The death of the closest person - your mother - can throw anyone off balance for many months and even years. When faced with trouble, a person seems to forget that death, like birth, is caused by the natural order of things in nature, and it is important to be able to get out of a state of boundless grief in time in order to have the strength to move on. How to cope with the death of a loved one? The advice of a psychologist will help the grieving person come to terms with himself and gradually return to normal life.

Analysis of the mourner's behavior

Psychologists note that in the first two weeks after the tragedy, virtually any reaction of orphaned children to grief is considered normal, be it a state of disbelief and apparent peace or aggression unusual for the target. Any feature of behavior these days is a consequence of the process of restructuring attachments in that part of a person’s life that the mother has so far occupied.

A sudden feeling of emptiness in nature does not always mean death; it also serves as a signal to us about a sudden loss. This explains the unstable behavior of people who, after the death of their mother, either fall into a “waiting mode” or begin to blame others for injustice. The image of a loved one appears to them in the crowd, his voice is heard from the telephone receiver; sometimes it seems to them that the sad news was wrong, and everything remains the same, they just need to wait or get the truth from outsiders.

If the mother's relationship with her children was contradictory and ambivalent, or showed strong dependence on both sides, the experience of grief may be pathological and expressed in an exaggerated reaction or delayed emotions. It is also bad if, in addition to the process of natural loss, anguish of a social nature is added: what will relatives think, how will they perceive the mourning of an employee in the work team?

Experts insist that no difficulties in understanding the situation by others should affect a person’s psychological need to go through all stages of grief at a measured pace. If the mourner has an urgent need after the death of his mother to complete some things that were important to her and spend time solving her lifetime problems, then this must be done. If he wants to live a little more according to the rules she once established, he cannot be prevented from doing so.

Over time, understanding the importance of leading your own full life and competently placing emphasis in favor of pressing problems will transfer the attitude towards the image of the deceased mother to a deeper, spiritual level. As a rule, this occurs a year after a family tragedy and is the natural end of the mourning period.

Maternity capital inheritance by an adult child after the death of the mother

Thus, if children do not have a father and are orphaned after a certain age, no funds will be provided. Other relatives (grandparents, brothers, sisters of parents, etc.) do not have the right to issue a certificate. The subsidy is credited to a savings account and paid upon her retirement. In the event of a woman's death, these funds are provided to legal successors in the general order of inheritance (any persons entitled to receive the property of the deceased).

A man can become the owner of a certificate for MK only in two cases. The first is when a man, a citizen of the Russian Federation, is the sole adoptive parent of the second child, if the court decision on adoption came into force on January 1, 2007.

Maternity capital can be spent on the education of one or more children in an educational institution of any level and direction. Wherein:

Articles on the topic (click to view)

- Conditions for using maternity capital to repay a mortgage in 2020.

- Federal Law 256 on maternity capital and Federal Law on large families

- Federal law on the use of maternity capital: rules for use in 2020

- Federal Law on the protection of family, motherhood and childhood

- Requirements for housing purchased with maternity capital

- Validity period of maternity capital after its receipt

- Deadlines for registration and receipt of maternity capital

- An educational institution (school, including art schools, technical school, university, kindergarten) must be located on the territory of the Russian Federation.

- The child must be no more than 25 years old at the start of training.

In the event of a woman’s death, the right to manage maternal capital funds passes to the father or to the children, if the woman raised them independently.

Stages of Grief

Each stage of a conventionally designated period of grief (usually limited to an annual cycle) is characterized by the experience of certain emotions, varying in intensity and duration of experience. During the entire indicated time, the severity of mental unrest may regularly return to a person, and it is also not at all necessary that the stages will be observed in exactly the given order.

Sometimes it may seem that a person, having achieved mental balance, has completely passed one or another phase, but this assumption is always wrong. It’s just that all people show their grief differently, and the demonstration of some “symptoms” of the classic picture of grief is simply not typical for them. In other cases, a person, on the contrary, can get stuck for a long time at stages that best suit his state of mind, or even return after a long time to an already passed stage and start the whole journey from the middle.

It is very important, especially for those whose mother died “in their arms,” that is, who experienced all the horror of the tragedy with direct participation, not to try to overcome their grief and not to “stay strong.” For at least another week after the funeral, a person should be away from the everyday bustle, immersed in his pain so much that after a while it begins to repress and outlive itself. It’s good if there is someone nearby who can tirelessly support and listen to the grieving person.

"Negation"

The countdown of the stages of experiencing grief begins from the moment a person learns about the misfortune that has befallen him, and the first wave of reaction occurs on his part. Otherwise, the stage of denial is called shock, which best characterizes the onset of the following symptoms:

- mistrust;

- irritation towards the one who brought the news;

- numbness;

- an attempt to refute the obvious fact of death;

- inappropriate behavior towards the deceased mother (attempts to call her, waiting for her for dinner, etc.)

As a rule, the first stage lasts until the funeral, when the person can no longer deny what happened. Relatives are advised to protect the mourners from preparing for the funeral ceremony and allow them to speak out and throw out all their emotions, which primarily express bewilderment and resentment. It is useless to console a person who is at the stage of denial - information of this kind will not be perceived by him.

Subscribe to news

06 February 2014 09:43

— Capital is called family capital, does this mean that the father also has the right to receive it?

— The recipient of the certificate can be not only a woman who has given birth to or adopted a second, third and subsequent children, but also a man in the following cases:

- if a man is the only parent or adoptive parent of a second, third child or subsequent children, and he has not previously exercised the right to additional measures of state support and if the court decision on adoption entered into legal force starting from January 1, 2007;

- in cases of the death of a woman, her declaration as deceased, deprivation of parental rights, her commission of an intentional crime against a child, related to crimes against the person, as well as in the case of cancellation of the adoption of a child, in connection with whose adoption the right to additional measures of state support arose.

— Do stepsons and stepdaughters have the right to maternity capital?

— Stepsons and stepdaughters do not give the right to receive maternity capital funds. When the right to additional measures of state support arises, adopted children who were stepsons or stepdaughters at the time of adoption are not taken into account. For example, if a woman adopted her husband’s child from her first marriage, and they are expecting a child together, then in this case there are no grounds for issuing a certificate for maternity (family) capital.

This is important to know: Who is given maternity capital?

— Can maternity capital be inherited?

— Maternity capital is not inherited. In the event of a woman’s death, the right to manage maternal capital funds passes to the father or to the children, if the woman raised them independently. But it should be remembered that maternity capital can still be used only to improve housing conditions, educate children, or form the funded part of the mother’s pension.

— Should the citizenship of the parents of a child who gives the right to maternity capital necessarily be Russian? Does the citizenship of children affect the possibility of receiving maternity capital?

— In accordance with the Federal Law of the Russian Federation of December 29, 2006 No. 256-FZ “On additional measures of state support for families with children,” the right to additional measures of state support arises for citizens of the Russian Federation, regardless of their place of residence. A child entitled to receive capital must also have Russian citizenship.

— Is it possible to use maternal (family) capital funds to purchase a second apartment for the family??

— Improving housing conditions remains the most popular option for using maternal (family) capital. In order to improve living conditions, maternal (family) capital funds can be used, among other things, for the purchase of residential premises with or without the use of credit funds. The legislation does not provide for any restrictions related to the ownership of other residential premises by citizens entitled to maternity capital.

— The law on maternity capital is valid until the end of 2016. Will it be possible to manage maternity capital funds after this?

"Anger"

Following the realization of the tragedy comes the state: “Mom died, I feel bad, and someone is to blame for this.” The person begins to experience anger, bordering on strong directed aggression against relatives, doctors, or even just those who are indifferent to what happened. This state may also be accompanied by feelings such as:

- envy of those who are alive and well;

- attempts to identify the culprit (for example, if the mother died in the hospital);

- withdrawal from society, self-isolation;

- demonstrating one’s pain to others with a reproachful context (“it was my mother who died—it hurts me, not you”).

Condolences and other manifestations of sympathy during this period can be perceived by a person with aggression, so it is better to express your participation by actual assistance in settling all the necessary formalities and simply a willingness to be there.

"Compromises (self-torture)" and "Depression"

The third stage is a time of contradictions and unjustified hopes, deep soul-searching and even greater isolation from society. For different people, this period proceeds differently - someone turns to religion, trying to negotiate with God about the return of a loved one, someone punishes themselves with a feeling of guilt, scrolling through their heads scenarios of what could have been, but never happened .

The following signs indicate the onset of the third stage of grief:

- frequent thoughts about Higher powers, Divine conduct (among esotericists - about fate and karma);

- visiting houses of worship, temples, and other energetically strong places;

- a state of half-asleep-half-awake - a person keeps getting caught up in memories, replaying scenes of both fictional and real nature from the past in his head;

- often the prevailing feeling is one’s own guilt towards the deceased (“mom died, but I don’t cry”, “I didn’t love her enough”).

During this period, if it drags on, there is a high risk of losing most of your friendly and family ties. It is difficult for people to observe the semi-mystical picture of this mixture of repentance with almost enthusiasm, and they gradually begin to move away.

From a psychological point of view, the fourth stage is the most difficult. Bitterness, hope, anger and resentment - all the feelings that have previously kept a person “in good shape” go away, leaving only emptiness and a deep understanding of one’s grief. During depression, a person is visited by philosophical thoughts about life and death, the sleep schedule is disrupted, and the feeling of hunger is lost (the mourner refuses to eat or eats in excessive portions). Signs of mental and physical decline are clearly expressed.

Procedure for inheriting maternity capital

To become the owner of a certificate, you must contact the local branch of the Pension Fund of the Russian Federation or a multifunctional center.

Parents (guardians, adoptive parents) of a child can apply for a certificate three years after the birth of the child or later. Question Three years ago, my husband and I adopted a child. He inherited half of his maternal capital from his mother, who had died before. The other half went to his brother.

State support for families and stimulation of fertility is used in many countries where the demographic situation leaves much to be desired. For Russia, this topic is doubly relevant: the large territory and low population density predispose to an increase in the population of Russians through the introduction of incentive programs.

For questions about obtaining them in the event of the death of the mother, you must contact the district administration at the place of registration.

Required documents The list of documents required to obtain a certificate includes:

- copies of passports of persons entitled to receive maternity capital;

- birth certificate of all children in the family (in case of adoption - adoption documents);

- the applicant's birth certificate;

- pension certificate;

- marriage document;

- documents confirming the citizenship of the Russian Federation of the mother (or adoptive mother) and the child.

With regard to other funds of pension savings, a similar rule does not apply today: legal successors have the right to receive them if, at the time of their owner’s death, he has not yet been assigned a pension.

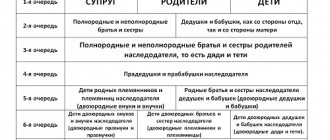

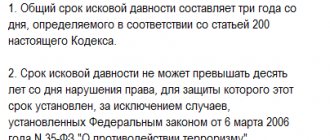

As a rule, the three indicated stages are sufficient for the property of the deceased mother to be transferred to those who have the right to receive it and turn it into their own property. It should be noted that the heirs of each of the queues, starting from the second, are called upon to succeed in the event that there are no those who could inherit everything within the previous queue.

For the purpose of uniform application of this Federal Law, if necessary, appropriate clarifications may be issued in the manner determined by the Government of the Russian Federation.

Not everyone will be able to inherit maternity capital May 11, 2012 The Ministry of Health and Social Development has developed rules for inheriting maternity capital aimed at forming a pension.

When the right to additional measures of state support arises, adopted children who were stepsons or stepdaughters at the time of adoption are not taken into account.

If the death of a citizen occurred before the appropriate payments were established for him, then the maternity capital must be returned to the state budget.

For example, if a woman adopted her husband’s child from her first marriage, and they are expecting a child together, then in this case there are no grounds for issuing a certificate for maternity (family) capital. — Maternity capital is not inherited.

Other relatives (grandparents, brothers, sisters of parents, etc.) do not have the right to issue a certificate.

According to the law, this cannot be done, since maternity capital funds can only be used for the purchase of residential premises, construction or reconstruction of an individual housing construction project (individual housing construction).

Rules for inheritance of maternity capital. The legal successors will receive a refusal if, at the time of the death of the owner of the funds, he has not yet been assigned a pension payment. In the event of the death of the insured person (mother) before the appointment of a funded pension, the funds of pension savings, including the funds and results of its investment, are paid to the heirs (legal successors).

This is important to know: How to apply for a monthly payment from maternity capital funds

An exceptional case is the repayment of debt and interest under a credit or loan agreement for the acquisition (construction) of an isolated residential premises. For this purpose, maternity capital can be spent at any time. A purchase and sale agreement with an installment plan for residential premises from an individual is not included in this category.

The application they submit indicates the purposes for which citizens wish to spend the funds or part of them.

A child raised in institutions for children without parental care and orphans may submit an appropriate application after reaching the age of majority. If full legal capacity occurs before the age of 18, funds can be received earlier. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual.

He also does not receive these rights if the child was recognized as left without parental care. Based on clause 2 of Art. 7 of this law, children without parental care and living in private or state institutions for orphans and children left without guardianship have the right to independently dispose of maternity capital.

Inheritance and maternity capital it belongs to those children with whose birth the right to a subsidy became available, or the child/children must be adopted from an orphanage (another family) by both spouses at the same time; he has not been deprived of parental rights by the court. It should be noted that the father has the right to receive a certificate even if he is not a citizen of Russia.

The law on maternity capital is valid until the end of 2020. Is the disposal of maternity capital funds limited by time?

I can’t figure out how to use this right, since the certificate is for MOM (deceased), and who is the inheritance right to this certificate?

In the event of the death of the insured person (mother) before the appointment of a funded pension, pension savings, including maternity capital and the results of its investment, are paid to the heirs (successors).

The imperfection of the regulatory framework governing the provision and disposal of maternity capital is causing a wave of lawsuits related to challenging real estate transactions.

Maternity capital is not inherited. In the event of a woman’s death, the right to manage maternal capital funds passes to the father or to the children, if the woman raised them independently. But it should be remembered that maternity capital can still be used only to improve housing conditions, educate children, or form the funded part of the mother’s pension.

Government officials report a rapid increase in the birth rate - this is the only fact that does not cause debate. The second is when the rights of a woman holding a certificate are terminated, for example due to death, deprivation of parental rights in relation to a child, in connection with the birth (adoption) of which the right to receive maternity capital arose, or the commission of an intentional crime against the child (children).

The final stage is “Acceptance”

The final stage of grief can be divided into two successive phases: “acceptance” and “rebirth”. Depression goes away gradually, as if dissipating in shreds, and the person begins to think about the need for his further development. He is already trying to be in public more often and agrees to make new acquaintances.

The grief experienced, if it systematically followed through all stages and did not “get stuck” for a long time on the most negative episodes, makes a person’s perception sharper, and his attitude towards his past life more critical. Often, after suffering a bereavement and coping with his pain, a person grows significantly spiritually and is able to radically change his life if it no longer suits him in any way.

Right to grief

How to cope with the death of a loved one? The advice of psychologists on this matter agrees on one important point - grief cannot be hushed up in oneself. It was not in vain that our ancestors created and conveyed to modern man through the centuries a complex and obligatory formula for saying goodbye to the deceased, which includes a large number of ritual episodes related to burial, funeral services, and wakes. All this helped the relatives of the deceased to feel their loss more deeply, to let it pass through them with the whole spectrum of negative emotions. And upon completion of the key ceremony - the anniversary of death - to be reborn for the next stage of life.

Here is what experts answer when asked what to do if your mother dies:

- welcome any positive memories of the deceased, especially in the first 2-3 months after the funeral;

- cry and cry again - every time the opportunity arises, alone and in the presence of those closest to you - tears clear your thoughts and calm your nervous system;

- do not be afraid to talk about the deceased with a person who is ready to listen;

- admit your weakness and don't try to appear strong.

What should you do if your mother died in the same house where her children live? Some people do not dare to disturb the sacred environment for them in the house or room of their deceased mother, creating a kind of home museum dedicated to the deceased. Under no circumstances should you do this! After the 40 days set by the church, it is necessary, if not immediately, to begin to get rid of all the things (ideally, furniture) of the deceased, distributing everything to those in need. When there is nothing unnecessary left, in the room where the woman lived, you need to do at least a small rearrangement and general cleaning.

Inheritance to a son by law

Regulates the right and order of inheritance after the death of a son (other relative) according to the law of Ch.

63 Civil Code of Russia. Articles 1141-1145 list heirs in 1st, 2nd, 3rd and subsequent order. The parents of a deceased child belong to the 1st stage, as do the spouse and children. This also includes the grandchildren of the testator, as well as their descendants. But grandchildren can inherit if the sons of the testator die. In this case, property is inherited by right of presentation (Article 1146 of the Civil Code).

Inheritance by law occurs if the testator did not leave a will. According to this method of inheritance, there is no right to an obligatory share. If the father/mother takes over the inheritance after the death of the son/daughter, then this fact is not important. Since the right of parents to the inheritance of a deceased son/daughter gives priority to inheritance.

Attention! Subsequent queues will be able to present their rights only if there are no relatives of the 1st queue.

Article 1141 of the Civil Code of the Russian Federation “General Provisions”

Read also: How to restore the birth certificate of a deceased relative

Article 1142 of the Civil Code of the Russian Federation “Heirs of the first stage”

Article 1143 of the Civil Code of the Russian Federation “Heirs of the second stage”

Article 1144 of the Civil Code of the Russian Federation “Heirs of the third stage”

Article 1145 of the Civil Code of the Russian Federation “Heirs of subsequent orders”

Article 1146 of the Civil Code of the Russian Federation “Inheritance by right of representation”

Feelings of guilt - justified or not?

It is difficult to find a person who, after the death of his mother, would never reproach himself for devoting less time to her than he should have, being less tactful or being stingy in showing emotions. Feelings of guilt are a normal response of the subconscious to a sudden feeling of emptiness after the loss of a loved one. However, sometimes it can take on pathological proportions.

Sometimes a person practically torments himself with thoughts that at the moment of receiving the news of his mother’s death he felt relief. This is a common occurrence if a woman’s last days were overshadowed by a debilitating illness or caring for her was difficult for her family. What to do? If the mother died under such circumstances, the way out of the trap of constant self-recrimination will be a “heart-to-heart conversation” with the image of a loved one stored in memory. There is no need to prepare special justifying speeches - just ask your mother in your own words for forgiveness for all your mistakes and mistakes, and then thank the mental image of the deceased for every minute spent together.

It is recommended to do this in a quiet environment at home or left alone at the monument to your mother.

How to bury your mother

What to do if your mother died? Traditionally, the deceased is buried no later than the third day after death, but during this period the children of the deceased are still in shock, and they may not be able to take care of all the formalities on their own. The main concerns for organizing the ceremony, as well as a significant share of material costs, should be taken on by relatives and friends of the family. The very essence of the ritual of farewell to the mother’s body is no different from the standard procedure.

What children of the deceased should know about how to bury their mother:

- children of the deceased cannot participate in carrying the coffin or its lid;

- everyone who came to the funeral should be invited to a memorial dinner, everyone should be honored with attention, and thanked;

- the remaining food from the tables is not thrown away, but distributed to people leaving the funeral so that they continue the meal at home;

- You cannot have lavish feasts, and it is also not recommended to have a ritual dinner in a restaurant.

Another important point that Orthodox priests very much insist on: wherever the tragic event occurs, the body of the deceased on the eve of the funeral must spend the night within the walls of her home.

What share of the inheritance is due to the mother after the death of her son?

» Inheritance by spouses October 10, 2020

How to accept an inheritance after the death of a daughter or son?

The death of a relative always results in a bereavement, which, moreover, is supplemented by legal formalities. Situations often arise in which relatives do not know how to properly divide the testator’s property among themselves. Questions often arise about how to divide the inheritance after the death of children.

Inheritance after the death of a daughter or son under a will

The testator has every right, at his own discretion, to transfer the property to a certain person, or to distribute the shares among the heirs in a different way. In addition, the testator can exclude from the list of heirs one or more persons who could have received it by law, without having to indicate the reason for such a decision.

Inheritance after the death of a daughter or son by will is a unilateral transaction. All the will and desires of the testator are indicated in the will. The mother or father has the right to inherit. to refuse it in someone else’s favor, you have the right not to take any action at all.

There is a circle of persons who have the right to an obligatory share in the inheritance. despite the will being drawn up. These include:

- Children who have not reached the age of majority

- Disabled dependents of the testator

- The testator's parents recognized as incapacitated

- Spouse of a deceased person declared incapacitated

- Children who are also recognized as disabled.

Inheritance after the death of a son or daughter by law

Inheritance after the death of a son or daughter by law occurs if they did not leave a will. The first priority will include children, spouse, and parents. The parents of the deceased inherit in equal shares with all persons of the corresponding order. However, some persons may be deprived of the right to inherit. even if they are specified in the will or provided for by law. These include unworthy heirs who carried out illegal actions in relation to the deceased person.

A certificate of the right to receive an inheritance is issued six months after the opening of the inheritance case. It is worth noting that each heir has the right to refuse the property of the testator in favor of another person or without specifying such. No reservations or conditions are allowed.

Procedures for distributing shares between possible heirs are always associated with legal problems. Only a legal specialist can help with this. Thanks to his help, many problems associated with accepting an inheritance can be avoided.

Inheritance after the death of a son

Not often, but in life there are situations in which a son can die faster than his mother. What can a mother do in such cases, how can she enter into an inheritance correctly in relation to her son’s property? It is necessary to take into account certain nuances of registering an inheritance in such a situation.

Does the mother have the right to inheritance after the death of her son?

Find out the order of inheritance in the event of the death of a son, if successors without a will enter into the inheritance. Citizens belonging to the first line of inheritance include the parents of the deceased citizen, his children and spouse.

Find out how the division occurs between first-line heirs. If the deceased son has a wife, then she has the right to receive an allocated share in the amount of 50% of the jointly acquired property. The second half of the jointly acquired property of the spouses, the personal belongings of the son, are divided equally between all heirs.

As a second-order heir, take ownership of the testator's property in the following cases:

- If there are no heirs in the first place

- If the direct heirs refused the inheritance in writing or did not take any action to enter into the inheritance.

- Children under 18 years of age

- Disabled primary relatives who received this status due to age or due to the acquisition of disability of groups 1 and 2

- Disabled dependents who lived at the expense of the testator for at least a year.

- Application according to the sample

- Son's death certificate in original

- Submit a certificate from the Federal Migration Service about the deregistration of your son after death at his place of last registration

- If a will document exists, then you need its original, which has a notary’s mark on the legality of its preparation and amendments.

- Papers that prove the degree of relationship in case of acceptance of inheritance by law

- Passport of the citizen applying for inheritance.

- Convince the heirs who accepted the inherited property on time to draw up a document of consent, according to which all legal successors agree to the redistribution of shares in the inherited property, taking into account the interests of the new legal successor

- File a claim in court with a request to restore the period for entering into inheritance.

- Convince the court that the missed deadline was caused by circumstances that did not allow him to communicate his intention to accept the inheritance to the notary

- Convince the court that the heir had no idea about the death of the testator for reasons independent of him and could not have known about the inheritance.

- Payment for notary services

- Payment for work on assessing the value of property in various categories

- Payment of the state fee, the amount of which is described in more detail above in the text.

- Disputes between successors become personal in nature and cannot be resolved independently by the participants in the inheritance case.

- A long period of time has passed since the death of the testator, and the successor receives information about his rights and the opportunity to receive the already distributed property of the testator.

- minor children

- dependents of a deceased subject who are disabled

- children, spouse or parents of the testator who, for one reason or another, cannot work.

- Around the clock. The Advocate Service portal operates 24/7. You can read expert articles, download samples, ask questions to a lawyer in an online chat, call the hotline

- Promptly. Have you asked a lawyer a question? After 10 minutes, an experienced lawyer will contact you.

- Confidential. Your question and the lawyer's answer are not published. We adhere to professional ethics and keep the information you provide confidential

- All cases are very individual and depend on many factors.

- Knowledge of the basics is desirable, but this does not guarantee a solution to your specific problem.

- On the right is an online chat: describe the situation to find out from a legal consultant. how to solve your problem

- Hotline for Moscow

- Hotline for St. Petersburg

- If you are from another region of Russia, follow the link below and fill out the form

The brothers and sisters of the deceased son are second-degree successors and can count on the testator's property only in the absence of first-degree heirs.

The parents of a deceased son have the right to enter into the inheritance as primary heirs. At the same time, they must have time to submit an application to the notary confirming their intentions regarding their son’s property.

Contact the notary within six months from the date of your son’s official death. Know that you can assume the rights of heirs on the basis of a document stating the will of the testator and on the basis of the law.

It is important to know that in the event of the death of an adopted son, his adoptive parents receive the inheritance as relatives, and biological parents, deprived of parental rights, are deprived of the opportunity to receive the property of the deceased citizen.

Inheritance after the death of a son under a will

A Russian citizen who is legally competent at the time of drawing up a testamentary document has the ability to transfer acquired property to any individual, any organization, foundation, company or state.

If the will is drawn up correctly and certified by a notary, then this document acquires the status of a transaction made unilaterally. Remember that when drawing up a will, it is better to immediately take into account the rights of the obligatory heirs, otherwise the will or part of it may be challenged, and the obligatory share will still be separated from the testator’s property by the court.

Mandatory heirs include the following persons:

The son, when making a will, will include or exclude from the compulsory heirs all citizens whom he wishes. The testator does not have to explain the reasons for his actions. Parents, if included in the heirs, can accept the inheritance to the extent that the son determines for them, but can renounce their share of the son’s property in favor of other persons.

Having decided to receive an inheritance, the parents of the deceased son must submit an application to the notary, submit all the necessary documents along with the application, and give the notary a receipt for payment of the state fee.

A fee is paid to obtain a certificate of inheritance of a son's property.

The fee for parents is equal to 0.3% of the estimated value of the property they receive under the will. If there is a lot of property and its value is high, then in any case, when receiving an inheritance, the parents will not pay an amount exceeding 100,000 rubles as a fee.

A certificate can be obtained from a notary only 6 months after the opening of an inheritance case in relation to the deceased son.

Entering into inheritance after the death of a son

Whenever you choose to receive inherited property, register it in accordance with the law. Please note that the date of the son’s death is considered in the inheritance case to be the date of opening of the inheritance. Applicants for the property of a deceased son must submit an application and primary documents to the notary's office within six months from the date of death of the testator.

It is possible to send an application for acceptance of inheritance by mail or using the services of an intermediary, who must have a power of attorney with a list of rights and capabilities.

Who is the first priority heir after the death of a son?

Read about the deadlines for registering an inheritance of property here.

Applications not delivered personally by the legal successor must be certified by notaries at the place of their preparation. Make sure that the representative's power of attorney clearly outlines his rights and responsibilities.

Declare your intention to enter into inherited ownership of the property of a deceased citizen by preparing certain documents in advance:

Please understand that the list of documentation can be supplemented with various special certificates, extracts, and documents regarding property of different categories.

As soon as you receive a certificate of inheritance, immediately go to the registration authorities for a special type of property acquired by inheritance. Register the car and register the owner's rights to the property.

If the heir missed the six-month period of time to accept the inheritance, then he can return the opportunity to receive the inheritance in two ways:

The agreement will have legal force if all successors agree to sign it and hand over the old certificates of inheritance to the notary in order to receive new ones after the redistribution of property.

Each heir must understand that when drawing up an agreement on the redistribution of property, each legal successor may lose part of his property that he currently owns from the testator’s property.

Most often, it turns out that a late successor does not meet with understanding from the current heirs and goes to court.

During the proceedings, the heir will have to prove his right to restore the inheritance period:

If the court makes a positive decision in favor of the successor, then there is no need to contact the notary for a certificate, since the court decision has legal force.

In the case of the mother of a deceased son, the situation may be different. The mother has the right to enter into the son's inheritance by actually disposing of the son's property and managing his property.

The mother can pay for repairs in her son’s apartment, make current utility bills, and protect her son’s property from encroachment by third parties.

Contact a notary to receive a certificate of inheritance 6 months from the date of your son’s death; to prove actual ownership of the property, provide receipts for rent, receipts for the purchase of building materials and payment for work, and evidence of property protection.

How much does it cost to inherit after death?

Determine the list of activities that must be paid in the process of obtaining the right to use the testator’s property:

Be sure to consider the possible costs of legal advice from specialists in the following situations:

Be sure to consider whether it would be profitable to accept a minor inheritance; perhaps it would be more profitable to write a waiver document and not participate in the inheritance matter.

When making a conclusion, know that if the notary refuses to accept documents confirming the actual entry into the inheritance, take a document containing information about such refusal in writing.

It is with this paper that you go to court to prove your actual entry into inheritance property and to receive official confirmation in a court decision of the rights to the property of your deceased son.

Was the Recording helpful? Yes No 0 out of 0 readers found this post helpful.

Comments on the article “Inheritance after the death of a son”

Inheritance after the death of children: son, daughter

Legal technologies

In order to determine the procedure for receiving property, it is necessary to refer to the so-called inheritance queues.

In a situation where it is necessary to divide the inheritance of a deceased child, the surviving parents are the first to receive the right to receive property benefits. Also, the first priority of inheritance includes the surviving spouse and children (if any). Further, these are the brothers or sisters of the deceased, his grandfather or grandmother. In the absence of these persons, the inheritance passes into the possession of the uncle or aunt of the deceased.

Representatives of the next, fourth stage are those persons who lived with the testator for at least five years before the day when the inheritance was opened. These could be guardians, adoptive parents, etc.

Inheritance after the death of a daughter: will

An individual has the full right to transfer certain property to an entity, which he chooses independently.

Benefits can be distributed evenly among several persons who are indicated in the will. In any case, the size of the shares due to each of the heirs is determined by the testator.

Such a procedure as inheritance after the death of a daughter (if there is a will). has the status of a one-sided transaction. All wishes and will of the child are written down in the will. The father and mother can either enter into an inheritance or refuse it, or not declare their rights to this or that property at all.

The following persons will necessarily receive a certain part of the inheritance:

Inheritance after the death of a son: law

This technology is appropriate in a situation where a will has not been drawn up. Each of the heirs has the right to renounce his share in favor of another individual, indicating the reasons, or the absence thereof.

First, the right to inheritance after the death of a son can be claimed by the parents themselves, and at the same time by the children or spouse of the deceased.

The father and mother inherit the property in equal shares. A certificate certifying the right to receive a certain inheritance is issued six months after the fact of opening the case.

The specifics of preparing documentation related to inheritance upon the death of children are always associated with a number of legal nuances. That is why in this case it is recommended to promptly seek help from an experienced lawyer.

Inheritance after the death of a son

The Advocate Service portal provides legal advice on inheritance and legal inheritance for free! Consultation with a lawyer on inheritance matters Get a free consultation online with the support of the Ministry of Justice of the Russian Federation!

Inheritance to parents after the death of a son and the inheritance process have a number of features: it depends on many circumstances, whether the son has his own family, children and other heirs. It also matters whether there was a will at the time of death. How do parents inherit from their son?

Legal subtleties

To determine the order in which property is acquired, it is important to identify the order of inheritance. If we are talking about the division of the property of a deceased son, his parents, spouse and children will receive. These persons are classified as the first category of heirs. Property is divided between them in a certain way.

If the testator has a spouse, his share is determined first. This is due to the fact that the spouse has the right to 1/2 of all jointly acquired property. All remaining property is divided in equal shares among the remaining heirs of the first circle. And only in the absence of heirs of the first circle or if they refuse the inheritance, the right to receive property passes to persons from the second circle.

When taking a self-defense in your dispute, remember.

Therefore, experienced lawyers + hotline work for you.

FREE LEGAL CONSULTATION Online legal consultation with the support of the Ministry of Justice of the Russian Federation!

Note! The first category of heirs does not include brothers and sisters. They can receive a share of the inheritance if there are no heirs from the first priority.

As for the parents, they are classified as the first category of heirs. To receive their share of the inheritance, they will have to submit an application to the notary in a timely manner in order to have time to enter into inheritance rights. The application is submitted after the death of the son, but no later than 6 months from this date. There are two main options - inheritance by will and law.

If we are talking about the inheritance of an adopted child, his adoptive parents will inherit as their own. Blood relatives are deprived of the opportunity to inherit after the death of their son.

Inheritance to a son by will

Any person can transfer existing property to a certain person or group of people. He also has the right to transfer his property to the state. In the case of a will, the procedure acquires the status of a unilateral transaction. All the wishes of the testator are recorded in one document. It is important to take into account that individuals who have the right to the obligatory part are identified. These are the following persons:

- Imperfect summer children

- Spouse, parents and children who are unable to work for any reason

- Disabled dependents.

Note! The testator may exclude one or more persons from the number of heirs without having to explain the reasons for his actions.

Parents, like other heirs, can enter into a will, or they can refuse it in someone else’s favor or without specifying a specific person. They may also take no action at all.

If parents want to enter into their son’s inheritance, they must submit a corresponding application to the notary’s office. It is important to submit it within six months from the date of your son’s death. And upon entering into inheritance rights, you will have to pay a mandatory state fee. Parents will have to pay 0.3% of the estimated value of the transferred value, but not more than 100 thousand rubles. And only after this the notary will prepare and provide a certificate of right to inheritance. The corresponding share is allocated according to it.

Inheritance to a son by law

This procedure is used if there is no will for inheritance. Each heir must submit an application within 6 months after the death of the testator. In this case, the heir has the right to renounce his share, indicating the successor or without indicating a specific person. The property is first transferred to the first priority heirs. These are the spouse, children and parents. Unable-to-work dependents will inherit along with them. But they must live with the deceased for at least 1 year.

First, the required half of the jointly acquired property is allocated to the spouse, as required by law. The share of the remaining heirs will be equal. The mother's and father's share will be the same. But some persons may be excluded from the inheritance, even if they belong to the first priority. This is due to the fact that they may be considered unworthy or have carried out illegal actions in relation to the deceased.

Note! In case of refusal of the inheritance in favor of another person or without his instructions, it is not possible to put forward conditions or reservations.

If the testator did not have a spouse or children, the parents receive all the property. This is due to the fact that in this situation they are the only possible first-line heirs.

Required package of documents

If you plan to take possession of your portion of the property, all intended heirs must file an application upon the death of the decedent. It is important to do this within six months. Only on its basis does the notary have the right to open an inheritance case. And after that you need to submit the required package of documents:

- A certificate from the testator’s last place of residence listing the persons who were registered with him

- Certificate of his death

- Heirs' passports

- Relationship documents such as birth or adoption certificates

- Title documents for property.

As a result, in order to receive an inheritance, parents need to contact a notary in a timely manner. And after receiving all the necessary documents, they will receive the right of inheritance.

An experienced inheritance lawyer will answer all your questions.

Describe your situation and your question in as much detail as possible in the chat on the right, our expert will analyze the message and give the most comprehensive answer

Sources: m.yurist-online.net, uropora.ru, www.nasledconsult.com, advocate-service.ru

Next:

No comments yet!

Share your opinion

You might be interested in

When can you sell real estate after inheritance?

Sample claim for recognizing an heir as not accepting an inheritance

How to sell an inherited car

Is it possible to take part in an inheritance?

Popular

Notification by a notary about the opening of an inheritance (Read 18)

Who did Steve Jobs leave his inheritance to (Read 14)

What is more profitable inheritance by law or by will (Read 13)

How to deregister a car by inheritance (Read 12)