Internet banking is popular today. Remote interaction with a financial institution simplifies payments and account management. Let's look in detail at how you can pay for a mortgage at Sberbank Online in a couple of minutes without straining your brain and without leaving your home.

The institution provides such an opportunity. The company's Internet service allows you to make payments on a loan received from Savings or other banks.

Initially, you need to create an account. The procedure can be performed using an ATM or via the Internet. To carry it out, you will need a phone number linked to a bank card. Having become the owner of a personal account on the Sberbank website, a citizen will be able to make current payments and repay the mortgage early.

Why do you need Sberbank Online

By logging into Sberbank Online, the user receives information about all his cards, accounts, loans, deposits, etc. Your personal account provides access to a number of operations where you can pay for a mortgage loan from Sberbank, as well as perform the following operations:

- open a deposit, replenish it or terminate a previously concluded agreement early;

- buy or sell currency;

- get a card statement, find out the details or block it;

- make money transfers;

- pay fines, housing and communal services, mobile communications and the Internet;

- order a loan from Sberbank by submitting an online application;

- find out about loan balances.

You can also view the mortgage, mandatory payment and mortgage payment schedule in your personal account.

Part 1. Offline payment methods (without the Internet)

Here we list the standard options.

Let's go to the bank

Of course, you can take your passport and go to the bank office, because Sberbank has many branches in any city. But even if the nearest branch is not far from you, you will still have to spend time visiting and, most likely, stand in line. This is a serious minus. The advantages include the absence of commission and the reliability of the method - the money will go to its intended destination without any problems.

We pay our mortgage using self-service devices

In most stores, supermarkets and shopping centers you will always find a Sberbank ATM (terminal). This is a multifunctional device that allows you to repay debt on any loan and pay for various services.

This payment method is not difficult if you know the 20-digit number of the credit account opened for you for loan transactions when you apply for it. Or you have a special card for paying for a Sberbank mortgage, issued by the bank.

How to pay for a Sberbank mortgage through an ATM

If you want to make a payment in cash, you need to insert it into the bill acceptor of the device. If the funds for payment are on a debit bank card, for example, a salary card, then instead of cash you need to insert this card into the card acceptor of the device. In any case, proceed as follows:

- on the screen we look for a section on loans;

- select the loan repayment item (tab);

- indicate the 20-digit account number for crediting funds or the details of a special card for a mortgage;

- Enter the monthly payment amount indicated in the schedule and pay.

Recommended article: How to calculate a mortgage with maternity capital in Sberbank using an online calculator

How to pay at the post office

Russian Post, among other payments, also accepts mortgage payments from Sberbank. In order to use this service, you need to visit any post office. The post office operator should provide the card number that is linked to the mortgage account, or the personal account number with Sberbank.

You will also need a passport to fill out information about the payer. Transfer of payment by mail is available through the federal City system with which it works. This system transfers funds to the payer’s mortgage account. It should be remembered that for such a service the post office provides a commission of two percent of the payment amount itself, and the completion time is about a week.

We pay through the company's accounting department

Mortgage payments involve regular payments over a long period of time. Therefore, there is another way to pay for a Sberbank mortgage - through the accounting department of the organization where the owner of the mortgage real estate works.

For this purpose, a form is drawn up, indicating the date and amount of payment. If the manager approves such a request, then part of the borrower’s salary will be regularly sent to the bank account.

Benefits of using Internet banking

Sberbank is not the only financial organization that allows you to pay your mortgage or make payments and transfers online. Most large financial organizations in the Russian Federation have a similar opportunity. An example is VTB or Alfabank. The client has the right to independently choose which financial organization to start cooperation with.

Features of using a personal account in different financial organizations may vary. But the essence is the same - manual management of personal accounts remotely via the Internet.

To access the system, you can use mobile devices running Android, iOS or Windows Phone. When creating a personal account, Sberbank pursued the following objectives:

- simplifying interaction with clients;

- increasing financial literacy of the population;

- attracting additional attention to the organization’s proposals;

- expansion of the list of available services, the list of which included payment of payments online;

- providing clients with the opportunity to independently perform banking operations, payments and transfers.

How to start using online banking from Sberbank

If a client wants to start using Sberbank online, he will need to create an account. Access to the system can be obtained by persons with a Sberbank debit or credit card. You can create an account yourself. The procedure can be performed:

- through an ATM;

- during a visit to the organization’s office;

- by calling the hotline;

- through the Internet.

If a citizen decides to create an account using an ATM, then you can acquire an access code yourself.

The procedure is performed according to the following scheme:

- A citizen starts working with an ATM. To do this, insert a card into the receiver and then enter a PIN code.

- In the main menu, you need to select the Sberbank Online section and click on the item that allows you to get a login and password.

- Wait for the device to provide a receipt. Information with the required data will be printed on it.

- When you need to acquire codes to confirm transactions in your personal account, you need to obtain one-time passwords by clicking on the item of the same name in the menu.

An alternative is to self-register online. The procedure is carried out on the official website of the company. You first need to connect your mobile bank.

Part 2. Payment methods via the Internet

These are modern payment methods with many advantages. First, let's get acquainted with the offers of Sberbank itself, read the instructions for paying for a mortgage through Sberbank and its services.

We pay through Sberbank services

The most convenient payment method is provided in the Sberbank Online service. This is online banking (virtual bank), which can be used both on a computer and using a mobile application.

How to pay a loan from a computer

We provide instructions for paying a mortgage through Sberbank online, accessible to any user:

- to get into the personal account of the service, you must enter your login and password, which the client received during registration in this service;

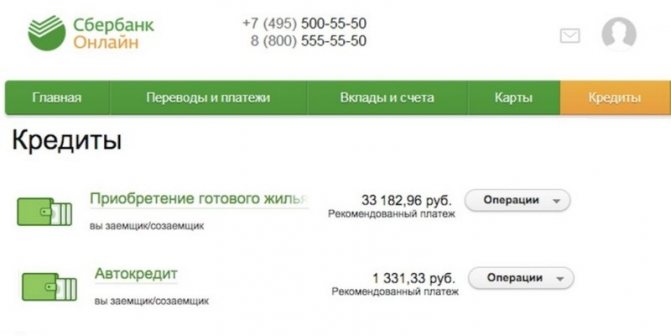

- Once you log in, you need to go to the loans section. There you need to select the loan agreement under which you need to make a payment;

- go to the operations section. Make a payment by indicating the bank card from which funds for payment will be debited;

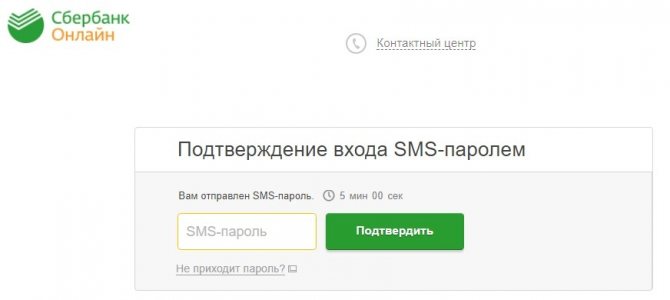

- The operation is confirmed by entering an SMS password using a smartphone ().

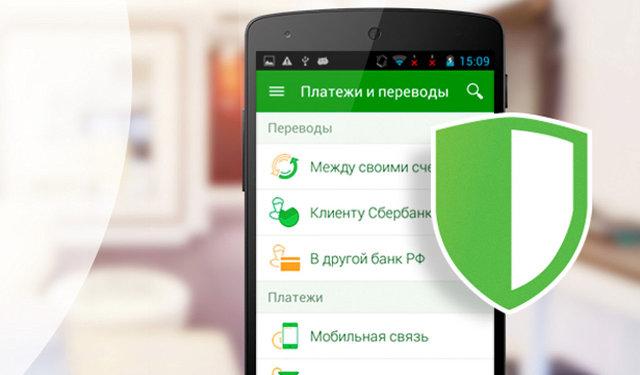

How to make a payment through a mobile application

By installing the Sberbank mobile application on your smartphone, you get a convenient way to manage your accounts and payments at any time of the day. And all this without leaving home or your workplace, in just a couple of minutes.

The application can be installed on a smartphone with any operating system – Android, iOS and others.

How to make a mortgage payment through Sberbank online from your phone:

- enter the login and password that were given when registering in the service;

- in the loans section, select the mortgage loan for which you need to make a payment;

- In the operations section, select Make Payment. We first check the availability of funds on the card;

- the operation is confirmed by SMS indicating a one-time password (the phone is linked to the Sberbank service).

This service allows you to make a payment for any loan from most Russian banks from your personal account. But for such operations a commission of 1% is taken.

We pay through third-party services

You can also pay for a Sberbank mortgage using the services of other banks. Let's look at the main options using examples.

Recommended article: Is it worth applying for Domclick mortgage reviews online

Payment from a card of another bank

If you are the owner of a bank card, you can use the VTB Online (Telebank) service or the bank’s mobile application. Many credit institutions now have similar services with convenient functionality.

You can pay your mortgage on the VTB website online by following simple steps. Log in to VTB Online by entering your username and password. Open the Transfers tab and use the function of repaying loans from other banks.

We select a bank using the bank's BIC or by entering the loan agreement number.

Next, enter the necessary data of the borrower and the agreement, select the card from which the funds are debited, Enter the payment amount, and make a standard confirmation of the transaction.

The term for paying a Sberbank mortgage from a card of another bank can be up to 3 business days, and there may be a commission. Details can be found on the VTB Bank hotline.

Payment from a mobile application of another bank

Many banks now also have their own proprietary mobile application for smartphones. In this case, you can pay for your Sberbank mortgage through such a service. Many of these applications can be downloaded from the Play Store or other systems, as well as from bank websites.

Having downloaded and installed, for example, the VTB application on a smartphone, you need to register in the application and then log in using your username and password. To pay for a Sberbank mortgage through the mobile application, you need to go to the payments and transfers section, then open the Rest item. Here you should enter all the necessary data, namely:

- indicate the receiving bank of the funds;

- details of the loan agreement;

- payment amount.

Next, pay for the Sberbank mortgage through VTB, also confirming your consent to the transaction.

This is a convenient and safe way to make financial transactions, for which it is enough to have a smartphone with the bank’s application installed.

In order not to have to re-enter all the data every month to pay for a Sberbank mortgage through the application, you can create a payment template in the application and use it regularly.

Payment from the current account of a legal entity

Quite a rare type of mortgage payment payment. If any organization undertakes to pay a mortgage for a borrower under certain conditions, then it must provide all the information on the details of the mortgage account with the bank.

Recommended article: Gazprombank mortgage without down payment

It should be borne in mind that when choosing this method, the borrower is deprived of a tax deduction. Indeed, the costs are borne by the legal entity, not the borrower. The borrower will also be forced to pay thirteen percent of income tax. After all, repayment amounts with this method are the income of an individual.

How to quickly pay a mortgage through Sberbank Online: step-by-step instructions

Making payments remotely allows you to avoid the need to personally visit the office of a financial institution, which significantly saves time. Instructions on how to pay a mortgage through Sberbank Online will allow you to understand the features of the procedure in advance and avoid difficulties. You must adhere to the following algorithm:

- Go to the official website and log in.

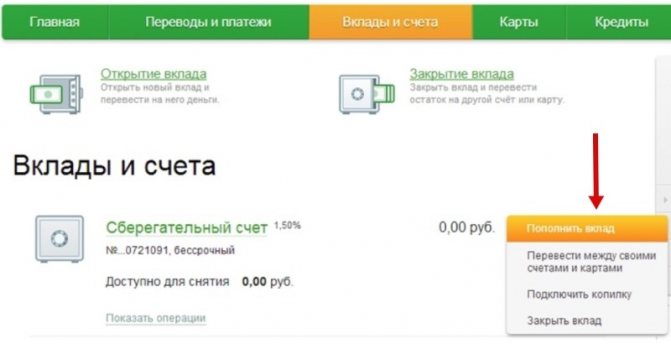

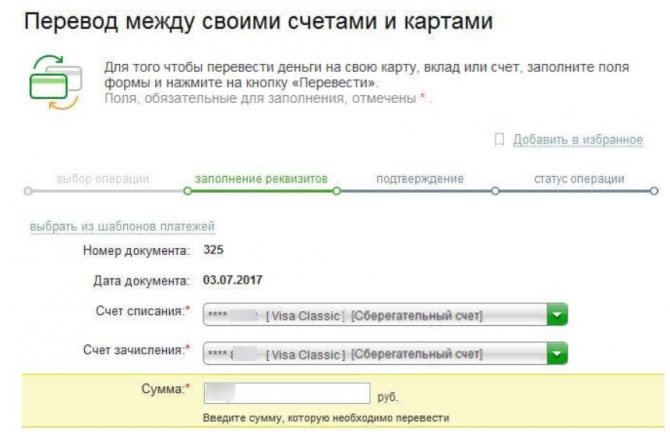

- Top up an account opened with a financial institution. To do this, you need to go to the deposits and accounts section, and then click on the appropriate item. You need to activate the “Top up account” function. Next, you need to click on the “Transfer between accounts” column.

- If you need to pay for a mortgage through Sberbank Online, you will need to indicate the card number and transfer options in the empty fields that appear.

- Click on the “Transfer” button and confirm the operation.

Using the above scheme, you can pay for your mortgage through Sberbank Online within 5 minutes. But you need to make sure that the money has arrived in your account. To do this, you need to select the “Loans” item in the menu, and then go to the “Purchase of housing” section and familiarize yourself with the service that is paid for. Here you will see information about your account status. The financial institution allows you to make payments ahead of schedule. But for this you have to write an application. The debt is paid by transferring money in favor of a credit institution.

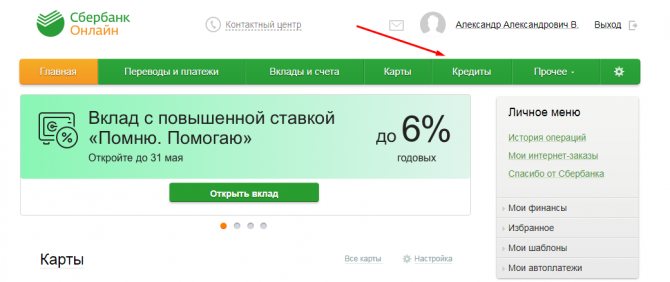

Login to Sberbank Online

The transition to Sberbank Online is carried out on the official website in your personal account.

To get into your personal account, you will need to specify your username and password, and then click on the login button. An SMS with a code will be sent to the phone number linked to the card. It works within 5 minutes. The combination must be specified for authorization in the system. If you fail to meet the deadline, you must request the code again.

Login to Sberbank Online can be done from a computer or phone. The authorization procedure is identical. If you are using a mobile device, the system will prompt you to install the application. If the client does not want to perform the procedure, you can go to the browser menu and click on the “Full version” item. The method will allow you to access the authorization window through your personal account.

Sberbank protects clients. During each login, the owner of the payment instrument receives an SMS notification that the authorization procedure has occurred.

From which account are the funds debited?

To make a payment, you need to specify an account. When applying for a mortgage at Sberbank, a citizen signs an agreement to open a loan. The account will be used to calculate the total amount and then write off the debt. To complete the procedure, open one of the following deposits:

- universal;

- poste restante;

- savings account.

All of them are designed for calculations. Therefore, the interest rate on offers is minimal. To find out to which account the mortgage payment should be made in Sberbank Online, you need to read the loan agreement or request data via the Internet.

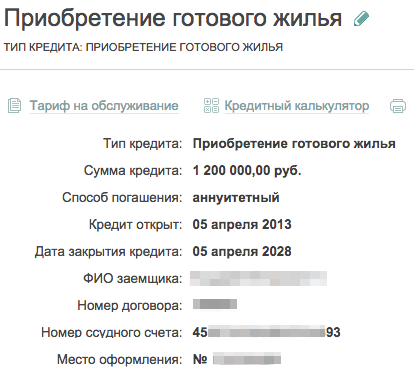

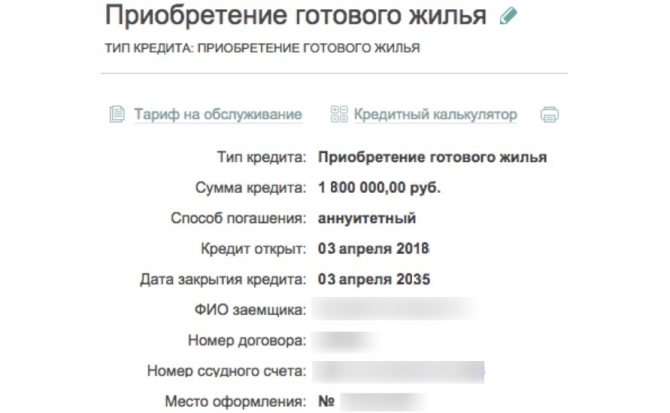

In the second case, you need to go to the Loans tab. In the list that appears, you need to select the offer you are interested in and click on it. Complete information about the product will appear on a new page.

Displayed here:

- type of service;

- amount provided;

- methods of closure;

- dates of loan and moment of repayment;

- information about the borrower;

- contract number;

- place of registration;

- loan account number.

The required attribute is the last parameter.

How to save a template for payment

In order not to enter data every time, you need to save the completed payment as a template. To do this, you need to click on the button of the same name, which appears after the transfer of funds. The system will prompt you to specify a name for the template. Then you have to confirm the operation by entering a one-time SMS password.

The template will appear in your personal menu. This is where you need to go in the future to pay your mortgage. You can also use the template through the mobile application. It will be located in the payments section in the sub-item of the same name.

Is it possible to pay a mortgage through Sberbank Online

Sberbank's electronic banking system provides numerous options for remote management of client accounts, incl. and open upon concluding a mortgage transaction to service it. The client gets the opportunity for free and remotely:

- view the exact amount of the credit balance;

- pay the mortgage;

- control repayments through a detailed statement;

- clarify the amount and make early full or partial repayment of the debt.

This form of payment helps clients pay regular monthly payments on time, forming a positive credit history, preventing the occurrence of overdue debt, accrual of penalties and fines, and simply saving time.

How to pay a mortgage through Sberbank Online - step-by-step instructions to help clients include interesting functionality for owners of any Sberbank plastic debit cards, who, having gained access to online banking, can make payments to repay existing loans in other banking or credit organizations using a wire transfer funds by account number in the “Repayment of loans in another bank” block. The only disadvantage of this option is that the bank charges additional commission.

Connecting the Sberbank Online application and paying your mortgage through mobile banking

We recommend installing the Sberbank application on mobile devices. This will allow you to make payments without access to a computer. You can download it for iOS on the AppStore, for Android in the Play Market, and for Windows Phone in the marketplace or Windows Phone Store.

The client just needs to find the program and start downloading. The application will be installed on your mobile device automatically. To use it to pay your mortgage, you must follow the following instructions:

- A citizen enters the application and selects the payments tab.

- You must give preference to one of two points - between your accounts or to a Sberbank client. The difference is that the account details belonging to the client are immediately displayed in the application. Then it will be enough to choose where the funds will be debited from and where they will go. If the “Sberbank Client” option is selected, you will need to enter the data yourself and confirm the transfer using a short SMS message.

- Specify the debit amount and confirm the transfer.

Step-by-step instructions for paying a mortgage through Sberbank Online

The whole process is divided into successive stages. Initially, you need to register in the system, after which you will find the required section. The form is filled out correctly, after which the required amount of money is transferred to pay for the mortgage.

Is there any benefit to paying off a mortgage with Sberbank early? Read here.

From which account are the funds debited?

When applying for a mortgage loan, a special account is opened for each borrower, into which funds must be deposited to pay the loan.

It can be universal or savings, and often a demand account is opened. All of the above accounts differ in the established interest rates, as well as the ability to write off funds if necessary.

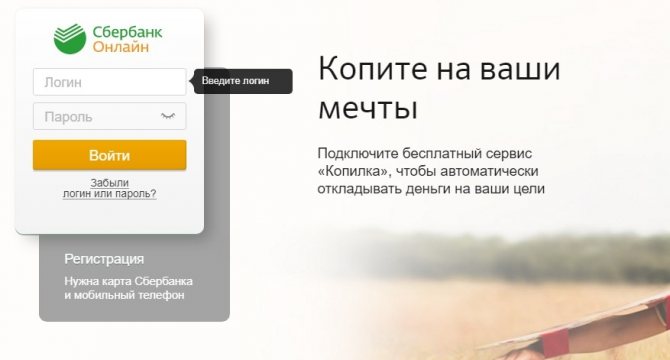

How to register in the system

To use the Sberbank Online service to pay a mortgage, you must first register with it.

This process is implemented in successive stages:

- you need to find an ATM owned by Sberbank;

- Using the card, you need to select in the main menu the section intended for connecting Sberbank Online;

- select the Registration line, where the card number is indicated and the password is entered, which will be sent to the phone in the form of an SMS message;

- To do this, the Mobile Bank service must be connected to the card;

- the user comes up with a login and password that will be used to log into the service.

After completing all the necessary actions, the citizen receives permanent access to Sberbank Online, which can be used even at night.

How is it paid?

After gaining access to the service, you can begin paying your mortgage.

To do this, follow these steps:

- First you need to log in to the system. To do this, visit the official website of Sberbank Online. Below are the previously created login and password. Afterwards you need to log in, for which you will receive an SMS with a one-time password on your phone.

- Next, a deposit is selected that is opened to pay for the mortgage during the process of applying for a loan at a Sberbank branch.

- Afterwards, select the “Credit” tab, where you can see the citizen’s loans. An operation involving replenishment of the account is selected.

- The required account is selected from which the selected amount will be debited, which is transferred to the account from which funds are withdrawn to pay the mortgage.

Who is a mortgage co-borrower and what does he provide? The answers are here.

Important! The procedure is simplified when creating a template.

Replenishment methods

It is clearly visible on the main page after registration in the Sberbank Online system, like other cards belonging to the same client.

You can top it up in different ways:

- through Sberbank Online by transferring from other cards or accounts;

- using ATMs of different banks;

- transfers of funds from accounts opened in other banking organizations;

- depositing funds in cash at the Sberbank cash desk;

- use of special online services;

- payment by transferring funds from electronic wallets.

There is no prohibition on paying for a mortgage with a credit card issued at Sberbank, but such a card charges a high interest rate, so using such a scheme is not very profitable for payers.

How the template is saved

When carrying out the procedure of transferring money from one account to another, you will see a button at the bottom with which the template is saved. You can even create the best name for it yourself.

In the future, when you need to transfer money to your mortgage account, you just need to select the desired option in your personal account templates.

Is it possible to pay off a mortgage at Sberbank Online ahead of schedule?

Payment for a mortgage through Sberbank Online can be made before the end of the contract. Obligations will be able to be closed in whole or in part. The financial organization has canceled the deadlines that act as restrictions for making payments. Previously, it was necessary to wait three months after the loan was issued. There is also no minimum payment amount.

Contacting a bank branch will theoretically speed up the crediting of funds to your account. You must obtain a certificate of no debt from a bank branch. Then the mortgage account is closed. The citizen will have to remove the encumbrance from the property and cancel the insurance.

How to calculate the early payment date

If you make a partial early repayment of a loan through Sberbank Online, the amount does not immediately go toward the debt. The operation will take place at the time when the next payment is due according to the schedule. On the next day after early repayment, a new scheme for closing obligations is drawn up.

Early settlement entails a reduction in the amount of the principal debt and the amount of accrued interest. But the last day of payment remains the same. Only the size of the monthly payments changes. If you regularly pay your debt ahead of schedule, you can significantly reduce the amount of overpayment. As a result, it can be paid off in one go.

A mortgage with Sberbank Online is paid in the same way as any other type of loan.

You can use a mortgage calculator to calculate.

Conditions for partial loan repayment

In order for a client to repay a Sberbank mortgage ahead of schedule, it is enough to have the required amount of money in the account. It is credited to the card or deposited through the terminal. Then you have to write a statement to close the obligations before the expiration of the contract.

Partial early repayment at Sberbank is carried out only by reducing the size of the monthly payment. It will not be possible to reduce the deadline for closing obligations.

How to pay a mortgage through Sberbank Online?

Payment of a mortgage through Sberbank Online is carried out without commission, and the payment transfer period is up to 1 business day. Payment instructions may vary depending on the special conditions that are specified in the mortgage agreement. Such conditions are the payee's account. This could be a credit account or a deposit. If you pay for a mortgage at Sberbank from a card of another bank, a commission of 1% will be charged, but not more than 1 thousand rubles.

Instructions for paying a mortgage loan

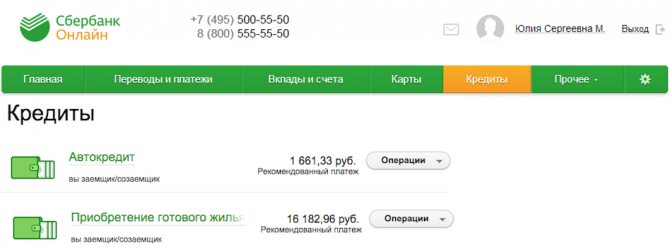

After authorization in your personal account, the user needs to go to the “Credits” tab. Information about all existing loans will be provided here, if the citizen has several of them. You must select the item that corresponds to the mortgage payment. It is usually called “Purchasing a Home”.

If you open the tab, you can see information on the mortgage:

- Date of loan;

- Sum;

- Place of conclusion of the contract;

- Contract number;

- Payee's account;

- Borrower's full name.

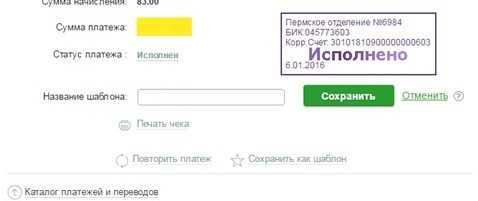

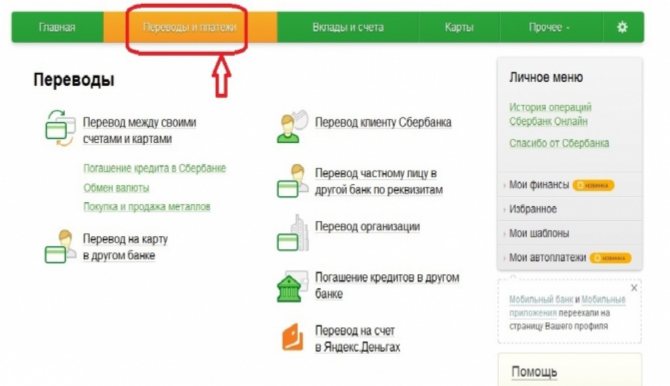

There will be no direct form for making a payment in this tab. However, the client needs to view the invoice here for payment. It may also be specified in the mortgage agreement. After the user copies the account number for paying the mortgage, you need to go to the “Payments and Transfers” -> “Loan Repayment” tab.

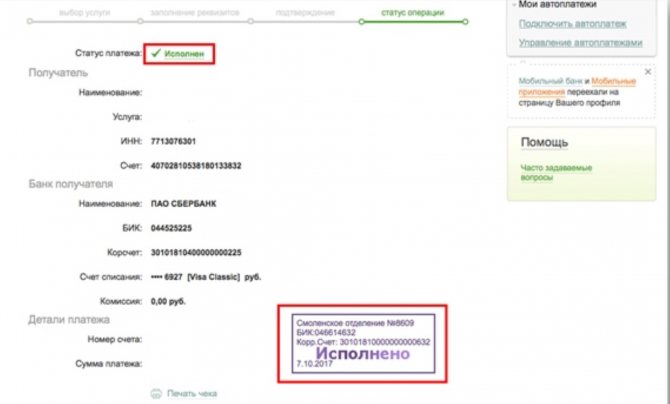

In this tab there will be a form for repaying the loan, where you will need to write down the account number of the payee, select your own account or card from which to write off and indicate the payment amount. At the end, the transaction will need to be confirmed with a one-time code that will be sent to the user’s mobile phone number. The system will display a message indicating that the transfer was successful, which will look like a stamp marked “Completed.” To facilitate future payments, the user is recommended to select “Save template as” at the bottom. Thus, the form with the details already filled out will need to be looked for not in the “Loan repayment” tab, but in the “Templates”.

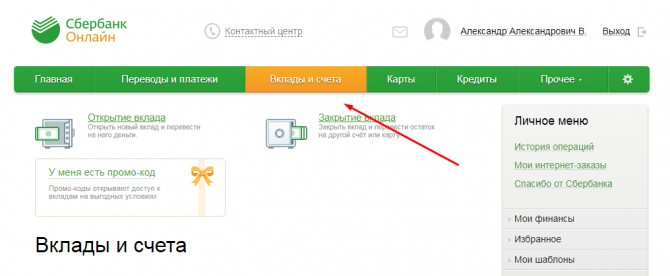

Instructions for paying for a mortgage registered as a deposit

The mortgage agreement may indicate that it is a deposit:

- Universal;

- Savings account;

- Poste restante.

Most often, a mortgage is created as a deposit if the agreement specifies payment in annuity payments, which means payment in equal installments. To pay for a mortgage of this type, you must immediately go to the “Accounts and Deposits” tab after authorization. Find the deposit that matches the mortgage and click on it. Next, a form will open to fill out, where you will only need to indicate the amount to be paid, as well as the account from which the payment will be debited.

To confirm the operation, you will need to additionally enter a code from SMS. All actions can also be saved as a template for further convenient payment. If necessary, the user can print a payment receipt, which will confirm the timely payment of funds.

When replenishing the “Universal” deposit, after debiting the payment, at least 10 rubles must remain in the account. In other cases, write-off of all funds is allowed.

How to find out the balance of debt

To obtain information about the balance of debt, you will need to log into your personal account and go to the Loans tab. It is located in the upper right corner. To find out detailed information about the debt of interest, you have to left-click on the product of interest. The system will display the balance and additional information about the service.

Information can also be requested through the mobile application. The request submission procedure is exactly the same as when using the company’s official website.

Is it possible to pay for a mortgage from another bank at Sberbank?

Sberbank Online allows you to repay a loan received from another bank. To perform the operation, you only need to know a number of details. You will have to proceed according to the following scheme:

- Log in to your account and go to the transfers and payments section.

- Select the item “Repay a loan from another bank”, and then indicate the region in which the mortgage was issued. You need to have a loan agreement at hand.

- From the list of options that appears, you need to click on the item “Loans and transfers to another bank using BIC”. Then you will need to provide the required information from the loan agreement.

- Select the account from which the funds will be debited, then continue with the operation. The system will automatically display the name of the bank and ask you to provide an account number. This information is indicated in the loan document.

- Display the full name of the credit account owner and “Continue”. Next, indicate the contract number and contact phone information.

- The payment amount is fixed. It should not be less than that reflected in the loan agreement. The transaction is confirmed. To do this, you need to enter the short password from the SMS message.

The operation requires a fee. Its size is 1% of the amount, but not more than 1000 rubles. Funds will be transferred to your account within 3 business days. It is advisable to make payments in advance.

Step-by-step instructions for paying off your mortgage

Repaying a loan through a mobile application is a simple and accessible procedure. However, clients doing it for the first time in their lives may experience some difficulties. Our detailed instructions will help you quickly understand all the functions of the application, so you can easily and quickly pay off your existing debt:

- Open the main page of the application, enter your username and password, then click the “Login” button.

- A one-time password will be sent to your phone, which consists of 5 digits; use it to confirm the authorization procedure. The password should be entered in the special field, and then click the “Confirm” button.

- The next step is to go to the “Credits” tab. In the window that opens, you will see a list of all loans issued by the bank, including mortgages.

- To view the information on the loan, click on its name - a window will immediately open in front of you with information on the amounts, repayment method, agreement number, your personal data, date of registration and closing, etc.

- If the loan agreement provides for annuity payments on the loan (that is, payment in equal installments), click the “Deposits and Accounts” button, then select the account you need and click the “Operations” button, then “Top up account”. When applying for a mortgage at Sberbank, in addition to the main agreement, the client enters into an additional agreement to open a bank account. According to it, this account is used to credit the principal amount of the mortgage and subsequently write off payments. This account can be a “Universal” deposit, a “Savings account” or a “Demand deposit”. Each of them is designed for calculations, and the annual rate is the lowest.

- In the window that opens, fill in the required fields: indicate the payment amount, card or account number to write off the amount. To confirm the operation, click the “Transfer” button. After this, the amount required to repay the loan will be debited by the bank from your account.

- If your mortgage is repaid through the “Universal” deposit, then you need to ensure that there is always a minimum balance of 10 rubles on it, that is, the money should be transferred with some reserve. When using the Savings Account deposit, there is no need to maintain a minimum account balance.

READ How to disable fast payment from Sberbank

Within a day, your money will be accepted by the bank to repay the loan. If the transfer is made between your accounts, then there is no commission for the transaction. So that the fact of payment can be proven at any time, we recommend that you always print out receipts and keep them all until the loan is fully repaid. Important point

— when filling out the fields in the mobile application when paying for a loan, be careful to avoid mistakes. If you are mistaken by even one digit, the entire amount will go to the account of another client. Refunding your money will take a lot of your effort, time and nerves. To avoid getting confused with your own invoices and entering them manually each time, we recommend using the template saving function. Enabling it is very simple - click the “Save as template” button. After this, account information will always be stored in your personal menu, in the “My Templates” tab. If you are using a mobile application, then account data should be found in the “Payments” section.

Other methods of paying for mortgage loans at Sberbank

Loan obligations must be fulfilled in a timely manner. In other situations, penalties or interest may be assessed. There are alternative payment methods. The client has the right to replenish the account in one of the following ways:

- Online service. The method allows you to transfer money remotely, but it requires paying a commission.

- Depositing the amount into the cash register. The method is considered the most reliable. The person can be sure that the money has been credited to the account. The operator will prepare all the documents and make transactions in the presence of the citizen.

- Transfer from cards of other banks. The method is popular. But it comes with a commission. We advise you to withdraw the amount and make the payment through the terminal.

- Using ATMs. They are present in many Sberbank branches and shopping centers. Using an ATM may involve additional risks, especially when you need to deposit a large amount.

Tips for working safely with software developed by Sberbank

When starting work, it is important to make sure that the connection is established with the official website of the organization. All other resources are informational and auxiliary in nature. If the site has a different design or repeatedly requires you to provide a phone number, it is better to stop working with it and leave the resource. If you switch to an unsecured connection, the computer will issue a warning. The use of such systems should also be abandoned.

We do not recommend saving your login information in a browser or password manager.

It is important to double check the payment details, verify the information received in the SMS and only then confirm the transfer. If the system prompts you to provide a password for the cancellation procedure, most likely there was an interaction with scammers. If you receive an SMS notification about a payment that has not been made, you must immediately contact the contact center.

conclusions

Using the Sberbank Online system significantly simplifies depositing funds to pay for mortgage loans. The citizen will not have to stand in line. It is important to be vigilant when translating. If the details are incorrect and the citizen has confirmed the payment, the money will not be returned. It is better not to make full early repayment through Sberbank Online. It is safer to deposit money into the cash desk of a financial institution, and then immediately take a certificate confirming that the obligations are completely closed.