Donation of an apartment between close relatives

- The donor may be a minor owner, but the transaction is carried out with the permission of his parents or guardians.

- It can also be a person with disabilities.

- The recipient may be a minor citizen.

- Persons in public service cannot accept gifts of real estate, even from relatives. Provided that the gift is somehow related to the official activities of the recipient.

- The donor cannot be an incapacitated citizen.

- Civil passports of participants or other documents that can be used to confirm identity.

- Power of attorney, if a representative acts instead of one of the participants in the transaction.

- Real estate documents. This includes papers confirming ownership, technical documentation, etc.

- Consent of the co-owners of the property to the transaction.

- Documents certifying that the property has no encumbrances (it is not pledged, etc.).

- Permission for the transaction from the parents or guardians of the donee, if he is under 18 years of age. In this case, the consent of the guardianship authority will also be required.

- Certificates from the BTI, house register.

Tax deduction for donating real estate

The gift agreement implies that the object is transferred free of charge and without any additional obligations. The value of the transferred (gifted) property is considered the income of the person receiving the gift. From this amount, the recipient is obliged to pay a tax to the state in the amount of 13% of the value specified in the contract or the market value.

Important! If the gift agreement contains additional conditions (lifetime maintenance, donation after death, etc.), it ceases to be considered as such. For example, if the document says a gift subject to lifelong care, this is an annuity agreement. Donation after the death of the donor is inheritance.

Who can count on a tax deduction for gifts?

Any citizen who has received an apartment, land, car, house or other valuable assets as a gift must pay income tax. An exception is made only when donating between people who are related.

According to the Family Code, these include:

- parents (including adoptive parents);

- spouses;

- children (including adopted children);

- sisters and brothers (both only begotten and not);

- Grandmothers and grandfathers.

Reference! If the subject of a gift between spouses is property acquired jointly, only one’s own share of this property can be donated. That is, before the donation, the property is divided and an agreement is drawn up for part of it.

When receiving ownership rights under a real estate donation agreement from direct relatives, the recipient is exempt from paying tax and, accordingly, cannot exercise the right to return a tax deduction.

Important! Close relatives do not include uncles and aunts, cousins, as well as brothers-in-law and mothers-in-law.

In any other cases, when accepting a gift of real estate, the recipient has the right to use the opportunity to return income taxes. According to Article 220 of the Tax Code of the Russian Federation, which states that all expenses associated with the registration of a house or other residential real estate, an individual can indicate as a tax deduction.

Tax on donating an apartment to a relative 2020

Receiving an apartment as a gift is certainly a very joyful event in life.

After all, real estate prices today are very high, and mortgage loans are unprofitable. But after receiving such a wonderful gift, in addition to joy, questions also arise. The very first one: do you need to pay gift tax? If the apartment was donated by a relative, what should be the degree of relationship? We will try to answer in detail these and other questions that arise when drawing up a gift agreement. Accordingly, the law says that a person who received real estate as a gift is obliged to pay personal income tax (NDFL) to the state treasury. For this reason, Russian laws introduce an exception for a narrow circle of relatives who have the right to receive an apartment as a gift from each other and not pay tax. This exception is made for a relative from among close relatives - in the understanding that is in the legislation regarding who is included in this number.

Who and how can receive a tax deduction when donating an apartment?

If they are close relatives of each other , then the property presented in monetary terms (as reflected in the gift agreement) is not subject to any tax. In this regard, the recipient, the new owner of the property, does not have the right, for example, to issue a property deduction for the housing received, since he received it without making any expenses. The donor, the previous owner of the property, will not be required to pay income tax calculated on the value of the donated apartment, since he did not receive the corresponding income.

- The recipient becomes obligated to pay personal income tax calculated on the cost of the apartment under the contract. This tax is calculated at a rate of 13%, like personal income tax on any other income.

- The recipient becomes obligated to submit to the Tax Inspectorate (FTS) a declaration in form 3-NDFL, which will reflect the income represented by the monetary value of the apartment donated to the person.

- The recipient acquires the right to reduce or compensate the calculated personal income tax if there are legal grounds for doing so. For example, when purchasing another apartment at your own expense, as well as when applying for a mortgage loan.

Are there any benefits when donating an apartment to a relative?

Grounds for challenging a gift agreement: - inconsistency of the form and procedure of registration; — limitation of the donor’s legal capacity at the time of donation; - on the grounds of the “imaginary transaction” (this is related to the issue of writing down a clause on further residence in the contract); - pressure, coercion, delusion; — unworthy treatment of the gift; - death of the recipient if this is specified in the contract; — violation in determining the terms and subject of the contract; — additionally — a number of special cases.

Not everyone knows that when registering a deed of gift for an apartment, you will have to incur expenses in the form of income tax. Let’s figure out when a transaction is taxed and what are the nuances of paying it in 2020. Are close relatives required to contribute a certain percentage of profits?

Benefits when donating an apartment to a relative

In relation to real estate, donation is one of the types of transactions - an agreement when the donor gratuitously (without payment) transfers certain property to the donee, or undertakes to transfer it in the future. After the donated apartment is registered in the Unified State Register of Real Estate under the name of the new owner, according to Art. 217 of the Tax Code (clause 18.1), the need to pay tax on income does not arise only in two cases: if it happened between persons recognized as family members and (or) close relatives.

We recommend reading: Time when you should not make noise

First, you need to figure out who legally belongs to the category of close relatives. According to Art. 2 and Art. 14 of the RF IC, close relatives and family members are recognized as:

- grandparents and grandchildren;

- brothers and sisters (equally full and half).

- parents and children (equally natural and adopted);

- spouses;

Tax on the gift of an apartment to a close relative belonging to the category listed above is not paid.

Benefits for labor veterans when moving to another region

Topic: Veteran of Labor I am a veteran of labor in the Chelyabinsk region when moving to the BASSR, benefits will remain. Which I am currently using. read answers (1) Topic: Veteran of Labor Will a Veteran of Labor of the Stavropol Territory retain benefits when moving to Rostov-on-Don? read answers (2) Topic: Moving to another region When moving to another region, does a veteran retain benefits Veteran of Labor areas? Does the place of relocation matter: the south, St. Petersburg, Moscow, the middle zone, etc. read answers (5) Topic: Benefits when moving I am a Labor Veteran of the Khanty-Mansi Autonomous Okrug, will I retain this title and benefits when moving to another region of the Russian Federation? read answers ( 1) Topic: Veteran benefits for housing and communal services When moving to another region, veteran benefits for a labor veteran are issued from the moment of filing an application or from the moment of registration in a given city read answers (1) Unified Telephone Legal Service Legal advice on any legal issues.

We recommend reading: How to Determine the Body and Structure of a House Examples

Contracts. Transactions Labor law and social security Biography: 35 years old, higher education in law, work experience in the specialty for more than 13 years. From 2001 to 2014 - assistant judge. From 2014 to the present - private practice on legal issues (arbitration, courts of general jurisdiction).

Taxation when donating an apartment to relatives in 2020

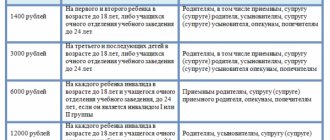

The legislation regarding gifts provides for one important detail - there is a category of close and relatives from whom personal income tax is not charged for expensive gifts. The following people, when re-registering an apartment in their name on the basis of a gift agreement, will only pay a state fee:

If you decide to “make happy” a distant relative or a person with whom there are no family ties at all, then the “lucky one” will have to pay the state the required thirteen percent on the income of individuals. A relative (if there are supporting documents) does not need to pay income tax.

Tax on donating an apartment to a relative in 2020-2020

Gift tax must be paid by July 15 of the following year after the deed of gift is issued. Otherwise, a penalty of 20% of the tax amount will be applied, or 40% if it is proven that the gift tax was not intentionally remitted.

- A declaration of income and expenses is completed in form 3-NDFL. It is better to take the help of a specialist, as for a person who is not familiar with tax returns, this can be a difficult task. If an error is detected in the document, a Federal Tax Service employee may not accept the declaration.

- You must provide the following documentation to the territorial office of the Federal Tax Service at your place of residence: a completed 3-NDFL declaration, a civil passport, an extract from Rosreestr on the registration of property rights, a deed of gift, a document on the transfer and acceptance of the apartment, if one was issued.

- After checking the declaration and calculating the amount of gift tax, the Federal Tax Service will receive a notification of the tax amount and a receipt. The deadline by which the tax payment must be made will be indicated in the notice.

- The received receipt can be paid at any bank branch.

Benefits for labor veterans for housing and communal services

If in a family the husband and wife are both labor veterans. They apply for a general benefit for utility bills of fifty percent. If a son who is not classified as a veteran lives with them, the amount of the benefit will be recalculated in proportion to the number of veterans. My son will pay one hundred percent for utilities.

- Contacting the local branch of the social welfare authority at your place of residence with a package of documentation. You can fill out an application for benefits on site. If you have any difficulties filling out the form, you should seek the help of a specialist - an employee of the institution.

- Within 10 days, the appeal is reviewed and a decision is made. If a positive decision is made, starting from the next month, the assigned amounts are transferred to the specified bank account. The refusal can be challenged in a court of general jurisdiction. To do this, you must obtain a written refusal, indicating the reason.

20 Feb 2020 etolaw 1640

Share this post

- Related Posts

- Social payments to liquidators of 1986 Chernobyl victims in Russia

- Is there a fine for late receipt of a passport at 14 years of age?

- Time to carry out noisy work in a Belgorod apartment

- What Documents Are Needed to Make a Birth Certificate for a Child?

Taxation when donating an apartment to a relative in 2020

The transaction is subject to taxation. This is a general rule of procedure, the participants of which are not in close family relationships when property is involved. The legislation does not provide for benefits; taxes on the gift of real estate are paid in full. Many actions in this direction are subject to fees.

- Drawing up a real estate donation agreement with a precise description of the data on the share.

- Obtaining consent from spouses or guardianship authorities if the interests of persons under 18 are protected. This transaction will be subject to fees if there are no blood ties.

- Signing the contract, registering the fact of transfer of ownership in Rosreestr. Afterwards, if the circumstances are appropriate, you are required to pay tax on the gift.

When donating a share of an apartment

The taxation procedure for donating not the entire apartment, but only its share, corresponds to the same procedure when the object of the transaction is an entire living space.

The calculation of the amount that will have to be paid when conducting a transaction to donate a share of an apartment will depend on the value of the transferred part of the property and the presence of family ties between the parties to the agreement.

Tax on donating an apartment to a relative in 2020

The donor of the apartment has no obligation to draw up a declaration and pay tax, since the person who donates the property to another entity does not receive any income. If you receive a letter from representatives of the tax service containing a demand for tax payment, the donor must write an explanatory document and send it to the tax authorities with a deed of gift attached.

Having legally registered the ownership of an apartment received as a gift, the recipient must indicate the corresponding income in the declaration and then pay the necessary tax. The completed declaration by the citizen must be submitted to the tax authorities by April 30 of the following year. The taxpayer will be required to draw up a corrective document if the value of the property received as a gift is not indicated in the declaration. To tax a donated apartment, you should take into account the information from the cadastral valuation. Payment of the tax must be carried out by the recipient within the regulatory deadlines after receiving the appropriate receipt from the tax authorities.

We recommend reading: To register with the employment service, documents for registration

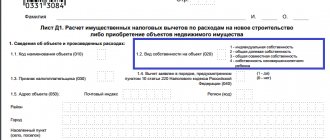

Registration of a deduction when donating an apartment

So, if the apartment was transferred by gift and the recipient paid 13% of its value to the state treasury, it has every right to return part of the funds in the form of a tax deduction. For this purpose, you must contact the Federal Tax Service directly. This can be done, as mentioned above, at the end of the year or at any other time. The recipient must understand the importance of paying income tax. Otherwise, he will not be able to receive a deduction and will also face the need to pay a fine. The tax return must be submitted by April 30 of the following year in which the property was transferred.

The new owner of the apartment must provide the tax service with the following list of documentation:

- Application in the prescribed form.

- Passport.

- Tax return.

- Certificate of income.

- Bank details.

You can submit documents in person, through a registered letter, by an employer or an official representative, provided that a power of attorney has been issued for him. A tax deduction for donating an apartment is issued according to the standard procedure.

Documents required to donate an apartment to a relative in 2020

The state duty is 2000 rubles. If you decide to use the services of a notary’s office, this will require additional costs and you will only find out how much the entire procedure for registering a deed of gift will cost after visiting a notary. His services will cost you from 3 thousand rubles.

The closeness (degree) of family relationships must be documented. If everything is in order with the documents, and the agreement is really concluded within the same family, then the recipient does not need to pay tax or submit a 3-NDFL declaration to the Federal Tax Service.

Tax on donating an apartment to a non-relative in 2020

So, for example, an apartment can be donated through a close relative. For example, gifting real estate to a nephew requires a tax payment. But if an uncle first donates an apartment to his brother, and he, in turn, transfers it to his son under a gift agreement, then he will not have to pay tax on the income received. As a result, the transaction will be completed, but there will be no obligation to pay funds to the budget.

When a gift agreement is concluded between people for a car or a share of a land plot, it is necessary to correctly and timely notify the state about this, i.e., register the transaction. Then, before the end of April next year, the Federal Tax Service will have to prepare a declaration of income for the past tax period, i.e., the year. If you miss the deadline for filing a declaration, an administrative fine of one thousand rubles will be imposed on the person. Interest on profits must be paid before July 15 of the current year. For missed payment deadlines, the amount of administrative liability will be increased and will amount to 20% of the cost of the object. If the Federal Tax Service has information that the interest paid is intentionally delayed, the amount of recovery will be 40% of the amount specified in the declaration.

One thought on “Is it possible to get a tax deduction when donating an apartment”

- Sergey 10.21.2019 at 14:35 Hello, if I was given an apartment in 2020, in 2020 I paid 13% tax on it.

I bought a home in 2019, can I apply a property deduction? I read an article on your website that if I had bought a home in the same year that the gift was made to me, then the next year I could apply a property deduction and pay the gift tax, minus the property deduction for the purchase of another home. And if 3 years have passed since the date of donation and the tax has been paid, is it possible to apply the deduction to newly acquired housing? Next ↓

Donating a share of an apartment to a close relative

In a word, the deadlines are not that impressive. It’s easier and smarter to draw up a deed of gift on your own, but it wouldn’t hurt to consult a lawyer for advice. In order not to look for qualified but busy specialists, write to our lawyers - we will give answers to all your questions and select further instructions for you.

- place and date of agreement;

- Full name, passport details and other contact details of the parties;

- what is the subject of the transaction - share in a privatized apartment, address of housing, area, floor, building, structure, cadastral information;

- the basis for allocating the donor’s share (for example, a court decision or an apartment privatization agreement);

- information about other residents of the apartment;

- conditions that do not contradict the law - for example, you can indicate that the donor retains the right to live in the apartment indefinitely, will transfer the share to the child after graduation from school/university, etc.);

- rights and obligations of the parties;

- how many copies of the agreement are available;

- signatures.

Are the benefits of veterans of labor for housing retained after registration of the deed of gift?

1. Make the donation now, the mother will remain to live, you, as the owner, will not be against it. 2. Write a will (if there are other heirs), but there may be nuances here - what if one of the remaining heirs of the 1st stage becomes disabled at the time of mom’s death? Then he will have the right to an obligatory share. 3. Lifetime annuity agreement. The apartment will become your property immediately after signing the contract, and your mother will receive the right to live in the apartment for life.

We recommend reading: When Can I Get 13 Percent Back on an Apartment?

If it is a deed of gift, you are already the owners of the house!! And you don't need anything!! Well, the parents planted the pig! Couldn't you make a will? Let the gift deed be declared invalid. . Then you will again be left without property and have the right to land or compensation for land to purchase an apartment. . Like a large family. . Or is it a will? Then you have NO property!!

Benefits when donating an apartment to a relative

Tax payment procedure After registering the gift agreement, the donee (he is also the new owner of the apartment, but we will call him that) must visit the tax office before April 30 of the following year after the date of the transaction to fill out and submit a tax return on income for the past accounting period.

When receiving such a letter, there is no need to worry - the tax authority sometimes receives only data on the alienation of property, assuming that a sale has been made and you have received income. You can write an explanatory note to the tax authority and attach a copy of the gift agreement to it (or simply ignore the letter from the tax service).

Preservation of the donor's benefits when making a donation

donations. A simple written form is simply a contract drawn up in writing and signed by the parties. notarized form is an agreement drawn up in simple written form, signed in the presence of a notary (not always observed) and certified by a notary.

We recommend reading: What documents must be submitted to the tax office for an income tax refund for sanatorium and resort treatment

After registration of the donation, the father’s benefits will not be preserved since the owner becomes another person who does not have the right to benefits. After the donation, you can live on your former share with the consent of the new owner, but you will no longer have any rights to this share and the owner will decide everything at his own discretion. According to Article 578 of the Civil Code of the Russian Federation