What kind of document is this and why is it compiled?

In accordance with the law, a mortgage is a (registered) security that certifies the legal right of its owner to repay loan obligations secured by a mortgage, as well as the right of pledge on real estate encumbered with a mortgage.

This document is subject to mandatory state registration.

The security is issued by the bank and signed by the mortgage borrower on the day the loan is received. However, the law does not prohibit the registration of a mortgage without drawing up this document.

The subject of such securities is usually the property, the rights to which are transferred to the borrower after signing the agreement.

The spread of this instrument on the market is explained, among other things, by the ability of banks to solve the problem of lack of money in the long term with their help:

- the lender has the right at any time to sell the rights to claim the mortgage to another bank;

- a credit institution has the right to issue securities secured by mortgages and, thereby, raise funds for mortgages on the market.

But the main purpose of its execution is to provide the bank with guarantees of the borrower’s solvency.

Ways a bank can use a mortgage for an apartment

As already mentioned, a mortgage is the main document that protects the interests of a banking organization in the event of non-repayment of loan funds by the borrower. In this case, the creditor has the right to sell the collateral to cover the debt.

This document also serves as insurance for a banking organization in the event of possible bankruptcy. The bank has the right to dispose of it until the debt on the mortgage loan is fully repaid, unless the agreement contains conditions prohibiting this.

A mortgage on an apartment can be used by the bank in the following ways:

- Partial sale of collateral.

- Assignment of rights.

- Exchange of mortgages.

- Issue of mortgage-backed securities.

- Partial sale of collateral .

In this case, the banking organization transfers part of the collateral to another company, after which the main lender must also transfer to the buyer of the mortgage the corresponding share of the fees paid by the borrower. This operation allows the mortgage lender to quickly receive the required amount of funds, usually not too large. There are several ways to partially sell collateral. The first involves making multiple payments by the borrower to a third party. In such a situation, the creditor organization does not receive funds at this time. The second method is to transfer part of the borrower’s contributions to a third party during the entire period of repayment of funds under the apartment mortgage agreement. In this case, the banking organization independently distributes the payments received without notifying the borrower. - Assignment of rights . The bank completely transfers ownership of the mortgage on the apartment to another bank. Mortgage holders usually resort to such actions when a large amount of funds is needed. For the borrower, the terms of the mortgage agreement remain the same, since changing them is prohibited by current legislation. The only thing that can change is the current account to which monthly payments are transferred. The borrower must be notified of this either directly at the branch of the banking organization or by postal notification. Sometimes such operations on the assignment of rights lead to restrictions on certain operations for the borrower. The new mortgagee argues that he did not apply for a mortgage on the apartment. An example is the program to help borrowers with mortgage loans from VTB 24. On the Internet you can find information that the bank prevented borrowers from receiving 1.5 million rubles provided by the state to pay off the debt on a mortgage for an apartment.

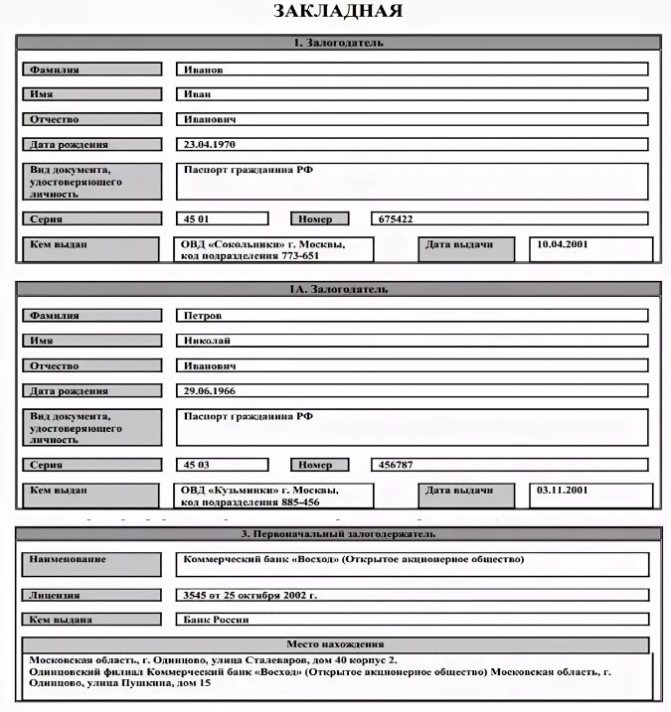

Contents of the mortgage

The security must contain the full name of the borrower, the parameters of the collateral property, and the terms of the agreement.

- Name and location (registration) of the pledgor.

- Date, number, place of conclusion of the mortgage loan agreement.

- Amount, loan interest and loan period.

- Date of loan issuance.

- Description of the collateral property.

- Details of the document establishing the rights to the pledged property.

- Marks of state registration authorities.

- The date the document was issued to the original mortgagee.

Drafting requirements are also regulated by law, but banks have the right to impose additional conditions. At Sberbank, for example, mortgages may vary slightly depending on the loan issuing offices.

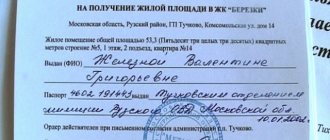

A sample and what a mortgage looks like can be seen here.

What is a mortgage on an apartment and why is it needed?

The law specifies the basic requirements for the format of a security.

The bank has the right to receive interest on the loan from the borrower. In the event of bankruptcy of a credit institution, mortgages save the situation, serving as an insurance basis for receiving money. When applying for a mortgage on a secondary home, a deposit is a mandatory condition. The collateral can be:

- Land plot,

- House with land,

- Apartment,

- Other premises or buildings.

The bank assumes responsibility for storing the collateral. After termination of loan obligations, the mortgagor can return his property.

AHML Mortgage

To obtain details of a mortgage issued by the Housing Mortgage Lending Agency, just call the toll-free hotline number 8-800-505-11-11.

This information is officially posted on the AHML website https://dom.rf manual for users of their personal account.

Applying for a mortgage - step-by-step instructions

From July 1, 2020, registration of a pledge can be done electronically. Below we will consider the methods of paper registration.

Stage 1. Signing documents at a credit institution

Alexander Nikolaevich Grigoriev - head of the mortgage lending department: - “ The mortgage is the most important document for you. According to it, you leave your apartment as collateral to the bank. Errors in a loan agreement are not as bad as errors in a mortgage. If there is something wrong with this document, you will not be able to remove the encumbrance from the apartment. You'll have to sue the bank to do this. You will waste time and money. Always check the paper carefully and compare it with the loan agreement. Mistakes will cost you dearly."

This is important to know: What deposit is taken when selling an apartment, sample contract

Stage 2. Pay the state fee

Registration of property rights occurs simultaneously with the registration of a mortgage on real estate. To register property rights, you must pay a state fee:

- For individuals – 2,000 rubles,

- For legal entities – 220,000 rubles.

Payment can be made:

- In a banking institution,

- At the Rossreestr box office,

- Using the terminal.

If real estate that is already owned is transferred to the bank as collateral, then there is no need to pay the mortgage.

Stage 3. Register a mortgage through the MFC

Having collected the entire package of documents, you can go to “My Documents”. Center specialist:

- will check the contents of the package and its correctness,

- will issue 2 receipts with a list of these documents. The second copy will need to be handed over to the bank,

- will send documents to Rosreestr for registration,

As a rule, the registration period is from 3 to 5 working days. It will take another 2 to 4 days to transfer the documents.

Alexander Nikolaevich Grigoriev – head of the mortgage lending department: “The MFC acts as an intermediary between Rosreestr and the borrower. Registering a mortgage through the MFC is more convenient, but longer. If you contact Rosreestr directly, the mortgage will be registered faster. However, at Rosreestr you usually have to stand in lines. Therefore, pledgors more often send documents through the MFC.”

Stage 4. Receive documents from Rosreestr

The Organization must present a receipt issued by a specialist at the MFC. An employee of Rosreestr issues an extract from the Unified State Register of Real Estate with a note indicating that the property is encumbered in the form of a mortgage.

IMPORTANT! The mortgage is issued once and signed once. There can be as many additional agreements and copies as you like. Corrections to the document are not available.

Stage 5. Get a duplicate from the bank

When receiving a mortgage note, it is better to make a duplicate, which will serve as confirmation in case the first one is lost. A mark is placed on the copy indicating that it is not the original. You should make sure that all data in the copy matches the original.

What is a mortgage? Tips for registration

A mortgage is a type of loan for the purchase of real estate, which is issued for a long term. Sometimes it even reaches 20 years. A mortgage is also issued for purchases, for example, a car. In any case, the loan amount will be quite large, so concluding a mortgage agreement requires a lot of documents and permits. One of the most important papers is the mortgage on the property.

A mortgage is the most reliable option for obtaining a loan to purchase a home, both from the bank and from the borrower. Even if you have too little income or don’t work at all, the bank will allow you to get a mortgage if you have a mortgage in hand.

The nuances of obtaining a military mortgage: how to find out the mortgage number in AHML or a bank

- Obtaining a certificate of participation in the NIS program - it is issued no earlier than 3 years from the date of entry into the program.

- Search and selection of specific real estate.

- Contacting the bank for advice and obtaining a list of required documents.

- Filling out the application form and providing the full package of necessary papers.

- Opening an individual client account for transferring funds accumulated through NIS.

- Signing the purchase and sale agreement.

- Registration of documents in Rosreestr.

- Transfer of real estate as collateral to the bank (drawing out a mortgage).

- Contact your lender. The mortgage note is drawn up in two copies: one of them is kept in Rosreestr, the second in the bank.

- Make a request to Rosreestr. You can view the number in the Unified State Register extract received upon the personal application of the mortgagor.

- Using your personal account. If you don’t know how to find out the AHML mortgage number for a military mortgage, then just go to the agency’s website. There you will see not only the mortgage number, but also the loan agreement, payment schedule, account balance and much more useful information.

What to do if the bank has lost the mortgage on the apartment

The loss of even such an important document as a mortgage is a fairly common situation, both in very small financial organizations and in large serious banks. As a result of such actions by the lender, the borrower faces many problems.

- Where does the problem start? Basically, the borrower learns about the fact of the loss of the collateral document after full repayment of the loan debt, when he contacts a banking organization to get the mortgage back. The reason for this problem lies in the long-term nature of mortgage lending (from 5 to 20–30 years). Despite the fact that most borrowers pay their debt ahead of schedule on average within half of the period specified in the contract, this is enough time for the document to disappear. Loss of documents often occurs due to relocation, re-registration, audit or simple negligence of employees. Even the fact that such documents are stored in a depository, since they are securities, does not provide adequate security. Nevertheless, in reality the document can still be found in most cases.

Mortgage for an apartment - sample and procedure for registration

Even with a military mortgage (at the lowest interest rate), there is a need for a mortgage. The fact is that any mortgage program is a long-term instrument. Rarely does a reputable bank be willing to risk its assets. And the situation in Russia in the banking sector sometimes looks very unstable.

- Submit an application or express your wishes.

- Take a photo with your passport.

- Wait for a positive decision within 3-4 days.

- Remember that this loan offer is valid for a period of 4 months.

- Choose the ideal home from a large database of new buildings and secondary housing.

- Go to the bank and apply for a mortgage.

Where is the mortgage on the apartment?

The mortgage on an apartment is kept in the custody of the mortgagee (the banking organization that provided the mortgage, or another bank to which it was transferred) until the debt is fully repaid by the borrower. After repayment of the borrowed funds in full, the lender must transfer the mortgage with the appropriate mark to the owner of the property. Upon receipt, the borrower should make sure that the document bears the signature of an authorized representative and the seal of the organization.

To permanently cancel the rights under the mortgage, you will also need to contact the government agency that registered the ownership rights to the apartment purchased with a mortgage. A government agency employee must remove from the register data on the credit obligations of the property owner. After these procedures, the borrower is considered completely released from mortgage obligations.

What is a mortgage on an apartment?

The mortgage is a document necessary for the bank to exercise its material rights, therefore it is drawn up in a single copy and is not issued to the mortgage borrower . In the event of a loss or a controversial situation, it will be useful to have a copy of the document on hand, which allows you to judge the legality of the pledgee’s claims and the correctness of the execution of the duplicate.

- information about the entity that provided the collateral, including personal and passport data of a private person and full details of a legal entity;

- information about the holder of the pledge who received it from the pledgor, including the name, information about the license and the issuing authority, as well as the detailed location of the subject;

- a description of the mortgaged or other real estate being pledged, allowing it to be unambiguously identified and including a description of the location, characteristics and details of the title document, as well as the presence of encumbrances on the part of persons who are not parties to the transaction;

- the estimated value in the currency of the loan and the details of the person who performed the examination;

- lending conditions, including the amount of borrowed funds, interest rate, frequency of payments, amount of contributions and deadline for debt repayment;

- information about the date of preparation of the document and its number.

What is a mortgage on an apartment

A mortgage for a bank is a security that gives the lender the right to recover costs associated with the borrower's insolvency by reselling the mortgaged property. In Russia, this registration procedure is optional only when working with banks that have good financial reserves.

The credit institution is interested in drawing up the document, because it serves as a guarantee of the return of funds on the housing loan. The borrower must be extremely careful when signing, because the collateral, in most cases, becomes the only home. In the event of a conflict between the parties, the court considers a case based not on the mortgage agreement, but on the mortgage.

| Mortgage debt, rub. | Monthly savings, rub. | Refinancing costs | ||

| — 1% | — 2% | — 3% | ||

| 1 million | 500 | 1000 | 1500 | 15500 |

| 1.5 million | 800 | 1600 | 2400 | 21000 |

| 2 million | 1050 | 1600 | 3100 | 26500 |

| 3 million | 1600 | 3200 | 4600 | 37500 |

| 4 million | 2150 | 4250 | 6300 | 48500 |

| 5 million | 2825 | 5560 | 8250 | 59500 |

| 6 million | 3500 | 6870 | 10200 | 70500 |

The mortgage comes in several forms:

- in the form of a paper document;

- electronic.

The document is valid only until the payer repays the loan in full. Before this, the lender does not have the right to sell the mortgage for his own purposes without the client’s permission.

AHML personal account

Connection to the System is possible for borrowers or co-borrowers under a loan agreement, the mortgage under which belongs to AHML (or the Agency represents the interests of the legal owner of the mortgage). To clarify your status, please call the Hotline.

The issue of residential mortgage lending is more relevant than ever. Huge prices for housing stock and crazy interest rates on real estate loans contributed to the creation of a mortgage lending agency. The peculiarity of working with the AHML agency is the possibility of obtaining a mortgage loan for a long term. Only in this way can young families get housing on credit and not connect their lives with rental property. Borrower's personal account - your guide!

Agreement on the provision of mortgage examination services

_________________________________________,

hereinafter referred to

the “Customer”

, represented by _______________________________________________, acting on the basis of ___________________________________, on the one hand, and the Limited Liability Company Regional Mortgage Financial Agency”, hereinafter referred to as the

“Executor”

.

P., acting on the basis of the Charter, on the other hand, collectively hereinafter referred to as the “Parties”

, have entered into this Agreement as follows:

- provide, based on the results of the examination, an Expert opinion on each mortgage (in the form of Appendices No. 8a, No. 8b, No. 8c to this Agreement) within 7 (seven) working days following the day of transfer of the mortgages and documents constituting the loan file for Expertise ;

What should be contained

According to Chapter 3 of Federal Law No. 102, there is no single form for registering a pledge. The mortgage document for the apartment must indicate:

- Document's name,

- Borrower details,

- Pledgor details

- Mortgagee details

- Terms of the loan agreement,

- Parameters of the issued loan,

- Mortgage repayment terms,

- Collateral object,

- Mortgage price,

- A document confirming ownership of the property,

- The presence of encumbrances,

- Signatures of all members of the transaction,

- Date of.

Important! It should be remembered that by signing a mortgage, you give the bank the right to take the property if the terms of the contract are violated. Therefore, it is better to make sure that the document is formatted correctly.

Mortgage agreement No.___

This is important to know: Refusal of a share in an apartment

City __________, "___"__________200_

______________________, hereinafter referred to as the “Pledgee”, represented by _____________________, acting on the basis of ____________, on the one hand,

and citizens ________________ (passport series ______, number _______, issued ______________, “___”_________19__), “___”_______19___ year of birth, registered at the address: ____________________, and ________________ (passport: series _______, number ________, issued _______________, “__”______19__), “___”________19___ year of birth, registered at the address: ________________________, who are spouses (marriage certificate series ______, No.______ dated “___”_________ 19___, issued _________) hereinafter referred to as the “Pledger” , on the other hand, have entered into this Agreement as follows:

- Subject of the agreement

- 1. The Pledgor, in order to secure obligations, according to (name and details of the agreement on the provision of funds) concluded between ______________ and the Pledgee (hereinafter referred to as the Main Agreement), pledges to the Pledgee a residential premises located at the address: _______________, consisting of ____ rooms, with a total area ______, living area ________ (hereinafter referred to as the Living Premises).

- 2. The cost of the Residential Premises, by agreement of the Parties, is ______________ rubles.

- 3. The pledged property remains with the Pledgor in his possession and use.

1.3. The parties agreed that the rights of the Mortgagee under this Agreement are certified by the mortgage.

1.4. The main agreement was concluded between the Pledgee and the group __________________ on the following conditions:

— The amount of funds provided is ________ rubles;

— The purpose of providing funds is the renovation of residential premises located at the address: __________________________, consisting of ________ rooms, with a total area of ___ sq.m., including a living area of ___ sq.m., located on the ___ floor of a ___ storey building (hereinafter referred to as Residential premises);

— The period for returning the funds provided is __________________________ months, counting from the date of actual provision of funds.

— Interest rate — ___ (____) % per annum.

— Interest is accrued on the balance of the amount of funds to be returned on a monthly basis, starting from the day following the day of actual provision of funds, and up to and including the day of the final date for payment of funds.

The interest period is the period from the first to the last day of each calendar month (both dates inclusive).

— The procedure for returning funds and accrued interest:

1.5. The Mortgagor’s ownership of the Residential Premises is certified by Certificate of Ownership No.___ dated “____”_____________, issued on the basis of _________________________________.

1.4. The Pledgor informs the Pledgee that as of the date of conclusion of this Agreement, the above-mentioned Residential Premises has not been sold to anyone, has not been donated, has not been pledged, is not in dispute, under arrest or prohibition, and is not encumbered with rent, lease, lease or any other obligations.

- 2. Rights and obligations of the parties.

2.1. The pledgor undertakes:

2.1.1. Do not alienate the Residential Premises, carry out a subsequent mortgage on it, or otherwise dispose of it without the prior written consent of the Mortgagee.

2.1.2. Do not rent out the Residential Premises, do not transfer them for free use, or otherwise encumber them with the property rights of third parties without the prior written consent of the Mortgagee.

2.1.3. Take measures necessary to preserve the mortgaged Residential Premises, including current and major repairs.

2.1.4. Notify the Pledgee of the threat of loss or damage to the pledged Residential Premises.

This is important to know: Claim for division of marital property

2.1.5. Timely pay taxes, fees, utilities and other payments due from him as the owner of the Residential Premises, as well as conscientiously fulfill other obligations arising from him as the owner of the Residential Premises.

2.1.6. Provide, upon request of the Mortgagee, at least once a year, documents (receipts) confirming payment of taxes, fees, utilities and other payments due from him as the owner of the Residential Premises.

2.1.7. On the day of signing this Agreement, under the control and with the participation of the Mortgagee, draw up a mortgage certifying the rights of the Mortgagee to the Main Agreement and under this Agreement, perform all necessary actions on his part to transfer the mortgage and this agreement to the body that carries out state registration of rights.

- 1.8. No later than 2 (Two) working days from the date of state registration of this Agreement, insure the Residential Premises at your own expense with the Insurance Company, agreed in writing with the Mortgagee, against the risks of loss and damage in favor of the Mortgagee for the period of validity of this Agreement plus one working day after concluding the Agreement (policy) of property insurance, where the Mortgagee will be indicated as the first beneficiary;

You can view the full version of the document by following the link.

Example of a mortgage form

MORTGAGE

on an obligation secured by a mortgage

________________________ "___" _______ ____ g.

- Pledgor

Full name, year of birth, passport details _________________________________________________________________________________ _____________________________________________________________________________________________________________________

- Debtor ________________________________________________________________________________________________________________

Full name, date of birth, passport details ________________________________________________________________________________

- Original mortgagor

Name (for legal entity): __________________________________________

License No. __________________________________________ issued by the Central Bank of Russia "___" _________ ____

Location: ____________________________________________________________

Bank details: correspondence/account _________________________in ___________________________________________VIC _______________________________ Taxpayer Identification Number _________________________________

4. Obligation secured by mortgage

Reason for occurrence: Loan agreement No. ___________________ (other monetary obligation, the fulfillment of which is secured by a mortgage)

Place of detention: city ___________________

Date of conclusion: “___” ___________ _____

Amount: _____________________ rubles.

Interest: __________________________ percent per annum

Deadline: ___________________ from the date of loan provision

- Subject of mortgage

- Location of the subject of the mortgage: ________________________________________________

___________________________________________________________________________

Title and description sufficient for identification:

Cadastral number: ___________________________

Information about encumbrances: ____________________

As of “____” ____________ ____ year. monetary value of an item

Mortgage for an apartment

- you receive documents from the bank confirming full repayment of the loan and the absence of debt,

- you contact them at the Registration Chamber office in your city,

- submit the documents for verification, write a statement. The service is free, but if you want to receive a clean certificate without a credit note, you will need to pay a fee,

- wait until the certificate is produced, usually no more than 3 days.

- Full name of the borrower, if the client is a legal entity, then you need to provide his details;

- The name and place of registration of the location of the pledgor must be recorded in full format;

- Details of the mortgage agreement, date and place of conclusion;

- Amount of credit funds, credit conditions (interest and method of calculation);

- Date of loan provision and its terms;

- Detailed description of the pledged property;

- Data from the document that confirms the mortgagor’s right to real estate, i.e. property registration document;

- Inscription of the state registration authority;

- The date a mortgage is issued to the original mortgagee.

Sample mortgage note for an apartment under Sberbank mortgage

So that the procedure for registering a pledge does not become a big surprise for you, it is advisable to familiarize yourself with the form and its contents in advance, so that you do not get lost when entering data. If you do not understand something, it is better to consult with an expert or a person who has repeatedly encountered filling out this official document. This could be one of the employees of Sberbank, who is actually engaged in mortgage lending to individuals with the preparation of the relevant documents.

A sample document can be obtained directly from Sberbank or downloaded from Internet resources. When downloading a form from third-party sites, you need to make sure that the version of the document is up-to-date so that it is not outdated. You can also see an example of a completed document.

How to find out the participant number of a military mortgage

Hence, each participant in the system has an urgent question: how to find out the amount of savings on a military mortgage, we will try to answer it. We will discuss how to find out the savings on a military mortgage by registration number a little later. The request is considered within 4 business days and the response is posted in a closed section of the website, which an NIS participant can enter using their registration number. In order to find out how to calculate the amount of a military mortgage, you need to refer to a special calculation calculator. How can you find out the status of your military mortgage account? Where to enter the registration number of the military mortgage participant on the website? To obtain information about the issued certificate, you can immediately enter the registration number in the section of the same name. How can I find out how much money is in my NIS account? The main task of the NIS participant’s personal account is at this stage it is necessary to enter the registration number and date of origin Home » Military mortgage » NIS participant’s personal account: how to use it and what it is How to find out savings on a military mortgage. On the official website of Rosvoenipoteka you can find out the amount of accumulated funds of a participant through his personal account.

N 30) and you can become a participant in the mortgage by expressing such a desire (that is, by writing a report). whether he has just arrived - that is the question. I repeat - if you. Those who are obligatory participants in the “military mortgage”, in writing, discuss issues related to military mortgages and legal consultations are conducted on our forum. In the forum sections you can also find out news on military mortgages in 2020. The savings-mortgage system can receive a targeted housing loan and buy an apartment using a military mortgage. Knowing its registration number, it is easy to track its movements and find out in advance the approximate date of issue of the Certificate of Eligibility for a NIS participant to receive a Dictionary of the Military Mortgage program. NIS - savings and mortgage system TsZHZ - targeted housing loan DDU The participant is assigned a unique number. Knowing it, you can go to your personal account on the Rosvoenipoteka website and find out how much money you have in your account.

How to apply for an electronic mortgage for an apartment

It became possible to issue an electronic mortgage from July 1, 2018. To do this, you need to fill out the appropriate form on the Rosreestr website or on the State Services portal. All necessary documents are provided electronically. Also, electronic signatures of the borrower and the lending bank are affixed to the collateral document.

A document drawn up in this way is transferred for storage to a special company that deals with transactions with securities (depository). Storing a document in electronic form protects it from possible loss by a banking organization.

An electronic mortgage for an apartment has the following advantages:

- The electronic version of the document, unlike the paper version, is protected from the risk of loss.

- The banking organization independently registers such a document; the borrower does not need to contact Rosreestr or the MFC.

- Automatic transfer of the document for storage to the depository selected by the banking organization immediately after registration is completed.

- There is no need to write an application to cancel the document after full repayment of the debt.

It is worth noting that not all banking organizations can issue an electronic document. Therefore, the paper version of the mortgage still remains in demand, and there are no plans to abolish it at the legislative level.

You can register an electronic mortgage on the official website of Rosreestr: https://rosreestr.ru/wps/portal/p/cc_present/reg_rights#/

Open the above link in a new tab of your browser and on the page that appears, select “Registration of restriction (encumbrance) of rights.” After this, you need to click on the button at the bottom of the page “go to request details”. Then provide the required information about the property and the applicant.

Aizhk how to find out the mortgage number

A mortgage is drawn up by the mortgagor if he is the debtor, and if the borrower is not a bank, then so is he. Due to the fact that most often the mortgagee is a bank, it is drawn up by a financial institution, which obliges the borrower to sign it. The signed documents are transferred to the registration chamber, and immediately after state registration the paper is issued back to the bank. If the document is executed after the registration of the mortgage, it is necessary for both parties to submit a joint application and then the government agency issues it within one day.

According to the Mortgage Law, a mortgage is a registered security that certifies the right of its legal owner to receive execution of a monetary obligation secured by a mortgage, as well as the right to pledge the property. In other words, its presence confirms that the document holder is the mortgagee of the real estate under the mortgage loan and this security, due to the fact that it is registered, can essentially replace the mortgage agreement (or the pledge agreement can be concluded in the form of a mortgage).

Military mortgage is a special government project that allows all defenders of the Fatherland to acquire their own housing in any region of the country in the shortest possible time. Such housing loans are unusual in every way: preliminary accumulation of state funds in a military serviceman’s personal account, monthly deductions from the budget, drawing up a mortgage, the possibility of transferring it from one financial institution to another, etc. (Federal Law “On the savings and mortgage system of housing for military personnel” dated 08/20/2004 N 117-FZ (latest edition)). Sometimes a borrower wants to get more information about the mortgage on their property. You will learn how to find out the AHML mortgage number for a military mortgage from this article.

What does a mortgage on an apartment look like: a sample from Sberbank

The list of data that must be reflected in the mortgage, as well as the general procedure for its execution, are specified in Chapter 3 of the Mortgage Law. However, each banking organization has the right to establish its own form of this document with a different color of the form and order of points. You can find out more information at the branch or on the official website of the banking organization.

[offerIp]

The mandatory clauses of the pledge document established by law are as follows:

- Name and identification number . The name is indicated as “Mortgage”; The number is usually reflected in the header of the document.

- Information about the pledge holder (banking organization) . The following must be indicated: name, address at which the legal entity is registered, license number, TIN, checkpoint.

- Information about the mortgagor (borrower) . For individuals, it is necessary to indicate the last name, first name and patronymic, passport data of a citizen of the Russian Federation, registration address, SNILS. Legal entities indicate the full name, registration address of the legal entity, checkpoint, tax identification number. If the mortgagor is not the borrower, but another person, his details must be indicated. However, such situations are quite rare.

- Information about the mortgage agreement . It is necessary to reflect the date of conclusion and agreement number, loan amount, interest rate, monthly installment amount, payment schedule. For loans in foreign currency, you will also need to indicate the exchange rate, which will ensure that the correct debt amount and interest rate are established. This point is one of the most important, since if the terms of the mortgage agreement are violated, the banking organization has the right to seize the collateral. Therefore, check that it is filled out correctly as carefully as possible.

- Information about the collateral : location address, cadastral number, area, number of rooms.

- The price based on the assessment results, as well as the price set by an independent expert.

- Information about other encumbrances on real estate: rent, arrest, etc. The fact that there are no encumbrances is also indicated.

- Signatures and seals . The seal of the banking organization, signatures of the parties and the date of signing of the document are affixed. The borrower, who is a legal entity, must also affix a seal.

Since the collateral document can be transferred to other financial institutions, space is usually provided on the form for information about its transfer.

Please note that the mortgage for an apartment is considered a fundamental document in the event of a legal dispute. It is on this basis that the court can transfer your collateral property to the bank in the event of a violation of the mortgage agreement. Therefore, carefully ensure that all data is entered correctly.

Mortgage note

Features and conditions of a military mortgage in 2019

Military mortgage is a targeted housing loan, that is, a synonym for free housing for Russian military personnel. Anyone related to the RF Armed Forces can take out a housing loan without paying a penny of their own money. The down payment in the form of a state subsidy is allocated from the country's budget and transferred to a special military account, and then monthly mortgage payments are also made from state funds. The loan term coincides with the time that a military man must serve - 20 years. While a citizen repays his debt to his homeland, his personal debt to the bank is repaid. In case of early dismissal, you will have to pay off the remaining debt yourself.

How to apply for a mortgage on an apartment

An apartment mortgage is a document drawn up and signed along with the loan agreement. It is a guarantee for the bank that the obligations of the mortgage terms will be fulfilled in a timely manner and in full. Drawing up a mortgage for the Russian banking system is more rare than the norm, but in the case of a military mortgage, where the state is the guarantor of debt repayment, this paper is necessary.

When signing a mortgage note, you must carefully check it against the existing loan agreement. There should be no discrepancies in the data!

The mortgage signed by the parties to the transaction must be registered with Rosreestr within the established time frame. Otherwise, the document will be invalid.

Required documents

Registration of a mortgage represents the final stage of the military mortgage procedure and will require the provision of certain documents:

- identification card of the mortgagor;

- documents confirming ownership of the collateral (sale and purchase agreement, extract from the Unified State Register of Real Estate, replacing the certificate of ownership).

Where does mortgage registration take place?

Registration of a mortgage on an apartment or residential building, as well as all other real estate transactions, requires mandatory state registration. This procedure is carried out at the request of the parties and can be carried out:

Valuation of an apartment for obtaining a mortgage

One of the conditions for drawing up a mortgage is that it contains information about the estimated value of the collateral property (apartment or house). Therefore, the borrower will have to carry out an assessment procedure for the selected housing and provide a conclusion on it to the bank.

Important conditions for real estate valuation are:

How to apply for a mortgage?

The mortgage is drawn up in accordance with current regulations and represents a security. Rights of its owner:

- if the borrower is late in payment or stops servicing the debt, claim the property that is pledged;

- demand full fulfillment of the obligations specified in this agreement.

Changes in the terms of the agreement are made by mutual agreement of the parties, therefore, if the bank sells the mortgage, this will not affect the conditions for granting the mortgage previously agreed upon in the document.

Before taking out a mortgage, a Sberbank client should keep in mind that it is not drawn up in some cases:

- if it is impossible to determine the amount of the security obligation;

- when registering the right to lease a property complex;

- when transferring a business entity as an object of security.

This security is drawn up in 1 copy by bank employees and certified by the signatures of both parties. It is registered and sent by Rosreestr to the bank that stores it.

The borrower receives the mortgage after he fulfills his contractual obligations. The pledged property is subject to an expert assessment to determine the estimated value of the pledge.

The signing is preceded by the submission of documents for registration of the mortgage.

Features of registration of a military mortgage in Russian banks

Each financial institution has the right to introduce its own rules when applying for a military mortgage. Let's look at them using the example of individual banks.

- Sberbank. A prerequisite is to carry out an assessment of an apartment or house using the services of a company accredited by a bank.

- Gazprombank. Borrowers are given the right to purchase real estate in houses under construction. In such cases, the mortgage is issued for property rights of claim, and after the house is put into operation, it is re-registered for an apartment.

- VTB 24. A pleasant surprise for the bank’s client will be free registration of a mortgage and a real estate appraisal at the bank’s expense.

How to get a mortgage for an apartment step by step

Let's look at step-by-step instructions on how to make a mortgage on an apartment with a mortgage.

Step 1. Contact the banking institution.

As a rule, the signing of a mortgage occurs simultaneously with the conclusion of a mortgage agreement for an apartment. The document is filled out by an employee of the banking organization; the borrower is only required to sign. The package of documents required for drawing up a mortgage is the same as for concluding a mortgage agreement. Therefore, clarify in advance what exactly you will need, since each bank has certain nuances regarding the list of documents.

Most likely you will need:

- Passport of a citizen of the Russian Federation who enters into a mortgage agreement. Typically, a banking organization requires that the borrower have permanent registration. Registration in the purchased apartment is allowed.

- A document confirming the existence of grounds for ownership, for example, a transfer and acceptance certificate or an apartment purchase and sale agreement.

- Certificate of ownership of the apartment or an extract from the Unified State Register of Real Estate (USRN). Necessary to confirm ownership of the purchased apartment.

- Report on the assessment of the market value of the apartment. The assessment can be carried out by an independent appraiser or directly by a banking organization. This procedure is necessary to confirm the market value of the apartment. The assessment report will cost approximately 2500–5000 rubles.

- Insurance of collateral property. It is necessary to ensure full repayment of borrowed funds in the event of loss of collateral property, for example, as a result of a fire. The insurance company also reimburses the banking organization if the borrower loses property as a result of exposure to factors beyond his control.

The mortgage note for an apartment reflects information from all of the above documents. The entire filling process usually takes no more than 30 minutes. An employee of a banking organization draws up a document, after which the borrower signs and registers it.

Please note that the list of required documentation may vary in each individual case and depends on the conditions of the banking organization you have chosen, as well as the legislation in force in your region.

Step 2. Pay the state duty.

Registration of ownership of real estate is a paid service. Usually, simultaneously with this procedure, registration of the mortgage is carried out. To save time on visiting Rosreestr again, it is better to pay the state fee in advance. The amount of the state fee for registering ownership of real estate is established by the Tax Code of the Russian Federation. It depends on who is the owner:

- for individuals the amount is set at 2 thousand rubles;

- legal entities – 220 thousand rubles.

Payment of the state fee is accepted at the Rosreestr cash desk, at any banking organization or self-service terminal. To confirm payment, you must have a receipt with you. Otherwise, when submitting documents for registration, a refusal will follow.

In some cases, a mortgage can be registered free of charge. For example, if, when applying for a mortgage loan for a new property, you provide an old apartment as collateral. You also do not need to pay a state fee when registering a mortgage for an apartment that is already your property, that is, new property is not purchased.