Selling an apartment by inheritance is beneficial for the seller, but for the buyer there is a risk of the transaction being challenged by a suddenly appearing heir. It's all about the statute of limitations, during which you can file a claim to invalidate the purchase and sale agreement (hereinafter referred to as the SPA). But the requirements are not always met. Let's consider what are the features of inheriting real estate, what are the risks for the buyer, how to check an apartment before buying, draw up a contract and avoid challenging it in court.

Features of real estate inheritance

Content

Inheritance of property is regulated by Chapter. 61-65 Civil Code of the Russian Federation. You can inherit real estate by law or by will. In the first case, there is a sequence of heirs:

- First priority: children, parents, spouse of the testator (Article 1142 of the Civil Code of the Russian Federation).

- Second: brothers, sisters (full and half-blood), grandmother, grandfather (Article 1143 of the Civil Code of the Russian Federation).

- Third: aunts, uncles (Article 1144 of the Civil Code of the Russian Federation).

There are also successors in subsequent stages: great-grandmothers, great-grandfathers, children of nephews or cousins (Article 1145 of the Civil Code of the Russian Federation).

The principle of distribution of heirs according to priority is very simple: the property is accepted by the first-order successors, it is distributed between them in equal shares. If there are none, the successors of the second, third or subsequent stages enter into the inheritance.

With a will everything is simpler. A person can indicate anyone in it, not necessarily a relative, and then the property will go to him. But there are people who are entitled to a mandatory share in the inheritance, even if a will is drawn up, and they do not appear in it (Article 1149 of the Civil Code of the Russian Federation). These include disabled or minor children, spouse or parents of the testator. They can receive at least half of the share that would be due to them by law.

This is where the danger lies: citizens who are entitled to a mandatory share can show up at any time.

There are other features of inheritance that need to be taken into account:

- The testator has the right to impose a testamentary refusal on one or more legal successors (Article 1137 of the Civil Code of the Russian Federation). For example, write a will stipulating the right of another person to live in an apartment for life. The heir will become the owner, but he will be obliged to provide living space for the use of another person, and he will have to live with him. In the future, real estate can only be sold under the DCT with the right of lifelong residence, but some sellers are silent about this right.

- The period for entering into inheritance is 6 months from the date of death of the testator, but can be extended if the heir proves that he did not know and could not know about the death of the testator, or there were good reasons for missing the specified period.

- There may be several wills, but the last one has legal force.

Note! Both individuals and legal entities can be called upon to inherit (Article 1116 of the Civil Code of the Russian Federation).

How do you enter into inheritance?

The short procedure for entering into inheritance looks like this:

- The testator dies, certificates are issued.

- The heir turns to the notary with an application for entry into the inheritance, a death certificate and documents confirming the relationship (in case of inheritance by law).

- The notary accepts documents and, if necessary, requests additional information.

- After six months, a certificate of inheritance is issued. With it, the assignee goes to Rosreestr and registers ownership of the apartment.

Six months are given just so that all the heirs have time to declare themselves. But this is not always the case, so buying an inherited apartment can be a risky proposition.

Buying an apartment by inheritance: risks for the buyer

What are the risks when buying an apartment by inheritance:

- The seller may not inform about the testamentary refusal, which is entrusted with granting the right of lifelong residence to another person in the apartment. The buyer will buy the property and will be its owner, but this person can show up at any time and live in the living space legally.

- The seller may be recognized as an unworthy heir after the sale of the apartment.

- People who are entitled to an obligatory share will appear.

- Citizens who did not have time to enter into an inheritance may appear and file an application to restore the deadline.

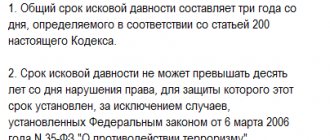

Note: these risks are typical for real estate inherited less than three years before sale. Three years are indicated for a reason: this is the general limitation period, which begins to be calculated not from the moment of death of the testator, but from the moment when the plaintiff learned about his right to inheritance, provided that he had good reasons for missing the deadline, but they disappeared no more 6 months before going to court for restoration. Good reasons mean serious illness, illiteracy, helplessness and other factors related to the personality of the plaintiff. The maximum limitation period is 10 years from the date of death of the testator.

If more than three years have passed

If more than three years have passed since the registration of property rights on the basis of an inheritance certificate, the risks are reduced, but they still exist. It is unlikely that a person will appear who has the right to permanent residence in the apartment, but the sudden appearance of heirs who did not know about the inheritance is quite possible.

If the apartment was received by will

Before purchasing real estate, you need to clarify how it was received - by law or by will. In the latter case, there are also risks for the buyer. There may be other heirs who are entitled to a mandatory share. But here it all depends on how much time has passed since the registration of the seller’s property rights.

There are several other factors:

- A will may be declared invalid if it can be proven that it was drawn up by an incompetent testator or under physical or psychological pressure.

- It is possible for a stranger to live on the basis of a testamentary refusal, which is not always disclosed to buyers.

Lawyer's advice: when buying an inherited apartment or house, it is better to seek comprehensive support from a lawyer or realtor who can check the property for legal purity.

If the apartment was received through hereditary transmission

Inheritance transmission occurs if the successor dies after submitting documents for inheritance. Then the property passes to his heirs by law or will.

The risks here are the same as in other cases. The inheritance can be contested.

Risks for the buyer of an inherited apartment

There are several main risks of buying an apartment by inheritance:

- cancellation of PrEP through the court is the most significant risk;

- identifying lifelong tenants who cannot be evicted;

- discovery of debts of the deceased, which the new owner will have to deal with.

The likelihood of their realization in life depends on a number of factors, which include the period of ownership of the apartment, the basis for its inheritance (law or will), and sometimes even the cause of death of the owner.

Cancellation of a purchase and sale agreement

The main danger for the new owner of a home inherited by the seller is the cancellation of the purchase and sale agreement through the court and the seizure of the apartment. Of course, if the transaction is declared invalid, the buyer must return the money paid, but, as a rule, this is either impossible in practice or takes a very long time. The trial lasts several months. During this time, the seller will have time to spend a large amount, which will then be collected in installments from his official salary.

The following may demand cancellation of a transaction through the court:

- Heirs whose rights were violated during the distribution of property. Of particular danger are the owners of a compulsory share in the inheritance - dependents of the deceased, disabled spouse, parents and children.

- The spouse who was not allocated a spousal share.

- Heirs who did not manage to accept the inheritance within the required 6 months for valid reasons (serious illness, service, etc.).

- Citizens who have proven their relationship after the death of the testator. If this fact had been established in time, the property would have been distributed differently.

There may also be several court procedures for canceling the purchase of an apartment by inheritance. Depending on the requirement of the interested party:

- contesting a will;

- appealing the actions of a notary;

- restoration of the deadline for accepting an inheritance;

- recognition of the heir (seller) as unworthy;

- cancellation of the policy itself.

As a result of any of the above procedures, the purchase is cancelled, the apartment is returned to the estate and a new distribution of property occurs.

Legatees

A significant risk when purchasing an apartment received as an inheritance is identifying lifelong residents:

- legatees - by testamentary refusal;

- annuity recipients - under an annuity agreement that was not terminated by the death of the payer.

Legatees can not only live in the apartment for life, but also exercise any other rights. For example, use it temporarily.

The wording “testamentary refusal” has little to do with any negative consequences. Upon refusal, the person (the legatee) receives a certain benefit - in this case, associated with living in an apartment. This benefit is not conditioned by his relationship with the deceased or his right to inheritance. Only the will of the testator is sufficient to grant someone at his discretion the right to live in the apartment for life.

Attention! It will not be possible to forcibly evict the legatee even after several sales of the apartment.

The refusal is stated in the will and looks like this:

If there is no will, then there is no refusal. In this case, only one refusal can be indicated in the will.

Debts of the deceased

A risk that can arise with any purchase, not just an inherited apartment, is the discovery of debts of the former owner. Most often these are debts for utility bills. The burden of debt repayment is distributed as follows:

- utility bills - housing department, water, sewerage, heat, gas - are paid by the seller;

- contributions for major repairs follow the apartment and after purchase are repaid by the new owner.

Read more: “Buying an apartment with debts on utility bills: how to check the debt.”

Fraudulent schemes

Some of the situations presented below are difficult to call fraud from a legal point of view, but they can add problems to buyers:

- The seller hides the legatee - a person who has the right to live in the inherited apartment on a permanent basis.

- An agreement between an heir and another person entitled to an obligatory share. Taking advantage of the buyer’s ignorance of the laws, they can act like this: the legal successor inherits the apartment and sells it. Next, another heir is announced, who is entitled to the obligatory share, and applies for the restoration of the terms. In their opinion, the buyer must pay compensation for the share, but the law states otherwise: it is compensated by the heir.

- Cancellation of power of attorney. The heir issues a notarized power of attorney for another person, then immediately revokes it. An authorized person sells an apartment on behalf of the principal, who then presents everything as if he is a victim of deception.

The most dangerous thing is a deal with a black realtor. He can force a person to draw up a will on him using criminal methods, and then kill the testator and sell the apartment. If the legal heirs show up and challenge the will along with the transaction, the buyer will be in an extremely unfavorable position and will lose the property.

How to reduce risks

If you are about to purchase an apartment received by inheritance, be extremely careful:

- Avoid offers to urgently sell an apartment - the owners of such properties are most often interested in “getting rid of” the disputed property;

- Remember, if the title document indicates “inheritance by will,” the risk of challenging the purchase of an apartment received by inheritance remains. In addition, even minor children and other incapacitated dependents of the testator who are not specified in the will retain the right to a share. Sometimes their existence becomes known only after the purchase of an apartment by inheritance is formalized.

- When conducting transactions with such real estate, lawyers recommend indicating the entire amount to be paid in the contract. In this case, if disputed, the buyer has a chance through legal proceedings to return all the money spent on the purchase.

How to check heirs when buying an apartment?

The problem is that there is no way to check the inherited apartment when purchasing. You can only track the history of the transfer of ownership and refuse the transaction if the property was inherited less than 10 years ago - the safest period after which it will not be possible to challenge the transaction.

Legal advice: to minimize risks, it is advisable to have the DCP certified by a notary. he will check the legality of the transaction, and if there are problems with the documents or other heirs, he will refuse notarization. This is a reason for the buyer to refuse the deal.

How to avoid problems when buying an apartment received by inheritance

Are you going to sign documents for the purchase and sale of an apartment? Take your time - first, study the “history” of real estate.

This is interesting: Cousin is the heir of what order in 2020

How to do it?

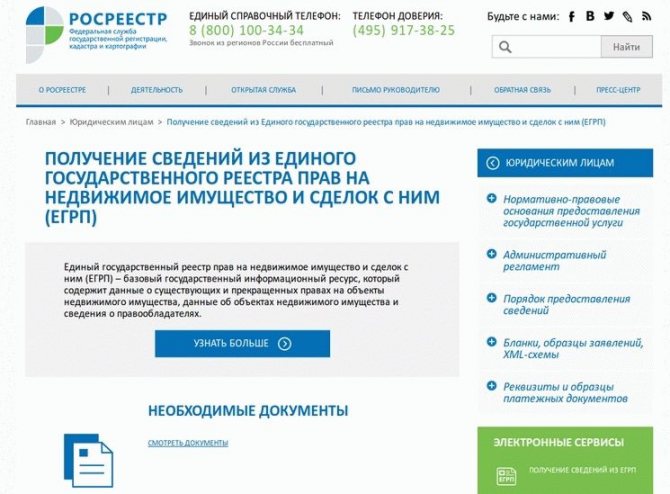

- Request an extract from the Unified State Register. You will receive all the information about transactions with the apartment from 1998 to the present day. You will also learn about possible “encumbrances” imposed by the owners.

- Get an extract from the house register. This is extremely important information for you about all those persons who are registered in the apartment.

- Take the time to chat with your neighbors. If the deceased has only one child, and the apartment went to him, it is unlikely that you will face legal proceedings. But if the property is bequeathed to a common-law spouse, and the deceased has children, it makes sense to think about it!

- Make sure there really are testamentary refusals, as the seller convinces you. You can obtain such information from a notary.

If there are several heirs, each of them signs the purchase and sale agreement. But it also happens that the seller has a power of attorney from all heirs. What is your situation? Be sure to check what “actions” the representative can perform, whether he has the right to sell the apartment and receive money for it. Be sure to check the identity of the seller himself: the passport office staff will help with this.

But that's not all. Make sure of the fact of the death of the owner of the apartment. Maybe he is on a long trip, or has gone missing? Ask the seller for the relevant documents: a court decision recognizing the owner of the home as deceased, or a death certificate (of course, the original).

When can a purchase or sale not be challenged?

The buyer will not have to return the money for the apartment or pay part of the share to a sudden heir if he proves that he is a bona fide purchaser. This means a purchaser who did not know and could not know about possible heirs or illegal acquisition of real estate by the seller.

In addition, there is paragraph 42 of the Resolution of the Plenum of the RF Armed Forces dated May 29, 2012 No. 9, which often plays a decisive role in legal proceedings:

“If, when accepting an inheritance after the expiration of the established period in compliance with the rules of Article 1155 of the Civil Code of the Russian Federation, the return of the inherited property in kind is impossible due to the absence of the corresponding property from the heir who accepted the inheritance in a timely manner, regardless of the reasons why it was impossible to return it in kind, the heir, who accepted the inheritance after the expiration of the established period has the right only to monetary compensation for his share in the inheritance (when accepting the inheritance after the expiration of the established period with the consent of other heirs - unless otherwise provided by a written agreement between the heirs). In this case, the actual value of the inherited property is assessed at the time of its acquisition, that is, on the day the inheritance is opened (Article 1105 of the Civil Code of the Russian Federation).”

In other words, after the sale of an inherited apartment to a suddenly appearing heir, the seller, not the buyer, will compensate his share.

Should I buy an inherited apartment?

You can buy an apartment that was inherited, but after carefully weighing all the pros and cons of the transaction:

This is secondary housing, and it usually costs less than apartments in new buildings

If more than 10 years have passed since the seller accepted the inheritance, the risks for the buyer are reduced to zero

People are wary of buying inherited apartments, and sellers often reduce prices slightly

There is a possibility of challenging the transaction. The apartment and money will most likely not be taken away, but the courts will have to waste time and nerves

If the seller lowers the price too much, this is a reason to be wary: perhaps he wants to get rid of the property as quickly as possible to hide legal flaws

Possible scenarios

The risks of buying an apartment by inheritance are often caused by the following situations:

- The spouses did not live together, but were not divorced either. During the distribution in the first place, the wife was not included in the inheritance list;

- The deceased had no living children or other immediate relatives. The property was distributed among the heirs of the second stage, but grandchildren were not taken into account. They claim their rights to real estate by right of representation (Article 1141);

- Heirs are declared under a will, the drafting of which the deceased did not remember, or the opposite situation is the will being contested.

Consequently: if the number of heirs changes, the purchase of an apartment inherited can be challenged in court.

How to protect yourself when buying an inherited apartment?

To minimize risks, it is important for the buyer to follow several rules:

- Carefully study the documents and history of the transfer of ownership. Information can be requested from Rosreestr.

- Indicate only the real cost in the DCP. The seller may ask to indicate a reduced price there in order to reduce the tax amount. But if the deal is challenged, the buyer will receive only what is specified in the contract.

- Buy an apartment if it was inherited at least 7 years ago. The likelihood of heirs appearing remains, but at a low level. If 10 years have passed, they will not be able to challenge the deal.

Note! It is advisable to indicate in the DCT that all financial risks in the event of litigation when other heirs appear are borne by the seller. This is already defined by law, but it is better to reflect such a clause in the contract.

Buying an apartment after inheritance: step-by-step instructions

The purchase and sale of inherited real estate consists of several stages:

- Obtaining a certificate of inheritance and registering the seller's ownership.

- Search for a buyer, discussion of the terms of the transaction.

- Conclusion of the contract, receipt of the deposit.

- Submission of documents for re-registration of ownership in Rosreestr, possibly through the MFC.

- Receipt of the final set of documents. It will be issued after 7 working days if the application was submitted to Rosreestr, and after 9 working days if applied through the MFC.

If the DCT is certified by a notary, he independently submits documents for registration; no fee is charged for this (except for the state fee). The registration period is reduced to three working days.

Contents and sample agreement

The DCT of the inherited apartment must include information about the parties to the transaction and other items:

- The document on the basis of which property rights are registered - a certificate of inheritance.

- Date of registration of the seller's ownership.

- Information about the property: address, area, number of rooms, cadastral number.

- A reference to the fact that the transaction does not violate the rights of third parties, and if they make claims, the seller bears responsibility.

- A guarantee that the property is not encumbered.

- Responsibility, rights and obligations of the parties.

- Cost, payment methods and procedure.

- Date of preparation and signature of the parties to the transaction.

Sample contract

Documentation

For the transaction, the seller must prepare:

- certificate of inheritance;

- extract from the Unified State Register of Real Estate;

- registration certificate;

- certificate of absence of debts for housing and communal services;

- extract from the house register.

The buyer will only need a passport.

These documents are submitted to Rosreestr along with the DCP in three copies, except for an extract from the house register and a certificate from the housing and communal services.

Expenses

The buyer pays a state fee for re-registration of ownership - 2,000 rubles. If the contract is certified by a notary, and certification is required by law, a state duty is paid for this in the amount of 0.5% of the transaction amount, but not more than 20,000 and not less than 300 rubles.

Note: notarization is required if the property of a child or incapacitated person is sold, or a share in the right of ownership to a stranger who is not the owner of the other share.

If the parties turn to a notary at their own request, instead of a fee, a tariff is paid in accordance with Art. 22.1 “Fundamentals of legislation on notaries”:

| Who is the property being sold to? | Tariff size (RUB) |

| Child, spouse, parent, grandchild for a transaction price of up to 10 million; | 3,000 + 0.2% of the amount |

| From 10 million | 23,000 + 0.1% of the amount over 10 million. |

| To a stranger with a housing price of up to 1 million. | 3 000 + 0,4% |

| From 1 to 10 million | 7,000 + 0.2% of the amount over 1 million. |

| From 10 million | 25,000 + 0.1% of the amount exceeding 10 million. |

Registration of ownership

After the transaction has taken place, the buyer needs to contact Rosreestr, since it is after registration that he will acquire ownership of the apartment. To do this, you need to fill out an application and attach the necessary documents to it. The appeal is drawn up in a standard form.

The text should indicate the following:

- Information about the registration authority - name, location.

- Information about the initiator - full name, date of birth, number, passport series, registration address.

- Reasons for obtaining an apartment. In this case it will be a purchase and sale agreement.

- Detailed description of the apartment - area, quantity, number of rooms, location address.

- List of attached documentation indicating the number of sheets of each paper.

- Signature of the initiator and date of drawing up the appeal.

This is interesting: What are the names of the heirs and their parents in 2020?

After the application is completed, it must be submitted, along with all documents, to Rosreestr. You can do this in several ways:

- Personal delivery or transfer through your legal representative. This option is the most common. It allows a person to personally verify that his message was delivered to its destination. In this case, errors and inaccuracies can be corrected on the spot or you can receive detailed advice on how to eliminate them.

- Contact the Multifunctional Center. This method allows the initiator not to perform any actions independently. The center’s specialists will send all the necessary documents to their destination.

- Direction by email. This option allows a person to carry out the transfer independently. But for this you will need to have at your disposal technical means for converting documentation into electronic format.

- Express delivery. This method entails additional costs. There is also a risk of loss or damage to documents.

A person chooses any of the options at his personal discretion, based on his capabilities and the nuances of the current situation.

List of documents

To implement the procedure for registering property rights, the initiator must submit a number of mandatory documents.

- Buyer's and seller's passports.

- Contract of sale.

- The act of acceptance and transfer of the apartment.

- Cadastral passport for the premises, indicating its area, number of rooms, sources of electricity, heat, water and gas, as well as layout. If it has changed, this should be reflected in the document.

- Receipt for payment of state duty.

A power of attorney may also be required if a legal representative is acting on behalf of the buyer. If an apartment is sold, the owner of which is a minor, then the consent of the guardianship authorities, parents or persons replacing them will be required.

Timing and cost

For the implementation of the procedure for registering property rights, the current legislation establishes certain deadlines. It all depends on the method of sending documents. If a person sent information by email, the procedure will be completed within one day. When transmitting information through the MFC, the period will be five working days. If delivery was carried out independently or through a legal representative, registration will occur within three working days. The execution period is calculated from the moment the information is received. If this happened on a weekend, then the countdown begins on the next working day. Upon completion of registration, the new owner will be issued an extract from the ERPN.

The cost of the service in Rosreestr for individuals will be two thousand rubles.

Lawyer's answers to private questions

What is more risky for the buyer: buying an apartment received by the seller by law or by will?

In the first case, legal heirs may appear who missed the deadline for accepting the inheritance. In the second - people who are entitled to a mandatory share, and who also missed the deadline. The risks are approximately the same everywhere.

What are the risks when purchasing an inherited share of ownership?

The buyer risks only if the seller has not provided the pre-emptive right to purchase to the remaining share owners (Article 250 of the Civil Code of the Russian Federation). But then the notary will refuse to certify the DCT, and Rosreestr will not accept the agreement without his signature and seal.

How to prove to the acquirer that he is in good faith?

It all depends on the specific situation. The courts are examining whether the buyer could have found out about the right of third parties to the apartment, whether he knew about it. But in most cases, they are still recognized as bona fide, and compensation is paid by the heirs-sellers.

Do I need my wife's consent to sell real estate that I inherited during marriage?

No. According to Art. 35 of the RF IC, such real estate is considered the personal property of the heir-spouse. Notarial consent is required only for the disposal of a shared apartment.

Can a buyer protect himself from loss of ownership of an apartment inherited by the seller?

Yes, for this it is enough to issue a title insurance contract. Such insurance precisely protects against the risk of loss of property rights, and is usually issued for the statute of limitations for challenging the transaction. But if the risks are minimal, it is not always advisable to buy it.

Actions in case of disputes

If a dispute does arise, it can be resolved in several ways. The simplest and most beneficial for both parties is negotiations. This option allows you to resolve all issues with less significant expenses. For example, after mutual settlement it turned out that other heirs were also laying claim to the apartment. In this case, in order to avoid problems, the parties draw up an additional agreement to cancel the previously signed agreement. In such a situation, the documents will be returned to the seller and the money to the buyer. It should be noted that it is most advantageous to use this method before the ownership has been registered in the manner prescribed by law.

If the parties fail to reach an agreement, then each of them has the right to go to court. To do this, it is necessary to fill out a statement of claim and attach to it all the documents that were the basis for the implementation of the transaction.

The text of the appeal must indicate the following:

- The name and address of the court to which the claim is being filed.

- Information about the plaintiff and defendant - full last names, first names, patronymics, place of residence, contact information.

- Detailed description of the transaction - date and place of conclusion, subject, price, obligations of the parties.

- What was the violation of the terms of the contract?

- Plaintiff's claims.

- List of attached documentation. This will include a purchase and sale agreement, an apartment acceptance certificate, a receipt for receipt of funds, and a receipt for payment of state duty.

- Signature of the plaintiff and date of application.

This is interesting: Heirs as subjects of copyright 2020

It should be noted that filing an appeal to the court is possible only if the initiator has received a refusal from the other party to resolve the issue pre-trial. The completed claim along with the necessary documentation must be sent to the court.

You can do this in several ways:

- Deliver in person or through a proxy. In this case, the documents are handed over against signature.

- Send by mail.

- Send over the Internet.

The plaintiff determines the method of transfer independently. Once the material has been received and verified, a trial will take place. At the end, the court will make its decision and send it to the parties to the dispute.