Donation procedure without the participation of a notary

The law allows you to draw up a gift agreement without a notary. The procedure is carried out on the basis of the document itself . Participants must visit the registration room with the required documentation.

When making a transaction, it is not necessary to contact a legal representative. The specialist must only:

- check both participants for legal capacity:

- make sure that you are conscious and have a desire to perform the procedure;

- to attest that there is no pressure on the participants.

The meaning, correctness of what is written, and the provisions of the contract are checked by the one who draws it up, as well as by the person who receives a certain object as a gift.

Attention! The main thing is that the transaction is formalized in writing without necessarily specifying the conditions.

A deed of gift differs from a will in its legal status and consequences. After death, donation is impossible , so if a person wants to transfer property to a close relative, he must draw up a will.

The legislation provides that it is possible to draw up a gift agreement without a notary in simple written form . The help of a specialist is not necessary, but it will help to avoid controversial issues, because the conclusion of a transaction is possible through deception or pressure.

An important point is the fact that the notary carries out a sanity check, so the possibility of canceling the deed of gift is reduced. If the paper is lost or damaged, he may issue a duplicate .

How to choose a notary to draw up a deed of gift

So, according to Article 56 of the “Basics of Notaries”, to receive services, the donor can contact any notary who practices within the Russian Federation. You can find a complete list of subjects of the Russian Federation in Article 65 of the Constitution of the Russian Federation.

Simply put, if the owner gives away an apartment located in St. Petersburg or Moscow, then he should look for a specialist either in Moscow or St. Petersburg, because these 2 cities are separate subjects of the Russian Federation. In other cases, you can contact any notary office of the district, region, republic or region. For example, if the donated property is located in Yekaterinburg, then contact any notary who works in the Sverdlovsk region.

It is worth noting that in cases where the donee or donor does not have the opportunity to personally contact a notary (this often happens when the parties live in another region or city), they can draw up a gift agreement with a local specialist, and then send the document certified by him to a trusted a person who will subsequently have to contact the parties to their notary to conclude a deed of gift.

Important : Remember that the donee, according to the legislation in force in 2020, does not have the right to issue a power of attorney for the donee himself, because, based on the information contained in paragraph 3 of Article 182 of the Civil Code of the Russian Federation - in this case, the parties giving and receiving the gift will perform as one person!

The main criteria when choosing a notary for participants in a transaction are the service provided by the office. Prices for services in 2020, due to high competition in this area, remain almost the same . Therefore, be sure to study customer reviews, noting:

- how quickly its employees work;

- Is the specialist polite and experienced in this matter?

- Is he ready to advise the client during the period of drawing up the deed of gift and its registration, etc.

EVERYONE NEEDS TO KNOW THIS:

Invalidation of a gift agreement

It is on these factors, from our point of view, that effective business relationships are built, and since, starting from 2020, 90% of transactions are accompanied by notaries and they have no shortage of orders, some of them, in pursuit of fees, have stopped monitoring the quality of the services they provide.

In turn, the Legal Ambulance website offers a free consultation to anyone facing problems or uncertainty in legal matters! Just call us or describe your case in one of the feedback forms in the article!

But, let’s return to the stages of making a donation with a notary.

Collection of documents at the first stage

Let us immediately note that all of the listed documents required to accompany the deed of gift by a notary are needed in their originals! At the same time, the parties are recommended to contact a specialist at the stage of concluding a verbal agreement, so that he has more time to study the situation as a whole and create a list of certificates and deeds needed for donating a house, car or other property.

If necessary, the notary may come to the parties in person. For example, quite often this happens if one of the parties has health problems or cannot leave the apartment due to advanced age. The main rule is that the client must understand the consequences of his actions when drawing up and signing the contract.

Today, the list of mandatory documents to accompany a deed of gift by a notary includes:

- passports of the parties to the transaction (donor and recipient);

- if the recipient is 14 years old but not yet 18 years old, you will need not only his passport, but also the passport of one of his legal representatives (parent or guardian);

- if the party receiving the gift is a person who is not yet 14 years old at the time of concluding the transaction, you will need his birth certificate and the passport of the child’s legal representative;

- a certificate confirming the registration of ownership or an extract from the Unified State Register of Real Estate (for real estate);

The last papers must be in the hands of the donor, as they serve as the basis for the legal conduct of the transaction. Simply put, they prove that the donor is the owner of the donated living space.

EVERYONE NEEDS TO KNOW THIS:

How to draw up a gift agreement for parents - mother or father

Also, we note that although the registration certificates were canceled in the summer of 2020, if you have a document issued earlier, be sure to present it to the notary.

If you do not have a certificate, then an extract from the Unified State Register of Real Estate, which confirms ownership, listing all owners of the donated real estate, is suitable as a similar title document. Getting such an extract is easy! To do this, you need to submit a corresponding request to the MFC or the Registration Chamber and pay 400 Russian rubles.

Also, before accepting a gift, we recommend that the recipient check whether the property is pledged to the bank, as we described in the article on donating an apartment with a mortgage.

- foundation agreement, which is an agreement on the basis of which the owner of the apartment can dispose of it as he wants, a purchase and sale agreement, an inheritance certificate or any other similar document (for example, a privatization agreement);

- a technical passport for the living space (apartment or house), which the donor can obtain through the MFC or from BTI employees;

- written notarized consent of the spouse to carry out a transaction with property included in the jointly acquired property;

This document, according to paragraph 3 of Article 35 of the Family Code of the Russian Federation, must be certified by a notary. The cost of the procedure today ranges from 1,000 to 2,000 Russian rubles. You can learn about donations between spouses by clicking on the link.

- documents confirming the relationship of the parties, if any;

In previous articles of this section, we have repeatedly mentioned the fact that, when receiving a donated car, apartment, garage and other property, the donee, who is not a relative of the donor, must pay the corresponding tax, amounting to 13% of the total market value of the object of the transaction. At the same time, a gift to a person included in the category of close relatives, a list of which you can find in paragraph 18.1 217 of Article of the Tax Code of the Russian Federation, is not subject to taxation.

At the same time, when conducting transactions, each notary is obliged to report information concerning them to the tax office. This also applies to data on the relationship of the participating parties (according to paragraph 6, paragraph 85 of Article of the Tax Code of the Russian Federation).

- an extract from the house register, which is also often called a certificate of family composition or a certificate of registered persons;

- a medical certificate from a psychoneurological dispensary, which can sometimes be requested by a notary to confirm the fact that the donor acts consciously, fully aware of his actions;

- a medical certificate from a narcological clinic, which the specialist accompanying the donation transaction may require to prove the adequacy of the identity of the participant in the donation.

Drawing up and notarizing a deed of gift at the second stage

At the next stage, after collecting the documentation, you can visit the notary and hand over the documents to him.

The specialist will draw up the correct gift agreement (at least 3 copies will be drawn up), which will need to be signed by the parties to the transaction in his presence. Moreover, if the donee party is a person who has not yet turned 14 years old, his legal representative can conclude the transaction instead. If the child has already turned 14, but is under 18 years old, he himself signs the deed of gift, after which the document is also signed by his guardian or parent.

Important : The total number of copies of the main act depends on how many participants in the donation are present when it is certified. In any case, 1 copy of the deed of gift remains in the archives of the notary himself.

After the document is signed by the donee and the donor, the notary certifies the gift agreement and issues one copy to each of the parties. At the same time, the person who accepted the gift will receive a deed of gift drawn up on a form specially established by law with watermarks, while the donor and the notary will receive a deed of gift on plain paper.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement between legal entities

List of documents for registration of donation

Any transaction relating to real estate, for example, its donation, does not in itself mean a transfer of rights to it, unless registration has been carried out. For this procedure, you need to collect a list of documents. Participants in the transaction must visit Rosreestr with:

Depending on the situation, additional paperwork may be required:

- consent of one of the spouses to dispose of property acquired during marriage;

- consent of the creditor. Typically, banking organizations give it very rarely;

- consent of representatives of a minor or incompetent citizen;

- consent of the guardianship and trusteeship authorities. It will be required if a child or a person with disabilities is registered in the living space.

When the documents have been collected and the deed of gift has been drawn up, you need to visit the registration chamber.

Is it possible to draw up a deed of gift without a notary?

The gift of property is a two-way transaction and implies the consent of the donee to accept the thing. Taking into account the provisions of Art. 574 of the Civil Code of the Russian Federation, an agreement can be concluded orally or in writing; accordingly, a transaction is recognized as valid only after consent to accept the gift in the same form .

Important

When an agreement is concluded orally, the moment of making a gift is the transfer of the thing and its actual acceptance by the other party. If there is a written agreement, the transaction is concluded from the moment the agreement is signed by both participants and the item is received into the possession of the donee.

The legislation establishes the conditions under which a deed of gift must be made in writing , namely when transferring real estate. This is due to the fact that such a transaction is subject to state registration, and for its implementation it is necessary to provide a written agreement and attach documents to it (clause 1 of Article 131 of the Civil Code of the Russian Federation).

Until 1998, for state registration of the transfer of ownership of real estate, a mandatory notarial form of a gift agreement was established. Currently, the law does not oblige you to contact a notary to conclude such a transaction, with the exception of the following cases:

- the object of donation is in common ownership;

- property acquired during marriage;

- the donation occurs with the permission of the guardianship and trusteeship authorities from a minor or incompetent citizen.

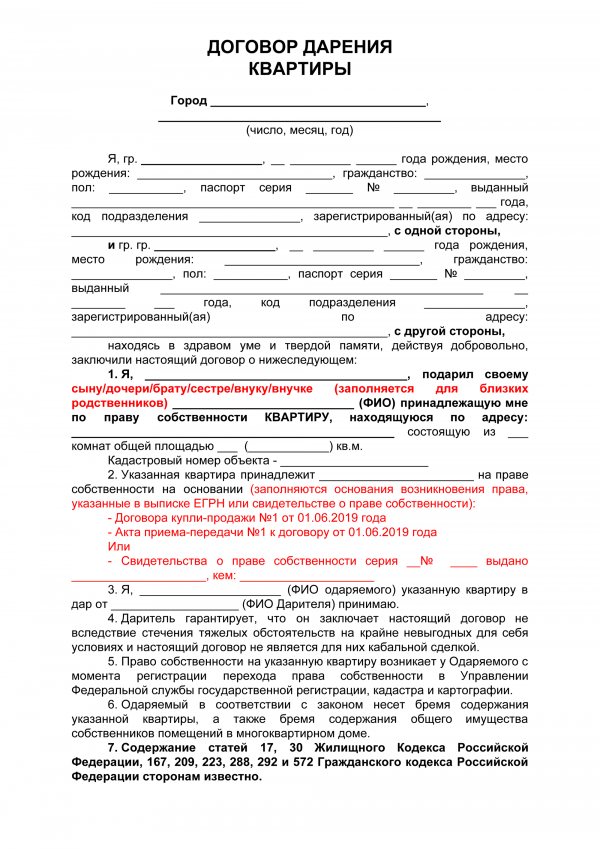

Mandatory provisions of the gift agreement

There are no difficulties in preparing a deed of gift without a notary. The main thing is to check whether the form is drawn up correctly and the terms of the agreement are correct.

Transferring property to a relative without legal representatives is possible for any capable citizen. Any person can receive a gift, regardless of profession, social status, or financial status.

The legislation does not strictly regulate the form of deed of gift without a notary. It is important that the owner takes action in writing . The document must contain mandatory terms that minimize errors and incorrectness. Necessary:

- Make a detailed description of the apartment using the documentation for it.

- Indicate the condition of the living space.

- Inform the start date of the agreement.

- Prescribe the complete transfer of rights to ownership and disposal of the donated object.

- Note that there are no other citizens who can claim the property.

- Specify the person who will pay the cost of the registration procedure.

- Describe the degree of relationship.

- Confirm in writing that both parties have familiarized themselves with the provisions of the civil code relating to property issues.

- Write down how many copies of the deed of gift have been made.

- List the papers confirming ownership rights.

Each participant in the transaction receives his own contract form. First, the paper must be filled out by the donor and the recipient together. At the end they leave their signatures.

Sample gift agreement without a notary:

If the owner has correctly drawn up a deed of donation of an apartment without a notary, then after his death it is difficult to challenge the document. This action can be carried out in court.

The person receiving the gift may refuse it before the transfer is completed. This must be done in writing. The donor must visit the court to cancel the transaction. This is possible in case of an attempt on the recipient’s life or infliction of severe bodily harm.

How to draw up a gift agreement correctly

This procedure is quite simple and has a number of advantages. However, if the document is incorrectly drafted or contains errors in the text, problems may arise.

Because of these errors, the gift deed may be returned and rejected. If after some time the donor decides to return his property, he can challenge the transaction in court, using errors or inaccuracies in the contract that were missed during execution. Therefore, the recipient needs to be especially careful. It is in his interests to conclude the deal without fail.

In order to avoid mistakes in drawing up a deed of gift and simplify the procedure for completing the transaction, you can use the services of a notary. A specialist always knows the intricacies of the procedure better.

However, you can draw up a gift agreement without a notary. It will need to be taken to the Registration Chamber independently, without the help of a notary.

Absolutely anyone can draw up a deed of gift without a notary. If the donor intends to transfer his property to a relative, neither the place of work nor the financial status of the donee is taken into account.

Strangers are a little limited, because in order to avoid corruption, they do not have the right to be recipients:

- Teachers

- Doctors

- Civil servants

Registration

After collecting the necessary documents, participants in the process must contact Rosreestr. an application based on them .

When the state act is handed over, the parties sign receipts stating that the list of documents has been submitted. reviews the application within ten working days If the transaction is approved, the recipient will be issued a certificate of ownership .

Attention! For close relatives there is no need to pay income tax (13%). This category includes parents, children, and spouses. But before the procedure, you must pay the state fee.

Terms and cost of the transaction

Rosreestr employees must consider the appeal within 10 days. When the regulated period expires, documents are issued. The process of registering a deed of gift for an apartment without a notary will cost each party one thousand rubles .

Reference! To register ownership rights, you must pay a state fee of 2000 rubles. The costs are borne by the person receiving the gift.