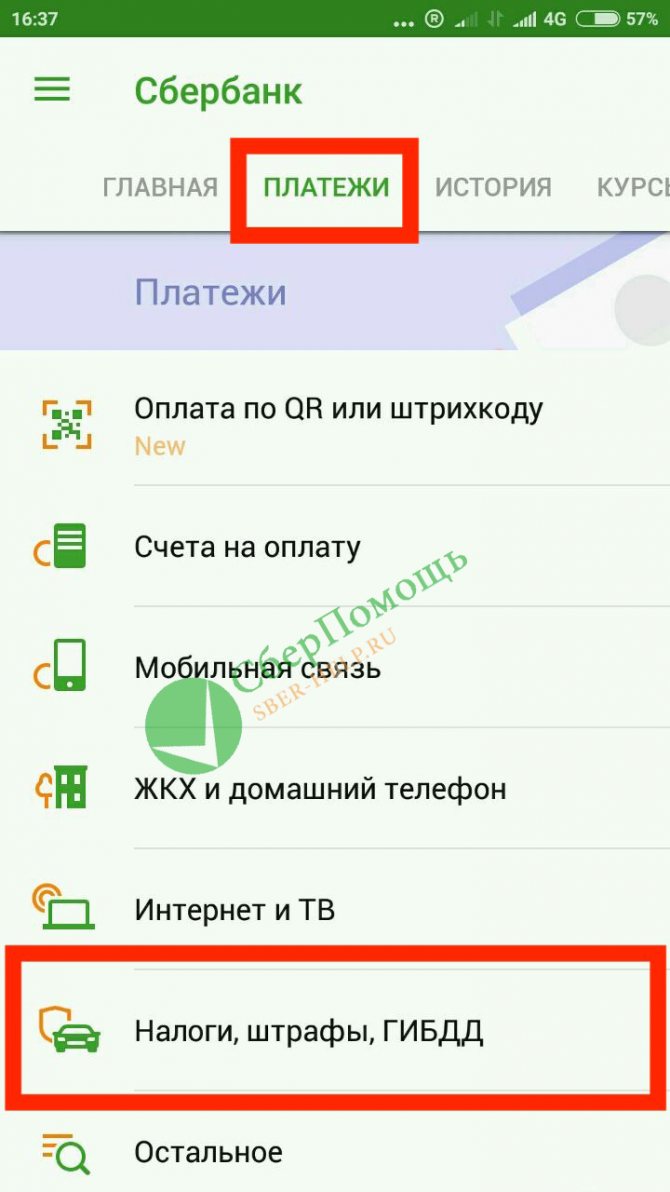

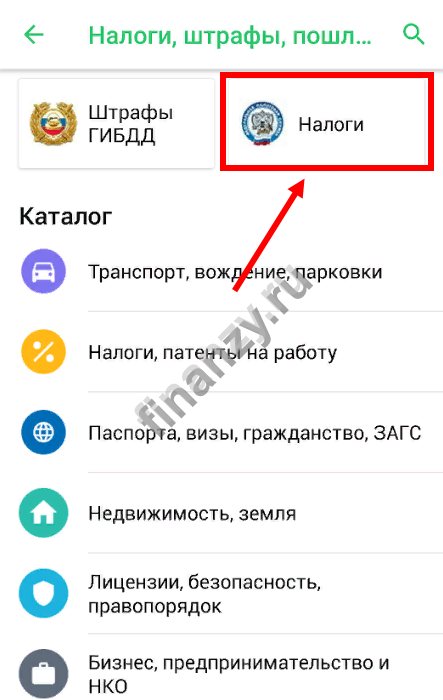

- Select the “Payments” tab, and in it “Taxes, fines”;

- In the open window, go to “Taxes” again;

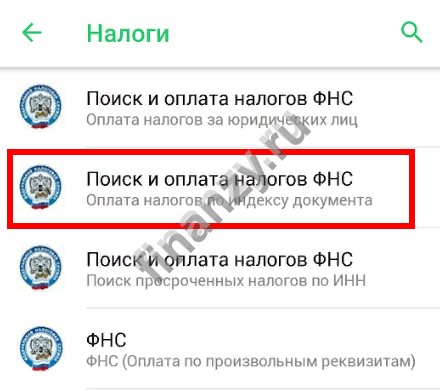

- Of the presented options, the simplest is to search by document index, and select it;

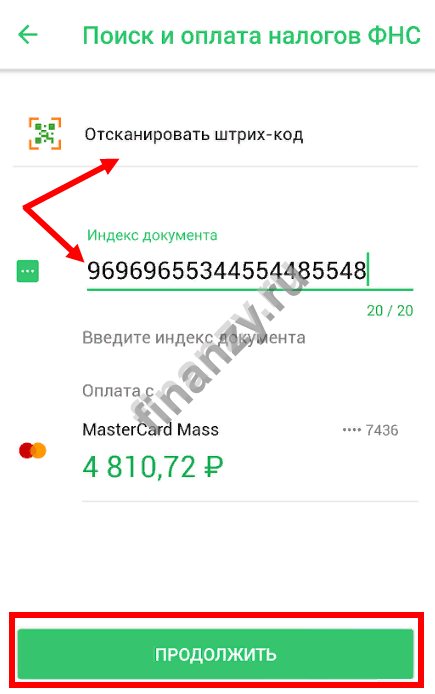

- We scan the barcode of the land receipt or enter the 20 digits of the UIN from it;

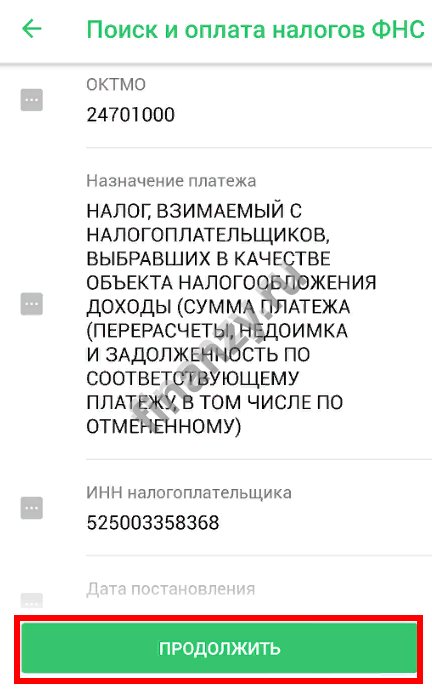

- Now we check the correctness of the data - amount, address, purpose of payment. Click “Continue”;

- “Continue” and “Pay” again. After this, you can print a receipt.

You can pay land tax through the Sberbank Online application in literally 5 minutes; it’s very easy to do.

Who is this service available to?

Payment of land tax online is available to all categories of taxpayers:

- individuals;

- individual entrepreneurs;

- legal entities (companies).

It is worth considering that they must pay from their own funds.

So, if the tax is supposed to be paid from a card, then it must belong to the owner of the land plot. Payment from the money of the tenant of the land instead of its legal owner is not allowed.

Often, owners of a land plot who own real estate as common shared ownership are interested in how to divide the land plot into two plots. What is a predial easement and when is it established? Find out about this from our article.

Is it possible to legally sell land without land surveying? We talked about it here.

How to pay taxes through the Sberbank Online application?

In the Sberbank Online mobile application you can pay current taxes, as well as find and pay overdue taxes.

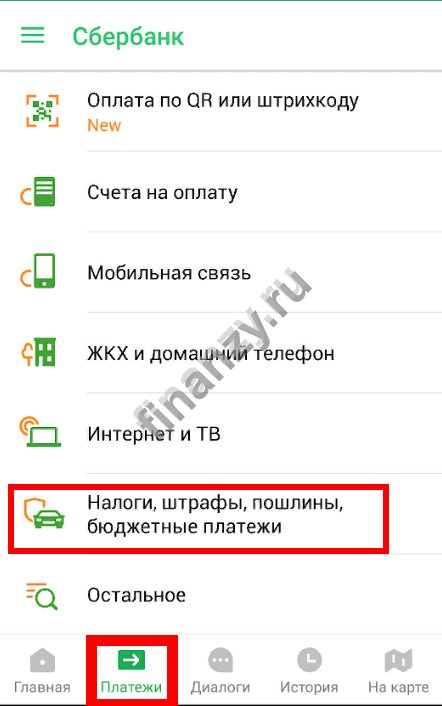

Step 1. Authorization and payment selection

To get started, open the official application from Sberbank and log into it using your password.

In the main application menu, find the Payments and go to it. “Taxes, fines, traffic police” in the general list of all kinds of payments and transfers and select it.

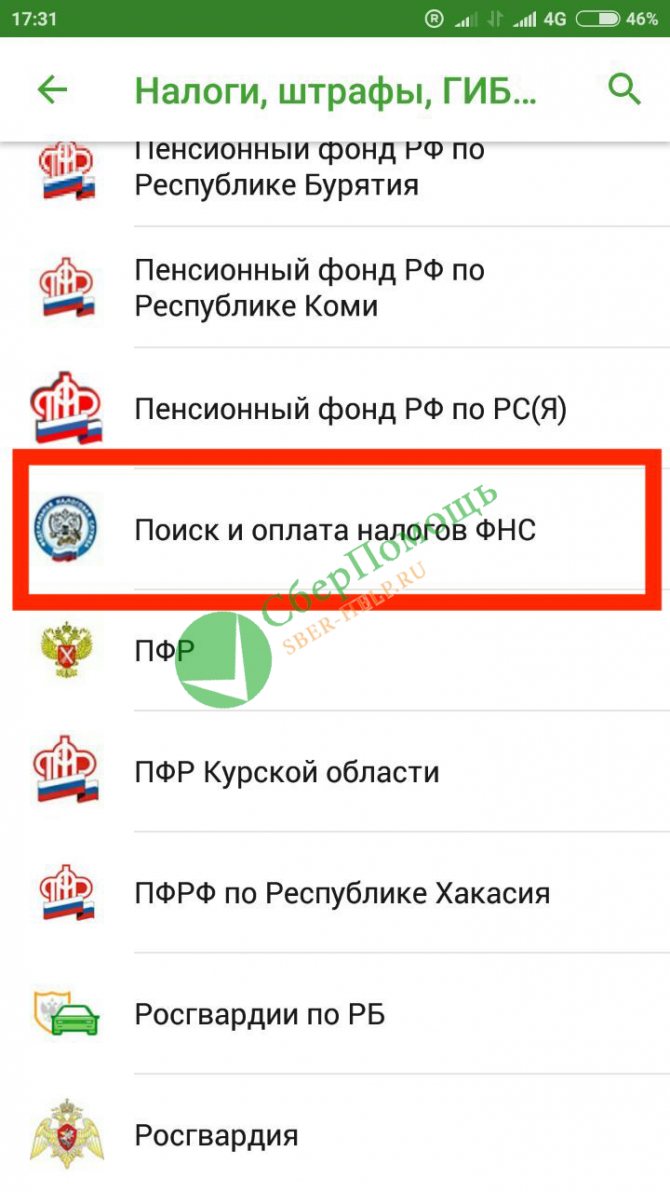

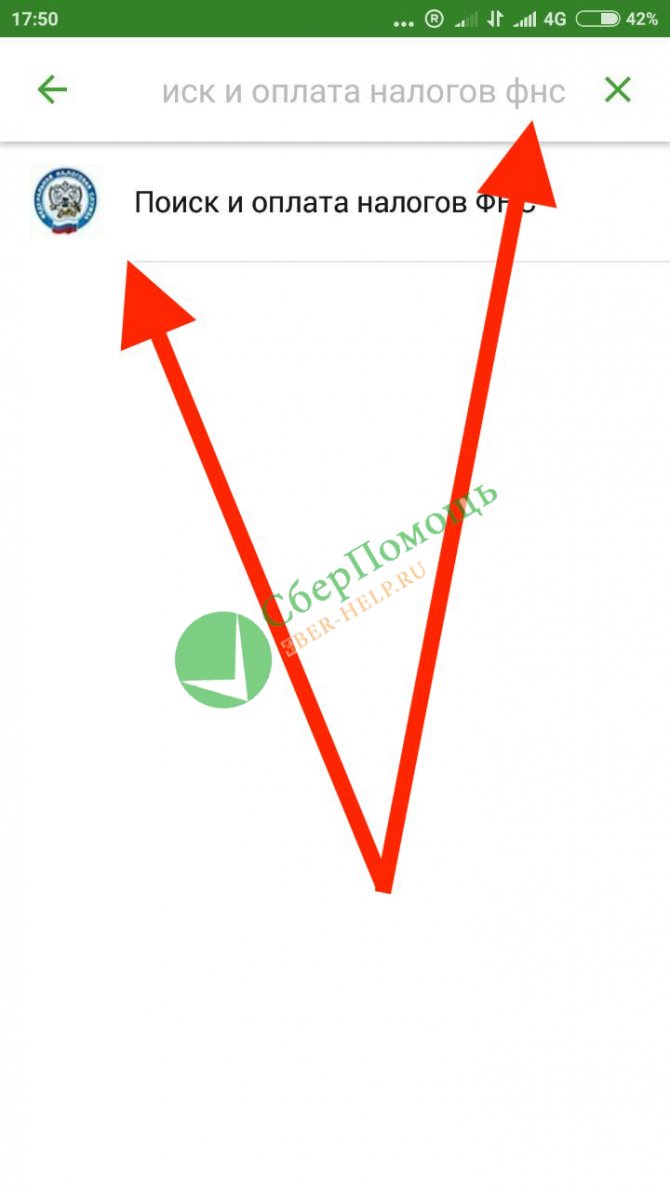

You will be offered a list of organizations and services, arranged in alphabetical order. Scroll through it and find . For your convenience, there is a search bar at the top of the screen.

|

|

|

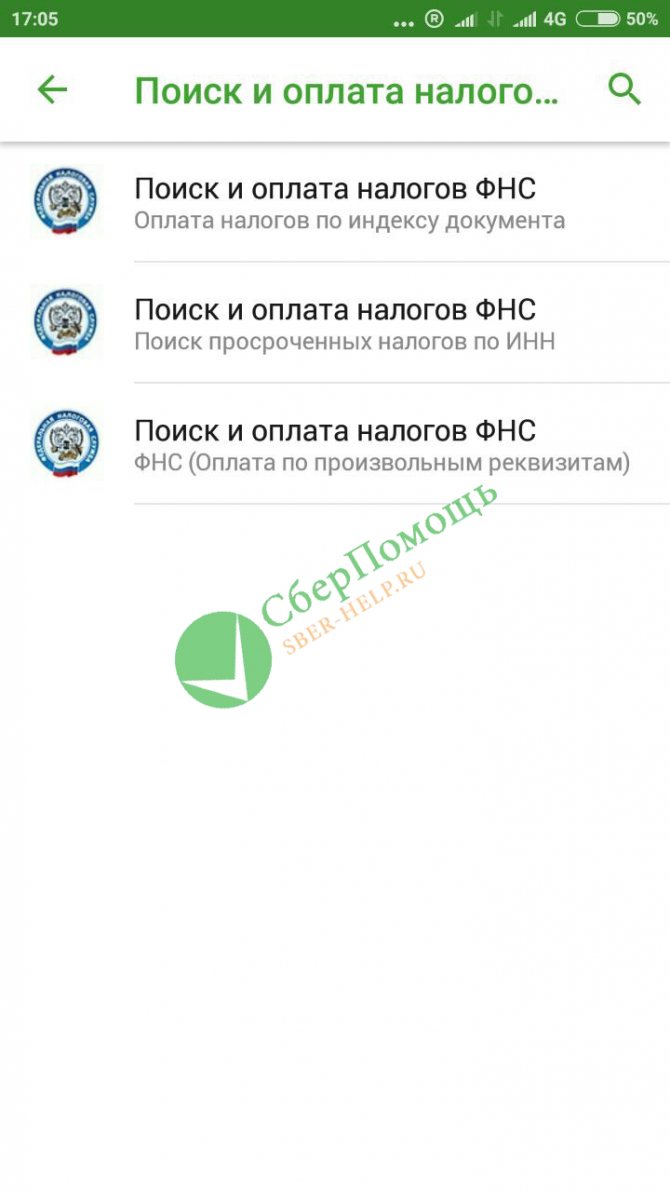

Step 2. Selecting a tax payment search method

The service Search and payment of taxes to the Federal Tax from Sberbank Online offers the following options:

- Payment of taxes by document index

- Search for overdue taxes by TIN

- Payment using arbitrary details

Let's look at them in more detail below.

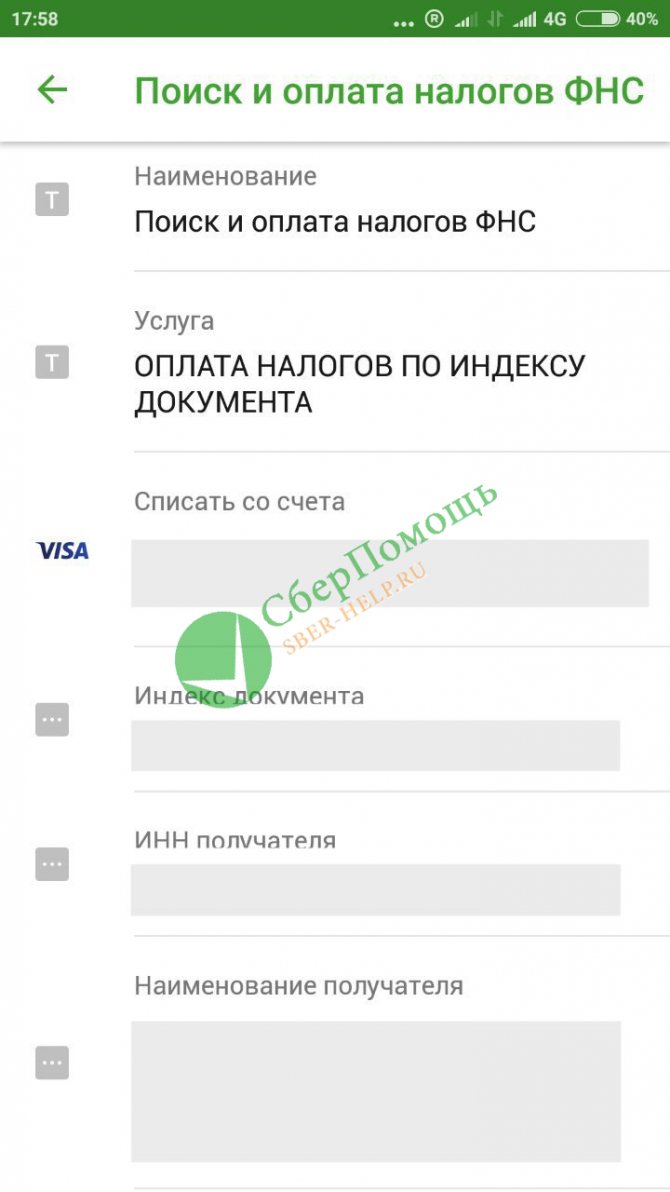

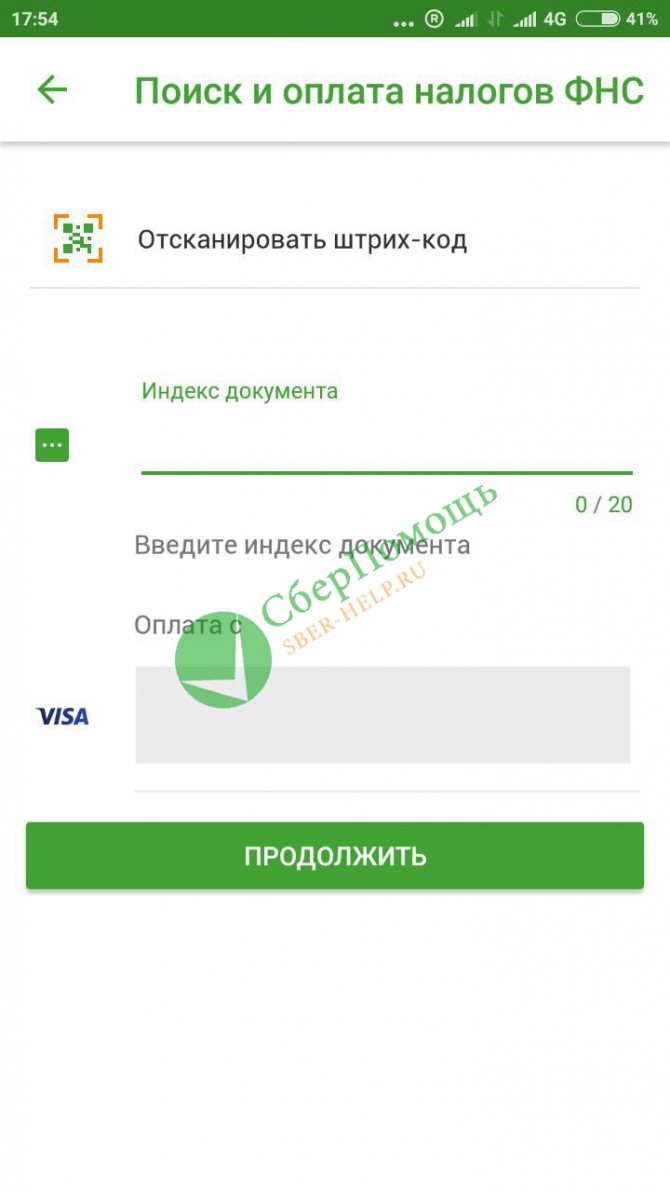

Payment of taxes by document index

This is a simple and convenient way when you have already received notices from the tax service and know the tax notice index.

Select the item “Pay taxes by document index” and enter the document index in the form that opens. It is usually listed at the very top of the notification and should be no more than 20 characters.

Instead of manually entering the 20 digits of the postal code, you can take advantage of the option to scan the barcode or QR code, which are usually located at the bottom and left side of the notification, respectively. To do this, click on the Scan barcode inscription and follow the instructions.

Here you can choose from which card funds will be debited to pay taxes. If the card that Sberbank offered by default is not suitable, then click on it with a light short touch and you will be offered several of your cards to choose from.

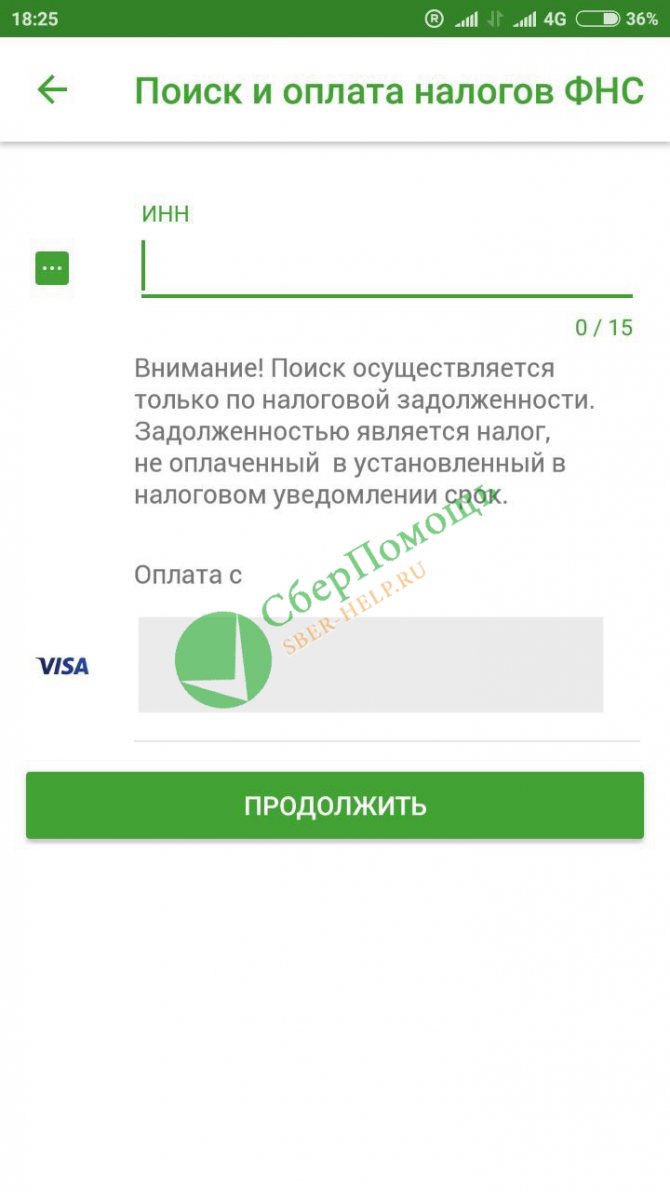

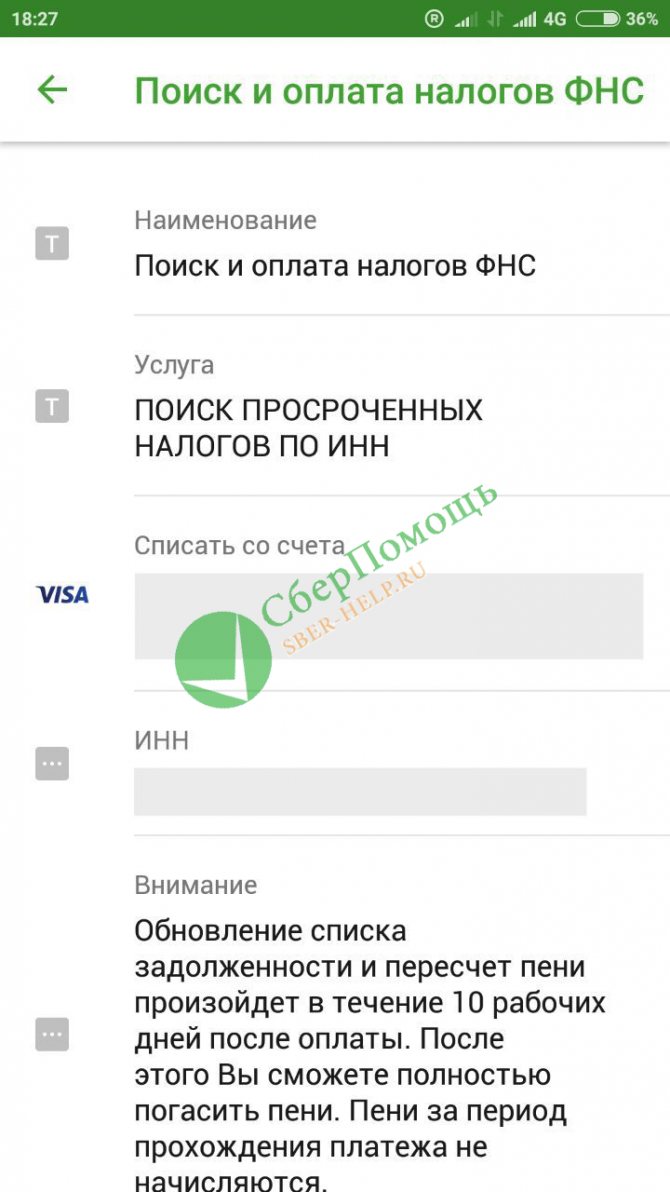

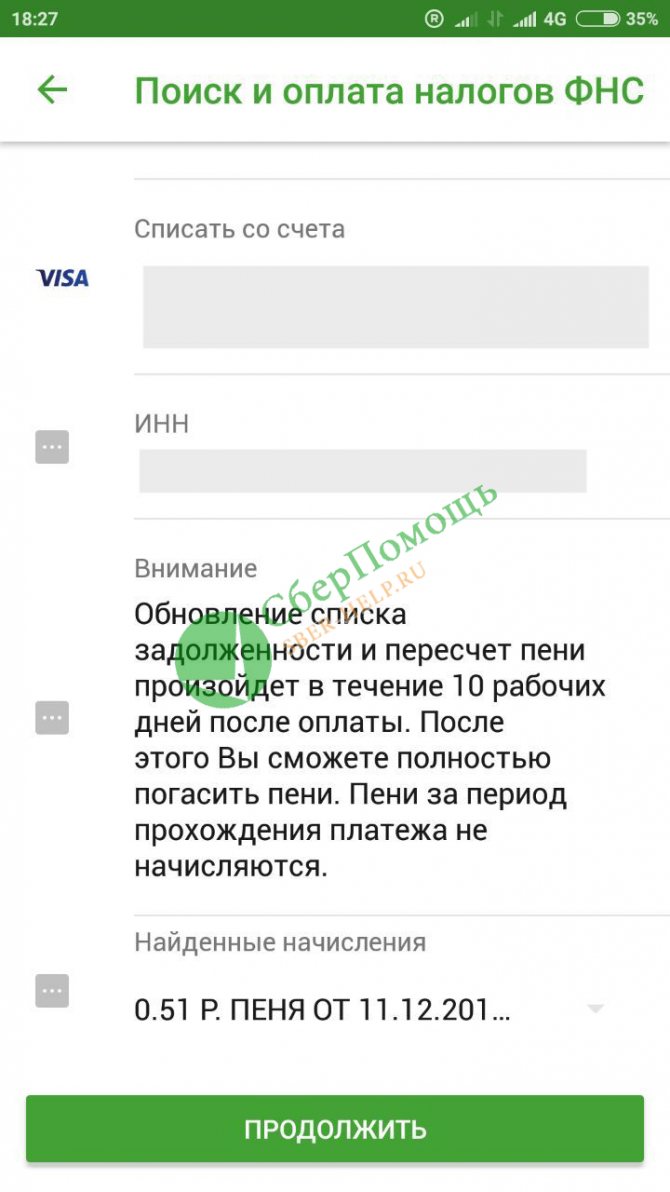

Search for overdue taxes by TIN

If you missed the deadline for paying taxes on time or want to make sure that all debts are paid (for example, before traveling abroad), then this can easily be done in Sberbank Online.

In the form provided, enter your personal INN, select a card for payment and click Continue. On the next screen you will see a list of charges found and you can continue the payment process.

|

|

|

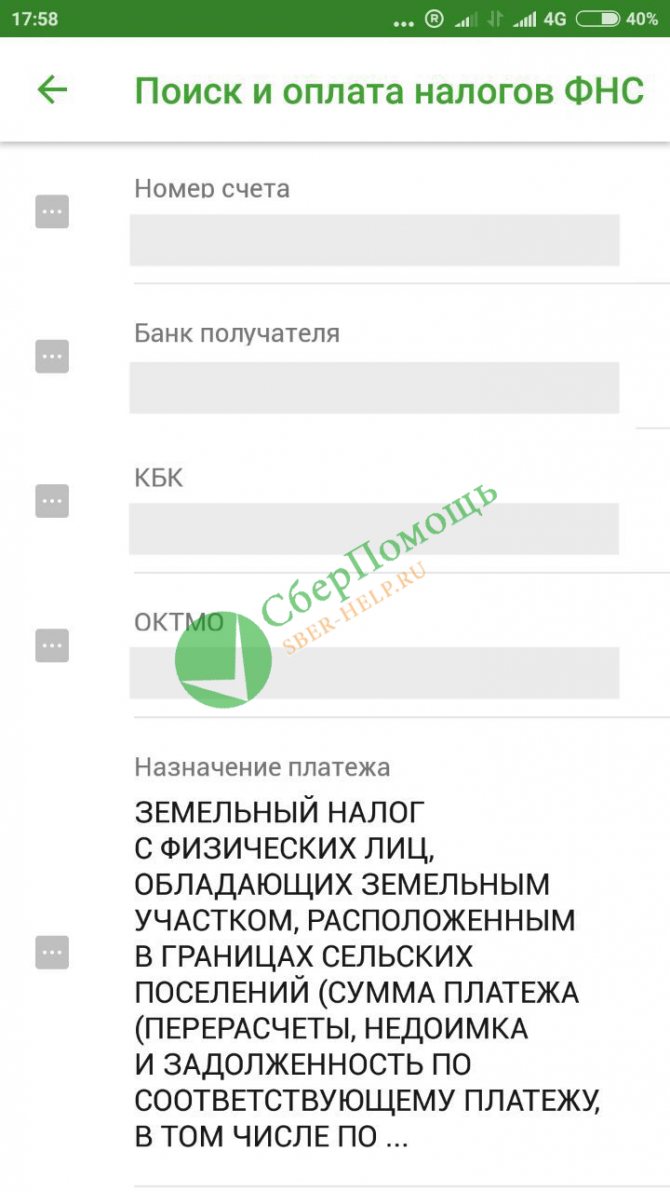

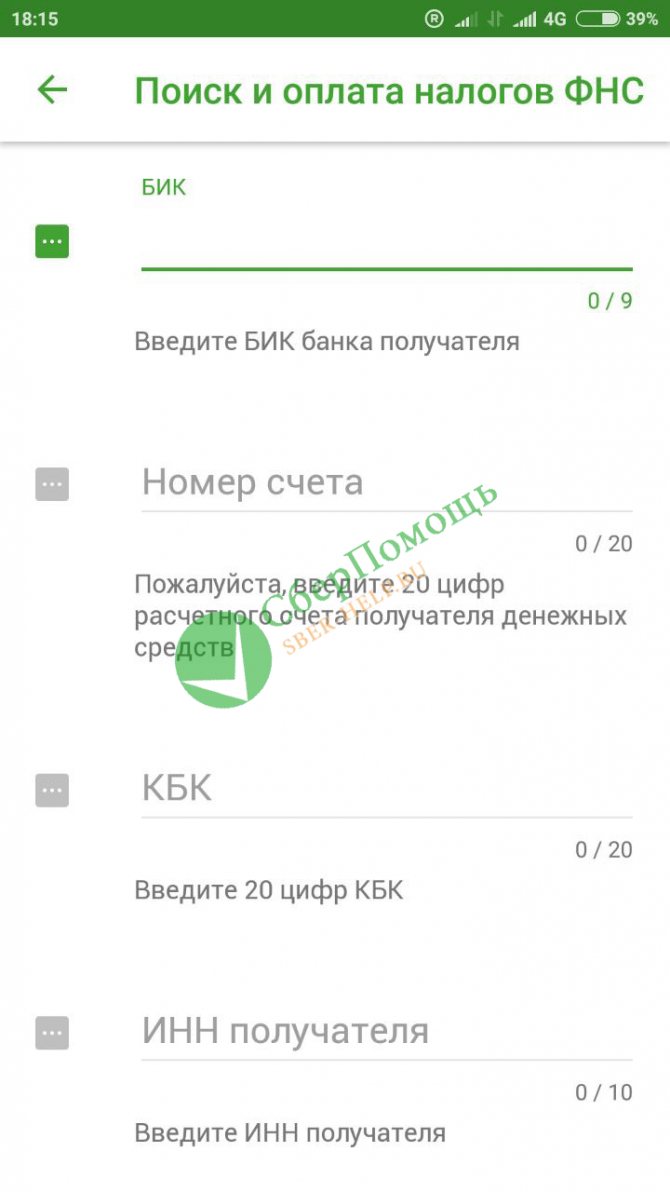

Payment of taxes using arbitrary details

If you select this option, you will need to manually provide the following details:

- BIC of the recipient's bank

- Recipient's account number

- KBK

- Recipient's TIN

You can also select a card for debiting funds here.

Next, you will need to manually fill in the missing payment parameters, such as:

- OKTMO

- Payer's TIN

- Taxable period

- Basis of payment

- Payer status, etc.

This is not the easiest and fastest way, we still recommend using the convenience of automatically filling in all the data required for tax payment using a barcode, document index or QR code, described in detail in this step-by-step instructions.

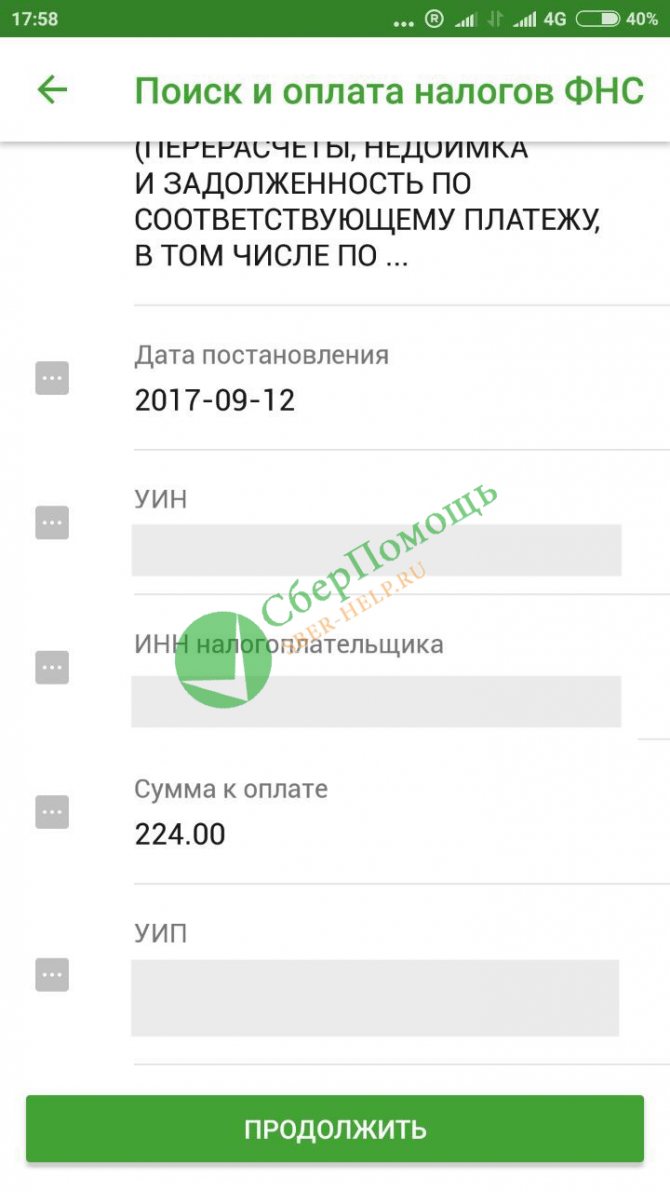

Step 3. Confirmation of transfer

After all the data has been filled in, click Continue and the application will generate information for paying the tax. Carefully check all amounts and details - they must match what is indicated in the official notice from the Federal Tax Service.

The pictures below show an approximate view of the confirmation screens; all data is hidden for privacy reasons. Here, as an example, land tax was paid. When paying transport tax, personal property tax or another type of tax fee through Sberbank Online, the relevant information will be indicated in the Payment purpose field

|

|

|

If everything is correct, click Continue. Since a completed payment is quite difficult to cancel and return the funds back, the system will ask you several times to confirm the correctness of the details, the amount of tax and commission, and your desire to make this payment.

After final confirmation, you will be able to save the receipt and view payment details.

Step-by-step instructions for paying land tax online

Through the State Services website

To pay through the State Services website you must:

- Log in to the portal.

- Select the “Tax Debt” tab. The system will automatically perform a search, since information about the taxpayer is already known to it (TIN and full name).

- Select the required type of tax and click the “pay” button.

- Select the payment method and the bank through which the tax will be paid. There are many methods offered: mobile balance, bank card, electronic wallets, etc.

You can also select the required department (Federal Tax Service) in the electronic services section and find the function of paying taxes online there.

A similar opportunity for online payment of land tax is provided on the official website of the Federal Tax Service. The advantage of this option is that the taxpayer does not need to create an account on the State Services portal and undergo lengthy identification.

Payment on the Federal Tax Service website is made in the “Electronic Services” - “Pay Tax” section.

Next you will need to enter the following data:

- FULL NAME;

- TIN;

- tax type;

- taxpayer address;

- payment method: cashless payment.

Here you can not only make an online payment in any convenient way, but also generate a receipt for the bank (if for some reason it did not arrive in the mail).

If necessary, the service will automatically redirect you to the page of the bank that you specified in the preferred payment method section.

Through the Sberbank website

The largest Russian bank, Sberbank, has the largest number of clients. Therefore, one of the most popular methods of paying taxes is the Sberbank-Online Internet bank. All salary card holders and consumer loan borrowers can connect to it absolutely free of charge.

Instructions for payment through Sberbank will look like this:

- You need to log in to online banking using your username and password, enter the SMS verification code that will be sent to your linked phone number.

- Go to the “Payments and transfers” tab, where select the “All payments and transfers” option.

- In the “Taxes, duties, contributions to the budget” section, select the agency responsible for collecting taxes – the Federal Tax Service.

- In the “Search and pay taxes” section, select the land tax we need from the list that opens.

- We enter the document index in a special field (it is contained in the receipt that the Tax Inspectorate sends to all owners) and click the “Continue” button.

- All that remains is to fill in the proposed fields: amount to be paid and select the account from which funds will be debited (if the taxpayer has several accounts). The remaining details are entered automatically.

- After clicking the “Pay” button, the Sberbank client needs to enter a one-time password to confirm the operation.

The money is credited to the budget within 24 hours. After the transaction is processed, a blue “Completed” stamp will appear on the payment form.

Legal entities and individual entrepreneurs can use the special “Client-Bank” service for business.

Payment algorithm

To pay tax through Sberbank online, you need to register in the service, which takes a few minutes. After completing the procedure, the user will have access to the full range of services. Transfers can only be made from a registered card account, and this can be done using the TIN or document index.

Taxes are paid according to the following algorithm:

- The user is authorized in the service - enters the login, password and confirmation code sent in the message;

- On the main page, select the “Payments and transfers” option and in the next section select the Federal Tax Service;

- Goes to the “Search and pay taxes” section and selects the desired type of deduction from the list.

The further payment algorithm depends on the type of collection and the selected method of conducting the operation.