Home » Inheritance » Registration of a land share as property by inheritance

1

Registration of a land share as an inheritance is somewhat different from the standard procedures for accepting property received after the death of a relative. This is a long and costly process, accompanied by many bureaucratic operations. There is a special algorithm for legal registration, during which a citizen can obtain the right to dispose of a plot of land assigned to him by inheritance.

Is land share inheritable?

According to the legislation of the Russian Federation (Article 130 of the Civil Code), a land share is considered one of the types of real estate. But formally it is not a land plot, but only the right to claim it in a specific amount. This is an unallocated part of common land, which can be registered in the name of a citizen and transferred to his possession. Only after the execution of the State Act does the share become a land plot with specifically defined boundaries. The owner of the share can partially dispose of it even before its allocation.

The Federal Law “On the Turnover of Agricultural Land” will determine the list of actions that can be carried out with land at the discretion of the owner. They can be used for their intended purpose, sold, donated, rented, or bequeathed. There are some restrictions regarding the unallocated land share. It can be transferred by will, but it cannot be rented or sold until a specific plot is allocated.

The transfer of a land share by inheritance can be carried out by law or by will. The only condition is that the owner of the plot has ownership rights.

A professional lawyer will help you quickly and correctly complete all the necessary steps. He will tell you what actions need to be taken and what documentation to prepare, and can also accompany the heir to meetings with other applicants for shared property. You cannot do without the help of a specialist in cases where the deadline for accepting the inheritance has been missed or there are other circumstances that complicate the procedure.

Register a land share as your property

- The procedure for registering ownership of a land plot

At the end of the land surveying procedure, the shareholder must obtain consent from the remaining shareholders to register the “Land Deed”. The next stage will be the preparation of a cadastral plan and, based on it, an identification (cadastral) number will be assigned to the site. This is done through the land committee located at the place of land registration. A cadastral passport for a share can be obtained after ten days.

The final stage will be a visit to the registration authority. Where it is necessary to write a corresponding application and submit a cadastral passport for the plot in order to subsequently obtain the right to own it. You can register your right either at the regional office of Rossreestr or submit documents to any branch of the multifunctional center.

Download the Application for state registration of rights to real estate and transactions with it (individual) (82.0 KiB, 374 hits)

Application for registration of ownership of a land plot. Blank (20.2 KiB, 299 hits)

Read: How to register a land plot in the cadastral register.

Important! When drawing up a cadastral passport and registering the right to a land plot, it is necessary to highlight the fact to which forms of land use it will relate. After allocation, it can be used for construction (individual housing construction), private household plots, etc.

Legal regulation

Chapter 3 of the Civil Code of the Russian Federation regulates the process of inheriting an agricultural land share. The legislative act establishes the necessary procedure for registration and the list of documents, and also determines all the features of the procedure and deadlines for completion.

In order to receive or inherit a share on your own without the help of lawyers, you will have to carefully study the regulatory framework. This will allow you to complete all the necessary steps correctly. Legal regulation is carried out:

- Art. 1110 of the Civil Code of the Russian Federation - will determine the right of the testator to dispose of his property at his own request.

- Art. 1112 of the Civil Code of the Russian Federation - defines the main components of inherited property, as well as the rights and obligations of the testator.

- Art. 1181 of the Civil Code of the Russian Federation - regulates the process of obtaining a land share by inheritance.

- Art. 1154 of the Civil Code of the Russian Federation - establishes the deadlines for entering into legal inheritance.

Methods of transferring land by inheritance

A citizen receives the right to a land share after a meeting of all participants in shared ownership, land surveying procedures, registration of the allotment with the state and registration of ownership. There are two ways to enter into an inheritance: by will and by law.

The first option implies the presence of a testamentary document, which expresses the last will of the deceased in relation to the property that belonged to him.

If the will has been drawn up taking into account all the requirements and signed by a notary, the procedure for transferring land is carried out in the order specified in it, regardless of the order established by law.

How to inherit and re-register a land plot

Heirs of a land plot should contact a notary as soon as possible, but after consulting with a lawyer. If a citizen has the right to receive real estate and other material assets, he is required to submit an application. Land inheritance in Ukraine has its own characteristics. For example, you need to obtain an extract from the cadastre.

You might be interested in:

This document is provided only upon application of a notary. Therefore, the procedure is carried out like this:

- the notary draws up a corresponding request and transmits it to the heir;

- he goes to the local department of the State Land Agency and receives an extract.

The request for receipt contains the personal data of the heir. As soon as the extract reaches the notary in charge of the inheritance case, he begins to draw up the documents.

At the stage of applying for an extract, many legal successors are faced with the fact that the privatized land does not have a cadastral number. This happens sometimes. And then potential heirs need to carry out the procedure for entering the plot into the appropriate register.

To do this, you need to contact a lawyer, enter into an agreement, which will organize the relevant work and obtain the latter. Specialists will check the boundaries, establish the boundaries in kind, and then provide the necessary technical documentation.

Next, the heirs have to wait until the notary issues the appropriate certificate. It is required to confirm the right to the property of the testator. With the help of a certificate, the legal successor can re-register the plot in his name. Re-registration in Ukraine is carried out by applying to the relevant government agency, whose powers include registration of land ownership. But you can limit yourself to a certificate issued by a notary.

Re-registration of a certificate for a land plot, if ownership is obtained on the basis of inheritance, is the responsibility of a notary. He prepares documents electronically, checks for encumbrances, etc. Registration is carried out based on the submitted papers.

The standard registration procedure lasts no more than 5 days. This period can be either shortened or extended. As for the extension of the period, the procedure is carried out by suspending registration for the heir to perform certain actions. If within 1 month the future owner does not fulfill this condition, registration of ownership will be denied. But this does not deprive him of the right to reapply.

With an accelerated state registration procedure, the amount of the administrative fee (duty) increases.

Mandatory share

The only exception is the presence of a mandatory share in the inheritance. In accordance with Article 1149 of the Civil Code of the Russian Federation, the following are entitled to it:

- minors or incapacitated children;

- parents or spouse who have lost their ability to work;

- dependents of the deceased.

They are assigned the right to receive part of the property even if they are not mentioned in the will. The legislation established this restriction in order to take care of this category of citizens who may find themselves in a difficult financial situation after the loss of a breadwinner. This condition also protects them from pressure and coercion to transfer their own share. In the absence of a will or if it is declared invalid, inheritance of property occurs according to law.

According to Art. 1141 of the Civil Code, relatives can claim inheritance in a certain order, according to the degree of relationship with the testator.

How to inherit a land share

The heir to a land share must complete a certain legal procedure before registering ownership of it.

First, you need to contact a notary to confirm your right to receive property. In the case of inheritance under a will, this should be handled by the lawyer who drafted it, who can confirm the authenticity of the document.

If there is no testamentary document, you need to contact the notary office at the place of residence of the deceased.

How to indicate your claims to a land share when entering into an inheritance?

To indicate your claims regarding the deceased’s allotment and become the rightful owner of the territory, you need to go through the procedure of registering an inheritance. It is standard, but an asset such as an allotment comes with some nuances that are worth knowing about.

Submitting an application for acceptance of values

This stage is the first. The decision of the successor will determine whether he receives the assets due to him or not. It is worth noting that consent represents the will of the citizen, and not an obligation dictated by legal acts. No one can impose any benefits on a person. At the same time, refusal, as well as acquisition, applies both to property and to the debts encumbering it. Selective actions by applicants are not permitted by law.

First of all, you need to submit an application to a notary office. This can be done according to the last place of registration of the deceased or the location of the land. If a person does not know where the expression of will was drawn up, then he must still perform the above action. A lawyer whose competence does not include the case will redirect the applicant to the correct address.

Important! The notary will help you draw up the document correctly and issue a standard form for this. At the same time, experts recommend that you familiarize yourself with the contents of the paper in advance so that additional questions do not arise later.

Package of documents

Actions to accept and register an inheritance necessarily require the collection of documentation. As already noted, the package of papers that may be needed during inheritance is impressive. However, it is worth remembering that not all acts should be immediately transferred to a lawyer. Sufficient time is allocated for preparation.

First of all you may need:

- passport;

- a will or documents indicating the relationship of the parties;

- death certificate of the testator or a corresponding court decision;

- certificate received at the place of registration of the deceased.

In addition, additional acts will be required that will reflect the parameters of the inherited property. A complete list of papers can be obtained directly from the notary to whom the case is assigned. It may vary depending on the circumstances surrounding the inherited mass. As a rule, this includes: documentation for the site; certificate of right to allotment; paper confirming the absence (presence) of encumbrances on the asset; assessment report of an expert organization; receipt of payment of state duty.

Is there a duty to pay or can it be avoided?

Payment of state duty is required. However, its value will differ depending on the degree of relationship between the successor and the testator. Collection of funds is provided for the implementation of actions to produce a certificate. So, for example, the amount for children and parents of the deceased will be 0.3% of the amount of assets, and for distant relatives - 0.6%. The base value is the value of the property indicated in the report of the expert company that conducted the assessment. It is worth remembering that the duty cannot exceed the limit amounts established at the legislative level.

In addition to the fee, the notary's actions are subject to payment. The cost of services depends on the tariffs established by the office, as well as the complexity of the case and the volume of procedures performed.

Another important issue that worries beneficiaries is the need to pay tax on the acquired land. So, according to Art. 217 of the Tax Code of the Russian Federation, income received by inheritance, regardless of its form (cash, in kind), is not taxed. Thus, there is no need to prepare additional funds for the acquired land. However, after registering the rights, the new owner will receive a receipt annually. Payment for it is carried out in a general manner similar to any other real estate.

Question:

How to register ownership of what is received from the deceased?

Answer:

After the notary transfers the certificate confirming the status of the successor to the beneficiary, the latter must go through the procedure of state registration of property. To do this, you need to visit the Registration Chamber and submit an application for changing the information entered in the Unified State Register of Real Estate. For this operation you will have to pay a fee of 350 rubles. After the document is issued, the heir is recognized as the rightful owner of the share and can do whatever he wants with it.

Documentation

To receive an agricultural share, you need to collect the following package of documents:

- Death certificate of the previous owner.

- Certificate from the place of registration of the testator.

- Passport of the heir.

- Documents for land (cadastral plan, certificate of allotment of land, property rights).

- Evidence of a family relationship with the testator (birth, marriage, etc.).

- Certificate of ownership of the plot, issued in accordance with the request of the notary authorities.

Grade

To receive a share as an inheritance, a land valuation is required. This procedure is carried out by the Land Committee of the area where the share is located. To determine the price of a plot, a special commission is appointed, which collects and analyzes documents, selects a valuation method and calculates the cost. Based on the results of the work carried out, the commission draws up a report indicating the cost of the site.

Valuation of a land share is a mandatory document for the heir to obtain ownership rights.

Certificates from the tax office

The heir must contact the tax office to obtain two documents:

- A certificate confirming the absence of restrictive measures on the use of the allocated plot - arrests or other prohibitions limiting the right to dispose of the share.

- A certificate confirming that there are no delays or arrears in paying taxes for the plot. If such debts exist, they must be paid off in order to enter into an inheritance.

The issuance of documents to the tax office is carried out on the basis of an application from the heir and does not require a notarized request.

Package of documents

In order to register a land share as an inheritance, you must collect the following package of documents and provide it to the notary along with the application:

- Identity document.

- Available documents for land.

- Death certificate of the testator.

- Documents confirming relationship with the deceased.

Application deadlines

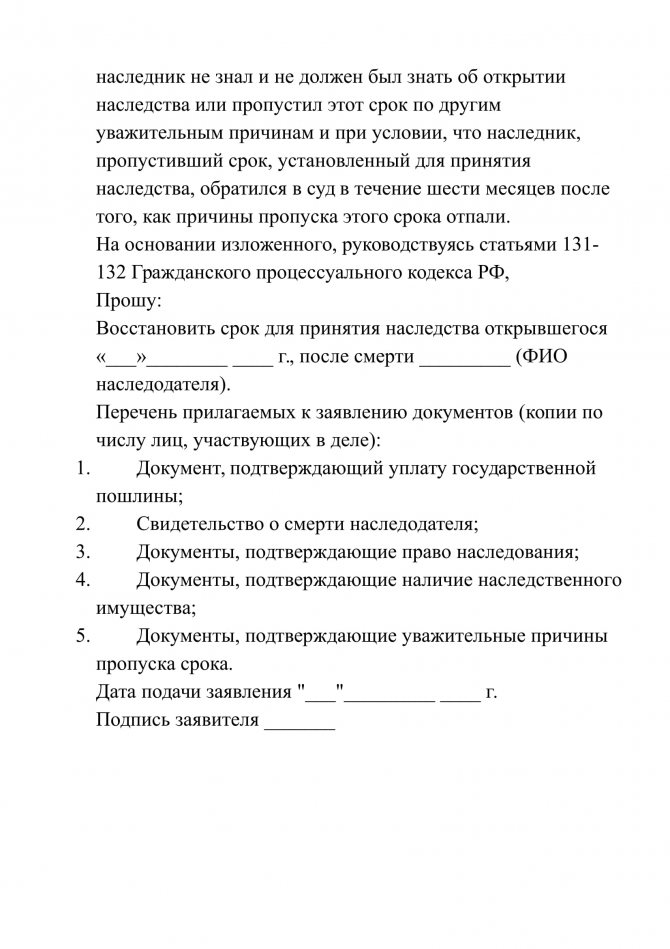

You should contact a notary within 6 months from the date of death of the testator or from the moment the court makes a decision declaring him dead. However, if this deadline was missed for a good reason, the citizen has the right to restore it through the court. To do this, you will need to prepare an appropriate statement of claim and support the stated facts with evidence.

If during the judicial review it is established that the heir did not know about the death of the relative, the decision will be made in favor of the applicant.

There is also a mechanism for registering an inheritance after missing a deadline without trial. A prerequisite is the consent of all heirs of the property who previously assumed their rights. The procedure consists of the following steps:

- In the presence of a notary, all heirs confirm in writing their consent to the entry into the inheritance of a person who has missed the deadline allotted by law. If the simultaneous presence of all heirs is impossible, it is allowed for their signatures to be certified by a notary separately.

- The property is re-divided.

- New certificates of inheritance rights are issued.

Property, the rights to which were not claimed within 6 months from the date of death of the owner, is considered escheated and becomes the property of the state.

The procedure for receiving a land share by inheritance

The procedure for receiving a share as an inheritance will depend entirely on whether there is a will or whether the inheritance is carried out according to law.

If there is a will, executed in the proper manner, inheritance is carried out in accordance with the will of the testator.

In general, inheritance is carried out in accordance with the general procedure, subject to mandatory assessment of property. The heirs submit an application and enter into the inheritance six months after the opening of the inheritance.

The mandatory share rule also applies. If minor children or other dependents of the testator are not present in the will, then they are entitled to half of the property due to them by law.

If there is no will, then registration is made according to the general rules of inheritance by law. Inheritance is carried out in order of priority; when submitting an application, it is necessary to document the relationship with the deceased.

Statute of limitations

The legislator sets a six-month period for entering into inheritance. After this time, it will be impossible to submit an application to a notary until the deadline is restored in court. The grounds for reinstating the term must be substantial, otherwise the court will not restore the term.

Opening of property and cases related to it

After opening an inheritance case, the heir needs to carry out a number of actions that will secure him in the future as the owner of the share. First of all, you should submit an application for inheritance to the notary at the place where the inheritance was opened.

If the deadline was missed, then you can restore it either through the court, or take notarial consent from other heirs, if there are several of them. If each of them confirms their consent to the inheritance of the person who missed the deadline, then it will be possible to do without filing an application to the court.

After submitting the application and after a period of six months, the notary will issue a certificate of inheritance, which will be the basis for registering a share in the property.

If there are several heirs

The division of property between heirs can be carried out in one of the following ways:

- If the deceased left a will, the shares are determined based on the will of the owner of the property.

- In cases where the existing will does not indicate the parts of each heir, the land share is divided equally between all applicants.

- In the absence of a testamentary document, the land plot becomes property in accordance with the law, and all heirs receive an equal share of the property.

Registration process

After checking the correctness of all documents and their authenticity, as well as the legality of the rights claimed, the notary opens an inheritance case. In some cases, additional documents may be required, of which the official will notify the applicant.

Upon completion of the checks, but not earlier than 6 months after the death of the relative, the notary issues the heir a certificate of inheritance.

Then the heir will need to start registering the property. To do this, you need to contact the registration service, where, on the basis of a document on the right of inheritance, you can obtain a certificate of ownership of the land.

Key points for inheriting a land share

Inheritance of a land share has a number of features, which are presented below.

Collection of documents

To register an inheritance, you will need to collect a certain package of documents. At the same time, the legislation provides for a specific procedure for processing documents.

If you have a completed will, the procedure will be easier. In this case, it is advisable to visit a notary’s office and find out the list of required papers. The appropriate employee will provide a list of all documents that the heir must collect.

To register and accept an inheritance you must have:

- death certificates of the testator;

- heir's passports;

- a certificate issued at the place of residence of the testator;

- documents evidencing the relationship between the heir and the testator;

- documents for the land plot (including a certificate of allotment, cadastral plan);

- conclusions on the cost of the site, which is issued by the Committee for Resource Affairs of the district in which it is located;

- a document confirming the absence of any encumbrances (for example, a pledge) - this document is issued by the tax service;

- a certificate issued by the tax service, which indicates the absence of debt on mandatory payments.

This is the main list of documents required to register an inheritance for a land share. But in some cases it may be necessary to present additional papers.

If the heir cannot present documents indicating the presence of a family connection with the testator (he has lost them), then in this case it will be necessary to provide a court decision, according to which this connection is considered established

Stages of registration

To register a land share as an inheritance, you need to collect the entire package of necessary papers and submit a corresponding application to the notary’s office. Based on this document, a case is opened and inheritance is entered into.

The notary checks not only the fact of the death of the testator, but also the authenticity of all documents presented. If the heir has done everything correctly, then after the expiration of the period provided for accepting the inheritance, the notary issues him a certificate of inheritance. It is this document that is the basis for state registration of the heir’s property rights.

Having received the specified certificate, the heir must present it to the registration authority to carry out state registration of his property rights. Along with this document, you must also present your passport and application. In addition, you need to pay a state fee.

Based on the presented documents, the registering authority carries out state registration of the heir's property rights and issues a certificate of ownership. This procedure takes 5 working days.

That's all the stages of registering the inheritance of a land share.

How much does it cost

Many people are interested in the question of how much a land share costs. Its price for each case is determined individually.

The rules for registering an inheritance under the Civil Code of the Russian Federation are established depending on the type of inheritance. What constitutes entry into inheritance rights under a will - read in this material.

It depends on various factors, including:

- from the region in which the site is located;

- from its area;

- on the degree of fertility (for agricultural land), etc.

For example, land located near large settlements is much more expensive than land located in small villages.

The cost is determined by a special committee that deals with issues related to the use of land resources in a particular region. The expert opinion of this committee indicating the value of the share is among the mandatory documents required for registration of inheritance.

It is also necessary to know that the current legislation provides for the procedure for calculating the cost of a land share. But committees are not always guided by these rules.

Taxes

Many people have a question about whether they need to pay taxes when inheriting a land share. This issue has received its clear legislative regulation in the Tax Code of the Russian Federation.

In particular, the law states that the heir is obliged to pay tax on the land share after registration of ownership. This is due to the fact that inheritance is considered as income, and accordingly, it is subject to taxation.

In addition, the law obliges land owners to pay taxes if they:

- use agricultural land to satisfy their personal needs;

- grow vegetables or fruits for sale;

- have plans to create a farm or agricultural complex;

- engage in livestock breeding;

- carry out other types of agricultural activities.

In all of the above cases, the tax paid by land owners is local and goes to the budget of the local government.

But in addition to this, individuals must also pay tax for ownership, as well as for the lifetime use of the land. This type of mandatory payment goes to the state budget, and its amount depends on the cadastral value of the land plot.

When registering ownership of a land share, it is necessary to take into account the fact that the owner also acquires certain obligations related to the payment of taxes, and for failure to fulfill these obligations he may be held liable under current legislation

Deadlines

Current legislation provides for specific deadlines for accepting and registering an inheritance. They must also be observed when inheriting a land share.

In particular, the Civil Code of the Russian Federation states that the heir is obliged to submit an application to the notary for acceptance of the inheritance within 6 months from the date of death of the testator. This is a mandatory legal requirement that must be complied with. The notary will not accept an application that was submitted after the specified period of time has expired.

The only exception to this rule is a valid reason for absence. In this case, the heir can restore the period for accepting the inheritance through the court by filing an appropriate statement of claim. The procedure is quite complex and requires a professional approach, since the courts do not always recognize the reason for absence as valid.

After the expiration of the 6-month period provided for accepting the inheritance, the notary issues a certificate to the heir. This document indicates a list of property that passes to the heir. It is on the basis of this paper that the state registration of the heir’s property rights is carried out.

The legislation also provides specific deadlines for state registration. In particular, the registration authority is obliged to consider the case and issue a certificate of ownership within 5 working days from the date of presentation of the application and the necessary papers.

Taxation

Art. 217 of the Tax Code of the Russian Federation establishes that when inheriting property in kind, including a land share, a citizen does not have to pay tax. This reduces costs and simplifies the inheritance procedure.

After registration of the plot, the new owner is obliged to pay land tax once a year on an equal basis with other land users in accordance with the general procedure in accordance with Federal Law No. 141 dated November 29, 2004.

Registering a share as an inheritance is a specific procedure that differs in many ways from accepting other types of property. Without knowledge of the laws and certain skills, it is quite difficult to pass. The procedure can be simplified by the help of professionals who know all the nuances of the process and have extensive experience in solving complex legal problems.

On the portal ros-nasledstvo.ru you can get a free consultation online, as well as order, entrusting specialists with the entire procedure. We will help you prepare documents with a notary, and in case of litigation, we will prepare a statement of claim and provide assistance during meetings.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

15

Does a common-law wife have the right to inherit after the death of her common-law husband?

There is an opinion that the concept of “civil marriage” implies an unregistered...

11

Statement of claim to establish the fact of family relations in 2020

According to Articles 262 and 264 of the Civil Procedure Code of the Russian Federation, an application for...

7

How to find out if there is an inheritance

The sudden death of the testator or lack of contact with other applicants may...

14

Mandatory share in the inheritance by will and by law (without a will)

The legislative act regulating civil law in the field of inheritance (section V...

14

Are loan debts inherited?

The short answer is YES, debts are inherited if the heir accepts the inheritance...

5

Limitation period for inheritance cases

Some people mistakenly correlate the statute of limitations in inheritance cases with...

What rights does the heir to a land share receive?

The collected list of basic documents is submitted for examination to a notary representative, who issues a formalized certificate of the right to inheritance with the possibility of using and disposing of the land plot, including leasing it for planting agricultural plants.

The ownership indicated by the certificate gives the advantage by law to allocate a share of the land in kind or transfer it to private use after the execution of the state privatization act.