Life is so unpredictable that you never know what to expect in the next minute.

As a result, suppose a decrease in income or deprivation of the opportunity to earn money, the material base of each family suffers. The situation is always complicated by credit debt, especially when a mortgage becomes a burden. People simply don’t know how to repay their debt, so they start saving and surviving on pennies.

To support the population, the highest government authorities have created a federal program to write off the principal mortgage debt.

Thanks to her, many were able to have a roof over their heads without turning over their housing to the bank.

What are the grounds for debt forgiveness?

Special government decree No. 373 allows restructuring of mortgage debt within the framework of the law.

The document began to take effect in July 2020, but at the beginning of December of the same year, amendments were made to the resolution, which were not taken into account at first.

The law became more thorough and allowed certain categories of the population to write off half of their mortgage debt without problems.

This document of national importance was put into effect by presidential decree number 1331.

You can read more and familiarize yourself with the resolution in the attachment.

Options for writing off mortgage debt

First, we will tell you how you can legally write off mortgage debt. You need to choose which one is right for you based on the circumstances and characteristics of the situation in which you find yourself.

1. State program with the write-off of mortgage debt in the amount of 10% or 20% of the principal amount.

The state can compensate part of the debt. Until 2016, it was 10% of the principal debt, according to Government Resolution No. 373, but since December 2020 it was decided to compensate 20%. In other words, if with a mortgage loan of 5 million you have 2 million debt left, the state can compensate 20% - that’s 400,000 rubles.

This relief can be used up to 600,000 rubles. This is a threshold that cannot be exceeded under the current terms of the regulation. In order for you to take advantage of this government program, the apartment must cost more than 8 million rubles.

See also: Bankruptcy of individuals - writing off debts through the court

2. Write-off of mortgage debts for large families.

There are certain benefits that come with having children. When the first child is born, the family has the right to compensate the cost of 18 sq. m. of housing. When the second child is born, the state covers the same amount. The third can completely help you write off 100% of your mortgage debt.

To completely eliminate mortgage debt, you need to contact the Pension Fund of the Russian Federation with a package of documents. You will need to bring:

- Certificate of maternity capital;

- Mortgage agreement with a credit institution;

- Marriage certificate;

- Birth certificates of three children;

- Documents confirming ownership of real estate with a mortgage;

- Certificates from the bank about the amount of debt remaining at the time of application.

First, you can submit copies of documents; you will be asked to provide the originals at the reception. After verification, the debt will be written off and the mortgage loan will be closed.

Important! To take advantage of this benefit, you must have a mortgage lending agreement under the state program with the bank. If this is not the case, you must first renew it, and only then contact the Pension Fund branch.

3. Write-off of mortgage debt when earnings decrease.

To write off part of the principal debt on a mortgage due to a decrease in income, you need to document this. To achieve this, wages must be reduced by more than 30%. After this, 3 months must pass before you can apply for debt restructuring.

A similar situation is possible if the mortgage loan is in foreign currency. In this case, if the exchange rate changes and the monthly payment increases by more than 30%, while maintaining the level of wages, the debtor can apply to write off the principal debt on the mortgage.

Basic provisions of the law

The Government of the Russian Federation launched RF PP No. 373 to write off mortgage debt.

As part of this program, 4.5 billion rubles were allocated. This amount, within the framework of the law, served as a contribution to the capital of OJSC Agency for Housing Mortgage Loan.

This association, in turn, guarantees assistance to certain categories of residents who are faced with serious financial problems.

The provisions of a debt restructuring program include all the provisions that explain the process from start to finish.

One of the clauses of the law talks about who can apply for financial assistance from the state without discussion.

The following points list the requirements for home borrowers. Their implementation makes it possible to write off part of the mortgage debt.

Another decisive factor in the issue of debt restructuring is compliance with certain special requirements, namely:

- The delay in payment of mortgage debt cannot be less than 1 month and more than 3 months;

- The housing mortgage was issued before January 2020 (first edition of the law). The new version does not take this date into account;

- The loan was provided by the bank due to the contribution of a financial share for the construction or purchase of housing, or its major repairs.

Further, the restructuring program specifies the exact conditions for writing off mortgage debt, which apply to borrowers.

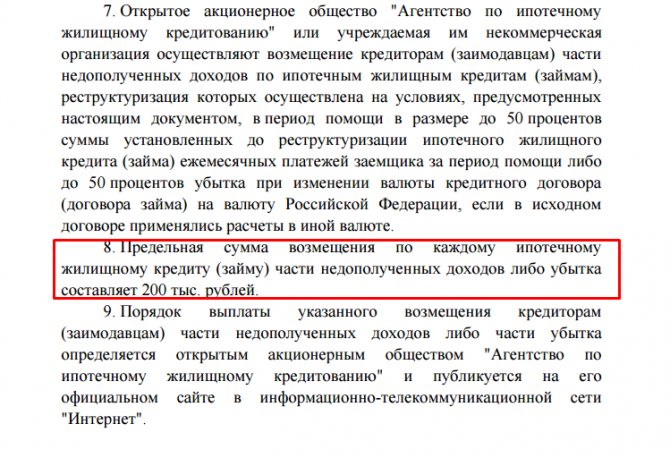

It is also stated in a separate paragraph that the Agency for Housing Mortgage Lending reimburses the lender for part of the borrower’s debt, as an institution trusted by the state.

For each mortgage loan, a maximum of 200,000 rubles is allocated to compensate for a share of the loss or lost income.

The procedure for making payments on mortgage debt is determined by AHML. This company must publish all actions taken on its official Internet resource.

Conditions for participation

To benefit from this support, different criteria are taken into account:

- significant changes in the salaries of citizens due to adjustments in the economy or other processes;

- an increase in mortgage payments, which applies to foreign currency borrowers.

Some people who took out a mortgage loan in foreign currency and received salaries in rubles found that their payment approximately doubled.

Decrease in income

The program takes into account that support is provided to people whose income has decreased by more than 30%. To do this, cash receipts are studied during the quarter before the mortgage is issued and at the time of filing an application to write off part of the debt.

Previously, 12 months were used for comparison, not 3. Due to the high level of inflation, the income that people received several years ago is considered unequal to the income that citizens receive now.

Therefore, borrowers think that the main negative aspect of this support is that the purchasing power of borrowers is not taken into account.

When calculating income, not only the cash receipts of the husband and wife are taken into account, but also all involved co-borrowers.

How to get a mortgage without a down payment - see here.

To qualify for a mortgage, it is necessary that one person does not have more than two subsistence minimums established in a particular region. If this condition is not met, then it is impossible to become a participant in the program on the basis of a decrease in income.

Course difference

This parameter applies only to mortgage borrowers who took out a loan in foreign currency. In 2020, the exchange rate increased significantly compared to 2014, approximately doubling, which hit foreign currency borrowers hard, so they began to need serious support.

Therefore, people whose mortgage payments have increased by more than 30% compared to the initial payments under the contract can take advantage of government assistance.

What documents will be required? Photo: dolg-faq.ru

This support assumes that the rate below that set by the Central Bank on a certain date is applied. Additionally, some of the debt is written off.

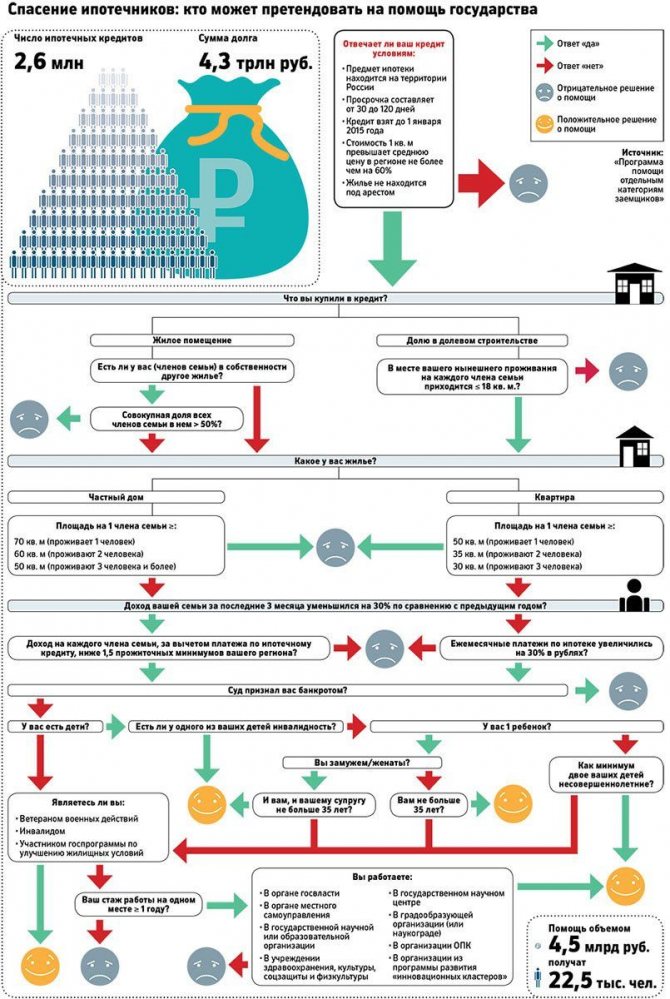

Who can participate in the program?

Not everyone can become a participant in the federal program. Only certain categories of the population have the right to restructure housing debt:

| No. | Citizen of which country | Category of the population entitled to partial write-off of a mortgage loan |

| 1 | RF | Those who participate in government programs and thereby strive to improve living conditions |

| 2 | RF | Families with 2 or more minor children |

| 3 | RF | Families with 1 or more children, in which the age of both parents or one of them is not older than 35 years |

| 4 | RF | Military veterans |

| 5 | RF | Disabled people or families with disabled children |

| 6 | RF | Those who work in government agencies or self-government bodies with at least 1 year of experience |

| 7 | RF | Workers in the military-industrial sector |

| 8 | RF | Doctors and research institute workers |

Income requirements for program participants

Restructuring scheme

The first version of the program for writing off mortgage debt provided for restructuring only in case of delinquency.

The new version, approved by the government, allows individuals who are not in arrears on their housing loan to apply for partial debt repayment.

When calculating the borrower's budget, the income of each family member who is officially registered is taken into account.

In order to be able to receive government assistance for restructuring mortgage debt, financial receipts 3 months before the loan is issued and 3 months before submitting an application for partial repayment of the mortgage are taken into account. During this period, income should decrease by at least 30%.

Useful video:

If the housing loan was taken out in foreign currency, then over the same period of time the amount of the regular payment should increase by 30%, in comparison with the amount of the first mortgage payments. At the same time, the borrower and his family should have no more than 2 minimum wages left for a month of life.

AHML repeatedly reminds that co-borrowers bear no less responsibility for the timely repayment of mortgage debt than the borrower.

Large families can write off part of their mortgage debt

What documents are needed to apply for a subsidy?

An application for a subsidy and a package of documents must be submitted to the credit institution that issued the mortgage agreement.

What is included in the package of documents:

Contracts. The borrower must have originals of agreements - a loan agreement for obtaining a mortgage, the purchase and sale of real estate or an Agreement for participation in shared construction. If the originals are lost, duplicates can be requested again from the bank that issued the mortgage and from Rosreestr. This service is paid, for information from the Unified State Register you will have to pay 300 ₽. The statement will be sent within 3 days.

If there was a refinancing, then in addition to the Refinancing Agreement, an agreement on the original mortgage loan must be attached.

Birth certificate. The child's birth certificate must have a citizenship stamp - it will be placed at the passport office at the place of residence. A stamp is not needed if the citizenship of the mother and father is included in the child’s birth certificate, and the children are noted in the parent’s passport, but the bank may refuse registration if it is not there. Therefore, it is better to play it safe and make a note in advance. The birth certificates of all children must be notarized.

If children have a passport, then additionally you need to make a photocopy of all its pages.

Documents confirming maternity or paternity for adopted children - an adoption certificate or a court decision on adoption. The bank may require a notarized copy of these documents.

Passport or identity document. A photocopy of all pages of the passport, including blank pages, will be required. There is no need to notarize your passport.

Insurance certificates. We need originals and copies of SNILS of all participants - the applicant, co-borrower and children.

Consent to the processing of personal data. This statement will be given to you by the bank. Consent will be required from the borrower, co-borrower and children over 14 years old.

Loan repayment application. The application is written in any form. You can write it at a bank branch - an employee will help you compile it.

Application for a subsidy in any form

The application is written by the person who is the parent of three or more children. If the mortgage agreement is not concluded for him, then he must be indicated as a co-borrower.

Some banks do not have the concept of “co-borrower” - the loan agreement says “guarantor”. This is not the same thing, the guarantor cannot qualify for a subsidy, and the number of his children is not taken into account.

Requirements for mortgage real estate

To receive assistance from the state to pay part of the loan, the characteristics of the real estate taken into the mortgage are taken into account:

- The mortgaged apartment is the only registered housing. It is also permissible to have no more than 50% of the ownership in another object and category of real estate.

- A square meter of an apartment taken on a mortgage cannot have a price higher than 60% than the average cost of the same housing in the borrower’s area of residence.

- Legal “purity” of housing.

- Living space for 1 person (lives alone) cannot exceed the limit of 50 m²; for 2 - 35 m², and for 3 - no more than 100 m² for all.

Interesting video:

Conditions for participation in the program

The first and most important condition for participation in the state mortgage restructuring program must be that the borrower belongs to one of the categories established by law.

The borrower must document a decrease in the average monthly budget for the previous 3 months (details described above).

There must be evidence that the borrower is not bankrupt.

When receiving assistance for debt restructuring, the area of housing, the number of people living, and the purpose for which the loan was taken are taken into account.

How to participate in the mortgage loan forgiveness program?

Can everyone have their mortgage debt written off? The list of groups of citizens who can take advantage of the state program is presented below:

- Families with two children;

- Young families with one child;

- Employees of the innovation cluster;

- Former combatants;

- Scientists and members of the Academy of Sciences;

- Workers of a factory or city-forming enterprise;

- Government servants or officials;

- Families with a dependent under 24 years of age without income;

- Families where a child or one of the parents has a disability.

See also: Simplified bankruptcy of individuals 2020

Real estate for which the principal mortgage debt can be written off must also meet a number of requirements:

- Be the only residence;

- Be “clean” in legal terms;

- The price per square meter should not exceed 60% of the average cost in the area.

Since 2020, there are also requirements for the debtor’s income - it must decrease (either for the borrower himself or for the family as a whole). The balance of money after paying off the monthly mortgage loan payment should be no more than two minimum subsistence levels per person, so that the family can take part in the government program and write off the principal mortgage debt.

Citizens who have gone through bankruptcy proceedings and are declared financially insolvent by the court cannot take advantage of this benefit. Also, a loan for an apartment or house must be targeted, and the overdue period must be no more than 4 months and no less than 30 days.

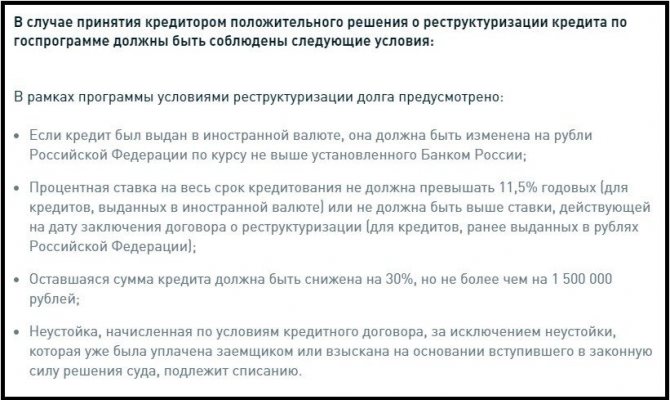

Possibility of writing off mortgage debt

When the owner of a mortgaged apartment meets all the requirements, he can make a request to the bank for loan restructuring based on the state program.

There are several ways to write off part of your mortgage debt. Whatever the borrower uses, state assistance will not exceed 10% of the outstanding balance, and in rubles - no more than 600,000.

| No. | Ways to write off mortgage debt on housing |

| 1 | If the loan is taken out in foreign currency, it must be converted into rubles. This is done exclusively at a rate that will not exceed the norms of the Central Bank. After this, the interest rate should not be more than 12%/year. |

| 2 | Reduce regular payments by half over a period of no more than 18 months. |

| 3 | Repay the corresponding part of the loan |

Video:

Write-off of mortgage interest at Sberbank

So, in order to be able to write off six hundred thousand rubles of debt, you must document that your income for the three months preceding your application for help from the state decreased by 30 percent or more compared to the same period before the mortgage was issued.

- families with at least one minor child. Guardians of children under 16 years of age can also receive assistance from the state;

- participants in hostilities who can confirm this participation with relevant documents;

- persons with disabilities, as well as parents or guardians of disabled children.

How to take advantage of government support when writing off part of your mortgage debt

If the restructuring plan involves establishing a period of assistance, then it cannot exceed 18 months, and the reduction in the monthly payment for this period must be no less than 50% of the planned amount. This occurs due to a reduction in the interest rate during the specified period, as well as due to the postponement of payment dates to a later date.

There is also a limit on family income. To obtain the right to write off part of the mortgage debt, it is necessary that the average monthly family income for the last 3 months before applying for restructuring, minus loan payments during the specified period, does not exceed twice the cost of living in the region of residence for each family member.

How a mortgage is written off at the birth of a child in Sberbank

In 2020, a number of government programs are operating in Russia that are designed to support families where children are born. Some of these programs are funded at the federal level, while others receive assistance from the regions. Banks also do not stand aside, offering clients favorable terms for mortgage loans when little Russians are born into their families.

We recommend reading: Benefits for Labor Veterans After 70 Years in Podolsk

The conditions of the concluded mortgage lending change immediately after the birth of the first child in a Russian family - parents are given the right to apply for a reduction in the mortgage interest. At the birth of a second child, adults can apply the state certificate. If the family decides to have a third child, the mortgage is written off partially or completely.

Mortgage debts: what does the resolution on writing off the principal debt say?

- Extending the loan term, while reducing the amount of the contribution, but increasing the final overpayment.

- Providing a deferred payment, the meaning of which is to pay only interest on the loan, and the “body” - when you can restore your financial stability.

- You can refinance your loan in a different financial structure.

Sovcombank clients with a positive credit history, as well as holders of the organization’s internal products, can apply for financial support.

In order for refinancing programs to be approved, you need to show the manager personal documents, income statements, and justification of reasons that significantly affect individual creditworthiness.

How to write off the principal debt on a mortgage legally

According to Government Decree No. 373 (came into force on July 23, 2015), some categories of citizens have the right to reduce mortgage debt by up to 600 thousand rubles.

In December last year, amendments were made to the program, which eliminated a number of shortcomings, but did not change the main essence. The law on writing off mortgage debt provides a real opportunity to reduce loan debt.

But to do this, the applicant must meet several requirements.

- passport and copies of the borrower’s pages;

- documents for housing with a mortgage;

- papers (certificates, statements) confirming the financial condition of the borrower and co-borrowers for the last three months;

- copies of the employment contract, work record book;

- marriage registration/divorce certificates;

- birth certificates of children or passports of minor children;

- mortgage agreement;

- extract from the Unified State Register;

- other documents confirming the right to benefits.

We recommend reading: Mother's rights to a child during divorce

The process of writing off the principal debt

Each financial institution determines its own options for helping the borrower write off mortgage debt.

Large banks can offer their clients three ways to resolve the problem:

- Credit holidays, which can be set in terms of 6 months to 2 years.

- Repayment of AHML 10% of the debt for the purchase of housing.

- Reduced monthly payment by 1.5 years.

Having decided on the loan restructuring option, an agreement is signed between the borrower and the bank.

Specific deadlines for reviewing a mortgage are not set, but usually the process takes no more than a week.

What program was put into effect by the Presidential decree on debt write-off

Resolution number 373 on writing off mortgage debts was issued on July 23, 2020. Just six months later it was edited and approved by presidential decree. The result was the possibility of writing off mortgage debts with the help of the state. Subsequently, a number of changes and improvements were made to the document (in 2020 and 2017), which expanded the opportunities for borrowers.

Features of the program:

- Reducing the amount of mortgage debt by up to 1.5 million rubles (previously - 600,000 rubles), but not more than 30%.

- Changing the lending currency.

- The percentage decline is below 11.5%.

- Write-off of existing penalties.

To simplify the process of repaying debt to clients of banking institutions, two restructuring options are available - changing the currency to rubles and reducing the rate to 11.5%.

Reviews

Nikolay, 40 years old : “It’s good that citizens of the Russian Federation have such an opportunity. I also had a mortgage. Thanks to the help of AHML and the state, my family was able to pay off the debt much faster. Now we live in our own house and don’t owe anything to anyone.”

Oksana, 29 years old : “We turned to the bank for mortgage restructuring. We collected and prepared all the documents. We spent a lot of money on certificates and free time, but we were simply refused. I don’t know what to do or where to turn.”