For most families, a sad day inevitably comes when a loved one leaves this world due to old age. Along with emotional stress, relatives are hit with organizational stress, which, no matter how much one would like it, cannot be avoided. A lot of time is occupied by issues of the deceased’s inheritance, which should go to his relatives. In addition to property in the form of living quarters and various material items (which are most often inherited), a pension is also the object of hereditary claims. Sometimes it happens that the pension recipient died before receiving the last payment: in this case, the relatives of the deceased can receive it. Therefore, questions naturally arise: can relatives receive the pension of the deceased? How to receive a pension for a deceased relative? Who has the right to claim a pension for the deceased? Are there exceptions and limitations? What documents will be required?

In this article we will answer these questions.

Is the pension accrued after death?

As soon as the question arises of how to receive the pension of a deceased relative, it is best to understand the features of pension accruals.

The pensioner receives cash payments to his account every month. This process stops on the 1st of the following month after the death occurs. However, if the pensioner did not withdraw the last accrued pension from the account before his death (sometimes several pensions in recent months), the relatives who lived with the deceased have every right to claim the entire remaining shortfall in pension accruals.

Whatever the date of death, the payment must be accrued for the entire month. Even in cases where death occurs on the 1st of the month, money is accrued in full. If at least part of them, in comparison with the full monthly payment, is withheld, this is illegal and may be a reason for going to court.

Funeral benefit

Calculation of pension after the death of a person

The death of a loved one is always a loss for family members and friends, regardless of the citizen’s advanced age. In addition to the psychological tragedy, relatives have a need to organize a burial and wake. Family members have the right to apply for assistance from the state, including applying for a pension for the deceased.

Claimants for deceased person's benefits

Regulatory documents regulate the timing of receiving benefits for a deceased person, as well as the list of citizens who have the right to apply. Payments are subject to compliance with the following points:

- belonging to family members, i.e. immediate relatives;

- documentary confirmation.

During the registration process, employees of the Pension Fund body consider the meaning of the first point. As a rule, money is transferred to children, grandchildren, husband or wife. In this case, it is important to live together at the time of death, which is also confirmed by papers. A simple option to prove the fact of living together with the deceased is the presence of registration in the same living space. To do this, you need to request an extract from the house register from the management company or homeowners association.

It is established at the legislative level that relatives have the right to claim social benefits in the amount of two pensions of a deceased pensioner. In addition to family members, dependents of a deceased citizen can apply for benefits.

Please note: relatives will be able to receive a pension for a deceased pensioner, provided that no payments were made during the reporting period. In addition, citizens are entitled to state assistance for organizing funerals. The amount is equal to 2 benefits of the deceased.

The legislator allows close relatives to issue certain types of subsidies:

- insurance payments;

- storage part;

- means of a military man.

If several persons apply to receive contributions, the amount of social compensation is paid based on each applicant. For example, if the husband dies, the pension can be divided between the widow, children and parents. Additionally, funeral arrangements are provided.

The nuances of receiving a pension for a deceased relative

Benefit payment period

The pension system operates in such a way that a citizen receives government benefits before death and after reaching the appropriate age. Length of employment affects the amount of subsidies. If there is not enough period of work, then the person is awarded a minimum amount of benefits. What these situations have in common is that upon death, payments stop. The exact period for completing the transfer of subsidies is established in Federal Law No. 400 of December 28, 2013 - Article 25, paragraph 1.

Read also: Inheriting a car after the death of the owner

According to the legislation of the Russian Federation, after the death of a person, pension payments to the deceased person stop on the first day of the month following the date of death.

For example, Prikhodko A.V. died on April 5, 2020. During the reporting period, the citizen did not receive funds. In view of this, the widow and other family members have the right to submit an application to the Pension Fund for registration of subsidies for the month of April.

An additional question that may be of interest to the relatives of the deceased is the period for which deductions are allowed. In this case, it matters how long the deceased did not receive funds. As a rule, this period is no more than a month, but in some situations the period may be longer.

For example, a man was undergoing hospital treatment, so he did not receive money in his hands. In such circumstances, relatives have the right to claim the entire amount not received.

Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”

Time for registration

The regulations establish that relatives can apply for a deceased husband’s pension within six months from the date of death. The day of death is recorded on the certificate. Otherwise, the money is provided based on a court order.

Who can apply for a deceased person's pension?

These are the closest direct relatives:

- children/grandchildren

- brothers/sisters

- parents of the deceased

If the situation develops in such a way that the deceased’s pension becomes the object of claims by several of his relatives at once, the paid amount is divided equally among all claimants.

How long does it take to receive a deceased person’s pension?

Sometimes no one applies for the deceased’s pension – this happens out of ignorance or due to lack of time. In any case, the period allotted for filing the relevant application is 6 (six) months. If no applicant expresses a desire to apply for payment, the remaining money is transferred to the estate of the deceased.

Who can claim payment

The legislation defines a list of persons who have the right to claim the payment not received by a pensioner:

- children, brothers, sisters and grandchildren under 18 years of age (up to 23 when studying full-time);

- one of the parents, regardless of age and ability to work;

- spouse of the deceased, regardless of age and ability to work;

- grandmother or grandfather of a pensioner, regardless of age and ability to work;

- brother, sister, child over 18 years of age, if they do not work, but are raising children, sisters, brothers and (or) grandchildren of the pension recipient under 14 years of age;

- both parents who have reached retirement age (60 men, 55 women);

- both parents are disabled;

- grandparents who have reached retirement age (60 - men, 55 - women) in the absence of persons who are obliged to support them;

- grandparents who are disabled in the absence of persons who are obliged to support them.

Please note that if none of the conditions are met or the deadlines set by law are violated, the lost pension of the deceased pensioner is credited to the inheritance estate, after which relatives can inherit the money in order of priority. The procedure for registering an inheritance is carried out through a notary.

- Earning Bitcoins

- Compensation for using a personal car for business purposes

- Top 6 gerontological centers

Is it possible to receive a pension for a deceased relative who lived separately from his relatives?

One of the questions that is asked most often is whether it is possible to receive a pension for a deceased person if he lived alone, apart? Alas, no, there is no legal basis for this. A document certifying the fact of cohabitation is a necessary condition to receive payment. If there are no applicants who have the appropriate confirmation of joint residence, 6 months after death the pension becomes part of the entire inherited property - the so-called. "hereditary mass".

In this case, the pension goes exclusively to persons who have entered into inheritance rights in relation to the deceased.

What documents are required to receive the deceased's pension?

In order to claim the pension savings of the deceased, his relatives must submit an application for their claim to the Pension Fund of the Russian Federation at his place of residence no later than 6 months. You need to take with you:

- Passport (of the person submitting the application)

- Application (requesting payment of funds not received by the deceased)

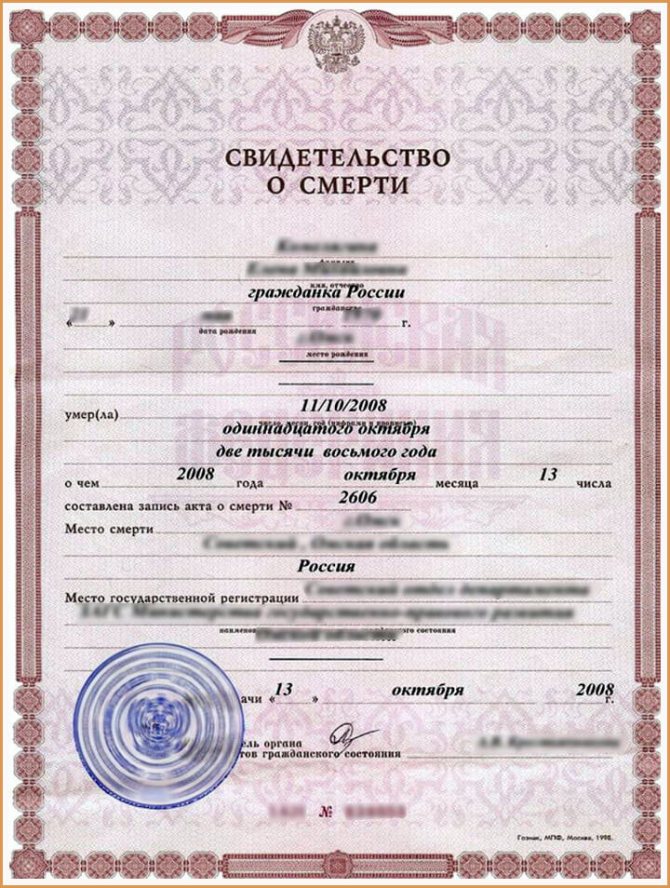

- Stamp death certificate

- Documents certifying that the applicant lived with the deceased in the same area (for example, an extract from the house register)

- A document certifying the relationship between the deceased and the person submitting the application (for example, birth certificates, marriage certificates)

The procedure for processing lost benefits

To process the pension payments of a deceased person, the widow, husband and other relatives must act according to the following scheme:

- Without waiting for six months from the date of death, contact the Pension Fund. However, before this, it is necessary to establish in which organization the funds were located - the Pension Fund of the Russian Federation or the Non-State Pension Fund.

- An application must be sent to the fund that pays subsidies.

- After 10 days, receive written notification.

- If employees of the organization have any comments, they should be addressed as soon as possible.

- If the verdict is positive, receive the money in the same way specified in the application.

If relatives do not have time to apply to the Pension Fund for benefits for a close family member within 6 months, then in the future the procedure moves to the court authorities. Citizens will need to provide evidence of a valid reason for missing a period.

List of documents

To receive an unclaimed pension from a deceased father, the applicant must send a package of documents to the government department:

- passport of a citizen of the Russian Federation;

- an application prepared on a special form;

- certificate of death of a pensioner;

Sample death certificate - papers confirming family ties with the deceased;

- SNILS of the deceased;

- documents indicating joint living and living arrangements;

- details of the relative applying for benefits.

The template is available for download on the official portal of the Russian Pension Fund.

In a situation where the deceased was a retired military personnel and was entitled to subsidies, a military ID is attached to the documents. If the department must transfer money to the applicant’s representative, then attach a notarized power of attorney.

Documents from relatives of a deceased military man or WWII participant

There is a separate category of relatives - the widow(ers) of a military person, namely, if the deceased citizen was:

- military personnel;

- an employee of the Ministry of Internal Affairs, the Ministry of Emergency Situations and the FSB;

- liquidator of man-made disasters, including at the Chernobyl nuclear power plant;

- other.

You can receive a pension if a person has died by providing the Russian Pension Fund with a package of documents necessary to assign contributions:

- statement;

- identification document of the applicant;

- death certificate;

- papers indicating family ties with the deceased - certificate of birth of children, marriage;

- an extract from the house register or other documents confirming residence in the same area;

- for dependents, you also need to provide papers confirming financial dependence on the deceased for a long time.

Read also: How to inherit under a will

For a spouse, when applying for subsidies for the loss of a breadwinner due to the performance of official duty, the amount will be calculated differently. The benefit amount is about 40% of the husband’s pension. It is noteworthy that payments for military personnel is a controversial topic and requires consultation with an employee of a law firm.

The procedure for issuing the savings portion by Russian Post

The funded part of the pension is included in the inheritance estate.

The funds remaining in the deceased person’s account in a non-state pension fund or pension fund of Russia are regarded as a deposit. After entering into an inheritance, money can be issued or transferred by bank transfer to the spouse’s personal account in the amount required by the rules of inheritance. However, there are certain peculiarities in this matter. Thus, only the spouse can receive the funded part of the husband’s pension. In this case, the deceased husband must meet the following conditions during his lifetime:

- independently transferred personal funds to the current account of the NPF or Pension Fund of the Russian Federation;

- contributed an amount from maternity capital to the Pension Fund;

- year of birth after 1967.

The procedure for registering the funded part of the benefit is carried out according to the regulations approved in PPR No. 711 of July 30, 2014. It is noteworthy that if money was transferred to the deceased through Russian Post, then the relative will receive subsidies in a similar way.

Decree of the Government of the Russian Federation dated July 30, 2014 N 711 “On approval of the Rules for the payment by the Pension Fund of the Russian Federation to the legal successors of deceased insured persons of pension savings accounted for in the special part of individual personal accounts”

Nuances of the procedure for issuing funds if the applicants did not live with the deceased person

In the rules for issuing pensions for deceased relatives, there is a condition - cohabitation. However, there are exceptions in some situations. For example, the legal successor has the right to claim the amount if he did not live together with the deceased, but was still listed as his dependent.

To confirm this status, it is not necessary to have a disability group, be under the age of 18, or be unable to work due to incapacity. It is enough to attach to the application a bank statement or other certificates confirming the systematic provision of financial assistance.

Example No. 1 Borisova N.D. was in hospital for two months and did not receive benefits during this time. The son, as the only legal successor, lives in another locality. After the death of his mother, Borisov P.P. applied to the Russian Pension Fund for payment of a subsidy, but the body’s employees refused. In this case, the department’s decision is legal, since the persons did not live in the same living space, and the son provided for himself independently. Therefore, for Borisov P.P. it is necessary to wait until the end of six months to enter into the inheritance.

Example No. 2 Abramova B. Yu. has a granddaughter with a disability group. The girl was supported by her grandmother, because her own allowance was not enough for living expenses. At the same time, the granddaughter did not have permanent employment due to her health condition. After the death of Abramova B.Yu., the granddaughter applied for subsidies from her grandmother. The funds were transferred in full, because the girl was able to confirm her financial dependence on her relative by submitting certificates and account statements.

Read also: How to issue a deed of gift for an apartment for a child

How to receive a funded pension for a deceased relative?

If the question is whether it is possible to receive the funded part of the deceased’s pension, then the answer is yes. To do this, you need to start an inheritance case and contact a notary - he must open the case in accordance with the Federal Law “On Labor Pensions” of the Russian Federation.

As a result, in order to receive the funded part of the pension for a deceased relative that is part of the inheritance, you need to contact the Pension Fund again. In addition to the same documents that were listed in the list above, you must also have on hand:

- certificate of family composition

- certificate of inheritance

After the procedure for reviewing the documents you provided is completed, the approved amount of money from the funded part of the pension will be transferred to the applicant’s account every month.

It also makes sense to contact a notary if the pension was transferred to a savings book. Then, in addition to the documents listed at the beginning of the article, you must have an inventory of the inheritance (it must reflect the entire amount of money in the deceased’s savings book).

Since this issue again turns out to be in the field of inheritance law, you will have to wait 6 months from the moment the case was opened. At the end of this temporary period, you are issued an inheritance certificate, along with which all the financial assets of the deceased, including the funded part of the pension, become your property.

The procedure for receiving a pension for a deceased relative

Payment of pensions not received due to the death of a citizen occurs on an application basis. It is necessary to contact the competent authorities within six months from the date of death of the recipient. The registration procedure looks like this:

- Prepare the necessary package of documents and draw up an application for receiving a pension after the death of the pensioner.

- Contact the authorized body. Since the Pension Fund (PF of the Russian Federation) is responsible for paying the lost money for the deceased, it is necessary to visit the territorial office at the place of residence of the deceased. You are allowed to submit an application through your personal account on the website of the Pension Fund of the Russian Federation or send documents by mail. If there is a Multifunctional Center (MFC) in the locality where the pensioner lived, you can submit the collected documents there.

- Wait for the decision to be made and, if the verdict is positive, receive the amount due.

What documents are needed

The application drawn up in person must be accompanied by a death certificate and SNILS, plus a certain package of documents. The list of papers will depend on the circumstances giving the right to receive the deceased’s money:

| Base | List of papers |

| Cohabitation |

|

| Dependency |

|

| Family ties |

|

Application processing time

The date of acceptance of documents is the day the applicant applies. If the papers were sent by mail, the starting point is the date indicated on the stamp of the envelope. Five days are allotted for consideration, after which the applicant must receive a response. If the verdict is positive, the money will be transferred within a month. In case of refusal, the Pension Fund of the Russian Federation must notify the applicant in writing indicating the reason for non-payment.

Please note that if the pension was transferred to the deceased before his death or on the day of death to a current account, relatives and dependents cannot receive payment through the Pension Fund of the Russian Federation. In this case, the entire amount is included in the “inherited estate” and is inherited in accordance with the law.

- Scientists have identified an unexpected cause of obesity

- Korean carrot salad

- Who is banned from selling alcohol?

If the deceased pensioner is the breadwinner, is it possible to switch to the deceased’s dependent pension?

A relevant case is when the deceased pensioner actually supported the rest of the family. Relatives of the deceased who were dependent on him have the right to request a pension “in connection with the loss of a breadwinner”: disabled parents and spouses can also do this, even if they were not entirely supported (this is possible in the case when they have lost their sources income).

In this case, unlike withdrawing the remainder of the pension, the time interval from the date of death is not important. To transfer to the deceased’s pension, a person who is in a registered marriage with the deceased should contact the Pension Fund, presenting:

- passport

- marriage certificate, as well as death certificate of the pensioner)

- SNILS of the deceased

- information about his earnings for an arbitrary 5 years, as well as his work experience

- documents certifying the applicant's dependent status or loss of sources of income

In some circumstances, additional documents may be required - this question must be asked to the Pension Fund, and they are required to answer.

If the deceased pensioner was a military man, his wife should go through a similar procedure for applying for his pension.