When to make changes

After registering a property, information about it is entered into the Rosreestr. Information is stored indefinitely, until the property is liquidated. And changes are made in cases where previous information loses its relevance.

In what cases do you need to make adjustments to the available information:

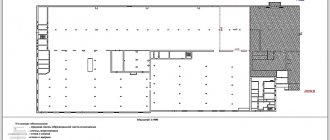

- Redevelopment. If the area, number and location of rooms, communications or doors have changed, then the redevelopment is approved by the BTI. After receiving supporting documents, changes are made to the register.

- Construction. The construction of a new facility on your own land plot leads to registration of real estate and amendments to the Unified State Register of Real Estate.

- Change of owner. In this case, the property ownership history is adjusted.

- Encumbrance. If real estate is used as collateral when receiving a loan, then documents are submitted to the Unified State Register of Real Estate, where a mark on the encumbrance is placed.

- Errors in documents. They can be detected immediately after obtaining rights to real estate or during operation. In any case, the presence of errors is another reason for contacting Rosreestr.

- New owner details. When changing the name, surname or patronymic, the owner must contact Rosreestr and submit the data of the new passport.

It may be necessary to make changes to the Unified State Register in other situations. But the purpose of these actions is the same - to correct the information in the Real Estate Register. They must be current at the time of sale, exchange or donation of the object, otherwise the transaction will not take place.

Sections affected by changes

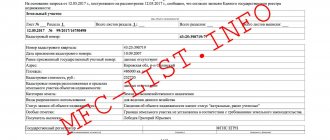

When changes are made to the Unified State Register of Real Estate, which also include all kinds of additions to existing records, be it in the field of cadastre or property rights, the following is indicated:

- Number according to the cadastre of real estate existing property or registration number of proprietary rights, its restrictions, encumbrance numbers, records with changes or additions;

- Changed and changeable characteristics of objects, changeable sections with registered rights, restrictions, including in transactions;

- Data on the papers that serve as the basis for making changes and additions (provided for in paragraph 51 of the Procedure for entering information into the Unified State Register of Real Estate).

When changes are made to other information available in the unified database, in accordance with the fifth paragraph of the same Procedure, they are assigned a new number. It should consist of the registration number of proprietary rights, the number of legal restrictions, encumbrances, transactions related to this section. Then, through a slash, the change or addition is assigned an individual number. At the same time, all information, even erroneous information that was available before the changes, is stored in a single registry.

Ways to make changes

Changes in the register are made at the initiative of the owner, after filing an application. Other persons cannot participate in this process, only with a notarized power of attorney. Also, adjustments are made based on a court decision.

How to make changes:

- Contact the MFC and submit an application.

- Contact the Rosreestr office.

- Go to court if the first two methods do not help.

In some cases, it is not possible to resolve the issue on your own. For example, when the cadastral value of real estate is underestimated or overestimated, changes can only be made through the court.

Changes to the USRN information are required in the following situations:

- after construction activities have been completed that affect the area and initial configuration of the room. Data that is indicated in the documentation when documentary changes are made: old area, new area , changes in technical characteristics as a result of repair and construction work;

- as a result of conducting an inventory of areas and identifying unaccounted for objects or discrepancies between the footage and those specified in the documentation;

- when dividing an object into smaller areas, or vice versa when combining into one;

- when there are changes in status and membership in a certain category in relation to a land plot.

Required documents

The list of documents depends on the legal status of the applicant. Legal entities are required to have an extended package, which additionally includes the organization’s legal documents.

Basic documents for data correction:

- applicant's passport;

- real estate document;

- USRN extract;

- statement;

- receipt of payment of state duty.

Additionally, a power of attorney is required if it is not the owner, but his authorized representative, who is applying.

Please note that the statement must be received no later than 7 days ago on the day of application.

All documents are submitted in person; electronic submission is not possible. But the result of data changes can be received by email. This must be indicated in the application before applying.

If necessary, other documents will be requested if some information is insufficient.

List of other documents and where to get the necessary certificates and forms

Before going to the Cadastral Chamber or MFC, the user must first prepare a package of accompanying documentation . The list of papers is standard in most cases and includes the following documents:

- payment document certifying payment of the duty fee;

- ID card of the donor and the recipient (passport). If guardians, trustees and other trusted persons are involved in the transaction, you will need to provide their personal information;

- marriage certificate and marriage contract (if necessary);

- an application for donation written by both parties to the process;

- a gift agreement, drawn up and completed taking into account all legislative recommendations;

- paper confirming the donor's ownership rights to the property (apartment purchase and sale agreement, privatization act, heir certificate, etc.);

- a certificate from the housing office confirming that there are no debts for utilities;

- data confirming the absence of any encumbrances on the premises. If there are any, in addition to completing the transaction, the written consent of a third party (creditor) or a paper confirming the removal of the encumbrance and its repayment will be required;

- cadastral passport and cadastral valuation data.

As for the cadastral valuation data, this document is ordered from the BTI. There you can also get an extract about citizens registered in the living space. In addition, this paper is also issued at the passport office.

This is important to know: Recognition of ownership of ownerless real estate

If the gift agreement is accompanied by any additional agreements, then they must be drawn up in accordance with the current requirements of the law and institutions that record additional agreements.

Sample gift agreement on the Rosreestr website

Donation of real estate is accompanied by the need to write a corresponding application.

Please note that an agreement in this format is optional for subsequent notarization. However, experts recommend affixing a notary visa, since in this situation it will be impossible to challenge it, and the recipient will protect his interests as much as possible.

The gift agreement is drawn up exclusively in writing, and when drawing it up, the requirements of Article 574 of the Civil Code of the Russian Federation should be taken into account.

The donation agreement form can be downloaded right here or obtained from a notary or realtor.

There is no such form on the official website of Rosreestr yet!

When they can refuse

Service may be denied for several reasons:

- an incomplete package of documents was provided;

- the state duty has not been paid;

- it was not the owner who applied;

- passport is not valid;

- the presence of corrections or errors in the application;

- there is no basis for adjustment.

If you believe that you are being denied wrongfully, go to court.

To make it easier to make changes to the Unified State Register, please contact us to receive an extract. We issue electronic certificates for rubles within 3 days.

How can I enter information into the USRN database?

Entering information into the Unified State Register requires compliance with a certain procedure. First of all, it should be understood that the initiative may come from the copyright holder or Rosreestr. On behalf of the owner, the service can be received by an official representative, provided that he has a power of attorney registered in a notary's office. Other persons cannot take part in the procedure.

Depending on the individual circumstances of the case, the procedure for entering information into the Unified State Register may change. In particular, adjustments can be made based on:

- Application submitted by the copyright holder;

- Initiative of Rosreestr (the copyright holder is required to notify of relevant changes);

- Judgment.

As practice shows, most often the entry of information into the Unified State Register occurs at the initiative of the owner. He must contact one of the authorized authorities by submitting a corresponding request. Next, we will tell you which organizations can provide the service and list documents that can become the basis for initiating the procedure.

Read more: Journal of transfer of shifts of teachers in kindergarten

State duty and payment procedure

A mandatory condition for carrying out registration actions regarding rights to real estate is the payment of the state fee. Its size is approved by Art. 333.33 part 1 clause 22 of the Tax Code of the Russian Federation, depending on the status of the applicant:

- 2000 rub. – for an individual;

- 22000 rub. – for a legal entity.

When submitting documents electronically (for example, through the State Services portal) and paying the state fee by non-cash method, individuals can receive a 30% discount (Article 333.35, clause 4 of the Tax Code of the Russian Federation), that is, the amount will be 1,400 rubles. The preliminary discount will be valid until January 1, 2021.

This is important to know: Features of the division of land

The costs of paying the state duty are borne by the person to whom the right to the property is transferred. In this case, the total amount for each applicant will be adjusted under different conditions of the transaction:

- If several persons apply, it is divided in equal shares among all applicants.

- When registering a share in common property (for purchase and sale transactions, donation, exchange) - it is calculated in proportion to the size of the share.

- When registering a share in common property (based on inheritance by law), it is paid in full.

Payment must be made no later than 5 days from the date of application. It is not necessary to provide a receipt (but it is still recommended to save it) (Article 18, paragraph 7 of Law No. 218-FZ), since the necessary information will be reflected in the State Information System on state and municipal payments. In the absence of such documents will be returned to the applicant without consideration.

In case of refusal to register the transfer of ownership after payment of the state duty, the latter is not subject to return (Article 333.40, paragraph 4 of the Tax Code of the Russian Federation). If you apply again for the same property, you will have to pay the fee again in full.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

Attached documents

The package of attached documentation may differ depending on the specifics of the transaction and the status of its participants. In general, you will need:

- Applicants' passports (original and copies) as confirmation of the identity of citizens who apply for the service.

- The basis document for the transfer of ownership (donation agreement, purchase and sale agreement, certificate of inheritance, etc.).

- Title documents for the object from the previous owner (seller, donor, testator, etc.).

- Cadastral passport.

- Insurance certificate of pension insurance (SNILS).

- Receipt of payment of state duty (optional).

This is important to know: Certificate of ownership of residential premises in Moscow

In addition, in some cases you must provide:

- Notarized power of attorney (if the interests of the applicant are represented by a trusted person).

- Consent of the second spouse to purchase/sell an apartment (if the object of the transaction is jointly acquired property).

- Permission from the guardianship and trusteeship authorities (for transactions involving minor owners).

- Waiver of the pre-emptive right to purchase (if the object of the transaction is a room in a communal apartment or a share in an apartment).