Is it possible to get mortgage insurance back from Sberbank Insurance when applying for a loan has become a common practice. Bank employees convince clients that a loan simply will not be approved without purchasing a policy. But there are situations when it is actually impossible to get a loan without insurance. One such case is a mortgage. You must understand that not all policies offered need to be purchased: there are compulsory types of insurance, and there are also voluntary ones. Is it possible to return money for insurance if the policy is not needed?

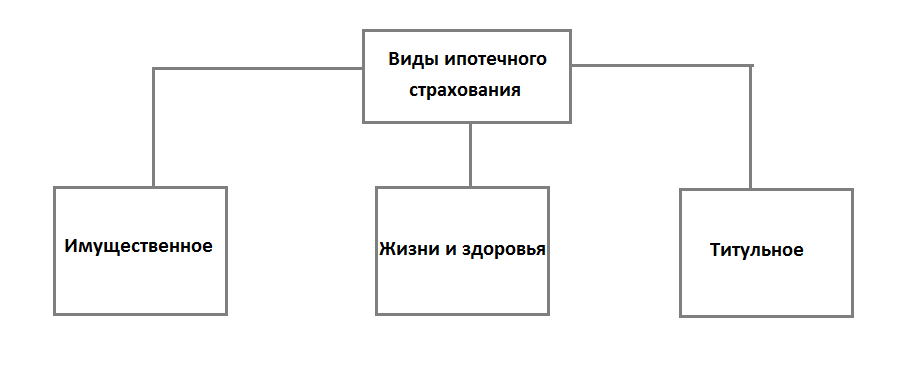

Types of insurance for bank lending

By providing a loan to its client, the bank assumes certain risks. Naturally, he tries to minimize them in different ways. One of them is insurance. And this is very relevant in the case of mortgage lending. After all, a mortgage is issued for a long period of time, therefore, the likelihood of an insured event occurring is high. That is why banks offer borrowers to enter into insurance contracts.

When lending, it is possible to conclude insurance contracts of the following types:

- Property.

- Life and health.

- Title.

Property insurance is a mandatory type. When applying for a secured loan, the collateral must be insured. This provision is enshrined in the Civil Code of the Russian Federation (Article 343) and the Federal Law “On Mortgage”. Thus, when taking out mortgage lending, it is mandatory to insure the property being purchased.

Life and health insurance is a voluntary type. However, this is very relevant for mortgages. During the period of debt repayment (which is sometimes estimated at 20-25 years), a lot can happen to the borrower and he may lose his solvency. But the debt to the bank will remain, no matter what, and will have to be repaid. Even if the borrower dies, his heirs will have to pay. If a policy is issued, the insurance company will cover the debt upon the occurrence of an insured event.

Title insurance is not that common. Typically, the bank requires that such a policy be issued if, based on the results of checking the borrower’s documents, the credit manager sees the danger of challenging the ownership of the property.

Rules for obtaining insurance at Sberbank

As part of mortgage lending, Sberbank offers clients three insurance options with different objects.

- Property: collateral housing is insured against damage and loss.

- Title: the object of insurance is the rights of the mortgagor to housing (which is especially important when purchasing housing with a mortgage on the secondary construction market).

- Voluntary (life/health): the object of insurance is the borrower, and the insured events are loss of ability to work due to deterioration of health and death.

- Comprehensive: combines several insurance options.

Sberbank employees offer the latter type of insurance most often, keeping silent about the fact that it requires the debtor to spend more money. In fact, insurance is forced upon clients without explaining that such insurance is optional.

The default validity period of the insurance policy is 1 year. The borrower must then renew it (and repeat this procedure annually until the end of the mortgage agreement). As an option, he can use the long-term “Protected Borrower” program from Sberbank.

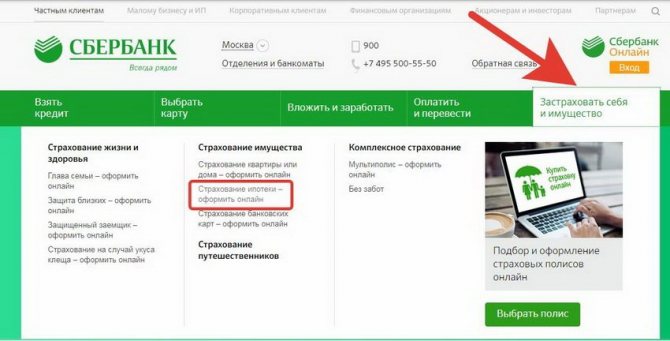

The specific conditions for drawing up an insurance contract depend on various factors: the type of insurance, the choice of insurance company, the total amount of the mortgage and the timing of its repayment. In the most general terms we can say that:

- Any capable citizen of the Russian Federation over 18 years of age can conclude an insurance contract;

- Registration of an insurance policy is mainly carried out through the Sberbank website online;

- The agreement is concluded using a digital signature.

Special cases of insurance require the insured to provide various documents. Thus, the borrower who draws up a life and health insurance contract is required to confirm that he has not previously suffered a myocardial infarction or stroke, does not suffer from cirrhosis of the liver, hepatitis C, or is not HIV-infected. Clients who do not meet these conditions can only be insured against accidents.

Objectively, insurance when taking out a mortgage can be beneficial to the debtor, bank, and state.

- For the debtor, agreeing to insurance increases the chance of getting a mortgage and reduces possible risks in repaying the loan.

- Banks are provided with coverage for losses on high-risk loans (and long-term mortgages are just such a case).

- The state benefits from stabilizing the mortgage lending system.

Look at the same topic: Application form for a mortgage from VTB 24 bank - sample filling and form for downloading

When collaborating with Sberbank, you should expect that it will recommend using the services of its subsidiary insurance company. However, Sberbank also works with other companies accredited by it.

Before agreeing to take out insurance, you should also read their terms and conditions. There is a possibility that the rate in them will be lower than in Sberbank.

It is worth considering the conditions of different insurers, since the insurance rate is calculated based on the total amount of the mortgage. As a result, the borrower must pay quite large amounts for insurance.

Important. If, when applying for a mortgage, a Sberbank employee insists on obtaining personal insurance through Sberbank Insurance, one can argue that insurance is issued through any company accredited by Sberbank. In difficult cases, you can require a reasoned refusal from the employee, sealed with his personal signature and the bank’s seal.

Is it possible to refuse mortgage insurance and how to do it?

You can only refuse life and health insurance. Moreover, the borrower has the right to do this at any time.

What documents will be required

In order to formalize the termination of the contract, you will need the following documents:

- Borrower's passport.

- A statement in which the client expresses his desire to return the mortgage insurance .

- Insurance contract.

- Certificate of no debt to the bank - in case of early repayment of the loan.

After submitting these documents, the bank will recalculate the insurance and return the balance to the borrower.

How to write an application

This document can be compiled in any form. But there is information that must be reflected in it:

- Full name and details of the insurance company with which the contract was concluded.

- Full name, passport details of the borrower, his registration.

- Date and number of the insurance contract.

- A description of the circumstances surrounding the conclusion of the contract and the reason why the client wishes to terminate it.

- Client's instructions for refund of insurance (full or partial).

It is also necessary to legally justify your position, i.e. indicate on the basis of which legal acts the borrower’s intentions are legal. At the end of the statement it is usually stated that in case of refusal, the client will resolve the issue in court.

The procedure for returning insurance in different cases

As already mentioned, return mortgage insurance from Sberbank at any time.

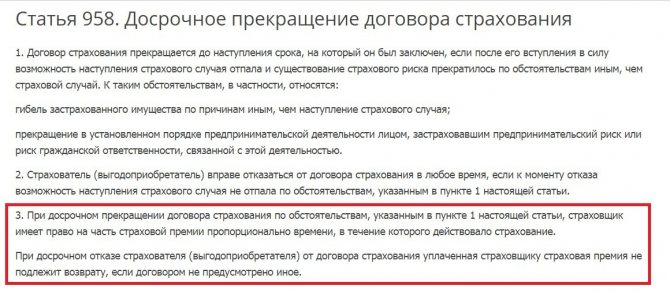

In case of early repayment

If the borrower repays the debt before the period specified in the contract, then he has the right to return the insurance (its unspent part). In this case, you need to act like this:

- Study the terms of the loan agreement. If it stipulates that the mortgage loan insurance can be returned upon early repayment or there is no such clause, then this means that the money can be returned. However, it may be stated that no refund will be made in such a situation. Then the issue can only be resolved in court.

- Determine the approximate amount to be returned. In general, this is not mandatory, since the bank itself will determine the exact size to be issued to the client. But if you’re going to start fighting for money, you need to at least roughly understand how much we’re talking about.

- Write a refund application and submit it to the bank or insurance company. The addressee depends on who is indicated in the mortgage agreement as the beneficiary, that is, you need to choose an organization that would be the recipient of the money upon the occurrence of an insured event.

If the enterprise is not successful, then there is only one option left - to restore your rights in court.

After timely repayment

In this situation, there is only one option, how to get your mortgage insurance back . The client will have to prove that this service was imposed on him. Then you need to act like this:

- Carefully study the provisions of the insurance contract in terms of their compliance with regulatory documents. Thus, you can try to invalidate them.

- Analyze the mortgage agreement in the same way, especially in those paragraphs that talk about insurance.

This case is quite difficult, so it is better to enlist the support of a competent lawyer.

During loan repayment

If the borrower believes that the service was imposed on him and he does not need the policy, then the best option is to terminate the insurance contract during the “cooling off period”. It is 14 days from the date of signing the contract. In this case, you need to act like this:

- Study the contract with the insurance company, especially those clauses that stipulate the procedure for concluding and terminating the transaction.

- Assess what consequences may occur after the contract is terminated.

- Submit an application for waiver of insurance to a bank or insurance company.

- Wait for a response from the insurer, which should arrive no later than 10 days later.

- If a refusal follows, you need to contact Rospotrebnadzor.

- Wait for a response from there. This may take up to three months.

- If an insurance or credit organization does not agree with the requirements of Rospotrebnadzor, they have the right to appeal its decision.

- Get the final decision. If it is negative, then you can file a lawsuit in court. All documents received at the previous stages should be attached to the claim.

By a court decision, the insurance contract will be terminated.

Insurance return methods

To return funds from insurance, you must submit an application to the bank itself (if it sells insurance packages) or to the insurance company. The second option is preferable because it allows you to resolve issues without an intermediary and receive only reliable information.

In case of early termination of the contract, an application for return of insurance is written at the bank office and attached to the client’s dossier. For example, at Sberbank insurance is issued for the entire term of the loan, so its return upon early termination is quite common. Please note that the money is returned at the request of the client, since the policy is concluded with an insurance company and essentially has nothing to do with the loan, it only protects financial interests in the event of insured events.

By the way, it is possible to receive a tax deduction on the amounts received. Thus, a mortgage and the interest accrued on it are, in theory, subject to personal income tax (NDFL), and, therefore, a deduction of 13% can be returned through the tax office. To do this, you need to fill out a declaration in the standard mode and submit documents to the Tax Office. Today, the procedure is also carried out electronically.

Let's get back to insurance. It is also possible to return it a year after receiving the loan, but it will be more difficult. And after repaying the loan, it is completely impossible, so contacting the bank must be timely. Therefore, when signing a contract, it is necessary to study it carefully. And not only the loan agreement, but also the insurance agreement.

For what reasons may an insurance refund be refused?

The main reasons why a bank or insurance company may refuse to terminate an insurance contract are as follows:

- The borrower submitted a waiver of insurance to the bank at the time the agreement was signed with the insurance company.

- There is no clause in the contract that the borrower has the right to refuse insurance.

- The contract expressly states that the insurance contract cannot be terminated. This may happen if insurance was purchased before June 1, 2020.

In any other situations, the bank’s refusal is unlawful. Then the borrower needs to contact the territorial branch of the Bank of Russia. The statement should indicate that the credit institution violated the instructions of the Central Bank of the Russian Federation. It is likely that in this case it will be possible to resolve the issue without going to court. Otherwise you will have to file a claim.

How to refund your mortgage insurance

There are typical cases when insurance returns are the most pressing. This is an early repayment of a mortgage or its refinancing and the death of the borrower.

It is also a good idea for the debtor to have a pre-developed algorithm of actions if Sberbank begins to impose insurance services, passing off voluntary as mandatory.

In case of early or planned repayment of the mortgage

Refund of the insurance amount during planned mortgage repayment is not possible. If the housing loan was repaid ahead of schedule, the debtor must receive back part of the insurance amount paid by him. It is calculated in proportion to the time that he gained from the total loan period by paying off before the end of the mortgage term.

To get part of the insurance money back, you need to contact the insurance company with an application, to which you attach copies of bank documents indicating full payment of the mortgage.

After the death of the borrower

Relatives (heirs) of the deceased must provide the bank and insurance company with a death certificate of the debtor as an evidentiary document. Further developments depend on whether death is included or not in the list of insured events. If the death of the debtor is an insured event, the insurance company covers the debt. The insurance funds will not be returned to the heirs of the deceased borrower, but they will not owe anything.

If the death of the borrower is not considered by the program as an insured event, the relatives of the deceased will be forced to assume all responsibilities for repaying the mortgage debt. All mortgage payment procedures are suspended until the inheritance rights take place.

However, the insurance program operating together with the mortgage may, for some reason, not suit the heir. Then he has the right to insist on re-issuing the insurance contract in his name, and then on abandoning it. Then a portion of the insurance money will be returned in proportion to the remaining time.

When refinancing

When refinancing, you can change the terms of the mortgage to the benefit of the debtor and achieve benefits in terms of insurance payments. A partial refund is also possible. The borrower has several options.

- If the insurance conditions are satisfactory to the borrower, and the insurance company is accredited not only in the old, but also in the new bank, the validity of the insurance policy is extended.

- If the terms of the insurance do not satisfy the borrower, and the insurance company is not accredited by the bank where the refinancing is carried out, it is permissible to terminate the insurance contract and obtain insurance through a company accredited by the new bank. When the old insurance contract is terminated, part of the money is returned to the borrower.

Look at the same topic: Everything about refinancing mortgages from other banks in Rosselkhozbank

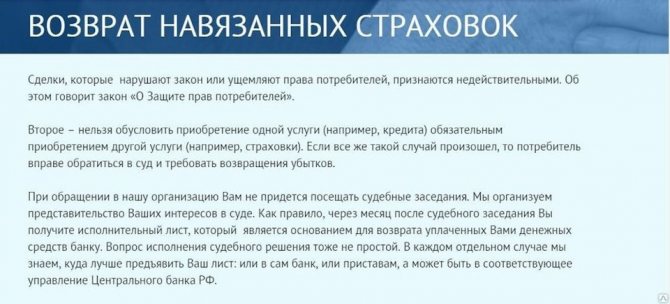

Unilaterally, if a service has been imposed

Very often, a Sberbank client is convinced that he will not receive a mortgage without insurance. However, life insurance in most cases of mortgage lending is not mandatory: the bank imposes this service in hopes of receiving commissions. When the client realizes that the insurance was not mandatory, he seeks to return the insurance money.

The refund amount will be greater the sooner the borrower refuses insurance by submitting an application to a branch of Sberbank or an insurance company. In the first two weeks from the date of registration of insurance, there is a chance to issue a refund. Some debtors, well-versed in banking policies, issue a waiver of unnecessary insurance literally in the first hours after signing the papers and receiving the loan.

No other information can be found on the Sberbank website, but in fact, you can submit an application for waiver of insurance later. Another thing is that it will be possible to return only part of the insured amount.

It is unprofitable for Sberbank to refuse the debtor's insurance, and it will try to delay the recognition of the refusal. A common practice is to refer the borrower to the insurance company (and the insurance company will refer him back to the bank).

Based on numerous complaints from borrowers, the Bank of Russia introduced a cooling period - a period of time during which the insured has the right to refuse the services imposed on him. However, this can only be done if a personal insurance policy has been issued.

Among banks, the scheme of collective insurance policies is now widespread. Such a policy is not purchased by an individual citizen: the latter only joins it. If a purchased policy can be canceled by law and demand a refund, joining a collective policy does not provide such opportunities. There is no legal justification for its refusal yet.

Useful tips

When concluding any contract, you must read it carefully before signing it. When getting a mortgage from Sberbank, you should especially carefully study the clauses regarding insurance. Here it will be very helpful to contact a qualified lawyer who will tell you how best to act.

It is important how the paragraph of the contract describing the use of insurance is worded. It may say that the insurance policy is valid for the duration of the loan. This means that in the event of early repayment of the mortgage, the borrower will no longer be a debtor to the bank, and therefore he will not need insurance.

You can draw the bank's attention to the fact that the subject of the insurance contract is the payment by the insurer of funds for the policyholder upon the occurrence of a certain event. If this does not occur during the credit period, then the client may qualify for a refund of mortgage insurance .

- Read also: Payment for a mortgage insurance agreement through Sberbank Online

What to do in case of refusal?

An application for a refund of the premium is considered within 30 days. In some cases, this period can be extended to 2 months. Long processing times are due to the fact that the package of documents must be approved by specialists from the head office located in the Russian capital. If the insurer refuses to return the money, then you need to demand an official response, which indicates the reason for rejecting the application (it is recorded in writing). After this, the policyholder can draw up a statement of claim and submit it to the court.