How to calculate the mortgage amount

The loan amount is calculated individually for each borrower. The following factors are taken into account:

- Applicant's income. The total family income is taken into account, that is, the monthly salary of both spouses, as well as other types of earnings (profit from business, pension and social benefits, royalties, etc.). The main rule of lending is that the monthly mortgage payment is no more than 50% of the family budget. Therefore, the higher the income, the higher the potential monthly payment and, accordingly, the maximum mortgage amount.

- Borrower's age. Despite the fact that the age limits for borrowers are set on average from 20 to 60 years, there is optimal data: borrowers 35–45 years old will be provided with the maximum possible amount. Persons of pre-retirement age will receive a minimum mortgage amount or a short loan term.

- Loan terms. Long-term loans are the most risky for banks, since it is difficult to foresee the economic situation in the country, currency fluctuations, the size of the Central Bank refinancing rate and other financial indicators. Therefore, when determining the size of the loan, bank employees focus on this indicator, limiting or increasing the mortgage limit.

- The down payment amount for a mortgage. Own funds contributed by borrowers are a guarantee of repayment of borrowed bank funds. The higher the down payment on your mortgage, the higher the maximum loan amount you can be approved for.

- Borrower's monthly expenses. When calculating the loan size, the presence of children and/or dependents in the family is taken into account. Standard banking practice reduces the amount of family income by the cost of living for each dependent. Some banks do not take children into account in their calculations, so the total mortgage amount may be significantly higher.

To make your own calculations without contacting the bank, you can use an online calculator. This program allows you to get the result after entering the basic parameters of the loan.

How is the mortgage amount calculated?

Any Internet user can independently calculate the maximum mortgage amount - just open our mortgage calculator. With it you can find out:

- Upper and lower thresholds for loan amounts;

- View the payment schedule for the entire loan period;

- Choose a convenient type of payment – annuity or differentiated;

- Determine the required income level for loan approval;

- Find out how early repayment of a mortgage will affect different periods and for different amounts;

- Understand the final payment after repaying the mortgage with maternity capital.

You can also contact the bank branch directly and pre-calculate the possible amount of the future loan.

What factors will the bank itself take into account when calculating the amount available for lending to a citizen:

- The borrower's income level - the mortgage payment should not exceed 40-60% of the funds received by the citizen. The citizen’s earnings are confirmed by a certificate in Form 2-NDFL, or as established by the bank. Additionally, papers confirming income and part-time employment, and other monthly income acceptable for accounting for income may be provided.

Sberbank, for example, allows a payment of such a size that about 10,000 of the remaining total income remains for each family member. At the same time, it takes into account additional income without documents. This allows you to significantly increase the loan amount.

- Borrower's age. Most banks limit the amounts for individuals who will meet the retirement age “thresholds” at the time of loan repayment. There is also a minimum age limit for a borrower; in most credit institutions it is 21 years or older.

From the age of 18 you can get a mortgage in Ak Bars and Globex Bank, and the maximum borrower age is in Sberbank and Transcapitalbank (75 years at the end of the mortgage)

- Total expenses for all family members, number of dependents. Each bank has its own calculations for the minimum amount to account for expenses for each family member. On average, this amount is within the minimum subsistence level.

A number of banks (VTB 24, Raiffeisenbank, Trankapitalbank, etc.) do not take children and other dependents into account at all when calculating the loan amount. This allows you to significantly increase the size of your mortgage. Moreover, if you have many children and not enough income, then we recommend, first of all, to contact these banks.

- Availability of existing and repaid loans, quality of fulfillment of obligations under them. If all debt obligations are repaid on time and there is a good credit history, the bank can issue a mortgage if there are other obligations to credit institutions.

Credit history is a topic for a separate discussion. Banks do not see all loans, and each interprets the permissible number of overdue loans differently from the point of view of approval. We recommend reading our post “Mortgages with a bad credit history” if you have doubts about the purity of your history with banks.

- Possibility to provide a full package of documents - preferential programs and mortgages under two documents have a reduced threshold for the maximum amount and loan term, but because Since they allow you to write any income in the application form, you can receive an amount significantly higher than if you provide a standard package of documents.

- Type of property - for housing under construction, finished housing, suburban real estate, the allowed loan size will be different, as will the size of the down payment and the annual lending rate.

- The presence or absence of co-borrowers and/or guarantors. It is necessary not only to obtain a guarantee of return of bank funds and confirmation of additional income. Quite often, a guarantee is issued, for example, for the duration of the construction of a facility when applying for a mortgage on housing under construction.

- The cost of the loaned object. Verified with the appraisal report provided by the borrower. If there is a significant difference, only the price indicated in the bank documents will be taken into account, or the borrower will have to choose another property.

- Place of residence of the borrower - for residents of metropolitan regions, the thresholds for minimum and maximum amounts change.

- The presence or absence of an insurance policy will affect the loan rate and accordingly affect the borrower’s financial ability to pay certain payments.

- A citizen has a preferential position - participation in government subsidy programs, or having a bank salary card.

- Capabilities of the bank itself. Taking into account its costs and time for processing and servicing the loan, the bank will determine the amount possible for lending.

Minimum size

Each financial institution independently determines what minimum mortgage amount to provide to borrowers. Mortgage lending practice shows that the minimum is 20-30% of the total cost of the selected property. Therefore, for example, the minimum mortgage amount in Sberbank is 300,000 rubles, since the minimum cost of housing in Russia has been set at 1,000,000 rubles (private house, 1-room apartment). A loan that corresponds to 10–20% of the value of the property is disadvantageous for either party to the transaction:

- borrower - if you have your own funds covering at least 80% of the cost of the purchased property, it is unprofitable to take out a mortgage; it would be more advisable to enter into a consumer loan for the missing amount, which does not require drawing up a mortgage and concluding an insurance contract;

- bank - financial institutions receive their main income from interest on loans; a mortgage for a minimum amount will not bring the desired financial result.

Maximum and minimum mortgage loan amount at Rosbank Dom

The minimum mortgage amount at Rosbank House is RUB 600,000. – for Moscow and the Moscow region, and from 300,000 rubles. for other Russian regions. As for the maximum amount, it is limited only by the borrower’s solvency and the selected property. At the same time, your citizenship does not matter to the credit institution. The main requirements for borrowers at Rosbank Dom are as follows:

- age – from 20 years (at the time of issuance of the mortgage) to 65 years (at the date of repayment);

- employment (individual entrepreneur or employee);

- co-borrowers (up to three people) and guarantors.

When applying for a mortgage on an apartment, the maximum loan term is 25 years; the bank can issue no more than 80% of the cost of the purchased premises. You can calculate the amount to improve your living conditions yourself. On the Rosbank Dom website there is a special service for this - a mortgage calculator. By setting the initial parameters, you can find out the approximate term, size, rate and regular payment for the mortgage.

Maximum

The maximum mortgage loan amount directly depends on the total value of the selected property. Banks provide housing loans that do not exceed 70-90% of the appraised value of housing (for example, the maximum mortgage amount at Sberbank is 8 million rubles). The difference of 10-20% is required to be paid by the borrowers themselves in the form of a down payment. In some cases, the maximum mortgage size is limited by the terms of the banking program and/or the region of residence of the borrower.

Some banks are ready to provide applicants with borrowed funds covering 100% of the cost of the property, that is, a mortgage without a down payment. But such banking products have a number of disadvantages:

- increased interest rates;

- compulsory insurance of title, real estate and life, health of the borrower.

The following circumstances will help increase the mortgage limit:

- Attracting co-borrowers. In addition to the official co-borrower-spouse, you can involve other close relatives, friends or even legal entities in processing the mortgage. This will increase the amount of income and also reduce the bank’s risks of non-repayment of the loan.

- Closing current debt obligations. Before applying to a bank for a large loan, it is advisable to close existing debts to third-party credit organizations. This also applies to credit cards.

- Conclusion of a marriage contract. This document can completely remove one of the spouses from the transaction. This is advisable in cases where there are many dependents supporting the family or there is a large debt load on one of the spouses.

- Mortgage registration region. In cities of federal significance (Moscow and St. Petersburg) increased lending limits have been established. This is due to high real estate prices. When purchasing housing in these cities, the borrower can count on a large loan amount, and it is not necessary to have a Moscow or St. Petersburg residence permit. It is enough to provide a general civil passport of the Russian Federation with temporary or permanent registration in the country.

- Providing data on additional income. The mortgage amount based on the income of citizens is determined based on the size of the potential payment. If you have bank deposits or rental income, you need to provide them to the bank.

Employees of the selected bank will help you determine the parameters that affect the size of your mortgage loan. Before submitting an application, you can come for a consultation and clarify all the nuances of lending in a specific organization.

Offers from popular banks

Mortgage loans are included in the list of services of every bank. Let's consider the offers of the most popular financial institutions, as well as some nuances that affect the mortgage amount.

| Name of company | Minimum mortgage amount (in rubles) | Maximum loan amount (in rubles) | Additional terms |

| Sberbank | 300 000 | 8 000 000 | Special conditions for payroll clients and bank partner companies. Mandatory insurance of the purchased property, borrower, title. |

| VTB 24 | 600 000 | 60 000 000 | Wide selection of real estate for purchase. |

| Rosselkhozbank | 100 000 | 60 000 000 | Purchasing housing on the primary or secondary market, country real estate, land. Mandatory insurance of purchased real estate and title. |

| Gazprombank | 500 000 | 45 000 000 | |

| Tinkoff Bank | 500 000 | 100 000 000 | The application can be submitted online. |

| Investtorgbank | 300 000 | 20 000 000 | Pledge of purchased or existing property is possible. |

| Binbank | 300 000 | 10 000 000 | Any additional income is taken into account, as well as maternity capital and housing subsidies. |

| SOYUZ Bank | 500 000 | 30 000 000 | Down payment of at least 20%. Comprehensive insurance at the request of the borrower. |

| Moscow Industrial Bank | 100 000 | 18 000 000 | The maximum number of co-borrowers is 3 people. |

| Bank opening | 500 000 | 30 000 000 | The minimum down payment is 10%. Possibility of obtaining a mortgage for the purchase of housing under construction. |

| Promsvyazbank | 500 000 | 300 000 000 | You can purchase real estate in any region where the bank has a representative office. |

| RaiffeisenBank | 500 000 | 26 000 000 | Combination insurance is not required. |

| URALSIB Bank | 300 000 | 50 000 000 | Possibility to choose a mortgage repayment schedule (annuity or differentiated payments). |

| SMP Bank | 400 000 | 50 000 000 | Down payment from 14 to 40%. Mandatory insurance of purchased real estate and title. |

| Mortgage bank "Delta Credit" | 300 000 | 10 000 000 | The opportunity to purchase not only residential real estate (apartment, house, land), but also a garage or parking space. |

Sberbank mortgage calculator

Official website Mortgage calculator

Mortgage for the purchase of housing under construction and finished new buildings, the ownership of which has not yet been registered

| Bid | Term | Sum | An initial fee |

| from 4.1% | from 1 year to 30 years | from 300,000 to 60,000,000 rub. | from 10% |

Mortgage for the purchase of finished housing (secondary market)

| Bid | Term | Sum | An initial fee |

| from 7.3% | from 1 year to 30 years | from 300,000 to 60,000,000 rub. | from 10% |

Mortgage for individual construction of a residential building

| Bid | Term | Sum | An initial fee |

| from 8.8% | from 1 year to 30 years | from 300,000 to 60,000,000 rub. | from 25% |

Mortgage for the purchase of an apartment, residential building or other residential premises for military personnel

| Bid | Term | Sum | An initial fee |

| from 7.9% | from 1 year to 25 years | from 300,000 to 3,141,000 rub. | from 15% |

* Current as of 08/01/2020

When is the best time to take out a mortgage?

Mortgage lending has a number of advantages for borrowers:

- allows you to purchase and move into your own home in the shortest possible time;

- the opportunity to apply for a property tax deduction, as well as for the amount of interest paid on the loan;

- the opportunity to participate in government mortgage programs, under the terms of which 30 to 50% of the loan is repaid from federal, regional or municipal budget funds.

This is why there is no need to give up your mortgage. It is important to choose the right moment for its design:

- having a permanent income - financial stability and confidence in the future are the basis for decision-making;

- possibility of early repayment - increasing the monthly payment on your own initiative will become a financial “cushion” in case of unforeseen situations;

- Availability of own funds - if you have a certain amount of money or expect the receipt of money (maternity capital, sale of a car or other expensive property), you can start looking at mortgage options from different banks.

2020, despite problems in domestic and foreign policy and the economy, was marked by the lowest mortgage interest rates. To prevent a home loan from becoming an unaffordable financial burden, you need to follow important rules when choosing a suitable loan:

- fixed interest rate – the percentage will not change over the years, but wages and income will generally increase;

- loan in rubles - the foreign currency exchange rate fluctuates and often not in favor of borrowers, but the national currency is stable;

- time of year – profitable offers from banks and developers are formed in mid-autumn and spring (March, April, October, November), so it is better to look for a suitable banking program and apply for a mortgage at this time of year.

What affects the amount

Banks set limits on mortgage loans based on the cost of housing, but within these limits, borrowers influence the size of the approved loan independently:

- Credit history. The borrower's past credit experience is of great importance when calculating the mortgage amount. If the client made payments on time, avoided delays and repaid the bank loan, the limit on the mortgage amount will be much higher. A bad financial reputation will be a reason to refuse lending, reduce the loan size, or increase the interest rate.

- Existing debt obligations. The availability of open loans from third-party financial institutions is taken into account when calculating the feasible monthly mortgage payment. If the amount of obligations is large, the bank will refuse to approve the application or provide a minimum mortgage loan amount.

- Insurance. Consent to conclude an insurance contract will increase the loan amount and reduce the interest rate by 0.5-2%. In addition, comprehensive insurance will protect the borrower from the risk of job loss, health, and property loss.

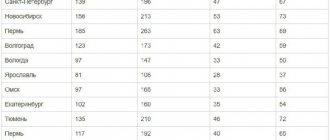

- Region. The cost of real estate and the purchasing power of citizens depend on how developed, “rich” and in demand the region is. Therefore, the size of the mortgage will vary in different regions, republics and districts in the Russian Federation.

- Attracting guarantors or collateral. Additional guarantees that the borrower provides to the bank have a positive effect on the mortgage amount.

The size of the mortgage loan only matters when you have a specific home in mind. And even if calculations show that real estate is too expensive and the bank will not give that much money, you can increase the mortgage amount.

Housing market in Moscow

The amount of recommended income when paying off a mortgage is higher than the average salary in Moscow. However, in 2020, the number of mortgage borrowers increased by a million people compared to 2020. Experts believe that this increase is caused by a decrease in mortgage rates with the same level of demand for housing.

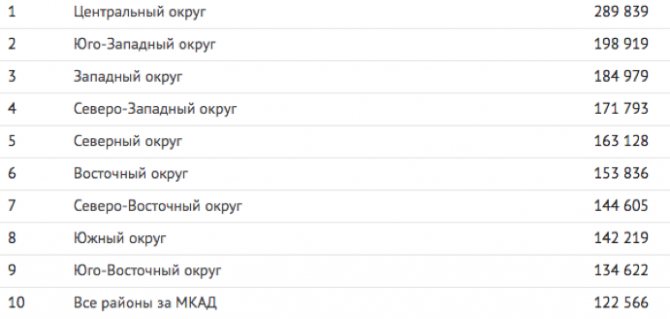

According to the Real Estate Market Indicator, as of June 2020, the most expensive living space in Moscow is located in the Central and South-Western districts, and the cheapest is in the South-Eastern district and in all areas beyond the Moscow Ring Road.

Price per square meter in Moscow

That is, the price for a three-room apartment with an area of 70 sq.m. will range from 8.6 to 20.3 million rubles.