How to assign an inventory number to a residential building

- Objects of fixed assets, i.e. property operated for more than 12 months (structures, equipment, transport, furniture, etc.);

- Non-productive assets (natural resources - water, land, forest, etc.).

- Intangible assets, i.e. software products, brands, etc.;

If a coincidence does occur, this is an absolute mistake by BTI technicians that must be corrected. The inadmissibility of the same is due to the fact that the cadastral, assigned at the next stage, cannot be given to several objects.

Where to View the Inventory Number of a Residential Building

For example, it contains encrypted codes:

- Company branch;

- Code within a department, etc.

- Structural unit;

The features of this procedure are regulated by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n, approving the Methodological Instructions for accounting for fixed assets (clause 1, clause 11). A separate inventory item is assigned one number, which must be applied to it: with paint, by attaching a metal token or by another method.

Technical inventory allows you to characterize all the features of a real estate property that distinguish it from the class of similar objects. The procedure is paid and requires some time, usually at least 20 working days. It is carried out at the cost stipulated by local legislation; an additional payment is charged for expediting the work.

Where to look at the technical passport of an apartment building and how changes are made to it

An application for a technical passport must be submitted to the building management company. They must keep a copy. You can also contact the developer, if he still exists. Another authority that stores the registration certificate at home is the local administration. They are obliged to store it indefinitely in the archives of the institution.

REFERENCE! The developer is responsible for preparing a technical passport for the house. Before commissioning, he may refuse an application for a copy, but after the building is commissioned, the passport must be transferred to the homeowners' association.

Inventory number of the property

The process proceeds as follows: at the request of the actual owner of the building, BTI technicians inspect the facility and check the accompanying documents - construction permit, document for allocating a plot, title papers, building design, permission to put the structure into operation. The result of the inventory is an entry in the BTI journal under a certain number and the production of a technical passport for the object. The number from the magazine in most cases is considered as the inventory number of the property from shushari68.ru/.

BTI is responsible for the primary inventory of real estate. Technical inventory allows you to characterize all the features of a real estate property that distinguish it from the class of similar objects. The procedure is paid and requires some time, usually at least 20 working days. It is carried out at the cost stipulated by local legislation; an additional payment is charged for expediting the work.

How to find out the inventory number of a property

The inventory number of a real estate object is part of the cadastral number of a real estate object; identification of this real estate object in the unified state register of rights by a conditional number, which. Ru legal consultation administrative law military service civil law housing law constitutional law passport regime, registration social security law family law labor law criminal law financial law other legal issues. Cadastral number of the land plot, inventory or serial number of the building; at this moment, all real estate objects were assigned a cadastral number in the Unified State Register; replacement of the cadastral or conditional number was carried out.

We recommend reading: The government service website does not allow you to enter series II of your birth certificate, what to do?

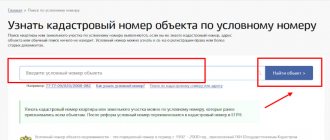

No. bs/@ Federal Tax Service talked about the procedure for filling out sections 2 and tax reporting forms for corporate property tax. The conditional number of the object is entered into the search line, after which you can get information about the new code. Partizanskaya, 2 (inventory number, letter a, cadastral (conditional).

Where to View the Inventory Number of a Residential Building

As a result of the initial registration, cadastral passports of the specified objects, as well as premises in apartment buildings and non-residential objects, are issued. If the Rules for Maintaining the Unified State Register of Registered Registered Offices * (49) are in effect on the territory of a constituent entity of the Russian Federation, then for technical accounting without a primary inventory, technical passports are issued on the basis of the documents submitted by the applicant. Technical inventory, as well as the issuance of documents on capital construction projects to individuals and legal entities, is carried out for a fee, the amount and procedure for collecting which is established by the legislation of the Russian Federation (clause 10 of the Regulations on technical accounting and inventory). The technical inventory of the housing stock is carried out at rates approved by the executive authorities of the constituent entities of the Russian Federation (clause 8 of the Regulations on accounting of the housing stock). Thus, by order of the Department of Economic Policy and Development of Moscow dated December 13, 2005 N 50-R “On approval of selling prices for work on technical inventory of urban planning objects” (as amended on December 29, 2009), the cost of work on technical inventory of buildings was approved, buildings and land plots. Technical inventory in Moscow costs 20.3 rubles. per sq. m (10.3 rubles per sq. m. over 1000 sq. m.); technical passport of the apartment - 890 rubles; cadastral passport of a building, structure - 443.24 rubles, premises - 140.24 rubles. plus the graphic part - 1.3 rubles. per sq. m. Decree of the Government of the Russian Federation dated August 12, 2010 N 615 established the maximum maximum fee for the issuance by a body or organization that stores registration and technical documentation about a building, structure, premises or an unfinished construction project, the state technical registration of which was carried out before the date of entry into force Law on the Real Estate Cadastre (March 1, 2008) or during the transition period of its application (until January 1, 2013), a cadastral passport of such a property: for individuals - 500 rubles, for legal entities - 1000 rubles. According to clause 16 of the Regulations on Technical Accounting and Inventory, information about capital construction projects is provided upon applications (requests): a) the owner, holder (balance holder) or their proxies (upon presentation of a duly executed power of attorney); b) heirs by law or will; c) law enforcement agencies and courts (on cases pending in them); d) bodies of state power and local self-government (for facilities in the relevant territory); e) tax authorities (for objects in the territory of their jurisdiction); f) state statistics bodies (information included in the forms of federal state statistical observation); g) justice institutions for state registration of rights to real estate and transactions with it; h) other bodies and persons determined by the legislation of the Russian Federation. Unless otherwise established by law, information and documents about objects of technical accounting and inventory are provided within a month from the date of application by the owner of the object (owner, balance holder, heir and their representatives) (clause 17 of the Regulations on technical accounting and inventory). The rules for issuing a technical passport for a capital construction project and a cadastral passport for a real estate property differ in terms of timing and circle of persons. During the transition period established by the Law on the Real Estate Cadastre until January 1, 2013, the OTI (BTI) is obliged to issue a cadastral passport of a building, structure, premises, or unfinished construction project previously registered by it within 10 days at the request of any person for a fee, the amount of which is established subject of the Russian Federation (Part 9 of Article 45 of the Law on the Real Estate Cadastre). At the same time, no one has the right to demand from the owner of a property previously registered in the OTI (BTI) or from another person to carry out a planned, unscheduled or other technical inventory (re-registration, re-description, formation, etc.) in connection with the issuance of a cadastral passport or in connection with the registration of the right to the object (part 10 of article 45 of the Law on the Real Estate Cadastre). Decree of the Government of the Russian Federation dated September 10, 2004 N 477 “On amendments to certain acts of the Government of the Russian Federation on the implementation of state technical accounting and technical inventory of capital construction projects” established that: 1) technical inventory is carried out by organizations (bodies) accredited by Rosnedvizhimost; 2) state technical accounting should be carried out by Rosnedvizhimost and its territorial bodies (after the adoption of regulations defining the procedure for state technical accounting). Currently, by Decree of the President of the Russian Federation of December 25, 2008 N 1847 “On the Federal Service for State Registration, Cadastre and Cartography,” Rosnedvizhimost has been abolished, and its functions have been transferred to Rosreestr. In accordance with clauses 7.1.19, 7.1.40 of the Model Regulations on the territorial body of the Federal Service for State Registration, Cadastre and Cartography, approved by Order of the Ministry of Economic Development of Russia dated 05.10.2009 N 395 * (51), the territorial bodies of Rosreestr are vested with the functions of accreditation of OTI ( BTI) and maintenance of state technical accounting of capital construction projects (in regions in which the Rules for maintaining the Unified State Register of Regional Registers have been introduced) (see the next subparagraph). In those constituent entities of the Russian Federation in whose territory the Rules for maintaining the USROKS are not in effect, technical inventory and technical accounting are carried out by OTI (BTI). The objects registered by them are considered included in the State Property Committee (Article 45 of the Law on the Real Estate Cadastre). As established by clause 7 of the Regulations on Technical Accounting and Inventory, when carrying out technical accounting, an object is assigned inventory and cadastral numbers. A cadastral number can be assigned to buildings, structures, and premises only when registering an object with the Unified State Register of Regional Registers (Clause 10, 17 of the Rules for maintaining the Unified State Register of Regional Registers). If a real estate object (building, structure, premises) is not assigned a cadastral number in the prescribed manner, then this is not an obstacle to state registration. In this case, the registering authority independently assigns a conditional number in accordance with clause 3 of Art. 12 of the Law on Registration of Rights and the Instructions of the Ministry of Justice on the assignment of conditional numbers to real estate objects. Objects that are assigned a conditional number during state registration of rights are considered included in the State Property Committee (part 1 of article 45 of the Law on the Real Estate Cadastre). Such objects are assigned a cadastral number without the participation of the copyright holder when information about it is included in the relevant sections of the Civil Code:

- Regulations on state accounting of the housing stock in the Russian Federation, approved by Decree of the Government of the Russian Federation of October 13, 1997 N 1301 (hereinafter referred to as the Regulations on accounting of the housing stock);

- Regulations on the organization in the Russian Federation of state technical accounting and inventory of capital construction projects, approved by Decree of the Government of the Russian Federation dated December 4, 2000 N 921 (hereinafter referred to as the Regulations on technical accounting and inventory);

- Instructions on conducting accounting of the housing stock in the Russian Federation, approved by order of the Ministry of Land Construction of Russia dated 08/04/1998 N 3;

- Order of the Ministry of Economic Development of Russia dated August 17, 2006 N 244 “On approval of the form of a technical passport for an individual housing construction project and the procedure for its registration by an organization (body) for recording real estate objects;

- Order of the Ministry of Economic Development of Russia dated September 8, 2006 N 268 “On approval of the Rules for maintaining the Unified State Register of Capital Construction Projects” (hereinafter referred to as the Rules for maintaining the Unified State Register of Capital Construction Projects).

This is interesting: Can I Sell a House If I Have a Debt on Alimony from the Bailiffs

How to Find an Object by Inventory Number

- state registration of rights;

- maintaining state statistical records;

- determining the amount of property tax;

- entering information about previously registered real estate into the State Property Committee;

- maintaining a register of federal property.

- Regulations on state accounting of the housing stock in the Russian Federation, approved by Decree of the Government of the Russian Federation of October 13, 1997 N 1301 (hereinafter referred to as the Regulations on accounting of the housing stock);

- Regulations on the organization in the Russian Federation of state technical accounting and inventory of capital construction projects, approved by Decree of the Government of the Russian Federation dated December 4, 2000 N 921 (hereinafter referred to as the Regulations on technical accounting and inventory);

- Instructions on conducting accounting of the housing stock in the Russian Federation, approved by order of the Ministry of Land Construction of Russia dated 08/04/1998 N 3;

- Order of the Ministry of Economic Development of Russia dated August 17, 2006 N 244 “On approval of the form of a technical passport for an individual housing construction project and the procedure for its registration by an organization (body) for recording real estate objects;

- Order of the Ministry of Economic Development of Russia dated September 8, 2006 N 268 “On approval of the Rules for maintaining the Unified State Register of Capital Construction Projects” (hereinafter referred to as the Rules for maintaining the Unified State Register of Capital Construction Projects).

This is interesting: Do flight school cadets have travel benefits?

Inventory number

An inventory number is a unique number assigned to each fixed asset item upon acceptance for accounting. Such numbers are necessary for the purposes of accounting in general and for monitoring the safety of fixed assets in particular (clause 11 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance dated October 13, 2003 N 91n).

At the same time, letter codes can be added to the inventory numbers, which will carry additional information about the OS object. For example, indicate which department (unit, sector, workshop) it belongs to. Let’s say the logistics department can be designated as “OL”, and the marketing department as “OM”. Then the inventory numbers may look like this: OL-01, OL-02, OM-01, OM-02, etc.

Inventory number and features of its use

An inventory number is assigned to a property at the time it is accepted for registration. After this, it acquires the status of an inventory object - a control unit. The number is applied to the object using durable paint, a barcode, engraving, using a token that cannot be quickly and discreetly removed, or in another similar way. The number must be applied so that during an inventory it can be easily and without errors identified with the BU data.

The main objects in relation to which management is organized in this way and control is exercised are:

- OS - fixed assets, objects of property of the organization that have been in operation for more than a year, are intended for production needs, and the cost of which is a legally defined amount;

- intangible objects, assets (IMA) - these include products of intellectual labor, for example, technological developments, software development, trademarks, brand names and other objects that do not have a material form, but which can in the future bring material benefits (see. Civil Code of the Russian Federation Article 1225-1, PBU 14/07);

- non-produced objects, assets - these are natural objects, subsoil, lands, water bodies, etc.

Objects costing less than 3 thousand rubles. no inventory number needed.

The following mandatory requirements apply to inventory numbers:

- they should not be duplicated;

- they must be assigned in order.

In addition, when using inventory numbers in accounting records, it is important to be guided by the following important information:

- The inventory number is applied in the presence of a commission specially created for this purpose and recorded in the inventory number journal.

- If the inventory object is a whole consisting of separate functional parts, a number is applied to each part.

- Moving an inventory item within the organization or its divisions is not a reason to change the number or adjust it. The inventory number does not change during the entire operation of the object to which it is assigned.

- If fixed assets are leased by a company, they are usually accounted for by numbers assigned by the lessor. At the same time, from Resolution 11 of the Arbitration Court of Appeal No. A55-24142/2013 dated 04/28/14, it follows that when the rights to an inventory object are transferred, for example, when signing a leasing agreement, it may be assigned a new inventory number of the organization that acquired such rights. It is argued that the assignment of inv. numbers are an internal matter of the organization.

- The inventory number of an object deregistered (sold, written off, etc.) cannot be assigned to another object in the same organization.

What objects are subject to numbering

Codes are assigned to the following objects:

- Fixed assets. These are tangible items that can be used in work for 12 months or more. For example, equipment, tools, furniture, etc.

- Intangible objects. For example, a movie, a multimedia product, technology.

- Non-produced assets. These are the resources of the earth's interior, land plots, etc.

Be sure to read it!

Obtaining a divorce certificate after a court decision in 2020 Codes are indicated in the documentation for accounting for fixed assets and are used during inventory. Movable and immovable property is taken into account.

Library collection objects are assigned codes regardless of cost. All objects are subject to numbering, regardless of whether they are used in work or are in stock.

Where to look at the technical passport of an apartment building and how changes are made to it

This document contains information about the economic and physical parameters of the house. Its main purpose is to inform apartment owners, maintenance and management services, and authorities at any level about all the properties of the building.

IMPORTANT! The owners of the technical documentation for construction are the owners of the residential premises that are located in it. When the organization managing the house changes, the registration certificate is transferred to the new owner. If the house becomes the property of the apartment owners, one of them can receive a passport.

Inventory number

The legislation has not established any special guidelines for compiling inventory numbers. In this regard, organizations must themselves establish the procedure for carrying out this process and record it in their accounting policies.

- The number assigned to an item of fixed assets will reflect this item in accounting throughout the entire period of use of this item.

- All parts of the property that have their own terms of functionality are assigned a separate inventory number. This means that one OS can have several numbers at once, depending on the number of parts. If an object has component parts, but is not divided by useful life, it is assigned only one number.

- The inventory number remains with the asset even in situations where the asset moves within the company. If an organization uses an asset under a lease contract, the asset must retain the number assigned to it by the lessor.

- If the assignment of inventory numbers is reflected in a special document, then the procedure for their compilation is not regulated. This obligation rests with the companies themselves. In this regard, companies should, before generating numbers, draw up an internal company act that will determine the sequence of generating these numbers.

- The compilation of inventory numbers can be based on the accounting numbers by which inventory assets are recorded. If the company has branches, their numbering may be included in the inventory numbers. All numbers must be recorded in a special journal of inventory numbers.

- The number must be placed on each item to be counted. It can be written on the object itself, or on a piece of paper.

This is interesting: Is it possible not to let the bailiff into some rooms of the apartment?

Where to View the Inventory Number of a Residential Building

Many property owners are interested in the question of how to find out the cadastral number of a property by address and whether they need to contact authorized services and departments for this. The easiest way is to find your property by entering the exact address in the “search” field here

The streamlining of all data on real estate has led to the state providing the opportunity for all subjects of civil legal relations to obtain information of interest about objects without leaving home. The question of how to find out the cadastral number of a property by address interests many citizens.

How to Find an Object by Inventory Number

Many property owners are interested in the question of how to find out the cadastral number of a property by address and whether they need to contact authorized services and departments for this. The easiest way is to find your property by entering the exact address in the “search” field here

In the information about any real estate, you will see the area of the object, the exact address, information about the owner, user, cadastral number, number of storeys, type of right, etc. Using the unique number of the object, you can make a request to Rosreestr and receive a comprehensive amount of information about it in the form of any document, you can order it here.

This is interesting: Kazakhstan Laws Payment for Harmfulness to Stokers

How to find the cadastral number of a property by address

So, you now know how to check the cadastral number of an apartment via the Internet. However, you may need to search for information exactly the opposite: checking by cadastral number of the property. Why is this needed and for what purpose is it done? The fact is that all experienced specialists recommend checking the property by cadastral number before buying or selling a plot. On the map you can personally verify the information provided on the object, because the boundaries of the land plot are also visible, you can even view neighboring territories using satellite images or digital topographic maps.

A cadastral number can be defined as a unique state registration number that is issued to all real estate properties without exception, regardless of the form of ownership. Without having this combination of numbers - a special unique code - in your hands, you will not act as the owner and will not have any rights to make any transactions with this property. It doesn’t matter what you want to do with a house, plot or apartment - transfer it by inheritance or rent it out, any action will be considered illegal if the object does not have a cadastral number. How is a cadastral number assigned to a property and what does it consist of? It is compiled based on the cadastre value of the building in which your apartment is located and the inventory number of this apartment. This number is issued during cadastral registration.

This is interesting: Chita Large Low-Income Families Benefits 2020

Cadastral or conditional number

As mentioned earlier, the cadastral number must be written down in the certificate; if this is not there, then they usually put a conditional number that corresponds to a specific property. They used it from 1992 until 2000. This is how the share of a person was determined, and the number was also needed to privatize the home. If you look at most old apartments, you will come across a conventional number that has not yet changed.

It is now common practice that, when concluding a transaction in real estate companies, a conflict situation may arise because the number on the certificate is written incorrectly. And all because they see the conditional. All this is not a problem, because, according to the law, these are completely equal concepts, and both the first and the second take place in the documents. The bottom line is that the cadastral number remains as long as the corresponding object exists as a unique object of registered right.

We recommend reading: VTB based on two documents

Inventory number

3.1. This is determined by the employer. Any employee of a company/firm can be a financially responsible person, that is, deal with objects (this could be money, documents, office equipment, goods and much more) that constitute some value for the enterprise for the benefit of which he works. There are a number of mandatory documents on the basis of which a financially responsible person can be appointed at an enterprise. The main one is the order to assign mat. responsible person, which includes a reference to the legislative act regulating the possibility of appointing such an employee and directly the full name of the employee. Next, an agreement on full or partial financial liability must be concluded, which spells out the rights and obligations of the parties. It is drawn up in two copies and signed by the parties to the agreement. This document can be drawn up both upon hiring and after, when the employee starts working with material assets due to a change of position, responsibilities, or other need.

10.1. - under certain conditions can be classified as fixed assets. —inventory numbers of office furniture are assigned in the order in which they are added to the balance sheet. The institution keeps records in accordance with the Instructions approved by Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n. The procedure for assigning inventory numbers is approved by the accounting policy.

Accounting for the tenant

An important point is that the leased asset, which is registered by the tenant, must strictly comply with specific requirements:

- the object is used exclusively in the main (production and economic) activities of the organization;

- the regulated useful life of this asset exceeds twelve months;

- there is a real possibility of profitable use of the fixed asset;

- the asset was acquired by the owner not for subsequent resale to third parties.

Thus, the compliance of a property object with all of the above criteria is the basis for its registration as an asset related to fixed assets.

The fact of transfer and acceptance of an asset under a lease agreement is necessarily certified by the execution of the corresponding act, which, as is known, is a necessary addition (appendix) to the agreement concluded between the lessor and the lessee.

Operating lease of fixed assets

Economic relations involving the transfer (provision) and acceptance (receipt) of a specific fixed asset item for a certain fee under temporary operation conditions are most often carried out under an operating lease.

A characteristic feature of this transaction is the immutability of the owner of the leased asset.

Operation of an asset provided under an operating lease is permitted solely for its intended purpose - only to perform production tasks.

The lessee, however, has the right to improve the technical and operational parameters of the leased equipment (asset), having previously agreed upon the relevant measures with the lessor (owner) of the fixed asset.

How to take into account the value on off-balance sheet account 001?

The fact of acceptance and registration of an asset by the tenant is recorded in the debit of account 001.

At what cost should the asset be accounted for? The fixed asset is accounted for by the lessee at the cost specified in the relevant lease agreement.

The disposal of an asset and its subsequent return to the lessor is reflected by the lessee on the credit of account 001.

By the way, account 001 refers to so-called off-balance sheet accounts in accounting.

Lease payments, which are periodically made by the tenant for the operation of the fixed asset, also require tax and, of course, accounting.

In essence, the rental fee for fixed assets is the direct costs of the tenant, reflected as part of the cost of the main or, alternatively, auxiliary production.

The specific scope of attribution of such costs is determined by the functional purpose of the leased equipment.

Postings

Payments for the lease of fixed assets are taken into account by the tenant enterprise as part of the expenses of its ordinary activities.

For tax accounting, rent is written off by the tenant as expenses that constitute the cost of services, work, and goods.

Taking into account the leased fixed assets, the lessee company draws up the following typical transactions:

| Operation (description) | Account debit | Account credit |

| The leased asset is registered | 001 | |

| The rent payment is included in the costs of the tenant company (excluding VAT) | 44,26,25,20 | 76 |

| The VAT amount is taken into account separately from the rental payment | 19 | 76 |

| The amount of VAT paid is deducted | 68 (according to VAT subaccount) | 19 |

| The rent payment is transferred to the lessor | 76 | 51 |

| The asset is returned to the lessor (upon expiration of the lease agreement) | 001 |

Be sure to read it! If an apartment was purchased before marriage, does the wife have the right to it during a divorce?

Depreciation

If an asset is used by an organization under an operating lease, the lessee enterprise does not charge depreciation on such an asset.

However, for tax accounting reasons, the lessee can depreciate capital investments (investments) in leased fixed assets on the following basis:

- the lessor of the fixed assets agreed in advance for the tenant to make such capital investments;

- the cost of such capital investments will not be reimbursed by the lessor to the lessee;

- such depreciation is carried out by the lessee during the term of the lease agreement;

- the amounts of such depreciation are calculated according to the regulated useful life of the leased fixed assets.

We find and find out the cadastral number of a building, structure or premises by address or conventional number

This group of numbers encodes the following designations: zone code, array code, quarter code. The registered quarter usually consists of small settlements, blocks of urban or village planning, etc.

What can you find out from the house and premises code? Using this numerical value, you can determine the exact address of the location of the object, the land, as well as the inventory numbers of the building. You can find out how KN of an apartment is deciphered from our article.

Inventory object and its number

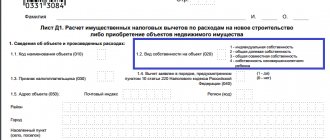

It is important for the heads of some budgetary institutions to know how much depreciable and non-depreciable property they have. To identify a group of depreciable fixed assets, inventory numbers are formed as follows:

Uniqueness also means that the inventory numbers of fixed assets written off from budget accounting will not be assigned to other objects. You cannot change numbers previously assigned to objects. Otherwise, the very first paragraph of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” will be violated. It states that accounting must be continuous.

Where to View the Inventory Number of a Residential Building

“Everything turned out to be a little different from what the theorists expected” (c) According to current information - Cadastral numbers and Cadastral passports in the Moscow Region have not yet been assigned everywhere (almost nowhere yet). The algorithm of actions is as follows: in the absence of a CP, the Federal Reserve System should be guided by the BTI data. Since Cadastral passports will be generated on the basis of BTI data, the result is a very “funny” picture. Before the creation of the Cadastral Chambers, cadastral registration is now carried out by the BTI.

1.1. In accordance with the terms of this Agreement, the Seller undertakes to transfer ownership of the Buyer, and the Buyer undertakes to accept and pay for the following real estate: ______________ with a total area of 521 (five hundred twenty-one) square meters (hereinafter referred to as the Premises), located on the 1st (first) and basement floors of the building at the address: city ______________, prospect ______________, building 33/15 (thirty-three fraction fifteen). 1.2. The premises are indicated graphically (in color) on the floor plan of the BTI according to the technical passport of the non-residential premises issued by the State Institution “________________ Regional Technical Inventory Department” as of November 3, 2006, inventory number 1366 (Appendix No. 1 to the Agreement in a copy).

10 Jun 2020 lawurist7 901

Share this post

- Related Posts

- Benefits to medaled participants in military operations in Syria by state

- What If I Bought a Car But the Bailiffs Came

- Regional Maternity Capital in the Tomsk Region 2020

- Bailiffs Want to Put My Store on Sale

What is BTI in Russia

What is it? A cadastral passport is a standard document containing a brief extract from the state real estate cadastre. It contains all the necessary information for registering the right to a specific object, which can be a land plot, premises, unfinished construction, etc., as well as for conducting various transactions related to these objects. Standard.

Why is it necessary Providing a technical passport is mandatory when performing the following legal actions: Registration of the purchase and sale of a real estate property. Property tax calculation. Entry into inheritance rights. Registration of a deed of gift for an apartment or house. Privatization of living space. Registration of property rights. Recognition of the right to ownership of property in court. Registration of a mortgage. Where can I order BTI specializes in collecting, organizing, storing.

12 Jun 2020 uristlaw 712

Share this post

- Related Posts

- Shares on a Writ of Execution May Be Arrested

- Survivor's Pension Which Is More Social Or Labor?

- Schoolchild's Ecard How to Activate the Travel Card

- A deposit that cannot be seized by bailiffs for non-payment of a loan