Who will not receive a tax deduction?

A citizen of the Russian Federation cannot claim a tax deduction in the following cases:

- does not pay personal income tax;

- an individual entrepreneur conducts his activities under a special taxation regime that exempts him from paying personal income tax (applies to part of the income received in the course of conducting this type of activity).

Example:

Citizen Belyakov B.B. has unofficial income - personal income tax is therefore not paid. In 2020 Belyakov B.B. underwent a course of paid treatment. In 2020 and beyond, for the provision of tax deductions Belyakov B.B. cannot claim, and even if it does claim, the tax authorities will refuse a tax deduction.

Options for obtaining tax deductions

Currently payments are made in two ways:

- Through the employer . The enterprise where a citizen who has the right to receive a deduction works is sent a notification from the tax office about the need to recalculate the amount of taxes withheld from the income of an individual. In the future, the enterprise does not transfer part of the personal income tax tax to the fiscal authority, but gives it to its employee along with wages according to the established schedule (1 - 2 times a month, it is also allowed with an advance).

- To a bank account. This option is used by citizens who independently file a tax return (that is, they do not have an employment contract with an employer and work for themselves). In this case, the funds will be credited in installments to an open bank account in the following reporting year.

But even if a citizen has an employment contract, he can also request that the deduction be transferred to a bank account. The employer will pay taxes at the established rate along with personal income tax. The only nuance that should be taken into account: when receiving payments to a bank account, delays may occur, which depends more on the bank, as well as the working schedule of the Federal Tax Service. Therefore, it will be more convenient through the employer: the citizen will know exactly when he will receive the next part of the provided deduction.

The amount of tax deduction that a citizen can claim

What tax deduction can be obtained through government services?

Through the State Services Portal it is possible to issue any tax deduction:

| Type of tax deduction | Explanation | Normative act |

| Property | In the case of purchase of an apartment, room, house, or share of real estate by spouses, the real estate is automatically considered common shared property. To receive a tax deduction, only one of the spouses must submit to the tax authorities an application approved by Letter of the Federal Tax Service of Russia dated November 22, 2012 No. ED-4-3 / [email protected] , which will indicate the joint decision of the spouses on the distribution of the tax deduction. The amount of deduction for expenses is no more than 2,000,000 rubles per person. | Article 220 of the Tax Code of the Russian Federation |

| Social | Training costs: · own training; · education of children under 24 years of age (full-time); · training of current and former wards under the age of 24 (full-time); The amount of deduction for children's education expenses is no more than 50,000 rubles per year. · education of a sibling (full-time). Treatment costs: · own treatment; · treatment of spouses, parents, children under 18 years of age; · medications prescribed by the attending physician to the taxpayer himself, spouses, parents, children under the age of 18; · insurance premiums under voluntary insurance contracts for the taxpayer himself, spouses, parents, children under the age of 18. The amount of deduction for expenses on your own education, education of a brother or sister, in combination with other expenses subject to tax deduction - 120,000 rubles This restriction does not apply to the provision of expensive medical services. | Article 219 of the Tax Code of the Russian Federation |

| Standard | Tax deductions are provided monthly to parents, spouses of parents and adoptive parents: · 1400 rubles – for the first child; · 1400 rubles – for the second child; · 3000 rubles – for the third and subsequent children; · 12,000 rubles – for a disabled child under the age of 18 and for a full-time student (resident, intern, graduate student) under the age of 24 (disability group I or II). A tax deduction is provided monthly to guardians, trustees, adoptive parents, and the spouse of an adoptive parent: · 1400 rubles – for the first child; · 1400 rubles – for the second child; · 3000 rubles – for the third and subsequent children; · 6,000 rubles – for a disabled child under the age of 18 and for a full-time student (resident, intern, graduate student) under the age of 24 (disability group I or II). The tax deduction is provided in double amount to the only parent, guardian, or adoptive parent. A tax deduction for one of the spouses can be provided in double amount, provided that the second spouse has written an application for refusal to receive the tax deduction due to him under the law. The tax deduction is valid until the taxpayer’s annual income exceeds the amount of 350,000 rubles. | Article 218 of the Tax Code of the Russian Federation |

Advantages of applying for an income tax refund through State Services

, the State Services Portal is an electronic service for interaction between citizens and government agencies; it has a number of undeniable advantages:

- Saving time - no need to leave home or stand in line to apply for a refund.

- The electronic service will provide tips on how to correctly fill out the application.

- If you make a mistake or enter incorrect data, you can immediately correct the written text.

What are the advantages of filing a tax deduction through government services?

Thanks to the portal of State Services of the Russian Federation https://www.gosuslugi.ru, the provision of documents to the Federal Tax Service significantly optimizes the time and financial costs of the taxpayer:

- You can fill out the documents yourself - you do not need the help of a specialist, which you will have to pay for;

- To generate and submit documents, you only need a computer with Internet access, which saves time on visiting tax authorities and saves the money needed to travel to the Federal Tax Service (especially in remote areas).

How to apply for a tax deduction through government services?

In order to apply for a tax deduction through government services, you must:

| № p/p | Stages | Explanation |

| 1 | Visiting the government services website | https://www.gosuslugi.ru |

| 2 | Registration or authorization on the portal | Registration: 1. Fill out the registration form and password. 2. Confirm personal data - create a Standard account by providing details of your identity document and SNILS. 3. Confirm your identity – create a Verified Account. To do this, you must select one of the following options: · visit the Service Center; · receive an identity confirmation code by mail; · use an Enhanced Qualified Electronic Signature or a Universal Electronic Card (UEC). If the user decides to register at the Service Center, a Verified account will be immediately created. |

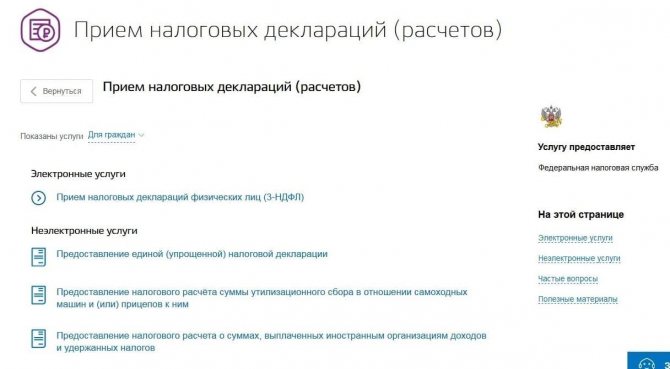

| 3 | In the Service Catalog, select the “Taxes and Finance” section | In this section, select the subsection “Acceptance of tax returns (calculations)”, where you need to select electronic. |

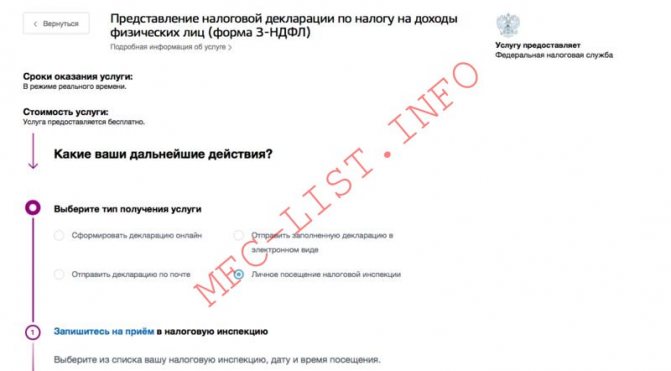

| 4 | Select type of service | Choose |

| 5 | Filling out 3-NDFL | Fill out the 3-NDFL tax return electronically |

| 6 | Submit a tax return to the tax authority | It should be noted that the tax return must be certified with an Enhanced Non-Qualified Electronic Signature, to obtain which you will have to contact one of the certification centers, the list of which is presented: · on the website of the Portal of the authorized federal body in the field of using electronic signatures (https://e-trust.gosuslugi.ru/); · on the website of the Ministry of Telecom and Mass Communications of Russia (https://minsvyaz.ru/ru/activity/govservices/certification_authority/) |

| 7 | Wait for information that the tax return has been filed | The status of the request can be tracked in your Personal Account and by receiving a notification by email. |

We issue a deduction through “Gosuslugi”

Receiving deductions for personal income tax is regulated by Articles 218-221 of the Tax Code of the Russian Federation. The right to them arises for every officially working citizen who has made relevant expenses in the current year (for treatment, training, purchase of real estate, etc.).

You can apply for a tax deduction for State Services for the years 2020, 2020 and 2019. To complete the procedure, you need an electronic signature.

You need to start by filing a 3-NDFL declaration:

Step 1. On the “Authorities” tab, select “Federal Tax Service of Russia”.

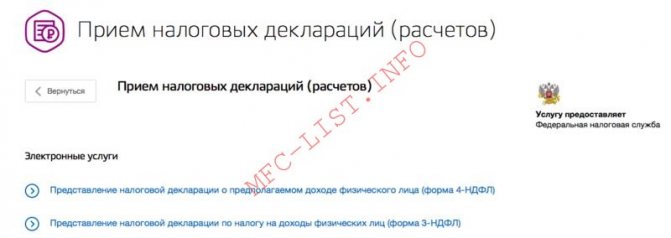

Step 2. Follow the link “Acceptance of tax returns (calculations)”.

Step 3. Click on “Acceptance of tax returns of individuals (3-NDFL)” and in the window that opens, click on the “Get service” button.

Step 4. Find the “Fill out a new declaration” button at the bottom of the page, and when you click it, select the year of interest.

Step 5. All your data will be downloaded from the identification system automatically.

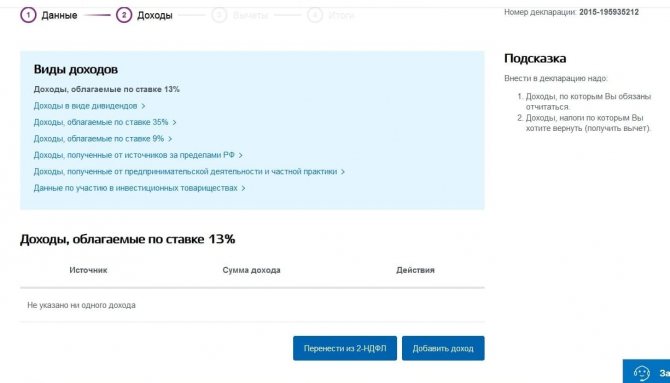

Step 6. Click the “Next” button and go to the “Income” tab. We add them manually or download them from the 2-NDFL electronic certificate automatically. The second option is more convenient and accessible to everyone.

Step 7. In the window that opens, check the boxes next to the sources of income and click “OK”.

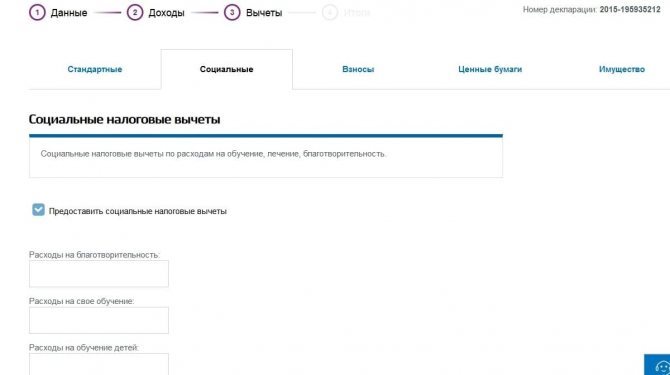

Step 8. After clicking the “Next” button again, we are taken to the page for selecting the basis for refunding part of the tax paid. The “Property” tab explains how State Services offer a tax deduction for housing. Regarding treatment and training - on the “Social” tab, the remaining options are formulated more clearly.

Step 9. Check the box that interests us.

Step 10. Enter the amount of expenses in the appropriate columns.

IMPORTANT! Tips periodically pop up on the website on how to file a tax deduction through State Services correctly: pay attention to them, they will help you avoid making mistakes in filling out your declaration.

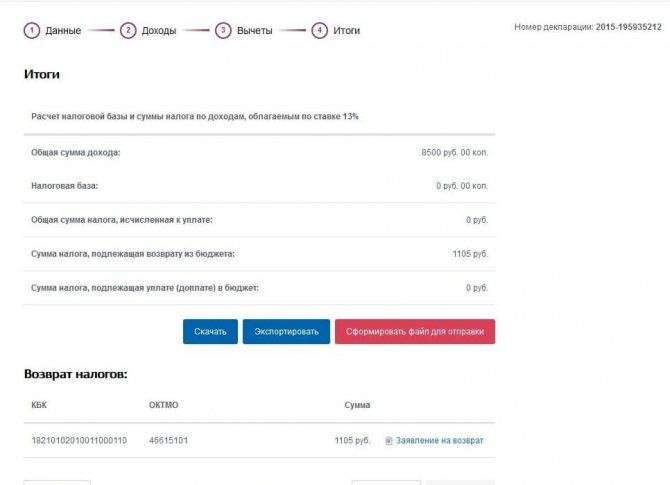

In the final window, everything we need will appear: calculation of the amount to be returned, a declaration file for printing and an electronic file for transfer to the Federal Tax Service. Below you will see a return application.

How long does it take to receive a tax deduction?

In accordance with Article 88 of the Tax Code of the Russian Federation, the following deadlines are established:

- 90 days – document verification;

- 10 days – the taxpayer receives a notification from the tax authorities about the decision made;

- 30 days – transfer of funds to the taxpayer’s account.

Moreover, it is important to note that the established deadlines are the same for both persons who provided documents in person by visiting the Federal Tax Service, and for persons applying for tax deductions through government services.

For example:

On September 1, 2020, documents were submitted to the tax authorities to receive a tax deduction.

By November 29, 2020, the documents must be verified and a decision must be made. By December 9, 2020, the taxpayer will receive a notification from the tax authorities about the decision made. If the decision is positive, funds will be transferred to the taxpayer’s account by January 8, 2020.

Why can they refuse to receive a tax deduction?

Tax authorities do not always make positive decisions regarding the provision of tax deductions.

Refusals to provide a tax deduction may be due to a number of reasons:

- not the entire package of documents has been provided;

- documents were submitted to the Federal Tax Service at a location other than the taxpayer’s place of registration;

- there were errors in the documents;

- documents have been provided to pay for the treatment of persons who do not fall into the category of relatives specified in the legislation.

Questions and answers

- I want to submit documents to receive a tax deduction through government services, but I do not have an electronic signature. Can I do this without a signature?

Answer: Unfortunately, without certification of the tax return with an Enhanced Non-Qualified Electronic Signature, the document cannot be sent to the tax office, and therefore you will have to take care of obtaining UNEP, or use another method of submitting documents to the Federal Tax Service.

- Can I simply fill out the 3-NDFL declaration on the government services website without sending it?

Answer: No, you cannot use such a service on the government services website, but there is a resource on the website of the Federal Tax Service (https://www.nalog.ru) (https://www.nalog.ru/rn77/program//5961249 /), allowing you to generate a personal income tax return (3-NDFL).

How to apply for a tax refund through State Services

Step 1. You must have a confirmed ESIA account (third level) and use it to log in to your personal account on the State Services website.

Step 3. Next, select online declaration generation. If you are submitting 3-NDFL for the first time, please fill out a new declaration; when using the service again, click continue entering information into the existing form.

While at the tax office, you must fill out an application confirming the taxpayer’s right to a refund of property tax deductions; a sample form can be downloaded in advance.

More detailed information and procedures can be obtained on the official website of the Federal Tax Service: