Mortgage is the most popular banking product in recent years throughout Russia. And the fact that it is the real estate purchased with the money received that is pledged is only beneficial to the borrower, since at least he does not risk what he already owns. But at the same time, he does not have full ownership of this object. In this article we will tell you whether it is possible to rent out an apartment taken with a mortgage.

What does the law say about renting out a mortgaged apartment?

The first paragraph of Article 40 of the Federal Law “On Encumbrance” clearly states that the owner of real estate purchased with a mortgage, on which loan payments are still being made, have the right to rent out this apartment/house, unless the mortgage agreement prohibits this and the following requirements are met:

- The duration of the lease is no longer than the repayment period of the debt.

- The collateral is not used for commercial purposes.

- The delivery of real estate was carried out legally.

According to banks, leasing a collateral property reduces its liquidity and, accordingly, its market value. According to the Mortgage Law, the lender can hold the borrower liable if the collateral property is damaged or its price tag has been reduced beyond normal wear and tear.

Based on regulations, banks have the right to prohibit renting out housing for daily rent, which will lead to rapid wear and tear.

What requirements do banks put forward when renting mortgaged housing?

In order to allow third parties to remove the collateral property, you must be guided by the mortgage agreement concluded with the banking institution. The most common conditions are:

- The bank admits that the borrower can rent out housing without its approval.

- The mortgage agreement does not say anything about renting the collateral property. The borrower needs to obtain information from the lender in this regard and act or fail to act after receiving a refusal or permission.

- The lender clearly indicates the parameters of the service in the mortgage agreement: period, terms of the agreement, registration of the transaction, etc.

- The borrower, when signing a lease agreement and moving strangers in, must find out whether the bank agrees to this.

- Renting is strictly prohibited. Disagreement to rent out an apartment/house is associated with risks for the banking institution itself, since the resident strangers will have nothing to do with the financial obligation to the lender.

Most banks, of course, allow the rental of mortgaged housing, but only if the following conditions are met:

- The borrower must submit a written application to the bank. Bank employees then promptly review it and provide a positive response if the client is in good standing, that is, makes all payments on time and maintains the home in good condition.

- Insurers are notified that the cost of the property policy is increasing by approximately 20% - 30% of its original price. This increase is justified by the high risk of damage to housing.

- Mortgage housing must be rented with the obligatory conclusion of a lease agreement, which stipulates all payment conditions.

- A tax return is prepared for the year to pay income tax in the amount of 13%.

- The borrower must provide the bank with a photocopy of the rental agreement, personal data and documentation of the tenant, and information from the insurance agency.

Mortgage real estate delivery

Without obtaining the bank's consent, you can rent out an apartment that is pledged only if the loan agreement does not contain a clause on the possible rental of the pledged property (including with military preferential lending).

If such a clause is still present in the contract, the owner is faced with a choice: obtain the consent of the credit institution and rent out the apartment officially, or use an illegal method.

In order to officially rent out an apartment you must:

Submit a written application to the bank with a detailed description of all the circumstances and reasons for the situation. Consideration of such an application takes 5 working days.

Important! Credit organizations do not always oppose the rental of apartments that are under encumbrance. Often, the fact of leasing is an additional guarantee for the bank of timely repayment of the loan.

The bank's consent can be obtained if:

- The property is kept in order.

- The necessary amendments will be made to the compulsory mortgage insurance contract.

After receiving the official consent of the bank, it is necessary to prepare additional documents:

- Certificate of ownership of the apartment or extract from the Unified State Register of Real Estate.

- Certificate of family composition (available from the Housing Office).

- Consent to rent out an apartment from all homeowners. The document must be executed by a notary.

The next stage is searching for tenants and concluding a lease agreement. It should detail the responsibilities for paying utilities and the amount of rent, indicate compliance requirements and indicate payment deadlines. An act of acceptance and transfer of the object must be attached to the contract, and the transaction must be notarized.

This is important to know: Responsibility of the lessor under a lease agreement for non-residential premises: requirements for the agreement

In the future, the lessor must annually pay personal income tax in the amount of 13% of the amount received.

In case of a negative decision, the credit institution is not obliged to explain the reasons for the refusal, but the reasons may be :

- The borrower's credit history has been damaged. Facts of repeated delays in payments and outstanding fines were revealed.

- In the event that the rental agreement is concluded for a period exceeding 1 calendar year.

- If a bank audit reveals the fact of renting out housing without obtaining the consent of the lender.

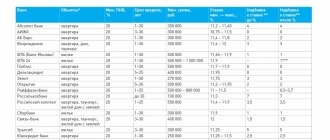

Banks that allow renting collateral housing

VTB Bank, Alfa-Bank, Sberbank, and Svyaz-Bank officially allow renting out collateral housing purchased with mortgage funds. According to the conditions specified in their mortgage agreements, actions to rent out an apartment/house are considered legal if the borrower notifies them in advance of his intentions in writing and receives consent.

Thus, since December 9, 2013, Sberbank has had general conditions for housing lending. And subclause 4.4.15 of the agreement states that the borrower does not have the right to rent out housing or rent it out for free use to relatives or friends without obtaining written consent from Sberbank. He is also entrusted with measures to help maintain the proper condition of the property, along with current and major repairs. Inspectors rarely check bona fide clients. Problems can only arise if you fail to make your mortgage payment on time.

VTB Bank also does not interfere with the rental of an apartment secured as collateral, but only if the borrower necessarily requests permission in writing in advance. On its official portal at the following link https://drive.google.com/file/d/1tTlJoSEwO_BXkEheTMIPX9RX-YnHEj9L/view you can find the procedure for obtaining permission to rent out a mortgaged apartment and an example application form https://drive.google.com/file /d/1J7ws7b72OYhAoPJVlH23qLiSkYIexLnr/view. According to the mortgage agreement, he still has the right to demand early repayment of the full loan amount along with accrued interest and penalties in the following situations:

- The rules for using mortgage housing were violated.

- The creditor was not informed about all the rights of strangers to the pledged property; other encumbrances.

Therefore, you need to inform the bank and insurance company about renting out a mortgaged apartment in order to avoid termination of the mortgage agreement and the application of sanctions.

How to rent out mortgaged housing if the bank has prohibited it?

Even if the mortgage agreement clearly states that renting out housing purchased with mortgage funds is strictly prohibited, there are several ways out of the situation.

First way. First, you need to try to negotiate with the bank manager to revise the previously concluded agreement. For motivation, we can say that without the proceeds from renting out your home, you will not be able to make full mortgage payments on time. The fear that bad debt will arise most often prompts the creditor to compromise with the client.

Second way. You can let people live in mortgaged housing without notifying the bank about it. Most lease agreements between a tenant and a landlord in the Russian Federation are concluded only in words. Even though the law requires a written contract, the parties decide to trust each other and avoid paperwork. In this case, even if the creditor finds out that the mortgaged apartment is actually rented, he will not be able to prove anything, since there is no official document. Therefore, if the mortgage agreement specifies a ban on renting out an apartment to third parties, and an attempt to reach an agreement was unsuccessful, then in fact this can be done only without concluding an official agreement with the tenant.

What happens if you violate the terms of the mortgage agreement?

If the banking institution that issued the mortgage loan accidentally or intentionally discovers to the client that he is renting it out, despite the prohibition, then:

- If such a violation is discovered only for the first time, then the bank can only issue a verbal reprimand and indicate that such actions are unacceptable.

- The lender will record non-compliance with the terms of the mortgage agreement and impose a penalty for deviation from the established rules.

- If, after issuing the first warning, the borrower continues to rent out housing, then the banking institution has the right to terminate the mortgage agreement with him unilaterally and demand early payment of the entire debt along with interest. Where the client will take such a sum for a short period of time, he will not worry.

- If the borrower does not pay the entire amount along with accrued interest, the bank will file a lawsuit to recover the collateral from him. The landlord and tenant will be evicted, and the property itself will be sold at a bank auction. As a result, the mortgage loan will be considered fully repaid, but this will negatively affect the borrower’s credit history.

- Since the fact of renting out housing on an illegal basis becomes known, the client will have problems with the tax authority. He will be given a fine to pay for illegal business activities and tax evasion.

Is it profitable to rent out collateral housing?

On online forums you can often find people discussing whether it is profitable to rent out a home if it is still under a lien from the bank. Let's start with the fact that such a scheme is suitable only for those borrowers who, in addition to a mortgaged apartment/house, also have real estate for living. If the apartment consists of two rooms and there is no separate housing, then you can rent out one room and live in the second. Then you will also be able to control the safety of all property. Three-room premises can be rented room by room.

If a borrower wants to buy an apartment with a mortgage and rent it out immediately, then it is worth choosing liquid options for the purchase. Housing from the secondary real estate market, located near transport interchanges and with good infrastructure, is most in demand. One-room apartments are a priority especially for young couples. The average price tag for housing with modern renovation and built-in appliances ranges from 30 thousand to 50 thousand rubles. in the central regions of the Russian Federation. Housing with two rooms is already more expensive, approximately 50 thousand - 80 thousand rubles.

Reference! Don't forget about the 13% income tax that you will have to pay and utility bills.

Tenants are usually responsible for paying only for the volume of cubic meters of water and kilowatts of electricity, and everything else is paid by the landlord from the money received from the rent.

Note! Many borrowers who have purchased an apartment of three or four rooms rent out the premises for offices and retail outlets, and this turns the property into a commercial type. This will be followed by administrative responsibility.

Is it worth taking out a mortgage if it is ultimately unprofitable?

So, we found out whether it is possible to rent out an apartment with a mortgage (for those who do not understand or have forgotten: it is possible) and how to calculate whether renting is profitable. If it’s profitable, it’s worth taking out a mortgage. What if it’s not profitable? What if expenses exceed income?

Here are some arguments in favor:

- the apartment will still remain yours, and you can monetize it in any other way, for example, by remodeling it and selling it at a higher price;

- The mortgage payment will remain the same, but the cost of housing and the amount of rent will increase - discount the cash flows and find the break-even point;

- after paying off the mortgage, renting out will begin to generate a stable income;

- If you are buying an apartment for yourself, but temporarily cannot pay the mortgage in full, then renting it out can be a good way to save money and build your financial safety net.

In the end, you can use a more aggressive method of renting out: rent out housing daily or monthly during sessions / for business travelers, you can divide the premises into two parts and rent out each separately, you can, on the contrary, make an elite renovation and rent out the apartment at exorbitant prices. something for the majors.

Arguments against":

- you will have to pay extra for the apartment, i.e. it will not be an asset, but a liability;

- you need to incur additional expenses: pay rent and taxes;

- after some residents will have to spend money on repairs;

- if you take it unofficially, it is fraught with unpleasant consequences;

- you may not be able to find tenants, and as a result, the living space will be idle;

- tenants may unexpectedly move out, damage the property, or particularly cunning ones may sublet the property or try to cheat in another way (for example, try to sell the apartment by posing as the owners);

- the price of real estate, and therefore rent, may fall.

Here’s another interesting article: Where to invest in euros: a complete overview of options

Thus, you can rent out an apartment with a mortgage - both officially and unofficially (and it is better officially). But whether it is profitable or not - you need to consider it. If it is profitable and you receive income or have found a balance point, then you can make renting out an apartment your business. If not, think about it: in some cases, taking out a mortgage and renting it out is still profitable. Good luck, and may the money be with you!

An example of calculating income and expenses when renting out real estate

To clearly show the costs of purchasing a finished apartment with a mortgage for its further rental to third parties, we use the mortgage program from VTB. The minimum interest rate for the use of borrowed funds is 9.7%, the lending period is 30 years. For example, the price of an apartment is 2.5 million rubles, and the down payment is 250 thousand rubles. (i.e. 10%). The monthly payment will be 16,200 rubles.

Renting an apartment from one room will allow you to receive 20 thousand rubles per month. + utility bills. Along with this, there will be an obligation to pay income tax in the amount of 13% and an insurance premium.

The total amount of monthly deductions will then be: 16200 (mandatory contribution) +2106 (tax) + 90 rubles. (addition to the insurance price tag) = 18,396 rubles.

As a result, it turns out that the money received from the tenant will cover the monthly mortgage payment, but only if the borrower also has real estate in which to live and not spend money on rent. If we consider housing located in Moscow or St. Petersburg, the result will be similar. The high cost of interest rates and mortgage payments is offset by the high price tag of rental housing.

Why can a bank or insurance company refuse?

Categorical refusals by banks and insurance companies are rare. They are not required to explain the reasons. The most likely:

- the amount of the debt is close to the appraised value of the housing, and if the tenants turn out to be careless, the amount of the collateral (=the cost of the apartment) will no longer cover the loan issued;

- identifying in the client’s history facts of abuse, violation of the law, directly or indirectly related to real estate transactions;

- If you apply verbally, there is a chance that you will end up with a specialist who is not sufficiently competent in the question of whether it is possible to rent out an apartment with a mortgage.

The insurance company will likely refuse to pay if an insured event occurs and the fault of the tenant living without the knowledge of the insurer is proven. To avoid this situation, notify the agent of your intention to rent out the apartment. The cost of the insurance policy will increase. The expenses are reasonable, and the rent will cover them in the first month.

Recommended article: Escrow account, what is it in simple words and how will the mortgage transaction proceed?

Risks

We described the advantages of renting out a mortgaged apartment in the previous paragraph - this is, first of all, the benefit in the form of covering the monthly mortgage payment with monthly rent. But there are also disadvantages, and first of all they concern the tenant. Before renting an apartment, it is recommended to immediately ask the owner whether the property is under encumbrance. If it turns out that it is still mortgaged, it is recommended to immediately check whether the lender has given consent to this. If you do not, the lease will be invalid and the tenant will have to vacate immediately.

Materiel: is it profitable to rent?

Now let’s calculate how profitable it is to rent out an apartment with a mortgage and what needs to be taken into account.

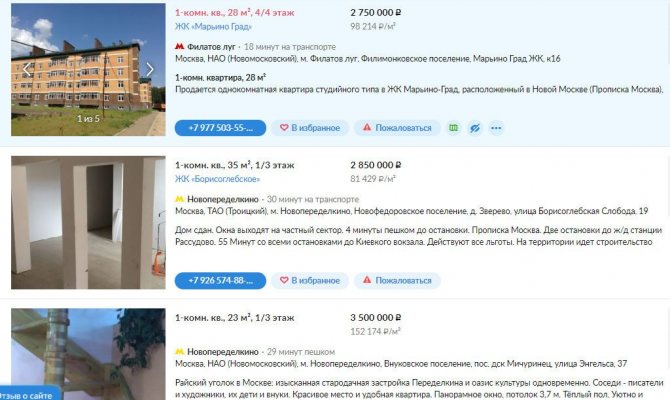

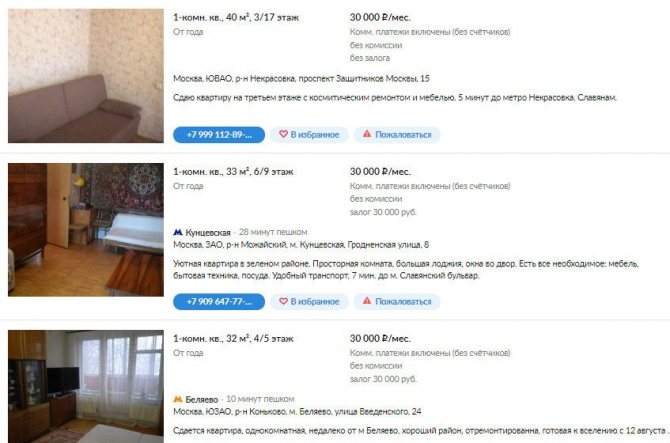

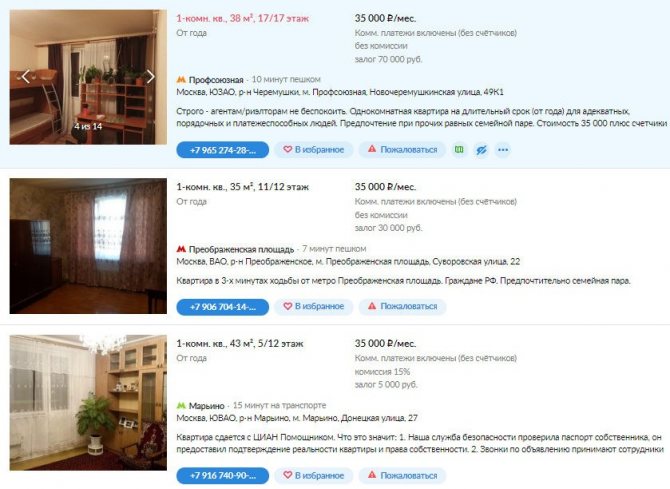

Let's take, for example, a one-room apartment in Moscow with an area of approximately 40-45 square meters, resale, from the owner. The cheapest options, according to the Cian website, start at around 2.75-3.5 million rubles. Let there be 3 million rubles for a convenient account.

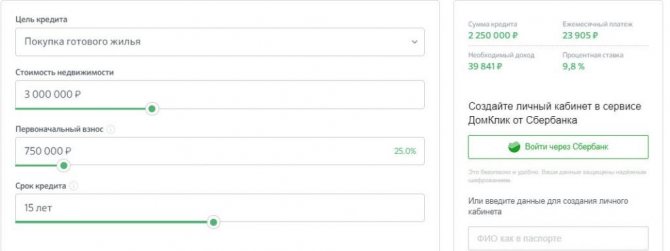

Let's say a certain Vasya has 750 thousand rubles for a down payment (this is 25% of the cost of housing). It’s quite enough to get a mortgage from Sberbank. In this case, the mortgage parameters will be as follows:

- loan amount – 2,250,000 rubles;

- rate – 9.8%;

- payment – 23,905 rubles.

You can rent out such an apartment in Moscow for at least 20-25 thousand rubles, and if you try (furnish it properly, redo “grandmother’s renovation” to look like Euro or high-tech, drag in a microwave and run the washing machine in the right direction according to Feng Shui), then for 30. Let there be these same 30 thousand.

What are the costs? A mortgage is understandable, here we pay 23.9 thousand rubles. Other expenses are utilities + taxes (we are honest landlords).

Utility costs are already included in the rent, i.e. the tenant does not pay for them, so they fall on the shoulders of the owner. Let a communal apartment in a Moscow one-room apartment cost 5 thousand rubles (for good measure). Meters are paid separately, they will be paid by residents, so we do not take them into account.

Now the tax. Profit from renting out – 30 thousand. We subtract 5 thousand - the cost of maintaining the apartment. What remains is net profit - 25 thousand. Tax – 13% of this amount, i.e. 3250 rubles.

Total expenses:

- mortgage – 23,900 rubles;

- communal apartment - 5000 rubles;

- taxes – 3250 rubles.

Total: 32150 rubles.

Obviously, renting out such housing for 30 thousand is unprofitable. You need to ask for at least 33 thousand, or better yet 35 thousand, in order to be able to pay for unplanned expenses (repairs, painting, purchase of equipment, etc.).

And here’s another interesting article: How to make money on Zaimoteka by issuing private loans?

And so the same CIAN shows that such prices exist. And I would not say that such apartments shine with renovation or unique location.

Conclusion: first calculate the costs, and then plan how and at what price to rent out a mortgaged apartment.

Naturally, each city and even a separate region of Moscow will have its own prices - I just gave an example of how an investor should think.

Additionally, you need to include expenses for individual entrepreneurs if you take out a commercial mortgage. Therefore, you either need to raise the rent or look for an option with a cheaper mortgage.

By the way, if you don’t know where to get a down payment for a mortgage and you have a small salary, then read this article.