What is DDU

An equity participation agreement (hereinafter referred to as EPP) is a type of agreement concluded between the shareholder and the developer. DDU is regulated by Federal Law 214 of the Civil Code of the Russian Federation “On participation in shared-equity construction of apartment buildings,” as well as a number of other regulatory documents.

The difference between buying an apartment with a mortgage is that the loan is secured by an equity participation agreement, and not by finished housing. As soon as the object is completed and put into operation, the apartment becomes at the disposal of the bank until the final payment of the borrowed funds. To protect itself from risks, the financial organization checks all participants in the share agreement. First, the borrower is checked for solvency. As soon as the bank approves a potential equity holder, the developer, the facility he is constructing and all the necessary documents are subject to verification.

To approve a mortgage under the DDU, the borrower must:

- have Russian citizenship;

- be over 21 years of age;

- be registered in the city where the creditor bank is located;

- have an impeccable credit history;

- work in one organization for more than six months with registration in accordance with the Labor Code of the Russian Federation.

Banks may have slight differences in the procedure for issuing a mortgage loan, but in most cases the conditions are approximately the same. The main criteria for obtaining a mortgage are:

- the size of the down payment is 10–20% of the total loan amount;

- The interest rate on the loan is most often 11.5–17% per annum;

- The mortgage repayment period varies between 20–30 years;

- The loan amount cannot be more than 85% of the cost of the apartment.

Each client’s application is considered individually, so the conditions for issuing a mortgage and interest rates differ depending on the characteristics of the borrower’s situation. Loan rates are affected by various nuances: the amount of the down payment, the repayment period of the mortgage, the size and availability of insurance, etc. Rates for housing under construction and an already completed property may also differ. On average the difference is about 5%.

[offerIp]

What is collateral under the DDU and until when?

If in a normal situation the acquired object serves as collateral for the loan, then in this case such an object does not yet exist . Therefore, the agreement for participation in shared construction with a mortgage provides for a different type of collateral. It is designated in federal legislation, and this is the right of claim that arose at the time of registration of the pledge in the Unified State Register of Real Estate . The condition for the emergence of rights of claim is specified in the agreement on participation in construction.

The contract must include the following information:

- what are the pledged rights of claim formed from;

- characteristics of the object and its assessment;

- term of transfer of real estate;

- the amount of obligations that the loan covers.

If this information is not specified in the agreement, it is impossible to identify the subject of lending.

Recommended article: Leasing housing for individuals - an alternative to a mortgage?

The termination of the pledge of rights of claim occurs simultaneously with the commissioning of housing. At this moment, the borrower has ownership rights and the mortgage of the apartment itself must be registered on the basis of the mortgage.

Advantages and disadvantages of the decision to purchase an apartment using a mortgage

When purchasing an apartment under a DDU with a mortgage, the developer must be a legal entity. But both a legal entity and an individual can purchase housing from him. In this case, the buyer is an investor: he invests funds in construction in order to claim his share after the project is completed.

From the investor’s side, such an investment is quite profitable:

- In terms of price, purchasing an apartment in a building under construction is equivalent to purchasing a “killed” Khrushchev building, while new buildings, as a rule, have larger dimensions and are much more comfortable than the options presented on the secondary housing market.

- The apartment in the new building has no former owners who could have left thousands of debts on utility bills or even mortgaged the apartment.

- If real estate is purchased in order to resell it in the future, the investor is guaranteed to remain in the black, since after the house is put into operation, the cost of apartments in it will become much higher.

- There is no need to buy the first apartment you come across in a disadvantaged area; you can buy superior housing with pleasant neighbors and developed infrastructure.

However, when buying an apartment with a mortgage below the market value, the risks should also be taken into account:

- After concluding a contract of agreement, you can wait two years to move, so this option is not suitable for people who want to immediately move into a new apartment.

- In addition to the costs of purchasing a home, you also need to take into account the costs of furnishing the apartment (repairs, furniture, appliances).

Therefore, when you decide to purchase an apartment using a mortgage, you need to weigh the pros and cons in advance so as not to find yourself in a hopeless situation.

Pros and cons of an equity participation agreement

| The cost of real estate at the construction stage is much lower than the price of finished housing. | There is a risk that the developer will go bankrupt, freeze construction, and deceive shareholders. |

| You can save money for furniture, household appliances, and repairs while the house is being built. | Force majeure may occur, which will affect the delivery time of the project. |

| Apartments purchased under DDU are classified as primary real estate, and the mortgage rate for them is lower. | During construction you will have to spend money on renting housing if you don’t have your own. |

In addition to the DDU, a regular purchase and sale agreement and a housing cooperative are used to purchase real estate on the primary market. The purchase and sale agreement is concluded when the house has already been commissioned - you can immediately move into the apartment, register, and register ownership. Housing cooperative is a housing construction cooperative agreement. It is similar to the DDU, but formally you become a shareholder - you join a community of people who are going to build a house. However, there are no clear construction deadlines or penalties for increasing them.

Housing cooperative or preschool building: which is better - everyone decides for himself. When registering a DDU, buyers are more protected from unscrupulous companies, and housing cooperatives offer greater benefits compared to DDU.

Double sales

A significant advantage in the mechanism of shared construction under 214-FZ is the registration of a shared participation agreement in the management of Rosreestr in your region. The fact is that this registration also means checking the database of all registered objects in a given apartment building and excludes re-registration of the right of claim. Translated into human language, this eliminates fraud in the sale of one apartment to several people.

The fact is that in fact you do not immediately get the result of fulfilling your duties. The process of interaction with the developer looks like this:

- You clarify what a DDU is in the understanding of the selected developer, whether there are any pitfalls in the object

- You enter into a share participation agreement

- You pay the amount under the contract yourself or with the help of a mortgage loan

- Waiting for the house to be rented

This is where pitfalls creep in. After all, in fact, you gave money for something that does not yet exist in nature. And until the legislator introduced registration of contracts with government agencies, developers took advantage of the loophole and sold the same apartment to different people. Yes, this is fraud, but such schemes are still being tried in court.

The equity participation agreement of the 2020 model requires those entering into it to fully describe the distinctive features of the apartment, including the number of floors, the location of this apartment in the plan and project declaration, as well as its number. Double sales are virtually eliminated.

Penalty

Previously, contracts for the sale and purchase of apartments in new buildings did not provide for a clear algorithm for imposing a penalty upon termination of the contract. In the case of using an equity participation agreement, the problem is solved. The law clearly defines liability under the DDU and the scheme for calculating the penalty. Thus, a penalty can be recovered in the following cases:

- The deadline for handing over the new building or handing over the keys to the shareholder was violated by more than two months from the date specified in the share participation agreement

- There are significant shortcomings in the built house - for example, cracks in the wall

- The developer gives you an apartment with a smaller area than what is specified in the contract

All these points are also grounds for termination of the contract. That is, you can demand from the developer the entire amount of the contract plus a penalty, or just a penalty and your apartment. Calculating the amount of late fees is quite simple:

- We need a house delivery date specified in the tenancy agreement - we count the number of days that have passed from it

- We find out the key rate of the Central Bank of the Russian Federation on the official website of the department - it is 8.5%

- Next, we calculate using the formula: 1/150 X 8.5% X number of days X cost of the apartment

For example, for a day of delay with a contract value of 1 million rubles, the developer will have to pay you a little less than 600 rubles.

Buying an apartment with a mortgage on DDU: step-by-step instructions

When buying an apartment using a mortgage, the transaction scheme is quite simple. A potential shareholder is required to have a passport and money with him. If the loan has already been approved, you need to come to the developer’s office to formalize the contract. If a mortgage loan is issued simultaneously with the signing of an equity participation agreement, the transaction becomes tripartite and can take place at a bank branch. Thus, when purchasing an apartment using a DDU with a mortgage, the stages of the transaction are arranged in the following order:

- Selecting a financial institution . You are probably aware of the need to obtain a loan in advance, so you should choose a suitable bank long before registering for a loan. Often, banks cooperating with a developer offer reduced interest rates on the purchase of housing from their partner. You need to take into account the size of the loan rate, insurance, the amount of the required down payment and other conditions for obtaining a loan.

- Obtaining information about the developer. Find out whether the company's facilities were always delivered on time, and whether there were any legal proceedings with shareholders. Documentation for the house under construction is also subject to verification.

It is recommended that you familiarize yourself with the following acts:

- project declaration;

documents on the basis of which the company carries out its activities;

- confirmation of payment of the authorized capital;

- financial reports for the previous year;

- detailed information about the project (construction permit, land ownership certificate, etc.);

- certificate of state registration of the developer.

- Read the contract carefully . The content of the DDU of different companies is, as a rule, standard, but some developers may include their own special clauses in it. Read not only the main text, but also the additional agreement, especially pay attention to the small print. If there is any misunderstanding, contact a lawyer for help.

- Preparation of a complete package of documents . To register a DDU, you need to have your passport and your spouse’s consent to purchase real estate certified by a notary. When purchasing an apartment under a DDU with a mortgage for two spouses, both spouses must be present at the conclusion of the transaction, each with their own passport. To get a loan from a bank to purchase real estate, you need to fill out a borrower application form and attach a certificate of income to it.

- Drawing up a share participation agreement . The DDU is concluded in simple written form. Shareholders put their signatures, the developer – the organization’s seal and signature. If a third party (bank) is involved, the agreement indicates the details of the creditor with the seal and signature of the representative.

- Registration of preschool education in Rosreestr. The procedure usually takes five days. After receiving the appropriate mark, you can check the status of the contract on the Rosreestr website. Once registration is confirmed, payment can be made.

- Choosing a service company . After the project is handed over, the question will arise about choosing a company that will maintain the house (take out garbage, clean the entrances and local area, etc.). The decision is made at a general meeting of shareholders. As soon as permission to put the house into operation is received, a transfer and acceptance certificate is signed, then the documents are sent to Rosreestr to register ownership of the finished housing.

- Making a down payment . The required down payment is sent to the developer's account via bank transfer.

The company is required to have an authorized capital determined by the scale of construction and the relevant clauses in the current legislation. Reviews from shareholders who have already dealt with this developer can also help. They can be found on forums on the Internet.

Deadline for registering a share participation agreement

In 2020, the period for registering a residential trust with a mortgage was changed, reducing it to five days (). However, documents can also be submitted through the Multifunctional Center. In this case, four more days will be added. Although the exact period depends on the type of agreement itself. When the primary contract is submitted to Rosreestr, you will have to check and enter information about the construction company into the register. This will take up to 18 days.

If the registration of a residential property with a mortgage in Rosreestr has not been completed, the department must provide the reasons for the refusal. To understand that the procedure was successful, you can:

- contact the government agencies responsible for registration;

- or make a request to the construction company.

Please note that in the agreement itself and in the application for registration the construction number of the apartment and the cadastral number of the land plot on which construction is being carried out will be written.

The agreement itself will bear the department’s mark, the signature and seal of the registrar, and the number by which the agreement can be found in the database. If you registered online, such marks should still appear on the paper agreement. To shorten the period of registration of a residential building in Rosreestr with a mortgage, it is advisable to apply for the service when the developer is already in the department’s databases.

Recommended article: Which apartment can you get a mortgage

Rules for drawing up a share participation agreement

The DDU does not require notarization; it is concluded in simple written form with subsequent registration in Rosreestr. The contract stipulates the obligations of the developer, namely: timely construction, delivery, commissioning and transfer of the designated property to the shareholder. The second party undertakes to pay in full the amount specified in the contract, as well as to sign the transfer and acceptance certificate if the apartment fully complies with quality standards.

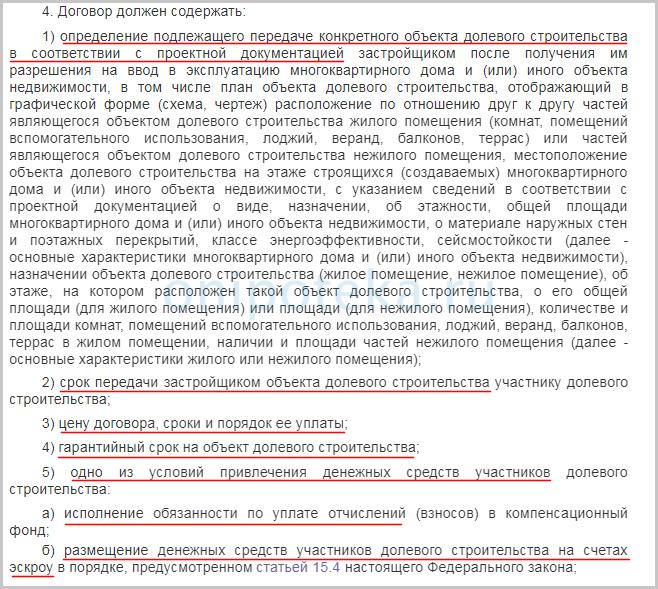

The DDU must include:

- subject of the contract (housing characteristics);

- cost of the apartment;

- terms of construction and commissioning of the facility;

- the period during which the company guarantees to fulfill its obligations;

- ways to ensure warranty obligations.

In addition, there must be details of the parties, documents confirming the right to carry out construction, the cost of one square meter of housing and the final price of the apartment, grounds for revising the cost, rights and obligations of both parties, liability in case of violation of the terms of the contract by the parties. If there are no essential conditions, registration of the agreement will be refused. The conditions of the DDU are verified in accordance with the project declaration. Registration with Rosreestr is intended to protect the shareholder, confirm his ownership, and also eliminate the possibility of double sales.

The additional agreement to the DDU may contain some conditions that are not specified in the main agreement; this is also worth paying attention to. Often they talk about postponing the delivery date of the house due to an increase in the construction period. Having become familiar with such conditions, the shareholder has the right to refuse to enter into an agreement. In addition, according to the law, he can challenge the delay in construction work in court. Additional conditions include:

- the right to assign claims under the DDU;

- the possibility of unilateral termination of the contract;

- clearly defined deadlines for delivery and acceptance of the object;

- conflict resolution regulations;

- terms of termination of the agreement.

The presence of a notary is also not required to sign additional conditions. They have the same meaning as the agreement itself, so before signing an additional agreement, consult with a lawyer or other shareholders.

Equity agreement for the purchase of an apartment can be found here: Purchase of an apartment using a DDU with a mortgage form

The procedure for registering a preschool educational institution

This agreement has no right to exist if it is not included in Rosreestr. As a rule, this function (entry into Rosreestr) is performed by the developer or his representative. However, this obligation may also fall on the shoulders of the equity holder if both parties discussed this aspect in advance.

The following documentation must be provided to the relevant authority for registration:

- charter of a construction organization that performs construction work related directly to the facility specified in the contract;

- the plan according to which construction work will be carried out in relation to this facility;

- a document that confirms the legality of the construction of a given structure in a specific location;

- project declaration;

- a corresponding agreement that provides for the obligation to transfer one or another residential premises to a person who has contributed a certain amount of money for the construction of this real estate object;

- application requesting registration of an equity participation agreement.

All the above documents must be submitted on time to the registration authority in a situation where this agreement is the first between the developer and the shareholder. If such an agreement is not concluded between these persons for the first time, then a civil liability insurance contract will be sufficient to register a new agreement.

Possible risks when buying an apartment under DDU

When buying an apartment with a mortgage below the market value, risks are inevitable. They may relate to the quality of work performed, registration of ownership, postponement of the date of delivery of the object, the financial side and much more.

- Increased construction period . Perhaps the most common problem in the construction of any real estate project. In the best case, the construction will last for several months, in the worst case, it will close completely. The most common reasons for missing deadlines are:

- The developer lacks sufficient financial resources . No money - no materials and means to pay workers. Many people hope to use the money from selling apartments, but it turns out to be not enough.

- Directing investors' financial investments to complete another construction project.

- Failure to fulfill obligations on the part of contractors: late delivery or lack of necessary construction materials . To avoid such situations, at the stage of concluding the contract, it is necessary to discuss in which quarter the construction will be completed and the house will be put into operation. Then, in the event of an increase in the construction period or its termination, the shareholder has the right to demand to pay a penalty or terminate the contract. If the commissioning of the house is delayed, the developer is in any case obliged to pay a penalty.

- Replacement of information specified in the project declaration. The project declaration is the main document during the construction of a real estate property. The first part of the declaration contains information about the developer company, and the second part contains the construction project. This document is in the public domain: it is either published in the media or presented at the first request of a person who wishes to familiarize himself with it.

The shareholder has the right to terminate the DDU and return the funds if the project declaration has undergone the following changes:

- making significant adjustments to the house design during the construction stage;

enlargement or reduction of one or more objects;

- unauthorized decision-making regarding non-residential premises, common property of shareholders, etc.

- Double sale of an apartment.This concept refers to the purchase of the same living space by two or more shareholders. The likelihood of such a situation occurring is due to the following factors:

- untimely exchange of information about sold apartments between the developer and the real estate agency;

preliminary preschool education;

- transfer of ownership to a third party;

- purchasing an apartment from a contractor;

- error in documentation (human error cannot be ruled out).

Naturally, the developer will try to delay the return of money as long as possible, so you should not expect a quick refund in the event of termination of the equity participation agreement.

In addition to the above situations, risks also include the developer’s requirement to transfer additional funds to carry out work not specified in the contract. This could be landscaping the territory, installing communications, or paying for the rent of a plot of land. Sometimes the area of a facility under construction increases during the construction process, which, in turn, entails additional costs.

To avoid such requirements, the contract must contain a condition under which the cost per square meter remains unchanged regardless of the circumstances.

To protect yourself when purchasing an apartment under a DDU with a mortgage from a contractor, the buyer should receive from him an act confirming the fulfillment of obligations to the developer.

The procedure for terminating an equity participation agreement with a mortgage

The procedure for terminating a DDU with a mortgage does not have any particular difficulties, provided that everything goes “smoothly”.

First of all, the client must obtain the consent of the lender to terminate the contractual relationship with the construction company. The bank agrees without any problems if the loan funds have not yet been transferred to the developer and are “hanging” on the letter of credit account.

After this, the shareholder notifies the construction company of his desire. The same notice indicates the period within which the developer is obliged to return the funds received. According to clause 2 of Article 9 of Federal Law No. 214-FZ “On participation in shared construction...” the money is returned within 10 days from the date of notification .

The letter is sent in person, sent by mail or online. If the developer transfers the funds received within the specified period, the shareholder can deal with them in two ways:

- return the entire amount with interest to the bank (if the loan agreement contains such a condition);

- purchase a new home and continue to repay the mortgage by changing the collateral.

If the developer refuses to return the money or responds with “silence,” the client goes to court. We will dwell on this point separately, in view of the duration and complexity of the judicial procedure.

Going to court

Termination of a DDU with a mortgage occurs in accordance with the generally established claim procedure. The shareholder draws up a statement of claim demanding cancellation of the transaction and recovery of the previously paid amount of equity participation.

The following are attached to the application:

- passport;

- a copy of the pre-trial notice;

- terminated contract;

- receipt of payment of state duty;

- certificate of ownership (if it has already been issued);

- bank loan agreement;

- a written calculation of the amount to be recovered from the defendant (this includes not only payment of the share contribution, but also the costs of state fees, attorney fees, penalties, etc.);

- other documents on which the plaintiff bases his claim.

The claim is considered with the participation of the bank, since its interests are also affected. The court makes a decision within 30 days. If you disagree with it, any party has the right to appeal it to a higher court.

A positive decision that has entered into legal force is the basis for the developer to return the money received. The decision always indicates the time period allotted for its implementation. If the defendant does not comply with it or ignores the court’s requirement, the shareholder submits the decision to the FSSP for forced execution. Then, by seizing accounts or other material assets, the bailiffs recover the awarded funds from the company. As mentioned earlier, the former shareholder spends this money in two ways.

If the bank is against

The situation discussed above was when the bank agreed to terminate the DDU with the mortgage received. But what to do if he is against it? After all, the agreement is essentially pledged, and without the consent of the bank, the equity holder does not have the right to break off relations with the developer.

In this case, you will also have to go to court, where the defendant will be the creditor. Most often, claims against the developer and the bank are considered during one proceeding.

How to protect yourself from problems when buying an apartment using a DDU with a mortgage

It is necessary to take into account many nuances of purchasing housing with a mortgage. The main point is that the apartment serves as collateral for loan repayment, that is, it remains pledged to the bank until the mortgage is paid in full. An encumbrance is placed on the housing, implying the impossibility of performing any registration actions.

It is mandatory to take out liability insurance. Shared construction of a property always involves risks. A variety of circumstances can affect the completion of construction and commissioning of a house. Given the unstable economic situation, the possibility of bankruptcy of the developer cannot be ruled out. The company that buys out the liability may not be interested in the immediate delivery of the property. If an accurate geological examination was not carried out at the preparation stage, the house may simply collapse due to soil instability and incorrect foundation laying.

Each of these risks is insured in favor of the credit institution. Without insurance, the equity holder finds himself in a very precarious position, risking losing the apartment, but maintaining the obligation to repay the mortgage. It would also be a good idea to take out life and capacity insurance, as well as a document confirming ownership. In addition, banks are willing to reduce the interest rate for citizens who have purchased a full insurance package.

Confirmation of payment according to DDU

Complaint

Power of attorney for DDU

Good evening! Tell me, is the power of attorney drawn up correctly?! Power of attorney for six employees. The text is as follows: to represent my interests before individuals and legal entities, in all competent organizations and institutions, government bodies, local government bodies of the city of Moscow and/ or the Moscow region, including in the Bureau of Technical Inventory (BTI), notary offices, the “one-stop shop” service, the Office of Rosreestr, the branch of the Federal State Budgetary Institution “Federal Cadastral Chamber of Rosreestr” in Moscow and/or the Moscow Region, in the Office of the Federal Service state registration, cadastre and cartography in Moscow and/or the Moscow region, the Office of Rosreestr, the body carrying out state registration of rights to real estate and transactions with it, Multifunctional centers for the provision of state and municipal services of the State Budgetary Institution MFC/MFC and other institutions, departments and organizations for issues: state registration of agreements for participation in shared construction, agreements for the assignment of the right of claim and transfer of debt under the agreement for participation in shared construction, additional agreements to these agreements, agreements on termination of the agreement for the assignment of the right of claim; agreements for terminating the agreement for participation in shared construction of a real estate property at the construction address: Moscow, - - building 6, as well as on issues of state registration of ownership under an agreement for participation in shared construction of a shared construction project, state registration of a pledge agreement for rights of claim, state registration removal of encumbrances (restrictions) on the right, collection of documents, certificates, extracts, duplicates, archival copies, cadastral passports, technical passports, explications, floor plans and other necessary documents and certificates necessary for registration of ownership of a shared construction object acquired in a real estate property the above construction address, obtaining registered title and title documents, including extracts from the Unified State Register of Real Estate, for which I give her/them the right to make statements on my behalf, submit and receive documents, take actions aimed at state registration of rights to real estate and transactions with it, including filing applications for state registration, applications for termination of rights (restrictions (encumbrances) of rights), applications for renewal of state registration, applications for suspension or refusal of state registration, applications for registration of mortgages by force of law, applications on repayment of the mortgage registration record, applications related to making changes to the entry in the Unified State Register of Real Estate, applications for correction of technical errors, applications for additional acceptance of documents, with the right to receive notification of suspension of state registration, notification of refusal of state registration, pay payments , fees and state duties, sign on my behalf, as well as perform other actions necessary to fulfill the specified powers. The power of attorney was issued for a period of five years without the right to delegate powers to third parties. Thank you in advance!

Marina Pogoreltseva December 24, 2020 - 20:49 DDU

The subtleties of buying an apartment under the DDU with a mortgage before marriage

So, you have decided to buy an apartment under the DDU, the mortgage does not scare you, and you are optimistic about the future. Remember that, by law, property acquired by spouses during marriage is the property of both and must be divided in half upon divorce. With real estate purchased under a regular transaction, everything is simple: the housing was purchased during marriage, which means that upon its dissolution it is divided between the two spouses. In the case of preschool education, everything is different.

By signing an equity participation agreement, the buyer invests funds in an object that currently exists only in the project, thus, the apartment cannot yet be classified as real property. After the house is put into operation, the housing becomes classified as real estate, as well as the property of the shareholder. Several years pass between the conclusion of the DDU and the delivery of the property, during which the shareholder can marry, divorce and marry again, which means that the ownership of the apartment will change in accordance with the situation.

What is fundamental in this matter is only the fact of ownership of the funds invested in shared construction. Let's look at several cases of purchasing an apartment under a DDU with a mortgage with the participation of spouses.

- Case No. 1. A citizen registers a DDU in his name and pays for the apartment with his own funds. During construction, he gets married, and the completed object is registered in his name after the marriage. After several years of marriage, the couple decide to divorce. In this case, there will be no problems with determining the owner of the property, since the apartment was purchased before the wedding with the money of one of the spouses. The fact that she transferred ownership later does not play any role here; after the divorce, the property will remain with the original buyer.

- Case No. 2. The signing of a share participation agreement was carried out by one of the spouses before marriage. Borrowed funds from a credit institution were used for the purchase. If after the wedding the spouses paid off the mortgage jointly, upon divorce the property will be divided equally. The division of the apartment in a situation where the spouse in whose name the mortgage is issued has partially repaid the loan becomes somewhat more complicated. The size of each spouse’s share is determined by the amount taken from the family budget to pay off the mortgage. Large amounts guarantee the second spouse the right to receive a share commensurate with the funds paid. For small investments on the part of the second spouse, the court may oblige the first to reimburse the funds spent, leaving him with the right to undivided ownership of the apartment.

How should payment be made under an equity participation agreement?

Purchasing housing under the DDU from a developer at the initial stages of construction is much more financially profitable than purchasing a ready-made apartment. There is an unspoken rule according to which the earlier the equity participation agreement is concluded, the cheaper the apartment costs. At the last stages of construction, square meters in cost are only slightly inferior to the prices existing on the secondary housing market. Therefore, it is most profitable to buy housing and make payments under the DDU during the period when the residential building is still under construction or construction has just begun.

So, you have found a developer, chosen an apartment with a comfortable location, and the managers of the construction company are actively trying to persuade you to sign an agreement. How to pay for DDU? When to pay rent for an apartment with shared participation? The legislation clearly establishes that payment before registration of a child-care facility is unacceptable; it is made only after its registration in Rosreestr. Thus, first the agreement must be signed, then its registration, and only then the funds must be transferred.

Previously, unscrupulous developers, instead of an equity participation agreement, could offer to conclude:

- investment agreement;

- preliminary purchase and sale agreement.

Currently, in accordance with paragraph 2 of Art. 1 of the Federal Law “On participation in shared construction...” No. 214-FZ, the acquisition and payment to the developer for an apartment that has not been put into operation at the time of sale is possible only under a shared participation agreement, and nothing else. The above law regulates all legal relations between the developer and the buyer, including those under the assignment of rights agreement - after its conclusion, the new shareholder receives the same rights as the previous one.

But even if you and the developer have concluded one of the above-mentioned agreements, there is no need to panic ahead of time. There is a high probability that the court will reclassify such an agreement as a DDU. Of course, this does not always happen; the judge will definitely analyze the content of the agreement and, based on it, make a decision. In any case, you can increase the likelihood of a positive outcome if you seek help from our legal team. Contact information is listed on our website.

You can also calculate the approximate amount of the penalty that you will receive in the event of a delay in the transfer of a shared construction project into your ownership. To do this, just follow the link “DDU Calculator” and fill out the special fields.

Find out about the mistakes of shareholders that reduce the amount of the penalty here .

Purchasing an apartment using a mortgage with maternity capital

Is it permissible to use maternity capital funds to participate in shared construction? To date, there are no restrictions on this type of use of the certificate.

Purchasing an apartment under a DDU with a mortgage using maternal capital is possible subject to several conditions:

- At the time of purchasing an apartment, the child after whose birth the parents received the certificate must be three years old. Otherwise, maternity capital cannot be taken into account when purchasing for cash.

- Purchasing an apartment under a DDU using maternity capital funds is only permissible if you obtain a mortgage.

To summarize, we can say that the use of a maternity capital certificate for the purchase of housing under the DDU before the child reaches three years of age is possible only when applying for a mortgage loan.

Features of a loan for living space in a new building under 214-FZ

According to the law, the buyer must enter into an agreement with the construction company or its representative. It protects against the negative consequences of non-compliance with agreements between the parties. However, other features of a mortgage for participation in shared construction must also be taken into account.

- The text of the agreement specifies detailed information about the property being purchased (number of floors, area, etc.), as well as the terms and cost of the apartment (). As a result, it is not abstract square meters that are purchased, but housing with specific characteristics.

- If an apartment is purchased under a DDU with a mortgage, the law provides for the emergence of the rights of a mortgagee for the equity holder (). The subject of the pledge is the site where the building under construction is located.

- According to the regulations, the object is guaranteed for five years. During this period, the construction company is obliged to cover any problems with housing that arise through its fault.

- The developer is liable in rubles for failure to meet construction deadlines (). And they are clearly stated in the agreement.

Recommended article: Is it possible to get a mortgage without official employment

Although there are also disadvantages to 214-FZ. Usually, mortgages, due to the law, require more time to complete the paperwork. This is due to the registration of the agreement in Rosreestr.

Latest changes in legislation regarding shared construction

Last year, Federal Law No. 218-FZ “On a public law company to protect the rights of citizens participating in shared construction in the event of the insolvency (bankruptcy) of developers and on introducing amendments to certain legislative acts of the Russian Federation” was adopted.

This law has tightened the conditions for shared construction. The developer company undergoes a thorough check to ensure compliance with the stated requirements. In particular, she must have experience in the construction of apartment buildings, a certain authorized capital, a complete list of necessary documents, etc.

The changes came into force in July 2020. The updated requirements have made life much more difficult for developers. It is possible that many will not be able to fulfill all the conditions and will be forced to cease their activities. It is now difficult to predict whether the changes will benefit shareholders by protecting them, or, on the contrary, will only worsen the economic situation by increasing the cost of apartments.