General data on property taxation

Currently, citizens of the Russian Federation pay the following types of garage taxes:

- Property. The contribution is paid by any person who owns a garage and this fact must be documented, that is, the property must be registered with Rosreestr.

- Land. A structure such as a garage is integral to the plot of land underneath it, that is, its owner will also have to pay land tax. This is carried out subject to: formalized ownership rights, perpetual use, inheritable lifelong ownership. When the plot is for free use or is leased, then there is no need to pay tax; in the case of a lease, rent is paid.

- Income. It is contributed to the budget through personal income tax in case of sale, donation, or inheritance. Tax rate 13%.

Notification of tax payment arrives within the time limits provided by law. The document indicates the amount to be contributed to the budget, and there is a receipt for payment. You need to contact the tax authority at the place where the property is registered.

Important! Payment for the garage is regional, that is, it goes to the budget at the location of the property. The national average does not exceed 1.5%.

Tax benefits for pensioners in 2020

According to Art. 220 of the Tax Code of the Russian Federation, pensioners can take advantage of the deduction when purchasing an apartment, house or land. Compensation can be issued for three previous tax periods. A non-working pensioner has the right to a deduction if he retired no earlier than 3 years before the year in which the right to the benefit arose.

According to analysts, in 2020 the amount of property tax will increase by 18%. The increase will continue until 2020. The tax will be calculated based on the cadastral value. According to the law, there is no limit on the area of a pensioner’s apartment or house.

16 Apr 2020 stopurist 1248

Share this post

- Related Posts

- Compensation for utilities for disabled people of group 2 in 2020

- What benefits does a disabled person of group 2 have in 2020 in Tatarstan?

- How to pay transport tax through government services

- Do I need to pay tax when selling an apartment and buying a new one?

Does a pensioner pay garage tax or not?

Until 2020, the Federal Law established that persons of retirement age do not pay garage tax. Now the situation is somewhat different - they have the right to choose one type of real estate such as a garage, room or apartment, house in order not to make tax payments for them. That is, if you own several apartments or houses, you will have to choose one object each - 1 house and 1 apartment, for which you do not have to pay. Moreover, this applies only to property: when owning a garage, you cannot choose between paying taxes on the land and the garage itself.

Important! Regional authorities have the authority to exempt pensioners or other categories of citizens from paying land tax. But given that all contributions go to filling the local budget, such a step is very unlikely.

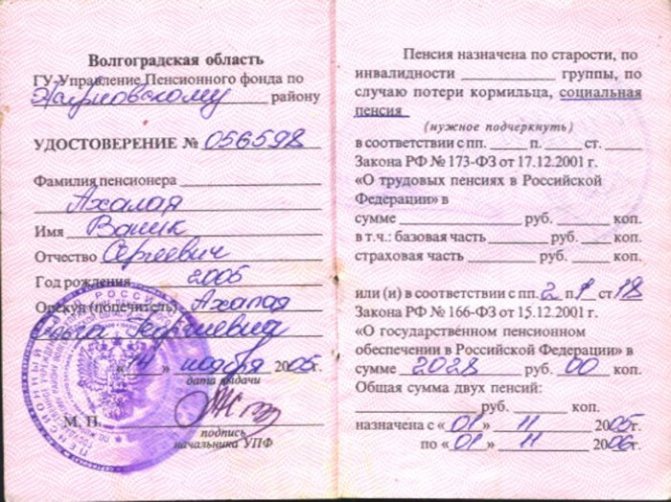

To apply for a benefit, you should contact the tax office at the location of the property with the appropriate application, passport or pension certificate.

Garage tax for pensioners

Under Russian legislation, pensioners have the right to special benefits and are partially exempt from tax payments for official ownership of property. Restrictions apply if a pensioner has two garages - for the second one you will need to pay the tax fees established by the Federal Tax Service. You will also need to pay tax for the land plot on which the garage is located.

If the garage building is in shared ownership and one of the parts of the box is owned by another person, the obligations for tax deductions will apply only to him, the pensioner will be exempt from paying fees for his own share.

The benefit does not apply to a land plot even in shared ownership, so you will have to pay standard contributions to the state for it. This issue is decided by regional authorities, so there may be individual amendments for each individual region.

To provide benefits to citizens on pensions, they will need to prove their right to exemption from the garage tax deduction. To do this, you need to contact the territorial tax office with your personal passport and write a special application in the prescribed form for exemption from garage tax. You must additionally provide a copy of your pension certificate, as well as a document certifying ownership of the garage property.

Tax rates for pensioners

Typically, the tax will consist of two payments: property and land. Their rates are different.

Property

It is paid for any type of garage: capital or metal. The main condition is the existence of ownership rights, which indicates the obligation to make a tax payment. The tax base is cadastral value. It is calculated by the appraiser, and the indicator can be found on the Rosreestr website.

Important! You can clarify this amount by ordering an extract from the Unified State Register of Real Estate.

In some regions, the value for tax is calculated from the inventory value transferred to the tax BTI multiplied by the deflator coefficient established annually by the Ministry of Economic Development of the Russian Federation. Rates are set by municipal authorities and may increase as costs increase, for example:

- When the price of a garage after multiplying by a deflator is more than 300 thousand rubles. The increase occurs by 0.1%.

- If the cost after multiplication varies from 300 to 500 thousand, the calculation is multiplied by 0.1-0.3%.

- With a total cost of over 500 thousand rubles, the result increases by another 0.3-2%.

You can check their size on the official website of the regional administration.

Land tax

You also need to pay for the land on which the garage is located. But there are some peculiarities here. So, if it is located in the GSK, but the land is not registered by a specific owner, then the procedure will be different. The general tax on land for the cooperative comes to the accounting department of the GSK, then there is a division between the members of the cooperative.

Important! If the GSK is registered in the name of a community of disabled people, then the pensioner (without disability) is not obliged to pay tax, since the tenant is an organization that has no obligation to pay tax.

If the garage is individual or in the GSK, but the land is registered as a property, then you need to pay tax on it. The payment is formed by 2 factors:

- Cadastral value of a plot of land.

- Tax rate in the region of location. It is also established by the authorities.

You must pay for a land plot from the moment construction of the facility begins or from the date of registration of property rights.

What is the tax on land under a garage

All owners, without exception, have an obligation to pay a tax levy on the land plot located under the garage. There are several main options for paying this fee.

If a property is included in a cooperative and ownership rights were previously registered for it, but not for the land, then the tax is paid by the cooperative association itself, where each specific owner will contribute a certain amount.

When registering a plot as official property, a receipt will be provided to the owners only once a calendar year. In situations where the cooperative, for certain reasons, does not pay the tax, the owner of the garage box also does not have to pay it.

The amount of the applicable fee may depend on the following key factors:

- on the tax rate of a particular region;

- from the actual location of the garage;

- from the value of the land plot according to the cadastre.

The fee must be paid from the time when the actual use of the land for its intended purpose begins. You will have to pay in any case, even if the garage has not yet been built. If any additional questions arise, interested parties can seek a free consultation from the competent staff of the registration center.

How to sell a privatized garage - first you need to decide on the cost of the garage and draw up the contract correctly. How to conclude a simple garage rental agreement - read in this publication.

What does it consist of?

Many citizens consider garage boxes to be rather primitive structures, but in fact they are complex objects consisting of complex structural elements and a plot of land underneath them.

Legislation establishes the obligation to pay taxes. In fact, these are two separate payments. The first is paid for the property, and the second for the land itself.

The garage is a full-fledged non-residential property. The tax rate in 2020 is determined by authorized representative offices of local governments.

The fee is calculated from the moment of actual registration of property rights with the territorial registration authority and depends directly on the value of the object itself. In this case, a progressive system is relevant - the more expensive the garage, the higher the tax.

Evaluation activities are carried out by specialists, but these processes may lead to some errors. In this situation, you can submit a completed application containing a request to recalculate the cost of the cadastre.

As for the amount of tax collection on a land plot, it directly depends on the cadastral valuation of the land, as well as on the tax rate in the region. The latter average for the Russian Federation is about 1.5%.

The amount of payments also differs depending on the type of property. If the land plot is owned by a citizen, then a receipt for payments will be provided by the territorial tax service.

However, if the land is owned by the GSK, in which the owner is a member, then the payment document will be common to the entire cooperative. The association's authorized accountants will independently enter the required amount into the receipt.

The owner of a garage box may, under certain circumstances, be exempt from making payments. This is relevant for cases where a particular cooperative is not subject to taxation.

In situations where garages are transferred in favor of other persons under lease agreements, tax must also be paid on the profit received from defined payments. The income tax rate as of 2020 is 13%.

Sample pension certificate

Payment and declaration procedure

The declaration must be submitted by April 30 of the year following the receipt by the seller of income from the relevant transactions. For example, if the garage was sold in October 2020, then the declaration must be submitted to the territorial tax authority by April 30, 2020.

Submission is made to the authority located at the place of permanent registration of the citizen. The possibility of a tax deduction is confirmed in each specific case by attaching to the declaration all the documents necessary in this situation.

It is not recommended to commit fraudulent acts in relation to tax inspectors by indicating in the agreement an amount less than 250,000 rubles, which allows you to get rid of the obligation to draw up the document in question upon receipt of profit. Authorized tax officials carefully check incoming information.

Declaration of real estate property

Each branch of the Federal Tax Service has expanded access to a certain set of information. Which are stored in the state cadastre register. That is why the actual value of a property can be easily determined. If the price is higher than the price at which the garage box was sold, then claims and questions will be brought against the parties to the transaction.

In the near future, the Federal Tax Service of the Russian Federation plans to accrue tax levies in an amount equal to the difference between the cadastral value and the price at which the garage was sold.

When you don't need to pay at all

A pensioner can be completely exempt from property and land taxes if he:

- Hero of the USSR or Russia.

- Disabled person of group I or II or childhood.

- Participants in wars, combat operations, partisans, combat veterans.

- Liquidators of the Chernobyl accident.

- Military personnel who have served 20 years or more.

- Internationalist warriors.

- Patients with radiation sickness.

- Some other categories are defined as beneficiaries by local authorities.

If the garage is sold

Sometimes such a burden as paying taxes is too much for a pensioner, and he decides to sell the garage. The question naturally arises whether tax is paid on the sale of such property. The answer depends on several factors:

- Period of ownership of the garage. If the period exceeds 5 years, then you do not need to pay personal income tax on the sale. However, Form 3 Personal Income Tax must still be submitted. Otherwise, penalties may follow. If the holding period is shorter, then the pensioner can take advantage of the tax deduction. This is a refund of 13% of the amount of 250 thousand rubles.

- Real estate sale price. If the cost of selling a garage is less than 250 thousand rubles, then there is no need to pay tax, regardless of the period of ownership of the real estate.

- If the garage is rented out, then such income must be declared and 13% tax must be paid on it.