Author of the article: Lina Smirnova Last modified: January 2020 4355

Donation of residential real estate acquired using maternity capital allocated at the birth of children is a procedure that has become widespread in recent times. However, the agreement to donate an apartment using maternity capital has its own characteristics, because such real estate is acquired primarily in the interests of the children born, and they must be observed when carrying out any transactions for its alienation. What are the specifics of donating an apartment purchased with the participation of maternity capital, we will consider below.

Decorating an apartment as a gift for children

Most often, maternity capital is invested in the purchase of housing. This gives rise to certain problems, some of which are related to the name.

Many believe that if the capital is “maternal”, then his money belongs to the mother, that is, part of the real estate that was purchased with it also belongs to her. This is incorrect: maternity capital is aimed at supporting the entire family, that is, it belongs to the father, mother and their descendants.

It is important to know: a father can also receive maternity capital if he is the adoptive parent of two children.

If a family decides to spend the certificate on improving living conditions, it needs to remember the need to allocate part of the apartment to the heirs. This must be done, since every minor by law must have his own registration and the right to living space. This became the reason for the emergence of such a thing as allocating a share in real estate to minors.

The procedure can occur in three ways:

- If parents decide to change an apartment or buy a new one, they simply register their heirs as owners in it;

- If the family already owns property and is paying off the mortgage, it can use the money to pay off the debt to the bank. In this case, the parents must draw up a notarized obligation to allocate shares in the real estate to the children.

- Once the mortgage is fully repaid, a deed of gift can be issued, according to which specific shares in the real estate owned by the parents will be allocated to the descendants. Until the mortgage is repaid, the property is considered the property of the bank and cannot be transferred.

Apartment as a gift for children

According to the rules established by the legislation of the Russian Federation, a minor (under 14 years old) child has no right to act as a donor. However, all minors without exception can accept the gift.

Features of the procedure

When it comes to inexpensive, small household gifts (toys, clothes, money), even a six-year-old child can accept them on his own. With real estate things are a little different.

Until the age of 14, instead of the child, the parties to the transaction are his parents or, if they are absent, guardians. After 14 years, the teenager himself signs the deed of gift, but only with the consent of the parents.

As you know, the main sign of giving is gratuitousness. That is, the donor cannot demand anything in return from the child. However, some restrictions may apply. So, for example, taking possession of donated housing will happen:

- Upon graduation from school or university;

- After the wedding;

- At a certain age, etc.

Not only relatives of a minor citizen, but also strangers can act as a donor. However, most often, donations to children are made in several cases:

- When selling an apartment where a child is a co-owner;

- When parents divorce;

- As a present from relatives.

A minor recipient may refuse the gift. In this case, a written refusal is drawn up on behalf of the child (or each of the children, if there are several of them), which is subject to state registration. Most often, the reasons for refusal are the deplorable condition of the housing or its location.

In order to transfer, under a gift agreement, his share in a joint apartment for the whole family to minor children, one of the parents does not need the consent of the other.

The following video will tell you about the possibility of donating an apartment to a minor child, as well as some related nuances:

Drawing up a deed of gift

The deed of gift in the name of the child (children) is drawn up in writing. You can do this yourself, or contact a trusted specialist, which will be more correct, since an incorrectly drawn up agreement can subsequently be declared void, as a result of which the child will be left without an apartment.

The number of copies (directly originals) depends on the number of participants in the transaction. Plus one copy remains in the Registration Chamber.

The text of the deed of gift contains detailed information about the donor, the donee and the latter’s legal representative. Also, the property being transferred is described in detail.

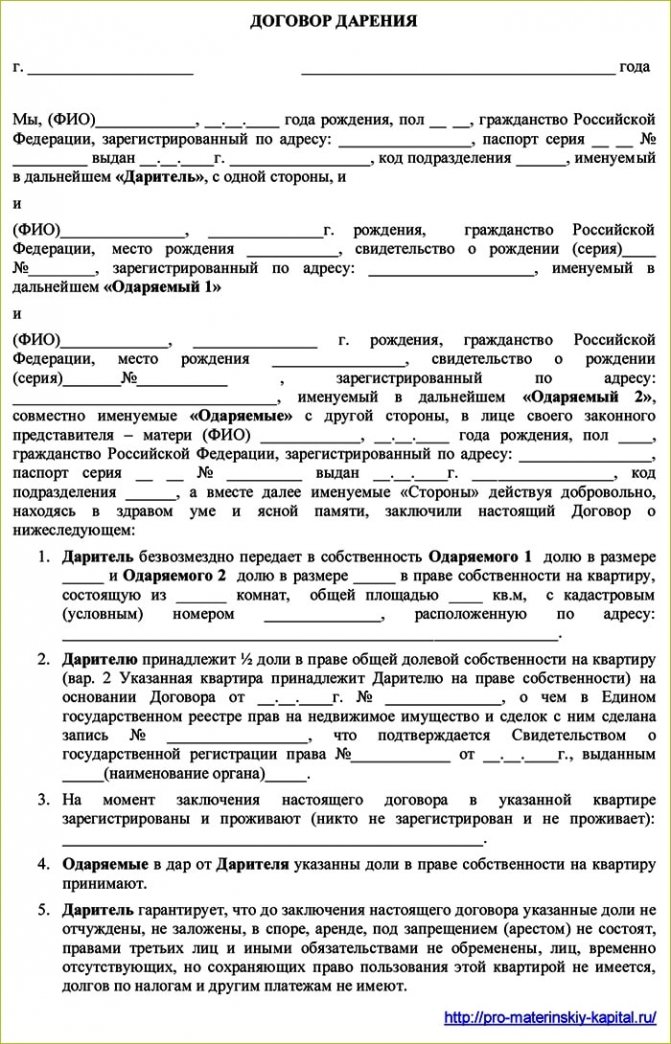

For your convenience, we have attached a deed of gift form of this type to the article.

Sample agreement for donating an apartment to a minor child

Required documents for registration

No matter who drew up the agreement, it is certainly subject to state registration, otherwise the transfer of property rights in favor of the minor donee simply will not take place.

To do this, the required number of copies of the deed of gift, as well as a number of other documents, are submitted to the Registration Chamber:

- The donor's passport and the child's documents (certificate or passport);

- Cadastral passport for the transferred apartment;

- Results of the apartment assessment carried out by the BTI;

- Papers confirming that the apartment is the property of the donor;

- Extracts from personal accounts and house books;

- Consent of the donor's spouse;

- Consent of the child's parents/guardians/trustees;

- Certificate of persons registered in the apartment, as well as information about the donor’s family;

- State duty receipt;

- Application from the donor requesting the transfer of ownership;

- Application from the donee requesting registration of his rights to the received property.

Both parties and their legal representatives must be present at registration. Registration of deed of gift takes 10 days. Then the child receives a certificate of the acquired right to housing, but he cannot dispose of it until he reaches adulthood.

Gifts from close relatives are not taxed. In other cases the rate is 13%.

You will find even more useful information on the issue of drawing up an agreement to donate an apartment to a minor in the following video:

https://youtube.com/watch?v=0HcBIkY69UA

How the procedure works

Donation takes place in several stages:

- First, parents must invest money in a mortgage. To do this, an application is written to the Pension Fund with a request to transfer funds to pay off the mortgage, in which they indicate that the children will definitely receive their share.

Please note: the certificate cannot be used as a first payment; it is accepted only as a further payment.

- After this, a standard gift agreement is drawn up, one party of which will be the parents, the other – their descendants. It is certified by a notary. The document must be in writing and the adults signing it must be of sound mind and memory.

- The gift agreement is registered in Rosreestr, and the children’s new ownership of real estate is also registered there.

It is worth remembering that until the age of 18, parents are responsible for children as official guardians, and they also sign documents. That is, officially the parents transfer the share and sign that they received it.

Legal consequences of allocating shares to children under a gift agreement

Since maternal capital is subject to division among the whole family, when dividing shares of real estate by agreement, if in the future there are more children who will claim a share in the property, there will be a need to again redistribute shares in the right to housing among all family members.

A gift agreement is a transaction that cannot be canceled. In other words, it will be impossible to redistribute shares between all parties to the agreement. Parents will be able to do this only in relation to their part of the property.

As a result, all family members will be home owners. But, in this case, there will be some restrictions when making transactions with this real estate. So according to paragraph 1 of Art. 575 of the Civil Code of the Russian Federation, donations on behalf of minors are not allowed.

If the spouses want to sell their home, they will need to contact the guardianship and trusteeship authorities in order to obtain permission to complete a transaction with those parts of the property belonging to their minor children. Such consent will be issued on the condition that in return housing will be purchased where minor family members will own shares in the ownership equal to or greater than those that were sold.

Consequences of failure to fulfill contract obligations

If the obligations of the contract are violated, you may encounter:

- Not recognition of the validity of the transaction.

- Enforcement.

- Fine.

- Administrative punishment.

- Return of the entire amount of maternity capital back to the state.

- Probation.

- Seizure of property.

Note! The state always closely monitors this issue, as it is interested in the future of children. In the event that their rights begin to be infringed by their parents, the prosecutor's office begins to open a detailed investigation of the case, and subsequently determines the extent of non-compliance with the law.

Maternal capital helps children to further improve their future. Therefore, you should not try to circumvent the law; this is punishable by severe punishment.

If the property was purchased using funds allocated by the state, then the property is not subject to further sale until the child is 18 years old. Before purchasing a home, it is imperative to verify the authenticity of all documents, as well as check for seizures by the state or bank.

Sources

- https://KPPKDirection.ru/ipoteka/darenie-materinskij-kapital.html

- https://lawinfo24.ru/heritage/darstvennaya/dogovor-dareniya-kvartiry-po-materinskomu-kapitalu

- https://allo-urist.com/dogovor-dareniya-doli-kvartiry-detyam-po-materinskomu-kapitalu/

- https://dogovor-darenija.ru/darstvennaya/sostavlenie/dolej-zhilya-detyam/

- https://pravonaslednik.ru/nasledodatelyu/darenie/kak-sostavit-dogovor-dareniya-doli-detyam-pod-materinskij-kapital.html

- https://law-divorce.ru/dogovor-dareniya-doli-kvartiry-detyam-po-materinskomu-kapitalu/

- https://naslednik.guru/darenie/materinskij-kapital-i-ipoteka.html

How to draw up a gift agreement

A sample can be found on the Internet or obtained from a notary. It is compiled in one copy, regardless of how many people are donors: one parent or both.

The document must contain the following information:

- Full name and passport details of both parties, signatures are placed below.

- What kind of real estate is being donated: its address and characteristics (number of rooms, area, floor), cadastral number.

- On what basis do they own housing: bought it, received it as a gift, exchanged it. They immediately indicate the document number that confirms this.

- What part goes to the children: it can be either the entire living space or a share.

- Who else, besides the parents, is registered in the apartment.

Keep in mind: before you sign the documents, you should check with the notary whether the agreement is filled out correctly.

It is also necessary to indicate that:

- The document is signed by the parties voluntarily, they are of sound mind and memory.

- The transferred living space has not been seized, given as a gift to other people or mortgaged.

- The parties to the transaction are familiar with the articles of the Civil Code that are responsible for the transfer of gifts.

- How many copies have been compiled: one for each party (for example, mother, father and two children) and one copy for the Federal Service Office.

How to draw up a gift agreement correctly?

A prerequisite is the requirement for the form - the gift agreement must be drawn up in writing.

Parents or one of the spouses act as donors - homeowners who want to transfer a share of the apartment to their children. Minors - act as donees , i.e. recipients of a share of the apartment.

If there are two donors (husband and wife), you must first enter their surnames, first names and patronymics into the contract, and then indicate the name “Donors” (similarly for two children).

Documents for registration

Here's what else you need to bring, in addition to the contract:

- Parents’ passports and children’s birth certificates, as well as SNILS and marriage certificate if the parents are married;

- Documents confirming the owners' rights to the apartment: for example, a purchase and sale agreement;

- Extracts from the Unified State Register and house register;

- Cadastral passport, technical documentation;

- Certificate of maternity capital;

- A certificate from the housing and communal services department stating that the family has no payment arrears;

- An extract from the bank stating that the apartment was under mortgage;

- Consent of the second spouse or the guardianship department for the gift.

It is impossible to give away an apartment that is currently under mortgage - a notarized promise to allocate a portion to the children after repayment is drawn up for it.

Registration of ownership

Any real estate transaction, be it an apartment, a house or a plot of land, is subject to state registration. To register property rights, a citizen should contact Rosreestr. It is also possible to submit documents using one of the MFC branches.

To re-register an object in his name, the recipient must write an application. Its sample can be downloaded from the official website of Rosreestr. The application is accompanied by the following documents:

- extract from the Unified State Register;

- technical documentation for the alienated object;

- title documents;

- marriage registration certificate;

- child's birth certificate;

- deed of gift;

- extracting books from home;

- receipt of payment of state duty.

The average duration of the registration procedure is a week. The maximum period is 12 days. When submitting documents through the MFC, the waiting period increases by a couple of days, which are necessary to send the papers to Rosreestr and receive a response. When ownership is registered, the new owner of the object will receive an extract from the Unified State Register.

Decorating part of an apartment as a gift for children

You can donate not only the entire apartment, but also its share. In this case, the deed of gift is drawn up taking into account some nuances.

The main feature of this option is that the property is acquired not by one owner (child), but by several (parents and children).

That is, after reaching adulthood, children will not be able to kick their parents out of their own home, nor will they be able to sell the property without the consent of all owners.

Good to know: either one parent or both can donate a share.

But the agreement of all owners when donating is not required, since the donor disposes only of his own property.

What documents are needed

To register the agreement with the relevant justice institution, the parties to the transaction will have to provide the following list of documents:

- civil passport of each party to the agreement;

- original document confirming the donor's ownership rights;

- technical passport of the donated property;

- receipts confirming the absence of debts on utility bills;

- a certificate stating that the specified object of donation is not pledged and is not subject to arrest;

- written consent of all co-owners of the living space to provide part or all of the property to another person;

- permission issued by the guardianship authorities to participate in the acceptance of property from incapacitated persons;

- an extract made from the house register or a certificate containing all the information about the persons registered in the territory of the specified housing;

- divorce or marriage certificate.

In the vast majority of cases, all these documents are sufficient to complete the donation transaction.

From time to time, it is also recommended, at the time of signing the documents, to obtain an appropriate certificate from a narcologist and a psychiatrist in order to confirm the donor’s full legal capacity

Drawing up a contract for donating shares to children

The contract is drawn up according to the points indicated above, the list of documents also does not change. The only difference is the need to describe the specific share that will be donated. It should be written in parts, for example, 1/20 share.

Example. The father wants to transfer half of his share in the apartment to two children, the mother does not transfer anything. In this case, it is necessary to indicate in the deed of gift that everyone will receive 1/8 of the apartment: the father has the right to half of the housing (1/2), half of it is 1/4.

Please note: without specifying the share, the paper will be considered invalid.

Therefore, each baby gets half of 1/4. The mother's consent is not required, since only the spouse's part is transferred.

Donation agreement for children's share when using maternity capital

The ambiguity arose due to the fact that not a single article of the law describes the procedure by which the share of housing acquired with the help of the MS should be transferred to the child, and each law enforcement official interprets the legislation in his own way, for example:

- The Chamber of Notaries, in its letter No. 2305/03-16-3 dated 06/01/2016, refers to the requirements of Part 4 of Art. 10 Federal Law No. 256. The letter states that, in accordance with these requirements, at the time when the residential premises were purchased, the co-owners already had the right to common shared ownership of the housing; accordingly, the transfer of the children's share should occur by agreement.

- On the other hand, in 2020, the Volgograd Regional Court made a decision according to which, in the law on MS, an agreement should be understood as an agreement that any shares will subsequently be determined, and not the type of document by which these shares will have to be transferred. If we follow the logic of this court decision, then the transfer of part of the property into the ownership of children should be carried out through a civil transaction. A gift agreement is just such a transaction.

Example

Nina Petrova, when she got married for the second time, had a daughter from her first marriage, and soon the couple had a second child, a son. After the birth of her second child, Nina received MS, and the couple decided to improve their living conditions, sold their joint one-room apartment, added maternity capital funds and bought a two-room apartment with an improved layout.

Read more: If your husband refuses to pay alimony, what to do?

Since the couple received MS after their common child was born, they drew up an obligation to allocate a share in the new apartment to Nina’s daughter from her first marriage. In accordance with this obligation, they transferred 1/4 of the living space to each of the children, issuing deeds of gift for their shares of the apartment property.

How are shares allocated for maternity capital?

The law does not precisely define how shares should be distributed to children. The share can vary from the minimum to the entire apartment.

However, you should not think that you can leave your unloved son 1/1000th of the share of housing, and the second son the rest. Such a decision will not be approved by the trusteeship department, which will lead to their refusal and the inability to make a donation.

According to the Housing Code, the minimum standard is 12 square meters. meters, according to sanitary standards the value is reduced to 6 square meters. meters.

This is important: the norm may differ in different regions.

It happens that maternity capital was used after the birth of the second child to pay part of the mortgage. The mortgage itself was fully repaid only a few years later, during which a third baby appeared in the family. In this case, each of the three children is entitled to a part of the share, regardless of whether he was using the certificate.

How to fulfill the obligation for maternity capital?

The method and timing of fulfillment of the obligation to transfer real estate acquired using maternal capital into the common ownership of the family depends on many circumstances:

- whether ready-made housing is purchased or its construction (reconstruction) is being carried out;

- how housing is purchased and under what agreement maternity capital funds are transferred from the Pension Fund (purchase and sale, equity participation agreement, mortgage, etc.);

- which spouse is the title owner at the time of fulfillment of the obligation, etc.

The transfer of housing into common ownership occurs within 6 months after:

- transfer of maternal capital funds by the fund to the real estate seller, when the residential premises are immediately registered as the property of parents and children;

- payment of the last installment under a purchase and sale agreement with installment payment;

- removal of encumbrance (mortgage) upon full repayment of the loan;

- obtaining a cadastral passport for a new building, putting it into operation as an individual housing construction project, an apartment building (when purchasing an apartment under the DDU);

- full settlement with a housing construction or other cooperative.

The following methods of fulfilling an obligation can be identified :

- agreement on determining the size of shares between family members;

- agreement of donation of shares;

- the court's decision.

The choice of the most suitable option for distributing shares does not only occur at the request of the spouses. Often, the will of the parents alone is not enough, and it is necessary to draw up exactly the document that in a particular region is accepted by Rosreestr as the basis for registering the right of common shared ownership of a family to residential premises.

This ambiguity arises due to the fact that the law does not describe the procedure for transferring housing purchased using a certificate, and law enforcement officials interpret the existing provisions of the law differently.

For example:

- In letter dated July 1, 2020 No. 2305/03-16-3, the Federal Notary Chamber, taking into account the clarifications of the Supreme Court of the Russian Federation, indicates that in fulfillment of the requirements of Part 4 of Art. 10 of Law No. 256-FZ, an agreement must be concluded indicating the size of the shares in the ownership of each co-owner of the residential premises, since these persons, by virtue of the direct instructions of the law, at the time of purchasing the housing, already had the right of common shared ownership of the residential premises . Such an agreement may contain elements of an agreement on the division of the spouses’ common property , since housing is purchased not only with government funds, but also with the personal funds of the spouses.

- On the contrary, the Vologda Regional Court, in its decision made in 2020, indicates that the “agreement” in the law on maternity capital does not mean the type of document, but only an agreement to determine the size of shares. Therefore, the agreement concluded between parents and children does not comply with the requirements of the law , since minors are not initially participants in the shared ownership of the purchased housing, therefore they cannot act as parties to the agreement on determining the size of shares in the right of common shared ownership.

Following the logic of the court, the transfer of property should be carried out only under a civil law transaction , one of which is a gift agreement.

Sample gift agreement for maternity capital

Sample contract (click to enlarge)

You can see how a deed of gift is filled out at any notary office, and options are also easy to find on the Internet. This is a regular real estate gift agreement: maternity capital is just part of the financial investment in housing, and therefore is not even mentioned additionally.

Below are examples of a deed of gift for an apartment and an obligation to allocate shares after paying off the mortgage:

- Donation agreement - sample

- Obligation to allocate shares - sample

The registration of a deed of gift may be refused if:

- The document is formatted incorrectly or the necessary papers are missing.

- There is no precise indication of which apartment is being donated, or there are inaccuracies in the description.

Lawyer's advice: you cannot write “I am transferring my apartment”, since we are talking about any apartment; specifics are required.

- Some points contradict the law: for example, conditions are specified that suppress the freedom of the recipient. The most common conditions are marriage to a certain person, choice of profession, birth of a child, or refusal to do so. Instead, time frames may be indicated: graduation, marriage.

- The apartment does not belong to the citizen, for example, it is municipal, arrested or mortgaged.

How to correctly draw up an agreement for donating a share of an apartment to children using maternity capital

The main requirement for a deed of gift is a written form. The key condition of the deed of gift is gratuitousness. When drawing up an agreement, you need to take into account the general provisions of the law and individual regulations on the use of maternity capital.

Form

A standard sample agreement can be downloaded from the website. Then all you have to do is fill in the required fields. Basic sections of the agreement:

- Title of the document.

- City, country, date of document preparation.

- Data of the parties to the transaction (full name, date of birth, passport details, registration address).

- Subject of the agreement. The fact of transfer of an object (size of part, area, location) to the recipient is described.

- Link to a document confirming the rights of the donor (purchase agreement, certificate).

- Confirmation of the fact of acceptance of the gift by the beneficiary.

- The donor's guarantee that there are no encumbrances.

- The moment of emergence of property rights.

- The procedure for paying costs for the current transaction.

- Mention of the number of copies of the agreement.

- Signatures of the parties to the transaction.

Content

When preparing a draft agreement, you need to take into account life circumstances. Typically, citizens use a ready-made template in which they need to fill out the relevant sections.

The introductory part contains information about the participants in the transaction (full name, registration address, when and by whom the passport was issued). The text of the agreement must indicate the specific will of the donor in relation to the alienated property. For example, Pankeyev K.S. transfers free of charge a room with an area of 16.4 square meters into the ownership of the recipient. m., which is located in an apartment consisting of two rooms. Additionally, the total and usable area of the housing is indicated, as well as its location and cadastral number.

Next, there is a link to the title papers. For example, the room belongs to me on the basis of a purchase and sale agreement dated December 10, 2015. Separately, you need to indicate by whom and when the agreement was registered, the number and date of the certificate of state registration of the right.

The next clause of the agreement is a reference to confirmation of the fact of acceptance of the property by the recipient.

When drawing up an agreement, the donor must provide guarantees that the housing is not under arrest or the subject of legal proceedings.

Additionally, the parties must record the moment of emergence of ownership of the property.

Another important point is the provision for payment of expenses. This includes notarization of deeds of gift and state registration of property rights. Typically, the burden of expenses falls on the beneficiary. However, the parties to the transaction can change the established procedure.

Next, the parties refer to the number of copies of the document and sign.

Consequences of failure to fulfill contract obligations

This refers to a notarized promise to allocate a portion of the apartment to the children after the mortgage is paid off. Repaying a mortgage can take several years, and parents simply forget to re-issue the document after repaying it.

This leads to unpleasant consequences: the interested party may go to court and demand that the interests of the child be satisfied legally.

Expert commentary: in some regions of Russia, compliance with the obligation is monitored by the state bodies themselves: the prosecutor's office, the trusteeship department or the Pension Fund.

If the apartment is sold, you can challenge it in court. In this case, a reverse exchange occurs: the seller returns the money, and the buyer returns the property. In this case, the plaintiff may be the adult children themselves, their relative or a government agency.