What it is

The conditional number of a property is a set of numeric characters that were previously assigned to buildings erected on land plots, that is, buildings, structures, residential buildings, until 2002.

As a rule, the assignment of such a numeric code, without the presence of state documents for the property, means that previously in relation to this building, state registration was not carried out.

Please note that this number remains with the object even if the person holding the title to it has changed.

Remember that real estate (apartments, houses, buildings) can have both a conditional number established by law and a cadastral number, so if the documents indicate different codes, there is no need to worry.

How to enter the type of property in line 020

After the applicant for the deduction has noted the name of the property in the 3-NDFL form, the tax inspector must make it clear what type of property is registered for this property. The indication of the type is required in paragraph 1.2 near the designation 020. The numbering of these types is four-digit. We propose to understand the meaning of each of the signs:

- One. This code is written in situations in which the taxpayer has registered a private type of property for housing and is the sole owner of the property.

- Two. This code must be used if the property is jointly owned by two or more individuals, one of whom is an applicant for a reduction in the tax base. Moreover, the housing is not only jointly owned, but shares are also distributed.

- Three. Three is indicated if more than one individual invested in the purchase of real estate. That is, when the owner of a given object is more than one person.

- Four. Russian legislation allows for property transactions related to the registration of housing or land in the name of individuals who are currently under eighteen years of age. Thus, if the property is owned by a child, then the number four is written on the 3-NDFL form.

In addition to the name code and type of ownership of the property, you must write the coordinates of its location on sheet D1. You will also need to enter data regarding the date of receipt of documents on the basis of which the taxpayer became the legal owner of housing or land. And only after this can you proceed to settlement transactions related to the calculation of property tax discounts.

After the sheet is completely completed, be sure to check whether it contains the page number, surname, initials and identification code of the applicant for the deduction, as well as his personal signature and today’s date.

What is the difference compared to cadastral designation

So, is a cadastral number different from a similar conditional one, and what is the difference?

The main difference is how cadastral numbers are assigned to immovable properties.

Conditional is assigned to any building that has the status of immovable (new building, apartment building, office building, apartment) with the exception of a land plot.

A land plot can only receive a cadastral number. A conditional cadastral number of a land plot is assigned to it at the time of registration of rights to it and entry of data about it into the register of the authorized body.

Another difference is the written presentation of numerical values. Some conditional ones consist of 7 digits, while cadastral ones must have only 6 digits.

What is the purpose?

Why do you need a conditional apartment code? It is not given to land plots, only to houses, apartments, rooms . Such a digital code is an identification indicator of this particular object, and not another.

By the signs contained, you can find out where the property is located. This code is needed to link all objects to the area and put them on maps.

But they do not include this code in the State Property Committee register; only when registering with the State Property Committee will all available information about the property be entered, including the old code.

Read on our website also about how to find out the cadastral value of a real estate property, for example, a building or a residential building, using a code from the register on the Rosreestr website.

Validity period of the cadastral passport

Cadastral passport is a document that is an extract from the cadastral register of data. This document includes information about the object, its purpose, as well as about the person who has ownership rights to this building.

The law establishes a rule according to which the validity period for such a document is not provided. In turn, it should be understood that if changes are made to an object that are subject to state registration, this must be reported to the authorized body, which, based on new data, issues a document with new information.

Declaration 3 personal income tax for 2020 object number code where to get it from

If the taxpayer, according to the Declaration, claims property tax deductions for expenses associated with the acquisition (construction) of several (different) real estate objects, then the required number of pages of Sheet D1 are filled out, containing information about the objects and expenses incurred on them (item 1 of Sheet D1). After opening the declaration program, the first field for filling out the conditions will appear in front of you - everything is quite simple here.

What is the object number code in 3 personal income tax

Find out the appropriate BCC for your case on the website of the Federal Tax Service. In addition, you can use a service that will help you determine not only the BCC, but also the numbers of your inspection of the Federal Tax Service and the All-Russian Classifier of Municipal Territories (OKTMO).

The object name code in 3-NDFL is a mandatory element of the declaration submitted for the return of tax payments as part of the property deduction. Regardless of what code is indicated in the column, the total maximum benefit amount will remain unchanged - 2 million rubles. Personal income tax Deadline for filing income tax returns.

Decoding, obtaining additional information

The set of numerical values in is selected in accordance with a special principle. Each numerical value contains certain information.

The outdated cadastral number represents numeric characters that are not separated by hyphens or bars, unlike the new ones.

Each character has the following meaning:

- The first two numeric characters indicate the code of the region in which the object is located;

- The next two numbers indicate the county in which the information was entered into the registry;

- The next two digits indicate the code of the authority that entered the information into the register;

- The three numbers following them indicate the number of the book in which the records were kept;

- The next 4 digits are the year in which the entry was made;

- The last three digits of the entry are information about the serial number.

Conditional number: what does it mean for a property

The conditional number contains the following information about real estate:

- serial number (code) of a specific subject of the Russian Federation;

- serial number (code) of a specific registration district;

- code designating a specific division of the registration service that received from the applicant a set of documents (papers) necessary for state registration of property;

- incoming number assigned by the registration authorities to the package of documents received from the applicant for proper registration of real estate ownership;

- the year the applicant submitted a package of papers for Rosreestr authorities to carry out registration actions (procedures) in relation to a specific object;

- number (numeric identifier) under which information was entered into the accounting book confirming the fact that a package of relevant documents was accepted from the applicant for the purpose of carrying out registration actions.

Cadastral and conditional numbers have the following similarities:

- The digital designations included in these identifiers are unique (do not contain duplicate values).

- The arrangement of numbers (symbols) in both numbers follows a certain pattern.

- The assignment of these numbers is the exclusive prerogative of Rosreestr authorities.

- These numbers should be indicated on all official documents identifying real estate, as well as certifying ownership.

The cadastral code is always assigned by Rosreestr to a real estate property in typical situations:

- Initial registration of a real estate property that has not previously been registered in the Rosreestr database.

- The ownership of this object is registered by its owner for the first time.

- The creditor bank demanded that the real estate acquired by the borrower with a mortgage be assigned a cadastral identifier with the relevant data entered into the Rosreestr database.

- Significant redevelopment (reconstruction) of the property. Allocation of certain parts in property owned by several entities under the right of common ownership.

How to find out the cadastral number assigned by Rosreestr authorities to a specific object? For residential real estate, cadastral numbers must be indicated in the relevant papers - cadastral passports, issued when registering the property. The cadastral number should always be checked in a situation where the interested party needs to personally verify the legality of the documents drawn up during a transaction involving the alienation of property. It is impossible to carry out a legal act of purchase and sale or other transfer of ownership for a real estate property that does not have a unique cadastral number at the time of registration (conducting) the transaction.

Search for cadastral number by conditional

Today, the legislator allows you to search for a cadastral number using a similar conditional number .

In order to carry out such a search, you must use the official website of Rossreestr.

Upon entering this site, you need to find the “Online Information” section. After this, the service will offer three fields that must be filled in to receive information. One of these fields is the “conditional object number”. You must enter a numerical combination and click the “Submit” button.

The service will search for information and display it on the screen.

Please note that this method will not provide all information about the object, but the service will display information about cadastral data.

the new cadastral number using the old conditional one by personally contacting the Rossreestr.

It is necessary to enter the available data into the application form and indicate the known conditional number of the building.

Remember that in this case, you must provide a receipt for the mandatory state fee.

The cost of providing this service is 150 rubles.

The application is considered within no more than days from the date of the person’s application.

How to find out the old KN?

To begin with, let us clarify that it is not easy to find out the old cadastral number using a new one. The obtaining procedure itself is very simple, but the chance that the old cadastral number is not entered into the database is very high. You have two ways: either look at the old KN online on the Rosreestr website (the easiest and fastest way), knowing the new KN or the address of the storage facility. Or you can contact the MFC in person and submit a petition.

If you chose the first path, then you need to go to the official website of Rosreestr USING THIS LINK. Then:

- From the list.

- We fill in the fields to choose from: either Cadastral number or Land address, as in the screenshot below:

- After filling out, press the “form request” button and send the information.

This service is provided free of charge. The interested person will receive the required information, provided that information about the site is included in this program.

If you have chosen the second path and access to the Internet causes difficulties or the old number is not entered into the database, you can directly contact the MFC by submitting a request for an extract from Rosreestr indicating the old number. This service is paid and requires payment of a fee of 200 rubles, the order execution period is 5 days.

If you don’t know whether you have a CN for a property, but you know its address, then we recommend that you study:

- 3 ways to check the CN of a land plot;

- 2 simple methods for checking the CV of a house and building;

- current schemes for checking the CN of an apartment.

You can also find out the cadastral value of a property by address and number. But which of these methods is better? Find out by reading the articles!

Object number code in the 3rd personal income tax declaration for 2020 where to get it

If there is no information about the inventory or other asset code, it is necessary to identify the property by indicating its location. It is necessary to enter information about when the applicant bought a house, apartment or other asset, and on what date the ownership title was registered. If a deduction is claimed for several acquisitions at once, the object name code in the 3-NDFL line is indicated separately for each asset. That is, for each property a separate sheet of Appendix 7 is drawn up with the designation of the corresponding type of property.

Sample of filling out 3-NDFL when purchasing an apartment - 2020

Property deductions associated with the acquisition of a new property are recorded in Appendix 7. If other types of deductions are applied for the reporting year, they must be indicated in the declaration in Appendix 5: standard, social, investment.

One line entitled “The amount paid for undergoing an independent assessment of one’s qualifications for compliance with qualification requirements in organizations carrying out such activities in accordance with the legislation of the Russian Federation” was added to paragraph 3 “Calculation of social tax deductions in respect of which the restriction established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation (rub. kopecks).”

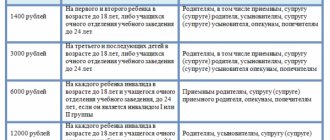

01 The owner of a housing property for which a property deduction is claimed for personal income tax 02 The spouse of the property owner 03 The parent of a minor child - the owner of the property 13 The payer claiming a property deduction for expenses associated with the purchase of housing in the common shared ownership of himself and his minor child (children) 23 A payer claiming a property deduction for personal income tax for expenses related to the purchase of housing in the common shared ownership of the spouse and his minor child (children)

This is interesting: Should clinics install a light-curing filling for free?

Declaration 3-NDFL 2020 for 2020

When to submit 3 personal income taxes for 2020? In order to receive a tax refund on new housing, Ivanova must first pay these taxes to the budget, otherwise she will have nothing to return. She will work the entire year 2020, the employer will withhold 13% tax from her salary, transfer it, and at the end of the year will issue her a 2-NDFL certificate.

Depending on the number of types of transactions with securities, the code of which is indicated on line 010 of Appendix 8 (given in Appendix 8 to the procedure for filling out the declaration), the required number of blocks of lines 010 - 070 is filled in.

Calculation of property tax deductions for new construction expenses. In Appendix 7 of Form 3‑NDFL (former sheet “D1”), the number of indicators that need to be provided to obtain a property deduction for new property has been reduced.

The procedure for filling out a declaration by individual entrepreneurs

Line 050 reflects the attribute of accounting for losses on income specified in line 020 of Appendix 8, received from the totality of transactions performed with securities and derivative financial instruments (DFI), as well as on REPO transactions, the object of which are securities, on securities lending transactions , for operations carried out within the investment partnership:

In addition, you can use a service that will help you determine not only the BCC, but also the numbers of your inspection of the Federal Tax Service and the All-Russian Classifier of Municipal Territories (OKTMO).