The land tax declaration is an official document that contains the necessary information on the collection and is subject to submission to the authorized bodies within the period established by law.

We will tell you how to fill out the 2020 land tax return without errors, and we will go through all the stages of drawing up this important document.

IMPORTANT!

In 2020, legal entities submit a declaration for the last time; from 2021, such reporting is canceled in accordance with the order of the Federal Tax Service of Russia dated 09/04/2019 No. ММВ-7-21 / [email protected] , which will come into force on 01/01/2021.

Who needs to submit a declaration

Legal entities and individual entrepreneurs reasonably have a question: do they need to submit a land tax return for 2020, and if so, to whom? This tax document must be prepared by those organizations that own or own land plots and are recognized as taxpayers for land tax in 2020. Those who are exempt from paying it under Art. will also have to report. 395 Tax Code of the Russian Federation. This tax is local, and it is payable to the budget at the location of the land. The authorities of the constituent entities of the Russian Federation set rates by their own legislative acts, so they differ in different regions and should not exceed the limits allowed by the Tax Code of the Russian Federation.

In accordance with the amendments made to Federal Law No. 347 of November 4, 2014, for individual entrepreneurs, the payment is calculated by the tax authorities, after which they send a notification of its payment by mail.

Where to file a land tax return

The declaration is sent to the Federal Tax Service with reference to the location of the taxable object - a land plot (clause 1 of Article 398 of the Tax Code of the Russian Federation). An exception is made for the category of largest taxpayers - they have the right to submit a report to the Federal Tax Service division at the place of registration of the company.

The choice of the format in which the report will be submitted depends on the number of individuals employed by the enterprise:

- according to the norms of Art. 80 of the Tax Code of the Russian Federation, with an average number of employees of 100 or less people, a business entity has the right to submit a declaration on paper;

- in other cases, only the electronic version is allowed (the document must be certified with an enhanced digital signature).

For violating the tax reporting format, a business entity may be fined 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). The paper version of the declaration can be submitted personally by the director of the company or his authorized representative; the option of sending the document by mail in a valuable letter is acceptable. In the latter case, it is necessary to attach a list of the attachment and a notification of receipt.

February 1 is the deadline for submitting the land tax return. Taxpayers must report for 2020 using a new form. Our article will help you understand the new reporting form.

Tax return for land tax: sample, rules and procedure for filling out

The procedure for filling out the reporting form is regulated by Appendix No. 3 to the corresponding order of the Federal Tax Service of Russia. The report form consists of three pages:

- 1st page - title page;

- 2nd page - section 1. The amount of land tax to be paid to the budget;

- 3rd page - section 2. Calculation of the tax base and the amount of land tax.

A sample filling is given for a Russian commercial organization, VESNA LLC, which is registered in the federal city of St. Petersburg. Carries out activities in the wholesale trade of food, drinks and tobacco, the company owns one plot of land located in the same city, cadastral number - 78:06:0004005:71. The cadastral value of the plot is 1,200,000 rubles. The organization has owned it for 12 months, the tax rate is set at 1.5%. KBK 182 1 06 06031 03 1000 110. OKTMO - 45908000. The LLC made advance payments to the budget during the year and transferred the following amounts:

- I quarter - 4500 rubles;

- II quarter - 4500 rubles;

- III quarter - 4500 rubles.

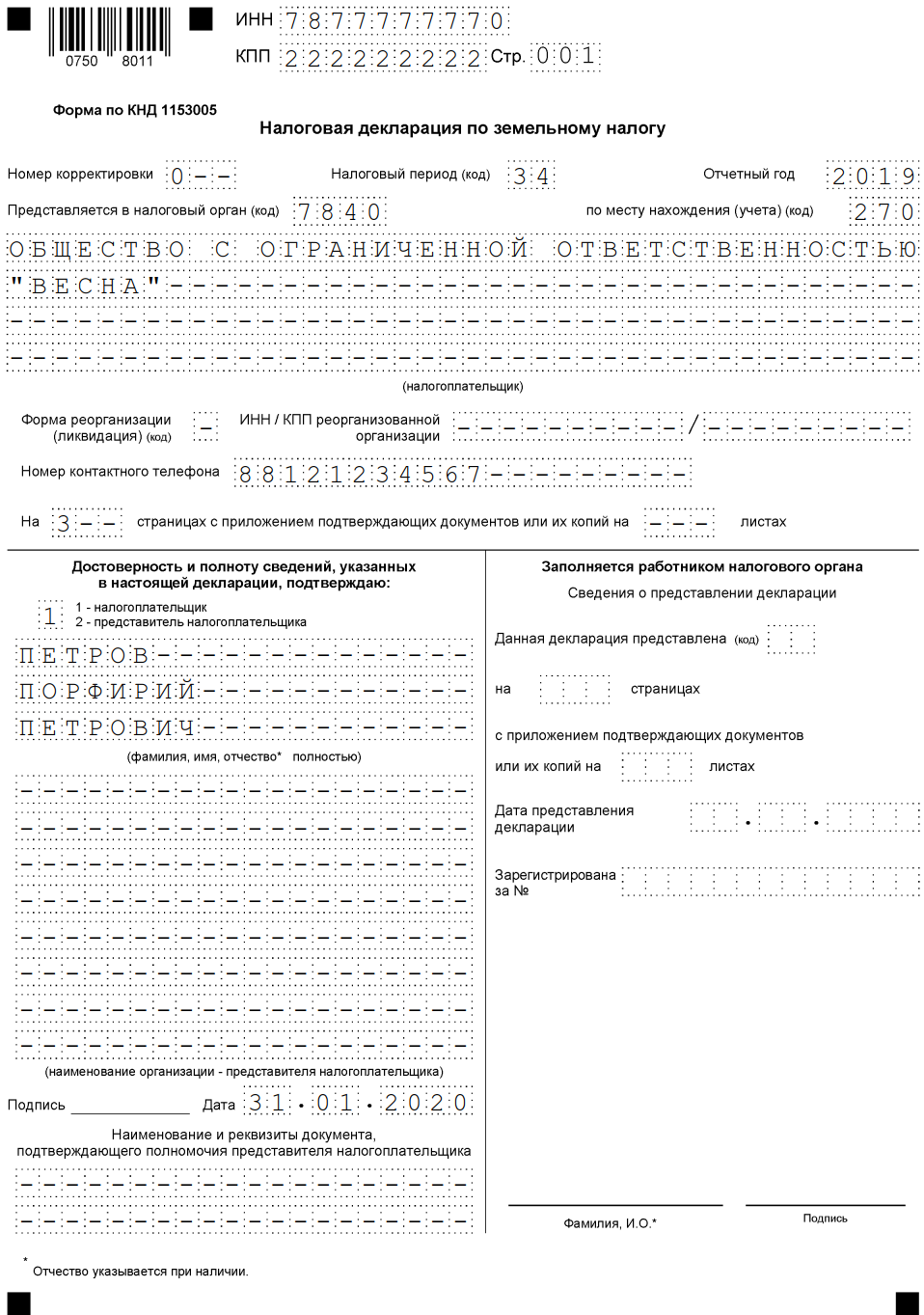

1 page - title page

The title page is filled out directly by the taxpayer himself, with the exception of the field “To be filled out by a tax authority employee.”

Let's consider a sample of filling out a tax return for land tax for 2020 for each field separately:

- the corresponding values are indicated in “TIN” and “KPP”, then they are automatically entered on each page;

- in the “Adjustment number”, if provided for the first time, indicate 000, for subsequent adjustments - 001, 002, and so on;

- in the “Tax period” we enter the required date of the tax period. For a calendar year - 34;

- in the “Reporting year” - the date the form was filled out;

- Each inspection to which reports are submitted has a personal, non-repeating four-digit code in its Federal Tax Service Inspectorate or on the official website of the Federal Tax Service. The 2 digits of the code at the beginning indicate the region, the other 2 digits indicate the code of the inspection itself. Since the tax return for land tax 2020 is submitted to the Federal Tax Service at the location of the plot or share in the plot, in our case the Federal Tax Service Inspectorate No. 9 of the Central District of St. Petersburg is indicated;

- The taxpayer enters the code at the location (accounting). In our case - 270;

- We enter the name of the organization in the empty and longest field of the title page, separating the words from each other with an empty cell. For our example: VESNA LLC;

- in the next line we enter the payer’s contact phone number;

- Next, we indicate the number of pages to be submitted to the inspection. Ours submits a report for 2020 on 3 pages, without attachments;

- in the place where it is necessary to indicate the taxpayer, enter the value 1 and full name. director or proxy;

- at the end we will put a date and signature;

- in the “Name of the document confirming powers under a power of attorney” there is a dash, since the report was signed by the director of the company in his own hand.

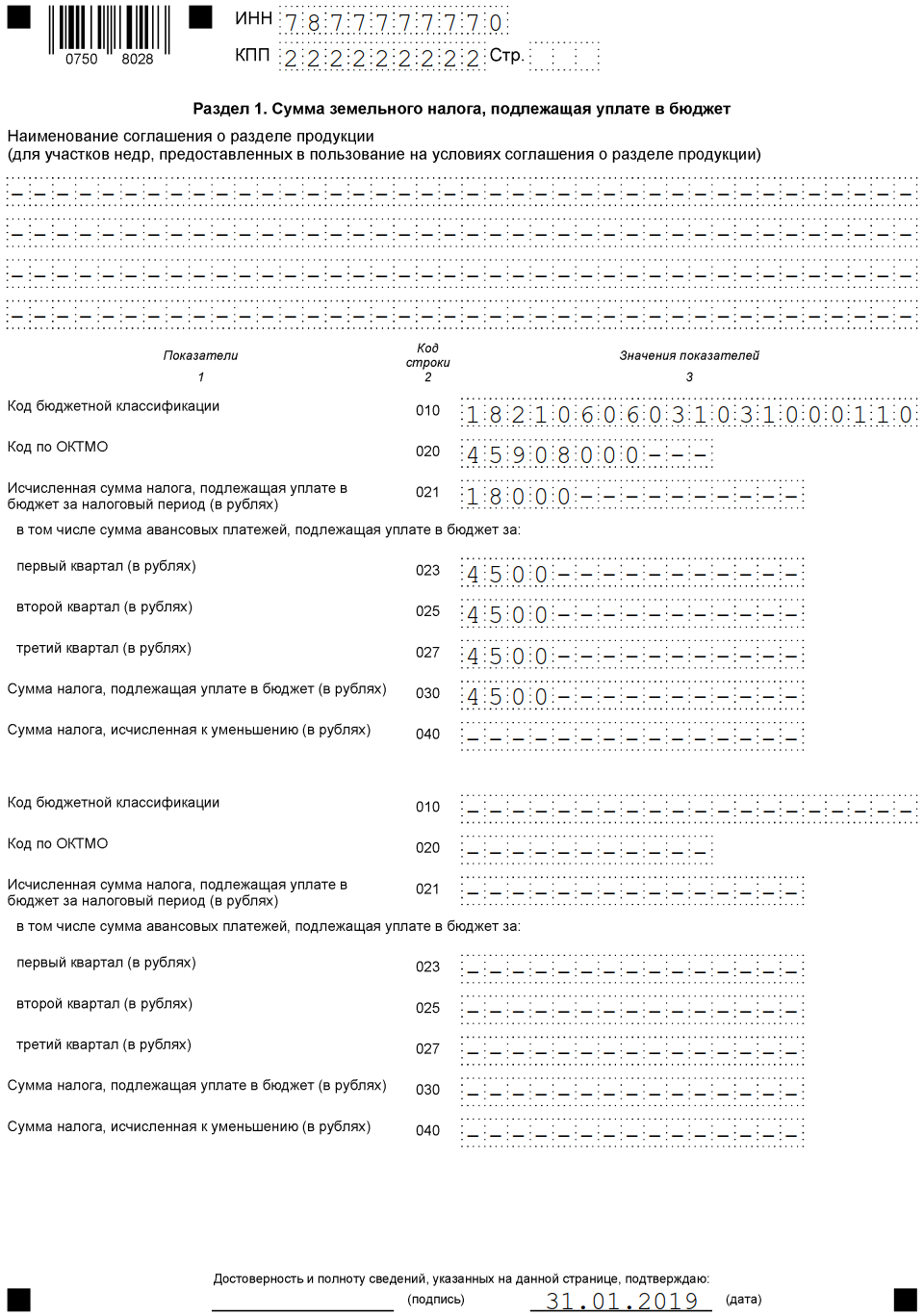

Page 2 - section 1. The amount of land tax payable to the budget

Let's look at a sample of filling out a tax return for land tax 2020 for each field separately:

- first you need to indicate the name of the production sharing agreement, since in our situation it is missing, we put a dash;

- in 010 we write the budget classification code KBK in accordance with the legislative acts of the Russian Federation on budget classification. Each time we check the relevance of the specified BCC. Our plot is located in the federal city of St. Petersburg - we indicate KBK 182 1 0600 110;

- 020 “OKTMO” indicates the code of the municipality in whose territory the mandatory fee is paid. For our company, we will enter 45908000 in the 2020 land tax return;

- 021 - total amount of payment calculated and subject to payment to the budget according to the corresponding codes KBK and OKTMO;

- from 023 to 027, the values of advance payments paid for the 1st, 2nd and 3rd quarters are recorded, respectively;

Advance payments = 1/4 × interest rate × cadastral value of the land plot (share) = 1/4 × 1.5% × 1,200,000 = 45,000 rubles;

- 030 is calculated as follows: 021 - (023 + 025 + 027). If the result is a value with a “–” sign, then a dash is placed everywhere;

- 040 = 021 – (023 + 025 + 027). The amount is calculated to decrease, therefore, if the result is: a negative value, put it without the minus sign;

- positive - put a dash. In fields 030 and 040, according to the conditions of our example, we put dashes;

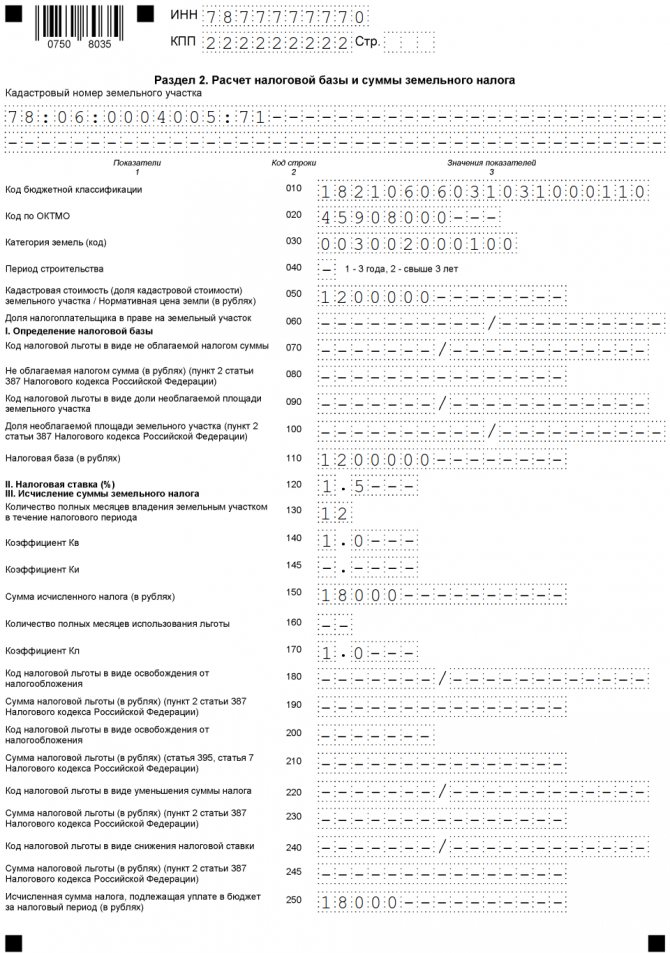

Page 3 - section 2. Calculation of the tax base and the amount of land tax

Let's consider filling out section 2 of the tax return for each field separately:

- TIN and checkpoint are entered automatically from the first page;

- We enter the cadastral number of the plot, this number is included in the certificate of state registration of ownership, from an extract from the Unified State Register or from the cadastral passport. 78:06:0004005:71;

- 010 - from Order of the Ministry of Finance No. 150n dated December 16, 2014, select and indicate the budget classification code;

- 020 - from the All-Russian Classifier of Territories of the Moscow Region we enter into the OKATO declaration;

- 030 - from Appendix No. 5 to the Federal Tax Service order No. MMV-7-11 / [email protected] select and indicate the land category code. Other lands - 003008000000;

- 050 - we take the cadastral value of the plot from the relevant Rosreestr documents or from the cadastral passport;

- 060 — enter the share size. If the land belongs entirely to the organization, put a dash;

- from 070 to 100 in the declaration we fill in the relevant information about benefits, which we take from the Tax Code of the Russian Federation and from documents confirming the rights to benefits. In most cases, commercial enterprises do not have benefits. In our case, there are no benefits either, which means dashes are added;

- 110 - the cadastral value of the object is indicated here. We have 1,200,000 rubles;

- 120 - we take the rate from the legislative acts of the local regulatory level, since the fee is local. For the category of our site, a rate of 1.5% is applied;

- 130 - indicate the period of ownership of the plot during the tax period. Indicated in full months. 12 full months;

- 140 - calculated as follows: line 160 (KV) = tenure / 12, for us = 1, since VESNA LLC owned the site for 12 months;

- 150 - determined by the formula: 110 (tax base) × 120 (rate) × 140 (Q coefficient). This amount is also reflected in field 250. 150 = 1,200,000 × 1.5% × 1 = 18,000 rubles;

- from 180 to 240 - we will fill in the data on the existing benefit. In our case there are none - we put dashes;

- 250 - enter the total payment amount that the organization pays to the budget.

Submission of land tax return 2020: deadlines

The length of the tax period corresponds to the calendar year. For 2020, enterprises owning land plots will have to report no later than 02/01/2019. This time the deadline fell on Friday, and in situations where the deadline for submitting a land tax return coincides with a non-working day, the transfer is carried out according to the rules 7 tbsp. 6.1 of the Tax Code of the Russian Federation - the deadline for filing is postponed to the next working day after such a day off (non-working holiday). There is no transfer this time.

For late filing of the declaration, liability and enforcement measures are provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation. The taxpayer is fined for such an offense. The amount of the penalty is tied to the amount of obligations indicated in the reports submitted late - 5% of the amount of unpaid tax (according to the declaration) for each, incl. incomplete, overdue month. Even if the report reflects a zero tax liability, material punishment will be applied, but in a minimum amount equal to 1000 rubles. The maximum penalty is 30% of the value of the unpaid tax liability reflected in the overdue return.

When a land tax return is prepared, the deadlines must be met, but it is equally important to generate the report using the correct template. The declaration form was changed in 2018; for this year it will be necessary to report on a new form, changes to which were made by order of the Federal Tax Service dated August 30, 2018 No. ММВ-7-21/509.

How to fill out a land tax return

Section 2 is completed for each land plot (share of a land plot located within the boundaries of the corresponding municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol), share in the right to a land plot), owned by right of ownership, right of permanent (perpetual) use organizations. In this regard, the declaration may include several sections 2, since section 2 of the declaration is filled out separately for each land plot with the corresponding OKTMO and KBK codes.

The declaration is generated in relation to the amounts of land tax payable to the budget according to the relevant OKTMO of the municipality. At the same time, the declaration submitted to the tax authority indicates the amounts of land tax, the OKTMO codes of which correspond to the territories of municipalities.

How to submit a land tax return

However, if the company owns several plots, then the procedure for submitting the declaration is as follows.

If land plots are located on the territories of several municipalities and are under the jurisdiction of one Federal Tax Service, then one declaration is submitted with the completion of sections of the declaration according to the corresponding OKTMO codes. In this case, a separate section 2 is filled out for each of the sections.

If the sites are under the jurisdiction of different Federal Tax Service Inspectors, then you can submit a declaration for all sites to one of them, notifying other inspections in any written form.

If the plots are located in different municipalities and are controlled by the same Federal Tax Service, then you need to submit one declaration. In this case, a separate section 2 is filled out for each section indicating the corresponding OKTMO code.

If the municipalities where the sites are located supervise several inspections, then declarations are submitted to each of them.

The largest taxpayers submit declarations to the tax authority at the place of registration as such.

Land tax declaration in 2020: deadlines, sample and instructions for filling out

Legal entities and individuals are required to pay land tax. This local tax is regulated by the current Chapter 31 of the Tax Code of Russia, and is also characterized by regulations issued by local executive authorities.

When collecting this fee, the tax structure requires landowners to provide documentation reflecting state registration of their property rights. As soon as the owners receive notification at their place of residence, they are responsible for paying tax contributions on time, as well as submitting completed reports to the regulatory authority.

Payment deadlines

Reporting is submitted by taxpayers before February 1 of the year following the end of the tax period (Article 398 of the Tax Code of the Russian Federation). The reporting periods are the first, second and third quarters; the tax period is recognized as a year. If the deadline for submitting the report falls on a weekend, the declaration is submitted on the next working day.

Thus, in 2020, the declaration for 2020 had to be submitted no later than February 1. Reports for 2020 must be submitted by February 1, 2020.

Individuals who are owners of land plots are not required to submit declarations. They are sent a notification 30 days before the upcoming payment, which must contain details, fee amount, object, tax base and payment terms.

The tax base

To calculate the tax amount, you need to know the tax base. This is the cadastral value of the plot as of January 1 of the year for which land tax is paid. If the plot is formed within a year, the tax is calculated based on the cadastral value as of the date of its inclusion in the Unified State Register of Real Estate.

If the real estate register does not contain information about the price of land according to the cadastre, then there is no basis for calculating the tax. In this case, the payer submits a declaration within the established deadlines, in which he indicates the tax base equal to zero.

The cadastral value of land plots is determined in the following cases:

- formation of a new land plot;

- changes in the area of the land plot;

- changes in the type of permitted use of the land plot;

- transfer of a land plot from one category to another or assignment of a land plot to a certain category of land;

- inclusion in the state real estate cadastre of information about a previously registered land plot.

The cadastral value of a plot can be challenged pre-trial, as provided for by Federal Law No. 135-FZ of July 29, 1998 “On Valuation Activities in the Russian Federation.”

You can go to court in connection with disagreement with the cadastral value of a plot only if the application is rejected by the commission or if it is not considered by it within the established month period.

Who rents

Article 388 of the Tax Code of the Russian Federation defines the circle of taxpayers. These include legal entities and individuals who are owners and users of land on the right of ownership, perpetual use or lifetime possession.

The tax on plots included in mutual investment funds is paid by management companies.

under the right of free use, including temporary ones, are not taxpayers .

Declarations are submitted only by payers - legal entities. Ordinary citizens, as well as individuals with individual entrepreneur status, do not submit reports.

If the company does not own any land, it is not recognized as the payer, and he does not submit a declaration. Owners of land that is not a taxable property also do not file reports.

Related publications

When is the land tax return due? If a business entity owns a taxable asset in the form of a land plot. The enterprise must have documentary evidence of ownership of the territory.

Based on the data in the declaration form, taxes are paid to the budget.

The requirement to prepare a report on land tax applies only to legal entities; individuals (including individual entrepreneurs) do not charge this type of tax on their own, the Federal Tax Service does it for them, so they do not need to report.

Where to take it

The declaration is submitted to the Federal Tax Service at the location of the site (Article 398 of the Tax Code of the Russian Federation). The rule does not apply to large payers - they submit reports at the place of registration.

An organization may own several lands, which are located in different municipalities. If these areas are under the jurisdiction of one inspection, only one document is submitted.

If municipalities are controlled by different inspectorates, the report must be submitted to each of them - at the location of each facility (Letter of the Federal Tax Service of the Russian Federation dated 08/07/2015 No. BS-4-11/13839).

Who approves the form?

The form of the reporting form for organizations for making mandatory payments for plots is a land tax declaration, which is approved by the Federal Tax Service of the Russian Federation.

According to it, in 2020 it was necessary to report for the previous year (2016) using the old declaration form.

Source: https://KPPKDirection.ru/drugoe/srok-sdachi-deklaracii-po-zemelnomu-nalogu.html