If you plan to exchange an apartment, you need to know how to do it and what difficulties there are in carrying out the transaction.

The problem is that most offers on the real estate market come from realtors and agencies. Choosing a competent agent who will provide complete and reliable advice is very difficult. And most of them, for a considerable fee, cannot even answer the question of what are the features of the barter agreement and draw it up correctly.

Let us examine in detail what barter and exchange are, what is their difference and what nuances exist. A complete list of documents required when concluding an agreement will also be provided. And as a bonus, you can have an apartment exchange agreement.

Apartment exchange: concept and features of the contract

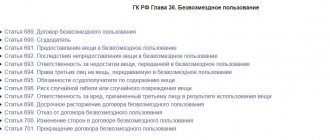

Civil Code (Civil Code of the Russian Federation) in Art. 567 states that under a barter agreement, one party transfers goods in exchange for another. Barter has been known since ancient times, when money as such did not exist. This type of transaction is often used in our time. However, due to the high cost of apartments and the occurrence of controversial situations, apartment exchange is not so popular. Exchange is theoretically very simple: the owner of the apartment transfers it to another person, and in return receives a product greater/less than or equal to the value of the exchanged housing. If there is a difference in price, then one of the parties makes an additional payment.

Barter is not limited to the exchange for similar housing - the subject of the transaction can be any movable and immovable property, with the exception of money. That is, an apartment can be exchanged, for example, for a car.

As for the opportunity to exchange your apartment for an apartment with or without additional payment, it is provided only on the secondary housing market. And in order to carry out an exchange transaction, you first need to find the owner of the apartment who wants to exchange it for another, of equal value or with an additional payment. Next, the owners enter into an agreement and re-register the property in Rosreestr.

The peculiarity of such a transaction is that each participant is a seller and a buyer at the same time. Thus, it is similar to a dual sale and purchase agreement, and the rules of Chapter 30 of the Civil Code of the Russian Federation apply to it. As for the agreement itself, it must be drawn up only in writing, since it is the basis for registering property rights.

Sample exchange agreement

An important point for apartment owners is that there are 2 types of apartment barter: barter and exchange. On the one hand, they are absolutely identical. But there is a main difference - exchange involves the transfer of a non-privatized apartment (find out how to inherit a non-privatized apartment), and exchange is possible only in transactions with privately owned real estate.

How is state registration carried out?

Drawing up an apartment exchange agreement is only half the battle. An equally important part of the event is the successful state registration of the transaction. For this to happen, the following steps must be completed:

- sending both parties of the necessary documents to the notary (possibly in electronic form);

- official registration of submitted packages of documentation in a justice institution, issuance of a receipt;

- carrying out an examination of documents provided by the parties;

- making the appropriate entry in the Unified State Register for real estate objects, registering the transaction.

In terms of taxation of the transaction, the same rules apply as in the case of drawing up a purchase and sale agreement; there are no special nuances in this matter. If the owner of the apartment involved in the exchange has been such for more than three years, he is exempt from the mandatory payment of personal income tax. If the period of ownership of the apartment is less than three years, it becomes necessary to pay tax, but at the same time there is the opportunity to take advantage of a tax deduction and return a certain percentage of the amount of 1 million rubles.

Advantages and disadvantages

Like any transaction, exchanging an apartment has its pros and cons, which we will discuss below.

The advantages of barter over other transactions lie in several aspects:

- Both parties immediately receive housing - that is, after selling the apartment, there is no need to waste time looking for new living space.

- Opportunity to receive a property tax deduction for both parties to the transaction.

- In case of termination of the contract, both parties remain with the same property.

The disadvantages of barter are as follows:

- An exchange agreement is only possible between apartments of the same type - that is, it is impossible to exchange a municipal apartment for a privatized one.

- Limited choice of apartments – when purchasing an apartment in the classic way, the buyer is given a wide choice of options, and when exchanging, the list is significantly reduced.

- Income tax is required to be paid even when the exchange was of equal value. Since me is a realization, and in accordance with Art. 38, 39 of the Tax Code of the Russian Federation, income is taxed.

Features of the exchange agreement

In the future, gaining experience and understanding the difference, they simply follow the path of least resistance and act in accordance with the established stereotype, and not with market conditions, which offer a variety of options for property transactions.

Basic conditions for exchanging an apartment

The main rule of exchange, in particular of non-privatized real estate, is that they must be owned by the same type. This means that housing received under a social rental agreement can be exchanged for the same municipal or state apartment in another district or region. This provision is enshrined in Art. 72 of the Housing Code.

Another important condition of the transaction is that the persons participating in the transaction must be the owners. In particular, when an apartment has several owners, it is necessary to obtain the notarial consent of each and the permission of the guardianship authorities if the shareholder is a minor child.

Another condition when exchanging living space is the absence of debts on utility bills and the presence of encumbrances (read more about what an encumbrance on an apartment is). Otherwise, Rosreestr has the right to refuse to register property rights, and the injured party may file a claim to terminate the contract.

The question of indicating the cost of apartments remains open for many citizens, even after studying the legislative framework. Art. 568 of the Civil Code of the Russian Federation establishes that if the price is not indicated in the contract, then the objects are recognized as equivalent. However, the rules of purchase and sale apply to the transaction. So is it necessary to indicate the cost of apartments in the agreement?

Absolutely yes. Since indicating the price will allow you to correctly calculate personal income tax and property deductions.

You may be interested in how to get a property deduction when buying an apartment.

What documents are needed to register an apartment exchange agreement?

Good afternoon For state registration of an exchange agreement, the following documents are submitted to Rosreestr:

— Applications for state registration.

— Document confirming payment of state duty.

— Document proving the identity of the applicant.

— Title and title documents of the person carrying out the alienation of property.

— Exchange agreement in the required number of copies.

— A certificate of persons who have the right to use residential premises indicating this right, certified by the official responsible for registering citizens at the place of stay and place of residence.

If the right has not previously been registered in the Unified State Register of Rights - a certificate from the technical inventory authorities about the absence of arrests and prohibitions. If the applicants are not copyright holders - documents confirming the powers of the representative of the copyright holder (notarized power of attorney).

If the passport of the corresponding real estate object was not previously provided and was not placed in the file of title documents of Rosreestr - a cadastral passport of the real estate object (objects).

If the party to the agreement is a legal entity and the file of title documents does not contain the following documents - constituent documents of the legal entity with all current amendments and additions or notarized copies of constituent documents; a document confirming the fact of making an entry about a legal entity in the Unified State Register of Legal Entities; taxpayer registration document; a document confirming the authority of the person who signed the documents on behalf of the legal entity or a notarized copy of this document; a certificate of the percentage ratio of the value of property to the net assets of the enterprise (for JSC) or to the value of all property (for LLC); in cases provided for by law - a decision of the body of a legal entity authorized to dispose of property (minutes of a meeting of shareholders of a JSC or participants of an LLC on alienation or acquisition).

If the alienated object is in common shared ownership, the co-owners waive the right of first refusal. If one of the spouses is a party to the agreement, and the property is in the common joint ownership of the spouses, a notarized consent of the spouse.

If one of the spouses is a party to the agreement, and the property is acquired into the common joint property of the spouses, a notarized consent of the spouse. If the exchange agreement does not have the force of a transfer deed - an act of acceptance and transfer of real estate to the exchange agreement.

If necessary, other documents provided for by current legislation and necessary for conducting a legal examination and verifying the legality of the exchange agreement: permission (consent) of the guardianship and trusteeship authority, if the alienated residential premises are owned by minors, partially capable or incapacitated persons, or in the alienated residential premises the premises are inhabited by minor members of the owner's family; written consent of parents, adoptive parents or trustees, if the party to the agreement (copyright holder) is a minor aged 14 to 18 years.

With regard to the form of the contract for the exchange of real estate, I explain that, within the meaning of Art. 161, 163 of the Civil Code of the Russian Federation, an exchange agreement, as well as a preliminary exchange agreement, can be concluded in simple written form and do not require mandatory notarization. At the same time, despite the optional notarization of a transaction, by agreement of the parties, it can be notarized. To prepare the necessary documents, we recommend that you contact persons specializing in the field of support of real estate transactions. Believe me, the participation of a qualified lawyer in this process will not only save you time and protect you from mistakes, but can also reduce the overall costs of the transaction.

Required documents

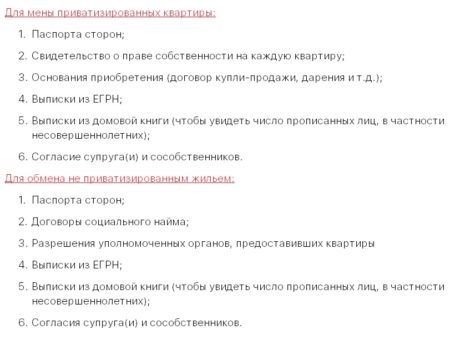

To draw up a contract, a package of documents similar to a purchase and sale is required. The difference is that both participants collect the same papers.

The specified list of documents is needed to register property rights. Plus, you must provide an exchange agreement and an acceptance certificate, as well as 2 receipts for payment of state duty.

The state duty is paid by both parties to the transaction, since registration of 2 objects is required at once.

In what case can a contract be declared invalid?

In practice, there are situations where the transaction is void from the very beginning. In other words, the agreement concluded between the parties has no legal force and does not bear legal consequences. In this case, the contract is invalid, and a court decision is not required to recognize it as such.

There are also cases when the transaction is voidable. In this case, a court decision is necessary to declare it invalid. Until this moment, the parties are obliged to comply with the terms of the agreement.

Reasons for invalidating a contract:

- one of the parties to the transaction is an incapacitated person;

- the transaction was made by a person who is unable to direct his actions and evaluate them (due to age, illness, etc.);

- the contract was made under threat, fraud or misrepresentation;

- the terms of the transaction contradict the laws of the Russian Federation;

- the transaction was completed without the consent of third parties or permission of authorized bodies;

- the transaction is imaginary or feigned*.

To invalidate the contract, the injured party to the transaction or any interested party, including a representative of government authorities or an organization, can apply to the court. Subsequently, the guilty person will be obliged to reimburse the costs incurred to the victims, and, possibly, pay compensation for the damage caused.