Agreement for free use of premises: briefly about the main points

Free use of non-residential premises, despite the lack of payment, is documented. To do this, a loan agreement is concluded, the features of which will be discussed in more detail.

Regulatory justification

The main standard in this area is the Civil Code of the Russian Federation. Chapter 36 of the Civil Code of the Russian Federation regulates the legal relations that arise as a result of the signing of such an agreement.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(free call for all regions of Russia)

Definition

Under the loan agreement, square meters are transferred into operation for a certain period of time. In this case, the second party does not have any financial obligations to the counterparty. However, it is important to stipulate that the borrower undertakes to return the agreed object in the condition in which it was received, taking into account physical wear and tear.

Is it possible to do without paying rent?

As we have already determined, the use of real estate is possible on a free basis. Let’s take a closer look at when concluding such an agreement would be appropriate.

When is the best time to choose free rental?

The loan agreement serves as evidence of the legal use of the property by a legal entity or individual who is not listed as its owner. For a legal entity of this kind, property is transferred to it for various purposes: office equipment, warehouse, point of sale, cafe, etc.

Pros and cons of the solution

By taking out a loan with one or another organization, the borrower will experience an undeniable advantage - receiving square meters for which you do not have to pay. However, you should not expect that because of this the party will not be assigned any responsibilities. So, along with the rights, the borrower will have to:

- carry out current and major repairs;

- ensure the proper condition of the premises;

- protect property;

- pay bills for maintaining the premises;

- fulfill other obligations specified in the documents.

The owner also has some obligations. For example, provide the property in proper condition, transfer the necessary package of documents, etc. It is worth mentioning that this type of agreement does not in any way limit the owner’s rights to dispose of his property.

Parties

The subjects of the agreement are the lender and the borrower. The first refers to the direct owner of the square meters or another entity who has the appropriate rights to them. The borrower is the party who receives the property for use and temporarily becomes its title owner.

The regulations also establish some restrictions regarding the parties to such a transaction. Thus, a commercial company does not have the right to transfer objects for free use to its founders, participants, managers and members of regulatory bodies.

The essence and procedure of registration

The loan agreement must contain the following elements:

- Title of the document;

- date of signing;

- place of detention;

- preamble (data of the parties);

- subject (type of building, its characteristics);

- additional conditions (for what period is it concluded, responsibility of participants, etc.);

- ways to ensure an agreement and the procedure for transferring square meters;

- procedure for terminating the agreement;

- individual conditions;

- details of the parties.

The document should be drawn up in accordance with the general rules for preparing business documentation. Remember: the more points are settled by agreement, the less likely it is that disputes will arise in the future.

Special conditions

The essential terms of the agreement in question are its necessarily specified subject matter. It is important to clearly specify which premises are being given for use, its characteristics and location. It is also necessary to indicate that the use of square meters will occur on a free basis, otherwise it will already be a lease agreement.

The regulations do not establish any other special conditions for the loan.

In what cases can a contract for the provision of services be concluded free of charge?

The possibility of concluding a contract for the provision of services free of charge depends on who the parties to the contract are. Commercial organizations and individual entrepreneurs cannot provide services to each other free of charge.

Most often, gratuitous agreements are found in relation to non-profit organizations within the framework of charitable activities. To ensure that the contract you conclude is free of charge, clearly indicate in it that the services are not subject to payment.

In what cases is a service agreement free of charge?

A contract is gratuitous when there is no need to pay for services rendered or give any other consideration (transfer goods, provide counter services, etc.) (Clause 2 of Article 423 of the Civil Code of the Russian Federation).

We believe that it is possible to conclude a free government contract for the provision of services, since Law No. 44-FZ does not prohibit this.

Please note that the mere fact that there is no price or obligation to pay for services in the contract does not make it gratuitous. As a general rule, the contract will be considered compensated (clause 3 of Article 423 of the Civil Code of the Russian Federation). In this case, the recipient of the services will have to pay for them at the price that, under comparable circumstances, is usually charged for similar services (clause 3 of Article 424 of the Civil Code of the Russian Federation).

However, if the payment condition for a specific contract is essential, in its absence the contract may not be concluded (Clause 1 of Article 432 of the Civil Code of the Russian Federation).

Therefore, if you want to enter into a gratuitous contract, indicate directly in it that no payment or other consideration will be made for the provision of services (Clause 2 of Article 423 of the Civil Code of the Russian Federation).

Can commercial organizations and individual entrepreneurs enter into an agreement for the provision of services free of charge?

Commercial organizations and individual entrepreneurs cannot provide services to each other free of charge.

An agreement for the gratuitous provision of services between commercial organizations falls under the characteristics of a gift, which is prohibited between such persons (clause 1 of Article 572, clause 1 of Article 575 of the Civil Code of the Russian Federation). A similar ban applies to individual entrepreneurs (Clause 3, Article 23 of the Civil Code of the Russian Federation).

The law allows donations between commercial organizations or individual entrepreneurs in the form of ordinary gifts, the value of which does not exceed 3,000 rubles. (Clause 1 of Article 575 of the Civil Code of the Russian Federation).

However, it seems that the gratuitous provision of a service cannot be considered an ordinary gift, since gratuitous services are not typical for relations between commercial organizations or individual entrepreneurs.

Thus, the gratuitous provision of services between these persons is effectively prohibited, regardless of the cost of the service.

If the parties, in violation of the prohibition of paragraph 1 of Art. 575 of the Civil Code of the Russian Federation will conclude a gratuitous agreement, it will be void (clause 2 of article 168 of the Civil Code of the Russian Federation, clause 75 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated June 23, 2015 N 25). In this case, only the condition of gratuitousness can be void (and the contract itself can be valid) if the contract could have been concluded without it (Article 180 of the Civil Code of the Russian Federation).

If your potential counterparty is an individual who is not an individual entrepreneur, you can enter into an agreement with him for the provision of services free of charge (donation of services).

This is allowed since the parties are free to determine the terms of the agreement (including its price), and based on the composition of the parties, such an agreement is not subject to the prohibition of donation (clause 4 of Article 421, clause 1 of Article 424, clause

1 tbsp. 575 of the Civil Code of the Russian Federation).

However, there are cases when the provision of gratuitous services to individuals is not permitted. For example, it is impossible to provide services free of charge to civil servants in connection with their official position or in connection with the performance of their official duties.

If the potential counterparty is an NPO , then concluding a gratuitous contract is also possible, and this does not depend on whether the NPO is the customer or the contractor. Firstly, an NPO is not a commercial organization, and therefore an agreement for the donation of services with it does not fall under the prohibition of paragraph 1 of Art. 575 of the Civil Code of the Russian Federation.

Secondly, an agreement with an NPO-executor may be subject to the prohibition of donation only if the NPO carries out income-generating activities, since it is in this case that the rules governing business activities apply to NPOs (clause 21 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated June 23, 2015 N 25).

However, since services are provided free of charge, their provision cannot be considered as an activity that generates income for the NPO.

Situations where an NPO is a performer do not occur often. As a rule, an NPO is the recipient of services within the framework of charitable activities (Article 1 of the Law on Charitable Activities).

Source: https://urist7.ru/grazhdanskoe-pravo/vozmezdnoe-okazanie-uslug/v-kakix-sluchayax-mozhno-zaklyuchit-dogovor-bezvozmezdnogo-okazaniya-uslug.html

Features of the loan agreement

The following features of the agreement under consideration are highlighted:

- establishing the essential characteristics of the specified object;

- the premises must be free of defects that impede its intended use;

- after signing such an agreement, the borrower has the right to transfer the received square meters for free use to third parties;

- the property is transferred with all documentation, unless the parties decide otherwise;

- the agreement can be concluded for any period.

document can be found below.

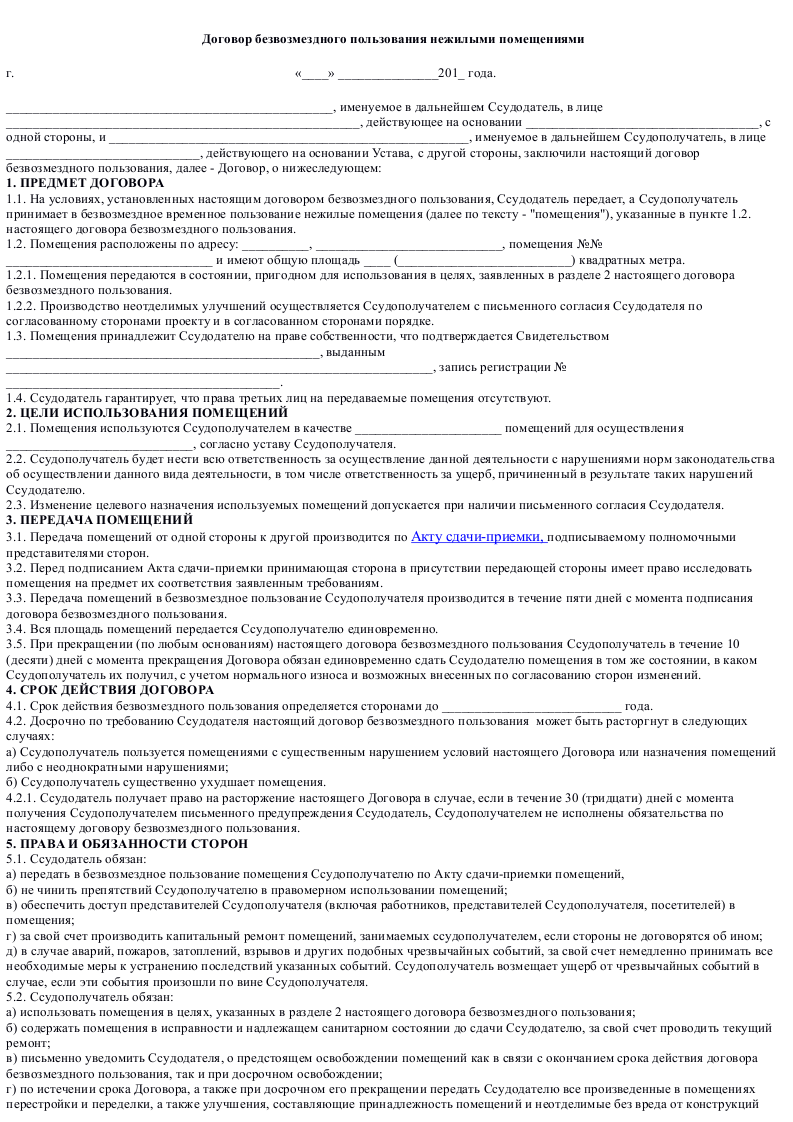

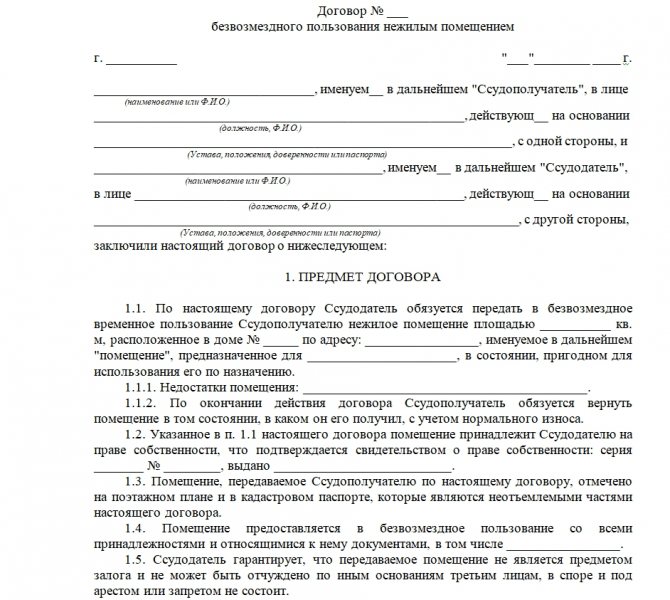

Sample agreement for free use of non-residential premises

As we have already determined, property, being in gratuitous use, is documented. For this purpose, a loan agreement is drawn up, an example of which is presented below.

Agreement for the provision of free services of the Civil Code of the Russian Federation

What is a contract for the provision of free services? In the literal sense, this is an agreement concluded between at least two counterparties, one of which receives and the other provides services.

Moreover, such services are provided free of charge.

If the service provider party receives any income for the services it provides (money, property, material and other benefits), then the contract can no longer be treated as gratuitous.

For example, when entering a supermarket and leaving his belongings in a box for storage, a person enters into an agreement with the organization that owns the supermarket. This agreement for the provision of services for saving his belongings does not require payment and, accordingly, is free of charge. Moreover, the buyer in this case is not obliged to buy anything in the store.

Thus, people make thousands of service contracts every day without thinking about it. It should also be noted that the conclusion of a gratuitous agreement does not relieve the service provider from the proper fulfillment of obligations. They are assigned to him in the same way as in a paid contract. Failure to comply will result in civil liability.

Civil legislation does not define detailed rules under which a contract for the provision of gratuitous services must be concluded. At the same time, it contains permission to conclude such an agreement. Thus, the Civil Code establishes that subjects of law can enter into not only paid, but also free contracts.

Thus, the general criteria set for all bilateral and multilateral transactions are applied to the type of agreements under consideration. That is, when drawing up an agreement for the provision of services free of charge, it is necessary to adhere to the requirements established for the form and other attributes of agreements.

Possibility of concluding a contract for the provision of services free of charge

Civil Code in ch. 39 contains detailed regulation only of the provision of services on a reimbursable basis. There are no special rules devoted to the contract for the provision of gratuitous services.

In Art. 423 of the Civil Code of the Russian Federation establishes the presumption of consideration of the contract, unless otherwise follows from the law or the essence of the transaction.

Proponents of this doctrine, referring to the exclusively compensated nature of relations for the provision of services, argue that their provision cannot be free of charge.

IMPORTANT! The law names certain varieties of this agreement, which represent specific cases of the provision of services in the absence of reciprocal provision, for example, free storage of things in the wardrobe (Article 924).

The legislation does not contain direct prohibitions on the use of a contractual structure that mediates the gratuitous provision of services, but according to Art. 421, which enshrines freedom of contract, the parties have the right to formalize relations through the conclusion of transactions, both mentioned and not mentioned in the law.

Judicial practice confirms this approach. In particular, YOU in the ruling dated 16.07.

2010 No. VAS-9448/10 considered the dispute about the admissibility of the parties establishing a free model for the provision of services for placing information in a printed publication.

The court came to the conclusion that the existence of a contract for the provision of services free of charge is admissible, noting that it does not contradict the legal nature of the provision of services, and invalidation only on the basis of gratuitousness is impossible.

Go to Cadastral passport for a garage, how to get it

The Civil Code of the Russian Federation provides for the possibility of concluding paid (with remuneration) and gratuitous contracts, that is, those that involve the provision of services (carrying out work, transferring valuables) without remuneration.

Thus, the possibility of concluding an agreement in which there is no provision for payment or other compensation for services provided is not limited by law, although the Civil Code does not contain provisions that would describe the specifics of concluding such agreements.

Based on this, we can say that a contract for the provision of services, including one that does not provide for payment, must meet the general requirements that legislation imposes on contracts. The only difference in this case will be that a separate clause of the contract will be a statement that the services under it are provided free of charge.

Termination

When drawing up a fixed-term contract, it is valid until the moment specified in the text of the document. If the agreement is indefinite, you can terminate it at any time, but to do this you will need to notify the other party of your intention 3 months in advance.

The text of the document itself usually indicates the specific procedure for terminating the contract and the conditions under which this is possible. One of these, for example, is the use of an object for other than its intended purpose or the loss of the ability to use it in this way.

Change and termination of the contract

Article 450 of the Civil Code of the Russian Federation provides the grounds on which an agreement can be amended and terminated:

- By agreement of the parties.

- At the request of one of the parties, the contract is changed or terminated only by a court decision.

A court decision to change the terms of the contract or terminate it can be made only if there are significant violations of the contract by one of the parties, as well as in other cases provided for by current legislation for certain types of contracts.

The consequences of changing and terminating the contract are listed in Art. 453 Civil Code of the Russian Federation:

- Changing the contract entails changing the obligations under it.

- Termination of the contract entails the termination of obligations, unless otherwise provided by legislative acts or follows from the essence of the concluded agreement.

- The term for changing or terminating obligations is considered to be the period by which the agreement to change or terminate the contract was signed.

The legislation provides for compensation for losses if a change or termination of the contract entails their occurrence. From the website dogovor-urist.ru

Every day we are faced with the provision of gratuitous services, sometimes without suspecting it ourselves. The simplest example is putting outerwear into the wardrobe. In this case, the contract is not drawn up in writing, but the organization that accepted the clothes provides services for its temporary storage and bears corresponding obligations. Therefore, in the understanding of the law, such an agreement is recognized as a contract.

However, there is an opinion that if the contract is gratuitous, then the parties do not have the obligations that usually accompany the preparation of a gratuitous contract. This is fundamentally false: just because some services are provided free of charge, this does not mean that they may be provided improperly. Thus, the written form of a gratuitous agreement in this case is needed precisely in order to clearly indicate the responsibility of the parties for its execution.

Parties to the agreement

These are:

- Lender (lessor) . This is the party that transfers the thing, that is, non-residential premises - an office, a retail outlet, etc. As a rule, this is the owner of the object, as well as a person authorized by law or the owner. The lender can be a commercial organization, but in this case certain restrictions will be imposed on it (Article 690 of the Civil Code). The fact is that she does not have the right to transfer the object free of charge to representatives of the same organization, including founders and employees, as well as supervisory authorities. When transferring premises, any lender must take into account the rights of third parties who may have claims to this property.

- Borrower (tenant) . This is any subject of civil law (individual or legal entity) who can temporarily and free of charge exploit the received non-residential premises. He is given the right to use, but undertakes to maintain the premises in proper condition, take risks for possible damage and return it to the lender after an agreed period of time in proper condition. At the same time, he may terminate the contract and demand compensation for financial damage if he was not informed in advance by the lender about the restrictions associated with the rights of third parties.

With the permission of the owner, the borrower can transfer a non-residential property for free use to a third party, but he does not have the right to sublease it.

The agreement can be signed not personally by the participants in legal relations, but by their legal representatives, if they have a power of attorney to carry out such actions.

When concluding such an agreement, the concept of the possibility of changing the parties also comes up. This means that the premises can be rented out by other persons, which does not affect the rights of the borrower. Upon the death of the person transferring the object, the contract remains in force, and all its rights and obligations pass to the heirs. If the tenant dies, the deal is immediately canceled. All these points need to be discussed on paper in order to avoid unpleasant moments in the future.

Features and terms of the agreement

This agreement is drawn up in Russian in 2 copies having equal legal force, one copy for each of the parties. The conclusion of such an agreement is the same throughout the country, including the Republic of Kazakhstan; a similar document is used in Belarus, but this cannot in any way imply the signing of an agreement without knowledge of at least the basics of the legislation of this state. So as not to belong to the number of deceived, “thrown” and others.

This is important to know: Residential building and residential building: difference in 2020

Such a document belongs to the category of agreements drawn up when leasing or subleasing real estate. The purpose of its preparation is to implement the actions of individuals or legal entities aimed at the operation of non-residential premises.

In the first case, the tenant receives ownership of the property, and in the second case, the object is transferred for a period of time for operation free of charge.

Possibility of free use of residential premises, its rental

There are two types of free rental of premises by an individual:

- when, under such a transaction, residential premises are transferred to another individual;

- when transferring non-residential real estate to an individual entrepreneur or business entity.

In the first case, the contractual relationship is subject to the legal requirements of a gratuitous loan and a rental agreement. That is, the owner of the property transfers it for free use to the tenants, but does not receive any payment. Hiring differs from rent precisely in that it is concluded only between citizens, for living in an apartment or house.

If a citizen rents out his apartment or house to a legal entity or individual entrepreneur, where his employees will live, then this is already a free rental. That is, other legal relations arise here.

Based on them, taxation of participants in such transactions will occur.

It is important to remember that, according to the Law, an individual can also be the owner of non-residential (commercial) premises. Residential real estate has a special legal status, since it can only be used for people to live in it.

Content and proper drafting of paragraphs

A lease agreement for non-residential premises for gratuitous use does not provide for payment for use, however, the law regulates issues of financial liability in case of non-compliance, as well as issues of safety of property and terms of execution of the contract.

This issue arose in connection with the adoption on January 1, 2018 of the Federal Accounting Standard for public sector organizations “Rent”, approved by Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 258n (hereinafter referred to as the GHS “Rent”).

As a rule, the tenant's obligations in this case are somewhat broader than under a standard lease agreement.

It is important to know: What rights to real estate must be registered

The object of the agreement for the gratuitous use of property is residential or commercial premises, cars, equipment, office equipment, and interior items.

The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

Is it legal for an individual without the status of an individual entrepreneur to provide the use of non-residential premises to an individual entrepreneur who is his wife free of charge.2.

The inspection of the premises must be done very carefully, since the borrower will be responsible for hidden defects that appear during operation.

Currently, many residents of our vast homeland have to register non-residential and residential premises for free use in order to run their business. This happens because starting a business requires start-up capital, and not everyone has a certain amount that can cover all expected and unforeseen expenses.

The right to use an asset accepted for accounting is depreciated over the period of use of the property established by the contract.

But in some cases (permitted by the legislation of the Russian Federation or by the borrower himself), only certain objects can use the object received as a loan. The Code contains one single condition, as a result of which it is not possible to transfer the object on loan.

The agreement on the free use of non-residential property has a number of features :

- a specific description must be drawn up for the object of the contract;

- the premises must meet a number of requirements and be suitable for its intended use;

- the borrower may transfer non-residential premises for free use to third parties, but is responsible for subletting the property;

- the document must reflect the rights of other persons to a non-residential property;

- the owner is obliged to notify the user if the premises are mortgaged or encumbered with other rights;

- as a rule, state registration of the agreement is not required (an exception is the case when the non-residential premises are recognized as an object of cultural heritage or part of it).

If there is an insufficient number of documents and information necessary to determine the non-residential premises that are being transferred on loan, the terms of the agreement are considered invalid, and the agreement itself is considered unconcluded (according to clause 3 of Article 607 of the Civil Code of the Russian Federation).

In addition, the parties to the contract must carry out a joint inspection of the premises and draw up an acceptance certificate.

What are the consequences of failure to pay for major repairs? What happens if you don’t pay contributions to the fund for capital repairs of an apartment building?