Registration of a share in an apartment for a child under a gift agreement

A gift is a gratuitous transaction in which one party, called the donor, transfers ownership of property to the other party, and the donee accepts it. A transaction to transfer a share in an apartment must undergo state registration.

When you decide to rewrite your share in a home, you may have your own wishes. For example, you may want to retain your right to reside in the alienated property.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

All this must be included in the deed of donation of a share of the apartment. Therefore, we recommend entrusting the preparation of the document to lawyers.

They will draw it up in such a way that all your wishes will be taken into account, and the agreement cannot be challenged in court.

To rewrite the share of an apartment, you need to collect a package of documents. You will need:

- Documents identifying the donor and recipient. For adult participants in the transaction, these are passports. If part of the apartment is transferred to a child under the age of 14, his birth certificate will be required.

- Documents confirming the donor's right to a share in the apartment. This could be an extract from the Unified State Register or other papers.

- If a share in an apartment was acquired during marriage as a result of a purchase rather than a gift or inheritance, the consent of the donor's spouse is required to re-register the property. Such consent must be formalized by a notary.

- If authorized persons act on behalf of the donor or recipient, you will need powers of attorney and passports of these persons certified by a notary.

- If the child receiving part of the apartment is under 14 years of age, legal guardians act on his behalf. Most often these are parents. If this is not the case, documents establishing guardianship are needed. If the child has reached 14 years of age, but not 18, then the consent of the guardians is required to accept the share as a gift, and their passports will still be needed.

This is the minimum list of documents that will be needed to re-register a share in an apartment under a gift agreement. It is better to check the exact list of required papers at the multifunctional center (MFC). To rewrite a share of an apartment under a gift agreement, it must be drawn up by a notary.

Having drawn up the contract, you have already managed to rewrite the share of the apartment, but you also need to go through state registration of the transaction. When registering a transaction with a notary - and in our case it is obligatory - it is he who is required to register the transfer of part of the apartment. The cost of this service must be included in the cost of drawing up a contract for donating part of the apartment.

Typically, notaries transmit all the necessary information about the apartment transaction to the registrar electronically via the Internet. If this is the case, the share transfer transaction will be registered on the same day. If the notary submits documents in paper form, registration of the donation of the share will take three days.

This article describes in detail how to transfer a share in an apartment to a child. You want to transfer a share in an apartment to an heir. If you don’t know how to do this and where to start, then this article was written for you! The donation procedure, nuances, as well as other methods will be indicated here if the donation is not suitable for some reason.

Procedure for drawing up an agreement

When registering a gift of a share to a minor, several features are established:

Dear readers! Our articles talk about ways to resolve legal issues, but each case is unique.

- It is prohibited to carry out registration on behalf of an incapacitated or underage child if government officials have appointed a special delegate.

- It is legally prohibited to draw up a deed of gift with a person who has not reached the age of majority when his delegate is selected from the social field of activity: a teacher, a curator from a rehabilitation center.

Procedure and requirements for drawing up a donation agreement:

- Full date and exact address of the place where the contract is concluded.

- Full name, date of birth, place of permanent residence, citizenship and marital status of all parties to the agreement.

- Passport details: place of issue, number, and place of birth.

- An exact description of everything that is included in the property considered in the contract: when the renovation was carried out (how much it cost, in which rooms it was carried out), how many meters in each room, address.

- The consent of all co-owners must be confirmed by a notary.

The property must belong entirely to the owners - no claims from third parties. And yet, it is forbidden to enter into a transaction after the death of the donor.

When the contract is fully executed, it must be registered.

The donor may terminate the contract in the following cases:

- If the agreement is drawn up, but has not yet come into force, the financial situation of the donors has declined. Evidence must be presented: dismissal, major accident, theft, etc.

- The donor has died, and one of the relatives or friends has suspicions that the recipient has something to do with this. After the investigation, the case is considered in the courtroom, after which the donee’s guilt is proven or disputed.

How does registration work?

Like all papers, registration is carried out in writing. It happens that it is carried out in a different way, after which it is accordingly declared invalid. The operation itself is carried out under the supervision of a special government service. The beginning begins when the parties draw up an application.

The process of transferring the share of the apartment to the heir is completed by a special registration signature (accordingly, all previous procedures must be completed). Upon completion, the heir receives authentic documentation about the share in the real estate.

Do not forget that registration must be completed within a period of no more than one full month.

What taxes do you need to pay when transferring a share of an apartment to an heir?

A few words about taxes. In our case, when both parties are in a family relationship, there is no need to pay tax. In other cases, the tax is charged at 13% of the value of the property. An estimate of the cost can be obtained from the BTI.

In the same way, the law establishes the possibility of an heir refusing a share in an apartment. It is carried out without additional difficulties if ownership rights have not yet occurred. If this has already happened, then the refusal must be registered (a month is also given for this).

Giving is a convenient way. Even though it has its difficulties, it is considered fashionable (in the sense that it is used most often).

How to rewrite a share of an apartment as an inheritance

This information explains the rules for transferring an apartment share when the owner of the share dies.

If one of the owners of the property has died, then his share is transferred according to paragraph 62 of the Civil Code (by order specified in the will) or according to paragraph 63 of the Civil Code (by law). A descendant or heir of a share can dispose of the real estate at his own discretion: sell, bequeath, draw up a deed of gift or provide as collateral.

In case the apartment is divided (let's imagine into 3 equal parts), and one of the owners wanted to sell his to some third party. The first step is to inform the two other owners, after which it is best to offer them to buy his share.

Legally, both owners are first on the list of potential buyers. If they want to buy out the share at the proposed price, then nothing can be done about it.

If the owners agree that an outsider should buy a share, then at the time of execution of the transaction, the seller must have appropriate written agreements from both of them.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Nuance

To ensure that you and the new owner do not have any problems during the registration period, consider the possibility of canceling the contract. How to do this correctly is best to ask your lawyer, who will carry out the registration.

In this article you learned how to transfer a share in an apartment to a child. If you have any questions or problems that require the participation of lawyers, then you can seek help from the specialists of the Sherlock information and legal portal. Just leave a request on our website and our lawyers will call you back.

Re-registration of an apartment for a child has its own characteristics. There are situations when this procedure cannot be avoided. Anyone can figure this out on their own.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Is it possible to transfer an apartment to a minor child?

A child can become the owner of any property from the moment he receives a birth certificate. Such a gift can be given not only by a relative, but also by any sufficiently generous person. You can donate an existing apartment or buy a new one.

Age plays a key role in concluding such an agreement:

- Less than 14 years old. Parents, guardians and trustees have the right to sign, so when registering, you need the owner of the home and one of the child’s representatives.

- Over 14 years old but under 18 years old. A minor has the right to sign an agreement, but in the presence of his legal representative. The document will have the signature of the child, his representative and the owner of the apartment.

- Over 18 years of age is an adult citizen who has the independent right to enter into real estate transactions.

Can a minor donate his share in an apartment?

A young child rarely initiates a property transaction. However, children over 14 years of age can make their own decisions. One of such solutions may be the alienation of property.

In such circumstances, the consent of legal representatives will be required. The procedure for concluding an agreement is described above. The only difference is that on the eve of certifying the transaction, you must obtain permission from the guardianship authority to alienate real estate. If the alienated property is the only home of the donor, then he will be denied permission. If there is other property, such alienation is theoretically possible. However, the donor must justify his decision.

To donate part of an apartment to a young child, you need to prepare a package of documents, draw up an agreement and have it certified by a notary. One of the mandatory items is the payment of state duty. An exception may be the conclusion of a transaction between relatives. The final stage of the procedure is registration of ownership. After which the minor child becomes the new owner of part of the home. To avoid mistakes when preparing documents, it is advisable to consult a lawyer. This opportunity is available on our website. Consultations are provided free of charge.

Ways to re-register an apartment for a child

Registration only gives the right to reside. There are several legal ways to make a child the owner of an apartment:

- Privatization. During privatization, a child registered in an apartment has the right to an equal share. If the parents notarize their shares in his favor, then he becomes its full owner.

- Buying a home. You can conclude a purchase and sale transaction. A minor family member becomes the owner of the entire apartment or part of it. If housing is purchased under the “maternity capital” program, then a mandatory requirement is to allocate a share in the property to all children.

- Giving. Any owner of residential or commercial real estate that is not burdened with debt can issue a deed of gift. Real estate donated to a close relative is not subject to personal tax (from 13% to 30%).

- Will. The testator can be any person, not just a close relative.

This method has features:

- the will can be challenged in court by other heirs;

- expenses for re-registration of real estate (state fees, notary services) will fall on the child in the future;

- its preparation does not require the consent of the legal representatives of the donee;

- Along with property, the will transfers debt obligations to inheritance.

- if the inheritance case is opened before the child comes of age, then his representative will handle the registration of the inheritance;

- if there is no will, the child will receive only the share prescribed by law (if there is a relationship).

Is it necessary to allocate a share to a child when buying an apartment?

When purchasing a new apartment, the issue of allocating children's shares remains at the discretion of the parents. Some people register ownership of residential premises for one family member, while others allocate part of the property to everyone: parents and all children. But there are some situations when allocating a child’s share in the purchase is mandatory:

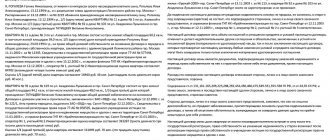

- According to Federal Law No. 256 of December 29, 2006, when purchasing residential premises on a mortgage using MS funds , after the encumbrance on housing is removed, parents are obliged to allocate shares to each of their children. But first, the parents pay off the mortgage loan, and only then allocate part of the living space to the minors.

- When selling an old apartment in which children were co-owners , the allocation of an equal share in the new apartment is also mandatory. Before the purchase and sale transaction of the old apartment, parents must formalize an obligation to allocate children's shares in the new residential premises, otherwise the PLO will not allow the sale. If they somehow circumvent this ban and do not allocate children's shares in the new housing, the transaction may be declared invalid.

- When privatizing municipal apartments, the allocation of children's shares is also mandatory.

This is important to know: Does a group 1 disabled person pay child support?

For example, the Novoseltsev couple with two children lived in a municipal three-room apartment under a social tenancy agreement. They decided to privatize the apartment and started paperwork. In order not to collect unnecessary paperwork, they initially decided to privatize the living space only for the husband; the wife signed a waiver of privatization in favor of her husband.

But the municipality refused to privatize Novoseltsev, since in addition to him and his wife, two minors were registered in the residential premises, and Novoseltsev was obliged to allocate their parts to each of them. He had to re-collect all the documents and submit an application for privatization on behalf of three people - father and children.

How to register an apartment for a minor?

Necessary conditions for registration

The procedure for registering the transfer of ownership requires the consent of the child’s legal representatives (parents, guardians). Permission from the guardianship and guardianship authorities is not necessary in a situation where property is acquired and is necessary if the property is taken away. Formally, the registration procedure has no other features.

Registration procedure

The order of registration will depend on the chosen method. A gift agreement is the simplest option. Sequencing:

- you need to obtain consent to the transaction from parents or guardians;

- draw up a deed of gift or purchase and sale agreement (indicating a representative);

- certify the donation or sale agreement at a notary office;

- submit a package of documents for registration to Rosreestr.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

It will take one business day to draw up an agreement, prepare documents, and visit a notary (if all documents are in order). The registration procedure takes less than two weeks.

After submitting a package of documents to the local MFC (multifunctional center), you need to wait. Within 10 working days, a new certificate of ownership will be received, in which the minor child will be indicated as the owner of the apartment.

Required documents

- application for registration of rights to real estate with signatures of the parties to the agreement;

- certificate of ownership of the apartment/house;

- a certificate from the Unified State Register of Real Estate Rights (registry of real estate rights) confirming the absence of encumbrances or restrictions on the apartment/house;

- birth certificate;

- technical passport from the BTI and cadastral passport from the local cadastral chamber (FGBU FKP Rosreestr);

- identification documents of the child’s representative;

- passport of a minor if he/she is over 16 years old;

- agreement of gift or sale.

The notary will request a more accurate list of documents based on the specific terms of the transaction.

How to allocate shares to children in a house or apartment

Allocating part of a residential property to minors is not as simple as it might seem at first glance. It is necessary to follow the registration procedure and certain rules.

Step-by-step instruction

So, when allocating shares, you need to perform several sequential actions:

- Draw up an obligation to allocate a share of property to minors.

- Submit a request : if MS is used when purchasing an apartment - to the Pension Fund of Russia;

- if residential premises are being built or purchased at your own expense - in the OOP.

- purchase and sale transaction;

- draw up an act of acceptance and transfer of residential premises;

- by agreement;

Nuances

When isolating children's shares, there are a number of nuances:

- In cases where minors do not yet have a passport (under 14 years of age), an application for a transaction is submitted by their legal representatives (parents or guardians). In this case, the presence of children is not necessary; the documents you will need are the original and a photocopy of the birth certificate.

- If the minor is already 14 years old, he participates in the transaction independently. But the permission of the parents, as well as their presence when signing the document, is required.

- When selling a residential property in which there is a children's part, the parents must draw up an undertaking that a similar share will be allocated to their son or daughter in the new apartment. At the same time, the purchase and sale agreement for a new residential premises must specify the proportions of the parts of the property of each future co-owner of the housing.

- In the event of an official divorce of parents, as well as in the event that they live in a civil marriage, when purchasing residential premises using MS, no property in the residential premises is allocated to the spouse.

For example, Nina Zavyalova and Oleg Nikanorov lived in a civil marriage in an apartment purchased by Nina before marriage. They had twin sons, thus Nina received the right to MS. They decided to improve their living conditions by selling their old apartment and buying a new, more spacious one, using MS funds.

Nina drew up an obligation to allocate the children's shares in such a way that she and her sons became co-owners in the new apartment in equal parts. Oleg did not receive any ownership rights to part of the residential premises.

Required documents

To allocate children's shares, it is necessary to prepare the following package of documents:

- Applications to Rosreestr from each family member. At the same time, children over 14 years old sign the document themselves, and for minors under this age, signatures are given by their legal guardians, in this case, parents.

- Photocopies of passports of father and mother (or guardians).

- Originals and photocopies of birth certificates of all minor children.

- Title documents for residential premises. This could be: a purchase and sale agreement, a loan agreement, or any other document indicating the right to own residential premises.

- Extract from the Unified State Register of Real Estate (extended). This document will indicate that the apartment is not under mortgage, under arrest, or any other encumbrance.

- Technical passport for residential premises.

- Receipt for payment of state duty.

Deadlines

Processing of documents will take up to 30 days.

Cost, expenses

When registering children's shares, the family will have to incur some material costs:

- Notary services will cost from 1 to 3 thousand rubles, depending on the region;

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

This is important to know: Statement of claim for cancellation of adoption

Difficulties in registering an apartment for a minor

Possible problems:

- The housing is in shared ownership. The consent of all owners will be required.

- If the apartment became the property of one of the spouses before marriage, then the consent of the second parent is not required to conclude the transaction. If it was acquired jointly, then a notarized consent from the second parent is required.

- If a redevelopment has been made, then it needs to be legalized and only then the apartment must be re-registered. There is a possibility that the transaction will be declared invalid by BTI employees.