Ask a lawyer

faster.

It's free! Free legal consultation Moscow and Moscow region: +7 499 938-93-12 St. Petersburg and region: +7 812 467-39-73 Fed.

number: 8 800 350-73-54 CONSULTATIONS CONDUCTED: today - 21, per month - 687, per year - 11,345

When purchasing an apartment from a legal entity, the buyer’s risks cannot be discounted. To secure your purchase, you need to know exactly how the transaction is carried out and what pitfalls there are. This will allow you to take a more conscious approach to choosing a developer and insure yourself against possible fraud.

How to buy an apartment from a legal entity

The cheapest housing is in a new building. Moreover, the sooner you get involved in construction, the less you will have to pay per square meter. When a house is at the foundation pit stage, housing can be purchased 30-40% cheaper than on the secondary market. Until the house is completed, prices are 10-20% lower, depending on the completion of construction .

At this stage, it will not be possible to conclude a purchase and sale agreement for an apartment with the developer - a legal entity, since in fact the residential property itself does not exist. Therefore, most often the parties sign a share participation or investment agreement.

The essence of both of these types of agreements is that the future tenant is actually sponsoring the construction. According to the agreement, he transfers money to the developer, who uses it to build a new building. It is beneficial for an investor to join at an early stage of construction, when the company most needs an injection of funds.

As soon as the construction is completed, the legal entity registers the housing as its own property, and then, upon assignment of rights, in the name of the shareholder.

Thus, by entering into share ownership, the tenant actually acquires not the housing itself, but the right to claim his apartment from the developer when he completes construction.

Buying an apartment from a legal entity by an individual: how to reduce risks and complete the transaction

- passports of persons signing the agreement;

- power of attorney (other document) for the person signing the agreement on behalf of the organization;

- documentation for real estate (title and technical);

- information about the absence of debts for payment of housing and communal services;

- certificate confirming the absence of registered residents in the apartment;

- legal documents face;

- consent to the transaction from the founders (if required).

- Firstly, before completing a transaction, buyers will have to study a large volume of documents. After all, in order to protect yourself, you should familiarize yourself not only with the documentation for the apartment itself, but also for the person selling it. It is important that at the time of signing the contract the seller organization is active and not in the process of bankruptcy or liquidation. It’s also a good idea to study the reputation of the future counterparty.

- Secondly, when alienating housing by companies, it is necessary to check the consent of its participants to the transaction and the authority of a specific person to sign papers. If the transaction is large in value for the company, then it may require the approval of its participants. Otherwise, the sale may be subsequently challenged. The person concluding a transaction on behalf of the organization must have appropriate valid authority.

- Thirdly, when making transactions with legal entities, buyers face more risks. It is often difficult for ordinary citizens to understand the documentation of organizations, so they are not always able to recognize fraudulent activities. Agreements may be signed by the wrong persons or without the consent of company participants. And this entails the invalidity of the concluded transactions.

Please note => Explanatory letter regarding early leaving work sample

Transaction options

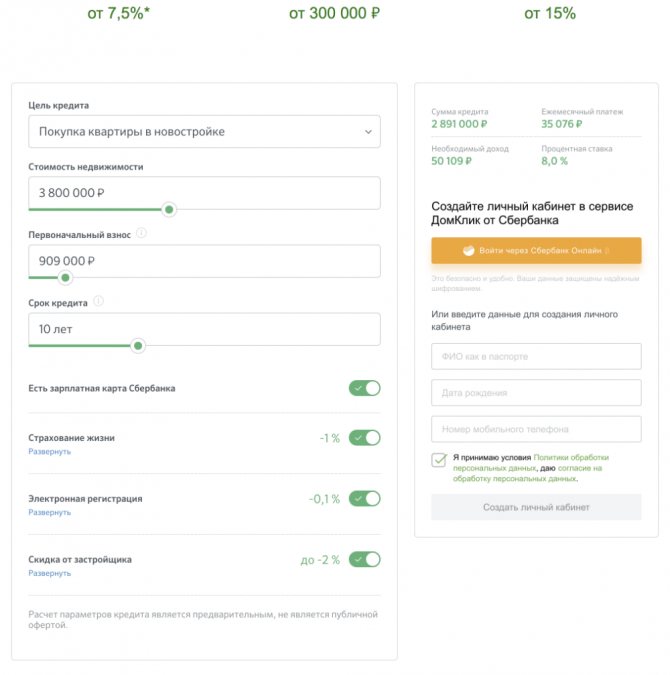

An example of mortgage programs from a large developer PJSC PIK Group of Companies.

It is clear that an ordinary person is unlikely to have several million rubles at once to pay for the purchase of housing, even if it is still under construction. Therefore, developers offer several calculation options:

- in installments - the shareholder pays the amount to the developer’s account in installments (agreed or arbitrary);

- by selling shares - the future tenant actually acquires securities of the housing cooperative, which he will subsequently exchange for an apartment;

- in a mortgage through the bank that accredited the developer.

Expert opinion

Stanislav Ershov

Qualified lawyer. Ready to answer any of your questions! Ask them right now!

Write to an expert

Each method has its own advantages and disadvantages. The most convenient way for the borrower is, of course, installments. There is no overpayment here, as with a mortgage, and there is no risk of a sudden depreciation of the shares of the housing cooperative.

But this method has a significant drawback: if you do not save evidence of payment, the developer may cheat and underestimate the amount of investment or even deny the fact of transferring money .

Features of buying a new building with a mortgage

Most often, home buyers take out a mortgage to pay off the developer. A loan is usually obtained either from a payroll bank or from an institution with which the construction company has established a partnership.

Key points to consider:

- To obtain a mortgage, you will need to make a down payment - usually 15-20% of the exhibited price of the home;

- funds are transferred to the developer’s account, the individual does not receive access to them;

- a tripartite agreement is concluded between the developer, the bank and the borrower, according to which the property is transferred to the bank as collateral after completion of its construction - the buyer will be able to remove the encumbrance only after the mortgage is fully repaid.

The greatest risk when purchasing a new building with a mortgage is that the developer will delay delivery of the house. As a result, the borrower will be forced to continue renting a home or live somewhere with relatives, while simultaneously paying off the mortgage and not being able to move into his own apartment.

What risks accompany the transaction?

The main risk that a buyer should take into account when purchasing an apartment from a legal entity is possible fraud on the part of the developer. The most common options:

- selling the same apartment to two or even three different buyers - in this situation you have to find out in court who paid for the housing first, and the rest have to wait for compensation from the developer;

- deliberately delaying the construction or delivery of a finished house;

- refusal to transfer ownership under any pretext;

- provision of an apartment for living that is not of the size or layout specified in the contract;

- cancellation of a contract based on forged documents.

Expert opinion

Stanislav Ershov

Qualified lawyer. Ready to answer any of your questions! Ask them right now!

Write to an expert

In addition, some unscrupulous developers initiate deliberate bankruptcy proceedings. As a result, shareholders are left without money and without an apartment, albeit with the right to demand compensation from the bankrupt enterprise. Since, by law, shareholders are third-priority creditors, in fact they rarely wait for compensation.

If a developer sells his apartments through a representative - another legal entity, then he does not even have to declare bankruptcy. There are precedents when a housing cooperative or a representative of a developer who sold shares on his own behalf declared bankruptcy. The result is a legal conflict: the developer formally promised nothing to anyone, and the shareholders cannot get him to fulfill his obligations.

What to pay attention to when signing documents

Knowing about the pitfalls mentioned above, the future shareholder can take a more balanced approach to choosing a developer and preparing documents. Please pay attention to the following points :

- what is the reputation of the developer, how many properties has he delivered, whether buyers have had problems buying a home and registering the transaction;

- what condition is the property in, is the house being built now and at what pace;

- does the developer have a construction permit, license, or membership in an SRO;

- analyze the housing tenure regime - the ideal option is when the land is purchased, but if the plot is leased, then the term should not expire in a couple of years.

Particular attention should be paid to the analysis of the contract. It must indicate :

- layout, number of rooms, project area and other parameters of the apartment;

- degree of delivery of housing - finishing, roughing or turnkey;

- liability of a legal entity for failure to deliver housing on time;

- options for resolving the situation if the developer declares its financial insolvency;

- settlement of disputes.

It is also advisable to enter into an equity participation agreement (EPA), which stipulates the right to claim the apartment after completion of construction, and not an investment agreement or purchase of shares. This way the likelihood of cheating will be much lower.

Some experts advise paying only 50% of the cost of the apartment before handing over the house, and the rest - after drawing up a contract for the sale and purchase of living space in Rosreestr. But this works if only the developer meets halfway, and the buyer has the entire amount in his hands.

Unfortunately, even the developer’s impeccable reputation and good financial condition do not guarantee that the process of transferring an apartment from a legal entity to a private buyer will proceed without complications . At the same time, the builder does not necessarily turn out to be a fraudster - sometimes the delivery of the house may be delayed due to disputes over the ownership of the land or regulatory authorities will not give permission to put the house into operation for some reason.

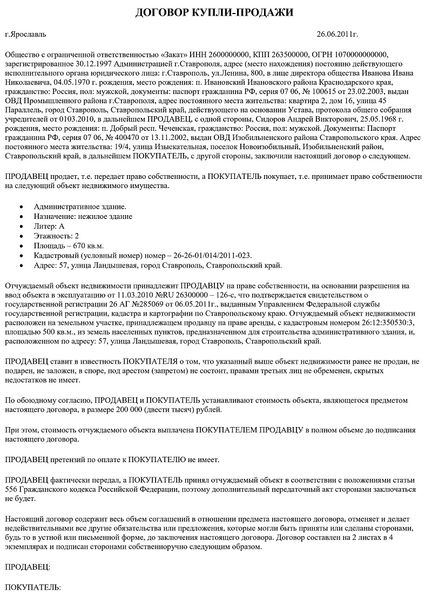

Apartment purchase and sale agreement between an individual and a legal entity (sample)

Rules for drawing up a contract

The purchase and sale agreement can be drawn up by either the selling company or the buyer. If a developer acts as a seller, he usually already has all the prepared standard forms in which he only needs to fill in the missing data about the client-buyer. A notary can also draw up an agreement, but this is usually a paid service. This fact can be discussed at the negotiation stage. The document must contain the following points:

- Detailed information about the parties to the transaction.

- A very detailed description of the apartment that is being bought or sold. It is not enough to provide an address. You need to enter the area (living and general), number of floors, number of rooms, cost, and so on.

- The price of an apartment is always indicated in numbers and words.

- There must be rights and obligations of the parties, as well as actions in case of force majeure.

- If this is agreed upon, various suspensive conditions may apply (for example, the client pays 50% of the cost of the apartment immediately upon concluding the contract, after which he has the opportunity to register ownership and only after that pay the remaining 50%).

- Date and signature. It is not allowed to draw up an agreement “retrospectively” or, conversely, to sign it “with an eye to the future.”

This is important to know: The act of mutual settlements when purchasing an apartment

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

What will change in 2020

To protect the rights of shareholders, the Government has developed a new payment scheme for private home buyers in new houses.

From July 1, 2020, the usual DDUs will no longer exist; instead, project financing through the intermediation of a bank will be introduced . The new scheme does not involve transferring money directly to the developer, as was the case before, which reduces the chances of misappropriation of funds and the risks of fraud on the part of the construction company to almost zero.

In general, purchasing an apartment in a new building from a law firm will look like this:

- the developer or a specially created company opens an escrow account with a partner bank;

- the investor (acquirer) enters into a tripartite agreement with the bank and the legal entity representing the developer, and deposits the required amount into a bank account or arranges a mortgage there;

- the funds are in an escrow account and serve as collateral against which the developer takes out a bank loan for the construction of buildings;

- Once the house is completed and put into operation, funds from the escrow account will be transferred to the company, with the exception of loan servicing costs.

If for some reason the developer declares bankruptcy, he will be liable with his property to the bank - the main creditor. The failed shareholders will receive their money back.

Thus, many of the buyer’s risks when purchasing housing from a developer in a new building will be removed.

Of course, the new rules will lead to higher housing prices, as well as the squeezing out of small construction companies from the market, especially since the requirements for these same companies will also be tightened. But shareholders will find themselves in a privileged position.

Frolov and partners

Real estate in Moscow is a good investment. It is necessary to understand that there are some features of taxation of the purchase and sale of real estate. Legal entities must pay a number of taxes both when buying and selling real estate. In fact, VAT is a value added tax that is charged to the buyer. VAT is added up at all stages of production of goods and includes all additional costs incurred by the manufacturer. This amount must be paid earlier than the final cost of the goods in the order in which expenses arise; in fact, of course, this amount is simply included in the total cost of the goods.

21 Dec 2020 marketur 213

Share this post

- Related Posts

- Housing prices in Moscow by region

- Why is a production characteristic needed in MSE?

- Stopping a car by a traffic police officer outside a stationary post

- Are Chernobyl Balls being added?