Home » Inheritance » Valuation of an apartment for inheritance

1

The purpose of appraising an apartment is to obtain the appropriate act, which is included in the list of documents required for registration of inheritance rights to real estate. It is required by all notaries, which confuses ignorant heirs, who are already in a state of confusion from collecting certificates and certificates in preparation for the remaining stages of succession. But it’s worth paying attention to the act of evaluation. The financial side of the process and other nuances that are not obvious at first glance depend on this document.

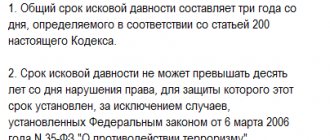

State duty in inheritance is levied only on the issuance of a certificate - in the amount of 0.3% of the value of the property received for heirs from among close relatives and 0.6 - for others. These percentages, as you might guess, are allocated from the actual value of the object of inheritance. And this is the first basis for conducting an assessment, but far from the only one.

The next reason to obtain a report on the current value of the inherited estate is its division. The successors, among whom the testator’s personal property is distributed in shares by law or by will, allocate the portion due to themselves, as a rule, on the basis of its established value. The same applies to the allocation of the marital share (half of the property acquired in marriage with the deceased, which, in accordance with Article 1150 of the Civil Code of the Russian Federation, is not included in the general inheritance).

Receiving the property of the deceased through court or challenging the succession right of other heirs requires an assessment also due to the payment of state fees. It is calculated based on the price of the claim, which is the estimated value of the subject of the trial.

An example of inheritance through the court, in which the appraisal act also served as evidence, is the following case. During his lifetime, the wife of the deceased inherited an apartment in an uninhabitable state. Thanks to the efforts of the husband (financial and physical), the condition of the living space improved significantly: major repairs were made, furniture, household appliances, etc. were purchased. All expenses were fully paid at the expense of the now deceased. Throughout their entire life together, the wife (the owner of the apartment) did not contribute to the family budget, as she was exclusively involved in housekeeping.

Result: after the man’s death, his adult son, who lived with his father and stepmother in her apartment, was forced to move out. According to the law, inherited property is not divided between spouses and the right to it remains with the heir. But justice in this case is the opposite of this legislative resolution and the son goes to court with a claim to recognize the apartment as joint property.

One of the decisive confirmations that the father had made significant improvements to the living space was its current assessed value, which was significantly higher in comparison with the assessment at the time of inheritance. After the court granted the request, the son received the right to inherit half of the apartment.

Method of appraising an apartment

According to paragraphs. 5 p. 1 art. 333.25 of the Tax Code of the Russian Federation, the heir (or other interested party) has the right to use three methods of assessing property: cadastral, market or inventory. However, in reality, only the first two are available - the inventory assessment was abolished on January 1, 2014 by Letter of the Ministry of Finance of the Russian Federation dated December 26, 2013 N 03-05-06-03/57471.

The notary's demands to provide a certain type of assessment are considered unlawful. The payer can use one or two payment methods, choosing the report with the lowest cost.

The cadastral value is established by the state every 2–5 years. In this case, the method of mass analysis of identical real estate objects is used based on the information contained in the cadastre at the time of the assessment. The defining parameters include:

- date of construction of the apartment building;

- degree of distance from the nearest infrastructure facilities;

- average price per square meter of similar real estate in the region;

- apartment area;

- economic situation of the region.

But, despite the improvement of the algorithm, its results remain rather average and do not always correspond to the real market value. Therefore, if the price seems unreasonably high to the customer, he can apply for a market assessment.

The market valuation, in contrast to the cadastral valuation, is determined based on the individual data of each analyzed object. The calculation takes into account the current situation on the local real estate market, and the resulting price most fully reflects the competitive cost of housing.

Which of the two options is better to choose for the cost analysis of the inherited apartment is impossible to determine exactly. In one case, it will be more profitable to order a cadastral valuation, in another - a market one. Surely this can only be found out by conducting both of them.

Who conducts the assessment

The name of the appraisal organization depends on the selected type of assessment:

- Inventory - BTI.

- Cadastral – Rosreestr.

- Market is an independent valuation organization.

Inventory

Papers on inventory value are issued by the BTI. However, the relevant ministry claims that when calculating the state duty, this indicator is no longer used (letter from the Ministry of Finance dated December 26, 2013 No. 03-05-06-03/57471). While no changes were made to the Tax Code in this regard.

You can obtain information about the inventory value if the object was technically registered before 2013. If the apartment is located in a house built later, then it is necessary to obtain a document on the cadastral or market value of the property.

If the house was built before 2013, then the applicant has the right to contact the BTI and receive a certificate of the cost of the apartment.

When determining the inventory value of an object, the amount of costs for the construction of the building is taken into account. However, the link is to prices in the billing period. Later, the average cost of 1 sq. m. is displayed. m. of housing.

The final amount depends on the square footage of the apartment. The inventory price is an order of magnitude lower than the market/cadastral value.

Not taken into account here:

- building location;

- presence/absence of shops or pharmacies;

- remoteness of public transport stops;

- number of floors of the house.

Example. Citizen V. prepared documents for inheritance. The inherited property included an apartment. The building in which the apartment was located was built in 1960. The heir decided to conduct an inventory assessment. To do this, he turned to the BTI. When submitting a certificate from the BTI to a notary, the specialist refused to accept the document. Referring to the fact that the cost of the object is underestimated. Citizen V. filed a complaint with the regional notary chamber. The certificate was accepted as the basis for the calculation.

Cadastral

Another assessment entity is the body for registering real estate objects at their location. In 2020, the State Real Estate Cadastre and Rosreestr merged. As a result, data on the cadastral value of an object can be obtained from Rosreestr. The information is contained in the Unified State Register of Real Estate.

To obtain help you must:

- contact Rosreestr in person, through the website or through the MFC;

- pay the duty.

- get a certificate.

Market

There are many appraisal companies in Russia.

Basic requirements:

- availability of a license to conduct appraisal activities;

- membership in SRO.

The basis for carrying out the necessary measures is an agreement between the heir and the appraisal organization. Valuation activities are carried out within the framework of Federal Law No. 135-FZ dated July 29, 1998.

The agreement displays the following provisions:

- Title of the document.

- Date and place of drawing up the contract.

- Information about the participants in the transaction.

- Subject of the agreement, purpose of the assessment.

- Cost of services, payment procedure.

- Service provision period.

- Rights/obligations of parties to the agreement.

- Responsibility of the parties to the agreement.

- Duration of the contract.

- The procedure for resolving controversial issues.

- Details of the parties, signatures.

Where to go for an apartment appraisal

To determine the current value, you can contact Rosreestr or independent appraisers (depending on the chosen valuation method).

Rosreestr

The recipient of an extract on the cadastral value of an apartment can submit his request through an electronic form on the official website of Rosreestr. In this case, he must provide the following information:

- object type (room);

- the date on which the information is requested;

- cadastral number of the apartment and/or its address;

- form for receiving an extract (electronically, on paper by mail or at the Rosreestr branch);

- type of applicant (individual);

- category of the applicant (person who has the right to inherit the property of the copyright holder);

- personal data of the recipient of the information (full name, SNILS, passport, series, number, etc.).

You can also order an extract during a personal visit to the territorial office of Rosreestr or to the public services center My documents with a passport, documents confirming the testator’s ownership of the apartment, and a floor plan with an explanation.

Independent appraisers

Currently, many organizations offer property valuation services. But before choosing the first one available, it is recommended to take into account the provisions of the Federal Law of July 29, 1998 N 135-FZ “On Valuation Activities in the Russian Federation,” which establishes the basic requirements for the selection of a contractor.

Before concluding a contract, you must ensure that the appraiser:

- Member of the SRO of appraisers (as confirmation, you can request an extract from the register of its members certified by the SRO).

- Has an insurance policy.

- Completed the educational program in his specialty.

It is prohibited to order a service from a person who has a personal property interest in the object of evaluation or any relationship with the customer (a close friend or family member of an individual, founder, shareholder or employee of a legal entity).

An agreement must be concluded with the selected contractor, which defines the conditions and procedure for conducting the assessment. Mandatory clauses of the agreement (according to Article 10 of Federal Law N 135-FZ):

- purpose of ordering the service;

- exact description of the apartment (address, number of rooms);

- type of assessment method;

- cost and timing of the service;

- information about the appraiser's insurance policy;

- name and address of SRO appraisers;

- a mention of the standards on which the contractor will rely when carrying out his activities;

- regulations on the occurrence of additional liability for failure to fulfill the obligations specified in the contract;

- data on the civil liability and independence insurance contract of the legal entity cooperating with the appraiser on the basis of an employment contract;

- Full name of the performers.

List of documents required for appraisal work:

- Customer's passport.

- Owner's death certificate.

- Acts confirming the deceased’s ownership of the apartment (privatization agreement, donation agreement, purchase and sale agreement).

- Floor plan of the house with explanations or a copy of the corresponding page of the technical passport.

Legal aspects of assessing inherited property

Re-registration of the deceased's property as an inheritance is regulated by the requirements of regulatory legal acts:

- the third part of the Civil Code of the Russian Federation;

- Article 35 of the Russian Constitution.

In accordance with the provisions of the Basic Law of Russia, the heir must have the right to a will.

The norms of national legislation are enshrined in the procedure for a citizen to enter into the rights of inheritance and ownership of property. The mechanism includes seven successive stages:

- Obtaining documents confirming the death of the deceased.

- You must have a place to handle probate matters.

- Statement of intent to assert inheritance rights.

- Documents for receiving the property of the deceased (documents on kinship, will).

- Conduct an assessment of the heir's future property. The notary must decide on the procedure and submit appraisal documents and assessments of the property. He must fulfill the same requirements.

- Pay the state fee for obtaining the property mass.

- Certificate of the right to inheritance of the deceased.

The appraiser's report is a public document for obtaining the property of the testator. Determine the cost of government duties.

For more details, read the article: “ Step-by-step instructions for registering an inheritance according to the law”

results

The result of performing the government service to determine the cadastral value of housing is the receipt of an appropriate certificate. It is issued by the state registration service within 5 working days after the request is submitted. And when applying through the My Documents center, it may take twice as long to complete the procedure.

All calculations of the value of inherited property are made taking into account data current at the date of death of the testator.

The outcome of the appraiser’s work is the preparation and delivery to the customer of a report containing the following information:

- Number and date of issue.

- Confirmation of the professional compliance of the appraiser and the independence of the legal entity coordinating his actions on the basis of an employment contract.

- Purpose, standards and grounds for assessment.

- Step-by-step work plan.

- The derived cost of the apartment with comments regarding the scope of its application and other possible restrictions.

- The date on which the calculation was made.

- List of documents characterizing the object of assessment.

The report, submitted in paper form, must contain the personal signatures and seals of the performers and the organizations to which they are assigned. If a document is executed electronically, its authenticity is supported by an enhanced qualified electronic signature.

Features of valuation of different types of property

Let's consider the procedure for assessing the following types of property:

- real estate (apartment, garage, land);

- car;

- shares;

- weapons;

- OOO.

The heir can order an assessment independently or through a representative. In order for a trusted person to order an assessment report, it is necessary to issue a notarized power of attorney, which includes the transfer of authority to contact specialized organizations to conduct an assessment. If the power of attorney does not contain these powers, the appraisal company will refuse to provide services.

Apartments, garages, land plots

In 2020, when inheriting an apartment, house or land, it is advisable to obtain a certificate of the cadastral value of the property. You can get it through the MFC, through a branch or the Rosreestr website.

The cost of a paper copy is 350 ₽

But the cadastral value does not always coincide with the market value. This situation is especially popular in small settlements, where the cadastral value can be 2 or 3 times higher than the market value.

In such a situation, it is necessary to calculate what will be more profitable - to conduct a market valuation or pay a state fee based on the cadastral value.

If the property does not yet have a cadastral value, then the only option is to conduct a market valuation. To do this, the heir must contact a specialized company.

The organization must meet the following conditions:

- provides services on the basis of an assessment agreement in accordance with the legislation of the Russian Federation;

- has a license to provide real estate valuation services;

- is in the SRO register.

The heir has the right to contact any company that meets these conditions. If he provides an assessment report from an organization that does not meet these conditions, the notary will not accept it for calculating the state duty and will not issue a certificate of inheritance rights.

Important! If an heir inherits an apartment or house in which he lived together with the testator at the time of his death, then he may not evaluate this property. If there are 2 or more heirs, then it is advisable to obtain information about the value of the property in case of a dispute or division.

Car

You can order a car appraisal only from a specialized appraisal company. The customer must provide the following documents:

- the applicant's civil passport;

- owner's death certificate;

- PTS and STS;

- title document for the car (sale agreement, donation agreement, certificate of inheritance rights).

When evaluating a car, the following is taken into account:

- vehicle model;

- brand;

- equipment;

- mileage and year of manufacture;

- availability of current and major repairs;

- participation in an accident;

- degree of wear.

Analysis of these factors gives the current market value of the car. On the one hand, the cost is set by analogy with the offers that are present on the market at the time of the death of the vehicle owner. On the other hand, the cost is always set individually. Therefore, even two conditionally identical machines may have different prices.

The cost of assessing a car depends on the type of car (car, truck, bus, specialized transport). The minimum price is set for the valuation of a passenger car.

In 2020, heirs will have to pay at least 3,000 rubles

Shares

If the inheritance includes currency or securities in foreign currency, then the assessment is carried out according to the state of the exchange rate on the day of opening of the inheritance (Article 333.25 of the Tax Code of the Russian Federation).

To evaluate shares, you must submit the following documents:

- passport;

- death certificate of the shareholder;

- an extract from the register of shareholders (if absent, you must take a certificate from the issuing company about the value of net assets).

The cost of valuation services starts from 2,500 rubles.

The duration of the service is 1-5 days.

Weapons

Finding an organization that is licensed to evaluate weapons is not so easy. Therefore, before concluding a contract, it is necessary to check whether the appraisal company actually has the appropriate permission.

Before conducting a weapon assessment, you must prepare the following documents:

- passport;

- death certificate of the owner of the weapon;

- weapons license;

- weapon passport;

- documents on the acquisition of weapons.

If you do not have a passport, you must provide information about the caliber and year of manufacture for firearms and the length of the blade for bladed weapons.

Important! The law does not prohibit the assessment of weapons that do not have a passport.

If documents are available, the assessment can be carried out without examining the weapon. But if there are no documents for the weapon, then it is necessary to provide the object for inspection by an appraiser. The inspection will take no more than 1 hour. But preparing the report may take 1 to 2 days.

The cost of the company’s services in 2020 will be from 1,000 ₽

OOO

An heir can participate in the activities of the LLC only if such a possibility is provided for by the organization’s charter. If the co-founders are against inheriting the share, then the heir receives only compensation for the share. But an assessment is necessary both when registering an inheritance for personal participation and to receive compensation.

The valuation of the share in an LLC is based on the profit and loss statement, as well as accounting analysis.

The heir must submit the following documents to the specialized organization:

- the applicant's civil passport;

- death certificate of the LLC founder;

- LLC charter;

- balance sheet 2 months before the death of the founder (form 1 and 2);

If necessary, the appraiser has the right to request additional documents.

The period for compiling the report is 2-5 days.

Assessment costs vary by region. In Moscow the cost will be from 10,000 rubles, in Smolensk - from 2,000 rubles.

How to challenge an assessment

The customer has the right to challenge the results of the apartment assessment if doubts arise about their validity. At the same time, if only one of the permissible types of assessment was carried out, then it is recommended to postpone the claim to the court and first apply for a different type of service. For example, after receiving an extract on the cadastral price of real estate, order its determination from an independent appraiser using a market valuation model, or vice versa. If none of the values indicated in the reports suit the heir, then they should begin to challenge them.

The revision of the cadastral value can begin by submitting an application to a specialized commission operating under each territorial Office of Rosreestr. To do this, the interested party must make a request to provide the object data on the basis of which the assessment was carried out. If they are clearly unreliable, an appeal is drawn up to revise the assessment result. It must be accompanied by:

- an extract on the disputed cadastral value;

- documentary justification for the irrelevance of the information contained in the cadastre.

The commission undertakes to make a decision within a month to reject or satisfy the applicant’s request. And, if its contents do not suit the heir, he has the right to apply to the court with similar demands.

Filing a claim in court may also be caused by the customer’s disagreement with the report on the market value carried out by the appraiser or appraisal organization.

How much does it cost to appraise an apartment for inheritance?

The cost of services in different appraisal companies may vary.

When making an assessment, the following is taken into account:

- region;

- type of property;

- popularity of the performer's organization.

On average, 3,000 rubles for appraising an apartment in 2020 . This takes into account the intended purpose of the property. Commercial properties are more expensive.

In BTI the cost of services is much lower. A certificate from the technical inventory bureau will cost the heir from 300 to 600 rubles. Much depends on the region of residence. However, the main savings will be when paying the state fee at the notary.

A certificate of cadastral value must be issued to the applicant in 2020 and costs 350 rubles.

Is it possible to do without appraising an apartment?

Theoretically, an assessment document can be dispensed with in the following cases:

- Acceptance of the property rights of the deceased without obtaining a certificate of inheritance. Only the issuance of a document is subject to a fee, so there is reason to believe that an appraisal act is not needed if the successor, when registering an inheritance, writes a statement only about its acceptance (which is also permitted by law).

- Actual inheritance. In this case, not only the estimated value is not needed, but also other documents requested by the notary, since the registration itself is absent, and the actions for actually entering into an inheritance involve the actual use and maintenance of the living space.

But in reality, the circumstances described are undesirable. In the first case, a certificate of inheritance will still be needed - without it, state registration of real estate in the name of the new owner is impossible. And in the second, there is a risk of registration of property by other heirs, as well as the need to recognize their inheritance rights in court.

Most citizens are not even aware of the opportunities that arise when choosing the right method and performer of assessment. But this can significantly reduce costs when entering into an inheritance, which is especially important when the natural value of the property being registered is considerable.

In this case, advice from acquaintances and friends is unlikely to be truly useful, since the cost of an apartment is calculated taking into account a complex system of indicators, and the resulting value, even among objects that are similar at first glance, can vary significantly. Potential customers for the assessment of inherited real estate will find it more useful to consult the lawyers of the ros-nasledstvo.ru portal. Our specialists will help you avoid unnecessary expenses and, if contacted in a timely manner, disputes with appraisal organizations.

Request a free consultation through the provided electronic form and receive a competent response from a lawyer in just a few minutes.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

79

State duty when entering into inheritance in 2020

According to the legislation of the Russian Federation on taxes and fees upon entry into...

16

Statement of claim to establish the fact of acceptance of inheritance in 2020

Actual inheritance from a legal point of view is regarded as a full-fledged method...

5

Who is legally a close relative?

In such a concept, obvious at first glance, as “close relatives”...

10

Inheritance by right of representation

The order of inheritance in the absence of a will is regulated by Chapter 63 of the Civil Code...

13

Selling a house or apartment after inheritance

After receiving the inheritance, the successors can dispose of it at their own discretion....

29

Actual acceptance of inheritance

To take possession of inherited property, you must accept it. Exists…

Who evaluates inherited apartments?

There are two types of documents in which appraisers record the value of apartments and other real estate. These are reports on cadastral or market valuation. The heir to the apartment chooses what kind of evidence to submit to the notary.

Typically, in inheritance cases, an extract from the Unified State Register of Real Estate (USRN) is submitted. There, the cadastral value of the apartment already exists: it is determined by order of the state every five years and is regularly updated in the Unified State Register of Real Estate database. The extract itself is usually included in the package of documents for the apartment - along with the purchase and sale agreement, cadastral passport and other papers.

However, the heir may not agree with the value of the apartment established in the register - and, accordingly, the amount of the inheritance duty. This is 0.3% of the total amount for spouses, children, brothers and sisters of the deceased (but up to 100 thousand rubles) and 0.6% for other heirs (but up to a million rubles).

So, if the cadastral value of an apartment as an inheritance is higher than the market value, for example, by 500 thousand rubles, the overpayment of duty will be from 15 thousand. In such cases, ordering an examination of the market value of an apartment is often more profitable.

In addition, accepting an apartment as an inheritance with an assessment at market value is convenient if:

- it is difficult for you to visit the location of the inheritance and collect papers from government agencies;

- there is too little time left until the moment of inheritance (six months after the death of the testator), and there is no time to collect papers for the apartment;

- The condition of the inherited apartment, due to someone else’s fault, worsened even before the heirs took ownership, and this must be proven in court.

When ordering an independent examination, you need to receive a report on the assessment of the value of the inherited apartment in order to assume rights. Not a certificate, not an extract, act or other document. The notary simply will not accept them and will not include them in the inheritance case.

Also, private companies often offer an assessment of an inherited apartment through the Bureau of Technical Inventory (BTI). Such a document will not be legal, because the inventory valuation of apartments and other real estate is taken into account on a residual basis. That is, if it was done at the time of the testator’s death, such a document can be submitted. But, if this is done already when inheriting an apartment, the paper will be considered void.