Home » Articles » Mortgage » Removal of mortgage encumbrance in 2020

March 08, 2020 No comments

A mortgage loan, like other obligations, comes to an end at some point.

However, before the borrower becomes a full-fledged owner of the property, he will need to remove the encumbrance from the property and obtain from the registration service documents that do not contain the rights of third parties to it.

This article discusses how to remove a mortgage encumbrance, how long it will take, what documents are needed, and whether additional costs are needed.

Legislative regulation

The main legislative acts that regulate the process of removing encumbrances from housing are:

- Federal Law “102-FZ “On Mortgage (Pledge) of Real Estate”, adopted on July 16, 1998;

- Law of the Russian Federation No. 122 “On Registration” of July 21, 1997.

When registering a mortgage lending agreement with the Rosreestr service, an encumbrance on the property is assigned, which means that one cannot make transactions to dispose of the purchased housing until the loan to the bank is repaid.

To become a full-fledged owner of real estate, you must submit an application to the Rosreestr service in the prescribed form.

The Registration Law provides several ways to submit such an application:

| At a personal reception | through multifunctional centers providing services to the population, or state registration service bodies |

| By mail | It is possible to send notarized documents by mail (by registered mail with a list of attachments and acknowledgment of delivery) |

| Through the Internet | An application for removal of mortgage encumbrance can be submitted using the government services portal |

A wide selection of legally established methods for submitting applications allows borrowers to choose the most convenient method.

Regulatory rationale

An encumbrance under a mortgage is a restriction of certain rights of the owner of real estate, which has legal grounds.

A mortgage is always associated with restrictions regarding the rights to dispose of real estate; in particular, the borrower cannot enter into transactions (purchase and sale, donation, exchange, etc.) with the collateral object without the consent of the bank.

When concluding a mortgage loan agreement, the bank provides the client with funds to purchase housing.

After the borrower purchases an apartment (or house), his ownership is registered in the Unified State Register of Real Estate (USRN), and the encumbrance is also registered.

By virtue of federal law, the encumbrance is removed by the Rosreestr service.

Why does the borrower need, after repaying the debt to the bank, to submit an application to repay the bank’s collateral.

The application is submitted from both parties to the loan agreement: the debtor-citizen and the creditor-bank.

What documents do I need to receive after withdrawal?

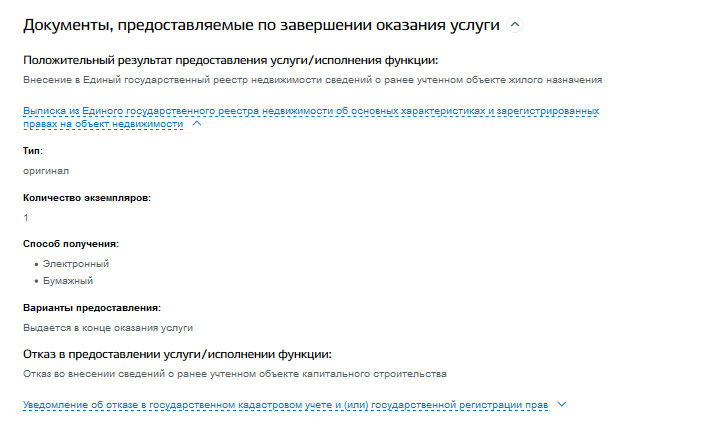

In accordance with innovations in legislation, updating the status of the right to a property is registered in Rosreestr. There is no need to obtain any certificates.

There are 3 ways to check whether the withdrawal has occurred:

- Go to the official website of the Federal Service of Rosreestr. Open the tab for reference information about residential properties. Enter the apartment's address, cadastral or conditional number in the appropriate line. In the “Form of Ownership” section, the “Restrictions on Rights” field must be empty.

- If you are registered on the “Government Services” portal, log in with your username and password, go to the “My objects” tab. After removing the restrictions, you will see a dash in the “Information on encumbrance of rights” field.

- Order an extract from the Unified State Register of Real Estate. In the “Rights restrictions” line, “Not registered” should be printed.

The validity period of an extract from the Unified State Register is 30 days. This service is paid. The first two verification methods are available without payment.

Features of the procedure

Borrowers should be aware of certain nuances of removing restrictions from mortgage real estate.

Understanding all the features of the procedure can greatly simplify and speed it up.

What nuances should you be aware of in order to facilitate the procedure for removing encumbrances from real estate:

| It is necessary to obtain a certificate or statement from the bank stating that the mortgage loan has been fully repaid | Regardless of whether this is the last payment according to the payment schedule or the borrower makes an early repayment, be sure to obtain confirmation from a bank specialist that the loan has been paid in full. It may take some time to prepare the certificate (up to 10 days), so you should request the document from the bank at the time of the last payment, which can greatly speed up the procedure |

| If the property was purchased as shared ownership, you will need to submit applications from each of them separately | for example, when spouses buy an apartment, it becomes theirs. If restrictions are lifted from it, it is necessary to draw up and submit applications on behalf of all owners |

| When taking out a mortgage on a property | It is required to contact the Rosreestr service not only of the borrower, but also of a representative of the credit institution who has a power of attorney |

How to remove mortgage encumbrances at the MFC: step-by-step instructions

As soon as you make your final mortgage payment, you need to do the following:

Step 1. Contact the bank, write an application on the spot, according to which you will be issued a mortgage note with a note on the repayment of loan obligations (according to the law, a joint visit with you by a representative of a credit institution or mortgagor to the MFC or Rosreestr is allowed).

Step 2. Make an appointment in advance at the MFC, otherwise you arrive at the nearest branch and receive an electronic queue coupon, in addition, you can request a preliminary consultation by calling the hotline.

Step 3. At the reception, the MFC specialist will once again check the mortgage and the presence of marks on it, and will help you fill out the application.

Step 4. If everything is in order, it will issue a receipt for acceptance of documents, by the number of which you can track the status of the application.

Step 5. As soon as the procedure is completed, you will be able to receive a document (extract from the Unified State Register of Real Estate) from the same branch of the MFC confirming your full ownership of the home without encumbrances.

If there was an apartment or house under encumbrance, now you have the right not only to live on their territory, but also to perform legally significant actions with the property:

- sell;

- give;

- exchange.

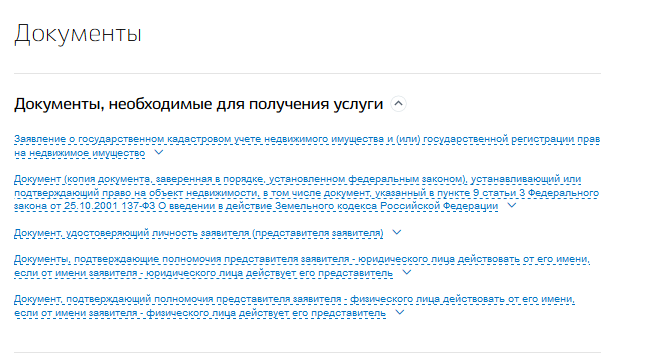

What documents are needed

- Application (to be filled out at the MFC, sample and printed in advance).

- Passport of a citizen of the Russian Federation.

- A mortgage note from a bank with a note indicating the repayment of loan obligations.

- A power of attorney certified by a notary if the procedure is carried out by another person.

Terms of provision of services at the MFC

The time during which the MFC will carry out the procedure for removing mortgage encumbrances, including military ones, is 3 business days; in some cases, it may take another 1-2 days to send documents to (from) Rosreestr divisions.

Read also: What benefits are available to a labor veteran?

In addition, if the borrower repaid the mortgage and at the same time participated (bought) an apartment in shared construction, the period is 5 working days.

If the bank undertakes to submit an application on its own, the deadline may take up to two weeks.

Amount of state duty in 2020

The procedure for removing encumbrances from real estate purchased with a mortgage is not subject to state duty and is carried out free of charge.

The procedure for removing mortgage encumbrances

Removal of the encumbrance from the property is possible after repayment of the borrowed obligations in relation to the bank that provided the loan.

The borrower's next step is to contact a credit institution to issue a mortgage.

If a mortgage is issued without a mortgage, a bank employee must contact the Rosreestr service together with the borrower.

Then you need to collect a package of documents to submit them to the registration authorities.

The next step is to submit an application for lifting restrictions, to which a set of documents is attached. As already mentioned, an application can be made in several ways established by law (at a personal reception, by mail, through the government services portal).

If the bank client cannot personally remove the encumbrance, he can entrust this procedure to his representative.

To submit an application by a third party on behalf of a bank client to the registration service, he must have a notarized power of attorney.

After the encumbrance is removed, the former borrower will be able to receive an extract from the Unified State Register of Real Estate, which will not contain information about the collateral in the “restrictions” column.

Previously, Rosreestr authorities issued certificates of state registration of property rights; currently, it is enough to have an extract from the Unified State Register of Real Estate.

After preparing and submitting all the necessary documents to the Rosreestr service, you will need to wait until the registration procedure is completed.

Documents confirming that the property is no longer restricted by anyone's rights must be issued within 5 working days.

The procedure for removing encumbrances from real estate under a mortgage is simple and can be done independently by the borrower.

Payment of state duty

When removing a mortgage encumbrance, some borrowers do not know how much the state fee is for performing this action.

In fact, removing restrictions from an apartment is free of charge.

Read how to calculate your mortgage overpayment here.

In Rosreestr

The government body that deals with all issues related to the registration and accounting of mortgage agreements is the Rosreestr service (Federal Service for State Registration, Cadastre and Cartography).

Registration of mortgage agreements, pledges and removal of encumbrances is carried out in accordance with the law, namely regulated by the Federal Law “On State Registration of Rights to Real Estate and Transactions with It” dated July 21, 1997

The following are submitted to the registration authority:

- Statements from the client and the creditor bank.

- Court decisions on the basis of which the encumbrance is removed.

- Separate appeals from pledgors and pledgees.

Removing encumbrances from collateralized real estate is completely free.

That is, in order to remove the encumbrance you do not need to pay, everything is registered absolutely free of charge in the Rosreestr authorities.

Deadlines

The actual procedure for removing the encumbrance on housing will require a little time and effort from the bank client.

You will have to wait the longest for the bank to issue the necessary documents (loan repayment certificate, bank account statement, etc.)

As a rule, the bank prepares documents within 10 days, but no longer than one month.

In the registration service, all actions are regulated by law. When you present a repaid mortgage to the Rosreestr service, the procedure will take three days.

If a mortgage has not been issued, a bank employee must also appear to contact the registration service.

It is also possible to issue a power of attorney to a bank client, who will be able to sign an application from the bank.

In this case, the procedure will require five working days.

It is important to know that if the borrower applies independently, the bank is obliged to submit to the registration service within 30 days documents that indicate the repayment of the debt and are necessary to remove the encumbrance from the mortgaged property.

Through the court

There are situations in which the removal of restrictions on living space is not allowed without the consent of the credit institution and you need to go to court to complete this procedure.

For example, in cases:

- If the bank was deprived of its license or it ceased its activities on its own;

- If the borrower has disappeared;

- death of the borrower;

- if the debtor refuses to remove the encumbrance from the housing;

In these cases, the following documents must be submitted to the court:

| Mortgage loan agreement | and a document confirming the refusal to lift the restriction |

| Receipts | on payment of state duty |

| Documentation | for inheritance if the borrower dies |

The procedure for removing the encumbrance through the court will take much longer.

It will take a long time to schedule a hearing in court and to consider the case.

After the court makes a decision to lift the restrictions, you will need to wait until the court ruling comes into legal force.

The adopted court decision is submitted to the registration service along with other documents.

Cancellation of mortgage encumbrance through State Services

Using the online service, the owner can make changes to remove the encumbrance in the Unified State Register. To do this he must:

- Register on the site, receive a login and password.

- Log in to your personal account, which stores all data about the ordered services and the status of their implementation.

- Open the “My objects” section, where all the applicant’s property is reflected.

- Select the method of receiving the service.

- Having received notification of the date and time of reception, provide a set of documents to the selected department.

The status of the application is checked using the “Notifications on Applications” tab or the application itself.

- Receive an extract or refusal to make changes.

- In case of refusal, send a complaint pre-trial.

This simple algorithm will help property owners figure out how to remove the encumbrance through the State Services website.

Having received an extract from the Unified State Register of Real Estate, the owner again acquires the right to dispose of his property without approval from anyone: sell, donate, exchange, and so on.

Required documents

In order to become a full-fledged owner of your home, after repaying your mortgage loan, you need to collect and submit for registration a set of the following documents:

| Borrower's passport | Original and copies (passports for all owners are required) |

| Certificate from a credit institution | which confirms the client’s full fulfillment of his debt obligations |

| Extract | from a bank account |

| Application for removal of encumbrance | signed and certified by a bank representative |

| Real estate mortgage | with about loan |

| Mortgage agreement | as well as the purchase and sale agreement |

| Receipt | about payment of state duty |

Each municipality may have its own rules regarding the required documents.

The procedure may not require all of the specified documents, but it is better to prepare the maximum number of papers so as not to contact the registration service again.

It is recommended to first find out the list of required papers at the registration service office or on its website.

Exact timing of removal of mortgage encumbrance in Sberbank in days

We have already mentioned above that it takes about 1 month to remove the encumbrance from the mortgage, but this is the longest period - the maximum. For some it may be shorter. Time spent on:

- 2 days pass from the moment you fully repay your loan debt. After these couple of days, Sberbank will begin the procedure. This will be notified to your phone in the form of SMS.

- It takes up to 1 month to withdraw.

Don’t worry that the procedure will either take longer or not start at all. It always starts automatically as soon as the mortgage is paid off. Everything ends in exactly the same way - on time, and not after it.

Sample contract

In the process of removing the encumbrance from real estate, it is necessary to submit a mortgage loan agreement to the Rosreestr service, one copy of which must be with the borrower.

In addition, you must provide the registration authority with the apartment purchase and sale agreement concluded with the seller.

The borrower's possession of these documents is an indispensable condition for completing the process of removing the collateral from his real estate.

Possible expenses

After paying off the debt to the credit institution, the question arises about lifting restrictions on housing.

In most cases, bank specialists can offer former clients services to remove encumbrances from the purchased apartment.

Of course, such services will require additional costs.

All other procedures related to the removal of encumbrances are free.

Which banks issue mortgages without a down payment, see the article: mortgages without a down payment.

Removal of the encumbrance from an apartment purchased with a mortgage can be carried out in a short time.

The withdrawal procedure is simple and can be done independently by the borrower.

Video: Removing mortgage encumbrances

(No Ratings Yet)