Published 10/10/20

Often, an apartment or house is purchased by parents together with their minor children, or ownership is transferred directly to the children. Since parents spend their own money to buy housing, the question arises: can parents get a tax deduction for a child?

Until recently, the Tax Code of the Russian Federation did not contain provisions regulating this issue, and the situation was regulated by numerous (and sometimes contradictory) letters from regulatory authorities and decisions of the Constitutional Court of the Russian Federation.

On January 1, 2014, changes to the Tax Code of the Russian Federation came into force, which indicated that parents (adoptive parents, foster parents, guardians, trustees) when purchasing property for their (ward) children under the age of 18 years can receive property payments for them deductions (clause 6 of Article 220 of the Tax Code of the Russian Federation).

Let's consider various features of the application of property deductions depending on how housing is purchased and into whose ownership it is registered.

Is a property deduction possible for children?

An officially employed person has the right to various types of deductions, some of which are related to children. For example, money can be returned for a child’s education. There are also so-called social deductions that allow you to reduce the amount of monthly personal income tax paid. Is there such a possibility regarding property deduction?

Even 5 years ago this issue was not directly regulated by law. But from January 1, 2014, this right was officially reserved for parents in. Therefore, now a parent can receive a deduction when buying an apartment, both for himself and for his child. But there are some nuances here.

Are children's rights to deductions lost upon reaching adulthood?

While granting parents the right to receive property tax deductions when purchasing an apartment for a minor child, the law does not deprive the adult child of this right.

Parents, having exhausted the deduction for their shares and the shares of minor children in the amount of 2,000,000 rubles (for housing purchased after January 1, 2014), no longer have the right to take advantage of such deductions. And if an apartment or house was purchased before December 31, 2013 inclusive, then this right is lost regardless of the amount of the deduction used (the right is given only for one object and once in a lifetime).

And children for whose shares a deduction was received do not lose their right to property deductions. Upon reaching 18 years of age, a boy or girl who purchases a home can take advantage of the full tax deduction (up to 2 million rubles). This law protects the rights of minor children and prevents possible fraud on the part of unscrupulous adults.

Conditions of receipt

To receive a deduction for their child, a parent must fulfill a number of conditions. By the way, in fact, such a preference is also available to adoptive parents, since the level of relationship does not matter. In general, you will be given a deduction if:

- you have not used your right to deduction at all or have used it only partially;

- you are a Russian citizen or a resident of the Russian Federation, i.e. you stay in the country for at least 183 days a year;

- you pay personal income tax to the state treasury - everything is quite natural here: if you don’t pay tax, then there is nowhere to issue a refund.

By the way, you can receive a property deduction for your own children only until they reach adulthood. If the child turns 18 years old, the parent will no longer have the opportunity to issue a refund.

Moreover, it will not matter whether the child has officially started working or is studying at the university. It is interesting that in the latter case, deductions for studies and social benefits are retained by the parent, but the right to a property deduction is not.

Deduction for children's shares in the apartment

In order to receive a deduction for the share of several minor children in one home, you must collect and provide to the tax authorities or the employer a list of documents consisting of the following originals and their copies:

- Father's or mother's passports.

- Birth certificate of the minor owner or several children.

- Marriage document, if available.

- A purchase and sale agreement, a certificate of registration of ownership of real estate (a share in it) or an extract from the Unified State Register of Real Estate (if the right arose after 07/15/2016).

- Documents confirming payment of the entire amount of funds.

If you submit documents to your employer to receive the specified tax benefit, you must attach a notice confirming the right to deduction (issued by the tax office at your place of residence).

If you want to get it through the tax office, then you will need to attach a certificate from your place of work in form 2-NDFL and a tax return 3-NDFL.

3 personal income tax per child in the process of purchasing real estate

To obtain a deduction, it is necessary to prepare a reporting document in Form 3 of the Personal Income Tax, and its basis is a certificate of income from the place of work in Form 2 of the Personal Income Tax. The lack of an official document is the main reason for denial of deduction.

To receive a deduction, you need to fill out a declaration not only for yourself but also for a minor child.

A distinctive feature of filling out will be that the personal data of the daughter or son is written in the document, however, on the title page of the declaration, the “taxpayer’s representative” box should be noted with the data of the father or mother (depending on who will file the deduction).

How to calculate the tax deduction for buying an apartment for a child

Based on the current tax legislation, the calculation of the tax deduction when purchasing real estate by a family with children is quite simple. These are two calculation options:

- Paid for the apartment 2,250,000, rub. personal funds. The deduction will be 200,000.0 rubles. x 13%. The amount will be 260,000.0 rubles.

- The house was purchased for 2 million personal and 7 million mortgage funds, the credit% is 700,000.0 rubles. per annum. The deduction is calculated as follows: 200,000.0 rub. x 13% + 700,000.0 x 13% = 351,000.0 rub.

When can I get it?

Additionally, requirements are imposed on the transaction being performed. So, a deduction is provided if the apartment was purchased:

- using your own funds (if you used a mortgage, you can also get a deduction for a child, but this is a different type, a larger amount and different conditions of application);

- not from close relatives (this restriction was introduced to prevent people from making fictitious real estate purchase and sale transactions, wanting to receive a tax deduction, without actually paying for anything and without receiving ownership of the apartment).

Additionally, parents are afraid that they do not always have the right to a deduction for their child. A refund can be issued for a minor if the owner is:

- Only a child . For example, you bought an apartment for 1,500,000 rubles. and registered it for the child. If you have not previously used the deduction, then you can get a full refund for the child.

- Both you and your child . For example, purchasing the same apartment for 1,500,000 rubles. ½ for each, you can get a deduction for yourself and for a child of 750,000 rubles.

If a child has several parents, then each has the right to a deduction, but in total it should not exceed the cost of the share.

For example , if for 2,700,000 rubles. you purchase housing as the property of yourself, your spouse and 1 child and each receives 1/3, then the parents can apply for a deduction for themselves in the amount of 900,000 rubles. and divide the remaining 900,000 rubles. between themselves. Moreover, this division does not have to be in half (the entire share can go to one parent, be divided in half or not in equal proportions - as agreed).

Sometimes other family members may also participate in the purchase, then their share will not be taken into account when calculating the deduction, and for the child and yourself you will return the money in proportion to the cost of your part.

Read: Double tax deduction for a child: who is eligible and how to get it

If the housing is registered for one parent and child

The procedure for obtaining a tax deduction for a child is regulated by clause 6 of Art. 19 July 2011 N 03-04-05/7-521.

If you bought an apartment as a property with a child, you can receive a property deduction for both shares - for yourself and for the child. The child's consent is not required.

Example:

You bought an apartment for 2 million rubles and registered it in the name of yourself and your 12-year-old daughter. Even though you each own ½ of the apartment, you can get a tax break for the entire home.

As a result, 260 thousand rubles of overpaid personal income tax will be returned to your account (13% x 2 million rubles).

Example:

You bought a house for 3 million rubles and shared it with your minor son. You have the right to receive a tax deduction for your share - 1.5 million rubles and partially for your son's share - 500 thousand rubles.

Why can't you use the child's entire share? According to paragraphs. 1 clause 3 art. 220 of the Tax Code of the Russian Federation, the maximum amount of property deduction cannot exceed 2 million rubles. Therefore, you have the right to increase your deduction only within this amount.

Quick deduction service: personal income tax refund in 7 days, not 4 months!

Order service

When should you apply?

Some parents, even knowing about the possibility of receiving a child deduction, do not take advantage of it. To make the right choice, you need to know about important nuances:

- The deduction amount for yourself and children is not cumulative . That is, if you have no children, 1 child or 5, the deduction amount will be the same - 2,000,000 rubles. Some people mistakenly believe that each child is entitled to the same amount.

- The child does not lose his right to a deduction . And this became possible precisely thanks to the previous limitation. If the deductions were summed up, it is unlikely that the child could receive this benefit for himself in adulthood.

These two rules make it possible to understand when it makes sense to issue a deduction for a child, and when it is inappropriate. Property returns for children should be made if:

- you bought inexpensive real estate (that is, if your share does not cover the maximum deduction amount, then it makes sense to get a refund for the child);

- all or most of the housing is owned by minor children;

- You can receive your child’s share before his or her 18th birthday.

Sometimes this option makes no sense. For example, if you buy an apartment for 5,000,000 rubles. for yourself and your child in equal shares, then for each you have 2,500,000 rubles. Even from your share you can get a refund only for 2,000,000 rubles. Therefore, money will not be returned for the child.

There are also more complex cases when one of the parents is not the owner of the apartment. Then it makes sense for the latter to receive a preference for children.

Read: How to write off your mortgage when you have a baby in 2020

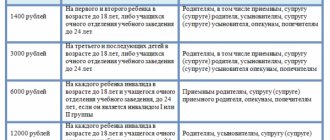

Size per child(ren)

The limit on expenses for the purchase of real estate is 2 million rubles.

for each of the owners. Thus, if the apartment was purchased by the father for 4 million rubles. and ½ of the part was registered in the name of his son, the father will be able to receive a tax in the amount of all costs for the purchase of this property, namely 4,000,000 rubles. The amount of interest on credit interest is determined depending on the year in which the apartment was purchased. If before 2014, then the entire amount of the overpayment on the mortgage is subject to compensation; if later than the specified year, then only in an amount of no more than 3 million rubles. It is also necessary to note that if a parent previously received a deduction for interest, then he will not be able to claim it again, even if it is for a child.

Features of receiving

When you receive a deduction for yourself, you need to bring a standard package of documents to the tax office, which includes:

- application for a deduction;

- completed declaration 3-NDFL;

- papers confirming the purchase of an apartment (purchase agreement, deeds, if additional renovations were done in a new building, then the costs can also be taken into account, but there are some nuances there).

Download the application for personal income tax refund (2020 sample/form recommended by the Federal Tax Service)

Download a free application form for personal income tax refund

3-NDFL for individuals:

| Reporting period | Base | File for download |

| 2019 | Order of the Federal Tax Service of Russia dated October 7, 2019 No. ММВ-7-11/ [email protected] | Excel/PDF |

| 2018 | Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected] | Excel/PDF |

| 2017 | Order of the Federal Tax Service of Russia dated October 25, 2017 No. ММВ-7-4/ [email protected] | Excel/PDF |

If we are talking about a deduction for a child, then the parent must bring additional papers to the Federal Tax Service, namely:

- birth certificate (for each of the children, if you receive for several);

- agreement on the distribution of the minor’s share (concluded between the parents, after which it will no longer be possible to change the decision, so determine the most profitable option in advance).

You won’t have to re-draw up the agreement in subsequent years, and you won’t have to bring documents for the apartment. All that remains is to submit 3-NDFL. By the way, you can do this for the previous 3 years at once if you don’t want to go with documents every time.

Design features

The tax deduction for an apartment for a child is calculated according to the same principle as for adults, and only a birth certificate is added from the documentation. The complete list contains the following copies and originals of documents:

- An application to the Federal Tax Service for a refund, which indicates in detail who the property is being purchased for and how the shares will be distributed. Indicate the bank account number where the due amount should be transferred.

- Declaration 3-NDFL.

- Certificate from place of employment 2-NDFL, which confirms the official income.

- Title documents for children indicating the price of the object.

- Birth certificate (identity card for children from 14 to 18 years old).

- Identification of the parent or guardian who will receive the refund.

By the way! If a passport is received, then a birth certificate is necessary in any case to confirm the degree of relationship. After turning 18 years of age, an adult receives a refund for himself.

When registering an apartment, the following situations for calculating deductions to parents are possible:

- Only for children.

- For the share of an adult and a minor.

- The parent’s share and part of the property registered in the children’s name.

- Only for myself.

Design methods

A person can apply for a deduction for a child, as well as for himself, for the purchase of an apartment in 2 ways:

- Through the Federal Tax Service . You can apply in person or send documents by mail. The advantage of this option is the ability to receive money immediately over a long period of time. But the application itself is considered for quite a long time + it takes time to transfer money to your current account. Typically the entire procedure takes about 90 days.

- Through the employer . This option is suitable for those who do not want to wait and want to receive a salary without deducting personal income tax. But be prepared that first you will have to receive a notification from the Federal Tax Service confirming your right to the benefit. And you will have to issue it every year. But this approach requires fewer documents, and the paperwork will be simpler.

And don’t forget to double-check all documents before submitting to reduce the likelihood of refusal and speed up the process of applying for benefits. Otherwise, the papers may need to be collected and re-submitted in full, which will take extra time.

Read: Is it possible to get a tax deduction when exchanging an apartment?

Is it possible to apply for a tax deduction when buying an apartment for a child?

Currently, if a family with minor children buys an apartment, shares are often immediately allocated for the children. Sometimes such a step is dictated by legal requirements. For example, if targeted payments are used when purchasing an apartment, shares must be allocated for all minor children in the family.

Sometimes parents acquire a residential property only for the sole ownership of their child, but at the expense of the parents. In this case, it turns out that one person is listed as the owner of a share or the entire property, and another as the payer. If the cost of housing is expensive and the parent’s share in it is significant, the factor of allocating a share in favor of a minor child will not play a significant role when applying for a tax deduction.

For example, an apartment was purchased for 5 million rubles. the property of mother and child in half. The deduction for the transaction is 2 million rubles, and the woman will receive it in full. But if the same home is completely registered in the name of the child, the question of whether the parent can file a deduction for the child in his favor becomes relevant.

Tax legislation establishes that deductions when purchasing an apartment as a child’s property are granted to the following categories (subject to a number of conditions):

- his parents, including adoptive ones;

- official guardians.

You can receive a tax deduction only if the payer is a parent. If targeted government payments were used for the purchase, they must be deducted from the purchase price. The tax deduction does not apply to them.

It is important to consider that although they focus on the fact that the state provides a deduction for the child’s share when buying an apartment, in fact, it does not belong to him initially. This is a deduction from his parent, which can only be taken once in a lifetime. And if the parent has already exercised this right, i.e. Once upon a time he already received a tax deduction for himself and spent it in full, he is no longer entitled to another.

Owners: one parent and child

If an unmarried parent purchases some kind of housing for himself and his child, the state provides him with the opportunity to receive a deduction for the child’s share, as well as for the personal part of the real estate. The maximum possible amount is 13% of the amount of 2 million rubles. This option is beneficial if the cost of housing is not very high.

For example, a woman saved up money and purchased an apartment worth 2 million 300 thousand rubles. She was registered as shared ownership: 50% each for the mother and her son. The woman applied for a tax refund and received the maximum possible deduction, i.e. for both shares at once.

If the parents are divorced and the apartment is bought for the parent with whom the child remains to live, and for the child himself, the second parent can also claim a deduction, but only for the child’s share. This option is beneficial if the parent with whom the child lives has previously spent his deduction or does not pay personal income tax.

In such a situation, if the parent with whom the child does not live submits payment documents that prove that he paid for the purchase of real estate, he can receive a deduction for the child.

Owners: spouses and their children

When a property is acquired into the common shared ownership of spouses and children, the procedure for calculating deductions will have a number of features. First, each spouse issues a separate deduction for the purchase of their share. If they completely take out the entire amount due to each, they will not be able to receive a property deduction for children.

If the value of the property is not very high and the parents do not choose the entire amount as personal tax deductions, they have the right to return part of the funds for the shares allocated to minor children.

For convenience, parents are given the right to distribute the refund amount in any proportional amounts among themselves. For example, parents with a small child purchased a real estate property worth 5 million rubles. All family members received equal shares in the property. Each of the adult owners, after purchasing the apartment, returned the due amount of 1 million 667 thousand rubles. (1/3 of 5 million). Therefore, each of the parents can further apply for a deduction for the share of a minor child in the amount of 13% of 33 thousand rubles, because they have almost completely used up the amount of deduction that the state guarantees to one taxpayer. Each of the parents received an additional 4 thousand 290 rubles.

The owner is only a child

When relatives purchase a home only for the benefit of their child, both parents have the right to receive a tax deduction. If they are married, it does not matter which of them appears as the payer on the payment documents. In this case, they can divide the deduction amount among themselves in any shares.

If the object was purchased as the property of a child by parents who are not married, they can also apply for a deduction upon purchase, but each for the amount that was paid by the particular parent.

For example, a child was purchased housing worth 2 million 400 thousand rubles. The parents are married. When purchasing an apartment, they took out one maximum deduction, dividing it in the following proportions. The father got 70% (182 thousand), and the mother 30% (78 thousand).