In the section on the deed of gift, we are often asked how to draw up a deed of gift for a garage in 2020 and whether there is a way to save on the procedure, within a short period of time and without violating the law. A practicing lawyer and constant author of the Legal Ambulance website, Oleg Olegovich Ustinov, will tell you about all this, as well as about important nuances, ignoring which can lead to loss of property.

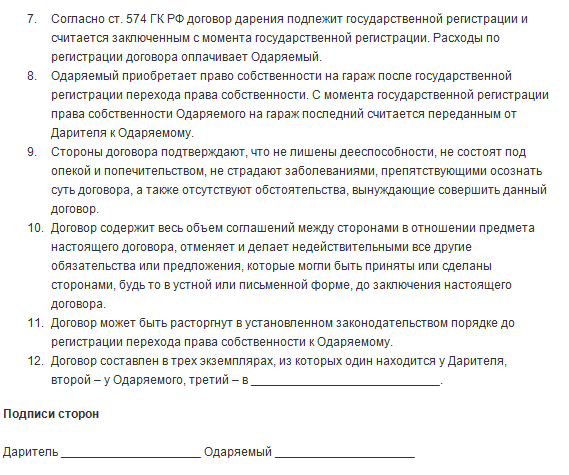

So, first it is worth noting that, according to the letter of the law, a garage is included in the category of real estate, which entails conditions and rules for its transfer specific to real estate transactions. At the same time, the donation of this object today requires mandatory official registration, which is regulated by information from paragraph 3,574 of Article of the Civil Code of the Russian Federation, namely, “Form of the gift agreement.”

This concept includes not only the execution of a deed of gift in accordance with all the rules established by law, but also the mandatory registration of the property under the name of the new owner in Rosreestr.

How to close a deal?

In 2020, Russians have the opportunity to donate a garage that is part of their property in one of two ways:

- contact a notary to draw up a gift agreement;

- conclude a deed of gift independently, without involving a specialist, by preparing all the necessary documents and registering the transaction with Rosreestr.

As you understand, the first option is suitable for sellers who want to save as much as possible. However, we note that it is quite difficult for people who do not have certain experience in this area of law to control its legality, which often becomes the reason for the cancellation of the contract. Therefore, we recommend, at a minimum, that you seek help from our free lawyers, telling them the whole situation and receiving important recommendations.

Question to the website “Legal Ambulance”:

I heard that when donating a garage in 2020, you need to submit documents to the tax office. This is true?

Lawyer's answer:

No. This is completely unnecessary. By submitting documents to the MFC or directly to Rosreestr, you can count on the employees of these organizations to independently send the necessary data to the tax service.

Another method is an excellent option for those who do not want to bother studying the laws, but want to have guarantees that the terms of the transaction will not be violated. Just contact any notary, pay the required amount and be sure of the transparency and legality of the deed of gift.

At the same time, the garage donation transaction in question, according to existing legislation, does not require mandatory notarization and in order for the agreement to have legal force, you only need to correctly draw up its contents and confirm the signature of each of the parties, confirming acceptance of the conditions set out in it.

Step-by-step process for donating a garage

If you decide to transfer real estate to another person, you will need to go through the following steps:

- preparation of a mandatory package of documents, the list of which is established by the current legislation of the Russian Federation;

- drawing up a deed of gift or gift agreement with the help of a notary or independently;

- signing of the agreement by the parties;

- submission of all certificates and papers to Rosreestr or the MFC to undergo the mandatory procedure for state registration of the transfer of ownership of the object of the transaction to another person;

- transfer of completed documents to the donee.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement between legal entities

Rules for registering a deed of gift

Since the legislation in the Civil Code of the Russian Federation establishes the rules for drawing up agreements, when drawing up a deed of gift for a garage, it is important to consider the following points:

- the subject of the transaction is indicated accurately and unambiguously. If the item is missing, the transaction is considered invalid;

- additional conditions are included in the gift agreement if they do not contradict the law;

- It is unacceptable to include in the deed of gift conditions on the reciprocal transfer of a gift from the donee to the donor, the payment of money or the provision of a service;

- Since the garage is considered a piece of real estate, after drawing up the agreement, it is necessary to register the resulting ownership. Without registration, the object is not considered the property of the recipient of the gift;

- donation from a minor or incapacitated person is unacceptable;

- the donation must be voluntary, the donor must be aware that the transaction will deprive him of ownership of the object;

- a deed of gift cannot be canceled due to a change of mind of the donor, so it is worth thinking carefully about this step.

Thus, there are rules that cannot be violated in the process of formalizing a transaction for the gratuitous donation of a real estate object.

What documents are needed to draw up a gift deed for a garage in 2020?

In addition to a signed, correctly drawn up gift agreement, to register the transfer of ownership of the garage, the party donating the property is obliged to provide the following documents to Rosreestr or a multifunctional center:

- deed of gift in three copies (one for the Rosreestr specialist and for each party to the transaction);

- passports of the donor and recipient;

- a written statement from the donor confirming the fact of the voluntary donation of the garage and a similar document from the donee, in which he agrees to accept this property on the terms established by the contract.

In addition, you will also need documents related to the object itself:

- cadastral plan;

- technical certificate;

- a document confirming the fact that the transferred property is not under encumbrance (optional);

- documents that confirm the existence of family ties between the parties to the transaction (in the event that the object is transferred between close relatives);

- ownership of the donated object;

- a receipt confirming successful payment of the state duty established by the law of the Russian Federation.

Also, in our practice, there have been cases when a specialist of the state registration authority asked to include other papers in the mandatory list of documents - for example, papers confirming the fact that the property has no other (shared) owners.

Procedure for registering a garage as a gift

A garage can be the subject of a donation transaction. It refers to immovable objects, and therefore is drawn up according to a similar scheme. The parties who decide to conclude a deal have two options for execution:

- do it yourself. This option is cheaper, but labor-intensive for the participants in the transaction;

- through a notary - the option is more expensive, but more reliable.

This alternative arises because the law did not oblige the deed of gift to be concluded in notarial form.

For an agreement to have legal force, it must simply be written and signed by the parties.

Self-registration

When drawing up a deed of gift without the help of a notary, the following information should be indicated in the text of the agreement:

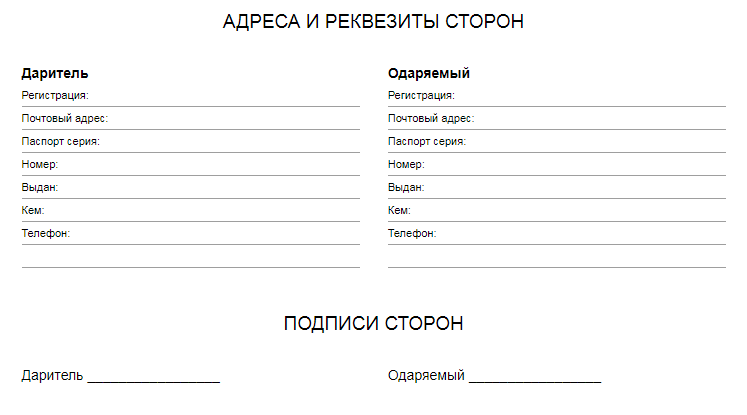

- FULL NAME. the donor and the donee, passport details, place of residence at the time the contract was signed;

- object number in the garage array, its location or address, distinctive features (area), data from technical papers;

- indication of the date of transfer of the gift;

- signatures of the parties.

Moreover, if an object is given to a minor, the papers are signed by a representative, but the owner is the recipient himself.

To independently draw up a garage donation agreement, prepare the following documents:

- passports of the parties to the transaction. If there is a representative, his passport is also required;

- a document from which the method of transferring the garage into the property of the donor is clear (for example, an exchange agreement);

- certificate of state registration of rights. In some cases, a registration certificate is presented instead (if the ownership was registered before 1999);

- cadastral passport of the object (technical passport no older than 5 years);

- documents for the plot of land on which the donated object is built;

- powers of attorney, if the parties to the transaction do not represent their interests themselves.

Papers are necessary to confirm the legality of the transaction and fill out the contract with reliable data.

After drawing up the text of the document, it is signed by the donor and the recipient. However, registration must be completed with state registration of the right. To do this, follow the step-by-step instructions:

- Contacting the authority responsible for registering rights and submitting an application.

- Supplementation with the listed papers with the attachment of a signed agreement and a receipt for payment of the state fee.

- Receiving from the employee who accepted the package of papers a receipt about this, information about the date of application for the finished document.

- Appear on the appointed day and receive the completed certificate.

Only after this the donee becomes the owner of the donated property and has the right to dispose of it at his own discretion.

If the participants in the donation are not considered to be closely related, the recipient will have to pay tax at a rate of 13% of the value of the garage.

Registration by a notary

It is much easier to draw up a deed of gift for a garage at a notary’s office. To do this, submit the specified package of documents and pay some expenses. In addition to the state registration fee and tax in some cases, their list will include:

- state fee for notarization of a document. A gift agreement is not one that must be certified. The duty rate for it is calculated in a special way;

- payment for the work and consultation of the notary at a rate established by him.

After the notary has drawn up the agreement, the parties sign it. Then state registration is required, which the notary can complete himself; the parties only have to receive a completed certificate and agreement.

Thus, independently drawing up an agreement to donate a garage is cheaper, and with the help of a notary it is faster and more reliable. However, the parties must make their own choice based on the situation.

How to give a garage to a close relative?

It’s worth noting right away that the procedure for donating a garage between close relatives (for example, donating a garage to a son from a father) is practically no different from the procedure usual for drawing up a donation agreement for a stranger or distant relative.

Lawyers believe that the only significant difference in the transaction is the fact that in the case of close relatives, the donee is exempt from paying state tax!

Question to Oleg Ustinov : Is it legal to draw up a deed of gift between strangers without going to a notary office?

Answer : Yes, there is nothing illegal about it. According to current legislation, people can enter into a gift agreement without notarization in a simple form.

When drawing up and registering a deed of gift, you will need to prepare the same package of necessary documents as we described above. However, in addition to them, it will be necessary to provide a document that confirms the family relationship between the parties to the transaction. This paper can be, for example, a marriage or birth certificate.

Requirements for donating real estate

The norms of the current civil legislation establish the following requirements for the donation of real estate:

- the terms of the signed agreement must not contradict the law;

- an incapacitated person or a minor cannot act as a donor;

- the subject of the contract must be specified - this means that, having studied the text of the contract, each person must understand what kind of garage we are talking about;

- the transaction must be registered in a unified register - the moment of registration is considered the moment of transfer of ownership of the garage from the donor to the donee.

How to draw up a deed of gift for a garage so that it is not rejected by the MFC or Rosreestr?

Quite often, citizens who choose the “economical” way of conducting a transaction and do not contact a notary’s office make mistakes when drawing up and executing an agreement. Therefore, let's look at the most common reasons for refusal and cancellation of a deed of gift for a garage.

So, first of all, we note that the agreement must be drawn up in writing. At the same time, there is no mandatory form for its preparation and therefore it can be done in a free interpretation.

EVERYONE NEEDS TO KNOW THIS:

Agreement for the donation of a share of a room: how to draw it up correctly?

At the same time, a correctly executed document must necessarily contain the following points:

- name of the document (see sample photo);

- place, as well as the actual date of drawing up the contract;

- important data about the donee and the donor (full name, registration addresses, passport details, etc.);

- the most accurate characteristics and description of the donated object (garage) - data on the land plot on which the building stands, technical condition, etc.;

- rights and obligations of each party to the transaction - it should be indicated that the donor is ready to transfer the property of his own free will, and the donee is ready to accept it.

Also, as we already mentioned above, we recommend that you be sure to indicate in the content the fact that the property being transferred is not encumbered, and also indicate on the basis of which of the documents attached to the deed of gift the garage belongs to the donor (for example, a certificate from Rosreestr on registration of property rights) .

Question to a lawyer : Tell me, can I draw up a deed of gift for a garage for a minor child?

Answer : Of course! But, if the donee party is a person who has not yet turned 14 years old, then his interests during the transaction must be represented by a legal representative (parent, guardian or employee of the guardianship and trusteeship authorities). Moreover, if the donee has reached the age of fourteen, but has not yet turned 18, his parent must be with him at the time of signing the deed of gift, who will also need to sign the document.

An equally important point is the listing in the contract of the grounds for its termination (for example, the deed of gift will be terminated if the donor survives the donee). Also, try to ensure the quality of the signatures. Thus, they must be legible and belong exclusively to the parties to the transaction.

Donation procedure

When starting to formalize, the parties to the transaction must prepare the documents required by law and directly draw up the text of the deed of gift, according to the current sample. The agreement is printed in the required number of copies, signed and registered with Rosreestr.

The legislation of the Russian Federation does not oblige the parties to notarize the deed of gift, but, with mutual agreement, the parties can notarize it. The process of registering a deed of gift in Rosreestr lasts 10 calendar days. Upon completion of registration, the final change of ownership of the garage and adjacent land occurs.

Preparing to formalize the agreement

In preparation for executing a gift agreement for a garage, the donor must complete the following steps:

- Legalize ownership, if this has not been done before.

- Accept the fact that this is a free transaction.

- Confirm that the donee has the right to be one.

- Prepare a package of documents required by law.

- If the donated object is jointly owned by the family, you must obtain the consent of your spouse.

The donor must understand that the transfer of ownership rights to the object will occur immediately after the completion of registration of the donation agreement in Rosreestr, in accordance with Article 574 of the Civil Code of the Russian Federation. It is almost impossible to cancel and challenge decisions on a deed of gift without having significant grounds for its cancellation.

What documents are required when registering a deed of gift?

Before you start drawing up a deed of gift for a garage, you need to familiarize yourself with the list of documents established by law so as not to miss any of them. Russian citizens will need:

- passports of both parties to the contract;

- garage documents;

- certificate of ownership;

- written permission from your spouse (if necessary);

- directly the donation agreement (according to the currently relevant sample).

Provided that the garage is included in the cooperative, the owner additionally attaches a certificate confirming the repayment of contributions and the absence of debts.

To complete the deed of gift process, it must be registered.

To carry out the registration procedure, the registrar is provided with the following documents:

- Statement.

- Passports of both parties to the contract.

- Three copies of the gift agreement.

- Receipt.

- Transfer act.

- Documents confirming ownership.

- Spouse's permission (if necessary).

If the deed of gift is registered by the legal representative of the person, the registrar must additionally provide the original power of attorney and the representative’s passport.

How to draw up a gift deed for a garage

The participants in the transaction can draw up a deed of gift for the garage themselves, using the sample that was current at the time of drawing up. Participants can also seek help from a notary who can certify the document. Or, even entrust the paperwork to a realtor or lawyer, who will do everything professionally.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

Experts advise contacting lawyers, at a minimum, for advice, so that the parties to the transaction are convinced that the documents are drawn up correctly. For those who want to reduce the likelihood of challenging the deed of gift in the future, the best solution would be to have the agreement certified by a notary.

The gift agreement must be drawn up in writing, and the form of drafting is free. The document must include the elements indicated in the sample.

This is important to know: Features of taxes on a gift for an apartment in 2020

According to Russian law, a deed of gift for a garage must include:

- Name;

- date and place of drawing up the deed of gift;

- information about the donor;

- information about the donee;

- complete information about the donated object;

- rights of the parties to the transaction;

- data on the absence of prohibitions on alienation;

- start date of the contract;

- full information about representatives (if necessary);

- data on registration costs;

- signatures of both parties;

- list of attached documents.

The donation agreement is prepared in the required number of copies. Provided that the documents are not certified by a notary office, you will need an additional copy of the documents: one remains with the registrar, and the remaining two are given to each of the participants.

An additional copy of the gift agreement is required for preservation in the archives of the notary office. Copies of the deed of gift are drawn up in the original; copies of the agreement cannot be used, and have the same legal force.

Deed of gift for garage and land in 2020

Depending on the design features, a garage may be included in the category of both real estate and movable property. For example, since it is impossible to move a building made of brick or reinforced concrete, such an object will be classified as real estate. The same cannot be said about a “metal box”, which can be transported and, therefore, belongs to movable property.

Problems with a gift agreement for a real estate garage, as a rule, arise when the donating party does not own the land plot on which the building is located. However, if he has documents for the “land”, the transaction will go through without complications and problems.

At the same time, in cases where donors are members of garage cooperatives and pay a regularly established share for a plot, the donor will be obliged to complete the transaction, in accordance with paragraph 4 of Article 218 of the Civil Code of the Russian Federation, to pay the share in full.

We also note that if the object is part of a garage cooperative, when registering it, the donating party is obliged to prepare not only all title documents, but also:

- certificate of successful payment of share contributions;

- a valid certificate of membership in the cooperative.

EVERYONE NEEDS TO KNOW THIS:

Gift of property to a nephew or niece

In the event that the donor illegally installed his garage and does not have documents for the site, in order to transfer ownership, he will be required to legitimize his construction.

How much does it cost to issue a deed of gift for a garage?

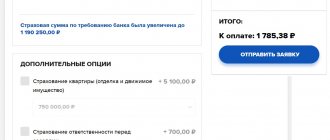

In 2020, the cost of drawing up a gift agreement can be “broken down” into several separate items, which include the price:

- notary services, which can vary depending on various factors (region of registration, specialist status, complexity, consultations, etc.) from 300 to 20,000 Russian rubles;

- official registration of ownership of the new owner, amounting to 350 rubles for a land plot and 2,000 for the garage itself;

- tax established by the legislation of the Russian Federation in the amount of 13% of the total value of the object being donated (applies only to cases when strangers or distant relatives act as parties to the transaction).

The final cost can be determined by a specialist at the first stages of the transaction. In addition, you can find out about it by contacting our duty lawyer at any time.

Procedure for drawing up a deed of gift

An agreement to donate a garage can be drawn up without the participation of a notary. The signature of the parties to the transaction makes the document valid without the need for a lawyer. This is quite convenient, although you should not forget that the help of a notary will help you avoid mistakes in drawing up a deed of gift. However, given the cost of legal support, everyone chooses the form of the transaction.

The donation of a garage is carried out according to the basic principles of drawing up donation agreements:

- A deed of gift for the garage is drawn up in 3 copies: each of the parties to the transaction must have the original document, the third copy is provided to the Federal Registration Service or MFC. The agreement must contain the following information: full data of the parties to the transaction, including the address at the place of registration and telephone number, a description of the object of the transaction, its location and the basis of affiliation. You can draw up an agreement yourself or use a sample document.

- The recipient party pays the state fee in the prescribed amount and confirms its consent to receive the property as a gift.

- Provide all necessary documents to the registration authorities: passport of each party to the transaction, ownership of the garage, cadastral passport. The list can be supplemented by employees of the Federal Social Security Service or the MFC.

- Also, to recognize the validity of a gift agreement for a garage, it is required to provide written consent to the conclusion of the transaction from all relatives who have the right to the property. If the donor is married, the other spouse must also certify that there are no claims on their part. This type of document must be notarized.

- The period for consideration and acceptance of an application for the transfer of property as a gift is about 30 days, after which the recipient will become the new owner of the garage.

How to donate a share in a garage?

According to the current legislation of the Russian Federation, the donating party has the right to dispose of its property at its own discretion, including donating a share of the garage, and not the entire property. At the same time, the donor can give several such shares to several persons at once.

Question for an expert : A neighbor says that my grandson will also have to pay tax on the garage, which he inherited from my husband - his grandfather. Is it so?

Answer : If you mean personal income tax, that is, tax on individuals, then the recipient, in the role of a close relative, is completely exempt from paying it. At the same time, the grandson will still have to pay a fee established by the state when registering the transfer of ownership of the garage to him.

The process of registering a deed of gift in this case will remain completely similar to the procedures described above and its only difference will be that in the content of the deed of gift the donor will need to indicate the fact that not the entire garage is being donated, but part of it (with the obligatory indication of each transferred shares).

Who can be parties to a garage donation agreement?

The donor can present the gift to close relatives or third parties.

In this situation, the average person needs to know who is included in the circle of immediate relatives. Thus, the presence of family ties can have advantages in drawing up an agreement, which we will talk about a little further.

According to the Family Code of the Russian Federation, the following persons can be considered close relatives:

- father and mother;

- brothers and sisters, including those who have only one common parent;

- husband and wife;

- children who may also be adopted;

- Grandfather and grandmother;

- grandchildren.