The procedure for registering a plot of land in the name of another person

The most common option is to transfer the land to a related person. In this case, aspects related to land surveying and cadastral valuation of the object are identified. As a result, the price of re-registration changes.

Important ! Whatever the agreement (deed of sale or deed of gift), it must contain the exact parameters of the object, the conditions for the transfer of rights and future use.

The legislator took care of protecting the rights of the owner of the land plot. According to Art. 40 of the Land Code of the Russian Federation, a person who owns land has the right to carry out any transactions with it.

If you re-register the land plot to another person, this will entail a change in the type of right.

The following options for this procedure exist:

- transfer of land to another owner;

- land lease;

- unlimited use;

- urgent free use.

The listed types of legal relations are regulated by the norms of the Land Code of the Russian Federation. To transfer a plot of land to a relative, you must strictly adhere to the requirements of the law.

Re-registration with donation of land Source involokolamsk.ru

Nuances of land re-registration:

- The procedure involves the execution of a transaction (sale or purchase) with another person. The document must contain the main points of the transaction, including a description of the buildings, if any, on the site. According to the law, it is unacceptable to re-register land without taking into account residential and non-residential buildings. The legislator adheres to the principle of unity of the transaction.

- If you re-register land in the name of a spouse, the use of jointly acquired property does not change, which poses difficulties when transferring rights. This procedure must be notarized, and the transaction price will accordingly increase depending on the notary's fees.

When re-registering land, it is important to decide which type of transaction is most suitable: purchase and sale or donation.

Sale of land Source diols.ru

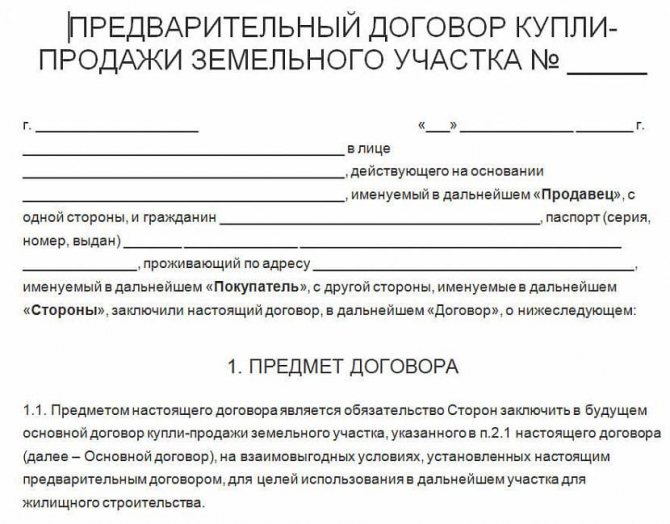

How to re-register land in case of purchase and sale

Before mandatory registration of a transaction, all documentation must be prepared. You can view the list of documents at your local federal registration office.

To alienate a land plot you will need:

- passports of the parties;

- title document for land;

- cadastral passport (from the owner);

- a copy of the agreement between the seller and the buyer;

- power of attorney to carry out a transaction (if someone represents the interests of the seller or buyer);

- application to FUGRTs.

When registering a deed of gift, you need to prepare the same package of documents. However, the basic agreement will not be a sale and purchase agreement, but a gift agreement. When re-registering as a relative, you must provide a document confirming the existence of a family relationship.

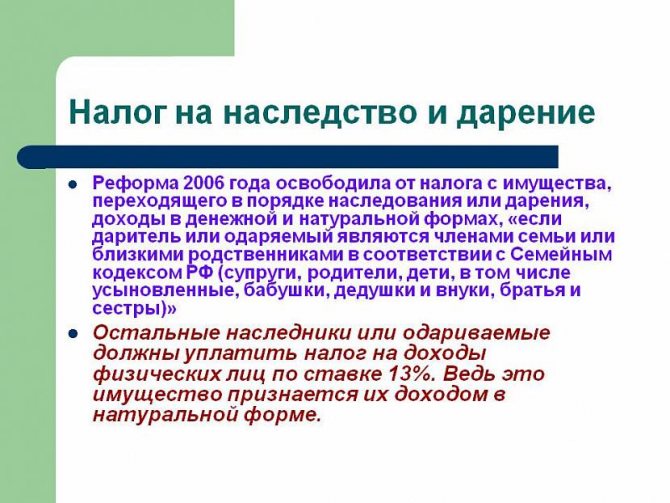

Donation of land is preferable if it is transferred to relatives, since this gratuitous transaction is not subject to tax.

Plot purchase and sale agreement Source novomikhaylowka.ru

See also: Popular plots in the Moscow region for building a country house.

Current restrictions on the sale of land:

- You cannot sell a plot that is legally encumbered (is pledged, a court decision has been made on it, etc.);

- The land must first be demarcated and assigned a cadastral code;

- When a plot of land is the subject of a dispute, it is not permitted to alienate it, as is the case if it is managed by several persons.

In order to correctly carry out the purchase and sale, it is recommended to check the object and establish its status through the Rosreestr database.

Detailed instructions for re-registration of land

Land registration is a government service. For all questions, you should contact the authorized registrars working in the cadastral chamber.

MFC provides similar services. However, the place where the transaction is executed does not in any way affect the completeness of the package of documents, which remains unchanged.

Instructions are given below.

The Cadastral Chamber resolves issues regarding land registration Source yandex.net

Step No. 1. Collection of documents

The package must be completed strictly according to the law, otherwise registration will be refused.

Some nuances should be taken into account:

- Typically, the parties to the transaction are two persons who present documents proving their identities.

- The contract must specify all the terms of the transaction. The form of the agreement is chosen depending on how exactly the right to the plot is transferred from one owner to another.

- The certificate of title to the plot is presented by the legal owner. True, this document can be replaced by another act confirming the owner’s right. This may be an act of the regional administration, a certificate of inheritance, etc.

- If the interests of any of the parties are represented by an attorney, then a power of attorney for him must be issued by a notary. This is important, since if the document is declared invalid, the transaction is, accordingly, considered void.

- Why is it so necessary to confirm family ties when a transaction is made between relatives? A citizen, purchasing a plot of land, receives taxable income. However, the relative is exempt from paying tax. That is, when donating a plot to a relative, there is no need to pay 13% of the transaction price to the federal budget.

Gift tax Source novomikhaylowka.ru

How to draw up a deed of gift for a dacha with a plot of land

The methods for registering a gift between close relatives differ only slightly from concluding a regular real estate transaction. The donation is also formalized by a written agreement. The rights of the donee to the dacha and plot are subject to mandatory registration in Rosreestr. Documents for registration of rights are submitted to the MFC or through a notary.

In a gift agreement between close relatives, the degree of relationship of the donee must be indicated with reference to the details of a document certifying the relationship - a marriage certificate, a birth certificate. Copies of documents are attached to the agreement.

You can prepare a gift agreement yourself and submit it for registration at a multifunctional center or contact a notary to draw up a document and submit it directly to Rosreestr. However, when drawing up a deed of gift from a notary, you must keep in mind that the cost of his services depends on the market price of the property that is being donated. Therefore, carrying out registration with a notary is not always advisable in terms of costs.

This is important to know: State housing certificate for a young family in 2020

There are a number of requirements when a gift agreement must be executed only through a notary. Notarization is required if :

- the donor is a minor (from 14 to 18 years old);

- donor - a citizen recognized as having limited legal capacity;

- The donor is not the only owner of the dacha, but has the right only to a share in the right of common ownership.

A sample agreement of gift for a dacha between close relatives can be downloaded here.

Required documents

What documents are needed to formalize a deed of gift for a dacha and land? For this you will need :

- gift agreement in at least three copies (one for each party and one for Rosreestr);

- documents confirming ownership of the dacha and land (certificates of registration of rights or extracts from the Unified State Register of Real Estate);

- documents confirming the degree of relationship (birth certificates, marriage certificates);

- fee for registration of rights;

- passports of the parties;

- application (filled out by an MFC employee).

Additionally, you may need the notarized consent of your spouse or other co-owners of the dacha for donation.

The state fee for registering the rights of the donee is 2,000 rubles. for each object (dacha, plot). If rights to a plot of agricultural land are registered, the fee is 350 rubles.

Reference. A receipt for payment of the fee may not be provided to the MFC employee, but it must be paid at the time of submitting documents, otherwise registration may be suspended.

Briefly about the main thing

It is easier to re-register a plot of land to another person if you plan to donate the land plot to a relative, in which case the registration is not subject to tax.

In the case of a sale or purchase, you will need to notarize the transaction, take a scan of the contract and submit an application along with real estate documents to the relevant authority (FUGRTs).

If there are any buildings on the site, you will first need to register ownership of them, and then proceed with the registration of the land plot. In any case, you will need some time to collect documents in order to finalize the transfer of the plot to other hands.

Ratings 0

The procedure for drawing up a dacha donation agreement

As we have repeatedly noted in previous articles on the Legal Ambulance website, since an agreement of this type requires mandatory state registration - the agreement must be drawn up in writing! At the same time, the legislator allows the donor and the recipient to notarize the document drawn up by the parties, recommending that transactions be notarized due to their high cost.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Since the deed of gift regulates the conditions and procedure for the actual transfer of a country house and land, the success of the transaction, in general, will depend on the correctness of the agreement. Therefore, the parties must specifically, clearly and unambiguously state each point of the document!

However, lawyers note that an agreement can be challenged in 95% of cases if its content does not contain the following information:

- The intention expressed by the donor to transfer the dacha free of charge into the ownership of the donee or group of persons;

- the expressed consent of the recipient to accept the gift and assume all responsibilities associated with it;

- information about the parties to the transaction, including their passport details and actual residential addresses at the time of drawing up the dacha donation agreement;

- a detailed description of the properties and characteristics of the object of the donation, including data on the land plot, the address of the dacha, cadastral numbers of the house and plot, as well as the technical characteristics of all premises that distinguish the gift from among similar objects;

- list of grounds for termination of the deed of gift;

- instructions on the current legal capacity of the donee and the donor;

- indicating the period for transferring the object into ownership of the new owner;

- a list of obligations and rights of the parties, as well as their responsibility for violating the terms of the agreement;

- information about the absence of encumbrances or similar restrictions on the use of real estate;

- signatures of the parties.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement to a budgetary institution in 2020 - current sample, errors, rules

The next step in concluding a dacha donation agreement after drawing up and proofreading the main agreement is its mandatory state registration, or more precisely, the re-registration of ownership from the donor to the donee. All the parties need to do is go together to the registration authority, where they will have to write a corresponding application (from both the donor and the donee), hand over a package of necessary documents and receive a receipt from the organization’s employees with an approximate completion date of the procedure.

After employees of the Rosreestr bodies have carried out an examination and analysis of documentation, as well as verified the legality of the completed donation transaction (the legislator has given them 10 days for this), the parties to the deed of gift receive a copy of the donation agreement with a special registration mark. In addition, the donee (the new owner of the dacha) receives a certificate of entry into ownership of the property donated to him.