In addition to the required monthly payments, there are other payments associated with the mortgage. The overpayment during registration reaches several tens of thousands of rubles. In the future, every year the borrower will again overpay for additional services and actions directly related to the housing received with a mortgage.

Insurance fee

Expenses: The agreement with the insurer is concluded for the entire period of mortgage payments while the housing is pledged to the bank. The fee is charged annually at a specified percentage of the remaining balance of the mortgage. When concluding a mortgage agreement, the borrower must pay about 1% for insurance for the first year of insurance services.

Mortgage insurance is a legally established obligation, since the bank, having issued a large amount, requires security in case of non-repayment of the mortgage debt, damage or complete loss of property. However, only property insurance is mandatory, while most banks practice comprehensive property, health, and title insurance.

The terms of the mortgage agreement often contain the requirement of comprehensive insurance, and in case of refusal of it, the bank increases the interest (for example, at Alfa-Bank, the overpayment in case of refusal of comprehensive insurance increases by 3 points). A borrower with a mortgage is forced to agree, since it is more profitable to pay for insurance protection annually than to overpay the bank.

Sometimes the bank obliges you to connect only 2 out of 3 insurance services or increases the percentage equal to the cost of insurance. It is possible to refuse title protection from the 4th year of the mortgage, because challenging the transaction by a third party is allowed within the limitation period, i.e. within 3 years. You need to carefully read the clauses of the mortgage agreement in different banks, choosing a more profitable option, because the agreement is concluded for 10-15 years. It is easier to choose a lender with acceptable terms at the initial stage than to try to reduce insurance costs later.

Some insurers go even further in offering related services. For example, when insuring finishing. Before signing up for additional services, it is worth asking who the beneficiary will be. Insurance with reference to the mortgage agreement means that the bank will receive compensation. To insure yourself with the opportunity to receive compensation personally, the contract is concluded separately from mortgage insurance.

Payment for appraiser services

Expenses: To obtain an appraiser's opinion when preparing documents for a transaction, they spend about 2-4 thousand rubles.

Without an appraisal, it is impossible to draw up a mortgage loan agreement. This is confirmed by the provisions of the law on mortgages (clause 1, article 9), which obliges to indicate the cost of housing in the agreement with the lender. The services of an appraiser allow the bank to correctly determine the correct value of the purchased object. Obtaining an expert opinion is the buyer's responsibility and is included in the general preparation costs.

Expert prices may vary, but the bank will require that the apartment be assessed by an organization from a list of accredited companies. By using the services of other appraisers, the borrower will encounter opposition from the bank, or the process of preparing for the transaction will drag on for a couple of weeks. Refusal to accept the opinions of third-party experts is caused by distrust of the company’s results or inconsistency with the parameters of the report. Contacting an accredited appraiser does not guarantee that you will not have to redo the appraisal and spend money again, since the document is drawn up before obtaining mortgage approval. If the bank rejects the application to purchase the selected object, you will have to look for a more suitable object for purchase, which means spending money on an appraiser again.

You can save the assessment results if the already prepared conclusion is accepted by other banks. Realtors advise choosing companies for assessment that are accredited with several banks, so that if one bank refuses, try to negotiate a mortgage with another.

How much do the service cost?

It is important to mention the fact that the services described are provided on a paid basis. The fee for the provision of the described services is a commission retained by the banking structure. The exact value of the commission that clients will be forced to pay in a particular case is determined individually.

You should know that the amount of commission fees is influenced by two main characteristics:

- The volume of the concluded transaction.

- Discounts that a specific client can take advantage of.

Practice shows that the average commission fee for the provision of the described service is 0.8% of the volume of the concluded transaction.

It is important to mention that the commission that will be charged to you for using the service described is a fairly small price to pay for the confidence that your rights will not be violated and you will not become a victim of scammers. It should be understood that despite the efforts of law enforcement agencies, there are a huge number of scammers on the domestic real estate market who may try to steal your money. For this reason, the only guarantee that your interests will be reliably protected are the services of a secure transaction service from the described banking structure. It is for this reason that the described service is simply extremely popular among our fellow citizens.

Fees upon registration

Expenses: State duty receipts are paid twice: when registering the right to a mortgaged home with an encumbrance due to the mortgage, and then when the encumbrance is removed. For secondary housing, the fee is 2 thousand rubles, for new buildings - 350 rubles. To quickly obtain a mortgage, they charge 1.5 thousand rubles.

Costs for registration services cannot be avoided, and they are also included in the amount that will be required at the initial stage of applying for a mortgage. Payment cannot be postponed or refused as required by law.

To reduce costs, they use a digital signature when submitting documents electronically. If there is no digital signature, electronic registration is more expensive than the usual visit to the registration authority. The promise of an accelerated re-registration process through remote application is not always fulfilled, since public services often work with malfunctions, and there are some imperfections in the system that affect the timing.

Upon completion of the mortgage payments, you will have to apply again to Rosreestr to remove the encumbrances from the title. When issuing a mortgage, a fee is also paid.

Insurance costs when applying for a mortgage

A mortgage loan also comes with the need to pay insurance premiums. We strongly do not recommend saving on this. Why? The fact is that insurance is not always a lifeline for the bank in the event of loss of solvency of the debtor or force majeure. Sometimes insurance is the only possible solution or even salvation for the payer himself. Let's simulate a situation: the main breadwinner loses his job or dies, and his family members, without a source of income, simply cannot repay the mortgage loan. If you have life and death insurance, the amount may cover the balance or more of your mortgage.

Insurance costs when applying for a mortgage

If life and death insurance is not necessary when taking out insurance, then various insurances on the real estate itself cannot be canceled. Up to 1–2% will have to be paid per year to insure the real estate itself against loss or damage. This is a guarantee to the bank that you will pay the balance of the debt in any situation. Sometimes you may be required to have "title" insurance. We also do not recommend refusing this insurance. If you take out all the required types of insurance, the bank in most cases will reduce the interest rate on the mortgage loan, since the risks of non-payment will significantly decrease.

Notary

Expenses: Fees for notary office services are determined according to established tariffs and depend on the reasons for the application.

Notarization is required when applying for a mortgage if:

- The property is registered by the spouses; before concluding the transaction, the bank required the execution of a marriage contract for the property of interest or certification of a deed of sale.

- A notarized consent was required from the second spouse to purchase with a mortgage.

- A lawyer is involved in the execution of the transaction and the preparation of documents. To perform a number of actions, the lawyer requires a power of attorney from the buyer, certified by a notary.

- For mortgages, MSC (maternity capital) funds are used. Before agreeing on a tranche from the budget, the Pension Fund will ask you to draw up a notarial obligation to allocate shares to all family members after the final repayment of the debt and the removal of encumbrances on the real estate.

How much does the service cost?

The cost of the service is 2000 rubles. A banking organization may charge a commission for intermediation. The amount of the commission fee is determined individually and depends on the following factors:

- Possibility of discount.

- Transaction amount.

When a service is issued on general terms, Sberbank provides a commission of 0.8%. It can be divided between the parties to the contractual relationship.

Rent of a safe deposit box and other banking services

Expenses: To organize settlements with the seller, use a safe deposit box rented from a bank, a letter of credit or a nominal account. Each bank has its own prices for services. For example, you need to set aside an additional 3 thousand rubles per cell.

A safe deposit box is rarely used; banks prefer to use a letter of credit. If the seller has opened an account with another bank and requires funds to be transferred to it, the interbank transfer will also have to be paid according to the tariffs set by the lender.

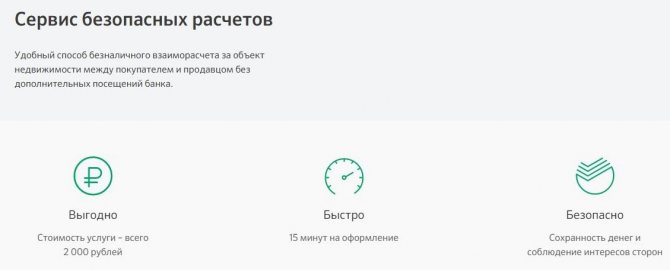

Secure payment service*

This is a convenient way of non-cash payment for real estate between the buyer and seller.

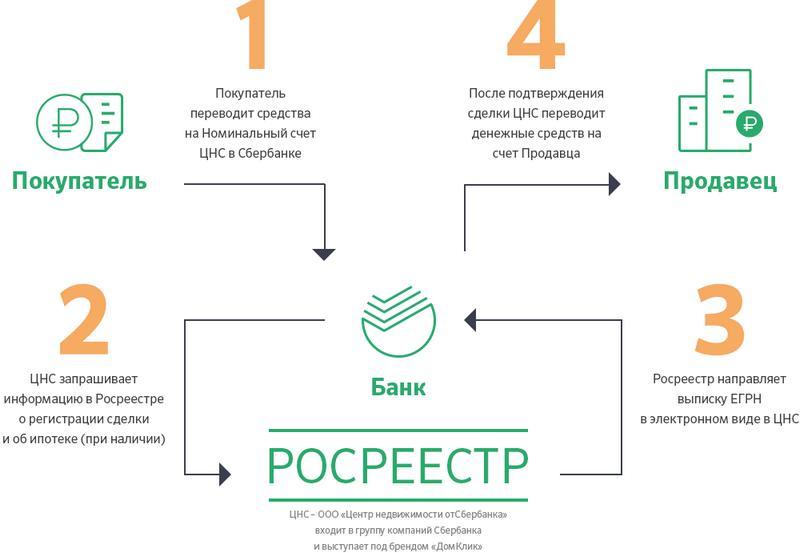

How it works?

- The buyer transfers funds to a nominal account opened with Sberbank;

- DomClick electronically requests information from Rosreestr about the transfer of ownership of real estate;

- Rosreestr sends the USRN extract to DomClick - electronically;

- Real Estate Center LLC from Sberbank, after receiving confirmation of registration of property rights from Rosreestr, transfers money to the seller.

Advantages of this service:

- DomClick monitors the status of the transaction online and, after receiving confirmation of registration of ownership, transfers money;

- transfer of funds to the seller only after registration of ownership without an additional visit to the bank, customer support through the DomClick personal account;.

- making payments for 1 visit to the bank, the ability to transfer money to the account of another bank.

Realtor, broker, lawyer services

Expenses: Payment for specialist services when coordinating a mortgage transaction averages 5% of the price of the purchased property.

Trying to save money on a realtor is often very expensive. In order not to become a victim of fraudsters and not to suffer from violation of the registration procedure, citizens prefer to pay extra to a professional specializing in real estate and mortgages. For a fee, a realtor will check the transaction for legal purity, guide you in the actions to be taken when agreeing on the transaction and issuing mortgage funds. Advice from an experienced realtor will protect the borrower from dangerous transactions and suspicious sellers.

Legal assistance is invaluable when it comes to reviewing a contract from the buyer's perspective. The lawyers' services include checking documents for the transaction, drawing up an agreement for the purchase of an apartment, studying the clauses of the agreement with the bank, including clauses that people like to write in small print.

Service cost and additional commissions

Regardless of the price of the purchased property, the cost of secure settlements for a mortgage transaction is 2 thousand rubles . Sberbank does not charge any additional commissions or payments.

However, if money is transferred to the special account of this service from the account of a third-party bank or financial organization, then a transfer fee may be charged. Its size will depend on the tariff policy of this third-party bank. If the account from which the buyer will transfer funds under the agreement is opened with Sberbank, then nothing additional will be required.

In addition, when Sberbank settles with the former owner of the apartment, an additional commission may arise due to the transfer from the account of a legal entity to the account of a citizen. You can clarify this point with the receiving bank.

Related bank services

Expenses: What services the bank will offer or require will be found out upon contacting a specific lender.

A financial institution is a commercial structure whose goal is to obtain maximum profit from providing services to clients. Often banks persistently offer legal services to ensure the security of the transaction. If the client does not have his own lawyer, such a service is in demand, because the bank vouches for the professionalism of the proposed lawyer.

It is impossible to know in advance how much a lawyer’s help with a mortgage will cost. It depends on the rates set by a particular bank. For example, checking real estate at Sberbank costs 15 thousand rubles, and preparing a bill of sale at VTB Bank costs 2 thousand rubles. It is necessary to understand that the bank does not provide guarantees on the results of the audit.

The services of a lawyer will help identify ambiguities and clauses in the mortgage agreement that are not written in the interests of the borrower. Due to inexperience and ignorance, the client risks missing important aspects of the mortgage transaction, which will subsequently negatively affect the borrower.

Requirements and necessary documents

Any Sberbank service has certain conditions that its customer must meet. For the secure payment service, the applicant must have Russian citizenship. Legal organizations using the portal are required to provide documents relevant to their activities. Organizations can act in transactions on the part of the seller of real estate or the person assigning the right of claim.

On the secure payment service, only direct agreements between two parties are legitimate, thus eliminating chain-type shady frauds. The number of accounts to which funds are transferred upon completion of the transaction is two.

If the owner is listed as the owner for less than three years, he is required to pay income tax when selling the apartment. In an effort to avoid this scenario, many owners in real estate transactions deliberately underestimate the real cost of the apartment in contracts on the secure payment service. Thus, when an agreement is concluded, it indicates a lower price for the property, and the buyer pays the remaining amount in cash or other means.

A significant drawback of such an agreement is the fact that in the event of possible termination of the purchase and sale of housing transaction, the buyer is returned only that part of the amount that is indicated in the application on the portal. And funds transferred in another way may remain in question.

A receipt for the transfer of a certain amount of money has legal force. But in order to get the funds back, you will most likely have to go to the courts. The trial procedure will take time and require new material costs. Therefore, transactions with reduced prices are justified only in cases where the counterparty is reliable and the history of the property is transparent and clean.

When concluding an agreement through the secure payment service, the following documents are required:

- from the purchaser - the borrower’s passport;

- payer's TIN;

- from the receiving party - an identification document of an individual, or a certificate of registration for legal entities;

- the seller must provide account details to which the money will be transferred.

A common document drawn up by both parties - a purchase and sale agreement - is also submitted to Sberbank.

Costs to obtain favorable mortgage interest rates

Costs: How much a client will pay for a mortgage depends entirely on the chosen bank, program, and size of the credit line.

Sometimes it is possible to reduce the final interest overpayment if the borrower makes an additional payment when signing the contract. Savings reach 1.5% of the initial rate. At first, such an offer seems profitable, but before agreeing, you should carry out mathematical calculations and determine the real savings. Sometimes the amount paid is comparable to the savings on a mortgage with a reduced rate. It may be easier to subsequently apply for refinancing and lower the rate some time after receiving the loan, but from a different bank.

Such a payment is beneficial only when planning mortgage payments strictly according to schedule, but all economic benefits are lost if the client plans to repay the debt to the bank ahead of schedule. To determine the reasonableness of the payment, it is recommended to consult with a realtor or lawyer.

Payments to a notary and budget deductions

When applying for a mortgage loan, you will need to pay a notary for registration of the transaction and pay a state fee. Budget contributions are only 500 rubles, but the price of notary services depends on the amount of real estate. You will have to pay several thousand rubles for registration; it will not be possible to avoid payment.

Services of mortgage brokers and realtors

Preparation of an extract from the BKI

Costs: There is a fee for requesting a credit history through the bank. Each bank determines the costs independently; this is at least 500 rubles.

The bank itself is unlikely to require the client to present an extract from the BKI, since it initiates the verification independently, separately from the borrower. It helps determine the degree of reliability of the future borrower and predict the likelihood of problems with mortgage repayment based on the history of repayment of previous loans. But such a statement will also be useful for the client to check in advance his chances of getting the mortgage application approved. If there are errors in the records or serious complaints about the applicant, there is time to correct the history before applying to the bank for a mortgage.

There is no single database in the Russian Federation, but in total there are 13 bureaus in the country that monitor the credit activity of citizens. It may happen that there are no records about the client in the selected BKI or they will be in all databases at once. The fact is that banks submit information about their clients only to some bank accounts.

To make contacting the BKI effective, it is recommended to first find out which specific databases store the history of a particular borrower. To do this, contact the Central Bank CI Catalog and clarify which organizations make sense to contact.

Every citizen of the Russian Federation has the right to independently submit a written request for the provision of a CI free of charge, but not more than once a year. However, it is more convenient to use the banking service by paying the bank about 0.5 thousand rubles.

Regular receipt of statements is an advisable preventive measure that helps to identify non-existent loans issued by fraudsters using the borrower’s passport data, or to detect errors in records and correct them before the bank refuses to provide a mortgage. For correction, it is recommended to contact the Central Bank directly. The application indicates the specific circumstances that prompted the request to adjust the records.

Features of the service

The service for ensuring secure transactions when purchasing real estate was developed specifically for Sberbank clients and allows you to eliminate fraud in mutual settlements. The essence of the operation is that an intermediate link is created, namely a special account in the Sberbank Real Estate Center (CNS), to which the buyer transfers the required amount equal to the value of the property (residential or commercial). As soon as the transaction is verified and registered with Rosreestr, the money will be transferred to the seller’s bank account.

The innovation was developed for participants in mortgage lending, but the parties to the agreement can be individuals and a legal entity as a developer company. The service is applicable for a secure real estate transaction from Sberbank for the sale or purchase of any type of premises: an entire apartment on the primary or secondary market or only its share.

Customer Service Benefits

The service provided by the bank for secure non-cash payments is beneficial to representatives of both parties. The main advantages can be highlighted as follows.

For the seller, the positive aspects include:

- there is no need for a personal visit, only account details for depositing money are indicated;

- Before the amount of money is credited, each bill is checked by an intermediary bank;

- instant transfer of a sum of money immediately after confirmation of the registration procedure (through the MFC or Rosreestr).