What is AHML Dom.rf

Dom.rf (formerly AHML) is a federal agency that was created in 1997 by the state to help the population in purchasing comfortable housing with the help of a mortgage and maintaining liquidity in banks issuing such loans. By type it is a joint stock company with 100% state capital.

At the initial stage of the agency’s work, special standards were developed, with the help of which the interests of the majority of categories of citizens of the Russian Federation are taken into account as much as possible. These standards contain generalized requirements for borrowers, the main terms of the mortgage transaction, the structure of the loan agreement, etc.

Housing loans according to Dom.rf standards are issued by authorized agent banks. Only Russian citizens aged 21 to 65 with full legal capacity can become recipients of a mortgage for a period of up to 30 years.

The main difference between AHML and a regular bank is state participation. The agency is a government agency seeking to increase the availability of mortgage lending throughout the Russian Federation. Banks are commercial institutions that carefully select borrowers according to their criteria and give preference to the most affluent.

Thanks to Dom.rf, military personnel, employees of budgetary organizations, large families, young families, etc. were able to obtain a mortgage.

Important! The agency's products are distinguished by favorable interest rates and social orientation, that is, support for the most vulnerable segments of the population.

Russian Government Decree No. 373 on assistance to mortgage borrowers in 2020

- Submitting an application to the bank for mortgage restructuring with the collected documentation package. If the lending bank has lost its license by this time, you will need to visit the successor bank.

- Consideration of the application and making a decision on it. The bank, together with AHML, verifies the accuracy of the submitted documentation and the candidate’s compliance with the program requirements. The Bank has the right to independently set deadlines for considering such an application and making a decision.

- Conclusion of a new loan agreement or additional agreement. Depending on which version of the decision on the application is accepted by the bank and AHML, new relations will be further formalized. Most often, a new agreement is drawn up to refinance an existing loan.

- Reduction in income level by at least 30%;

- The borrower’s family income for the last 3 months is below twice the minimum subsistence level per each family member;

- For foreign currency mortgages – an increase of 30% in the amount of payments;

- Participation of the bank in the ongoing government support program.

We recommend reading: Online calculator of arrears under an equity participation agreement

Main goals, objectives and activities

Dom.rf (AHML) was initially created to solve the following key tasks:

- support of government mortgage programs and their popularization among the population;

- prevention of possible risks in the mortgage industry;

- providing assistance to problem mortgage borrowers;

- obtaining competent advice on existing issues regarding the acquisition of real estate with the help of borrowed funds.

At the same time, the main goal of the former AHML is to maintain the liquidity of Russian commercial banks issuing long-term mortgage loans.

Key areas of activity of Dom.rf:

- lending to banks to issue housing loans;

- development of mortgage products;

- mortgage restructuring;

- purchasing rights of claim on housing loans of the population by placing agency bonds on the stock market;

- development of the rental market.

The activities of Dom.rf bring benefits to all participants in the mortgage transaction. Banks here are increasing their profits and expanding their line of mortgage products with new programs, the agency itself is developing a network of its regional offices without opening physical offices, and borrowers are solving housing problems.

Help for AHML on mortgages through Sberbank

Since it is not always possible to be sure of the stability of the situation in the future, you can also arrange a deferment, that is, a credit holiday. If Sberbank approves such a request, the borrower is exempt from making monthly payments for a certain time, but not completely. In any case, he will be obliged to contribute half of the sum. Nevertheless, this is a good opportunity to at least improve your financial situation and regain your solvency. In this case, the mortgage term is not extended, and the amount underpaid during the holiday period is scattered into monthly payments thereafter.

We recommend reading: Mortgage benefits for families with many children

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

Mortgage programs

Currently, AHML has developed and is implementing 8 main mortgage programs for various categories of borrowers. See the table below for details.

| The name of the program | Product Features | Additional options |

| For finished housing | With this program, the borrower can purchase an apartment or apartment on the secondary market. | · without proof of income (with a minimum package of documents); · maternity capital; · application of a variable rate; · apartments (this type of housing is allocated to a separate category for which special conditions are offered) |

| New building | You can purchase an apartment/apartment at the stage of building a house. | |

| Family mortgage | Issued to families in which a second and/or third child will be born before the end of 2022. At the same time, you can apply for a new loan or refinance an existing one to obtain favorable conditions. | · easy mortgage (registration using a passport and a second document of the client’s choice) |

| On-lending | The mortgage refinancing program at AHML (Dom.rf) provides the opportunity to lower the rate on an existing mortgage loan. | · variable rate; easy mortgage |

| Military mortgage | Military members of the NIS can use it. | · maternal capital; · payment of the loan at the expense of the state |

| Secured by an apartment | The goal is to purchase housing on the secondary or primary real estate market using existing housing as collateral. | − |

| Socipoteka MO | Doctors, teachers and scientists are eligible to apply for a preferential loan. The borrower will only pay the monthly interest accrued. The main debt and part of the cost of housing (no more than 50%) is paid by the Government of the Moscow Region. | |

| Regional programs | Administrations in Russian regions receive the authority to identify groups of the population in need of a preferential loan for the purchase of housing. Among such citizens: large and young families, disabled people, employees of budgetary organizations, etc. |

Additional options allow you to minimize the client’s time and financial costs, as well as receive support from the state.

How does the AHML mortgage assistance program work: conditions, requirements, procedure for receiving and reviews

- The program in its latest edition is aimed mainly at foreign currency borrowers, for whom the credit burden has become exorbitant after 2014.

- Practice proves a high percentage of refusals by AHML to borrowers who apply for financial assistance indicating the grounds for receiving it “the presence of dependent children.”

- Due to the volume of the required package of documents, their collection may take more than one week, which delays the time for reviewing the application and making a decision.

- The mechanism for providing support to families with four or more children has not been developed (AHML and banks refer to the possibility of using regional programs for this category of citizens in the form of subsidies).

- Partner banks are not interested in the program and are delaying assistance.

- Periodic interruptions in the implementation of the project to support mortgage borrowers due to the expenditure of funds allocated from the budget.

We recommend reading: Benefit for Pogrebente in the Moscow Region in 2020

Mortgage conditions AHML Dom.rf

Let's consider the conditions of the mortgage lending programs listed above in more detail.

New building

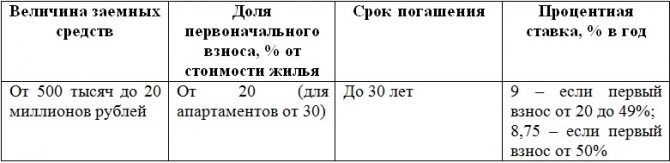

The parameters for purchasing an apartment/apartment in a new building are as follows:

For regions, the maximum loan amount cannot exceed 10 million rubles.

This program provides a preferential interest rate of 8.5% per annum for a large family, as well as in the case of purchasing housing in the Baikal region and the Far Eastern Federal District.

If the client is not able to prepare a complete package of papers, then it is possible to obtain a mortgage using two documents. The rate under these conditions will start at 9.25% per year.

Ready housing

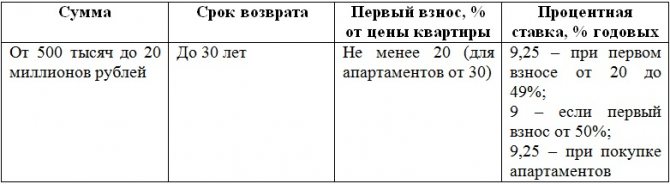

Key conditions of the program for the purchase of finished real estate on credit:

When submitting an application with a minimum package of documents, the minimum rate will be 9.5% per year.

Refinancing

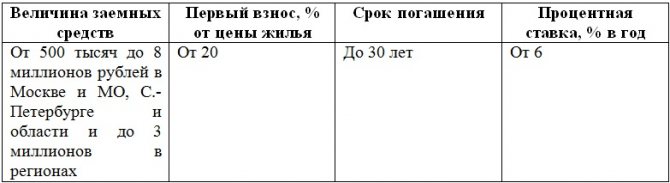

With the help of the mortgage loan refinancing program at AHML (Dom.rf), borrowers with a valid mortgage agreement have the opportunity to lower the established rate. The parameters will be as follows:

- the amount of the balance of credit funds is from 500 thousand to 20 million rubles;

- term – up to 30 years;

- rate – from 8.75% per annum.

In this case, the loan itself must comply with standard restrictions:

- making monthly payments for at least 6 multiple periods;

- absence of any delays or violations of the terms of the loan agreement;

- no restructuring.

As part of the mortgage refinancing product at AHML, the client has the right to use the “Variable Rate” option, for which the interest rate today is 9.67.

On bail

Using the security of an existing apartment or apartments, a person can purchase an apartment on the primary or secondary market. Parameters of this mortgage product:

The loan is strictly targeted, which requires confirmation of the expenditure item of the allocated funds. Until such confirmation, the contract rate will be increased by 4 percentage points.

No down payment is required.

Military mortgage

NIS participants apply for a military mortgage with AHML under the following conditions:

- interest rate – 9% per year;

- loan term – at least 3 years;

- down payment – no less than 20%;

- amount – up to 2 million 486 353 thousand rubles.

The first installment is paid from savings in an individual account or the serviceman’s own funds.

The maximum loan period is limited by the maximum age of military service.

Family mortgage at 6%

You can apply for a family mortgage under the following conditions:

The product provides a grace period of 3 to 8 years, during which a reduced interest rate (6%) will apply. Further interest calculation will be carried out as the key rate + 2%. At the moment, this figure is 9.25% per annum.

When refinancing, the conditions will be similar.

Social mortgage in Moscow and Moscow Region

Social mortgages from Dom.rf are issued to doctors, teachers and scientists living and planning to purchase housing in Moscow and the Moscow region.

Mortgage parameters:

- rate – 8.75% when purchasing an apartment in a new building and 9% for finished properties;

- repayment period – 10 years;

- first installment - paid by the Government of the Moscow Region (no more than 50% of the housing price).

Attention! The government will also take over the principal payment in the monthly payment structure. The borrower will only pay accrued interest.

Already working professionals, as well as people who are ready to move to the Moscow Region and take up open vacancies in budget organizations, will be able to get a mortgage with government support.

To obtain a social mortgage, you will need to contact the relevant Ministry and submit the appropriate application. The registration procedure takes place at BINBANK.

Social mortgage in the regions

At the level of individual constituent entities of the Russian Federation, preferential mortgage programs have been developed and are being successfully implemented, allowing the rate to be reduced to 5.75% per annum. Large families, young families, disabled people, public sector employees, etc. can apply for such a loan.

For consultation and submission of documents, a potential borrower should contact the regional office of the agency: Vladimir, Ulyanovsk, Omsk, Novgorod, Kemerovo, Udmurt, Voronezh, Volgograd, Sverdlovsk SAIZhK, etc.

The application will be submitted through local authorities, and the loan itself will be issued through partner banks.

Government Decree 2020 Assistance Program for Mortgage Borrowers House of the Russian Federation

For example, in 2020 Sberbank offers excellent conditions for restructuring or refinancing a mortgage loan. In this case, the new loan is provided on more favorable terms and fully covers the previous mortgage. The reduction in payment occurs due to a decrease in the interest rate and/or an increase in the total loan term.

- The existing mortgage loan is subject to restructuring at the same or another bank. Moreover, the new rate should be no more than 11.5% per annum. In addition, the total repayment term can be extended, resulting in a lower monthly payment.

- Part of the remaining debt is compensated from the budget (maximum 30%). Moreover, on the day of provision of assistance, the total debt should not exceed 1.5 million rubles.

We recommend reading: Extract from the Unified State Register on the transfer of rights

Mortgage calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

At the stage of choosing a mortgage program and before submitting an application, each client is recommended to use the AHML mortgage calculator (Dom.rf). This can be done using the online service on our website.

The tool includes the following blocks:

- bet amount;

- amount of credit;

- type of payments (annuity or differentiated);

- maternity capital (will payment be made with its help);

- date of loan issue;

- maturity.

By filling out this information, the potential borrower will receive visual information and calculate the final overpayment, minimum income and monthly payment amount.

How to calculate a mortgage?

The website provides an online calculator that allows you to calculate the term and amount of the monthly payment.

To do this, you need to select a mortgage program, housing cost, maternity capital (optional), down payment and desired mortgage term.

For example, if you choose the “New Building” program, the cost of housing will be 2,000,000 rubles, the down payment will be 400,000 rubles and the loan term will be 15 years, and the interest rate and monthly payment will be:

Search for partners

Requirements for the borrower

The key requirements for potential clients are:

- Availability of Russian citizenship and registration on the territory of the Russian Federation.

- Age limit: from 21 to 65 years.

- Sufficient solvency.

- Work experience of at least six months at the last place of work and a year in total.

- Full legal capacity.

- Possibility of collecting the necessary set of papers.

For preferential and social mortgage programs, borrowers are subject to their own specific requirements, which should be clarified with the authorized bodies.

Where can I get a mortgage?

Mortgages according to Dom.rf (AHML) standards are issued in branches of the Russian Capital Bank and reliable partners. Partners include an approved list of banks, including:

- Globex Bank;

- BINBANK;

- Alfa Bank;

- Metalinvestbank and others.

After reviewing the terms and conditions of registration together with a package of papers prepared in advance, the client will need to contact the selected agent bank to fill out a form and clarify the conditions.

Before submitting a mortgage application, each future borrower must understand the basic concepts of a mortgage and the nuances of interaction with a lender, including:

- know what a mortgage is;

- how a mortgage transaction is completed;

- what is important not to miss in the loan agreement;

- what is the effective rate, etc.

What documents will be needed

The list of required documents includes:

- Russian passport;

- application form;

- documents on income (requirements for a certificate in the bank form) and employment of the client;

- documents for the purchased property.

Military personnel provide a certificate of NIS participant, family mortgage clients - birth certificates of children, a marriage document.

For some programs, it is possible to apply for two documents. These include a passport and a second document of the borrower’s choice (SNILS, driver’s license, military ID, international passport).

Mortgage Borrower Assistance Program

Having learned about the extension of this program in early March, we called the hotline 8-800-7-5555-00, passed the compliance test successfully, and after telling the employees that we were eligible for this program, we began collecting documents. According to AHML employees, the program will be valid until May 31, 2020. Those. It turns out we have 3 months left. and we easily manage to collect the documents. None of the employees ever stipulated that the program could end early; if they had known, they would not have taken the risk and participated in this program. We have already ordered extracts from Rossreestr, which cost 7,400 rubles, and this is not little. The certificates themselves, by law, must be issued within 3-5 days, but in fact, from 1 month. who will be responsible for this? And it is also not possible to revoke the production of extracts, although we do not need them at all. (“Credit and insurance organizations, as well as

So what works in this case? Pressure works in two directions. The first direction is banks. We will definitely talk about this later, there is something to discuss separately. And the second (and in fact, the main) direction is pressure on the state, that is, on the culprit of the problem.

Procedure for obtaining a mortgage

Applying for a mortgage from AHML includes the following steps:

- Studying offers and choosing a loan program.

- Getting advice from a partner bank or Dom.rf.

- Collection of documents.

- Search for the property being purchased and preliminary agreement with the seller.

- Submitting a loan application.

- Making a decision on the feasibility of issuing a housing loan.

- Concluding a loan agreement and a mortgage agreement with a bank.

- Buying insurance.

- Payment of the first installment.

- Registration of the transaction in the Registration Chamber (housing encumbrance).

- Transfer by the bank of the remaining funds to the seller.

Social products additionally provide for interaction with relevant Ministries and other authorities.

Mortgage loan requirements

As part of the state support program, only targeted loans issued for the purchase of housing are subject to restructuring. At the time of contacting the bank, the contract must be valid for at least 1 year.

You can ask for help even if you have previously refinanced a home loan. If you meet the program requirements, you can submit documents no earlier than one year after refinancing.

Mortgage servicing

In accordance with the concluded agreement, the borrower undertakes to pay current payments in accordance with a clear schedule without violating deadlines. Responsibilities also include purchasing an insurance policy annually and informing the lender of any changes to your personal information.

Payment can be made through VTB Bank (free), ATMs, terminals and other financial organizations. Due to the possibility of a delay in crediting funds to the account, it is recommended to deposit the required amount at least 3 business days before the planned date.

Debt settlement procedure

In case of failure to pay the loan on time, the borrower will be obliged to pay accrued penalties and fines in the amount of 1/366 of the key rate of the Central Bank of the Russian Federation.

In a situation of malicious and systematic violations, the creditor has the right to demand termination of the contract and return of the balance of the debt, as well as foreclose on the collateral.

Non-payment and violation of the terms of the agreement will lead not only to a deterioration in the client’s credit history, but also to additional costs.

AHML - assistance to mortgage borrowers in 2020: package of documents

Please note: banks no longer require an extract from the Unified State Register of Ownership of the borrower(s) for the collateral, that is, for real estate purchased on credit, from applicants. Previously, they had to be taken, but now AHML itself requests this document from Rosreestr.

Thus, despite the fact that the assistance program is designed not only for foreign currency borrowers, its condition of increasing the monthly payment by 30% suggests that this program will be able to benefit mainly from citizens who have taken out a mortgage in foreign currency.