Home » Inheritance » Inheritance and registration of a share in a privatized apartment after death

13

After a person passes away, the property that he owned remains. As a rule, it passes to the heirs - relatives or other persons specified in the will. The division of property often causes disputes and disagreements, especially when it comes to the “housing issue”. Possible rights and obligations of heirs are reflected in the articles of the Civil Code. By following them, you can avoid mutual claims and maintain peace in the family.

The concept of shared ownership

An apartment can belong to several people (Article 244 of the Civil Code of the Russian Federation), each of whom will own a certain part of it. If the share of each of the co-owners of the apartment is not determined, they are considered to have equal shares of the property.

The share of the living space cannot be rented out by the owner or occupied by people who are not members of his family; the sale of such property is possible subject to the pre-emptive right of purchase by the co-owner of the property.

How can the owner of an apartment share dispose of his property? He can live in the premises, move his family members into the apartment, draw up a deed of gift for part of the property or bequeath it, and this does not require notification or consent of other owners of the living space.

How shares in an apartment are divided by inheritance

According to the Civil Code of the Russian Federation, property is divided between the legal successors of the deceased in 2 ways: by law or by will.

Heirs of a privatized apartment by will

Dividing the property into parts will not cause problems if a will has been drawn up for the apartment. It clearly defines the shares of inherited property and outlines the circle of heirs. The testator can obtain housing rights by submitting an application and other necessary documents to a notary within six months after the death of the testator.

If, in addition to the right of ownership, obligations are inherited, you can refuse the due part of the property, but only in its entirety. Persons who are owed an obligatory share in the inheritance are allowed to challenge a will.

Heirs of a privatized apartment by law

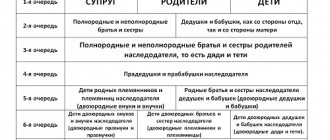

If a will has not been drawn up, inheritance occurs according to law. The order of receipt of property is specified in Art. 1411-1145 Civil Code of the Russian Federation. Children, spouses and parents are the first to have inheritance rights. In the absence of representatives of a higher order, relatives of lower orders take part in the section.

Thus, in the second place, property will be divided between brothers, sisters, grandparents; in the third - between the uncles and aunts of the deceased; in the fourth - between great-grandparents; in the fifth place, cousins' grandchildren and grandparents will take over; in the sixth place, the property will be inherited by great-great-grandchildren, cousins of the parents; in seventh place - adopted children, stepfather or stepmother.

If a child is adopted, but was officially adopted, he automatically becomes a contender for the 1st stage inheritance.

All heirs who are representatives of the same line have rights to equal shares of the inheritance.

Example. Citizen V. and citizen N., who were legally married, were the owners of the apartment, each of whom owned ½ of its part. Citizen N. died without leaving a will, so his ½ part of the apartment should be divided between his wife N. and two daughters in equal shares, that is, 1/6 each. Since at the time of the death of citizen V. one of his daughters died, the share due to her passed to her children by right of representation. As a result, the apartment was divided in this way: ½ remained the property of the wife and 1/6 was inherited from her husband, 1/6 was inherited by 1 daughter, and 1/12 went to the children of the deceased daughter.

Mandatory heirs

The Civil Code of the Russian Federation defines a group of persons who have the right to an obligatory share in the inheritance, regardless of the presence of a will. It includes:

- Children under 18 years of age.

- Disabled dependents from among the legal successors, if they were dependent for at least 1 year before the opening of the inheritance.

- Citizens not related to the circle of heirs who were dependent on the deceased and lived with him for at least 1 year.

If there is a testamentary disposition, these citizens receive at least half of the share that would have gone to them by law. If a will has not been drawn up, the obligatory heirs are called upon equally with the other primary legal successors.

Heirs of a privatized apartment by right of representation

The descendants of the deceased heir will receive the inheritance by right of representation if his death occurred before the opening of the inheritance or at the same time as the testator.

The share of the deceased heir in the apartment of the previous owner will be distributed among the new applicants.

For example, if mother died in 2014, grandfather in 2020, and the mother’s share of the inheritance was ¼ of the apartment, then this part will be divided among her children, despite the fact that they themselves would not be able to accept the grandfather’s inheritance.

Property is transferred to a relative

In the will, you can indicate relatives as recipients of the apartment. If the inheritance is divided according to the law, only relatives participate in the division procedure, and those closest to them have priority. For registration, you must submit an application to a notary. If this step is ignored, inaction will be regarded as a voluntary refusal. Claims must be made within six months after the death of the apartment owner. Missed deadlines can be reinstated in court only if there are valid, documented reasons.

This is important to know: Refusal of privatization in favor of another person

Is the degree of relationship taken into account?

When distributing shares of an apartment according to the law, this is a fundamental principle. The first applicants are immediate relatives, which include children, parents, and spouses. If they are not there, or a refusal is written, the others are called up in order of priority. When entering into rights under a will, kinship does not matter.

Do I need to obtain consent from other relatives?

This is necessary when completing certain types of transactions. It is prohibited to sell an apartment in which several people live without the consent of all residents. Also, you cannot give it as a gift or change it; there is at least one tenant who does not want this. Inheritance is another matter. Consents of cohabitants are not needed for a will, but the text can only refer to the share belonging to the testator.

Who has the priority right to receive a share in the apartment?

As a rule, the heirs of a privatized apartment come to mutual agreement on issues of determining the size of shares. In order to defend your right to a part of the indivisible property, you must have advantages over others. It could be:

- Living in the premises with the testator, using it for its intended purpose. It does not matter whether the applicant was the owner or a co-owner.

- Use of the premises, living in it after the death of the owner, unless such actions are illegal.

- Living with the owner of the apartment until the day of opening of the inheritance due to the lack of own or rented housing.

If entry into inheritance occurs on the specified grounds, other interested parties must receive compensation in monetary terms from the heir.

If it is impossible to resolve disagreements, the issue of determining the size of shares is resolved in court.

How are shares divided between heirs?

Registration of a share of an apartment in ownership after death is also associated with the need to divide property according to inherited shares between the heirs. In accordance with the legislation and practice of its application, the following situations are possible:

- an individual agreement on the distribution of shares is drawn up;

- separation is carried out through the court;

- shares are assigned in kind (the specific area in the room is indicated);

- the deadlines for entering into inheritance are restored, and the division procedure is revised taking into account the emergence of new late applicants (it is necessary to go to court);

- the heirs or part of them are recognized as unworthy;

- the will is challenged by an interested party in court.

Most issues regarding the division of inherited shares are resolved individually between the parties. If disputes or other legal complications arise, you send the case to court

Entry into inheritance

The procedure for inheriting a share in an apartment is carried out within 6 months after the death of its owner. During this period, it is necessary to submit documents to the notary to open an inheritance case. The basis for starting the procedure is an application and the first submitted document proving the fact of the death of the owner of the living space: a death certificate, a notice of death, a court decision declaring the person dead.

What needs to be done first

- Issue a death certificate at the registry office. To do this, you will need documents: a medical certificate with death certification (form No. 106/u-08), a passport of the deceased.

- At the passport office, remove the deceased from the registration register and receive a certificate (Form 9), which will indicate the extract. You need to have documents with you: passport, death certificate with a photocopy.

Required documents

Before visiting a notary, it is recommended to collect a package of documents in advance, which includes:

- application for inheritance;

- death certificate of the owner of the apartment;

- a document providing the basis for entering into an inheritance (will, data on family ties);

- a certificate indicating the cost of the apartment;

- certificate from the last place of residence of the deceased;

- documents confirming the presence of family ties between the heir and the deceased;

- form 9;

- an extract from the house register indicating all persons registered in the premises;

- documents for real estate to be inherited.

The estate does not include real estate that was not privatized by the deceased. However, a decision on the possibility of including such a share in the inherited property can be made in court.

Documents that a notary needs to register the right of inheritance to a share in an apartment:

- Privatization agreement confirming the transfer of municipal housing into private ownership.

- An extract from the Unified State Register of Real Estate (USRE), which combines information from the Unified State Register of Rights to Real Estate (USRE existed until December 31, 2016) and cadastral passport data. Such an extract can be requested by a notary in electronic form independently.

After 6 months, the notary issues certificates of inheritance to the heirs.

Procedure for drawing up a will for a share in an apartment

A will for a share in an apartment is drawn up in accordance with the provisions of the law.

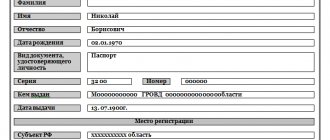

The document, in accordance with the provisions of the Civil Code of the Russian Federation, must consist of the following points:

- personal data of the testator;

- Date of Birth;

- the address at which it was registered;

- passport details;

- information about the apartment;

- personal data of the inheritance recipient;

- date of writing of the will.

If one of the listed items is missing from the will, this may become a basis for other heirs to challenge this document in court.

According to Art. 1130 of the Civil Code of the Russian Federation, the testator has the right to change the contents of the document or can completely cancel it.

A document will be considered legal if:

- was written personally by the testator and notarized;

- when writing it, the testator presented the necessary documents to the notary: passport, documents on ownership, agreement on the allocation of shares in common property, etc.;

- the main requirement for document execution is that the document is written in person by the owner of the property;

- There must be two copies available;

- the first is taken by the testator, the second remains in the custody of the notary.

When the heirs do not know how to write a statement, it is better to do it in a notary office. This way you can avoid various misunderstandings that may arise when registering an inheritance.

Share in a privatized apartment

As mentioned earlier, an owner who has a share in the common property must make a will if he wants his property to go to a worthy heir.

This is important to know: Who is the owner if the apartment is privatized for three

If there is no such document, the inheritance will pass to the legal successors, who are children, spouses, parents, brothers, sisters of the deceased, and so on. And the person whom the testator saw as his successor will be left with nothing.

What is the power of a will?

The legal force for the transfer of property to the heir specified in the will is that document that was not canceled by the testator, or if changes were not made to it, which ultimately changed its content.

Based on the will, the following will be executed:

- the last will of the deceased;

- the inheritance will be distributed among the persons indicated in the document.

We remind you that if the will has been amended, the document that has not been amended or annulled by the testator will have legal force.

A will that has not been certified by persons authorized to do so will have no legal force.

Although, if such a declaration of will was written in circumstances of a threat to the life of the testator, it can be recognized as legal provided that at least two witnesses were present when it was drawn up.

Inheritance by fact

If a person has not submitted documents to enter into an inheritance, but has assumed the costs of operating and maintaining the apartment, it means that he has entered into inheritance rights in fact. In order to subsequently legitimize the share of the apartment and become its owner, it is necessary to provide evidence of the use of the property: paid utility bills, data on the payment of debts, witness statements.

Otherwise, the heir will not be able to fully manage the property: make purchase and sale transactions, coordinate layout changes, register family members in the living space. These actions require a court decision recognizing the heir's right to property.

Missing the registration deadline

Heirs do not always approach the rules of inheritance with the proper degree of responsibility and often remain dissatisfied with the result of the division.

The court is considering questions about the settlement of a compulsory share of property and the possibility of inheriting a share of an apartment if the deadline for submitting an application to a notary is violated. In the latter case, the heir will need evidence of serious circumstances due to which the application deadline was violated.

The best way out of this situation is to obtain written consent from other participants in the process to include the violator of the deadline in the list of heirs. This document must be certified by a notary. Previously issued certificates of inheritance are subject to cancellation, and the shares of the apartment are redistributed anew. But in most cases, such situations end up in court proceedings.

How to register a share in an apartment by inheritance

Becoming a legal heir is not enough to manage property. It is necessary to register the share in the territorial branch of Rosreestr by providing the following documents:

- application for state registration;

- certificate of inheritance of property;

- heir's passport;

- cadastral data;

- a document certifying the testator's ownership of the property;

- agreement (court decision) on determining the share of each legal successor in the privatized apartment;

- receipt of payment of state duty for inheritance.

All provided copies of documents must be notarized.

After checking the documents, Rosreestr registers ownership of the apartment’s share. The waiting period for a registration certificate is no more than 10 days. Upon completion of this procedure, the owner of the inherited part can dispose of it at his own discretion.

How to make a will for a share in an apartment

Owners of housing, especially privatized ones, often think about the “fate” of their property after their death. To prevent it from remaining ownerless, the owners draw up a will for the person they would like to see as the owner of their own home.

The law establishes a clear procedure for drawing up a will. If, when drawing up a will, the testator acts in accordance with all the rules and requirements, then later the heirs will not have any problems with re-registering ownership of a share in the apartment.

Note! The absence of a will is a direct way of transferring inheritance according to the law in the order of succession. That is, the inheritance may not go to the person the owner himself would prefer.

A will can be made not only for a relative or a person who lived with the deceased before his death. In this case, any person chosen by the testator can become an heir.

The first version of a will may not always be final. The testator has the right to change its contents as many times as he sees fit.

The latest version of the document, which has not been subject to changes and has not been canceled by the testator, is considered current and legal.

According to the contents of the will:

- the property will be distributed after the death of the testator based on the expression of his last will;

- the share in the testator’s apartment, which was privatized, after the appropriate inheritance procedure will become the property of the heir specified in the document;

- The last version of the will has legal force (Article 1130 of the Civil Code of the Russian Federation).

A document that:

- incorrectly formatted;

- was certified by persons who do not have special authority;

- was drawn up by the hand of the testator under extraordinary circumstances, but the owner ultimately remained alive, and, at the same time, after a month after writing the “emergency” copy, he did not formalize the document properly.

Bequeathing a share in an apartment to a relative

Most often, owners of a share in a privatized apartment leave their inheritance to persons who are related to them.

The testator's decision is not influenced by the presence of not one, but several first-degree relatives.

With his last will, he can appoint any relative as heir under the will. It could be:

- one man;

- several persons, if the testator wants to divide his share among the heirs.

Important! Persons entitled to an obligatory share in the inheritance will receive it guaranteed, regardless of the presence of their surname in the owner’s will.

Drawing up a will without the consent of the other owners. If the owner plans to bequeath his share in the apartment to an heir whom he has chosen himself, he does not need the consent of the other owners of the apartment to this step.

Such consent must be obtained only in the event of a sale or exchange of a share. You can bequeath a share to one person, several heirs at the same time, or one part of the entire share.

There are two types of wills: open and closed.

Note! The contents of a closed will are a secret for all heirs, in fact, as well as for the notary certifying the document (Article 1126 of the Civil Code of the Russian Federation).

This type of will:

- written personally by the testator;

- handed over to the notary in a sealed envelope. The notary is required to certify the document by entering the details of the testator, the date the document was received for storage, etc.

At the next stage, the sealed envelope with the will is placed in another envelope, on which the details entered by the notary in a special register are placed.

An open will is drawn up by the testator when visiting a notary in his presence. Next, the specialist performs the necessary procedures. After being noted in the register, one copy of the document remains for storage in the notary’s office.

Can heirs be held liable for the affairs of the deceased?

What documents to provide to a notary for registration of inheritance after death, read here.

Sometimes the testator is not able to personally visit the notary because he is in a hospital, lives in a veterans' home, or is on military service. In this case, a person authorized for this action (doctor, commander, etc.) has the right to certify the document.

If emergency situations arise and the testator is in a hurry to make arrangements for his property, the document can be written by the testator in his own hand in the presence of two witnesses.

Inheritance of real estate in common joint ownership

If property was acquired by spouses during marriage, it is the common joint property of the spouses.

Until 1996, upon the death of one of the couple, the entire apartment passed to the second spouse, but subsequently the inheritance order changed. Now the surviving spouse is the owner of ½ of the property and inherits part of the ½ share of the deceased among the primary assignees.

For example, in the event of the death of a man who has a wife and child, the distribution of a privatized apartment upon inheritance in accordance with a will drawn up, in which the son is indicated as the sole heir, will occur as follows: ½ will belong to the wife, she can dispose of this half at her own discretion (sell, bequeath, etc.), and ½ will go to the son according to the will.

How much does it cost to inherit a share of an apartment?

Regardless of whether the heir is a relative of the deceased or a stranger, no property tax is paid, but a fee is charged for the work of a notary and registration of real estate.

To obtain a certificate of inheritance, you must pay a state fee. Its size is established by the Tax Code of the Russian Federation (Article 333.24) and is:

- For natural or adopted children, husband and wife, father or mother - 0.3% of the value of the share they inherit. The amount cannot exceed 100 thousand rubles.

- For other legal successors - 0.6% within a million rubles.

The basis for calculation is equivalent to the value of the inherited property. Without paying the state fee, a certificate of inheritance will not be issued.

To change an entry in the Unified State Register, you must also pay a state fee, which, in accordance with Art. 333.33 of the Tax Code of the Russian Federation is equal to:

- for citizens - 350 rubles;

- for organizations - 1000 rubles.

Additional expenses will be associated with payment for notary services. If it is necessary to certify copies of documents, a fee of 10 rubles is paid. per sheet, when witnessing signatures on documents - 100 rubles. The size of the notary fee is specified in Art. 22.1 Fundamentals of legislation on notaries. Legal and technical services are paid for by agreement with the notary.

Inheritance of a share in an apartment

You can enter into an inheritance and register an apartment, or rather a part of it, making it your own, after recording the fact of the death of the owner of the premises. If the owner is alive, acceptance of the inheritance is impossible.

To enter into an inheritance, 6 months after the death of the apartment owner, you need to collect a list of documents.

Heir Steps:

- Visit the registry office to exchange the deceased’s passport and death certificate for a death certificate.

- Make copies of the document.

- Go to the passport office, remove the deceased person from the registration register, get a certificate of form No. 9, with the date of discharge.

- Prepare documents for the notary's office: passport, certificate confirming the owner's death, will, if available, certificate of termination of registration, birth or marriage certificate confirming inheritance.

- Inheriting an apartment involves filing an application with a notary, indicating the heir's intention to receive the property that was in the possession of the deceased person.

- The notary requires the submission of papers: a privatization agreement, a state certificate of property registration. You will need an extract from the Unified State Register and a cadastral passport. Notaries receive these papers on electronic media, which has reduced the time required for registering an inheritance.

Selling part of an inherited apartment

If the heir has a desire to sell the inherited part of the apartment, he has every right to do so. To do this you need:

- allocate the due share from the common property through contractual or judicial procedure;

- notify each co-owner of the living space about the sale and offer to purchase a share of the property, since this category of persons has a pre-emptive right to purchase (Article 250 of the Civil Code of the Russian Federation);

- If the co-owners do not give a written refusal to purchase part of the apartment, then strictly in a month the heir can sell it to another buyer at the same price.

Carefully following the algorithm for entering into inheritance rights and registering a share of an apartment will allow you to become its full owner and subsequently avoid problems with the disposal of property.

You can speed up the procedure for inheriting a share after the death of a relative by taking advantage of a free consultation with specialists on the portal ros-nasledstvo.ru. Experienced lawyers will help you determine the list of necessary documents, correctly draw up an application to submit to a notary, and answer any questions that arise during the registration of real estate.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

39

Entry into inheritance after death under a will

The procedure and rules for entering into inheritance under a will are established by the chapter...

20

Lawsuit to restore the deadline for accepting an inheritance in 2020

The judicial hearing of the case on restoration of the period for accepting an inheritance begins with...

39

How to enter into an inheritance for grandchildren after the death of a grandmother or grandfather

The legislation establishes two methods of inheritance: by will and by law....

10

How is the inheritance divided between the wife and children after the death of the husband?

After registering the marriage, the husband and wife acquire in relation to each other...

28

What documents are needed to register and enter into an inheritance with a notary after death?

A complete list of documents required to accept an inheritance is established in the individual...

12

First priority heirs after death

The basic principles and rules of inheritance are defined by Part 3 of the Federal Law No....

Should the mandatory share be taken into account?

This is allowed, but not considered mandatory. If this is not done, the obligatory heirs will still receive their due share of the inheritance, even if it is part of the apartment. But if you foresee the situation, in order to avoid disputes between successors, indicate them in the will. But if over time more people appear who fall under this category, they will be called to inherit after the opening of the inheritance case.

List of compulsory heirs

Such applicants fall into three main categories:

- Minor children . Previously, legitimate children were taken into account. Now even an illegitimate child has the right to apply for an apartment. The same applies to adopted persons.

- Disabled parents . The reason is poor health, documented, or advanced age.

- Dependents . These are disabled people who are dependent and provide financial support to the testator during his last year of life. Living in an apartment is not necessary.

Any person from the group of these persons will receive their share, even if the inheritance is an apartment that is indivisible in kind. You just need to declare your rights by writing a statement to a notary.

How is the inheritance share divided taking into account this category of persons?

The sequence of property distribution is as follows:

- From the amount allocated without a will, a mandatory share is allocated.

- If it is not enough, the deficiency is compensated by part of the apartment provided by the will.

- The remainder of the bequest is transferred to the designated successors.

- Property not specified in the will is distributed in equal parts among the first-priority heirs from among the relatives.

In any case, persons in need of social protection from among the beneficiaries of inheritance will receive their due share.

This is important to know: Is it possible to privatize an apartment in a dilapidated building?