Home/Applying for a mortgage/Mortgage in another city

Citizens have the right to move freely throughout the territory of the Russian Federation. If a person decides to move to another city, he will need housing. Not all people have enough funds to purchase an apartment on their own. Banks are ready to issue mortgages. However, financial organizations prefer to lend money for the purchase of housing located in the same region in which the citizen is registered. This way the company minimizes the risks it may face in the event of borrower insolvency. However, in some situations it is still possible to take out a mortgage in another city. To understand in what cases companies will agree to approve an application for a mortgage loan in another region, it is necessary to study the issue in detail.

Is it possible to get a mortgage for an apartment in another city?

The main law regulating the provision of mortgages is Federal Law No. 102 of July 16, 1998. The legal act does not contain a ban on issuing a mortgage loan in another city. Therefore, a person can actually use the service. However, it must be remembered that issuing a mortgage is the right of a financial organization, and not its obligation. The company may reject an application for a mortgage in another city without giving reasons. When evaluating clients, the bank takes into account the profitability of the transaction.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call ext. 157 Moscow; ext.953 St. Petersburg; +7 (800) 700-99-56 ext. 402 Free call for all of Russia.

A borrower moving to another city may face difficulties in finding a job. In addition, it is not always possible to get a job in another locality. As a result, the person will decide to return back. The bank cannot control the process. It will be difficult for company employees to reach a borrower located in another locality. Therefore, banks prefer not to issue mortgages in another city.

However, the possibility of getting a mortgage loan approved in another region still exists. The chance of receiving a positive decision will be higher if:

- parents buy housing for children who will study in another city;

- a person takes out a mortgage to rent out real estate;

- the person was transferred to a position in another region, and the salary increased.

In all of the above situations, the bank will accommodate you halfway. Experts advise applying to online financial institutions. Examples of such companies are:

- Sberbank;

- VTB;

- Gazprombank;

- Post Bank.

Please note:

Organizations have many branches that interact with each other. Moreover, cooperation is carried out both on issues of issuing a mortgage loan and on collecting funds.

Is it possible to take out a mortgage in another city without registration?

If the borrower does not have registration in the place where the property was purchased, it becomes more difficult to obtain a mortgage. The bank will face problems when checking the borrower's solvency. In this situation, it is better to contact a network organization that has branches in both cities. Taking action will increase the likelihood of your application being approved.

IMPORTANT

Additionally, banks pay attention to the fact of registration in the Russian Federation. If there is no registration at all, the application for a mortgage in another city will be rejected without consideration.

Mortgage loan in another city with temporary registration

The presence of temporary registration increases the chances of approval of a mortgage loan in another city. Thus, financial organizations in Moscow are actively issuing mortgages to nonresidents who have managed to register at their place of residence. The fact is that there are quite a lot of visitors in the capital who subsequently want to finally move to the city and acquire real estate.

However, not all banks are willing to cooperate with citizens who have temporary registration. Sometimes loans are issued under more stringent conditions. Such a decision is associated with additional risks for the company.

Reasons for refusal to apply for a mortgage in another region

A mortgage is a long-term loan that requires preparation and planning. Moreover, not only the borrower, but also the bank must perform the action. The settlement period for the proposal is on average 15 years. Therefore, the lender wants to be sure that the client will be able to make payments on time. The borrower is carefully studied and assessed. The presence of registration is one of the additional guarantees. If there is no registration, finding a client in case of refusal to fulfill obligations may be associated with difficulties. Therefore, banks are more attentive to a potential borrower and check him more carefully. The reasons for refusal to issue a mortgage in another city may be:

- inability to verify the solvency of a potential client;

- the income level is too low for the region in which the person wants to borrow money;

- damaged credit history;

- non-compliance with bank requirements;

- excessive debt;

- lack of official work.

Attention

Please note that the borrower will be checked for compliance with the requirements that apply to the mortgage region. Thus, the minimum wage at which a mortgage application is approved for the regions is about 20,000 rubles. The indicator may vary depending on the financial institution. For Moscow, wage requirements are set at a minimum of 30,000 rubles. The exact figure depends on the presence of dependents, the amount of monthly expenses, the cost of living in the region, as well as a number of other factors.

Necessary documents for registration

You need to start preparing to apply for a mortgage in another region by collecting a package of documents. The list of papers is standard. It is necessary to confirm the information specified in the application form. Typically the bank requests:

- passport;

- a document confirming the presence of temporary registration, if any;

- income certificate;

- a copy of the work book certified by the employer;

- marriage certificate and marriage contract, if present;

- children's birth certificate;

- TIN and SNILS;

- military ID for men under 27 years of age.

Please note:

The list is not exhaustive. The financial institution reserves the right to request additional documents. So, when applying for a mortgage in another city, sometimes a second ID is required. In this regard, you can provide a license to drive a vehicle or a foreign passport.

Separately, it is necessary to collect documents for housing. The responsibility for preparing the list falls on the shoulders of the property owner. He is obliged to provide:

- title documents;

- cadastral passport;

- technical certificate;

- certificate of ownership or extract from the Russian register.

Additionally, a preliminary purchase and sale agreement and the result of a real estate appraisal may be required. The last document can only be issued by a specialist who has permission to conduct such activities. The borrower pays for the person's services.

How to Avoid Rejection and Increase Your Chances of Getting a Mortgage Loan

A potential borrower has several options to increase their chances of getting a mortgage.

- Contact a large financial and credit organization with branches in many cities of Russia. Even if the applicant wants to take out a mortgage in a place other than where he lives or works, the chance of getting approval for it will remain high. IT technologies allow bank branches to communicate with each other, and a single database allows one to find information about the client of any branch of a financial credit organization.

- Contact a bank that works with Russians remotely. Banks like Tinkoff have practically no offices, and for them the question in which locality the borrower plans to buy real estate does not matter.

- Taking out a mortgage on a finished home: when purchasing it, the borrower, by law, must immediately register ownership of it. Since this housing has already been rebuilt, the borrower registers it as collateral. In case of non-payment of the debt, the housing will go to the bank. When taking out a mortgage on housing under construction under a sales and purchase agreement (SSA), issued to a borrower without registration, the bank risks losing money and not receiving collateral in return.

- Provide the bank with a rental agreement for an apartment in the region where you plan to apply for a mortgage (if the owner of the rented property refuses temporary registration).

- Provide the financial institution with a copy of the agreement on the applicant’s transfer to a new place of work in the region where the bank operates.

- Find co-borrowers or guarantors and note this fact in the applicant’s application form. Co-borrowers and guarantors are one of the forms of securing a mortgage loan. The presence of co-borrowers who bear joint liability with the borrower is also proof of the financial solvency of the bank’s loan counterparties.

- Meet the other requirements of the bank: have sufficient and documented income to obtain a mortgage, have assets (real estate, car, deposit accounts).

- Apply for a mortgage in the bank through which the salary is transferred or in which the applicant previously opened an account for a large amount. This will indicate the financial solvency and stability of the applicant’s income.

Look at the same topic: The best new buildings with military mortgages in [y] year

How to get a mortgage in another city?

If a citizen has decided to obtain a mortgage in another city, it is necessary to proceed according to the following scheme:

- Personally come to the city in which the person plans to buy an apartment with bank money.

- Choose a financial institution to borrow money. It must be remembered that not all companies conduct long-distance transactions. Offers are definitely present in Sberbank, Gazprombank, VTB.

- Familiarize yourself with the terms of mortgage lending. When assessing the nuances of cooperation, it is necessary to pay attention not only to the interest rate, but also to other features of issuing a mortgage. It is worth taking into account the down payment, the amount of the available limit, and the presence of additional payments for account maintenance. You can clarify all the nuances during a consultation. It can be obtained by phone, during a personal visit to the organization or through the company’s website.

- Apply for a mortgage in another city. You can contact us through the organization’s website or during a personal visit. The citizen will have to fill out a form. All information must be provided in as much detail as possible. Banks want to know who they are dealing with. There shouldn't be any mistakes. All information is verified. If during the process of studying the information it turns out that the data is not true, the application will be rejected.

- Wait for the decision to be made. If it is positive, it is worth collecting a list of necessary documentation for the organization. The bank will check the documents again and then make a final decision.

- Find an apartment. The property must meet the requirements of the organization. Banks lend money only for liquid housing that has communications. The house should not be demolished or declared unsafe. Remember that the period for choosing a room is limited. The procedure for choosing an apartment with a mortgage takes from 1 to 3 months. If the period is missed, you will have to submit the application again.

- Agree with the owner of the premises to purchase an apartment with a mortgage. If the owner of the property agrees, it is necessary to conclude a preliminary purchase and sale transaction.

- Invite an appraiser and make an assessment of the market value of the premises.

- Submit real estate documents to the bank. The financial institution will check the housing for compliance.

- Sign a mortgage agreement with the bank and a purchase and sale agreement with the seller of real estate in another city.

- Provide a down payment on the mortgage.

- Re-register the premises with Rosreestr, take out a mortgage and purchase insurance.

- Wait until the funds arrive in the seller’s account.

When the amount is transferred, the citizen becomes the owner of the property and mortgage in another city. However, until the obligations are fully settled, the premises will remain encumbered by the bank. Repayment of debt to a financial institution must be carried out by making monthly payments.

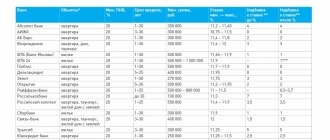

Which banks give mortgages without registration?

In 2020, a mortgage without registration can be obtained from the leaders of the regional network:

- Sberbank: issues up to 5,000,000 rubles;

- term – up to 5 years;

- interest rate – from 12.9%.

- issues an amount of up to 5,000,000 rubles;

- it is possible to take an amount of up to 3,000,000 rubles;

- you can take up to 3,000,000 rubles;

- issues an amount of up to 2,000,000 rubles;

- amount up to 5,000,000 rubles available;

- amount – up to 3,000,000 rubles;

- maximum amount – up to 4,000,000 rubles;

- amount – up to 1,000,000 rubles;

- amount – up to 5,000,000 rubles;

Interesting article: Do I need to change the STS when changing my registration in 2020?

These financial organizations are ready to offer their clients all types of mortgage programs. The conditions for intercity mortgages are close to standard. The difference is the complexity of completing documentation, sending papers between settlements and the need to repeatedly travel from one city to another.

You can get rid of the accompanying difficulties: enter into an agreement with a mortgage agent who will do the organizational work for you.

Is it possible to take out a mortgage in one city and buy an apartment in another?

There is also no ban on taking out a mortgage in one city and purchasing an apartment in another region. The application is usually approved if a branch of the creditor bank is present in the city in which the apartment will be purchased. Bank branches in different cities interact with each other and with realtors. However, such an operation is considered risky. A mortgage borrower in another city may face a higher rate. However, the company will make concessions if the person agrees to insure life and health. It must be remembered that mortgage transactions cannot be concluded by proxy.

For your information

The borrower may face additional costs of time and money when traveling between cities. In addition, there may be a delay in the transfer of an approved application from one part of the financial institution to another. Sometimes the process takes up to 1 month. Therefore, it is important to control it yourself. Sometimes there is confusion regarding payments. You need to control them yourself, keeping checks and receipts. The application will be approved only if you have a positive credit history, stable official income and a down payment.

Features of a mortgage without registration

There are 2 options for mortgage lending:

- the borrower is registered in one city, but works in another and takes out a mortgage at the place of work;

- the borrower is registered and lives in one place, works in the same or another, and applies for a mortgage in a third.

Interesting article: Everything you need to know about getting a loan and a loan without registration

If there is no registration

This is an unlikely situation in which taking out a mortgage is not possible: the applicant must have permanent or temporary registration. Lack of registration is a direct violation of the law, which, according to Art. 19.15.1 Code of Administrative Offenses of the Russian Federation, punishable by a fine. Therefore, to obtain a mortgage, register at least temporarily.

If registration is in another city

It is quite possible to take out a mortgage loan to purchase real estate in one city while working and living in another.

In such a situation, it is not easy for the bank that issued the loan to assess the level of solvency of the borrower. The lender takes into account the client’s registration and place of work. If they are in the same city, solvency is checked based on information from the employer.

Banks often have technical difficulties if the collateral is an apartment that is being purchased in another city. To play it safe, it is better to use the services of large banks that have branches in different cities. In this case, applying for a mortgage goes smoothly.

A nonresident borrower must have:

What is your registration?

Registration at the place of residenceRegistration at the place of stay

- Positive credit history.

- Stable income. The bank client must work at his last job for at least 3 months.

- The same period applies to living in the city in which the borrower plans to apply for a mortgage.

If the registration is temporary

Many banks are reluctant to issue loans to citizens without permanent registration. However, nowadays large organizations with many branches are meeting their customers halfway.

Key points to help alleviate the lack of permanent registration:

- borrower is a client of this bank, receives wages through it or has deposits;

- a positive credit history, especially if loans have already been taken out from this bank and repaid on time;

- the applicant has a permanent job and a stable salary, which can be confirmed with documents;

- the client brings a guarantor who has a permanent residence permit.

With temporary registration, the borrower does not have any additional difficulties in obtaining a mortgage. It only affects the timing of the loan. You can expect a positive decision if the bank understands the following issues:

- why there is no permanent registration (maybe the client sold his home to make an initial mortgage payment);

- if the client does not have permanent registration in the area where the bank is located, and the borrower has registered a temporary one, he only lives here or also works;

- whether he undertakes to obtain permanent registration as soon as he buys his own home;

- other questions.

After choosing a bank, the agreement includes a clause on the terms of registration in the purchased property.

After purchasing an apartment, the owner has the right to immediately register in it on a permanent basis. After registering, you are allowed to submit an application to the bank to adjust the terms of the loan agreement. Taking into account the fact that the registration status has changed, more acceptable conditions are chosen.

How to buy an apartment with a mortgage in another region?

If a person wants to contact the bank at his place of permanent residence, and buy an apartment with a mortgage in another city, the classic registration scheme changes. The person will:

- Contact the credit manager and find out if there is a possibility of obtaining an intercity mortgage. Additionally, it is worth clarifying all the nuances of cooperation.

- Study the real estate market of the selected region in detail and select housing. It must be remembered that mortgages are provided only for liquid real estate.

- Contact the owner of the apartment you like, discuss all the details about concluding the transaction and find out whether the person agrees to sell the premises with a mortgage.

- Familiarize yourself with the list of financial organizations that are present both in the city in which the person permanently resides and in the locality to which the person wants to move.

- Submit an application and wait for a decision.

- If the bank agrees to lend money, provide a package of documents confirming the previously specified information. The company will conduct the analysis again and make a final decision.

- Sign a loan agreement and a purchase and sale agreement. It is necessary to remember that there is a need for a preliminary assessment of the property. The service is paid for by the potential borrower.

- Re-register the property, purchase an insurance policy.

IMPORTANT

It must be remembered that a person will have to personally visit another locality to sign the documents.

Applying for a mortgage loan without permanent registration

When purchasing a home with a mortgage, the following stages go through:

- Approval of the client's questionnaire. After submitting a package of documents, employees of the banking organization check the borrower’s identity, his lending history and select the appropriate loan size. This process takes from 7 days.

- Search for suitable real estate. After the banking organization approves your application, look for housing. The main condition is the value of the property both at the time of purchase and during the period of repayment of the mortgage loan. Old housing in disrepair cannot serve as collateral. It is not allowed to purchase an apartment with an illegal redevelopment using a mortgage.

- Property approval. After you find a suitable apartment, order its appraisal, take photocopies of the documents for it from the seller and bring it to the bank. Only organizations accredited by the bank can evaluate housing. This is necessary for a financial institution to avoid various risks.

- Applying for a loan. If all the papers are collected and confirmed, a transaction day is set, at which three parties are present - the seller, the banking organization and the buyer. The borrower signs a loan agreement, receiving money to purchase an apartment, and a purchase and sale agreement.

Interesting article: Necessary documents for registration

To obtain a mortgage on convenient terms, it is desirable that the applicant be registered (permanently or temporarily) where he takes out the mortgage. A study of the conditions of mortgage loans shows that the absence of such registration threatens:

- reducing the loan term;

- an increase in interest rates;

- imposing comprehensive insurance (in addition to compulsory home insurance regulated by the Law “On Mortgage”, the borrower has to take out title and personal insurance).

Is it possible to get a mortgage in Moscow if you are registered in another city?

A large number of visitors live and work in the capitals. Many of them decide to permanently stay in Moscow. People often turn to a bank to buy a home. For financial organizations this is an additional source of income. Despite the risks, companies quite often approve mortgage applications in Moscow if the borrower is registered in another city. However, in most cases, only borrowers who have temporary registration and carry out official work activities in the capital can count on a positive decision. If a person is unemployed or his income is not enough to cover his obligations to the organization, the application will be rejected. Additionally, you must comply with all requirements for borrowers.

Military mortgage in another region

The issuance of military mortgages is carried out in accordance with the norms of Federal Law No. 117 of August 20, 2004. The document does not contain requirements obliging a person to receive a housing loan in the city in which it is registered. According to the law, a person has the right to take out a military mortgage in any locality on the territory of the Russian Federation. It is enough to register with NIS, wait 3 years and begin the registration procedure.

Mortgage loan in another region at Sberbank

Sberbank issues loans in other regions more often than other financial organizations. The company has a widespread branch network. Its representation is present in almost all regions. Therefore, it is easier to get a mortgage loan from Sberbank. All you need is Russian citizenship and permanent registration in one of the regions. The list of documents must include a passport with a registration mark. An additional advantage will be the presence of temporary registration in another city. The rest of the design is carried out according to the classical scheme.

Specifics of a mortgage issued without registration

First of all, it is worth understanding the terminology and understanding the differences between permanent and temporary registration. They are displayed in the table.

Look at the same topic: Mortgage in Alfa-Bank in [y] year: terms of provision

| Registration | Validity | Termination | Form |

| Constant | Indefinite | Voluntarily or judicially | Stamp in passport with registration mark |

| Temporary | For a specified period | From the date of expiration | Certificate (insert sheet) |

To obtain a mortgage on convenient terms, it is desirable that the applicant be registered, permanently or temporarily, where he takes out the mortgage. Mortgage conditions in the absence of registration in the region where the home was purchased is a question, the answer to which is sought on the bank’s website among the information in small print.

A study of the terms of the mortgage will show that the absence of such registration threatens:

- Reducing the loan term;

- Increasing the down payment from 20-25% to 50%;

- An increase in interest rates;

- Imposing comprehensive insurance - in addition to compulsory home insurance regulated by the Law “On Mortgage”, the borrower will have to take out title and personal insurance.

If there is no registration

This is an unlikely situation in which taking out a mortgage is not possible: the applicant must have permanent or temporary registration. Lack of registration is a direct violation of the law, which, according to Article 19.15.1 of the Code of Administrative Offenses of the Russian Federation, is punishable by a fine.

Lack of temporary registration threatens a fine not only for a person living without registration in a given region, but also for the owner of the rental property. By refusing to register a temporary tenant, the property owner does this in order to avoid paying taxes on the rental of residential premises, that is, he violates the law.

The bank, for its part, must be sure that in the event of non-payment of the loan, the borrower will be found. Therefore, registration of the borrower: a stamp in the passport or a certificate of temporary registration is mandatory.

If permanent registration is issued in another city

If a borrower wants to take out a mortgage, having permanent registration in another city, he must be prepared for the fact that small banks will refuse to approve his application, although with a certain degree of probability they will consider large financial organizations and banking associations. Having temporary registration in the region where you plan to take out a mortgage will greatly simplify the task.

However, the very fact of having a permanent residence permit speaks in favor of the borrower. In case of late payments, the bank can easily notify him of the fines and penalties imposed on him, and in case of termination of loan payments, find him.

If there is temporary registration

In this case, the chance of getting a mortgage loan is quite high. Mortgage conditions will be stricter than standard. The applicant will need to carefully study them, consult with bank employees and evaluate how much such a mortgage will justify the money spent on it.

If the applicant comes to the conclusion that it is advisable to take out a loan in the region of temporary residence, his next step will be to convince the bank of his financial solvency and integrity.

The mortgage will be approved if the borrower has the same region of work and temporary residence. In this case, the bank can check information about the potential counterparty with its employer.

Mortgage in another city at VTB

VTB Bank also cooperates with individuals who want to borrow money to buy an apartment in another city. To apply for a mortgage you must:

- Submit an application to the VTB territorial office and provide a package of documents. Among them must be documents confirming solvency.

- Wait for a positive decision and open an account.

- Provide a down payment. It can be placed as a separate deposit or on an account. Then the client will have to issue a power of attorney to the bank. On its basis, representatives of the financial organization will be able to manage the amount of the down payment. The action must be completed in order to grant the company the right to transfer funds to the account of the real estate seller.

- Find a suitable apartment and decide on the transaction scheme.

- Insure real estate, as well as life and health.

- Close a mortgage deal in another city. To do this, you need to visit a bank branch and sign the documentation.

Applying for a mortgage in another city

When applying for a mortgage to buy a home in another city, you need to be prepared for the fact that you will need to take more steps and it will take a longer time. However, it is possible to obtain such a loan; you just need to get the bank’s approval and go through all the stages of registration.

Requirements for the borrower

To obtain a mortgage loan, a potential borrower must meet some standard requirements:

- age must be at least 21 years and not more than 75 years at the time of full repayment of the loan;

- mandatory presence of Russian citizenship;

- total work experience of 1 year and at least 6 months at the last place of work;

- proven solvency.

A positive credit history, a permanent job with a high salary, and a significant down payment will help increase the chances of your application being approved.

List of documents

To apply for a mortgage loan to purchase a home in another city, a standard list of documents is required:

- passport of the borrower (co-borrowers), guarantors (if any);

- second document (for example, SNILS, military ID);

- marriage certificate and notarized consent of the spouse (if the borrower is married);

- documents for the purchased apartment;

- a copy of the work record book certified by the employer;

- income certificate in form 2-NDFL or in the form of the creditor bank.

Depending on the bank's conditions, additional documents may be required.

Registration procedure

If the borrower is located in one city, and the purchased property is in another, then the application and assessment of solvency is carried out by the bank branch at the place of his residence, and the transaction is documented by the branch at the location of the housing.

The main stages of the procedure for obtaining a mortgage are similar for different credit institutions.

To do this, the borrower must:

- send applications to banks that provide loans for the purchase of real estate in other regions (through websites or by visiting offices in person), and obtain approval of the application;

- find an apartment option that meets the wishes of the borrower and the requirements of the lending bank;

- independently or through a representative, prepare documents in relation to the acquired property for the bank to assess the legal cleanliness of the apartment and its condition (submitted to the branch at the location of the property);

- insure the purchased housing;

- conclude a mortgage agreement (at the borrower’s place of residence or at the location of the property);

- carry out state registration of the transfer of rights.

In essence, the registration procedure is no different from a regular mortgage, the only difference is that two bank branches are involved in this process.

Terms and procedure of payments

Final payments for a mortgage are made cashless, so a few days after registering ownership, the bank transfers funds to the seller’s account. Maternity capital funds or other government programs used during the purchase will be received by the seller later (in accordance with the terms of transfer under these programs).

Note! Some banks may charge a commission for transferring funds between regional branches. Inquire about the availability of this condition in advance to avoid getting into an unpleasant situation.