Welcome! Today we’ll talk about what a military mortgage is and who it is intended for. Military mortgage is a relatively new program for providing housing to military personnel and their families. Military mortgage 2020 is one of the effective tools to resolve the issue for military personnel and military pensioners. Read the post to the end and you will find out: is it worth taking out a military mortgage, is a mortgage possible for military pensioners, is a military mortgage issued a second time, as well as current offers from banks today.

Details

How is a military mortgage different from a regular one? A military mortgage for military personnel differs from a classic one in that while the borrower is in military service, his mortgage debt is repaid by the Ministry of Defense, and not by himself. The difference will be in the lending conditions and registration stages. The requirements for the borrower will also differ. You will learn about them further.

What is a military mortgage?

The essence of a military mortgage is as follows: the state annually transfers additional subsidies to the account of a military personnel who has reached the age of at least 22 years, and the borrower can subsequently use these funds to make a down payment.

It is possible to receive no more than 3,500,000 rubles, but if he prefers to take a more expensive home, he can add his own savings to this amount. With a military mortgage, you can purchase both secondary housing and real estate under construction, and even buy out a share in the construction of a residential complex.

In order to become a participant in a military mortgage, it is necessary, first of all, to register in the so-called savings-mortgage system (NIS). This system deals with the provision of military mortgages and is designed to ensure that during the serviceman’s participation in it (and borrowers from 21 to 50 years old can participate in this program), a sufficient amount of funds should accumulate in his account in order to buy real estate with an average area 54 square meters. According to the Ministry of Defense, this area is enough for a spouse and a child to live.

All military personnel are allowed to participate in the NIS, but there are restrictions for ordinary soldiers: they receive the opportunity to become participants in the military mortgage only when they enter into a second service contract. All other layers of military personnel (that is, officers, warrant officers, midshipmen, etc.) are automatically enrolled in the program; some of them need to submit a report for a military mortgage. Military mortgages for military personnel in 2020 can also be issued a second time.

There is a myth that a borrower can buy housing with a military mortgage only at the place of registration or service - but this is not true. There are no restrictions on the territorial location of “official housing” in military mortgage lending.

This scheme is used very often. Since you can buy housing in any region, a serviceman takes an apartment in Moscow or the Moscow region. Then he rents it out, and he uses the official housing for living. Thus, you get a kind of additional pension from the state for the period of service.

The requirements apply only to types of housing: you cannot purchase apartments in dilapidated buildings, in “communal apartments” and in “Khrushchev” buildings.

There are also no restrictions on the choice of bank that will provide a loan for a military mortgage: the register of military mortgages currently includes 77 Russian banks. You can find the best deals at the end of this article.

Sevastopol has become a very popular city for the implementation of this program, like the whole of Crimea. Next, you will find out which banks lend to this region.

"Pitfalls" of military mortgages for contract soldiers

Mortgage lending is a convenient way to solve the housing problem. However, there are nuances everywhere, and you need to remember this so as not to encounter unexpected difficulties.

Disadvantages of a military mortgage for contract soldiers:

- You cannot make real estate transactions . Property purchased under a military mortgage for contract soldiers is prohibited from being sold, exchanged, etc.

- Benefits are valid only for a certain period . If you are applying for mortgage loans for contract soldiers on preferential terms, you should know that they apply only to military personnel. If you decide to leave the workforce while paying off your mortgage, you will have to bear these costs yourself. Moreover, the interest rate may increase.

- You cannot have official housing at the same time . A military man who has received housing at his place of service does not have the right to enter into the savings-mortgage system and purchase an apartment with a mortgage, while continuing to enjoy sub-rental benefits. This is prohibited by law.

- Long paperwork . A military contractor who submitted a report and joined the NIS must purchase housing within the next six months, since the certificate of the savings-mortgage system is valid for six months.

However, the NIS system is improving every year and is likely to get rid of the above-described inconveniences over time. Whether to take out a mortgage for an apartment or not is up to you to decide. If you don’t want to save up for an apartment and want to take out a loan on favorable terms, a military mortgage for contract soldiers is an excellent choice.

Nuances

Next, we will analyze the pitfalls of a military mortgage: the disadvantages and problems of a military mortgage.

Military mortgage tax deduction. Do not forget that there is a tax deduction for military mortgages. You can get it, but only from your own payments for the apartment. The stumbling block here is that the RF Ministry of Defense will provide money for the purchase of an apartment. So, if you bought an apartment for 5 million and the state paid 3 million using funds in the NIS account, then from the remaining two million you can receive a tax deduction of up to 288 thousand rubles. Will also be available.

Military mortgage judicial practice. Judicial practice on military mortgages shows many cases when legal disputes flared up regarding the dismissal of a borrower from the Russian army, including those related to changes in the terms of military mortgage agreements. If you think it is possible to defend your right to a military mortgage even after leaving the Russian army, you should contact a military mortgage lawyer (fill out the consultation form in the right corner).

A military mortgage with a bad credit history can also be issued by a bank. The main snag here is to find a bank that will agree to give a loan on such conditions, but if you want, you can get it. Mortgages with bad credit history are described in detail in our last post.

A military mortgage in the event of the death of a serviceman can cause serious damage to his widow, but only if he served in the Russian army for less than ten years. If the borrower had more than ten years of service, the state continues to pay military mortgage payments for him after his death.

Military mortgage pros and cons.

Pros:

- The state pays the payments

- Low rate

- Almost no attention is paid to credit history

Disadvantages of a military mortgage:

- Difficulties with registration and deadlines.

- Limited number of banks

- Small amount

- Problems with tax deductions

- Although military mortgages approve shared construction, there are restrictions on the choice of developers and houses.

- The owner is only a military man.

Features and conditions of receipt

A military mortgage for contract soldiers is a more profitable and convenient option compared to free housing,

because it allows you to get it faster, without having to wait in line for a long time.

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

Also, the serviceman is not limited in his choice - he will not be satisfied with the option provided, but will be able to choose the region, city and specific apartment or house on his own.

So, how can a contractor get a military mortgage? To do this, a number of conditions must be met. For example, his age at the time of registration of the mortgage must be at least 22 years, and at the time of its repayment - no more than 45 years.

We talked more about how to return funds on a military mortgage and check the amount of savings in a separate article.

The terms of a military mortgage for contract soldiers are as follows:

- the maximum amount to receive is 2.2 million rubles;

- The down payment amount is 20% of the cost of housing.

interest rate - no more than 12.5%;

Certain features and difficulties may arise in the event of termination of a contract and termination of military service. In this case, the right to accumulated funds will directly depend on the reason for dismissal - if it is considered valid, the serviceman will be able to use them. Otherwise, he will lose the opportunity to use this money and will be forced to repay the loan himself.

Read more about how to get a mortgage for former military personnel and what will happen to the loan upon dismissal or death.

This is important to know: Conditions for obtaining a military mortgage

Another significant drawback of the program is the limitation on the maximum possible loan amount. Often these funds are only enough to purchase housing in not very large settlements, while the cost of housing in regional centers is much higher. We talked more about the pros and cons of a military mortgage in this article.

However, this problem can be solved at the serviceman’s own expense - he has the right to add the missing amount himself. Subject to these conditions, a mortgage may be granted to military personnel under a contract.

You can find out what the requirements and conditions for providing a preferential loan are here.

Sum

For 2020, the amount for military mortgage is set at 288,410 . Based on this amount, the monthly payment will be calculated, which the state will pay for the serviceman. In 2020 it is 24,034.

How much money is given to military personnel in a military mortgage? The terms of a military mortgage are calculated on an individual basis. In this case, a variety of factors can be taken into account: the bank takes into account the age of the serviceman, his length of service, the amount of contributions from the state, etc. A military loan is not issued without a down payment: today this is on average 20% of the total loan amount, although in some banks there are down payments as small as 10%. Interest rates are also set individually.

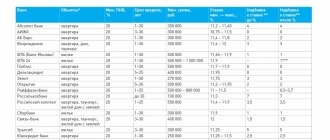

Military mortgage in 2020 amount broken down by top 10 banks + AHML.

How to get involved

How to become a participant in a military mortgage?

You can get a military mortgage if you:

- An officer who received his military rank later than 2005. They are automatically enrolled to participate in the NIS.

- An officer who received the rank of officer before 2005: in order to take part in the NIS, they need to submit a report. A sample report for a military mortgage can be requested at your place of service.

- Midshipman or warrant officer, service for more than three years.

- Private soldier, sergeant, sergeant major, sailor, etc.: people with these ranks can become participants in the program upon entering into at least a second service contract.

However, it is not necessary to use a military mortgage at the first opportunity. The Ministry of Defense in any case replenishes the serviceman’s account throughout the entire period of his work. A participant in a mortgage for military personnel can use the accumulated funds immediately and buy an apartment or house, bypassing the stage of concluding a mortgage agreement with the bank. But for this advantageous receipt of mortgage funds, the serviceman must have appropriate reasons. For example:

- The borrower has at least 20 years of service.

- The borrower leaves after serving for more than 10 years and without having his own home. At the same time, the borrower's family members do not own any real estate. If a serviceman owns real estate, he will not have to count on benefits.

- The borrower may receive savings for family reasons, health reasons, or in connection with decisions made at the place of his duty (for example, in connection with a transfer).

If a serviceman is in at least one of the listed situations, then, after submitting the appropriate report, all funds accumulated during his service will be credited to his account within three months. The same system is used to issue military mortgages for pensioners.

How to participate in the program

Not everyone is allowed to participate in the benefit program. Military mortgage is targeted, it applies only to certain categories of citizens:

- Career military personnel who began serving in 2005.

- Military personnel who returned from the reserves to serve after 2005.

- Persons serving on long-term contracts.

- Extended conscripts who entered into a re-contract after 2005.

- FSB employees whose status is equal to military personnel.

- Employees of the Ministry of Emergency Situations serving in rescue paramilitary units.

- Military personnel who went into the reserve due to deterioration in health due to injury, occupational disease, or work injury.

- Ministry of Defense employees who were fired during the disbandment of their military unit, after the termination of their contract.

Civil servants of paramilitary units, soldiers and sergeants in conscript service do not fall into the category of beneficiaries. Those who are entitled to it have the right to use it only 3 years after the conclusion of the contract. They need:

- Submit a report notifying your desire to participate in the program;

- Provide a photocopy of your passport and a copy of the contract;

- Expect to be included in the register and receive a personal registration number for an open personal savings account;

- Includes the military personnel in the current register of the housing department;

- After 3 years, the service member can use the funds in his account to pay the down payment of the mortgage.

When a serviceman breaks a contract early, he loses benefits and is removed from the register and his personal account is closed. At the same time, his rights to the already accumulated funds disappear. This rule does not apply to military personnel who served for ten years before breaking their contract. Then they can use the saved money to pay the mortgage.

Look at the same topic: Housing Mortgage Lending Agency (AHML) - what is it and how can it help?

How to get a mortgage

How to get a military mortgage: a step-by-step diagram.

To obtain a military mortgage, the borrower must be a member of the NIS for at least 36 months. These requirements are standard for most banks. If he fits the age range (from 21 to 50 years), then he should count on the loan repayment period based on his age: at 50 years old, the military mortgage must be repaid.

So, if you are eligible to participate in the military mortgage program, you can apply for a loan in several stages:

- First of all, you should submit documents to the bank of your choice (there may be several). You can, for example, leave an online application on the bank’s website. As a rule, banks require a passport, application and certificate of an NIS participant, but each individual financial institution may have its own additional requirements. A mortgage without a military ID is not possible.

- The bank manager fills out an application and sends it for a decision. If all requirements for the borrower are satisfied, the bank confirms the application and immediately notifies the client.

- Next, you need to collect all the documents required to obtain a military mortgage. These may include: documents of the borrower, documents of the seller, a purchase and sale agreement, some documents related to the purchased living space, and so on.

- The next step is the bank's real estate decision. The purchased housing must meet the requirements of a military mortgage. If the bank has no complaints about the object, then it issues a positive conclusion.

- Then the borrower must sign all documents, including the loan agreement. The mortgage bank sends a package of signed documents to Rosvoenipoteka.

- If there are no errors in the documents, then Rosvoenipoteka signs them on its part and sends them back to the bank. Also, Rosvoenipoteka immediately transfers funds for the down payment to the serviceman’s account. If the borrower was unable to obtain a military mortgage for the amount he expected, he can add funds to buy the apartment from his own savings.

- After these operations are completed, the serviceman can register ownership of the housing. He must hand over the documents confirming this registration to the bank.

- As soon as the bank receives these documents, it sends them to Rosvoenipoteka and issues mortgage funds to the borrower. From this moment on, Rospoenipoteka begins to pay off the serviceman’s mortgage debt until it is paid in full or until the employee is dismissed. In this case, the borrower will have to repay the entire loan independently and in full.

Using savings

The Law clearly addresses the procedure for using accumulated funds. According to legislative wording, they are allowed to be used only for the following purposes:

- Purchase of residential real estate;

- Acquisition of land with a residential building;

- Payment of the first loan installment in accordance with the terms of the military mortgage law;

- Payment of some part of the money during shared construction;

- Closing a mortgage.

These are the purposes of using gradual savings. In addition to them, the law provides for additional certain conditions. Military personnel are allowed to use available funds only 3 years after being enrolled as participants in the NIS. You also need to know that the purchased real estate will certainly become the subject of bank collateral.

At the same time, the Law regulates situations when members of the NIS are registered in an official marriage. Then they are allowed to separately enter into an agreement for a targeted loan. Each spouse is required to participate in the NIS for at least 3 years. Real estate acquired in this way becomes joint property.

The standard form of lending and the procedure for its execution are provided for by a separate government legislative act. The authorized body from the state provides a targeted loan for the entire period of military service of the applicant. During this period of time, such a loan is considered interest-free.

At the same time, the Law provides for the procedure for repayment of a targeted loan. Its repayment is made by a state authorized body if the grounds described by current legislation arise. For them, the main requirements are the following parameters:

- The duration of service must be more than 20 years;

- If the military personnel is discharged after serving at least 10 years;

- When a military man has already reached the maximum age limit for further service;

- If he is unable to perform professional duties due to illness.

Look at the same topic: How much does it cost to check the legal purity of an apartment before buying it? Is it possible to check the apartment yourself before buying?

When a soldier dies or is declared missing, his relatives receive the accumulated amount. If a serviceman leaves service early without valid reasons provided for by law, he is obliged to return the money previously paid by the authorized body for the monthly payments made. Then a clear repayment schedule is drawn up; the repayment period cannot last longer than 10 years.