Features of donating property

If you want to donate real estate, its owner must draw up a gift agreement (in everyday life - a deed of gift) and sign it on behalf of the donor. The recipient must also sign to indicate his agreement to receive the gift. The agreement does not have to be certified by a notary, but it must undergo a mandatory registration procedure with the Office of the Federal Service for State Registration, Cadastre and Cartography (Rosreestr).

The essence of donation is the gratuitous transfer of property from the donor to the donee. A gift agreement is convenient to use in certain cases, for example, as an alternative to a will, or if you want to free property from the danger of division upon divorce.

This form of transaction has certain limitations:

- the donor cannot be an incapacitated person or his representative;

- It is prohibited to give gifts worth more than 3,000 rubles. officials and social workers;

- a gift agreement cannot be concluded between commercial companies.

The donee is required to pay an income tax of 13%, except when the donor is his close relative, which includes:

- parents and children;

- grandparents and grandchildren;

- sisters and brothers;

- spouses.

For this reason, most often a gift agreement is concluded between close relatives.

Please note that a gift agreement can only be canceled under the conditions specified in the agreement itself, or through the court. For this reason, the donor should carefully consider the possible consequences of the act of donation.

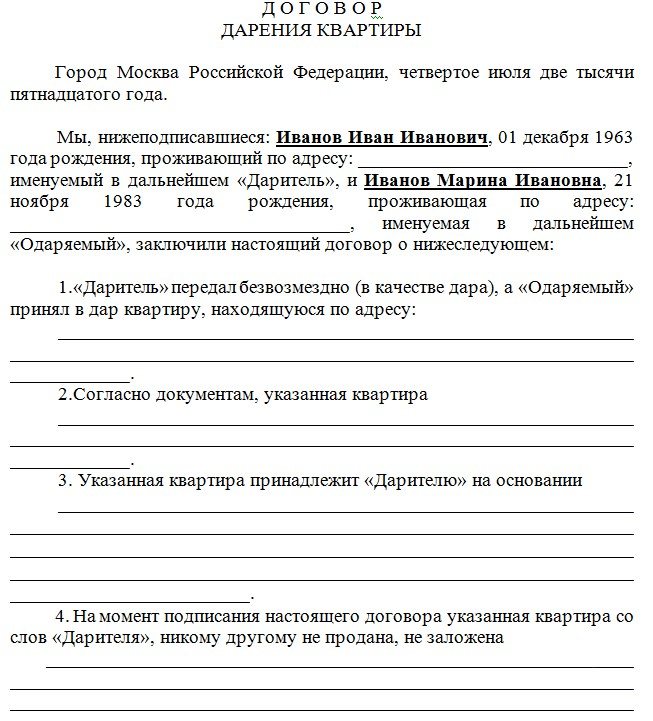

(example) gift agreement

To draw up an apartment donation agreement, you do not have to go to a notary: you can draw up an agreement yourself using a ready-made form or sample, which can be downloaded below. The samples comply with the legislation for 2017.

A transfer deed may be attached to the agreement, which records the fact of transfer of property to the donee, but the presence of such a deed is not necessary.

Please note that donating a car does not require registration at the MFC or Rosreestr.

Choose the option that suits you, fill in your data, print, sign. You can add your own terms to the contract, for example, specify the conditions for its cancellation (for example, the death of the donee or his careless attitude towards the gift, etc.).

When donating an apartment, notarization of the contract is not required. However, in the case of donating a share of an apartment, a notarized donation agreement is required.

Advice: when notarizing a gift agreement, check with the notary whether he himself can send the agreement for registration for you - many notaries now have this opportunity.

| Tired of reading? Save time, ask a lawyer a question for FREE: |

Preparation of contract

When drawing up a contract yourself, it is worth considering some nuances:

- an agreement for the gratuitous alienation of an apartment is drawn up in simple written form (oral transfer of a gift is allowed if its amount is less than 3 thousand rubles);

- the form must contain the following data: details of the parties, information from the housing cadastral passport, including its value, list of suspending documents, date of transfer of property, who is registered in the apartment at the time of registration of documents, date, signatures of the parties;

- the deed of gift does not require notarization. This can be done voluntarily.

This is important to know: Features of termination of a gift agreement

To ensure that the agreement does not contradict domestic legislation and is drawn up in accordance with the rules of document flow, it is recommended when preparing the original paper to use a template that looks like this:

Where can I make a deed of gift?

Registration of the agreement takes place in Rosreestr. There are several ways to submit a package of documents to the registrar:

- by contacting the representative office of Rosreestr, which is located in all major cities;

- visit any office of the multifunctional center;

- by legalizing the gift agreement through a notary.

All parties to the agreement or their authorized representatives must be present when filing.

Package of necessary documents

State registration of gratuitous alienation of an apartment is possible if the following package of documents is provided:

- passports of the parties;

- suspensive documents for real estate;

- agreement template in triplicate;

- registration application;

- receipt of payment of state duty;

- certificate of family composition;

- evidence that the donor has no debt for housing and communal services;

- cadastral documents.

If the recipient is a minor, the agreement is signed by a legal representative instead. When a daughter is between 14 and 18 years old, she signs on her own in the presence of her parents and guardians.

Registration of the agreement

To register a deed of gift, the parties must file documents with the registrar (Registration Office). The legalization of the gift agreement will be completed after checking the legality of the agreement and the accuracy of the submitted documents.

Registration costs and taxes

According to Art. 217 of the Tax Code of the Russian Federation, when registering a deed of gift in favor of a daughter, there is no need to pay income tax. The beneficiary must pay the state fee associated with registration in the amount of 2 thousand rubles (Article 333 of the Tax Code of the Russian Federation). When contacting a notary, you will additionally have to pay services for preparing the agreement form, a notary fee in the amount of 0.3% of the assessed value of the property, but not less than 300 rubles.

Where to go to register a gift agreement

How to draw up a gift agreement? There are several options:

- personally contact Rosreestr (Office of the Federal Service for State Registration, Cadastre and Cartography), which, in fact, carries out the registration of rights to real estate; You can make an appointment in advance on the Rosreestr website

- personally contact the nearest MFC, which will transfer all documentation to Rosreestr

- send an application for registration by mail to Rosreestr at the location of the property, with a list of attachments and a notification of delivery; in this option, all signatures must be notarized

- submit an application electronically to Rosreestr through their website, but in this option you must have an enhanced qualified electronic signature (UKES), which you must first obtain on your electronic media by personally appearing at a special accredited center of the Ministry of Communications, with a passport and SNILS (for a fee, cost in 2020 from 1500 rubles to 5000 rubles per year).

Below we will tell you how you can register a gift agreement at the MFC (the simplest and most convenient option).

The procedure for registering a donation at the MFC

It is not difficult to draw up a gift deed at the MFC; you just need to follow 4 simple steps.

STEP 1. Prepare the necessary documents and pay the state fee.

What documents will be required when registering a gift deed? The list of documents is given below - using the example of registration of an apartment donation agreement.

- a document confirming the identity of the applicant or representative (if his representative submits the application), in the latter case also a document confirming the authority of the representative

Please note: both the donor and the recipient, or their representatives, must be present with identification documents.

- gift agreement in 3 copies

- receipt of payment of the state fee (optional, but the state fee must be paid in advance)

- certificate of ownership of residential premises: the original “green card” (certificate of ownership), if any, or an extract from the Unified State Register of Real Estate (USRN), confirming the rights of the donor, which should be pre-ordered at Rosreestr or at the MFC

- consent of the legal representative, if the donee is incapacitated or a minor citizen;

- notarized consent of the spouse for alienation, if the donor is married and the apartment was purchased and not received as a gift or privatized.

When registering a donation of other real estate objects, for example, a share of an apartment, a plot of land, a garage, the list of documents may differ. You can clarify the information by calling your MFC, or by calling the Moscow State Service Centers - it operates 24 hours a day, seven days a week - or by calling Rosreestr.

You can also use the online service for selecting the necessary documents on the Rosreestr website.

STEP 2. Select the MFC closest to you and make sure that they provide services there. A reliable list of MFCs by region of Russia with telephone numbers and websites is presented on our website. Pay the state fee, the cost for individuals is 2000 rubles.

Receipts are usually available from the selected MFC website. An example of a receipt (for the Voronezh region) is available.

Please note: if the property is located in another region, you should not contact the MFC, but directly to the Rosreestr in your region.

STEP 3. Personally appear at the selected MFC for both parties to the gift transaction and submit all documents to the employee. An MFC employee will fill out an application for registering a gift for you, which you will sign, check the documents, give you a receipt for receipt of the documents and inform you of the deadline for readiness. By law, this period does not exceed 10 days from the date of receipt of documents at Rosreestr.

STEP 4. After the expiration of the period allotted for registering the donee’s right to the donated property (this period will be indicated in the receipt received from the MFC employee), come to the MFC and receive back the gift agreement with a mark from Rosreestr on the registration of the right, as well as an extract from the Unified State Register with seal of Rosreestr on registered rights.

When is a visit to a notary required?

In the comments there were many similar questions regarding the donation of shares in real estate, plus changes to the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” will soon come into force, so it would be appropriate to write a little about the role of notaries in real estate alienation transactions .

According to Part 1 of Article 42 of Federal Law No. 218-FZ of July 13, 2015, all transactions for the alienation of shares in the right of common ownership of real estate are subject to notarization (with the exception of certain cases that are not related to donation). And if you decide to donate your share in the common property, then a visit to the notary cannot be avoided. The degree of relationship or even the fact that the donee, after the end of the transaction, will become the sole owner of the property is not important.

From 01.02.2019, in accordance with clause 10 of Article 1 of the Federal Law of 03.08.2018 No. 338-FZ, notaries have an obligation to submit an agreement for registration to Rosreestr. You can refuse and do it yourself, but the notary must perform this action without charging additional fees . Deadlines for submitting a contract to Rosreestr by a notary:

- within 24 hours if the submission is electronic;

- two days if it is paper.

In situations where the property has only one owner, you can safely fill out the gift agreement in triplicate and go to the MFC. The same rule applies if the sole owner does not give away the entire property, but only a share. The main conclusion: if there is only one owner, then a notary is not needed, if there are several, you will have to fork out money .

Read also: Temporary registration through the MFC

But here we should not forget that in addition to shared ownership, there is joint ownership. If housing was acquired during marriage and is registered in the name of one of the spouses without allocating shares, then it is joint property. Before going to “My Documents”, you need to notarize the second spouse’s consent to the alienation .

Now let's talk about the changes this year . On July 31, 2020, Federal Law No. 76-FZ dated May 1, 2019, which amended Federal Law No. 218-FZ dated July 13, 2015, “On State Registration of Real Estate,” comes into force. The innovation will make it possible to carry out transactions without involving a notary when all participants in shared ownership their shares under one agreement . Key phrases are highlighted in bold: the transaction is concluded in one agreement by all co-owners!

Example : The apartment is in shared ownership of the spouses, each of whom has 1/2. At a family council, they decided to give the apartment to their daughter. From July 31, parents will be able to donate their shares in one agreement without notarization.