What objects are subject to insurance:

- apartment or room in an apartment in a residential building;

- house, outbuildings located on the land plot;

- interior decoration of residential premises;

- engineering equipment of an apartment or residential building;

- home furnishings and household items, such as furniture, household appliances, plumbing fixtures, etc.

In addition, you can insure not only your apartment, but also someone else’s. For example, a neighbors apartment. Then the clause “civil liability” is included in the insurance, and when an insured event occurs (you flooded the apartment from below), it is not you who pays the victims, but the insurance company.

Types and features of real estate insurance

The apartment can be insured:

- From theft. The cost of such insurance is lower than the cost of a reliable lock and alarm.

- From a fire. In the event of loss of property as a result of fire, insurance will compensate for the resulting losses.

- From flooding. It is not always possible to obtain monetary compensation from neighbors living above for the flood they caused. Insurance will at least partially compensate for this damage.

The risks against which a house is insured are similar to apartment risks. However, this type of real estate insurance also has its own specifics:

- The house is a separate building, which includes the entire communications system.

- The risks for a private house are greater than for an apartment.

- Estimating the value of a house requires more time and effort than appraising an apartment.

You can insure not only a house used for living, but also an unfinished house. However, for this to happen certain conditions must be met, including:

- Completion stage of construction work.

- The house must be owned or legally used.

- The cost of insurance is higher than for a manufactured home.

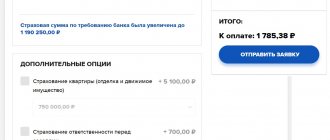

When insuring a mortgage, the subject of the contract is not real estate, but the amount for its purchase. The real estate itself serves as collateral. If the borrower loses the ability to repay the debt, this risk is compensated by the insurance company whose services he used.

Mortgage insurance is characterized by the following features:

- The term of the agreement reaches twenty-five years.

- Risks are distributed unevenly. After reaching the “peak” in the fourth year of lending, the risk of an insured event gradually decreases.

- Changes in the market value of real estate (systemic risks) can affect its insurance.

- Typically, when providing insurance, a banking institution does not consider the possibility of increasing the rate if the client makes a minimum down payment. In other words, mortgage lending is made profitable for the borrower who is unable to make a large down payment.

Title insurance provides compensation for losses in the event of loss of real estate. This type of insurance is often required when obtaining a mortgage loan. The maximum term of a title insurance contract is ten years. An insured event is considered to be the loss of ownership of real estate based on a court decision.

Mandatory terms of the insurance contract, regardless of the method of insurance, are:

- object of the contract - the property you want to insure;

- insured event - an event in the event of which harm or damage will be caused to property;

- insurance amount - the amount of monetary compensation of the insurer upon the occurrence of an insured event;

- contract time.

5 reasons for refusing to pay insurance for real estate

Country house insurance: what, from what, how to save?

How much will it cost

Since the new law has a number of shortcomings and does not have a perfect implementation mechanism, its implementation is quite slow, especially in the periphery. Today, compulsory home insurance is carried out on a large scale only in Moscow and Krasnodar. In these cities, the tariff is set at 1.87 rubles per square meter of total housing area. Approximately this figure should be expected for central Russia, where the risk of natural disasters is minimal.

As for areas where there is a high probability of floods, fires, landslides, and accidents at industrial facilities, the price there can vary between 2-5 rubles per square meter. The same applies to wooden houses and buildings with an expiring resource or in a pre-emergency condition.

Thus, in prosperous areas, the payment of the owner of a two-room apartment will be about 100 rubles per month or 1200 per year. Those living in risk areas will have to pay up to 250 rubles under the contract. per month and up to 3000 per year. The amounts are small and quite affordable even for pensioners.

Related article: Description and features of social insurance

Note! You can familiarize yourself with the terms of the contract on the website created by local authorities together with insurance companies. There are no general rules for all, since each entity develops its own list of risks.

What compensation can you expect?

Damage assessments are carried out by specially created local commissions after receiving requests from victims. If the housing is completely destroyed (burnt down, carried away by water or mud flow), then its assessment is carried out on the basis of documents available in the archive or an electronic database.

The maximum amount of payments is 500,000 rubles, it can be reduced by decision of local authorities to 300,000 rubles, if there are appropriate reasons for this. The procedure for determining the amount of compensation was approved by Government Decree No. 433 of April 12, 2019.

The following indicators are taken into account:

- the type of material from which the building is constructed;

- age (degree of deterioration of the structure);

- type of housing (room, apartment, house);

- total area of the room;

- average market value per square meter in the region.

The estimated amount of compensation is up to 20% of the price of the new living space. Victims have the right to choose an apartment from the municipal fund or receive money to purchase new housing.

Expert advice

About risks

When concluding a property insurance contract, you need to take into account the maximum list of risks. This will increase your chances of receiving an insurance premium. “If the event that occurs does not fall under the insured risk, payment is not possible. Such stories sometimes happen with country houses. For example, the risk of ground movement is not always included in the list of insured persons and payment in this case is not made. For apartments, the risk of flooding due to roof leaks, interpanel seams, and unclosed windows is often eliminated,” explains Artem Iskra, .

At the same time, it is worth excluding phenomena that are absurd for your region from this list. “As a rule, insurance companies provide three groups of risks against which housing can be insured: natural disasters, actions of third parties and civil liability of the owner to third parties. The client should carefully study the list of possible threats. For example, in Moscow there is no point in overpaying for insurance against volcanic eruptions or earthquakes. Nevertheless, such options may be included by default in the insurance package,” comments managing partner Maria Litinetskaya .

About money

Remember that the insured amount cannot be higher than the market value of the property. “For example, you want to insure your apartment, the market value of which is 3 million rubles. Of course, you can indicate an amount of 4 million rubles in the insurance policy, but when paying the insurance premium, you will still receive an amount equal to its market value, since amounts exceeding it are considered invalid,” says tax consultant Evgenia Zaltzeiler .

In addition, you must know exactly the period during which you need to inform the policyholder about the occurrence of an insured event and submit claims for insurance payment, insists Anton Klyuchnikov . “A common trick of insurers is to set a minimum period (1-3 days) during which the client must notify the company about the occurrence of an insured event. The policyholder may not always comply with this requirement. For example, if a client insured his home while on vacation, he may miss the right moment and lose compensation,” warns Maria Litinetskaya .

Educational program on movable property insurance

I paid off my mortgage early 4 years ago. Can I get my insurance premiums back now?

When will compulsory apartment insurance be introduced?

Today, the main burden of real estate insurance lies with the state, which has assumed the obligation to pay compensation for the complete or partial destruction of residential buildings. The new law on compulsory home insurance provides for a redistribution of the degree of participation of all parties to the process.

The new bill is already at the approval stage. Looking at its inconsistency, it is problematic to wait for its implementation today. But given the importance of the innovation, we can expect that it will be adopted this year. Deputies are working hard in this direction.

As for the interest of citizens, local authorities are given complete freedom of action in this direction. Proposals for compulsory insurance of apartments and houses must be so convincing that they cannot be refused. First of all, it is the accessibility and ease of drawing up the agreement. The first step towards the population has already been taken here.

The main conditions for home insurance against emergencies are as follows:

- Low tariff. Its value is set at 1.5-3.0 rubles per square meter.

- Easy registration and payment. The cost of compulsory home insurance is included in a single electronic monthly receipt for utility bills.

- Availability of the program. All categories of the population and real estate of any form of ownership can take part in it.

- Application of benefits for low-income citizens.

- Attracting budget funds when paying compensation.

- The rights of local authorities to include in agreements the risks of terrorist attacks, damage to finishing and electrical wiring from the actions of third parties.

Article on the topic: Features of the law “On the organization of insurance business in the Russian Federation”

Note! The Home Insurance Law 2020 provides for the receipt of compensation from the insurance company. Receiving new housing is not provided. This is one of the nuances that should be taken into account when choosing an insurer.

Why might an insurance company refuse to pay?

There are many options here. For example, if you or your relatives accidentally caused the same fire, insurance payment is most likely not expected. On the other hand, insurance companies themselves often resort to cunning. So, you may be denied compensation if the year the house was built was incorrectly indicated or you carried out redevelopment without notifying the insurers. Also, insurance compensation is usually not available in case of force majeure. Alternatively, in the event of hostilities or if a plane fell on your house.

Who needs compulsory property insurance

At the end of 2020, the government developed a bill, according to which the state, insurance companies and citizens are assumed to be collectively responsible for the financial security of property interests in real estate. The purpose of the regulatory act is to increase people's responsibility for the maintenance of their own and rented apartments, houses and other residential properties. In addition, the planned introduction of a new insurance system will help stimulate this market segment and increase the revenue side of the country's budget.

Related article: Features of Law No. 400-FZ “On Insurance Pensions” in the Russian Federation

Today the principle of voluntariness still applies, but citizens living in the following conditions should insure their property:

- seismically dangerous regions;

- old and dilapidated houses;

- an area where natural fires often occur;

- areas located near bodies of water that cause catastrophic floods.

In addition, when deciding on real estate insurance, you should pay attention to the list of risks included in the agreement. The latest law gave regions the right to draw it up independently, not limited only to the consequences of natural disasters.

Important! To attract a larger number of citizens, the contract may include such risks as man-made disasters, terrorist attacks, military operations, riots, local destruction on the scale of an individual apartment - flooding, fire, household gas explosion. In preparation for the transition to compulsory home insurance, a gradual reduction in the amount of compensation is being carried out for citizens who refused to join the current program voluntarily.

Commercial risks

The risks of entrepreneurs and businessmen are not limited to bankruptcy or a drop in demand. Every serious insurance company allows merchants to enter into an agreement that will help protect against the following situations:

- Bankruptcy.

- Decrease in turnover and, as a consequence, revenue due to the reasons specified in the insurance policy.

- The occurrence of mandatory expenses in excess of the planned budget. For example, urgent repairs of premises for clients, purchase and replacement of damaged equipment, etc.

- Civil liability insurance of third parties and contractors.

- Unfavorable business environment, competitive pressure, etc.

A huge part of all business risks is production downtime and associated losses. In such a situation, the insurance company will calculate the total downtime and lost profit. Depending on the terms of insurance and the amount of compensation, the client may receive either part of the financial loss or its full value back.

Manufacturing is almost always a dynamically developing industry. Technologies are changing, equipment is being improved, and turnover is growing. This is the basic principle of doing business in Russia. In this regard, insurance companies do not conclude contracts for more than 1 year.

The nuances of insuring unfinished real estate

Some insurance companies allow the possibility of insuring residential buildings or apartments under construction, provided that such real estate is legally used or owned by the policyholder. In such cases, the insurance policy usually provides for a limited list of risks and higher insurance rates.

The cost of insuring unfinished real estate directly depends on the number of risks provided for in the contract, the current market price, condition, environment, safety measures taken into account, etc. Moreover, the assessment of such real estate is a very labor-intensive process, which only an experienced expert can provide.