Deposit agreement for the purchase of land

A deposit agreement for the purchase of a land plot is signed between the seller and the buyer of the plot to confirm the buyer’s intentions to purchase the plot and the seller’s intentions to sell this plot, as well as fixing the main terms of the future agreement.

The parties sign after inspecting the site and documents confirming the seller’s ownership of the site, in particular after checking the certificate of ownership. The amount of the deposit is determined by agreement between the parties and is not regulated by law. In practice, most often there are contracts with a deposit amounting to 5-10%.

After signing the contract, the buyer transfers the amount agreed upon by the contract to the seller (deposits into the account or gives in cash). We recommend that all transactions be carried out through a bank, depositing the required amount into the account

. So, if the seller refuses to sell, it will be easier to prove the fact of making a deposit.

As a rule, after signing the deposit agreement, the seller undertakes to stop searching for a buyer for his plot (removes advertisements, suspends showings, etc.), and the buyer stops searching for the land plot.

If the seller refuses to sell the land, he is obliged to return the deposit amount to the buyer and pay a fine in the amount of the deposit for failure to deal.

If the buyer refuses to purchase the land, the amount of the deposit is not returned by the seller to the buyer .

The essence of the deposit agreement is to insure the risk of the parties against refusal or change of the agreements reached. Therefore, it is recommended to specify in the deposit agreement as many agreements reached by the parties as possible. The contract must necessarily contain the address of the land plot and other information on the basis of which it is possible to accurately identify the property being sold.

Download the land deposit agreement form in docx or pdf format

See also:

Template for deposit agreement when purchasing a car

Template for deposit agreement when purchasing an apartment

Deposit agreement for the purchase of equipment (download)

How to properly draw up a deposit when purchasing a plot of land

Having identified the plot of land you are looking for, check with the owner about its value. If the parties have reached a consensus on financial issues and the buyer is ready to make an advance payment, a deposit agreement is drawn up. He reserves the property for this buyer and after this agreement is completed, the property is removed from sale.

Article 380 of the Civil Code of the Russian Federation states that a deposit when purchasing a plot of land is a guarantee of the transaction. It is paid as an advance payment, but when the acquirer exits the transaction, it is not returned. According to Article 381 of the Civil Code, if the transaction fails due to the fault of the seller, then the deposit is paid in double amount.

If you want to protect yourself from unexpected incidents and have the right to withdraw the deposit if the deal fails, indicate that the amount was paid as an advance payment. In this case, the opposing party will return the advance only in the amount in which it was received if it finds another buyer. Thus, the guarantees are almost zero.

The amount of the deposit is established by agreement of the parties, and is not enshrined in regulations. Agreements with a deposit amount ranging from 5% to 10% are widespread.

The deposit agreement is drawn up in two situations:

- The acquirer does not have the amount necessary to purchase a plot of land and plans to receive funds soon (is applying for a loan, preparing to receive an inheritance, selling his own property, and so on);

- The seller does not have certain documents necessary to formalize the purchase and sale agreement.

An earnest money agreement is an ideal method of securing the right to purchase land for a specific person. Since both parties sign the deposit agreement, the risk of deprivation of funds and fraud is minimal.

The contents of the document indicate the final price of the plot, which allows the parties to definitely know the amount to be paid based on the results of the contract.

If, due to certain circumstances, the transaction fails due to the fault of the seller, the deposit is transferred to the buyer in double amount. If the buyer is at fault, he will lose the amount paid. If disagreements arise, the deposit agreement can act as documentary evidence of the transfer of money in court.

In order to figure out whether it is necessary to draw up a deposit agreement, you need to understand what a deposit is from a legal point of view. This concept is enshrined in Article 380 of the Civil Code of the Russian Federation and defines a deposit as a financial payment transferred in favor of one of the parties to the transaction against the assigned payments under the main contract as confirmation of the conclusion in the near future and a guarantee of its execution.

If the buyer gives a certain amount to the seller without written documentation, he will not be able to return these funds legally. In addition to the agreement, a receipt can confirm the fact of transfer of money.

In the event of fraudulent actions by the seller, it will be extremely difficult to insist that you are right without documentary evidence. Since there will be little oral evidence in court, do not neglect to create an official document.

To formalize a deposit agreement, the following documents are required:

- Identification documents of the parties;

- An extract from the Unified State Register of Real Estate, or a certificate of land ownership;

- Cadastral passport (if available);

- Documents establishing ownership of structures located on the land (if any).

In addition to the above documents, others may be needed, depending on the situation. Drawing up an earnest money agreement will help the seller collect the missing documents without wasting time and without fear that the transaction will not go through.

First you need to find out whether the documents provided are genuine. Carefully analyze the title documents. Compare the cadastral numbers, territory and other data of the land plot. When creating text, accurately enter the details of your identification documents (full name, address, etc.). If errors are found, the document may be invalidated.

Do not give money or enter into an agreement if the seller does not have a certificate of ownership or an extract from the Unified State Register of Real Estate! The presence of these documents is a prerequisite for the sale of land, so if you don’t have at least one of them, you should look for another plot to purchase.

Be sure to discuss the amount of the deposit in advance. Fix this amount in the agreement.

See the preliminary contract for the purchase and sale of a private house with a plot of land here.

How to draw up a contract for the sale and purchase of a residential building with a plot of land, read the link:

A very important nuance is the duration of the agreement. Most often, the document is issued for a maximum of two months. This time should be enough to prepare for the purchase and sale. The next day after the agreement ends, you need to put your signatures on the contract for the sale and purchase of a plot of land.

When inspecting the property being purchased, you must pay special attention to the following:

- Existence of structures. If there are buildings, remember their number;

- Properties of buildings. Are they intended for housing, the material of the structure, their dimensions;

- The presence of vegetation on the ground;

- The correct location of structures relative to the boundaries of the plot and trees.

This information will be needed to compare documents with what is actually on the site. For example, if there are structures on the site that are not recorded in the technical plan, the new owner may have difficulties, since these buildings are recognized as unauthorized.

What is a deposit, why is it needed, and what documents are required?

Earnest money is a cash payment that is given to the seller before the actual purchase of the property. Its functions:

- helps the buyer book an attractive option for purchasing a living space (or other property);

- proves that the parties have reached certain agreements;

- plays the role of an advance payment (part of the price of the apartment is paid). Typically the amount is set as a percentage of the price of the property.

In order for the deposit to be regulated by the law of the Russian Federation, written agreements are drawn up between individuals:

- contract (agreement) for the transfer of the deposit payment;

- preliminary purchase and sale agreement (primary before the main purchase and sale document);

- a receipt from the seller that he has received the earnest money payment.

The deposit agreement is drawn up separately or attached to the primary contract when purchasing an apartment.

Agreement on deposit: is it necessary to draw up

If you want the deposit to be regulated by law, be sure to draw up a document. Moreover, only written form is considered, no oral agreements.

In general, the decision to transfer money before purchasing is voluntary. But, you must admit, the procedure for acquiring real estate in itself (as well as its sale) is a very risky business due to the high cost of property and the sufficient complexity of the legal procedure itself

. Receiving a deposit for an apartment provides at least some guarantee that the transaction will go through.

By the way! A deposit and a simple advance payment also serve as such a guarantee.

Deposit agreement for the purchase of land - sample 2017

When purchasing an apartment, house or land, the sample document will look the same:

(date of compilation) (localty in which it was compiled) (Last name, first name, patronymic, date of birth, passport data), hereinafter referred to as the Buyer and (Last name, first name, patronymic, date of birth, passport data), hereinafter referred to as the Seller, have entered into this agreement on the following:

1.1 The Buyer transferred and the Seller received the amount of the deposit in the amount of (indicate the amount in figures and words in rubles), as a guarantee of signing the purchase and sale agreement (indicate the type of real estate that will be purchased, its full address of location, on what grounds it belongs to the Seller). 1.2 The deposit amount was transferred to the Seller (indicate how the money was transferred).

2.1 The Buyer undertakes to purchase the above-mentioned object, and the Seller undertakes to sell the above-mentioned object within the period during which this document is valid. 2.2 If the Buyer fails to fulfill its obligations, the full amount of the deposit remains with the Seller.

Validity 3.1 This agreement is valid from (specify the full day, month, year) to (specify the full day, month, year) inclusive.

4.1 The Agreement is drawn up in (specify the number) copies, one for each participant in the transaction. 4.2 (At the request of the parties, any other conditions can be specified). | |

Passed on

| Received

|

It is not always possible to immediately draw up a purchase and sale agreement for a land plot that the buyer liked due to its location, size, shape, and also fits into the price bracket, the limits of which were outlined by the future owner according to his capabilities.

How to transfer the deposit correctly and not be deceived?

How is the deposit transferred?

First, agree with the other party in what form you are willing to accept the money: in cash or by transfer (indicate “Deposit for” in the purpose). In any case, the fact of transfer is documented in writing, for this you will need a receipt

. Some points when transferring the deposit:

- the party accepting the deposit writes the receipt manually with a simple ballpoint pen;

- funds are given only after signing the paper;

- It would not be a bad idea to involve independent witnesses (they will be present when drawing up the receipt and transferring the money; relatives will not come up).

For your information! Money can be left in a safe deposit box.

What is indicated in the receipt:

- information about both parties;

- the total expression of the deposit (how much money is transferred in numerical value and in words);

- indicates the number of the contract under which the property will be purchased;

- A brief description of the acquired property is given.

The receipt is sealed with a signature.

Deposit and advance: what are the differences?

If the transfer of money is not documented, it will no longer be a deposit, but a regular advance. Such payment is not regulated in any way by law.

.

If the deal falls through (no matter whose fault), the advance is simply returned to the owner

. The table clearly shows the main differences between a deposit and an advance payment.

| Advance payment | Deposit |

| Not documented | A standard deposit agreement is drawn up (a sample can be downloaded on the Internet). |

| Immediately counted towards payment for the purchase of property, but does not guarantee the purchase itself | Counted into the price of the property. |

| In any case, it is returned to the buyer if the deal fails. | Remains with the seller in full if the transaction is terminated due to the fault of the buyer. If the transaction is terminated due to the fault of the seller, the deposit is returned to the buyer in double amount. |

Important! In order for the payment to move from an advance payment to the category of an earnest money deposit, the parties enter into written agreements (deposit and preliminary purchase and sale agreement). Moreover, one agreement without the other is impossible - the Laws in such cases do not apply to them, and the transferred funds will be counted as a simple advance.

Deposit agreement for the purchase of a house with land

What form of agreement should I use when making a deposit?

In general, the Civil Code has norms that establish general rules for registering a deposit. These are Articles 380 and 381 of the Civil Code of the Russian Federation.

380 st. The Civil Code clarifies the concept and establishes some important points, for example, that if the deposit is not filled out correctly, the court may consider this amount an advance. And this causes other consequences. But we will look at the differences between a deposit and an advance in more detail in the next paragraph.

In addition, this article provides for the possibility of specifying the basic terms of the transaction in the preliminary agreement. And if executed correctly, they will be conditions for the main contract.

The second article (381) sets out the consequences in case of failure by the parties to fulfill their obligations. This article also refers to another article of the Civil Code, which provides the concept of termination of an obligation due to the impossibility of its fulfillment.

Thus, compliance with a written form of the contract with the main points will be a good guarantee for the parties that the transaction will be completed successfully.

Sample 2020 download

The latest changes in legislation regarding deposits were made in 2020, so in general, the main clauses of the agreement have not undergone significant changes.

Here are the main parameters that must be present in the deposit agreement:

- The details of the participants in the transaction are fully indicated so that they can be accurately identified.

- If the house has several owners, then everyone must be included, because each of them has a vote in the decision to sell the house.

- The price agreed upon by the buyer and seller for a home, as well as the amount of earnest money required.

- The date on which final settlement is expected to be made and the transaction completed.

- Description of the house that is the subject of the transaction, with full characteristics.

- Responsibility for each party. Specifying responsibilities in a contract will more effectively ensure compliance with the terms of the contract than referring to the law.

- Other conditions. Here you can provide for some additional conditions that are important for participants, for example, the absence of debt on utility bills.

The deposit agreement can be written out in detail and carefully, and duplication of conditions in the final purchase and sale agreement may not be required, according to clause 3 of Art. 380 Civil Code of the Russian Federation.

Order a contract

In order to complete the entire procedure as accurately as possible, we recommend that you download on our website a sample contract that is relevant for this year.

Sample receipt

The receipt is very important. If the word “deposit” does not appear in it, the court will be inclined to believe that the transfer of money is an advance. And this entails other legal consequences for the parties.

At the same time, it is also recommended to include the full details of the seller and buyer in the receipt so that, if necessary, they can be accurately identified. It is also recommended to indicate the property in respect of which the contract has been drawn up and the deposit amount is transferred according to the receipt. The seller must also include the date of receipt of funds and a handwritten signature.

If you have any doubts about how to correctly issue a receipt for the deposit, we also offer you receipts on our website.

How is a deposit payment made?

The payment is documented and signed by the parties to the transaction. The Civil Code does not provide for a standard model, so you can draw up a document yourself, but be sure to indicate:

- data of the parties involved in the transaction (passport, full name);

- information about the deposit payment (its amount in numbers and in words);

- what responsibility is provided for each of those participating in the transaction;

- brief information about the agreement under which the deposit payment is transferred.

The earnest money agreement can be drawn up as an appendix to the contract, and the fact that the seller has accepted the money - a written receipt - can also be attached there.

Is one receipt enough?

The receipt only confirms the fact of transfer of money, but does not provide any legal guarantees to either party. To secure a transaction, such a document is also not enough.

Features of signing

The documents are signed by all parties to the transaction. Therefore, absolutely all property owners are taken into account

.

They also act as sellers under a contract. The interests of children under 18 years of age are represented by legal representatives

.

By the way, the deposit amount is divided in equal parts between all property owners. For example, with a deposit payment of two hundred thousand rubles, four owners will receive fifty thousand each.

Rules for issuing a receipt for receipt of a deposit for a house and land plot

In order for the document to acquire full legal force, it will be enough to fill it out by hand, ensuring that it contains the following data:

- Full name of each party and their passport details;

- an indication of the exact amount of transferred funds in figures with clarification in writing, as well as a determination of the exact purpose of the transferred money;

- technical information about the property being transferred, including its area, cadastral number, and the size of the surrounding area;

- the exact date of execution of the transaction and signing of the receipt;

- signature of the person who previously owned the specified property, with a transcript.

When conducting a transaction, you should always insist that the former owner sign a receipt in the presence of not only the other party, but also several witnesses. At the same time, if you managed to draw up this document in the presence of third parties, it is highly recommended to indicate their passport details and signatures in the document. In this case, it will be possible to exclude any attempts to challenge the certified receipt in court if for some reason the former owner decides to say that he did not receive any money and they are trying to deceive him.

In the process of preparing all the documents necessary for a real estate purchase and sale transaction, you should prepare in advance a sample in accordance with which they should be filled out. Using a sample, you will be able to avoid some serious mistakes and save a lot of time that would have to be spent studying all the fields.

What payment amount will be optimal?

The final payment amount is not regulated by Russian legislation, so in fact it can be anything: at least 100 rubles, at least one million. The amount is negotiated and fixed by agreement.

In any case, the payment will be counted towards the main cost of the property.

Eg! If the property costs 3,120,225 rubles. and a deposit of 100,000 rubles has been made on it, then after the conclusion of the main contract the buyer will have to pay an additional 3,020,225 rubles.

The amount of the deposit can be calculated from the main price as a percentage. For an apartment this value fluctuates at 5-10%

.

In fact, it is not beneficial for anyone to make a large amount of the deposit payment, because if the deal is terminated due to their fault, the same amount (at least) will have to be returned

.

Refund

This method of securing the obligations of the parties is quite popular in the real estate market, since we are talking about considerable amounts. The risk of losing money encourages the buyer and seller to approach the purchase and sale transaction responsibly. According to legal norms, if the transaction fails due to the fault of the seller, the deposit must be returned to the buyer in 2 times the amount. If the deal falls through due to the fault of the buyer, he will lose his money paid as a deposit. This procedure is prescribed in Art. 381. Civil Code of the Russian Federation.

The buyer can return the deposit only in one case, if he proves fraud on the part of the seller, legal impurity of the site, or that he was not provided with a full range of information during the preliminary approval of the transaction (for example, the seller kept silent about the presence of defects that do not allow normal operation area in accordance with its purpose).

If the specified requirements for the return of the deposit to the buyer in double amount are ignored, he has the right to go to court to protect his interests. He will have to prove that the seller is avoiding or refusing to conclude the transaction.

What happens after termination of the contract

Termination of a transaction occurs in four cases:

- the seller is to blame: he did not prepare the paperwork on time, found an option to sell at a higher price, or changed his mind about selling the property altogether;

- the buyer is to blame: he found a cheaper apartment, changed his mind about buying, did not have time to find the required amount;

- it doesn’t matter who is ultimately to blame, the parties change their minds about entering into a deal by agreement;

- An unforeseen event occurred that made the transaction impossible.

Depending on who and what caused the termination of the agreements, the amount of money returned, as well as compensation for additional costs, depends.

Let's take a closer look at termination of the contract by agreement of the parties and the possibility of returning the deposit.

When is the deposit returned to the buyer?

Money is returned:

- double the amount if the seller is at fault and the transaction does not take place;

- to the same extent if the transaction did not go through due to the fault of the buyer or force majeure;

- in the same amount if the parties decide not to carry out the transaction.

In addition, if the contract is not fulfilled on time due to the fault of the seller, the second party has the right to demand compensation for various types of damage, as well as legal costs.

Deposit agreement for the purchase of a house with land

It is not necessary to notarize the deposit agreement, however, if the transaction price is quite high, which often happens when purchasing households with plots of land, it is advisable to use this procedure. The deposit agreement does not have a specially designed form for execution, but its content must necessarily reflect some basic provisions.

When drawing up this document, record the following points in it:

- personal information about the participants in the transaction, which involves indicating the full name, passport details, including registration, of both the alienator and the acquirer;

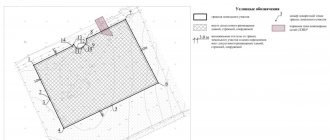

- designation of the subject of the contract, which is a specific landholding and a residential building built on it, a detailed description of these objects must be given to each individual.

The text of the section containing information about the allotment should reflect the following information:

- unique number of the plot according to the cadastre;

- exact location of the landholding;

- parameters of the alienated plot.

In relation to home ownership, in addition to the address and area, it is necessary to provide information regarding:

- number of floors;

- rights and obligations of the owner of the property being sold and the documents that confirm them.

Then the specified agreement on the deposit for real estate provides the following information:

- the amount of the transferred amount acting as a deposit (indicate how the agreed amount will be transferred);

- what is the responsibility of the parties to the transaction when it occurs (list possible violations of the terms of the contract by the seller and the buyer in accordance with the terms of the contract). For example, this may be the obligation of the seller to pay the buyer finances equal to double the amount of the deposit if a certain violation of the terms of the agreement is committed; the guilty actions of the acquirer provide for the release of the seller from returning the amount of the deposit received, etc.;

- Dedicate a separate paragraph to emergency situations that may arise, and provide for the sequence of actions of both parties to the contract in the event of such incidents;

- An essential point when concluding an agreement is the mandatory indication of the deadlines that indicate the time of entry into force of the agreement (in this way you get the opportunity to eliminate any inaccuracies and shortcomings before concluding the transaction);

- The last paragraph of the deposit agreement must contain the date and place of execution of the document.

The draft agreement must be signed by the seller and the buyer of the property specified in it.

The entry into force of the agreement is determined by the moment it is signed by the parties to the transaction. There is no need to register the document with the Rosreestr authorities. Although it is not necessary to have it certified by a notary, it is still recommended to visit a competent specialist.

The notary will conduct a legal examination of the drawn up contract and assist in its proper execution. In addition, the participation of the specified person provides guarantees of the legality of the transaction being concluded and the legal capacity of its participants. Remember that in cases of transfer of a deposit for real estate, participants in the procedure bear certain risks and may encounter some difficulties.

See the preliminary contract for the purchase and sale of a private house with a plot of land here.

For documents for selling a house with land, see the link:

In this case, the buyer is at greatest risk, so if you decide to purchase real estate, when drawing up a deposit agreement, pay attention to the following aspects:

- It is advisable to conclude a contract after inspecting the land plot and residential building, checking the package of documentation for the specified objects. If the seller promises to perform the specified actions in the future, in order to avoid problems, it is better not to rush to transfer the money;

- Before you proceed to signing the document, make sure that the remaining amount of money for the purchase of the property will be available when completing the sale and purchase. If you are not sure that you will receive the required finances (for example, if a loan from a financial institution has not yet been approved), assess all your risks and possible consequences regarding the transfer of the deposit, taking into account the expected difficulties;

- The size of the deposit should not be very large. This is justified not only by the fact that the buyer is trying to reduce possible costs subject to changing circumstances. Even if the transaction does not take place due to the fault of the alienator, the return of the deposit and the collection of penalties will occur in court. In this case, during the proceedings, it may be established that the seller does not have the required amount (for example, if he is unemployed and does not own property). In such circumstances, it will be very difficult to return the transferred finances;

- Please keep in mind that the title of the document must include the word “deposit”. Only if this condition is met, the provisions of the Civil Code of the Russian Federation that relate to the specified method of transferring funds will be applied to the executed contract.

Do not exclude the option of contacting a notary - after all, the money spent on providing such services, as a rule, amounts to a significantly smaller amount than the money that can be lost if the deposit agreement is not properly drawn up.

What must be specified in the initial agreement for the purchase of property

The form of the initial contract is also not regulated by the Civil Code or other legal acts. All that is important is documentation, signing and mandatory indication of the following points:

- information about the entities involved in the transaction (names, surnames and data from the passport are indicated);

- date of preparation of the document;

- brief description of the object of purchase of the contract. If this is an apartment, then the address, number of rooms, set price, etc. are written down;

- until what date the main agreement will be signed (if necessary, the date can be delayed by an additional agreement);

- what amount of money was paid as a deposit payment;

- in what order the buyer will pay the remaining part of the price;

- what to do in the event of force majeure situations.

At the end, the signature of all participants is affixed manually.

Important features when purchasing an apartment, house or cottage, land, garage and car

A deposit can be made when purchasing absolutely any property. But depending on the subject of the contract, take into account some features of the transactions

.

We give examples of the main ones

. Read them carefully before you sign the documents and give away your hard-earned money.

Apartment

Before concluding agreements, check the owner and the apartment. Order a certificate from the Unified State Register of Real Estate, ask the owners for an extract from the house building and a certificate of the absence of any debts to utility services and the management company

. These actions will protect you from purchasing an apartment with restrictions (mortgage, seizure and registration restrictions); with debts to pay (the new owner will have to pay); with restrictions on property rights (unregistered owners, heirs, etc.).

Land plot (with and without buildings)

Make sure that the land plot is transferred to the ownership of the owner, and not for long-term lease. Check the availability of technical documentation, pay special attention to the survey plan.

Fact! Objects located on a land plot must also be registered in ownership.

House, townhouse

Make sure that the land plot has clearly defined boundaries (land surveying has been carried out). Also make sure that the land on which the house is located is also registered as the property title.

Garage building

If you are purchasing a garage, first of all check whether the seller owns a land plot in addition to the real estate. You also need to check whether there is consent from municipal authorities for the construction of a garage within this land plot.

Country house, country house

Before concluding a transaction to purchase a summer house, you need to check the availability of ownership. You should also make sure that all owners are involved in the transaction and act as the seller.

When purchasing a summer cottage, follow these tips for purchasing land and a house:

- check the technical documentation and the presence of a land surveying plan;

- make sure of the registered ownership of both the land plot and the buildings located on it.

Commercial real estate

- Request technical documentation for the property (regardless of whether you are going to buy an office or industrial premises).

- Check the ownership, absence of encumbrances and arrears in payments.

- Check whether the premises meet fire safety and sanitary standards.

Passenger and cargo transport

Before transferring the deposit, do not forget:

- request information from the traffic police about fines, arrests, and restrictions on registering property rights;

- check the availability of a mortgage on the car through the website of the Federal Notary Chamber or another service.

As a rule, when buying a car, the deposit is limited to 10 thousand rubles.